Tickmill Review 2026

See the best Tickmill alternatives in your location.

Pros

- Tickmill’s multiple licenses with authorities like the FCA and CySEC aren’t just paperwork - they translate to real-world benefits. Your money is kept separate in secure accounts, and the broker offers negative balance protection. In practice, this means you won’t be on the hook for more than you deposit, providing peace of mind when markets get volatile.

- When using the Raw Spread account, you’ll notice how tight the spreads are - sometimes even zero pips - paired with a transparent per-trade commission. This setup helps keep your overall trading costs low, which is a significant advantage when you’re making frequent trades and want to avoid hidden fees that cut into your profits.

- Based on our actual trading experience, Tickmill consistently processes orders quickly - averaging ~59 milliseconds - with very few instances of slippage or requotes. For a day trader, that means you can trust your entry and exit prices without worrying about delays that might cost you money in fast markets.

Cons

- Tickmill’s demo accounts don’t support all platforms (like its proprietary one), which can make practicing your strategies less seamless. That’s a hassle if you want to thoroughly test your skills before going live, especially with newer Tickmill tools.

- If you’re used to cTrader’s modern layout and sophisticated order types, you’ll miss that here. Tickmill sticks with MetaTrader 4 and 5, as well as TradingView and its own proprietary platform, so there’s no cTrader option. This might slow down traders who rely on cTrader’s workflow or specific tools, such as cTrader Copy.

- Tickmill primarily focuses on forex pairs, select stock CFDs, indices, and a few commodities. If you like switching between many different asset classes, like crypto or a broader range of stocks, you’ll find the choices limited compared to brokers with thousands of instruments.

Tickmill Review

This Tickmill review goes into the detailed results of our latest round of testsmm spanning the areas that matter most to active traders.

Regulation & Trust

Tickmill began as a small broker in 2014 and has since grown to serve traders worldwide. Its most significant strength is regulation.

The broker is licensed by top authorities, including the FCA in the UK (reference number: 717270) and CySEC in Cyprus (licence number: 278/15), which are recognized as ‘green tier’ bodies in our regulator tracker, thanks to their strict rules and rigorous oversight.

The broker also holds licenses from the Dubai FSA (reference number: F0076630), ‘yellow tier’, FSCA in South Africa (reference number: 49464), ‘yellow tier’, and Seychelles FSA (license number: SD008), ‘red tier’.

That means Tickmill has to separate your money from its own business accounts and protect against negative balances. If the broker goes bust, your money won’t get mixed up in it.

But here’s what matters for day traders. With FCA and CySEC regulation, your account gets more protection and clear complaint channels. Other Tickmill entities, such as those in Seychelles, offer higher leverage but come with fewer safety nets. If you care about tight regulation and fund security, consider opening your account under an FCA or CySEC-regulated entity.

Compared to brokers lacking strong licenses, Tickmill offers better peace of mind, fair pricing, and reliable trading rules. Going with a broker that’s only weakly regulated can put your money at risk or make withdrawals hard.

| Tickmill | Interactive Brokers | xChief | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FCA, CySEC, FSA, DFSA, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | ASIC |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Live Accounts

Tickmill offers a few live account options depending on the platform you want to trade with.

The Classic Account is straightforward. It needs a $100 deposit. Spreads start at 1.6 pips, there are no extra commissions, and you get leverage up to 1:1000. This account works for beginners and lets you trade on MetaTrader 4 (MT4) and MetaTrader 5 (MT5) without additional fees.

The Raw Account is better if you want tighter spreads. It also requires an initial investment of $100. Spreads begin at 0.0 pips, so trades cost less in volatile markets. But you pay a $3 commission for each lot per side. That’s better for high-frequency trading and scalping on MT4/MT5 when every pip counts.

Tickmill also offers a swap-free Islamic Account. Both Classic and Raw accounts can be converted into swap-free versions that adhere to Sharia law. These accounts eliminate all overnight interest charges but incur small handling fees on some trades held for more than three days. This setup maintains trading conditions nearly identical to those of the standard accounts and provides a fair option for Muslim traders.

Some brokers we’ve tested offer more account types, but Tickmill keeps things simple, providing all accounts with fast trade execution and steady pricing. Compared to brokers that hide costs or require bigger deposits, Tickmill is transparent and fair.

For day traders, this means you know the trading costs up front and can start small.

Demo Accounts

Tickmill’s demo account is easy to set up and doesn’t require you to open a live account. You can trade on MT4 and MT5 with real market prices and no risk.

Disappointingly, there are no demo accounts for TradingView or Tickmill Trader platforms. Therefore, if you wish to utilize these platforms, you’ll need to test them with a live account.

You have access to all available instruments, including forex, stocks, indices, commodities, and crypto. You can choose your virtual balance and trade with the same conditions as a live account.

One advantage is that there’s no time limit. Most brokers cut off access after around 30 days, but Tickmill allows you to keep up to seven demo accounts (per email address) running indefinitely as long as you log in at least once a week. That helps new traders practice for real conditions at their own pace.

Compared to other top brokers, Tickmill’s demo feels fair and realistic. It’s not packed with flashy tools, but it gives what matters – smooth execution and market accuracy. For day traders, it’s a secure way to test strategies, spreads, and execution speeds before risking real money.

Deposits & Withdrawals

Tickmill offers several deposit and withdrawal options that are straightforward and generally fee-free.

Depending on your jurisdiction, you can fund your account using bank transfers, credit cards, debit cards, e-wallets such as Skrill and Neteller, as well as cryptocurrencies like Bitcoin transfers and Ethereum payments.

Tickmill requires a minimum deposit of $100 to open a live trading account. Withdrawals have a minimum amount of $25, which is reasonable for day traders who want quick access to their funds without high barriers.

However, the broker accepts deposits and withdrawals in only four currencies: USD, EUR, GBP, and ZAR. This is more limited than many other brokers, which handle a wider range of currencies including JPY and AUD, so you may need to deal with currency conversion through your banks or payment providers.

I find that deposits are usually quick, with cards and e-wallets providing near-instant credit, while bank transfers take 1-3 business days.Withdrawals are processed using similar methods, and I find they are typically completed within one business day after approval.

For day traders, these options mean you can get your funds in and out without hassle, and you won’t be caught off guard by hidden fees or long wait times.

While some brokers restrict withdrawal methods or charge fees, Tickmill maintains transparency. This makes cash management easier when you’re trading actively and need quick access to your money.

| Tickmill | Interactive Brokers | xChief | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | FasaPay, GlobePay, M-Pesa, Neteller, Paysafecard, Perfect Money, QIWI, Rapid Transfer, Skrill, Sticpay, Swift, UnionPay, Visa, WebMoney, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, FasaPay, Neteller, Perfect Money, Skrill, UnionPay, Volet, WebMoney, Wire Transfer |

| Minimum Deposit | $100 | $0 | $10 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

Tickmill offers a diverse range of tradable assets that cater to day traders seeking variety and flexibility. You can trade over 60 currency pairs, covering majors, minors, and exotics, with leverage up to 1:1000 for major pairs (depending on your location).

Besides forex, Tickmill offers over 20 global stock indices CFDs (e.g., Nasdaq-100, Nikkei 225, and FTSE 100), 98 stock and ETF CFDs primarily from American markets (e.g., Apple, Walmart, SPY, and GLD), over 12 commodities (e.g., gold, silver, crude oil, and natural gas), and over 13 cryptocurrency CFDs (e.g., Bitcoin, Ethereum, Litecoin, and Solana).

Depending on your location (such as the UK), futures and options may also be available. Leverage varies by asset class, with lower limits on stocks and crypto for safety reasons.

For day traders, this means you can diversify your strategies across multiple markets without needing to change brokers. However, while Tickmill’s offering is solid, it’s not the widest available. Other top-tier brokers offer a broader range of stock, ETF, and cryptocurrency CFDs, as well as real stocks and even options.

Still, Tickmill’s regulated environment, tight spreads, and execution speed make up for the limited asset range. It’s a practical choice for traders who want a mix of some of the most popular assets in one place.

| Tickmill | Interactive Brokers | xChief | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | Forex, CFDs, stocks, indices, commodities, cryptocurrencies, futures, options, bonds | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Margin Trading | No | Yes | Yes |

| Leverage | 1:1000 | 1:50 | 1:1000 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

Tickmill has a low-cost fee structure that suits active traders well. The Classic Account charges no commission but has wider spreads from 1.6 pips. The Raw Account offers tighter spreads, starting at 0.0 pips, but charges a $3 commission per lot per side.

Swap fees also apply when you hold positions overnight, due to the nature of leveraged CFD products, but shouldn’t really affect day traders who typically don’t hold positions overnight. These fees depend on the asset and market rates and are clearly listed on the platform.

Together, these factors create competitive total trading costs that are often lower than those of other brokers.

The broker also charges no deposit or withdrawal fees (although your payment provider might), which helps keep your costs down.

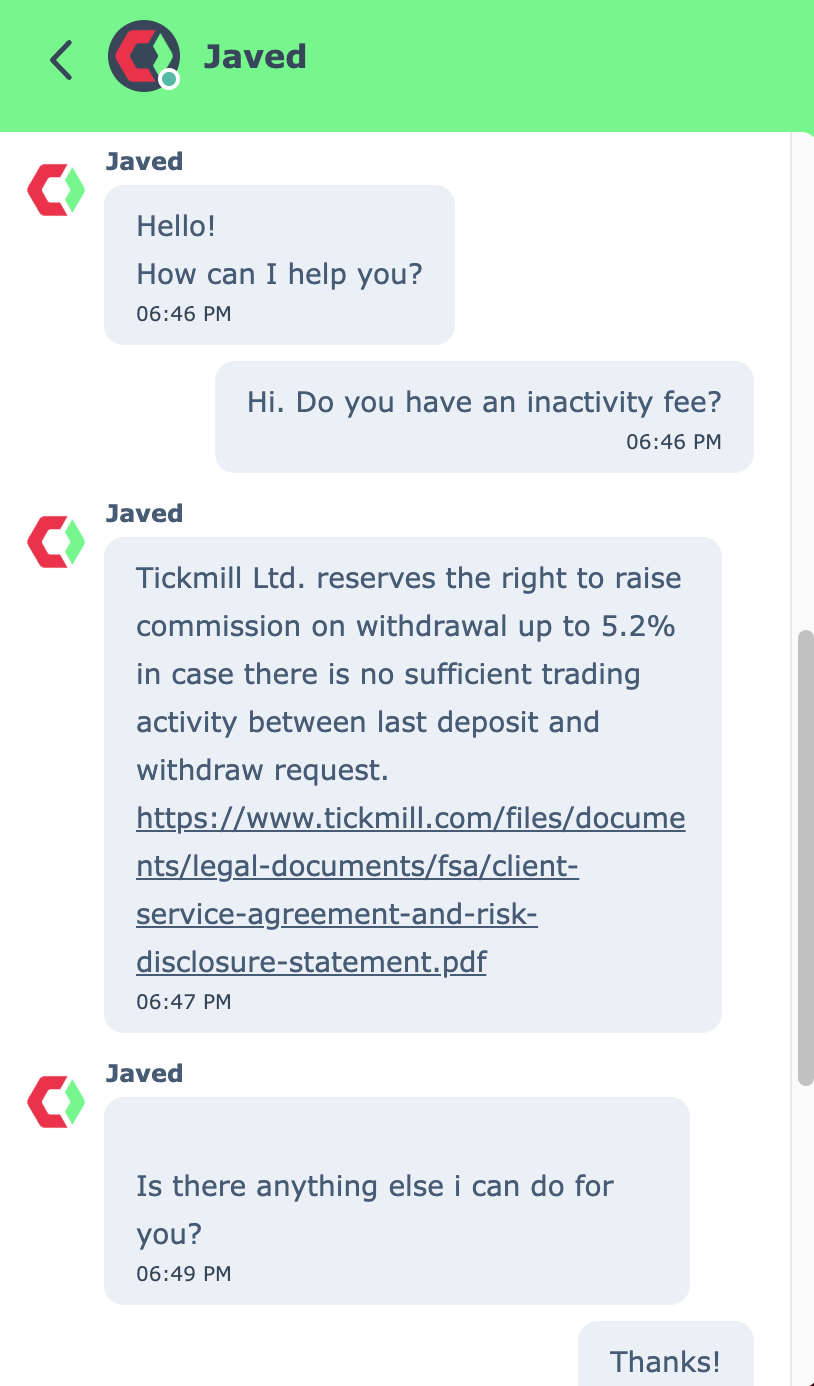

One important thing to note: Tickmill charges an inactivity fee of $10 per quarter, but only if your account remains inactive for 12 consecutive months. This is a fairly common practice, and the cost is relatively low compared to some other brokers who charge monthly fees.

Overall, Tickmill’s fees are transparent and predictable. For day traders, that means fewer surprises and easier cost management compared to brokers with hidden or unclear fees.

| Tickmill | Interactive Brokers | xChief | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.1 | 0.08-0.20 bps x trade value | 0.4 |

| FTSE Spread | 0.9 | 0.005% (£1 Min) | 70 |

| Oil Spread | 0.04 | 0.25-0.85 | 12 |

| Stock Spread | N/A | 0.003 | 50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

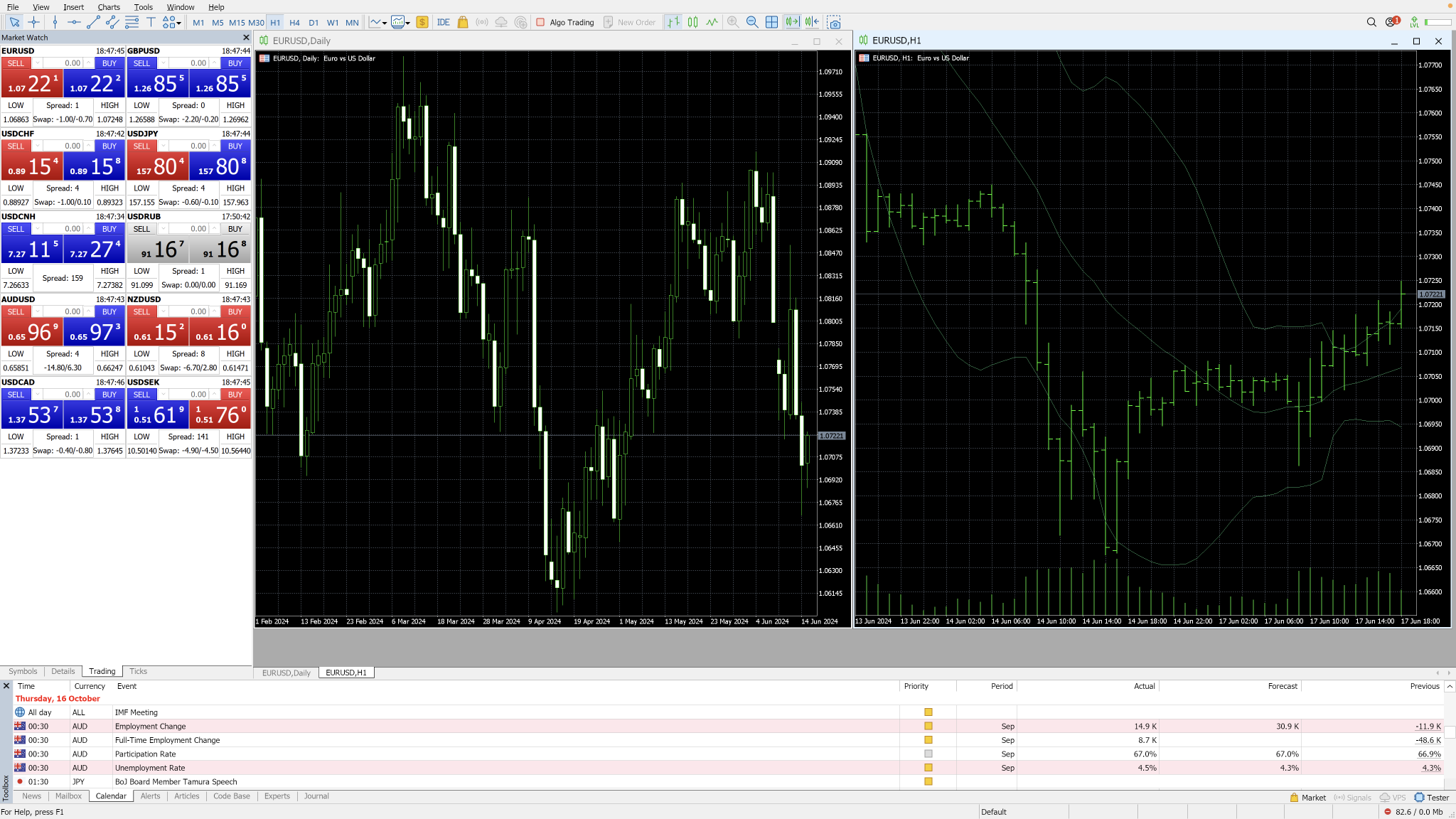

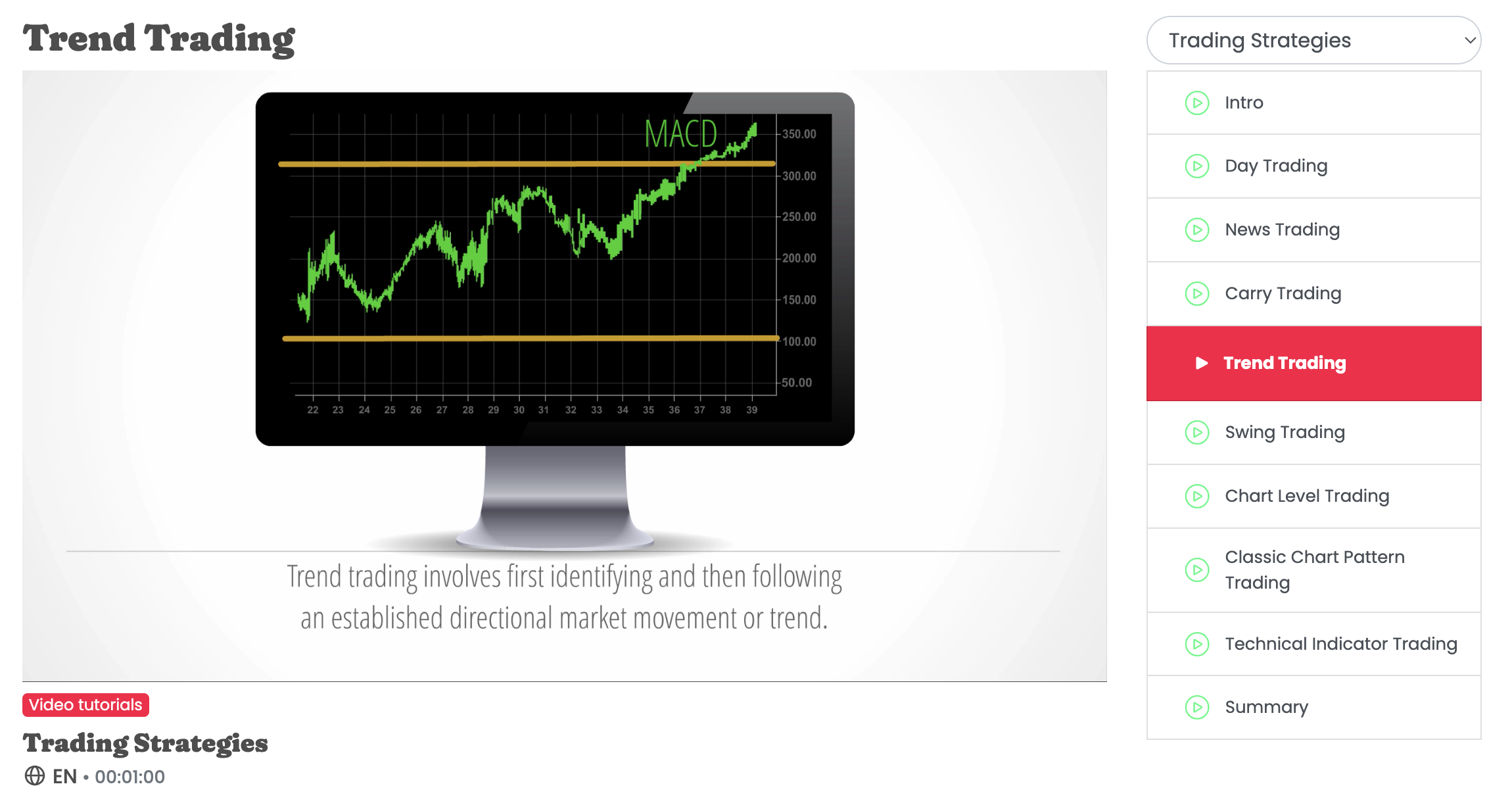

Tickmill offers a solid range of platforms and tools suited for short-term traders who want both simplicity and some advanced features. The primary platforms are MT4 and MT5, two of the most widely used globally.

MT4 is excellent for beginners and those who want tried-and-tested tools, while MT5 offers additional order types, indicators, and a multi-threaded strategy tester, which is particularly useful for advanced analysis or automating strategies.

Tickmill’s proprietary web and mobile platform, Tickmill Trader, offers a modern, clean interface with drag-and-modify orders right from charts—a feature many traders now expect.

It also includes performance analytics, helping you track trade details such as average win/loss duration and net profit, which provides practical insights for refining your strategies.

There are some limitations, such as the ability to apply only five indicators at a time, but overall, it strikes a good balance between usability and power.

A key advantage is full compatibility with TradingView, the popular charting and analysis platform. You can connect your Tickmill Trader Raw account to TradingView and trade directly from there, syncing trades instantly between the two platforms.

This setup is ideal if you want advanced charting and community-driven ideas, combined with fast order execution on Tickmill.

However, Tickmill does not support cTrader, which many other brokers offer for its modern features and interface. So, if cTrader is your preferred platform, you’ll need to look elsewhere.

Other tools include VPS hosting for reliable algorithmic trading, and API access for custom setups. Tickmill also supports copy trading, allowing beginners to follow and replicate the trades of other traders, which can be a helpful learning aid.

Overall, Tickmill’s platforms and tools cover the essentials, incorporating some additional features that strike a balance between ease of use and functionality.

The TradingView connection is a strong point that sets Tickmill apart from brokers that lack integration with popular charting software. Its proprietary platform also adds value, but isn’t as feature-rich as MT5 or TradingView.

| Tickmill | Interactive Brokers | xChief | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | Tickmill Webtrader, MT4, MT5, TradingView | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Mobile App | Yes | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

Tickmill’s research tools balance simplicity and usefulness, making them a good fit for most day traders.

The Expert Blog is a strong highlight – it’s run by a team of market analysts who post technical and fundamental breakdowns, updates on key events, and practical trading insights throughout the day. The content is clear, relevant, and backed by data instead of filler talk.

For traders like me who enjoy watching and learning, Tickmill’s YouTube channel is also one of the best in the space. It features trader interviews, live discussions, and tutorials that break down complex topics in plain language.

The third-party Acuity Trading Tool is gives real-time sentiment from Dow Jones news feeds. It scans headlines, data, and trends to show how bullish or bearish the market feels on specific assets.

Additionally, for technical and short-term ideas, Signal Centre signals are backed by analysis, which you can adapt or ignore depending on your strategy.

For quick tasks, Tickmill also includes simple tools like forex calculators and a currency converter to help plan trade sizes, margins, and pip values.

Overall, Tickmill’s research setup is clean and helpful. It gives you key tools you need to make informed decisions, without the noise or complexity found on some larger broker platforms.

| Tickmill | Interactive Brokers | xChief | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

Tickmill’s educational resources work best for traders who prefer hands-on learning. The video tutorials section provides a comprehensive walkthrough of trading basics, from setting up MetaTrader to handling technical analysis and various order types.

Each short video is well presented and covers a specific part of the process, allowing you to learn step by step without feeling overwhelmed.

The tutorials also cover real-world trade examples, risk management, and charts, which help new traders see how theory translates into practical decision-making. It’s structured like a proper mini-course but stays simple.

Tickmill’s YouTube channel takes it a step further. The broker regularly posts global seminar recordings, strategy talks, and panel discussions with professional traders.

These sessions are practical – no jargon or empty motivation – just actionable advice from people who trade for a living. You can watch live sessions or recordings at your own pace, which makes it easy to fit learning into your schedule.

While some brokers push heavy theory or big learning programs, Tickmill keeps its education focused on the essentials – how to trade smarter, not just longer. It’s a realistic setup that suits day traders learning by doing.

| Tickmill | Interactive Brokers | xChief | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

Tickmill’s customer support is solid and well-suited for active traders who need fast and clear assistance. Support is available five days a week through multiple channels, including live chat, phone, and email.

I find that live chat is usually the quickest way to get answers at Tickmill, with agents who can provide detailed explanations and even screenshots to help with tricky issues.Phone support is available for more urgent or complex problems during business hours across multiple regions.

From my experience, emails also get a thorough response, often within 24 hours, which works well for less urgent or detailed queries.

Tickmill also offers a comprehensive FAQ section that answers many common questions, which I find usually helps to eliminate the need to contact support.

While Tickmill’s support hours don’t cover weekends or holidays, the multiple ways to reach them and generally fast response times compare favorably to other well-regulated brokers.

For day traders, this means help is usually close at hand during active markets, providing a reliable safety net without the constant 24/7 availability that is rare even among top brokers.

| Tickmill | Interactive Brokers | xChief | |

|---|---|---|---|

| Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With Tickmill?

Tickmill is a solid choice for day traders who want clear pricing, reliable execution, and a straightforward account setup. Its tight spreads and reasonable commissions on the Raw account make trading costs predictable.

The broker offers helpful educational videos and practical research tools, plus solid customer support during market hours. On the downside, deposit currencies are limited, and demo accounts don’t support all platforms.

Overall, Tickmill works well if you prefer simplicity and transparency over a vast asset range or 24/7 support. It’s worth considering if those fit your short-term trading style.

FAQs

Is Tickmill Legit Or A Scam?

Tickmill is a legitimate broker with strong regulation from respected authorities, including the UK’s FCA and the Cyprus CySEC, both top-tier regulators. It also holds licenses in Dubai.

These layers of oversight ensure that your funds are kept separate and protected, and the broker adheres to strict rules regarding transparency and fair trading.

Tickmill offers negative balance protection, which means you can’t lose more than you deposit, adding a safety net for retail traders. In some regions, clients also benefit from investor compensation schemes covering losses up to certain limits.

Is Tickmill Suitable For Beginners?

Tickmill can be suitable for beginners thanks to its simple account options and transparent fee structure. Educational resources, such as video tutorials and webinars, will also help new traders learn at their own pace.

However, some features, such as limited deposit currencies and a demo that doesn’t support all platforms, could be a minor hurdle. Tickmill’s customer support is responsive during market hours, which is particularly helpful for beginners who need guidance.

Best Alternatives to Tickmill

Compare Tickmill with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

Tickmill Comparison Table

| Tickmill | Interactive Brokers | xChief | |

|---|---|---|---|

| Rating | 4 | 4.3 | 3.9 |

| Markets | Forex, CFDs, stocks, indices, commodities, cryptocurrencies, futures, options, bonds | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $10 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA, CySEC, FSA, DFSA, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | ASIC |

| Bonus | 30% deposit bonus | – | $100 No Deposit Bonus |

| Platforms | Tickmill Webtrader, MT4, MT5, TradingView | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | 1:1000 | 1:50 | 1:1000 |

| Payment Methods | 15 | 6 | 12 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by Tickmill and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Tickmill | Interactive Brokers | xChief | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | No |

| Silver | Yes | No | Yes |

| Corn | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | Yes | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Tickmill vs Other Brokers

Compare Tickmill with any other broker by selecting the other broker below.

The most popular Tickmill comparisons:

Customer Reviews

5 / 5This average customer rating is based on 1 Tickmill customer reviews submitted by our visitors.

If you have traded with Tickmill we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Tickmill

Article Sources

- Tickmill

- Tickmill UK Ltd - FCA License

- Tickmill Europe Ltd - CySEC License

- Tickmill UK Ltd - DFSA License

- Tickmill South Africa (Pty) Ltd - FSCA License

- Tickmill Ltd FSA License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I found myself in a difficult situation, unsure of how to move forward. While searching for help, I came across Emilysurvey.org, which had received numerous positive recommendations online. I decided to reach out, and from the very beginning, their professionalism and efficiency were evident. They responded quickly, took the time to understand my concerns, and demonstrated a sincere commitment to resolving my issue. Their patience and attention to detail reassured me that I was finally working with capable and trustworthy professionals.