TMGM Review 2026

See the Top 3 Alternatives in your location.

Pros

- Accommodates new and time-poor traders with copy trading support from HUBx

- Huge range of assets including 10,000 global stocks

- Free VPS for automated trading

Cons

- $30 fee levied monthly on accounts which are inactive for 6 months or have a balance below $500

- Shares are only available on the IRESS account, and not tradeable via MT4 and MT5

TMGM Review

TMGM (Trademax Global Markets) is an Australian-based broker that is regulated by top-tier financial watchdogs. The firm deals primarily with forex trading but also offers a range of equity, commodity and crypto CFDs. This 2026 review looks at TMGM’s main strengths and weaknesses, as well as important information regarding fees, platforms, account types and leverage. Read on to find out whether to open a TMGM trading account.

TMGM Overview

TMGM is an Aussie-headquartered global forex and CFD broker. The company was originally founded in 2013 under the name TradeMax but it has been operating under TradeMax Global Markets (TMGM) since 2020.

The online brokerage operates in over 150 countries. Its headquarters are in Sydney and it has additional offices in Melbourne, Adelaide, Brisbane, Limassol and Canberra, as well as regional offices in New Zealand and Taiwan. The company’s CEO is Lee Yu.

TMGM’s total platform trading volume has hit $220 billion, ranking it as one of the top forex brokers in the world. The broker has also become partners with the Australian Open Tennis Tournament and famous Italian goalkeeper Gianluigi Buffon.

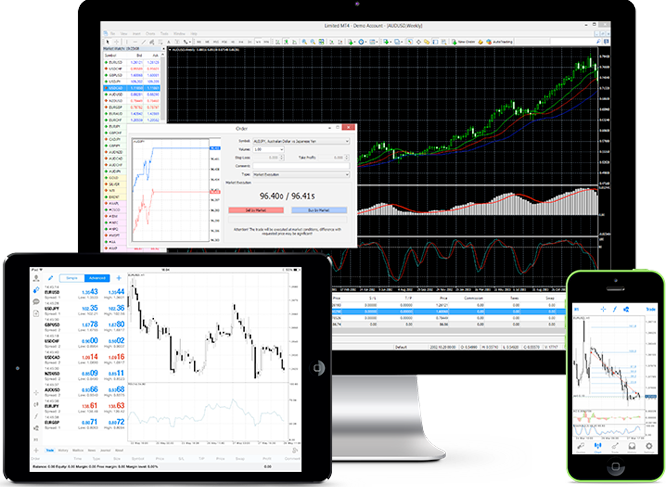

Trading Platforms

TMGM offers three trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5) and IRESS.

MetaTrader 4

MT4 is one of the most widely used trading platforms on the market. It provides all the essential trading features and is suitable for both novice and experienced investors. Both instant and pending order execution are available.

MT4 users have access to nine timeframes, over 2,000 technical indicators and 1,700 trading robots. Expert advisors (EAs) and MT4’s automation capabilities are partly why the platform is so popular.

But while MT4 is good for forex trading, it does not provide access to TMGM’s full range of CFD assets, including shares.

MetaTrader 5

MT5 is the next generation of MetaQuotes platforms. Whilst largely similar to its predecessor, MT4, the latest terminal has more advanced tools and features, alongside several underlying efficiency upgrades. These include additional timeframes, a larger variety of orders and accounting modes, plus Depth of Market (DOM) pricing. Automated trading is also available on MT5.

IRESS

IRESS is an advanced trading platform that works on all browsers. The software is designed for professional traders and, as such, has additional fees and a minimum deposit requirement of $5,000.

Some of the advantages of the IRESS platform include access to TMGM’s full range of CFD shares, direct market access (DMA) and real-time price streaming for US customers.

The terminal uses a highly customizable modular interface that includes over 50 indicators and advanced charting via TradingView.

Assets & Markets

TMGM is primarily a forex broker but also offers a range of other CFD instruments including crypto, shares, indices, energies and metals. Liquidity and fast execution are guaranteed by more than 10 tier-1 liquidity providers and the NY4 and TY3 Equinix Servers.

- Stocks: More than 10,000 stocks from NYSE, Nasdaq, ASX and HKEX

- Energies: Users can diversify their portfolio with crude oil or natural gas CFDs

- Forex: Over 50 pairs, including popular majors like USD/EUR, USD/JPY and AUD/USD

- Indexes: More than 15 global markets, including S&P 500, DAX 30 and FTSE 100

- Cryptos: TMGM offers 12 major crypto tokens against the USD, including Bitcoin, Ethereum and Litecoin

- Precious Metals: TMGM gives users access to popular metals, including gold, silver and platinum

In total, over 12,000 trading products are available across 7 asset classes.

Spreads & Commissions

Spreads and commissions start at 0 pips and $0 respectively, depending on the account type you choose. For EUR/USD, spreads come in as low as 0.3 pips, GBP/USD is 1.4 pips and energies have zero-pip spreads.

Other instruments incur variable spreads, which are detailed on the official website. Dividends from CFD shares and indices are passed straight to investors.

Leverage

If you are trading with TMGM in Australia, leverage limits are set by the ASIC. Leverage for forex pairs is capped at 1:30 for majors and 1:20 for minors. This is in line with regulators in the UK and Europe. Professional traders in Australia can access leverage of 1:400 for both major and minor pairs.

Traders in New Zealand fall under the jurisdiction of the FMA. This agency caps leverage at 1:200 for forex and precious metals and 1:100 for indices and energies. Traders outside of Australia and New Zealand can use up to 1:500 leverage.

Keep in mind that utilizing leverage is essentially borrowing capital from your broker. While it does increase your potential gains, it can amplify losses.

Mobile App

MT4 and MT5 are available to download as mobile apps for Android and iOS devices. The applications are reliable, user-friendly and have access to most of the features and functionalities of the desktop and web-based terminals. With that said, some charting and analysis tools are not supported and automation through APIs must be set up via the desktop client.

Mobile traders can also fund trading accounts and withdraw profits.

TMGM Deposits & Withdrawals

Any TMGM account using MT4 will require a minimum deposit of $100. Minimum deposits on the IRESS platform start at $5,000.

Accepted payment methods include bank wire transfer, debit cards and credit cards from Visa, MasterCard and UnionPay, alongside e-wallets Skrill, Neteller, FasaPay, RMB Direct Pay and Revolut.

The minimum withdrawal is $100 and there is no fee.

Demo Account

Free demo accounts are available from TMGM with the MT4 platform. You can choose between three funding amounts: $5,000, $10,000 and $50,000. You will have access to the paper trading account for 365 days but, if there is no activity for six months, you will lose your access.

Unfortunately, there is no practice account for the IRESS platform, so you cannot test it out before purchasing it.

Bonuses & Promotions

By opening an account, you will automatically join TMGM Rewards. This is a point-based loyalty system that rewards users with 10 points for every lot traded. Rewards start at 300 points and prizes include Apple devices and cashback up to $2,500. The TMGM Rewards program is available in a range of Asian, African and Eastern European countries.

TMGM has also been known to offer a $50 no-deposit bonus (NDB) to new trading customers. These promotions are time-sensitive, so be sure to review the broker’s website for terms and conditions and up-to-date information.

Regulation & Licensing

Trademax Australia Limited (ABN 76 162 331 311), trading as TMGM, is regulated by the Australian Securities and Investments Commission (ASIC).

For traders in New Zealand, TMGM holds a derivatives license with the Financial Markets Authority (FMA). TMGM TradeMax Global Limited (registration number 40356), is authorized and regulated by the Vanuatu Financial Services Commission (VFSC).

It is worth noting that ASIC, FMA and VFSC do not provide investor protection, which means you are not entitled to compensation if the firm goes bust. In addition, US clients are not accepted.

Additional Features

The firm is active on YouTube, Facebook, Twitter, Instagram and LinkedIn, where it regularly posts news, tutorials and career opportunities, such as internships. Brand ambassador, Gianluigi Buffon, also hosts online webinars which are free to register for.

TMGM offers a training feature called TMGM Academy. The academy is a three-stage education course that guides novice investors through the basics of trading through to more advanced strategies such as moving averages and Fibonacci extensions.

TMGM offers a full VPS service through a partnership with ForexVPS. This is a reliable solution for clients running EAs and signals on MT4. The basic VPS service is available for free but a minimum deposit of $3,000 is required. This will allow you to run three MT4 platforms simultaneously with a latency of 1ms and guaranteed 100% uptime. For the high-frequency VPS service, a deposit of $20,000 is required.

The broker is also known to run trading competitions, which usually run for three months. The leader board is updated daily and the trader ranking highest at the end of the period will be rewarded from a pool of up to $176,500. You can find full rules and terms and conditions on the official website.

Other features include HUBx (designed to facilitate copy trading), an economic calendar, a market sentiment tool, and access to Trading Central, which has a newsletter available in 7 languages.

Account Types

Before you sign up for TMGM, you will need to choose a live account. There are several solutions offered, each catering to different strategies and experience levels. We have broken down each account type below:

Classic

The classic account is available on MT4 and MT5. There is a minimum deposit of $100. No commission fees are charged on the classic account and spreads start at 1.0 pips. Users have access to the full range of forex pairs, commodities, cryptos, shares and indices.

Edge

TMGM offers a swap-free account for clients of the Muslim faith. It is available on Edge and Classic accounts only and does not receive or pay any interest/swap charges on overnight positions. There is a small financing fee for certain instruments, which mostly ranges between $10 – $20. With that said, the financing charge for EUR/TRY and USD/TRY is $100.

This account is available to traders in Azerbaijan, Bangladesh, Burkina Faso, Bahrain, Brunei, Brunei Darussalam, Algeria, Egypt, Guinea, Indonesia, Jordan, Kyrgyzstan, Kuwait, Morocco, Mauritania, Maldives, Malaysia, Niger, Oman, Pakistan, Palestinian Territory, Qatar, Sierra Leona, Chad, Tajikistan, Turkmenistan, Tunisia, Turkey, Uzbekistan and Kosovo.

Spreads start from 0 pips with commissions of $3.50 ($7 round turn).

IRESS Accounts

TMGM’s full range of CFD shares is only available on IRESS accounts. There are three types:

Standard

The standard account has a minimum deposit of $5,000. There is a platform fee of USD 35 / AUD 45 per month but this is waived if ten or more trades are placed each month. The commission rate is 2.25 (cps) and there is a minimum commission charge of $10. The minimum trade size is 333 shares.

Premium

The minimum deposit for a premium account is $10,000 and there is no platform fee, though charges will be incurred if no trades are made in a month. The commission rate is 2 (cps) and there is no minimum commission or trade size.

Gold

The gold account has a minimum deposit of $50,000. There are no platform fees and the commission rate is 1.8 (cps). Like the other accounts, fees will be charged if no trades are placed in a month.

Note, TMGM accounts will be charged a $30 inactivity fee per month if your account balance falls below $500 or if no trades are placed in six months.

Opening An Account

It is relatively straightforward to sign up with TMGM and the process is entirely digital:

- You will need to provide contact and personal information. This includes an email address, phone number, date of birth and address. You will also need to create a password to use every time you login to the broker’s portal.

- Choose your account type and base currency. You can choose from USD, EUR, GBP, AUD, NZD and CAD.

- Before trading, you will need to verify your identity and address by uploading a copy of your passport/ID and a bank statement or utility bill.

The online application takes around 15 minutes to complete and approval usually happens within one business day.

Trading Hours

The platform is available 24/7, however, some instruments such as shares and forex can only be traded 24/5 and within regional market open intervals. Cryptocurrencies, on the other hand, are available to investors at all times.

Head to the official site for details on holiday hours and public closures.

Customer Support

TMGM offers support via live chat, email and telephone. Help is available 24 hours a day, 7 days a week, including on weekends. The live chat feature is particularly active and response times are low.

Customer service representatives are knowledgeable and you can receive help in over 10 languages, including English, Chinese, Vietnamese, Portuguese, Spanish, Thai, Arabic, French, Indonesian, Italian and Filipino.

You will usually receive email responses from a helpful member of the team within 24 hours, but telephone support is also fast and reliable.

- Email: support@tmgm.com

- Live chat: icon on the website

- Phone: +61 2 8036 8388

Security

The ASIC is a top-tier regulator and works with the Australian Financial Services Authorization to protect the interests and rights of consumers and traders. ASIC protocols mean all TMGM clients have their funds held in segregated accounts.

To make sure that its operational procedures and regulatory duties are being followed, the TMGM Group has a regular third-party independent audit system in place. Professional indemnity insurance is also provided for up to 5 million AUD per client.

TMGM Verdict

TMGM offers excellent trade execution, low fees and a massive range of CFD products encompassing forex, stocks, cryptos, indices and commodities. With competitive trading platform offerings combining MT4, MT5 and the firm’s advanced proprietary solution, alongside several rewards and bonus programmes and a free VPS, there is little TMGM does not provide. If you are interested, you can check out the broker’s free demo account to trial the services, assets and features on offer.

FAQs

Is TMGM Regulated?

Yes, TMGM is a legitimate broker regulated in Australia by the ASIC, in New Zealand by the FMA and in Vanuatu by the VFSC. With top-tier regulation across the globe, TMGM is not a scam.

Does TMGM Offer An Islamic Account?

Yes, TMGM offers a swap-free account on which no interest fees are charged for overnight positions. This is available on the Classic and Edge accounts and certain instruments will incur a financing fee.

Is TMGM Right For Me?

If you are a forex trader, TMGM’s fees are generally low and in line with competitors like Pepperstone and Fusion Markets. There are also zero deposit and withdrawal fees and a wide range of accepted payment methods.

What Is The Minimum Deposit At TMGM?

TMGM Classic and Edge accounts use MetaTrader 4 and MetaTrader 5 and have a minimum deposit of $100. Deposits for the advanced IRESS platform start at $5,000.

What Payment Methods Are Accepted At TMGM?

You can deposit and withdraw from your TMGM account using several methods. These include wire transfers, credit and debit cards, RMB Direct Pay, Neteller, Skrill, UnionPay and FasaPay.

Best Alternatives to TMGM

Compare TMGM with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

TMGM Comparison Table

| TMGM | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 3.4 | 4.3 | 3.6 |

| Markets | CFDs, Stocks, Energies, Indices, Metals, Cryptos, Forex | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | ASIC, FMA, VFSC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | Point-based loyalty system | – | 100% Anniversary Bonus |

| Platforms | MT4, MT5, TradingView, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:500 | 1:50 | 1:200 |

| Payment Methods | 10 | 6 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by TMGM and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| TMGM | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | Yes |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

TMGM vs Other Brokers

Compare TMGM with any other broker by selecting the other broker below.

Customer Reviews

4 / 5This average customer rating is based on 1 TMGM customer reviews submitted by our visitors.

If you have traded with TMGM we would really like to know about your experience - please submit your own review. Thank you.

I like TMGM. I swing trade brent crude oil CFDs on their iPhone app and not had any issues. Spreads pretty good – they say from 0.3 but usually a bit higher in my experience. But plenty of leverage and trades go through quick because they have New York servers. I would like to see more oil insights in their technical analysis though. But still happy with TGMG overall.