Volatile Markets: 7 Strategies That Can Make Killings

Over the years we’ve seen exceptionally volatile markets during certain periods.

1929 and 2008 were fundamentally brought on by debt crises. Discerning sophisticated investors could have done the calculations to understand that there was a lot of debt coming due that would not be paid back. They could have adjusted their positions accordingly to benefit from a market that would likely be more cloudy than sunny.

On the other hand, with natural disasters – events like droughts and floods have wreaked havoc on local economies and civilizations throughout history – they are the types of events that give little to no forewarning. They are easy to catch you out of position.

If things get very bad, then traditional safe haven assets, like US Treasuries and gold, won’t provide much of an offset against declining equities and will lose value themselves (as they did).

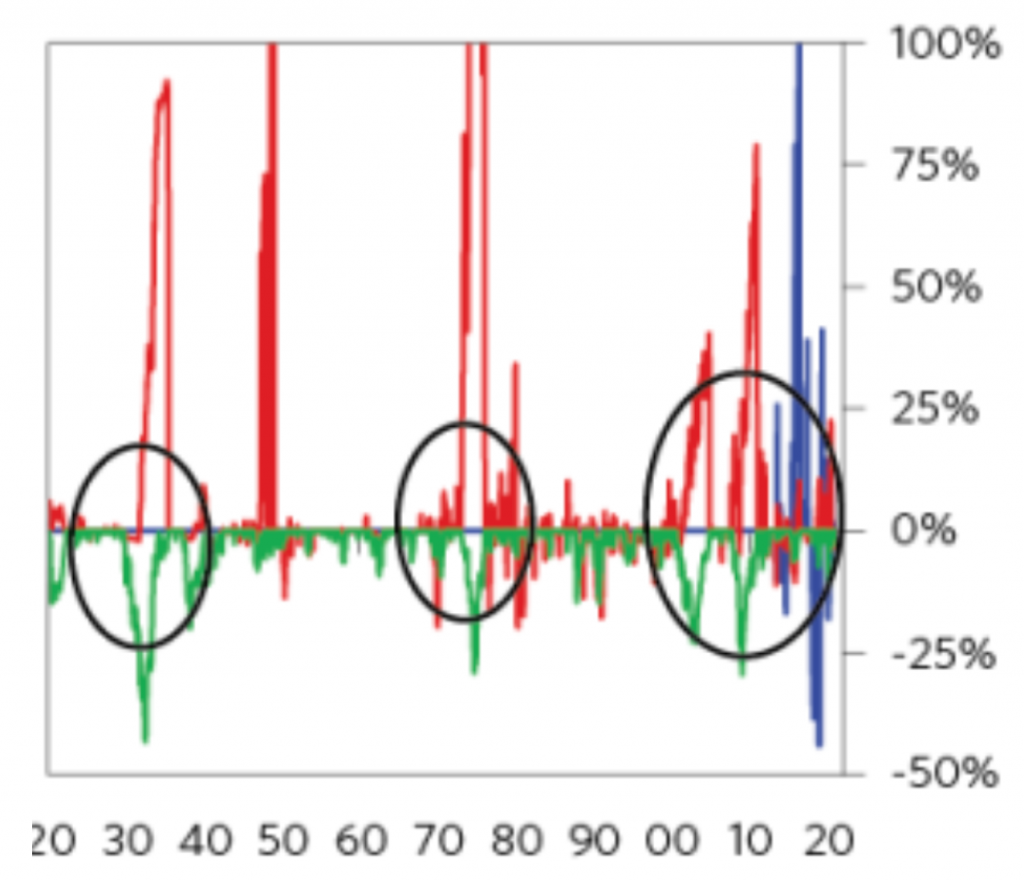

Historically, gold has provided a quality offset against a stocks and bonds portfolio (e.g., 60/40), though it’s not perfect.

Gold (red) vs. US 60/40 (green) vs. Bitcoin (blue): 1920-present

You can be pretty sure that financial assets will outperform cash over time. Modern economies heavily work off the idea that people with good uses for cash will use it to create a return on it.

When that’s not true, government policymakers have big incentives to get everything going again by easing monetary and fiscal policy in whatever ways necessary. That includes unifying them to get them rowing in the same direction.

Nonetheless, for periods of time, cash can outperform everything else and can blow a hole in your portfolio even with the appropriate balance and caution.

What types of strategies do best in these types of volatile markets?

Let’s go through a few of them.

Short selling

Let’s get the obvious one out of the way – short selling.

The reason why so many people lose money in recessions and in bad market situations – e.g., 2008, 2020 – is because they are systematically biased to be long in their positions.

It makes sense. Over time, we tend to learn more and become more productive. This typically increases companies’ values over time. Financial assets rise in value and throw off cash flows that benefit those positioned to be long risk premia.

Having a bullish long-term bias in the stock market is the backbone of most people’s portfolios.

Some well-known short sellers, like Jim Chanos, are actually typically net long the market. The intellectual capital of the business goes into short selling. But the way his firm, Kynikos Associates, typically operates is by having 2x long exposure to the stock market with the short book offsetting about half of the equity beta. That puts its correlation roughly on par with the market.

This makes the business viable. Dedicated short sellers who require making money to remain in business will have a much more difficult time. “Market neutral” funds, who roughly equally offset longs with shorts and fundamentally market themselves as providing a differentiated product, also tend to have difficulty making money over time.

Balanced Portfolios

In a separate article, we explained how to build a balanced portfolio. You can get stock-like returns with less risk, or better than stock-like returns at comparable risk (or some permutation thereof) by learning how to achieve effective strategic balance.

Most portfolios have lots of equity beta and fundamentally positioned for positive economic growth.

While economies grow most of the time and stocks are in bull markets more often than bear markets, years of gains can be wiped out in a very short period of time.

If you take big losses, it can take a very long time to get back. Japan’s stock market underwent a bubble in the late 1980s and over 30 years later it’s still well below that mark.

The NASDAQ took 15 years to come back to its previous level following the dot-com bust.

If you have a balanced portfolio your lows won’t be as extreme assuming you don’t go crazy with the leverage.

The main point is that if your overall portfolio has a systematic bias toward bull or bear markets in any particular asset class then there’s going to be an environment where your portfolio does well and an environment in which it does poorly.

Throughout history, there’s never been a 10-year period where any one asset class – stocks, bonds, gold, commodities – hasn’t declined 50-80 percent (or more). This also includes cash. Its volatility is negligible, but inflation and depreciation slowly eat up its returns over time.

And you don’t know which one that’s going to be. Markets are tough because it’s not whether things are good or bad, but whether things will be good or bad relative to what’s already discounted in the price.

Some people might favor stocks, bonds, gold, or another asset or asset class, but they can all be part of it if these assets are blended well.

Ideally, you’d like to avoid that to prevent having big drawdowns.

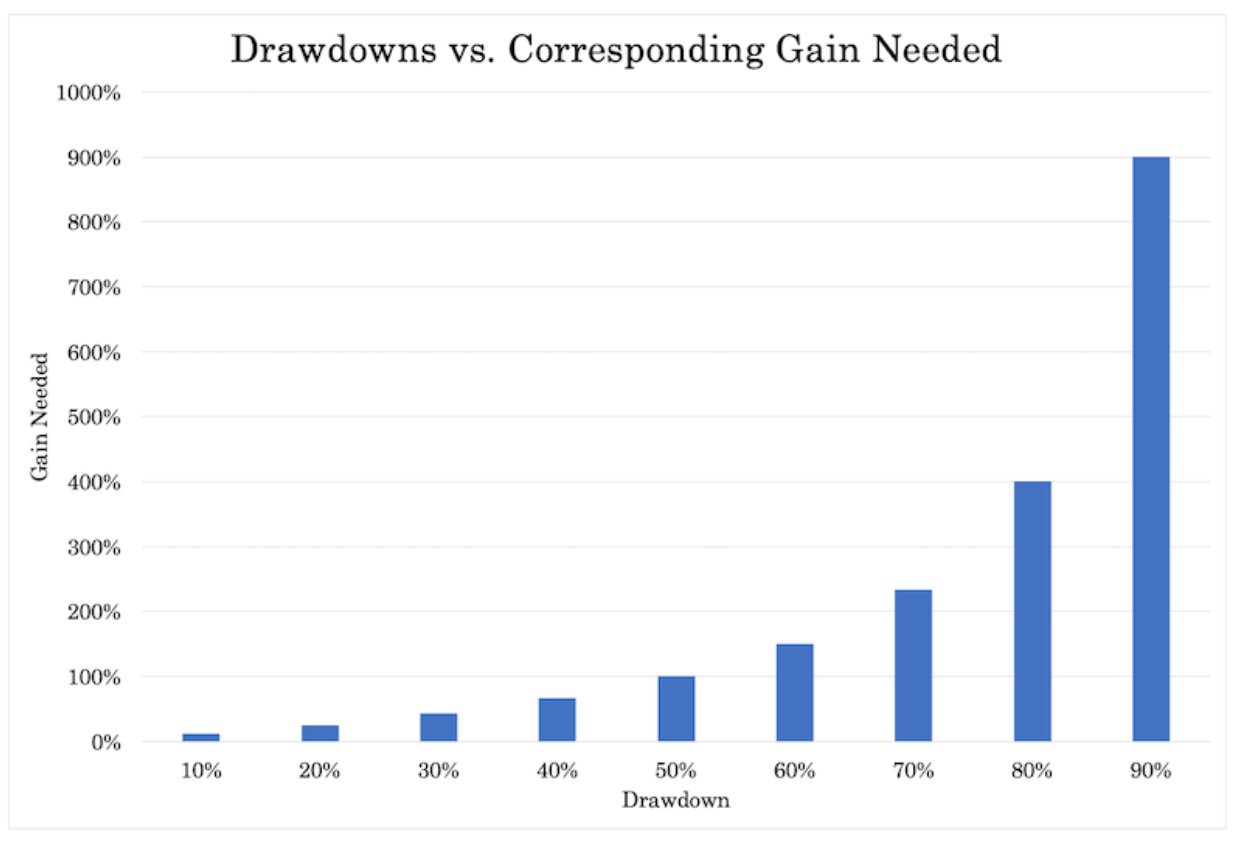

If you have a big drawdown it can be impossible to recover from or it may take many years. Accordingly, drawdowns should be avoided at all costs.

If you have a 10 percent drawdown, you need a reasonable 11 percent gain to get back to breakeven. A 20 percent drawdown requires a 25 percent gain.

However, the deeper you go into drawdown territory, the greater the disparity. A 50 percent drawdown requires a 100 percent gain.

Market making and HFTs

High frequency traders (HFTs) and many types of market makers have seen big profits during the market’s volatility.

HFTs employ strategies that range in complexity from the basic “buy the dip, sell the rip” that keeps asset allocations within pre-defined ranges to complex algorithms executed by powerful computers that move in and out of markets at incredibly fast speeds (i.e., milliseconds).

Virtu Financial is one of the world’s largest high-speed traders and most prominent market makers.

In Q1 2020, they pulled in over $500 million in revenue. That is more than double the amount they expected from the same period last year. It’s the highest quarterly trading revenue since the company had its IPO (and began publicly reporting its financials) in 2015.

Virtu’s stock had big gains in Q1 2020 (40 percent) while the S&P 500 was down about 20 percent. Flow Traders, another high-speed trading firm traded on the public markets, was also up around 20 percent over that time.

Periods of high volatility are often associated with declining stock values. Most asset managers, who have high correlation to the stock market, do poorly in volatile environments. High-speed operations can naturally serve as something of an offset for firms employing a multi-strategy approach.

HFTs have struggled in recent years as low market volatility and steadily rising markets have provided a sub-optimal operating environment. They do nonetheless account for around half of all trading volume on the US stock market and the technology they employ has displaced the need for having a high volume of traders working the floor of the exchanges.

HFTs have a similar business model to traditional market making. They make money off the different between the bid-ask spread, or the price difference between buy and sell orders. They sell high and buy low as stocks tick up and down.

Normally liquid stocks, like Google, Apple, and Microsoft, typically have spreads of around one cent between the bid and ask price.

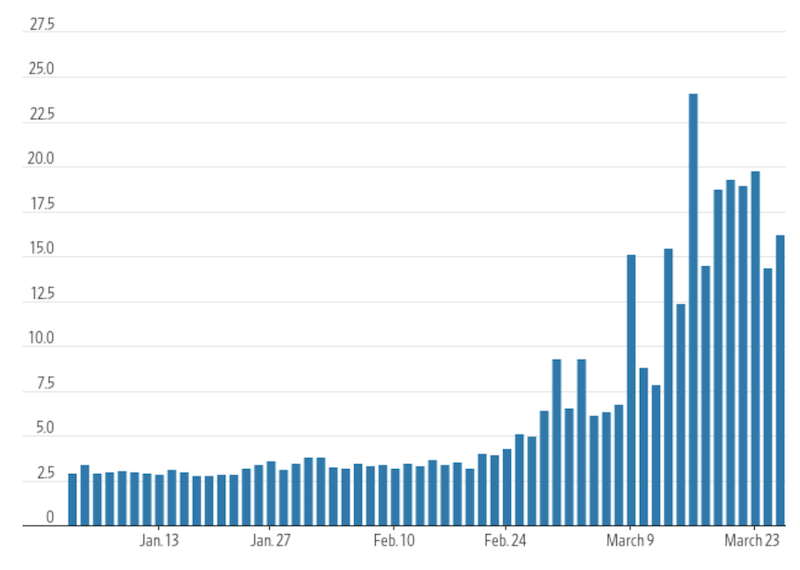

When markets are more volatile and machines and human traders have difficulty in understanding fundamental news and/or have a need to pull back on their activity, bid-ask spreads widen.

With wider spreads come higher risks, but firms that have the technology in place can exploit the difference to earn sizable profits.

Average bid-ask spread in basis points, S&P 500 stocks

(Source: Virtu Financial Analytics, courtesy of the Wall Street Journal)

Anti-carry trades

A carry trade is basically buying a high-yielding asset and funding it by shorting a low-yielding asset.

For example, a trader might want to buy a stock that he expects to earn six percent per year and fund the trade with cash or margin debt at one percent per year. That spread is 5 percent. If the trade is leveraged 4x, that’s a 20 percent return.

However, the leverage provides risk and there’s an added dimension of risk if the trade is funded with a foreign currency.

Many carry trades globally are funded with yen or euros because they’ve been cheaper to borrow in than dollars.

However, if that currency increases in value relative to your domestic currency, then that’s like a rise in interest rates. That reduces your return. Moreover, the value of the asset you’re buying could also go down and squeeze you that way.

When asset prices rise and volatility decreases, leverage normally rises. There’s the influence of rising asset prices compressing long-run returns and lower volatility giving traders more confidence to leverage up to get their desired returns on equity.

As you might imagine, the extra leverage in the system tends to magnify moves in the opposite direction when they do occur. Though, at the time, the natural tendency is to continue to extrapolate the good times forward.

Since the financial crisis, over $15 trillion of financial assets were purchased by central banks.

This led to a lot of liquidity going into the hands of institutional investors globally by bidding up the prices of financial assets.

We saw a boom in asset values, as well in alternative investments like private equity and venture capital. Investment managers have used the windfall from their fees to buy up luxury goods in the art market and in high-end real estate.

Every hiccup in stocks along the way – e.g., 2011 US credit downgrade, 2015 China devaluation and oil slump, 2018 over-tightening of monetary policy – had been corrected through central banks reaffirming or extending their commitment to ease monetary policy relative to what was already discounted into markets. This was a continued tailwind for risk asset prices.

Everybody’s major need has been to get money invested, which led to a shrinking in risk premiums.

In more tranquil environments, whatever has the highest yield will get bought against short positions of that which has the lowest yield. Before the virus fallout derailed the market, anything that had a higher yield than something else was getting bought.

Being long gamma

Being long gamma essentially means owning options.

Options are a limited risk trade structure (i.e., fixed downside) when they are owned. Your possible loss is limited to the premium paid for the option.

Out-of-the-money (OTM) options provide the highest upside relative to in-the-money (ITM) options. Because the price of the underlying needs to move further in your direction to profit from the trade, OTM options are priced more cheaply than ITM options. That comes with the ability to potentially earn more money.

Those who bought OTM put options on equities and stock indices before the crash could have made out very well. Any profit would depend on the stock or index, strike price, maturity of the option, and entry and exit price. With such a sharp, surgical move, some traders who timed it well could very well make 100x on their positions.

Of course, many use options as a means of capital preservation rather than an outright bet on market direction. Some will use it as part of a broader specialized strategy, such as dividend arbitrage.

Long-term investors typically want to own financial assets. To avoid losses during market shake-outs, options can help limit how much you can lose.

Such long gamma strategies can include:

- Long puts

- Put spread

- Covered call

- Collar

- Fence/Dutch rudder (covered call + put spread)

Alternative Risk Premia (ARP)

Alternative risk premia (ARP) refer to strategies that are largely long-short and beta-neutral.

One such strategy might be to go long low-volatility defensive stocks (e.g., consumer staples, utilities) and short high-volatility stocks.

It could also mean going long low P/E stocks in favor of shorting companies that have high P/E’s or don’t make money at all.

Or going long companies of larger size (bigger companies are more diversified with more stable cash flows) and shorting those that are smaller and less stable.

The basic idea is to isolate a factor that shows a higher probability of improving the risk-return profile of a portfolio.

ARP strategies look to go outside the confines of traditional equity and fixed income strategies toward sources of returns (i.e., risk premiums) that are uncorrelated with these markets.

Having more cash

One of the worst ways to kill a portfolio is brushing too close to your margin constraints. This increases the odds of running into a margin call.

It’s tempting to run a portfolio by being “fully invested” up to the maximum limits, but this is dangerous.

A margin call will force you to sell at inopportune times and rack up trading costs.

Keeping a sold 20 percent cushion is prudent. And having the discipline to not go under it.

It gives you liquidity and optionality. Cash enables you to take advantage of those times when there’s a large decline in asset prices that you can buy rather than having to be one of the many who to sell to raise cash.

At the same time, you don’t want too much cash. Cash doesn’t have a lot of volatility to it, so it’s perceived as a safe asset.

However, cash’s value declines over time because of inflation, making it a risky asset when thinking long-term. Also, in developed markets, cash doesn’t have any yield, so there’s not a direct investment return on it.

We know that central banks are going to target an inflation rate of at least zero, so people will be incentivized to invest their money in riskier assets so it doesn’t lose its value.

Conclusion

While most investors are systematically biased to have their portfolios do well in a specific environment – most notably a bull market in stocks – there are some strategies that perform well.

(i) While you don’t need to become a dedicated short seller – markets tend to rise over time – short selling can help you avoid over-extending yourself in any given asset class.

(ii) Having a well-balanced portfolio can help avoid the environmental bias that often leads to horrendous drawdowns in a portfolio. Having a strong strategic asset allocation mix leads to such benefits like lower drawdowns, better reward relative to your risk, and lower left-tail risk.

(iii) While high-speed trading and market making is more in the realm of an institutional or proprietary strategy, being able to provide liquidity to a market can also help for smaller traders.

If you see a spread of 10 cents on a security you’re likely to trade, if you want to buy it, consider putting in a limit order just below the ask. This can help tighten the spread of the security. You’re more likely to get in at a better price, which saves you money.

Some brokers have these features built in for you. Interactive Brokers, for example, has a very good order execution router to help re-route parts or all of your order to achieve great execution, price improvement, and improve any potential rebate that may be available to you.

(iv) Anti-carry trades involve deviating from the traditional way most investors go about their portfolios. Carry trades involve buying the high yielding asset against short positions in the low yielding asset.

When risk asset prices go higher and volatility runs lower, leverage tends to build. Investors become more confident at a time when the opposite makes more sense.

A bet on widening credit spreads is an example of an anti-carry trade. Institutional investors will typically structure this trade through credit default swaps (CDS), while an individual trader might short a high yield bond ETF like HYG, either as an outright short or through put options.

(v) Being long gamma, or long options, helps keep a floor under how much you can lose in the markets or limit how much you lose on outright wagers if you are wrong. Your losses are limited to the premium paid on the options.

(vi) Having alternative risk premia, which can enable you to go long or short certain types of factors (size, quality, volatility) that can meaningfully improve the risk-reward profile of a portfolio. For example, this could mean buying defensive stocks and shorting lower-quality names.

(vii) Owning more cash for the sake of having a prudent capital cushion to weather downturns. Holding more cash against an asset can help lower overall risk just as with some assets you might want to borrow cash to improve its overall return while keeping it within acceptable risk parameters.

If you buy OTM options and get the movement in your favor, you can have profitable (sometimes wildly profitable) trades. Some use options for sensible hedging purposes, while some use them as outright limited-risk positions to short the underlying securities.

These strategies, or a combination of them, can help traders maintain upside while avoiding the risk of having unacceptable downside.

Staying invested over the long run, including volatile markets

In the end, having to sell out of the market because you need cash makes it very difficult to do well in the markets over the long-run. You are probably going to end up selling low when you want to be doing the opposite. Ideally, when bear markets come you want to be picking up the scraps rather than being one of the many who had to sell to stay afloat and/or meet margin requirements.

A large share of a new bull market’s returns come in its very early stages due to the volatility.

We had a bull market in the US from March 2009 to March 2020. If you had put $100,000 into an S&P 500 index fund on the day the bull market began on March 9, 2009, that would have been worth $630,000 at the top of the bull market on February 19, 2020 when factoring in dividends.

If you had waited three months to ensure the market had indeed calmed down, that would have earned you 29 percent less at just $450,000.