Dividend Arbitrage: Strategies and Examples

Dividend arbitrage is a trading strategy where an investor is long a stock with an upcoming dividend payment and short the equivalent amount of stock through put options. It is designed to hedge against the drop in share prices once dividends are distributed.

The basis behind dividend arbitrage

When a company issues a dividend, the investor must own the stock before the ex-dividend date to be eligible to receive it. The ex-dividend date – also known as the ex-date – is an important date for determining which stockholders will be entitled to receiving it on the payable date (also known as the pay date).

Investors must hold the stock through at least the record date, which is typically two days after the ex-dividend date. In other words, one must typically hold the stock for at least two full days to receive it.

At the same time, when a company issues a dividend, this cash payment will lower the price of the stock by the amount issued per share, holding all else equal. This is because it represents a drop in the firm’s asset base; it’s a distribution of cash.

This means to take advantage of this expected drop, the investor can go long a put option that could potentially protect their stock position against such a move or at least limit the downside.

The dividend arbitrage strategy is best used on a stock with low volatility and low spreads (so that the option is cheap) and a high dividend. This may allow the investor to obtain profits on the dividend with the profit on the option due to the dividend-related price fall exceeding the premium paid.

Dividend arbitrage execution

Arbitrage is used to exploit price differentials between the same or very similar securities.

When they can be successfully exploited, they are the result of market inefficiencies. This means that dividend arbitrage is not always, or even normally, going to be something you’re going to be able to make money with.

Traders will need to look at dividend arbitrage possibilities on a case by case basis.

The Steps

1. Buy a dividend-paying stock before the ex-dividend date.

2. Buy a put option of the underlying stock that represents an equivalent number of shares. (There are 100 shares per options contract.)

These options can be in-the-money, at-the-money, or out-of-the-money. The more ITM the option is, the greater its hedge value. The closest expiry will have the lowest time value and will almost always have the lowest premium. This means weekly options are usually best to target, though not all stocks have weeklies available.

Under this setup, the investor will collect the dividend on the ex-dividend date (through a dividend payable, and officially receive it on the payable date). A drop in the price of the stock will increase the “moneyness” of the put option. If it lands ITM, it will obligate the trader to sell the stock at the put option’s strike price.

Dividend Arbitrage Examples

Let’s go through a few dividend arbitrage examples.

Example #1

First, we’ll use the example of Eastman Chemical (EMN), which is going ex-dividend the week I type this.

Eastman is currently $47.51 per share. Its quarterly dividend distribution is $0.66.

If we wanted to hedge this, we could buy EMN 47.5 puts.

Because of the higher implied volatility ongoing, this would cost us $2.50 per share at the minimum based on the current bid price. With 100 shares per contract, that means $250 per contract.

We know that with the dividend being disbursed, this will cause the stock to drop $0.66, or to $46.85, holding all else equal. (Obviously, the actual price will also be determined by other exogenous factors.) With 100 shares, this would save us the $65 from the price fall.

By having to pay $250 for the contract, this means we are spending an extra $185 ($250 minus $65) for this extra protection.

In this case, the amount we’re paying is not a dividend arbitrage opportunity because we’d be paying a lot for the downside protection and a bit of extra time premium that goes beyond the dividend payment. Because EMN does not have weekly options, we are forced to pay for an extra week of time premium.

For this trade to work, we would need implied volatility to be lower. Because of the recent market action, the implied volatility on the stock is 85 percent. Historically, EMN’s volatility has been about 32 percent, or slightly more than double the market.

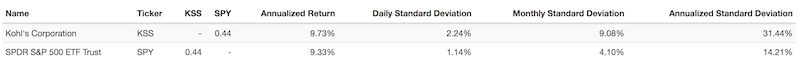

(Source: Portfolio Visualizer)

This would normally make the premium about $0.95 per share for an option trading with nine days to expiry. This is still more than our $0.66 dividend. However, with three days to expiry, our premium could typically decline to around $0.55 per share (i.e., holding implied volatility constant and adjusting the time premium).

This would give us a positive spread between the dividend and options premium. If we factor in fees and other trading costs (e.g., options are less liquid and thus typically have wider spreads than the underlying security), this would reduce the profit potential further. For every 100 shares, we could be making around $10, or about $100 for every 1,000 shares. In percentage terms, this would come to around a 0.2 percent profit potential – i.e., $10 per 100 shares divided by the cost of 100 shares ($4,750).

But note that other traders are looking for the same opportunities, which would likely boost the demand for put options leading up to the ex-dividend date. The disbursement of a dividend will have an impact on the share price proportional to its size, and is therefore a factor in determining implied volatility.

Example #2

Kohl’s (KSS) is set to go ex-dividend on a Tuesday this quarter. The record date will be a Thursday. So that makes the Friday expiry after the ex-dividend date a good choice.

The stock’s dividend this quarter will be $0.70 per share or $70 per 100 shares.

The stock is currently trading at $28.35 and options for this stock are currently trading for $1.85 for the 29 put with nine days to expiry.

If we wait over the weekend, the time premium will be lower. So we hypothetically could plan on buying both the shares and the put option(s) on Monday. Since we plan on doing dividend arbitrage, we naturally don’t need much time premium since naturally this is a trade intended for dividend capture purposes.

Again, due to volatile markets, we are facing a high implied volatility for this stock. Based on the current price of the option, this backs out an implied volatility of 84 percent. If we wait until Monday, our time decay whittles away some of the cost, so our premium – holding price constant – will be around $1.36.

Taking into account the “moneyness” of the option – the strike price of the put option is 29; the stock price is $28.35, giving it an intrinsic value of $0.65. If we take into account the $0.70 per share dividend, this totals to $1.35 ($0.65 intrinsic value plus $0.70 dividend value).

This means it’s only slightly unprofitable. Given transaction costs and spreads, this would be somewhat worse than the $0.01 per share differential.

Accordingly, we would also not be able to execute a dividend arbitrage trade on this stock. Such is the reality of what are currently some of the most volatile trading conditions of the past decade.

KSS is similar to our previous example given that the stock typically trades at about twice the volatility of the overall market.

Similar to all cases of potential dividend arbitrage, fellow “dividend arbitrage seekers” looking for the same opportunity may prevent the option’s price from cheapening to the level we would like.

Takeaways from these examples

Dividend arbitrage can be hard to execute for a couple main reasons.

(i) The price of an option is partially dependent on its implied volatility (IV). Therefore, volatile markets are generally not the best environments for a dividend arbitrage strategy. If the combination of the implied volatility and time premium is too high relative to the dividend, then the trade isn’t eligible to be termed “dividend arbitrage”.

There could of course be a reason why you’d want to own a put option in this case – either as a hedge beyond dividend payment reasons or as a limited risk way of betting against a stock. But it would not be considered dividend arbitrage.

(ii) Arbitrage is only truly arbitrage when there’s an inefficiency in the market. By nature, they should be fleeting. Other traders are looking for the same opportunities. Making a risk-free profit in the markets is rare. The only traditional risk-free source of return is cash (i.e., short-term government paper).

Conclusion

Dividend arbitrage is a trading strategy that involves purchasing a stock and put options before the ex-dividend date.

Executed well, it will involve exercising the put to offset the drop in the stock price associated with the disbursement of the dividend payment. Accordingly, a trader could obtain a low-risk way of profiting off the downside of a dividend-paying stock once dividends are issued.

Dividend arbitrage is most likely to be viable in a market environment where volatility is low, which will feed into low implied volatility and a cheap price for the option. Volatility regimes tend to follow a sequential relationship where volatility in the immediate future is likely to be proportionate to that seen currently or in the very recent past (relative to other random points in time). Accordingly, today’s volatility is likely going to be relatively highly correlated to volatility over the next several days.

Note that true dividend arbitrage opportunities are going to be relatively rare. The markets are competitive and other traders are also looking for opportunities where they can make money with the lowest possible risk.

Effective arbitrage opportunities in the public markets are typically spotted by machines specifically programmed to find them. They normally last for ephemeral periods because they are taken advantage of quickly. When they do exist the returns on them are small, which means large amounts of capital can be needed to benefit from their occurrence. Moreover, capital movements affect market pricing.

These opportunities are nonetheless viable from time to time. Not just in public markets, but entire business models are built around the concept of arbitrage. Drop-shipping involves buying a product in a cheap location and selling it at a more expensive price in another. Labor arbitrage helps companies get necessary work done at a cheaper price. When companies profitably buy ads from Facebook, Google, and other advertising networks, they are arbitraging the cost of the clicks/leads into a higher value over the course of time by selling these leads products and services.

You can find arbitrage opportunities in a variety of markets (financial markets, goods and services markets) and in many different ways. Dividend arbitrage is another to add to the toolbox.