EagleFX Review 2025

Please see the list of similar brokers or the Best Brokers List for alternatives.

Pros

- EagleFX offers 24/7 support (no phone option) that performed well during testing and 30+ cryptos, making it well-suited for traders navigating volatile crypto markets.

- EagleFX requires only $10 to open an account, making it accessible for beginners or those who want to start trading with minimal risk.

- EagleFX offers an unlimited MT4 demo account and zero inactivity fees, making it attractive to traders seeking a risk-free environment to develop day trading strategies.

Cons

- EagleFX seriously needs to step up its education with extremely basic guides and no learning articles added since 2022, made worse by the lack of market insights from analysts.

- The range of 170+ instruments on the EagleFX platform will be extremely limiting for advanced traders, especially compared to category leaders like Blackbull with its 26,000+ tradable assets.

- EagleFX still only offers MetaTrader 4 (MT4) and lacks support for other increasingly popular platforms like MetaTrader 5 (MT5), cTrader, or TradingView, limiting flexibility for traders with specific preferences.

EagleFX Review

EagleFX ceased operations and merged with LHFX in March 2025. If you were considering trading with EagleFX, take a look at our LHFX review.

Regulation & Trust

2 / 5Established in 2019, EagleFX was owned and operated by EagleFX Ltd, a company registered in the Commonwealth of Dominica.

Dominica does not regulate online trading activities, so EagleFX operates without oversight from any recognized financial regulatory authority.

This lack of regulation means that your funds are not protected by regulatory safeguards such as investor compensation schemes, which is a significant consideration. In the event of EagleFX’s insolvency, for example, your chances of getting your money back are slim.

EagleFX

Interactive Brokers

Dukascopy

Regulation & Trust Rating

Regulators

FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM

FINMA, JFSA, FCMC

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Accounts & Banking

2.5 / 5Live Accounts

EagleFX offers a single account. This account requires a minimum deposit of $10 and provides leverage of up to 1:500 for forex and metals, 1:200 for indices and energies, 1:100 for cryptocurrencies, and 1:20 for stocks.

EagleFX also offers a swap-free (Islamic) account for traders adhering to Islamic principles. This account replaces swap or rollover interest on overnight positions with administrative costs to comply with Sharia law.

To remain competitive, EagleFX needs to introduce professional and RAW accounts:

- A professional account could target high-volume and experienced traders who prioritize cost-efficiency and enhanced trading tools. These accounts could offer tighter spreads, reduced commission rates, and access to higher leverage options.

- A RAW account would provide variable spreads starting from 0.0 pips and charge a commission per lot traded. It is typically preferred by short-term traders, particularly scalpers and algorithmic traders, who require rapid order execution and consistent pricing accuracy.

Demo Accounts

Opening a demo account with EagleFX is quick and easy. You don’t have to register for a full live account before you can open a demo account. To get started, you just have to enter your name and email address.

After confirming my email address, I was able to familiarize myself with the MT4 trading platform and explore various trading instruments under actual market conditions on my desktop, web browser, or mobile device without risking real money.

This account has virtual funds so that you can practice without financial risk. You can also choose leverage settings and a demo balance to match your preferences.

Notably, the demo account has no time restrictions, so you can use it for as long as needed to refine strategies before transitioning to live trading.

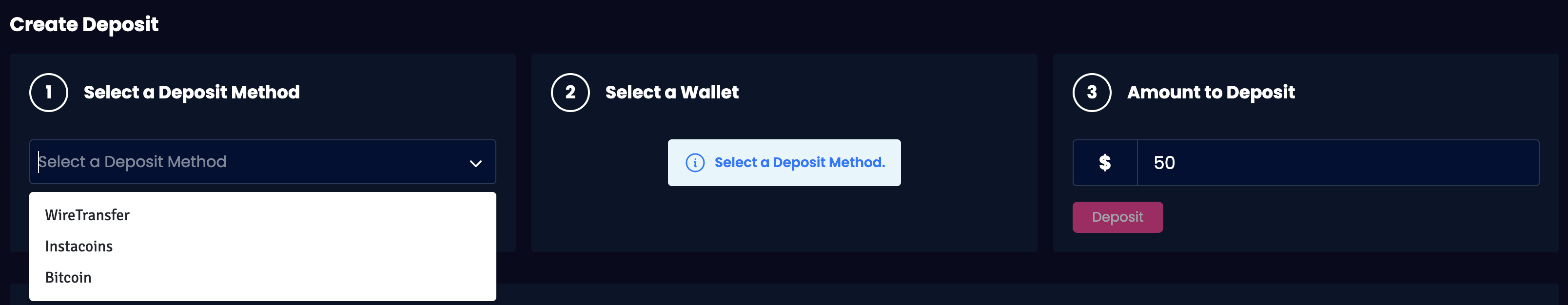

Deposits & Withdrawals

EagleFX’s funding options are amongst the most restrictive I’ve encountered during tests of dozens of brokers.

There are just two methods: Bitcoin payments, with a $10 minimum, and Instacoins, a third-party provider requiring a $50 minimum.

- Instacoins lets you purchase Bitcoin via credit cards, debit cards or bank transfers, which are then automatically transferred to your EagleFX account. This method is more longwinded than transferring Bitcoin from a wallet, but it feels more secure.

- Bitcoin can then be traded from its base account or converted to EUR, USD, or GBP accounts. It then has to be transferred internally to the appropriate MT4 account, another step I don’t appreciate.

Deposit processing times range from 1 to 6 hours, depending on blockchain traffic. Withdrawals are processed using Bitcoin, with no fees. Most withdrawals are completed within 30 minutes, requiring a minimum of $10 and no maximum limit.

For enhanced user experience, it would be good to see the platform supporting mobile payment solutions such as PayPal, Skrill, or Neteller, alongside traditional bank transfers for more significant transactions.

Furthermore, I prefer to see deposit and withdrawal options available in multiple currencies, as I am hesitant to move Bitcoin frequently due to the associated risks and transfer fees.

EagleFX

Interactive Brokers

Dukascopy

Accounts & Banking Rating

Payment Methods

Bitcoin Payments, Credit Card, Debit Card, Mastercard, Visa, Wire Transfer

ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer

Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer

Minimum Deposit

$10

$0

$100

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Assets & Markets

3.3 / 5EagleFX’s asset collection is considerably smaller than category-leading brokers like BlackBull, which offers 26,000+ instruments.

The complete list of tradable assets includes:

- Forex: 50+ pairs including majors (eg EUR/USD), minors (eg EUR/CAD) and exotics (eg USD/MXN)

- Stocks: 70+ stocks from leading US and EU companies like Amazon, Societe Generale and Deutsche Bank

- Indices: 10+ major global indices including the Dow Jones, FTSE 100 and CAC 40

- Commodities: 6+ commodities such as gold, silver and oil

- Cryptocurrencies: 30+ coins including Bitcoin, Ethereum and Ripple

- Futures: UD dollar

Expanding its stock coverage to include more global exchanges and introducing commodities beyond metals and energies, such as agricultural products, would attract a broader range of traders. Increasing the variety of futures contracts would further enhance its appeal.

The platform also lacks passive investment options (real stocks, real ETFs) and a copy trading service, as found at AvaTrade, eToro, and Pepperstone.

EagleFX

Interactive Brokers

Dukascopy

Assets & Markets Rating

Trading Instruments

CFDs, Forex, Stocks, Indices, Commodities, Crypto

Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies

CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options

Margin Trading

Yes

Yes

Yes

Leverage

1:500

1:50

1:200

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Fees & Costs

3.8 / 5EagleFX employs an ECN/STP model, ensuring direct access to liquidity providers without dealing desk interference, which enhances trade execution speed and reduces slippage.

The commission is competitive at $6 per lot round turn, while spreads vary with market conditions and liquidity. For major forex pairs, floating spreads came in as low as 0.1 pips during testing, with typical figures around 0.8 pips for EUR/USD and 0.9 pips for EUR/GBP.

Indices spreads, such as 1.2 for the FTSE 100 and 1.1 for the Nasdaq 100, are also competitive.

Swap fees apply for overnight positions, of course, but there are no deposit, withdrawal or inactivity fees.

| EagleFX | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.8 | 0.08-0.20 bps x trade value | 0.1 |

| FTSE Spread | 1.2 | 0.005% (£1 Min) | 100 |

| Oil Spread | 0.09 | 0.25-0.85 | 0.1 |

| Stock Spread | Variable | 0.003 | 0.1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

2.5 / 5EagleFX offers only MT4 and lacks a proprietary platform, which can make trading more complex for beginners who might benefit from a more straightforward interface.

IC Markets, by comparison, offers MT4, MT5, cTrader, and TradingView, ensuring a wider variety of platforms for active traders with different needs.

MT4, available on desktop, web, and mobile, is a widely popular trading platform. It is particularly renowned for its robust technical analysis tools and compatibility with Expert Advisors (EAs) for automated trading.

Although I find its interface outdated, it does have many powerful features, like multiple order types and high-speed execution, which are critical for day trading strategies.

However, the platform has its downsides. It lacks the advanced features and broader asset coverage of its successor, MT5, and beginners may find its technical tools overwhelming.

The platform’s limited compatibility with modern trading features like social trading also restricts its appeal compared to newer platforms like TradingView.

Watch my walk-through of the EagleFX trading platform below to get a feel for how it works, from setting up charts to placing trades.

EagleFX

Interactive Brokers

Dukascopy

Platforms & Tools Rating

Platforms

MT4

Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower

JForex, MT4, MT5

Mobile App

iOS & Android

iOS & Android

iOS & Android

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Research

0.5 / 5EagleFX provides limited research tools, putting it far below firms like Swissquote in this category.

While you can access basic market data and utilize MT4’s built-in charting and analysis features, the broker does not offer proprietary research tools.

To improve, EagleFX must introduce research tools such as an economic calendar, daily market insights, and expert analyses.

Additionally, integrating interactive tools like sentiment indicators and AI-based trading suggestions could help me to make more informed decisions.

If it lacks the resources to create its own content, it should license third-party tools from Autochartist, Trading Central, or Signal Centre.

Expanding these offerings would significantly enhance the trading experience for beginner traders.

| EagleFX | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

0.5 / 5EagleFX offers no educational material or structured resources like courses, tutorials, or webinars, falling miles behind category leaders like IG, which hosts its own Academy.

While some information in the ‘Education’ section on the website may be relevant to retail traders, the primary emphasis is on affiliate recruitment and growth.

At a minimum, the broker should develop educational content, such as beginner guides, to appeal to new traders.

| EagleFX | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

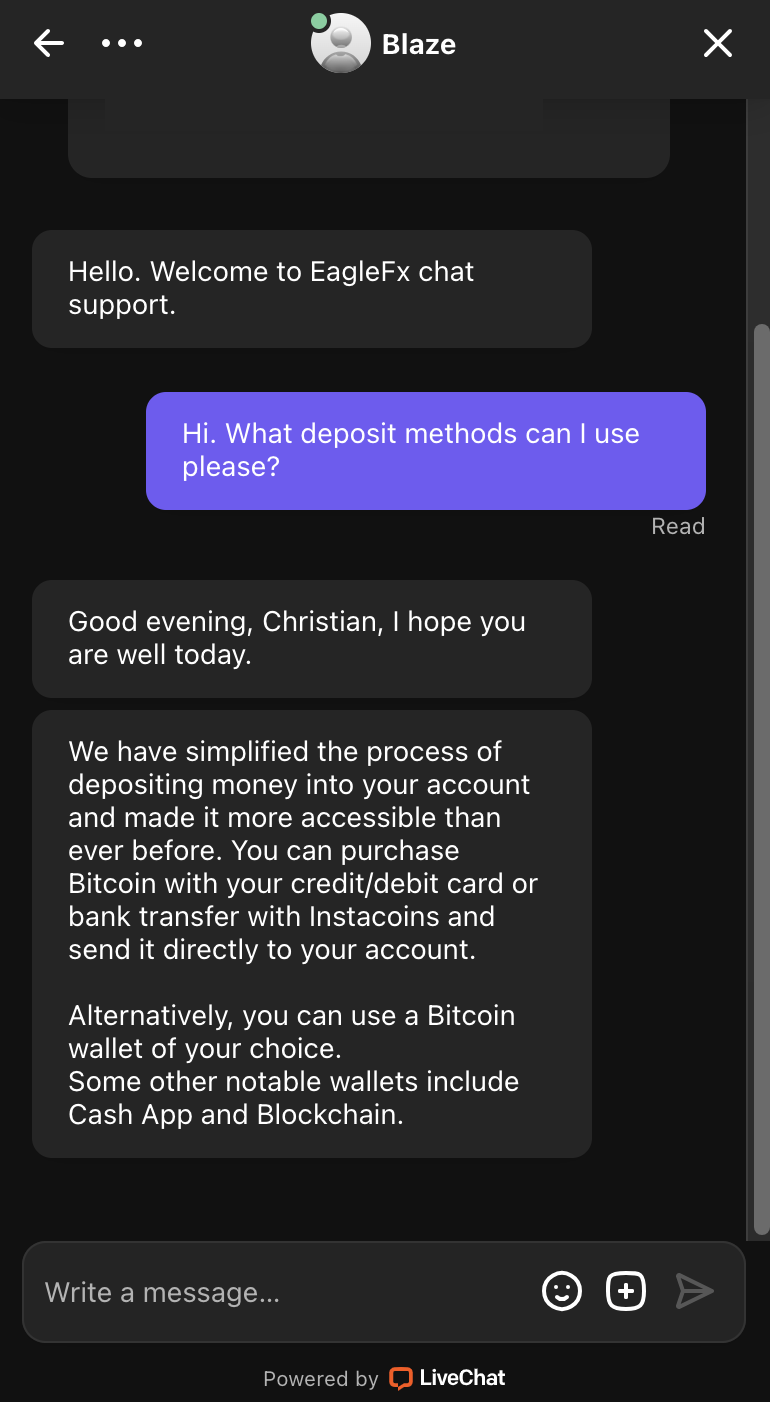

4 / 5EagleFX offers multiple customer support options available 24/7.

The fastest way to reach the broker is via live chat, which provides near-instant responses. From my experience, the staff are knowledgeable and polite.Submitting a support ticket via the website is another option for those who prefer not to chat. Based on our latest tests, the average response time is under a couple of hours.

Additionally, if you prefer speaking over the phone, you can request a callback, with a typical response time of around four hours. However, EagleFX does not provide a direct telephone line for immediate support.

The FAQ page covers a wide range of common questions, including account management, deposits, withdrawals, and trading specifics.

My only disappointment with EagleFX’s support options is the lack of video tutorials, which I’ve come to appreciate with brokers like Axi.

EagleFX

Interactive Brokers

Dukascopy

Customer Support Rating

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Should You Day Trade With EagleFX?

Whether you should day trade with EagleFX depends on your priorities and trading needs.

The broker offers attractive features such as a low minimum deposit, high leverage, and access to 24/7 cryptocurrency trading. Its use of MT4 also ensures a reliable trading platform with robust technical tools.

However, EagleFX’s lack of regulatory oversight, complete absence of any education or research resources, and lack of a proprietary or simplified platform may raise concerns, especially for beginners.

If transparency and regulation are essential, consider exploring other day trading brokers with stricter compliance and broader features.

FAQs

Is EagleFX Legit Or A Scam?

While the trading services offered by EagleFX appear legitimate and functional, there are concerns regarding its regulatory status that potential users should consider.

The company is registered in the Commonwealth of Dominica, which does not provide regulatory oversight for forex trading. This lack of regulation means EagleFX is not subject to the stringent rules and protections enforced by recognized financial authorities, such as investor compensation schemes.

Despite these issues, EagleFX has good trading conditions, including low deposit requirements, competitive leverage, and 24/7 customer support.

Potential clients should exercise caution, conduct thorough research, and consider these factors before trading with EagleFX.

Is EagleFX Suitable For Beginners?

EagleFX can be suitable for beginners due to its low minimum deposit requirement and fast trade execution, but it lacks in almost every other area.

While it offers a demo account that allows traders to familiarize themselves with the MetaTrader 4 platform, it lacks structured educational materials or research tools such as tutorials, webinars, podcasts, in-depth market analysis, or actionable trading signals.

Beginners may also find it challenging to make deposits and withdrawals due to the broker’s reliance on cryptocurrencies.

Top 3 Alternatives to EagleFX

Compare EagleFX with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

EagleFX Comparison Table

| EagleFX | Interactive Brokers | Dukascopy | World Forex | |

|---|---|---|---|---|

| Rating | 4.1 | 4.3 | 3.6 | 4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $10 | $0 | $100 | $1 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | – | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | SVGFSA |

| Bonus | – | – | 10% Equity Bonus | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5 |

| Leverage | 1:500 | 1:50 | 1:200 | 1:1000 |

| Payment Methods | 6 | 6 | 11 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by EagleFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| EagleFX | Interactive Brokers | Dukascopy | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

EagleFX vs Other Brokers

Compare EagleFX with any other broker by selecting the other broker below.

Customer Reviews

5 / 5This average customer rating is based on 1 EagleFX customer reviews submitted by our visitors.

If you have traded with EagleFX we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of EagleFX

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

DO NOT CHANGE ANYTHING EAGLEFX!!!! You guys are awsome. Great platform and company. I have been in demo for 3 months and have perfected my skill thanks to EAGLEFX great features and simplicity.