eToro Review 2026

See the Top 3 Alternatives in your location.

Awards

- Best Crypto Broker Runner Up 2025 - DayTrading.com

- Best Cryptocurrency Trading Platform 2022 - Finder

- Education Materials/Program 2022 - Investment Trends

- Best Copy Trading Platform 2021 - Ultimate Fintech Awards

- Best Multi-Asset Trading Platform 2021 - Ultimate Fintech Awards

- Best Stockbroker 2021 - Ultimate Fintech Awards

- Best Social Trading Platform 2019 - ADVFN International Financial Awards

Pros

- The eToro Club entry barrier has been lowered, with a $4.99/month subscription providing access to 18 perks, including a debit card that turns shopping into equities with 4% back in shares.

- The copy trading app facilitates a best-in-class social environment, with an engaging social feed and community chat that we love using.

- The web platform and mobile app perform better in user reviews and app rankings than top competitors, including AvaTrade.

Cons

- There is a $30 minimum withdrawal amount and a $5 fee, which will affect novices with low capital.

- There are no guaranteed stop loss orders which would be a useful risk management feature for beginners.

- The lack of additional charting platforms like MT4 will reduce the appeal for seasoned day traders accustomed to using third-party software.

eToro Review

In this in-depth review of eToro, we’ve gone beyond the surface – collecting over 200 data points across eight key areas and combining them with real-world experience.

One of our long-time team members has traded on eToro for years, and their firsthand insights – alongside analysis from the industry experts on our testing panel – help paint a true picture of what it’s like to use the platform day to day.

Regulation & Trust

eToro continues to uphold its reputation as one of the most trusted platforms, earning a very high regulation and trust score.

The broker has measures in place to ensure security and compliance with industry standards and is authorized by multiple reputable ‘green tier’ authorities in DayTrading.com’s Regulation & Trust Rating, including:

- Financial Conduct Authority (FCA)

- Cyprus Securities & Exchange Commission (CySEC)

- Australian Securities & Investments Commission (ASIC)

2025 saw eToro file for an initial public offering (IPO), with plans to list on the NASDAQ under ticker ETOR. If it comes off, the brokerage will be subject to even stricter disclosure requirements, boosting transparency and potentially earning it an even higher trust score in our proprietary rating system.

Several of eToro’s competitors have already gone public, notably FOREX.com (NASDAQ: SNEX), IG (LSE: IGG), and XTB (WSE: XTB).

As with any investment platform, there are inherent risks associated with trading. However, eToro takes steps to secure user funds by segregating client funds from the company’s operational funds. Additionally, the platform uses encryption and security protocols to protect user data.

Accounts & Banking

I’ve given eToro a high accounts and banking rating for its simple account offering and wide range of payment methods, though its withdrawal fee brings its score down slightly.

Live Account

The single live account offers a beginner-friendly $10 minimum deposit and can be opened easily within minutes.

That said, the first deposit requirement varies quite significantly by location, ranging from $10 to $10,000. Most clients will likely fall into the $50 and $100 deposit requirement.

Nonetheless, the all-in-one account solution means that retail traders get access to the broker’s full suite of markets, tools and resources from one unified account, making it a great option for beginners looking for simplicity and convenience.

It’s also good to see that a professional account is available for experienced traders who meet specific criteria, as well as an Islamic account which complies with Sharia law.

Additionally, we’ve bumped eToro’s Accounts & Banking Rating after it’s finally brought in EUR and GBP solutions alongside its USD feature, creating a more tailored trading experience for British and European traders while reducing conversion fees.

On the downside, day traders, scalpers, and algo traders may feel disappointed that there’s no choice of account conditions, such as raw ECN pricing. If this is important to you, IC Markets is an excellent alternative.

Deposits & Withdrawals

eToro provides a strong range of payment methods, including bank transfers, credit/debit cards, PayPal, Skrill, Neteller, and various other local payment options, depending on your location.

Minimum deposits start from $10, which is reasonable, though some alternatives do not impose a minimum amount.

Importantly, deposits to a live account are free, but a withdrawal fee of $5 applies (plus a frustrating minimum withdrawal of $30). However, Platinum, Platinum+, and Diamond Club members enjoy discounted withdrawal fees, among other perks.

During testing, deposits on eToro were typically processed quickly, often instantaneously or within a few business days, depending on the method used. Withdrawals typically take longer due to verification processes and banking procedures, usually ranging from a few business days to a week.

The recently introduced eToro wallet, named eToro Money, operates as a distinct mobile app enabling you to conveniently deposit, withdraw funds, and manage cryptocurrencies.

I’ve used eToro for over 3 years and can happily report that I have never had an issue depositing or withdrawing funds.

However, it’s worth bearing in mind that funds are automatically converted to USD in order to trade, so you can usually get a better conversion rate elsewhere and then import USD directly into eToro.

2025 saw eToro bolster its range of payment methods by accepting Bitcoin (BTC) and Ethereum (ETH). To fund or withdraw from eToro with crypto, transfer it to your eToro Crypto Wallet, sell it for fiat (such as GBP), and the funds will appear in your trading account.

Demo Account

eToro offers a free demo account to practice trading with virtual funds across all assets. The account comes with a generous virtual sum of $100,000.

The demo account provides a risk-free environment for you to explore the platform, test different trading strategies, copy the trades of other investors, and familiarize yourself with various assets before trading with real money.

Popular Investor

eToro’s Popular Investor Program is a unique feature for traders who allow others to copy their strategies.

The program encompasses four tiers: Cadet, Champion, Elite and Elite Pro. To attain the first paying level (Champion) and receive a monthly payment of $500, you must possess over $5k in account equity, draw in $50k in assets from clients copying your strategies, and uphold a maximum day risk score below 7 for a minimum of four months.

Benefits for Popular Investors include fee discounts, monthly payments, and a management fee for those reaching Elite status. Reaching the top-level ‘Elite Pro’ status rewards you with a 1.5% AUM bonus (annual).

Assets & Markets

eToro gets a high assets and markets rating for its huge investment offering spanning popular asset classes and regions.

The broker is continually broadening its asset selection, now boasting over 6,000 instruments – more than two of our Award winners, AvaTrade and Pepperstone, as you can see in the analysis below.

| eToro | AvaTrade | Pepperstone | |

|---|---|---|---|

| Number of Assets | 6,000+ | 1,250+ | 1,300+ |

This diverse range encompasses 55 forex pairs, 432 ETFs, 21 global stock indices, 32 types of commodities, and over 4,100 worldwide company stocks, including new ways to trade Dubai’s top stocks.

Fractional shares are an added bonus, reducing entry barriers for beginner investors by allowing partial ownership of single shares.

eToro was also an early adopter in cryptocurrency trading, offering one of the largest arrays of crypto tokens – I can currently access over 100 from my dashboard, though this may vary by location.

The platform actively strives to expand this market by adding new tokens as they gain wider acceptance. The platform further bolstered its suite of digital tokens in 2025, adding 29 new cryptos in April, from gaming and DeFi to AI tokens and memecoins.

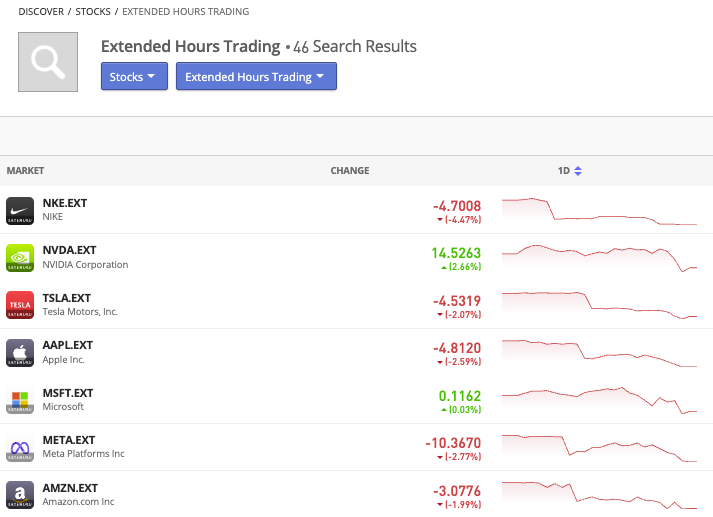

Additionally, eToro’s provision of out-of-hours stock trading is advantageous, enabling you to trade prominent U.S. stocks during extended hours, and presenting fresh trading opportunities, including renowned names like Tesla, Amazon, and Netflix.

I’m able to trade an impressive selection of 46 extended-hours stocks in my real-money account.

Fees & Costs

Trading Fees

eToro earns a strong cost rating for its competitive spread quotes and low non-trading fees, though it trails the cheapest brokers.

Importantly, I don’t recommend choosing eToro if you’re looking for the tightest spreads for day trading. Quotes on major currency pairs like EUR/USD are around 1 pip, which doesn’t contend with the near-zero spreads offered by top ECN brokers like Pepperstone. That said, many ECN brokers do charge a small commission on top of the spread.

To show you how eToro stacks up to more suitable alternatives, I’ve compared quotes on a few notable assets during peak market hours below. As you can see, spreads are not the lowest but contend well overall.

| eToro | OANDA | AvaTrade | |

|---|---|---|---|

| EUR/USD | 0.9 | 0.8 | 0.9 |

| S&P 500 | 0.75 | 0.4 | 0.25 |

| Crude Oil | 0.05 | 3 | 0.03 |

It’s also good to see that traders can access stocks commission-free, enabling purchases in bulk or fractional shares from as low as $10.

2025 also saw a welcome addition to the way eToro charges for crypto trading fees. Where it used to include commissions within the spread, eToro now charges the same commission separately, boosting transparency for short-term traders.

Non-Trading Fees

Trading in a currency other than USD, EUR and GBP may involve conversion fees based on your account denomination and live foreign exchange market rates.

Notably, after 12 months of inactivity, a $10 monthly fee will be charged on any remaining available balance. This won’t impact active traders but casual investors should keep this in mind. Alternatively, Pepperstone does not charge an inactivity fee.

Platforms & Tools

eToro’s unique selling point is its feature-rich in-house application and all-in-one account dashboard, earning it a high platforms and tools rating.

Web Platform

While this may feel restricting for experienced day traders who are accustomed to using third-party solutions like MetaTrader 4, I’m confident that newer traders will enjoy using this software.

Importantly, the broker also regularly enhances the platform and I’ve summarized some of the latest features below.

Design & Navigation

The platform and its widgets are accessible via major web browsers or as downloadable mobile apps for iOS and Android devices, ensuring compatibility with both PC and Mac systems.

The interface is very straightforward and user-friendly, equipped with easily accessible features and navigation tools, making it particularly suitable for beginners.

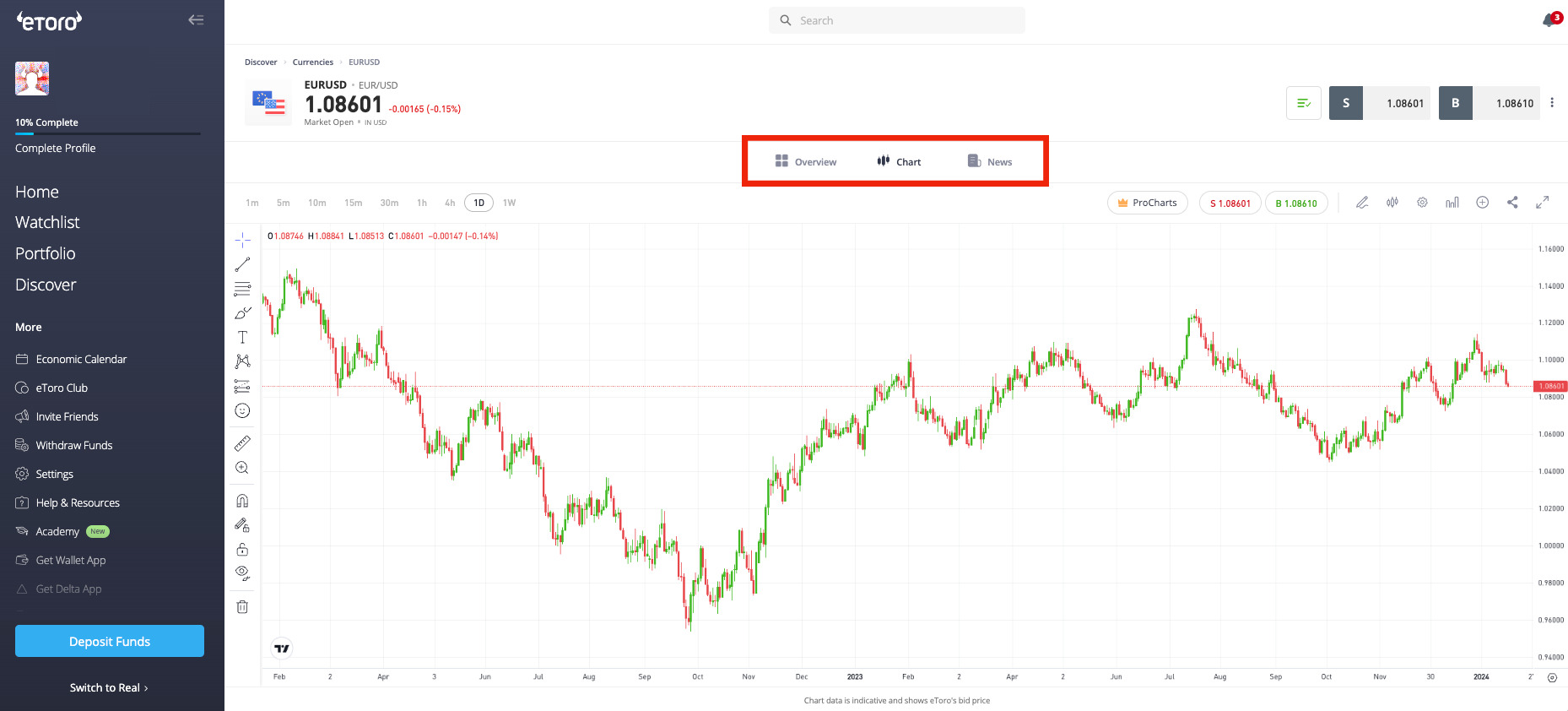

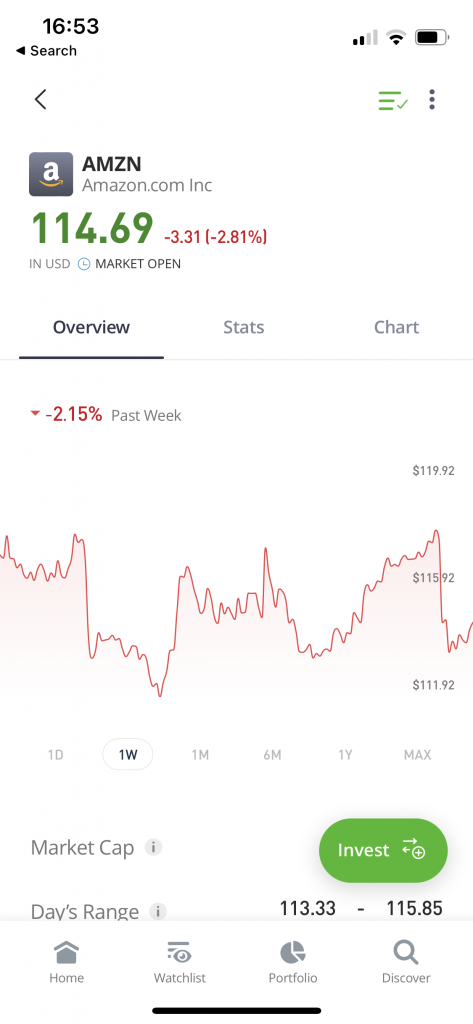

Each asset can be viewed in 3 different modes:

- Overview – A summary of the asset’s key details, performance statistics and latest news, plus a Twitter-style community discussion feed

- Chart – A real-time chart packed with technical analysis features and trade order functionality

- News – A live news feed relating to the chosen asset, delivered by top-tier news sources

All other functions, including educational resources and account settings, are located in the left-hand panel, providing a seamless all-in-one dashboard.

Charting Tools

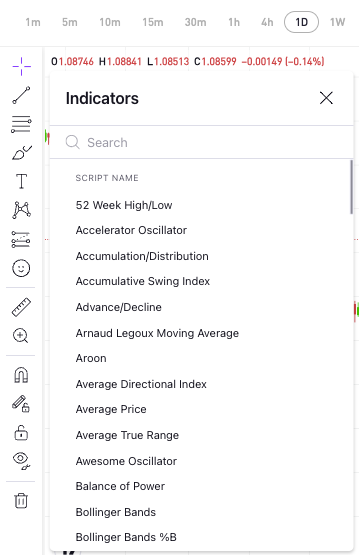

Despite its beginner-friendly feel, eToro hasn’t compromised on technical analysis features.

Charts are powered by TradingView, a highly respected third-party platform.

With this, you get access to 9 chart types, including hollow candles and Heikin-Ashi, plus an impressive suite of over 100 technical indicators including bollinger bands and relative strength index. There are also dozens of drawing tools for detailed chart analysis.

Extra Features

The multi-asset platform incorporates various helpful functions, including one-click trading, TipRanks research, and a professional-grade technical analysis tool.

The ProCharts function offers a suite of indicators and drawing tools that will serve seasoned day traders, and allows you to save and select from preset layouts, enhancing the charting experience significantly.

However, I am disappointed that the ProCharts mode is only available to higher-tier users. In addition, fully automated trading systems such as those supported on MetaTrader 4 or cTrader are not permitted on eToro, which will disappoint algorithmic traders.

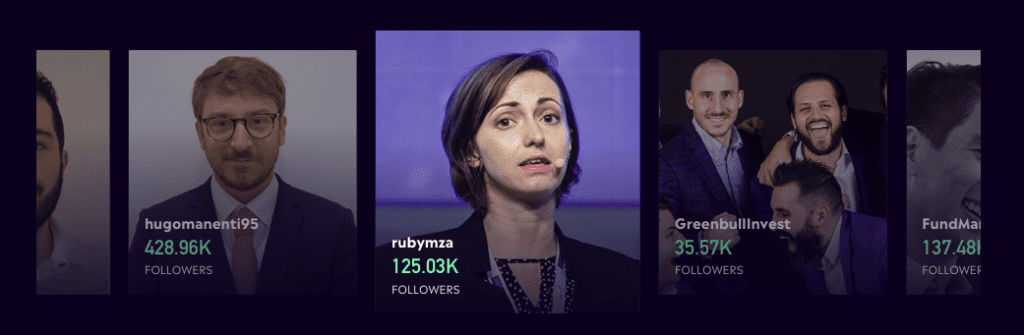

CopyTrader

From the same interface, you can also access the broker’s flagship CopyTrader which allows you to copy the trades of other investors.

You can easily search for investors by risk level, copy duration and asset type. You can also view various investor rankings to narrow down your search, including most copied and trending investors.

Traders also get full control over their copied trades, with the ability to start, stop and change their copied investments at any time.

Smart Portfolios

eToro Smart Portfolios are investment products that allow you to invest in thematic portfolios managed by eToro’s investment team.

Unlike copying a Popular Investor (a third-party investor), eToro’s Smart Portfolios are designed to follow specific investment strategies or market trends.

Instead of picking individual assets, you can choose a Smart Portfolio that aligns with your goals or interests, such as technology, clean energy, crypto, etc.

Pros:

- Unlike traditional investment funds, Smart Portfolios come with no management fees.

- eToro’s ‘experts’ actively manage the Smart Portfolios, adjusting asset allocation to reflect changing market conditions. In some cases, algorithm-driven strategies are also used to automate adjustments.

Cons:

- The most significant disadvantage of Smart Portfolios is the lack of customization.

- While these portfolios offer a ‘professionally’ managed investment option, investors have little control over the individual assets or the specific allocation within the portfolio.

- This means that if an investor has specific preferences or wants to tailor their investments to align with personal risk tolerance, market views, or ethical considerations, they may find the lack of flexibility limiting, especially as the performance of a Smart Portfolio can be significantly affected by broader market conditions beyond the manager’s control.

These eToro Smart Portfolio are an excellent opportunity to align your investment portfolios with specific trends or personal values while seeking potential growth opportunities.Being able to invest in a specific theme, such as ‘renewable energy’ or ‘healthcare innovation,’ rather than a broad sector or market index, is appealing if you want to invest in ‘ethical’ companies, for example.

However, after reviewing the eToro selection, I found that many other copy trading options on the platform can better these Smart Portfolios’ returns.

Mobile App

The complimentary mobile trading app is tailored for traders on the move and is available for both iOS and Android devices.

The app provides real-time trading capabilities, access to historical trades, news updates, and customer service sections, offering full functionality on portable devices.

I find the mobile app to be intuitively designed and easily navigable, preserving all the essential features of the web platform. Regular updates also ensure that all versions of the app remain up-to-date with the latest functionalities.

Research

eToro’s research offerings have steadily improved, now standing as a competitive force in the market and upholding its excellent research rating.

The introduction of weekly video updates featuring market analysis and in-house research articles positions eToro closer to top research brokers like IG.

eToro also presents an economic calendar, earnings reports calendar, news headlines, daily market analysis series, and podcasts. However, some of these features aren’t directly integrated into the eToro platform, which makes for a less convenient user experience.

Trading Central is accessible but exclusively offered to select eToro Club members at specific tier statuses. Moreover, only funded account holders can access research reports for stocks.

While eToro excels in incorporating fundamental analysis into its shares trading platform and daily blog articles, it lacks robust technical analysis compared to industry leaders like IG. Integrating technical analysis could significantly enhance eToro’s Analyst Weekly series.

Nonetheless, eToro calculates sentiment data solely from top traders’ trades, distinguishing itself from typical sentiment tools offered by brokers that rely on all user data. This approach resembles CMC Markets’ display of sentiment data.

eToro could improve the accessibility of certain research tools for retail traders. For example, I’d like to see the Digest & Invest podcast series directly integrated into the platform.

Education

I’m equally impressed with eToro’s educational offering which is worthy of a high education rating.

The Learning Academy and blogs offer a comprehensive range of videos, articles, and weekly webinars which are tailored by experience level.

The categorized videos and articles are especially useful for beginners and provide insights into trading instruments as well as the essential considerations before investing.

eToro’s YouTube channel also hosts a considerable number of videos, including archived webinars and market analysis. The only real downside for me is that differentiating between research, promotional, and educational content can be challenging and frustrating.

While eToro remains a best-in-class educational broker, a clearer organization of educational content and tutorials would further help to balance eToro’s video content in this category.

Customer Support

I find eToro’s customer service options to be somewhat lacking for a broker of its stature, hence only a reasonable customer support rating.

While support is accessible 24/5 (Monday to Friday), the available channels are limited.

You can submit queries using the online chatbot (and eventually a live agent) or contact customer services via a ticketing system, but not having a dedicated helpline phone number or even a direct email address is disappointing.

For urgent matters, I had to email or phone my account manager directly, who is always very helpful.

On the plus side, the customer support team can address various queries, including account closure, overnight fees, risk scores for copy traders, account verifications, limits, and beginner guides to the broker’s trading platforms and investing apps.

Should You Trade With eToro?

There’s a lot to like with eToro. Its user-friendly interface and copy trading features cater perfectly to beginners and intermediate traders, and its large library of assets should suit most trading preferences. It’s also one of the most regulated platforms and has measures in place to ensure client safety.

There are some big caveats, however. In particular, trading options depend significantly on your jurisdiction, including market coverage, minimum deposits and payment methods. Also, its advanced charting tools are restricted to larger account holders, and smaller account holders are further penalized with withdrawal fees.

If you’re more interested in the automated aspects of copy trading and smart portfolios than low spreads and day trading, you should definitely give eToro a try.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational pur poses only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

FAQ

Is eToro Legit Or A Scam?

eToro is a legitimate company registered in several highly regulated jurisdictions and is one of the most recognized platforms for online trading.

While it has a large user base of over 30 million and generally positive reviews, as with any investment platform, there are risks involved in trading and there are no guarantees you will be profitable.

Can I Trust eToro?

eToro has a significant client base and operates under the supervision of multiple financial regulatory authorities. However, trust ultimately depends on various factors such as individual experiences, the understanding of risks involved in trading, and personal preferences.

Be sure to to conduct thorough research, and understand the platform’s features, fees, and risks before making any investment decisions.

Is eToro A Regulated Broker?

eToro is regulated by several financial authorities in different jurisdictions, including the UK’s FCA, CySEC in Cyprus, and ASIC in Australia.

These regulatory bodies impose strict standards and guidelines that eToro must comply with, ensuring a certain level of security and protection for retail investors.

Is eToro Good For Beginners?

eToro is one of the best options for beginners. The platform’s simple and intuitive interface makes it easy for newcomers to navigate, whilst its social trading aspect allows beginners to learn from more experienced traders.

Educational resources are also comprehensive, including articles, videos, and a risk-free demo account feature.

Does eToro Offer Low Fees?

eToro’s fee structure varies depending on the trades and assets you engage with.

In comparison to some other platforms, eToro’s forex and CFD spreads are higher, starting from 1.0 pip for major currency pairs. Additionally, there are relatively high overnight and withdrawal fees.

However, zero-commission trading for stocks and ETFs for non-leveraged positions in certain markets could be advantageous.

Is eToro A Good Broker For Day Trading?

eToro is not the best option for serious day traders. Based on tests, eToro’s execution time is slower than competitors, and stock trades in particular can take up to 15 minutes to execute.

eToro’s strengths lie more in social trading, long-term investing, and copy trading. For day traders looking for high-frequency and rapid execution trading, there are better platforms suited to those specific needs, including IG.

Does eToro Have A Good Trading App?

eToro offers a highly polished mobile app for both iOS and Android devices. The app allows you to access your eToro account, trade various assets, view market data, manage your portfolios, and utilize social trading features on the go.

The app also provides a user-friendly interface similar to the desktop version.

Best Alternatives to eToro

Compare eToro with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

eToro Comparison Table

| eToro | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 4 | 4.3 | 3.6 |

| Markets | Stocks, ETFs, Options, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $100 |

| Minimum Trade | $10 | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | Get A Free Stock Worth $50 | – | 100% Anniversary Bonus |

| Platforms | eToro Web, CopyTrader, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:30 EU | 1:50 | 1:200 |

| Payment Methods | 14 | 6 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by eToro and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| eToro | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | Yes |

| Silver | Yes | No | Yes |

| Corn | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | Yes | Yes | No |

| Options | No | Yes | No |

| ETFs | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

eToro vs Other Brokers

Compare eToro with any other broker by selecting the other broker below.

The most popular eToro comparisons:

- Libertex vs eToro

- eToro vs OKEx

- Trade Republic vs eToro

- Saxo Bank vs eToro

- Plus500 vs eToro

- eToro vs Binance

- eToro vs Expert Option

- ZuluTrade vs eToro

- Tiger Brokers vs eToro

- eToro vs Emirates NBD Securities

- eToro vs Interactive Brokers

- Skilling.com vs eToro

- eToro vs CMC Markets

- eToro vs Vanguard

- Trading 212 vs eToro

- eToro vs Trade Nation

- Olymp Trade vs eToro

- Moomoo vs eToro

- AvaTrade vs eToro

- Nexo vs eToro

Customer Reviews

4.3 / 5This average customer rating is based on 3 eToro customer reviews submitted by our visitors.

If you have traded with eToro we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of eToro

For Specific Countries

Article Sources

- eToro Website

- eToro (Seychelles) Limited - FSA License

- eToro (UK) Ltd - FCA License

- eToro (Europe) Ltd - CySEC License

- eToro Money Malta Ltd - MFSA License

- eToro (ME) Ltd - FSRA (ADGM) License

- eToro AUS Capital Limited - ASIC License

- eToro YouTube Channel

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

eToro is easily the best platform I’ve used for swing trading. Most other ones feel the same to me just MT4 with some basic support nothing special but eToro feels different. The platform is clean and simple to use and I like the Discover feature it actually helps you spot trading ideas. You can see popular stocks big movers or even copy other people’s portfolios. A lot of people talk big about eToro and for me it’s been worth it. Only thing is if you’re trading fast stuff like volatile stocks or crypto the execution can feel a bit slow. For swing trades it’s perfect but for fast in and out trades maybe not the best choice.

I signed up with eToro because I’d heard good things about the copy trading app and they’ve turned out to be mostly true. I really enjoy using the app, it’s got a super clean look and feel that makes looking for and following other traders simple, especially for beginners like me. I want to try the Smart Portfolios next, but the $500 minimum investment is pretty steep. Will try and remember to leave another comment to let you know how I get on.

A solid pick if you want social investing. The platform is easy to use and there are loads of traders to choose from. I find their support team hard to reach sometimes though, and the withdrawal fee is frustrating when lots of brokers don’t charge one.