ACY Securities Review 2024

Pros

- I feel reassured that ACY Securities is regulated by top-tier authorization, the Australian Securities and Investments Commission (ASIC), with negative balance protection and segregated client funds

- I was pleased to be able to choose between the industry-renowned MT4 and MT5 terminals, as well as the respective mobile apps and additional tools like Capitalise.ai

- The range of 15+ commission-free payment methods including POLi, Perfect Money, Skrill and wire transfer is competitive and aligns with top competitors

Cons

- Crypto traders will be disappointed that digital currencies are not offered

- I think it's a shame that the global entity is regulated offshore by the St Vincent and the Grenadines Financial Services Authority, so some traders may not receive the same safeguarding measures as the ASIC-regulated branch

ACY Securities Review

ACY Securities (ACY.com) is a forex and CFD broker founded in Australia in 2013. The firm is doubly regulated, offering global access to over 2,200 assets on two of the most popular day trading platforms, MT4 and MT5. Read our full 2024 review today to discover ACY Securities’ fees, assets, licensing, security and more.

ACY Securities Headlines

The firm was founded in 2013 in Melbourne, Australia as ACY Capital, run by CEO Jimmy Ye. In 2014, the company moved headquarters to Sydney and made a partnership with the world’s 5th largest forex enterprise, OANDA. This partnership allowed ACY to offer services such as professional forex market tutorials, up-to-date analysis and personal trading training.

The move to Sydney also marked the beginning of international expansion for the firm, which soon opened offices in China and other countries in Asia. 2018 saw the company acquire leading Australian forex dealer, Synergy Financial Markets (SynergyFX), and its customer base expanded around the world.

Now rebranded as ACY Securities with a clear and simple logo, the company has a strong focus on technology and offers a wide range of trading products including FX, stocks, indices, ETFs and commodities. The broker is an ECN broker that has no dealing desk (NDD) and offers zero spread accounts. ACY Securities uses interbank liquidity from 16 of the biggest banks and financial firms in the world.

The company is a reputable broker and has been recognised with several awards. Most recently, ACY Securities was awarded ‘Best Multi-Asset Broker in Australia in 2020’ by tech magazine Technology Era.

How To Open An ACY Securities Account

- Open An Account – Click the “Open An Account” button on the top right-hand corner of the site. You will then be asked to select your country and account type.

- Verify Your Account – You will need to complete a six-page registration form and upload any relevant ID documentation.

- Fund Your Account – Choose from a variety of methods to load your account.

- Begin Trading – Get started with stocks, forex, commodities or ETFs.

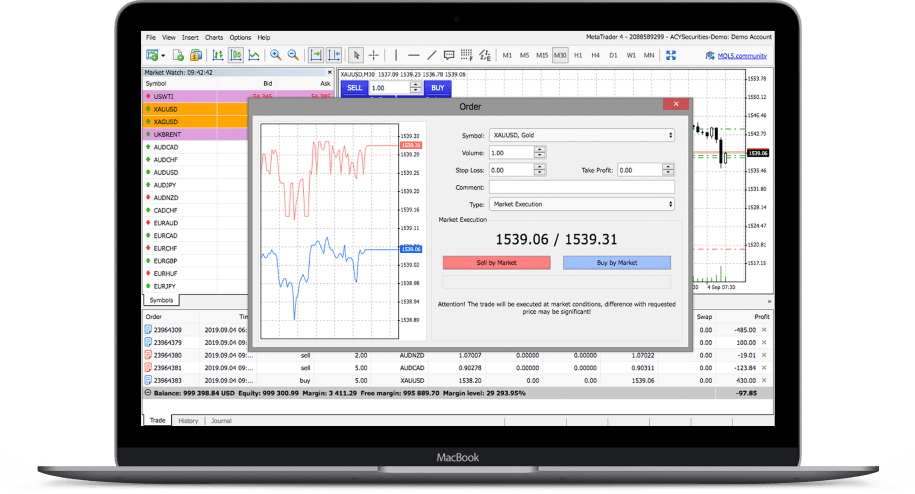

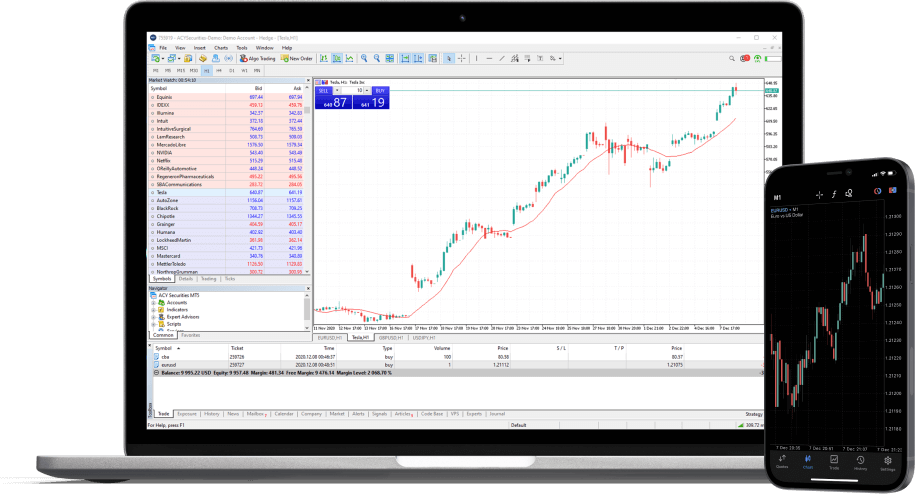

Trading Platforms

ACY Securities utilises the ever-popular MetaTrader 4 and MetaTrader 5 trading platforms. MT4 and MT5 are used by millions of traders and are optimised for desktop, web and mobile devices. You can download the MetaTrader app for Android (APK) and Apple (iOS) devices. The MetaTrader platform is widely used due to its comprehensive range of features and built-in tools, as well as its customisable and user-friendly layout.

MT4 supports multiple order types, including up to four pending orders. Users have access to 24 analytical tools and 30 inbuilt technical indicators and chart types, including lines, bars and candlesticks. All tradable assets can be displayed over nine timeframes.

MT5 is the successor to MT4 and, while holding much of the same functionality and layout, the newer version has access to global stocks, additional chart time frames, more order types, more technical indicators, depth of market (DOM) level II pricing, a built-in economic calendar and a multi-currency strategy tester.

Many firms choose only to offer proprietary software, which can often be clunky, slow and under-developed. ACY Securities chooses to operate with reliable MetaTrader platforms because they are known and trusted by traders around the globe.

Account Types

There are three account types available with ACY Securities, each catering to traders of different needs. Each type has access to up to leverage rates of 1:500, although this may vary depending on location. The minimum trading volume is 0.01 lots and accounts can be opened using USD, AUD, EUR, GBP, NZD, CAD or JPY.

Standard Account

The standard account requires a minimum deposit of $50. Spreads are variable with this account but a typical major currency pair like EUR/USD starts from 1 pip. There are no commissions with Standard accounts as fees are incorporated into the spread.

ProZero Account

This ACY Securities account type starts with a minimum deposit of $200 and spreads can be as low as 0.0 pips.

Bespoke Account

Bespoke Accounts are aimed at high-volume, professional traders. The minimum deposit is $10,000 and spreads start at 0.0 pips.

Islamic Accounts

If you contact ACY Securities customer support, they can convert your account to a swap-free Islamic account. Swap-free accounts are halal, not haram, and compliant with Sharia law. Swap-free trading is only available under the Standard account type.

Demo Accounts

Whether you want to get to grips with the platform or try out some trading strategies risk-free, demo accounts are a great way to refine your skills. Our ACY Securities found that the broker offers a demo account loaded with $100,000 in virtual funds. This account expires after 30 days and it is easy to switch to a live account at any time.

ACY Securities Fees

ACY Securities offers competitive, variable spreads that depend on your account type, assets and market conditions. Spreads can be as low as 0.0 pips for ProZero and Bespoke accounts and can be as high as 2-3 pips on Standard accounts.

There is no commission on standard accounts as fees are already accounted for in the spread. With a ProZero account, you can expect to pay a commission charge of USD 6/ AUD 8.5 on 1 full lot round turn for forex and metals and, with a Bespoke account, this goes down to USD 5 / AUD 7. There is no commission on indices.

ACY Securities provide fee-free withdrawals within Australia up to three times per month. Any further transaction will incur a fee of USD 25. If your receiving bank is outside of Australia, you will be charged a USD 25 service charge per withdrawal. Skrill will charge a 3% merchant fee per withdrawal. Deposits are also free of charge for Australians but international users may be charged for international bank transfers.

ACY Securities Assets

ACY Securities offer CFDs on over 2,200 different trading instruments including forex, metals, indices, commodities, ETFs and shares.

- Shares – MT5 users have access to over 800 global shares across the New York Stock Exchange (NYSE), the Nasdaq Exchange and the Australian Stock Exchange (ASX). These include Apple, Amazon, BHP, Commonwealth Bank and many more.

- ETFs – An Exchange-Traded Fund (ETF) is a financial instrument that tracks the performance of the top companies within a specific sector, for example, oil, technology or energy. There are over 75 ETF CFDs on the ACY Securities platform, including stock index ETFs, commodity ETFs and industry ETFs.

- Forex – The forex market is one of the largest and most liquid financial markets in the world. ACY Securities users can trade CFDs on over 60 FX pairs, including majors like EUR/USD, USD/JPY, GBP/USD; crosses like EUR/GBP, EUR/JPY; and commodity currencies.

- Commodities – Commodities are one of the most popular trading products in the world due to their constant presence in our everyday lives. At ACY Securities, you can trade a wide range of commodities including crude oil, natural gas and precious metals.

- Indices – A stock index CFD tracks the price movement of all the shares that make up that index. For example, the S&P500 index is made up of the top 500 public companies in the US. As the performance of each of these companies changes, so does the S&P500 index. With ACY Securities, you can access S&P500, Dow Jones, Nasdaq, Dax, FTSE, Euro Stoxx, Hong Kong 50, Nikkei, China A50 and the S&P ASX 200

Leverage

Leverage can be a way of making your money go further. By borrowing money from your broker, you can increase your position size and exposure to any potential profits, though losses are also magnified. ACY Securities state that leverage options can range up to 1:500, depending on account type and location. Typical leverage limits are as follows:

- TFs – 1:5

- Stocks – 1:5

- Forex – 1:30

- Indices – 1:20

- Commodities – 1:10

- Precious metals – 1:20

Deposits & Withdrawals

ACY Securities provides a variety of payment methods to cater to its international customer base. Deposits can be made using wire transfers (local and international), credit cards, debit cards, Skrill, Doku Wallet, POLi, PayPal, Neteller, FasaPay, Perfect Money, Trustly and China UnionPay. Simply login to your client portal, select “Cash Management” and click on “Deposit”. As mentioned earlier, ACY Securities charges zero deposit fees, though international bank transfers may incur charges. Bank transfers take 2-3 business days, card withdrawals take 3-5 business days.

Withdrawals can be made by making a withdrawal request on the Client Portal (Cloud Hub). Withdrawals received before 14:00 AEST are processed on the same day. Requests received after 14:00 AEST might not be processed until the next business day. It is possible to withdraw funds to your credit card using the acy.cloud client portal. Users can make three free withdrawals a month to banks located in Australia. Any further withdrawals or withdrawals to international banks will incur a USD 25 service charge. Skrill will also charge a 3% merchant fee per withdrawal.

Security & Regulation

ACY Securities is a privately owned company located in Chatswood, NSW, Australia. The firm holds two licenses: ACY Securities Pty Ltd (‘ACY AU’) is licensed and regulated by the Australian Securities and Investments Commission (AFSL 403863) and ACY Capital Australia LLC (‘ACY LLC’) is authorized by the St. Vincent and the Grenadines Financial Services Authority (SVGFSA). ACY Securities is the trading name of both ACY AU and ACY LLC. ACY AU takes on all Australian customers while ACY LLC caters to international customers, subject to local law and regulation.

Client funds are held in segregated accounts with the Commonwealth Bank Australia and HSBC bank, both of which are AAA-rated banks. Segregated accounts are a regulatory requirement and records are regularly maintained and audited to ensure full compliance. The ACY Securities FSG and PDS are available upon request or registration.

Customer Support

0 / 5ACY Securities has a well-trained and highly responsive customer support team on hand 24 hours a day, five days a week. The firm offers multilingual support and you can reach out via phone, email or live chat, located in the lower right corner of the website.

- Email: support@acy.com

- Taiwan Telephone Number: 02 5594 4927

- Australian Telephone Number: 1300 729 171

- International Telephone Number: +61 2 9188 2999

- China Mainland Telephone Number: 950 4059 5638

We found the customer support team to be friendly, helpful and patient. You can also follow ACY Securities on Facebook, Twitter, Instagram, LinkedIn and YouTube.

ACY Education

ACY Securities has a dedicated education portal that provides a range of forex learning resources designed to help traders at all levels. Through this portal, you can access market analysis, webinars, market news, forex e-books and other premium trading resources, including over 60 forex trading tutorials.

ACY Securities Promotions

ACY Securities runs regular time-sensitive promotions and bonuses. Common programmes include a 60% welcome bonus for initial deposits up to $500. Once you have opened an account, you can claim this by submitting a ticket titled “Offer 1 – 60% deposit bonus”. Furthermore, it is possible to earn up to $0.50 per lot traded through the Level Up Reward Program.

Another promotion offered is the chance to get a limited-edition signed & framed Tim Cahill jersey. Tim Cahill is a soccer player and brand ambassador for ACY Securities. You are eligible for this if you deposit $50K into your trading account and trade the minimum required volume.

ACY Securities Verdict

ACY Securities is a respected, regulated broker with a solid reputation. Having quickly gained recognition in Australia and winning several awards, the company has grown to provide a high standard of service to clients around the world. ACY Securities offers an impressive range of assets, with over 1,600 tradable products available, alongside decent educational material and ECN market access. However, clients outside of Australia may find the charges on international withdrawals a downside.

FAQs

Is ACY Securities Regulated?

ACY Securities holds two licenses, one for Australian customers and one for customers outside of Australia. These are with the Australian Securities and Investments Commission (ASIC) and the St. Vincent and the Grenadines Financial Services Authority (SVGFSA), respectively. Client funds are held in segregated trust accounts with the Commonwealth Bank Australia and HSBC.

What Is ACY Securities Minimum Deposit?

With ACY Securities, the minimum deposit to open a standard account with us is $50. This increases to $200 for a ProZero account and $10,000 for a Bespoke account.

Does ACY Securities Offer A Demo Account?

Yes, you can practise trading on a demo account with ACY Securities. This account is loaded with $100,000 of virtual funds and expires after 30 days. However, you can always create a new one using a new email and password.

What Assets Are Available On ACY Securities?

ACY Securities offers a generous selection of tradable products. You can choose to trade CFDs on over 1,600 instruments covering stocks, forex, indices and commodities.

Does ACY Securities Offer An Islamic Account?

ACY Securities offers a trading account for those unable to earn or pay interest due to their religious beliefs. This is known as a swap-free account and can be accessed by getting in touch with customer support.

What Are ACY Securities’ Fees?

ACY Securities accounts have variable spreads that range from 0.0 to 3 pips, depending on the asset, account type and market conditions. Deposits are free, though third-party charges may be incurred for international transfers. Australian clients can make three free withdrawals per month, after which each transaction is charged USD 25, which is the standard rate for all international withdrawals. ProZero accounts involve commission charges of USD 6 per lot, while Bespoke accounts can negotiate commission rates.

Top 3 Alternatives to ACY Securities

Compare ACY Securities with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- DNA Markets – DNA Markets is a forex and CFD broker established in 2020. The broker operates two entities in Australia and the offshore jurisdiction, St Vincent and the Grenadines. Traders can access 800+ markets, with a Standard account for beginners and a Raw account for experienced traders. The reliable MetaTrader 4 and MetaTrader 5 platforms are available, alongside Signal Start.

ACY Securities Comparison Table

| ACY Securities | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| Rating | 4 | 4.4 | 4.3 | 3.5 |

| Markets | CFDs, Forex, Stocks, ETFs, Commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Indices, Commodities, Stocks, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | ASIC, SVGFSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | ASIC |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:500 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:500 |

| Payment Methods | 16 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

DNA Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by ACY Securities and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| ACY Securities | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | Yes |

ACY Securities vs Other Brokers

Compare ACY Securities with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of ACY Securities yet, will you be the first to help fellow traders decide if they should trade with ACY Securities or not?