DNA Markets Review 2026

Pros

- DNA Markets offers top-rate platforms and charting tools for day traders with access to MT4 and MT5

- Convenient account funding is available with 7 base currencies, a $100 deposit and a wide range of payment methods

- You can access low trading fees with spreads from 0.0 pips in the Raw account and zero non-trading fees

Cons

- Unlike many alternatives, there are limited educational and research tools for traders seeking an all-in-one solution

- Despite access to MT4 and MT5, there is no proprietary trading app for seamless account management whilst on the go

- Although it continues to strengthen its client base and reputation, DNA Markets lacks the track record of top brokers like Vantage

DNA Markets Review

In this DNA Markets review, I give my take on this relatively new forex and CFD broker. I rate DNA Markets in each key area and compare it to other brokers to find out where it falls short.

Regulation & Trust

DNA Markets gets an overall trust score of 3 for the following reasons:

- The Australian-based entity is authorized by the Australian Securities and Investments Commission (ASIC), a top-tier regulator with high levels of investor protection.

- The non-Australian entity is registered offshore in Saint Vincent and the Grenadines. This entity is unregulated and provides limited investor protection.

- The broker has been in operation for less than 5 years, although its track record so far appears clean based on my research.

In conclusion, DNA Markets shows promise of a trustworthy operation, though non-Australian traders should be aware they will receive limited regulatory safeguards.

Accounts & Banking

Live Accounts

DNA Markets offers two live accounts: Raw and Standard.

Both are accessible, requiring only $100 AUD to get started and offering trade sizes from 0.01 lots.

I’d recommend the Standard option for beginners – spreads are competitive, from 1.0 pips on popular forex pairs. There are also no commissions which keeps pricing simple for those new to trading.

The Raw account is designed for more experienced traders. Spreads are tight from 0.0 pips and low commissions start from $3 per side.

The wide range of 7 base currencies is a bonus (AUD, USD, EUR, GBP, NZD, CAD and SGD) making the broker accessible to global traders looking to manage their account in their local currency.

Finally, day traders looking to use sophisticated strategies and setups will be pleased to learn that scalping and Expert Advisors (EAs) are permitted.

Deposits & Withdrawals

I have been impressed with the flexibility of DNA Markets’ payment methods, including bank wire, credit cards, e-wallets, crypto payments, QR codes and local bank transfers.

My funds have been made available instantly in most cases. I also don’t have to pay any fees to the broker on credit card deposits, though external fees may apply depending on the provider.

Withdrawals are available via all the same methods, again with zero fees. Processing times are also reasonable, taking up to 5 business days for cards and bank wire, and instantly for all other methods.

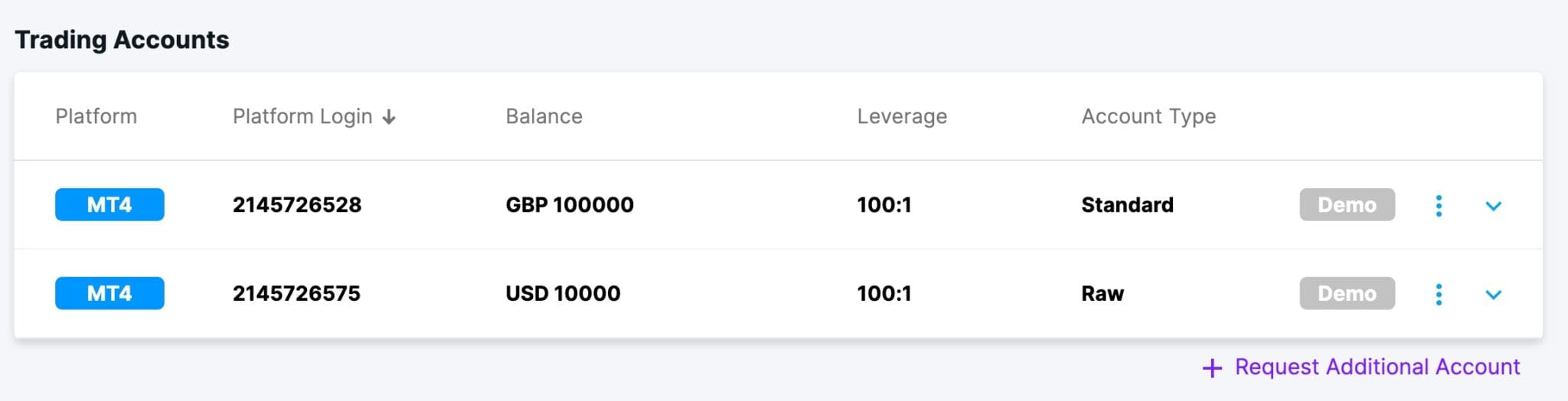

Demo Account

DNA Markets offers a free demo account for MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

I recommend practising in the risk-free demo mode for beginners who are new to these platforms, as well as seasoned day traders who want to test strategies before using real funds.

It’s easy to sign up – I just had to follow the standard account opening process on the broker’s website before opening a demo from within my dashboard. The process took me less than 5 minutes.

Assets & Markets

DNA Markets have recently broadened their market coverage, now offering a strong range of 800+ assets spanning forex, indices, commodities, stocks and cryptos.

As you can see below, DNA Markets offers more opportunities than some notable competitors, though not quite matching the 1000+ offered at our top-rated broker Vantage.

| DNA Markets | Fusion Markets | Eightcap | Vantage | |

|---|---|---|---|---|

| Number of Assets | 800+ | 250+ | 600+ | 1000+ |

With a selection of 50+ currency pairs and 120+ digital currencies, DNA Markets will serve serious forex and crypto traders.

There’s a strong range of 585+ stock CFDs and ETFs available on the MT5 platform, covering popular stock exchanges including the ASX, NYSE and NASDAQ.

I was also impressed with the selection of indices, including the US Dollar Index and the CBOE VIX, plus ample opportunities to speculate on precious metals and energy commodities.

Overall, DNA Markets offers a rounded selection of markets to suit both beginners and more experienced investors, though I’d like to see soft commodities like sugar and coffee added in the future. Pepperstone, for example, offers 15+ soft commodities.

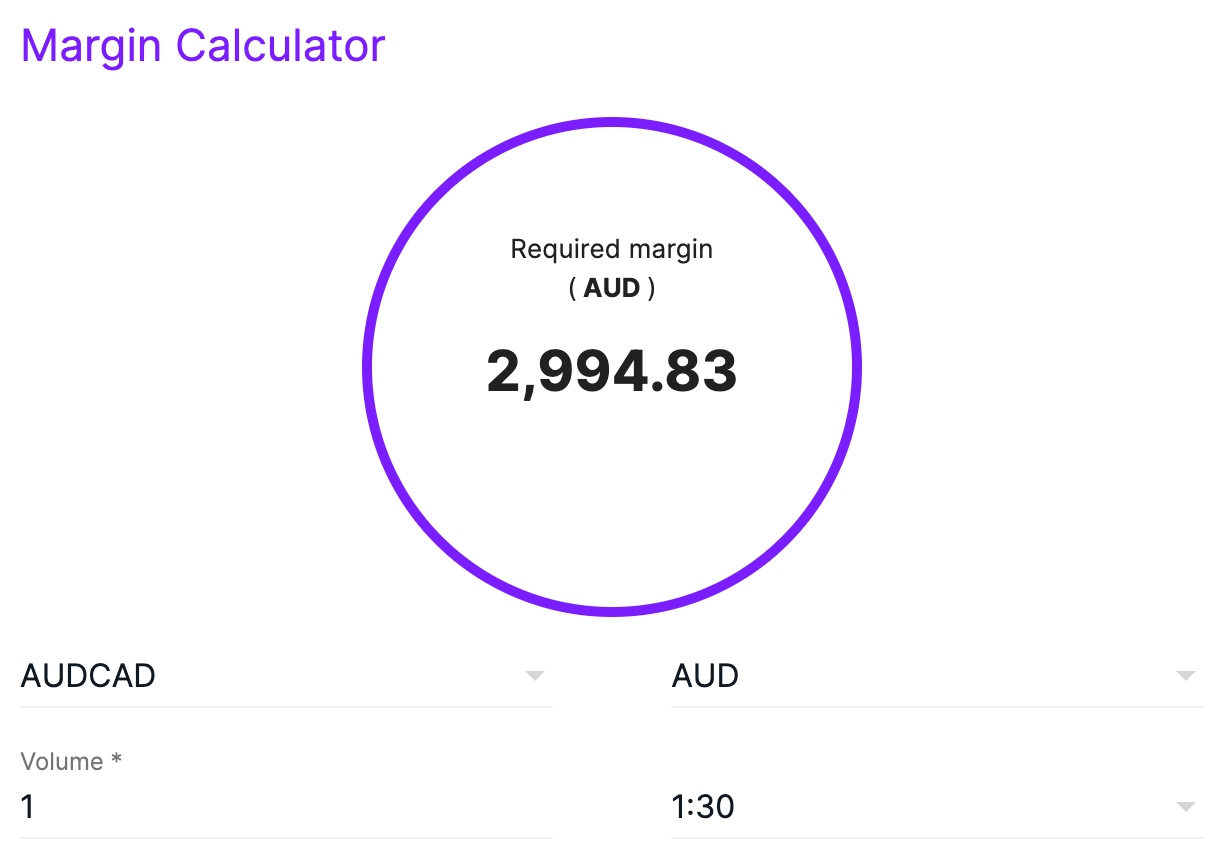

Leverage

Leverage at DNA Markets depends on the entity you register with. The maximum available for global clients is 1:500, whilst leverage at the Australian entity is capped at 1:30 in line with regulations.

Critically, high leverage can amplify losses as well as profits, so make sure you have a risk management strategy.

The broker has an 80% margin call and positions will be automatically stopped if your account reaches below 50% of the required margin.

Fees & Costs

I’ve scored DNA Markets well for its transparent and competitive fees. The broker is a good option for short-term traders looking to keep costs down.

Trading Fees

Trading fees are competitive in both accounts based on my tests:

- Spreads on the EUR/USD came in around the 1.0 to 1.3 mark on the Standard account.

- Spreads on the EUR/USD came in around 0.0 to 0.3 during peak hours in the Raw account. This, coupled with the $3 commission per side, is comparable to low-cost brokers like Pepperstone.

You can see how trading fees stack up against alternatives below.

| DNA Markets | Pepperstone | IC Markets | |

|---|---|---|---|

| EUR/USD Spread – Standard Account | 1.1 | 1.1 | 0.9 |

| Commission – Standard Account | $0 | $0 | $0 |

| EUR/USD Spread – Raw Account | 0.1 | 0.1 | 0.02 |

| Commission – Raw Account | $3 per side | $3.50 per side | $3.50 per side |

Non-Trading Fees

Non-trading fees are also low and there are no hidden costs.

You don’t need to worry about payment fees, other than those levied by third-party providers.

It’s also great to see that there are no inactivity fees – a charge I often see at popular brokers like Plus500, and which penalize casual investors.

Platforms & Tools

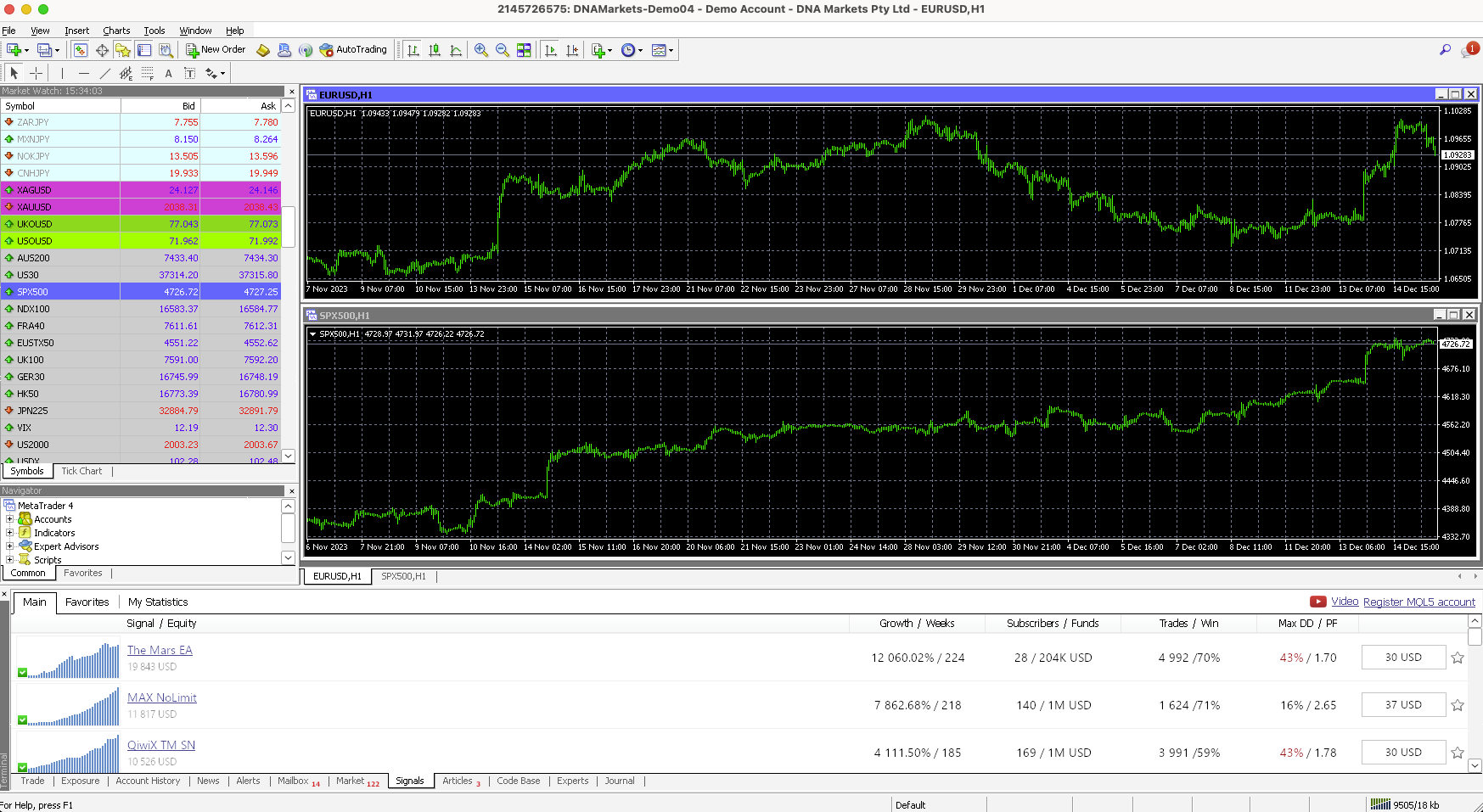

DNA Markets scores highly for its platform offering. With the market-leading MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, beginners and seasoned traders are catered to.

Both platforms continue to offer a host of intuitive and customizable features, as well as advanced order types and a vast marketplace for those seeking additional indicators and tools.

MT4 & MT5

Design & Usability

The interfaces are relatively straightforward to learn for beginners, though they are definitely dated in their design compared to the proprietary platform available at our top-rated broker – AvaTrade.

On a lighter note, the workspace layout is clean and easy to navigate. The charts are fully customizable, so you can move and resize to your preferences. Additionally, you can navigate quickly to all key features, including the Market Watch window and the online marketplace.

Importantly, DNA Markets offers the web, desktop and mobile versions of the platforms, making it highly accessible for traders with various system requirements.

Charting Tools

MT4 offers plenty of charting tools that will cater to most day traders’ needs. That said, I would recommend beginners start with MT4 before jumping to the more complex offering available in MT5, which was designed for multi-asset trading and is best for experienced traders.

On MT4, you’ll find over 30 technical indicators and graphical tools, plus 9 charting timeframes. There are also 4 order types available, including market orders and pending orders.

With MT5, you get over 38 indicators and drawing tools, 21 timeframes, and a total of 6 order types (to accommodate 2 additional pending orders).

Extra Features

The MetaTrader platforms continue to rank best-in-class for their suite of additional features, including:

- MetaQuotes Market: A vast library of community indicators, scripts and Expert Advisors (EAs). Alternatively, you can code your own bots in the Codebase.

- Historical data feed: You can download historical forex data starting from 1999. This is useful for forecasting future price movements.

- Signals: These allow you to automatically copy positions from other traders. You can choose from thousands of free or paid signals under the respective tab on the platform.

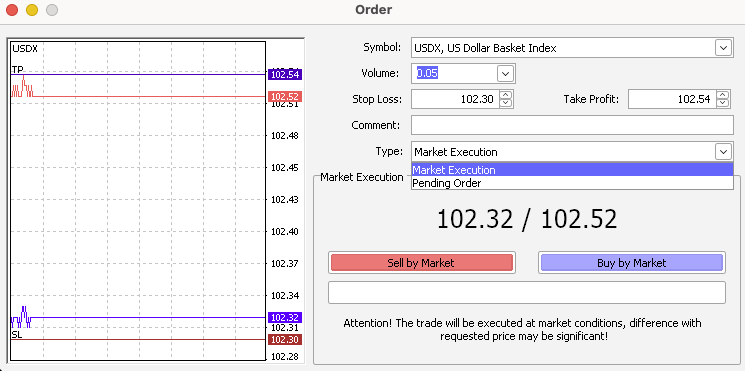

How To Place A Trade

You can place a trade on both platforms within minutes. The process is virtually the same and consists of just a handful of steps:

- Click on the ‘New Order’ button in the main toolbar

- In the order window, select the asset you want to trade and select either ‘Market Execution’ or ‘Pending Order’ from the drop-down

- Enter your desired position size, which is indicated in standard lots (100,000 units)

- Fill in your stop loss, take profit and expiry date fields, if applicable

- Confirm your trade

Tip: If you are executing a Market Order, you can set your stop loss/take profits after you have placed the trade. This is so you can enter the trade as fast as possible when the price is already moving.

Mobile App

I am disappointed that DNA Markets doesn’t offer a proprietary mobile app for managing accounts whilst on the go. While not a dealbreaker for me, this would provide a more complete trading experience and is provided by our 2023 Trading App Award Winner – CMC Markets.

On a more positive note, the MT4 and MT5 mobile apps are sufficient for making trades on the move, offering most of the same features available in the desktop versions.

The apps receive positive customer reviews overall – and for good reason. The platforms have been optimized exceptionally well for mobile use, including smooth chart functions and configurable windows using zoom and scroll options.

The best part is that you can set handy push notifications and access dozens of daily news materials from the palm of your hand, so you don’t miss out on trading opportunities.

Additional Tools

DNA Markets offers limited extra tools to improve the user experience, aside from some basic profit, margin, pip and currency conversion calculators.

You can also access Signal Start, which allows you to receive and act on trading signals. The tool includes a signal simulator which allows you to test various setups.

The good news is that you can get the first 3 months of the subscription free. The bad news is that the subscription costs $25 per month thereafter, plus an additional 30% for signal providers.

I also find it limiting because it lacks the social trading features available with apps like eToro, which provides more interaction with experienced traders, helping to up-skill beginners.

Research

DNA Markets seriously trails alternatives when it comes to market research tools.

Aside from the features in the MetaTrader platforms, DNA Markets doesn’t offer any additional research tools to help traders uncover market opportunities.

Most brokers I use, including Pepperstone, offer an economic calendar as a bare minimum, plus market insights and daily technical analysis. Day traders will have to look elsewhere for these standard resources.

Education

DNA Markets also falls notably short when it comes to trading education. Again, there are no educational resources for beginners or advanced traders looking for development opportunities.

Most leading brokers offer a one-stop-shop service for traders looking for trading courses, platform guides, ebooks and webinars. XTB is an excellent example here.

Customer Support

I have been fairly impressed with the customer support at DNA Markets. The broker is available 24/5 via live chat, telephone, email or contact form.

During tests, I received responses on live chat within 2 minutes. I also found my queries were dealt with effectively – the support agents were helpful and professional.

My only minor frustration is the lack of an FAQ section for quick answers.

Should You Trade With DNA Markets?

DNA Markets offers a compelling solution for short-term traders looking to use the reliable MetaTrader 4 and MetaTrader 5 platforms.

Importantly, DNA Markets scores at least 3 out of 5 in most of our core categories, performing particularly well for its account opening and banking options.

On the negative side, the lack of research and education is a major drawback for beginners. Additionally, I hope to see more regulatory oversight in place for non-Australian clients in the future.

FAQ

Is DNA Markets Legit Or A Scam?

DNA Markets is a legitimate broker, registered in Australia and St Vincent and the Grenadines.

Is DNA Markets Regulated?

Yes, DNA Markets Group (Focus Markets Pty Ltd) is regulated by the Australian Securities and Investments Commission (ASIC) which provides oversight for Australian clients. Focus Markets LLC is an unregulated offshore entity accepting non-Australian clients and providing limited regulatory protection.

Is DNA Markets Good For Beginners?

DNA Markets offers a Standard account for beginners looking for floating spreads from 1.0 pip and zero commissions. The minimum deposit is also reasonable at $100 and there is a free demo account. That said, it trails our top brokers for beginners like XTB because it lacks reliable educational tools.

Is DNA Markets Good For Day Trading?

DNA Markets is suitable for day traders. The Raw account, in particular, caters to active day traders with ultra-tight spreads, while the MetaTrader platforms offer advanced charting tools and reliable execution.

Does DNA Markets Offer Low Fees?

DNA Markets is a low-cost broker. Spreads start from 0.0 pips in the Raw account, with low commissions from $3 per side. Alternatively, Standard accounts come with zero commissions and floating spreads from 1.0 pip.

There are also no inactivity charges, and deposits and withdrawals are free on the broker’s side.

Best Alternatives to DNA Markets

Compare DNA Markets with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

DNA Markets Comparison Table

| DNA Markets | Interactive Brokers | xChief | |

|---|---|---|---|

| Rating | 3.5 | 4.3 | 3.9 |

| Markets | CFDs, Forex, Indices, Commodities, Stocks, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $10 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | ASIC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | ASIC |

| Bonus | – | – | $100 No Deposit Bonus |

| Platforms | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | 1:500 | 1:50 | 1:1000 |

| Payment Methods | 10 | 6 | 12 |

| Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by DNA Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| DNA Markets | Interactive Brokers | xChief | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | No |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | Yes | No | No |

DNA Markets vs Other Brokers

Compare DNA Markets with any other broker by selecting the other broker below.

The most popular DNA Markets comparisons:

Customer Reviews

4.3 / 5This average customer rating is based on 4 DNA Markets customer reviews submitted by our visitors.

If you have traded with DNA Markets we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of DNA Markets

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

I was pleasantly surprised by DNA Markets. While they may not yet be on the same level as established names like IC Markets or Pepperstone, they show great promise and could very well become a significant player in the industry. The entire process, from signing up to depositing and withdrawing, was seamless. Though they are missing a few basics like an economic calendar and some educational resources, overall, they provide a solid experience. 4.5 stars is where I would place them if I had the option to do so.

To be honest, I didn’t have the opportunity to rate them at 4.5, so I rounded up. Overall, I’ve been quite impressed with this broker. I haven’t encountered any problems with withdrawals; they’ve been processed swiftly. The account managers have been responsive whenever I’ve had questions, and the execution of trades has been prompt.

My only suggestion for improvement would be to include TradingView as that is my preferred platform. However, despite this, as a low-cost broker that provides essential trading tools, they fulfil their promise.

I can’t fault the account opening at DNA Markets. It took me a few minutes to get started and I was already familiar with MT5 so there wasn’t a steep learning curve there. My only gripe is the narrow choice of shares and cryptos. DNA Markets is only decent if you want to trade the most popular financial assets like US equities.

I’ve been trading currencies using DNA Markets’ Standard account for several months and have been mostly pleased. The MT4 platform is great for charting and technical analysis while the support team are always available when I need them. They could do more in terms of research tools though – I often have to use third-party solutions which is frustrating.