Is the Yen’s Safe Haven Status Changing?

The yen is typically thought of as the most notable safe haven in the FX market. That’s one of the first things an FX trader learns about the market.

There are a few main arguments why the Japanese yen is considered a safe haven:

i) Japan has a positive net foreign asset position. This means in times of crisis, it is commonly believed they’ll want to sell foreign assets to be defensive and repatriate their capital from abroad. This process of converting that capital back into yen would raise its price.

ii) The Japanese yen has zero to negative interest rates, making it common to borrow in. When there’s a crisis, people sell their assets and borrow less. The covering of the short positions (i.e., closing borrowing positions) causes the yen to increase in price. The general process of borrowing in a cheap currency and using that to buy assets with higher yields is called carry trading.

iii) There’s a level of extrapolation of how it’s performed in previous crises. This makes some hold an asset even when the fundamental conditions underlying it have changed. Or in some cases have never actually been there in the first place. The are narratives, habits, and predispositions that become built into markets.

Positive net foreign asset position

Japan is a creditor country, meaning other countries owe more to it than it owes to other countries.

They also don’t have dollar-denominated debt issues that many countries have, so their currency won’t get squeezed like many who borrow a lot in foreign currencies (which are usually dollars and to a lesser extent euros).

It’s also commonly believed that Japanese investors repatriate their investments from abroad during an economic crisis. This act of selling foreign assets and converting them back into yen would be positive for the currency. But that narrative requires closer inspection as we’ll look into below.

Zero interest rates

Another common feature of the yen and its safe haven status is the carry argument.

Though zero rates in the US and Europe largely didn’t come around until the financial crisis, Japan has been in that type of zero or close-to-zero environment ever since the mid-1990s.

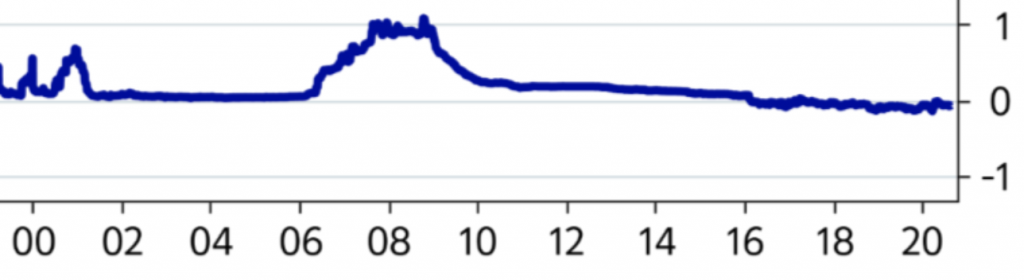

Japanese short-term interest rates

After the popping of its 1989 bubble, it never recovered previous economic highs, such as its stocks market highs.

Nikkei 225, 1984 to present

(Source: Trading View)

Because of its high debt and aging demographics, debt to income ratios have remained perpetually high.

This means interest rates have needed to remain low to avoid debt servicing commitments from becoming a problem.

The very low interest rates on JPY has made borrowing in it attractive. But now with other currencies in equal positions of offering zero (or negative) rates on the currency and on the bonds many years out, the JPY has competition.

US dollar and most euro lending rates are still at or around zero out ten years.

From a US or European trader’s perspective, if they want leverage, there’s no need to borrow in yen when their own currencies yield the same zero base rates.

Usually when traders borrow in a foreign currency they want to hedge it back into their own currency to get rid of that liability, fully or at least partially depending on the size of it.

If you borrow in a foreign currency and it goes up relative to your domestic currency then it’s the equivalent to a rise in interest rates. (Certain emerging market countries feel this pain regularly, such as Turkey and Argentina.)

Moreover, the returns of financial assets have gotten lower. Risk premiums between asset classes and less than what they’ve been historically. This means carry opportunities are less than what they were, given the same spread isn’t there.

For example, in 2009, the forward yields on US stocks was about 10 percent given the contraction in price after the financial crisis. Now, the forward yield on US equities is only about 4 percent.

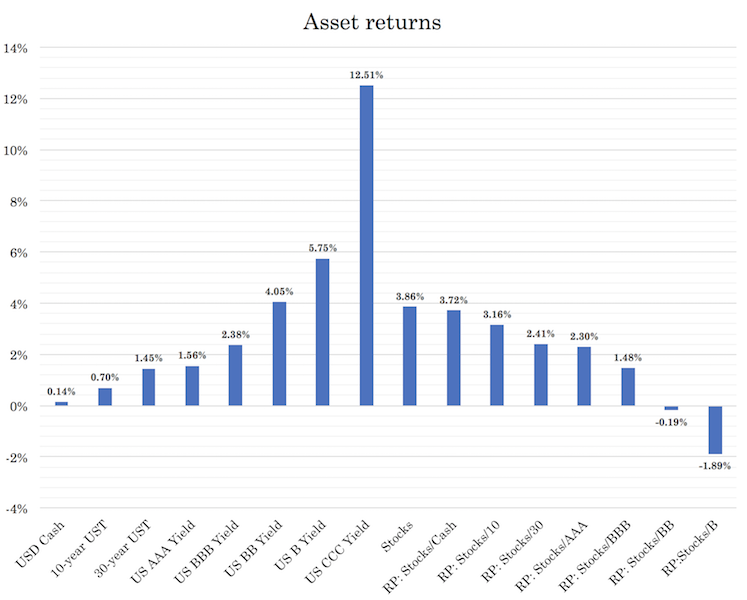

The chart below gives a representation of the yields on various US assets and the risk premiums (“RP”) between them. For example, if the 3-month USD borrowing rate is 14bps and the forward yield on stocks is expected to be 3.86 percent, the risk premium (“RP: Stocks/Cash”) is 372bps. In other words, for each turn of leverage at that rate, you are expected to get another 3.7 percent in return.

Trust in the yen as a safe haven

For years, traders have trusted the yen as a safe haven.

Sometimes narratives become so ensconced that the security or asset becomes bought simply because it becomes so widely believed.

It’s most common in equities where prices are the most prone to distortion due to narrative. In venture capital it becomes even more important as selling a vision of the company is most important without much in the way of traditional financial metrics to rely on. But it can be true in FX and other markets as well.

Owning the yen is considered a risk-off hedge due to its anti-carry properties. It becomes a source of diversification.

But currencies represent countries and the type of behavior they engage in at all levels of the economy (households, corporations, governments). Those can and will change over time, so narratives and general thinking can’t be blindly trusted.

The story on the yen is generally something like:

“Japan has more money invested abroad than other countries. Its net foreign assets outweigh its net foreign liabilities. When there’s a risk-off move (e.g., recession, some risk that wasn’t priced in), Japanese investors liquidate their risk assets, pulling in capital from abroad, and putting it back into yen. This causes the yen to appreciate and makes it a valuable hedge to own.”

It’s a good story to convince asset managers to own yen as part of their portfolio.

But like all stories, they need to be checked for accuracy to make sure that is what’s really going on.

Yen’s safe haven status historically

The SPY (S&P 500 ETF) has had a minus-0.23 correlation to FXY (JPY ETF) since the latter was introduced in 2007.

| Name | Ticker | SPY | FXY | Annualized Return | Daily Standard Deviation | Monthly Standard Deviation | Annualized Standard Deviation |

|---|---|---|---|---|---|---|---|

| SPDR S&P 500 ETF Trust | SPY | – | -0.23 | 8.67% | 1.31% | 4.45% | 15.41% |

| Invesco CurrencyShares Japanese Yen | FXY | -0.23 | – | 0.41% | 0.65% | 2.73% | 9.45% |

Using weekly returns since 1997, when the S&P 500 falls more than 3 percent in a week, the JPY appreciates against the USD 70 percent of the time. When this is upped to a 5 percent decline threshold, the yen appreciates against the dollar 76 percent of the time.

That’s a good historical track record. It suggests owning some yen in a smaller quantity for a foreign investor would help soften some of the blow from risk asset volatility.

But using the past to inform the future can be dangerous if the future can be different from the past.

Understanding cause and effect is much more important than using naïve extrapolations in informing investment behavior.

Understanding whether the yen still holds these properties and to what extent requires knowing who the buyers and sellers are in the market, their sizes, and their motivations.

Net foreign asset positioning

Net asset positioning is commonly known as net international investment position (or NIIP).

Simply NIIP is simply the amount invested abroad minus what international investors have invested in Japan.

Japan’s NIIP is the highest of all countries globally. In Q1 2020, the measurement came to USD$3.453 trillion, according to IMF balance of payments (BoP) and international investment position (IIP) data.

By comparison, the US has a negative NIIP and it’s the most negative globally, coming in at minus-$12.057 trillion.

The NIIP data is often put into different buckets. For example, it will be put into:

– Equity

– Debt

– Foreign Direct Investment (FDI)

– Financial Derivatives

– Reserve Assets and

– Other Investments

To best understand Japanese investors, it’s most important to study Equity, Debt, and FDI.

Reserve assets are controlled by the Bank of Japan. Other Investments are relevant to trade credits and payments to supranational institutions like the IMF.

Financial derivatives provide the net mark-to-market value of open derivative positions. But that doesn’t say much about investor behavior and overall positioning. Market moves cause derivative positions to open and a lot of it is done for hedging purposes.

That means equity, debt, and FDI are the most representative of investment flows and therefore investment behavior.

Pitfall of using NIIP

NIIP is affected by not only changes in asset valuations. It is influenced by changes in the exchange rate relative to the reference currency.

For example, if asset values fall in value by 10 percent then the NIIP contracts by 10 percent as well, holding all else equal. This can be true even if no actual asset transactions take place.

Therefore, one could come to the conclusion that a smaller NIIP leads to a stronger JPY when looking at the changes in USD/JPY. But this would be a mistake because NIIP’s fluctuation due to exchange rate changes can occur for reasons that have nothing to do with the underlying transactions.

Therefore, it must be studied at the transaction level.

What Japanese investors did in 2008

2008 is always a good reference point given the nature of the crisis.

It was the same “1929 dynamic” where a lot of debt was coming due, there was enough income available to pay it, the debt problem was concentrated within key entities, and a massive amount of assets came up for sale in light of these liquidity problems.

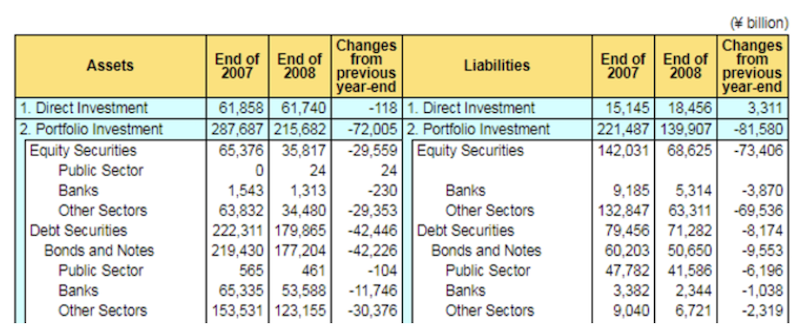

To get at transactions, or what Japanese investors actually bought and sold in practice, one has to look at the NIIP balance sheet and control for exchange rate impacts and asset valuations row by row.

Using a spreadsheet from Japan’s Ministry of Finance, we can see Equity Securities investments went from JPY65.4 billion from the end of 2007 to JPY35.8 billion at the end of 2008.

That might make it seem like the Japanese were selling off a lot of foreign stocks during 2008.

But when taking into account the exchange rate changes (of around +20 percent) and asset revaluations (of about -40 percent), it turns out the opposite was true. The Japanese actually invested heavily into foreign stocks in 2008. This also makes sense in terms of the prudent way to act because they became cheaper.

NIIP valued through equity revaluations and exchange rate changes was reduce by 55 percent. In reality, Japanese investors bought JPY6.4 trillion worth of foreign equities in 2008. They were not, in fact, being defensive and selling them.

Moreover, to their credit, most of these purchases came following the September 15, 2008 Lehman Brothers bankruptcy date. The markets continued to fall heavily past this date as the subprime issue was worse than anticipated. Many investors and lenders became illiquid, creating a need to sell a lot of assets, which became cheap.

The Bank of Japan notes the changes in its balance of payments and cross-border transactions in the publication Japan’s International Investment Position at Year-End 2008. They found that the Japanese bought more equities than had ever been recorded to date.

“Equity securities assets (foreign equity securities held by residents) amounted to JPY35.8 trillion, falling by 29.6 trillion yen or 45.2 percent from year-end 2007. This marked the first decrease in six years. Although investment in foreign equity securities by residents marked a record high in 2008, equity securities assets registered the largest decrease on record due to the appreciation of the yen and the worldwide decline in equity prices. As for factors responsible for changes in equity securities assets, the transaction factor accounted for an increase of 6.4 trillion yen, the largest such increase on record.”

The transaction factor is higher for debt securities, as the size of debt investments is larger.

The Bank of Japan comments:

“As for factors responsible for changes in assets in bonds and notes, the transaction factor accounted for an increase of 7.3 trillion yen. This reflects active acquisitions by “other sectors” resulting from the continued purchases of foreign bonds and notes by pension funds, individual investors, and business enterprises through investment trusts.”

The case of the yen in 2008

The yen appreciated in 2008 as global equity markets took a dive.

FX carry trading became a very popular strategy during and after the tech bubble collapse in 2000.

It became very popular to use a low-yielding currency like the yen and using it to buy a higher-yield currency like AUD. It commonly became misrepresented as “arbitrage” or “low risk”.

When 2008 came, many gains that took years to achieve were wiped out in a matter of weeks. The left-tail risk of carry trading was widely underestimated.

For example, here’s a chart of AUD/JPY.

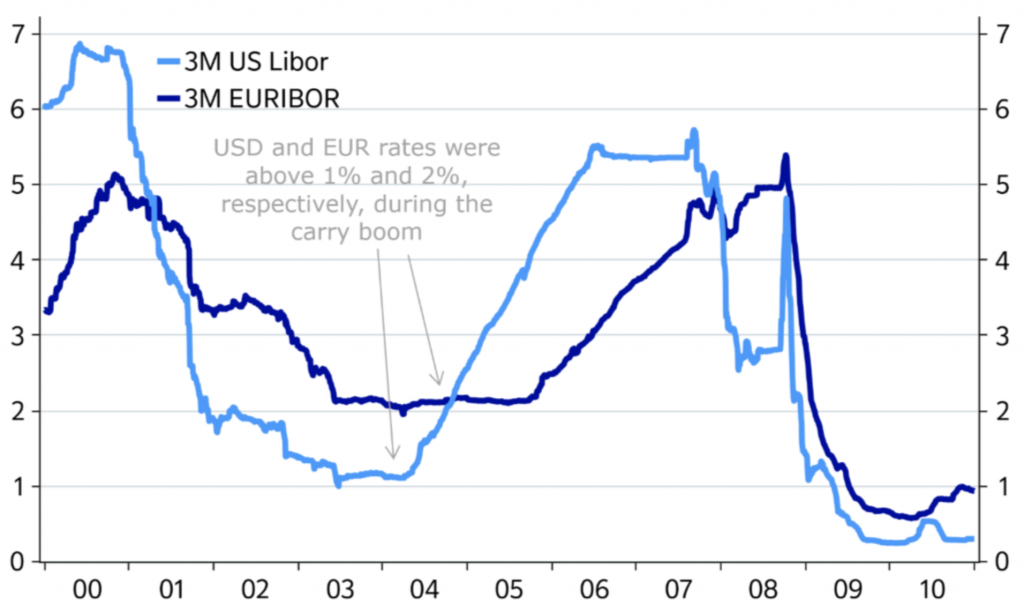

Back in the pre-2008 financial crisis period, the JPY was the only major currency with near-zero interest rates.

Though the US dollar is the world’s top reserve currency and thus the top funding currency, the yen became the most popular funding currency after it. USD cash rates hit around one percent following the tech bubble collapse in 2002.

Many European rates (e.g., Euribor) also hit around two percent as well.

But during that time, JPY rates were around zero or a few basis points.

US Libor rates started rising in 2004 and Euribor started rising in 2005, increasing the attraction of JPY as a funding currency.

(Source: Nordea, Macrobond)

JPY rates started rising in 2006, but made it up to only one percent by 2008.

Low interest rates helped fuel the injection of a lot of liquidity into the global financial system. When the price of credit goes down, the demand for it goes up, holding all else equal.

When there’s a lot of liquidity and market volatility is low, risk premiums fall, as price movement isn’t considered much of a risk. Practically everything with a lower interest rate (e.g., JPY, other low-yielding currencies) are borrowed to buy something with a higher interest rate or prospective yield.

When the financial crisis hit after a buildup of these concentrated risk exposures, risky positions were closed. This includes carry trades of higher-yielding currencies and risk assets (and reasonably safe investments, such as investment-grade debt) bought on leverage with cheap funding currencies.

This meant selling the riskier assets and buying back the low-yielding currency, often the JPY.

Moreover, in 2007 and 2008, when JPY rates were briefly elevated up to 100bps, the JPY was less appealing to use for new carry trades.

All this unwinding of carry positions caused the JPY to strengthen. Trend buyers came in and also bought JPY.

The momentum in the JPY appreciation was fastest after the Lehman bankruptcy in September 2008 and continued in the plunge in equity markets following.

JPY is no longer the only game in town

If carry trading becomes as popular as it did in the mid-00s, the JPY would have competition as a funding currency, with the two top reserve currencies also sporting approximately zero interest rates.

So, the JPY’s position as the go-to funding currency is no longer there. This was also true after 2008 when the EUR, CHF, SEK became popular funding currencies, though the JPY’s status as a cheap funding currency (and therefore, its risk-off relevancy) preceded the 2008 bust.

Given the competition from the USD in funding cheapness and the USD’s higher liquidity and use as a reserve globally (about 60 percent of FX reserves vs. 5 percent for the JPY), dollar funded carry is increasing.

Carry trading will always be popular in more placid markets. Traders and investors feel more comfortable about leveraging up their portfolios to turn smaller spreads into the desired return on equity. But unwinds of these trades will be more distributed.

The cheap rates combined with the dollar’s superior liquidity will surely increase the proportion of dollar funded carry.

Therefore, should carry unwinding occur again, the flow of money would be distributed among other major currencies – not just to the JPY as it did in 2008.

Foreign investors in Japan

An important dynamic in the yen situation is the flip-side of Japanese investors putting their money abroad – international investors investing in Japan (i.e., converting their own currency into JPY).

2008, for example, saw a record number of foreign investors selling Japanese financial assets. Selling JPY-denominated assets is bearish for the currency, holding all else equal.

If a country’s currency is high in relative terms to the rest of the world, this can make a compelling case for foreign investors to sell their assets.

In emerging market investing, it is not only about the fundamental value of the investment assets, but how they compare in currency terms. If a currency is cheap, they can make otherwise average-yielding investments look attractive.

The Bank of Japan argued this as a reason behind the large sell-off in Japanese assets in 2008. Considering the yen appreciation that year, it could make sense.

Did the JPY serve as a safe haven pre-2008 crises?

The yen safe haven argument was established well before 2008.

The latest pre-2008 crisis came during dot-com bust, where US tech peaked in March 2000 and equity markets didn’t bottom until October 2002.

Back then, the internet was being increasingly adopted among the masses and unleashing big opportunities in a variety of ways. But the valuations were far overinflated; everything on the internet would indeed not be a smashing success and the market eventually corrected.

The NASDAQ fell about 80 percent peak to trough. The S&P lost about 50 percent and the Nikkei 225 (Japan’s top benchmark) lost 62 percent.

During this period, the yen’s behavior is uncertain. The JPY increased against EUR and GBP but not against the USD.

After that, the JPY weakened against other major currencies despite equity markets dropping into Q4 2002.

Data kept back then is not as detailed and broken down as it’s kept today. We can only look at balance of payments transactions, or net amounts. We cannot determine whether flows from Japan are local or driven by foreign investors in Japan.

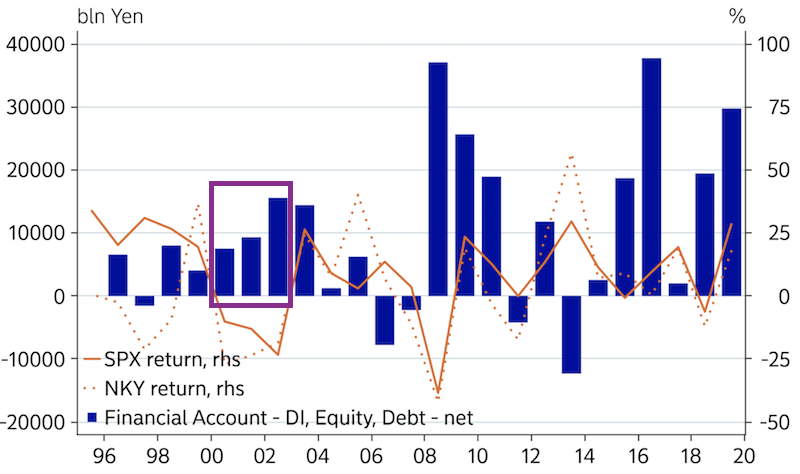

It can be determined, though, that the flows favor Japan toward international investments, as the years from 2000 to 2002 see increased flow.

During the 2000 to 2020 period, there have been multiple crises that were true global events on some level.

These include tech and subprime mortgages.

None of them saw a case of Japanese investors pulling back foreign investment to be defensive.

The future of the JPY

So, if the two most common bull theses behind the JPY are:

i) Repatriation of assets during major economic downturns or global crises

ii) Carry trade unwind

And neither of these are particularly robust, then the status of the JPY as a safe haven may not be an appropriate story to fall back on.

Nonetheless, stories can endure even when the fundamentals don’t align with the narrative. Stocks are the most prone to narrative-driven distortion because they are theoretically perpetual cash flow instruments.

But currencies can act the same way. Many managers decide to own yen because it’s a type of safe haven and perceived as risk-off hedge. And these beliefs and traditional way of going about things matter.

If the yen doesn’t serve its purpose as a safe haven and managers don’t see it act as they believe it should, that can damage its status.

If JPY didn’t perform well, then their investors will question why they trusted it. Reasoning that owning JPY was a good idea simply based on common habits and general beliefs is not a deeply logical rationale.

And because the yen has held its safe haven status for a relatively short period – at least in relation to gold, which has been tried and true over thousands of years – it is more likely to lose this status among investors.

What is a safe haven?

The term has been used frequently in this article, yet it hasn’t been well-defined. The reason, naturally, is that there isn’t a clear definition. While some terms have commonly agreed upon definitions, e.g., a “bear market” is a 20 percent loss from previous highs (to save the term from being liberally thrown around), a “safe haven” depends on subjective judgment.

Is a safe haven something that appreciates by a certain amount during a fall in risk assets?

Is it something that stays relatively stable or only loses a little bit?

Or can you make a correlation argument in that it has, at worst, only a slight positive correlation with risk assets.

And correlation should not be thought of in terms of “the yen is X percent correlated with Y” but rather the fundamental drivers.

Correlations between, stocks and yen, or between anything else, are not static. They change in response to “drivers” (i.e., catalysts) that can cause assets to move in conjunction with each or inversely.

If the yen is thought of as something that doesn’t depreciate during risk-off events, the yen could still be thought of in that way.

It will also hold value especially well relative to an emerging market currency, and may therefore have more diversification potential in a more EM-centric asset allocation.

The JPY is also liquid. Unlike the Norwegian krona (NOK), which sold off heavily every time someone tried to move a material amount of it, the yen isn’t an issue to buy and sell even for the largest investors.

Liquidity is a positive factor for determining what can be a safe haven. But fundamental properties matter a lot. Large cap stocks are also very liquid markets, but sell-off harshly when risk-off events occur.

Japan is still an export-centric economy. They also run a large government deficit and have high debt burdens relative to GDP. Given low productivity and a shrinking working population, Japan’s economic growth will also be low in real terms and likely will continue to be in nominal terms (as it has been for decades). This will keep real and nominal interest rates low on its assets.

While Japan is a reserve currency – i.e., savings in it through its debt – it’s not at the standard of the US dollar. The USD comprises 60 percent of all FX reserves, where the JPY tends to hover in the 4-6 percent range.

If a crisis pops up that requires the Bank of Japan to print a lot of money to fill in the gaps in incomes, spending, and lost financial wealth, they can do it. But to a lesser extent than a country like the US.

Printing money means having to sell a lot of debt. At a point, there is limited demand for this debt. If there’s limited demand for it, then the currency must become cheaper. In this case, if the currency is depreciating, then it’s not a great safe haven.

Previous work on the JPY safe haven status

A 2013 IMF paper analyzed the yen’s safe haven nature and concluded the following:

“We find that neither capital inflows nor expectations of the future monetary policy stance can explain the yen’s safe haven behavior. In contrast, we find evidence that changes in market participants’ risk perceptions trigger derivatives trading, which in turn lead to changes in the spot exchange rate without capital flows.”

So, they find that both portfolio rebalancing via JPY-based derivative transactions and self-fulfilling behaviors tend to cause appreciation in the yen.

It does not truly satisfy the question of what causes yen appreciation in crises (or usually), but the authors argue against the foreign investment repatriation (capital inflows) as the reason.

A November 2008 NBER paper found that lower interest currencies perform better than higher interest currencies in economic and financial crises. They argued that this is due to carry unwind and the risk-taking being pulled back on a general level by financial actors.

This is supportive of the idea that the popularity of carry trading has:

a) fallen since the early 2000s, and

b) is done in more currencies and is not as JPY-dominant as it was before the 2008 financial crisis

Accordingly, the carry unwind would have a less prominent effect.

The same was found by Habib and Stracca (2011) in their paper Getting beyond carry trade: What makes a safe haven currency?

They found that the interest rate differential between two currencies is not a driver of safe haven status in itself. Rather, it depends on the nature of the carry trade strategies being used. Certain trades that are “crowded” – namely, whose fundamentals aren’t likely to bear out the results extrapolated by the market – tend to be more risky.

Simply having a low interest on a currency or any asset doesn’t make it a safe haven.

Can any currencies better fulfill safe haven status than the JPY?

The world’s top reserve currency is the US dollar. It’s the most dominant money and credit system globally.

The dollar is a good bet during crises and this is likely to last for some time.

(Source: Trading View)

The secular fundamentals of the dollar are bad, as addressed in other articles. But as a risk-off safe haven, it’s the best fiat safe haven given the world’s monetary and credit system as presently constructed.

Longer term, and big picture, the dollar is a short with external debt at ~45 percent of GDP and all the claims that need to be monetized at ~15x current GDP. Nobody can sustain those kinds of deficits long-term. The US will need a weaker currency. The easiest way to relieve debt burdens, if you can, is to simply create more currency.

USD reserve status isn’t going away until the world finds a better system to adopt and they’re a long way away from that.

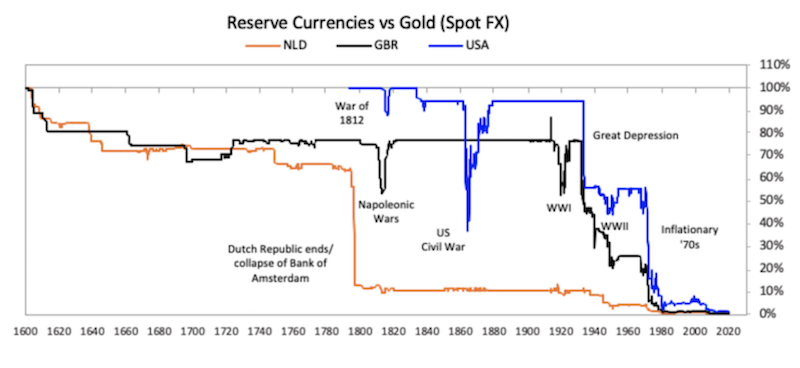

The US is 20 percent of global economic activity, but about three times that in terms of global debt and FX reserves. The US is going based on its reputation. But reserve status always goes with a long lag. It was true for the Dutch and British empires as well. It takes a long time to adapt to different reserve systems.

The currency of the dominant power tends to last after their relative proportion of activity fades.

The USD has depreciated a lot against a hard currency like gold, mostly due to the hard breaks from the gold standard in 1933 and again in 1971, though neither event cost the USD its reserve status.

Other risks

A lot of US debt is owned by foreign entities. They also happen to have a lot of conflict with the US. This includes China, in particular, and to a lesser extent Europe and Russia.

The dollar also doesn’t have the high interest rates it had during the 2017-19 period. When US carry was 2 to 3 percent over the other two main reserve currencies (EUR and JPY), it was more attractive. Now that they’re more in line, the carry is less than one percent. (The US is a hair off zero, keeping a 0-25bp range and EUR and JPY are both negative.)

‘Safe haven’ trade ideas (USD? EUR? CHF?)

If one wants more exposure to the dollar as a risk-off, one could try owning out-of-the-money call options on the USD.

If there’s a risk-off event, that’s likely to lead to a higher dollar and such could act as a hedge on a risk asset portfolio. Many brokers offer USD options via currency pairs. EUR and JPY currency pairs have the most liquid options markets.

The euro could also play some role. It’s the world’s second-top reserve currency. Though the EU is a type of pegged currency system that can get strained with many different countries having very different economic characteristics, the EUR is used heavily in the region and to some extent in global reserves, debt, and import invoicing.

There’s been stress in Italy and worries they could decide to exit the EU, and some view the European Union as having the potential to break up over time. That has undermined euro strength in previous crises.

The Swiss franc is also considered a common safe haven, given its creditor status and large surpluses (i.e., current account and fiscal).

But the SNB wants to get growth and inflation higher and is very reluctant to let the CHF go higher. The SNB will print francs and buy foreign assets to the extent that it wants to prevent the CHF from appreciating. Accordingly, it is not reliable as a safe haven.

There is also gold, a non-fiat store of wealth that is nobody’s political or credit risk. (See: Investing in Gold: Its Role in a Portfolio)

Conclusion

Narratives should always be checked. Sometimes they are too blindly trusted and inappropriately embedded in markets.

This is true for many types of stocks where valuations are out of whack with the economics of the business. But this can be true with respect to other asset classes as well.

Sometimes decision rules become so ingrained that it becomes better to do the opposite.

While the yen has commonly been thought of a safe haven currency, the two basic narratives behind it are faulty.

Japanese investors’ repatriation of foreign assets, and thus swapping this capital back into yen, doesn’t exactly appear to be the case. In fact, the opposite appears to be true, with Japanese investors buying cheapening foreign assets.

Moreover, the carry trade unwind is part of past JPY appreciations in crises when everyone wants to sell riskier higher yielding assets.

However, more currencies are funding vehicles these days with low interest rates across the board in the developed world. The JPY has more competition on this front.

A currency having a low interest rate in itself does not necessarily mean it’s a safe haven. Interest rates are a function of nominal growth rates. Consequently, low nominal interest rates are a reflection of low nominal growth rates. There is more to the fundamentals of a currency than just its interest rate, such as capital deficits and surpluses that dictate where money is likely to flow.