Argentina’s Dilemma

Argentina has been in the global markets headlines for over a year, with its tribulations with its economy and the volatility and severe depreciation in the Argentina peso. It is, once again, quite likely to default on its debt within the next few years unless it receives significant help from external sources (i.e., the IMF) to restructure it.

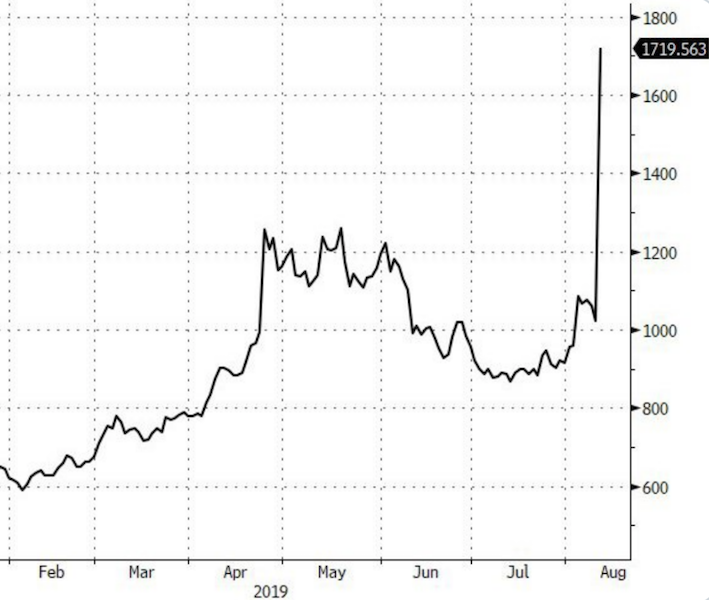

Below is Argentina’s 5-year credit default swap. A higher figure reflects a higher market-implied probability of default.

Argentina’s long-term challenge is to iron out what are essentially culturally rooted practices in how they operate their economy. There are longstanding traditions of mercantilism, populism, crony capitalism, trade protectionism, and the outsized role of unionized labor. Repeated debt issues are symptomatic of common ways of operating.

External debt (i.e., debt bought by foreign investors) is high and the economy is relatively walled off from the rest of the world. Resident outflows are high despite moderate IMF disbursements. Attracting new private inflows won’t be easy because of the losses already sustained by private investors.

The IMF’s growth forecast for Argentina is minus-1.3 percent this year, which means GDP growth in the second half of the year (“H2”) would need to come in strong, but that’s quite unlikely to happen. Being flat for H2 is more likely, meaning the contraction in its economy will be somewhere around 2 to 2.5 percent for the year.

For these reasons, there’s going to be a clear funding gap in the IMF program and the overall capital disbursement provided is too small. IMF financing, from the IMF’s perspective, only makes logical sense if there’s a pathway for Argentina to return to being financed through the private markets.

They also face a catch-22 situation as it pertains to their currency, the Argentina peso (ARS). The central government’s solvency requires real (i.e., inflation-adjusted) appreciation in the ARS because of its foreign debt obligations. A stronger domestic currency relative to what its foreign debts are denominated in lowers their effective interest rates. Thereby it makes them easier to pay off. On the other hand, their central bank needs real depreciation to balance local-currency liabilities with foreign asset valuations.

Argentina’s situation also causes some issues for markets and economies globally.

Argentinian assets aren’t that liquid, so traders compensate by selling assets from other markets, particularly in Turkey and Brazil. (Argentina competes heavily with Brazil in the export markets.) This means there’s a contagion element. The fall in the peso causes trading partners to see their own currencies appreciate in relative terms, which makes their goods comparatively more expensive and hurts their competitiveness. Almost all countries need a lower currency, both in emerging markets and developed markets as global growth slows.

With the recent weakening in the currency, imports will contract and push the current account back into surplus, which is positive for the peso. The ARS is actually somewhat undervalued currently as the real interest rate is now sufficient to both offset the inflationary effects – from the depreciation in the ARS that have already occurred – and the additional forward depreciation rate that can be backed out through the current account adjustment.

However, whether that plays out in practice (i.e., the peso bottoming) is a different story with where the central bank wants (in reality, needs) it to go to cover its liabilities in local-currency terms. The central bank, of course, has the greatest influence over its direction of any domestic policy institution.