Turkey’s Economic Dilemma

As we covered in our five-part series on trading emerging markets, Turkey is an emerging market that classically gets into the same balance of payments problem over and over again.

Turkey traditionally gets into economic trouble because greater borrowing by domestic corporations pushes up the country’s trade deficit, and the resulting increase in its need for foreign funding leaves it prone to a rising US dollar and higher oil prices. The country borrows heavily in dollars (as the world’s top reserve currency), so when the dollar goes up, it’s like a big increase in interest and principal payments, creating a squeeze on their finances.

Oil-importing emerging markets with notable current account deficits, low relative levels of FX reserves, large external financing requirements, and too much borrowing in foreign currency are all prone to balance of payments issues like Turkey.

Getting the balance of payments back in line

As we covered in Part V of How to Trade Emerging Markets, we asserted that the first step to getting emerging market economies and markets to bottom is to get the currency at a level that makes it investable. This gets capital back in the country from abroad.

This is done through:

a) a large devaluation that helps to close the balance of payments gap

b) an interest rate provided on the currency that is low enough to support positive economic growth but high enough to get investors, traders, lenders, and other market participants back in the currency.

Devaluing the currency helps reduce imports (i.e., by making them more expensive) and thus reduces spending to get it back in line with income.

In scenarios where it’s handled badly, policymakers will typically raise interest rates too far (hitting economic activity) or burn through foreign exchange reserves (whittling down an important source of savings).

For example, in their 2018 balance of payments crisis, Turkey’s policymakers tried to reduce borrowing in the currency by cutting the amount of swaps domestic banks were permitted to hold to 25 percent of regulatory capital, down from 50 percent. By limiting the supply of swaps, this constrained how much lira-based lending Turkish banks can offer. This sent the annual cost of borrowing in lira from 17 percent to more than 35 percent. Shorting the lira no longer looked that attractive.

Nonetheless, banks and their clients will use swaps as a way to protect against currency fluctuations. Regulatory limits against these products are therefore a negative given the various fiscal and monetary imbalances in the country spilling over into its economy and currency.

Regulators also allowed Turkish banks to calculate their capital ratios using the lira’s exchange rate retroactive to June 30 of 2018. This will help to prop up capital ratios in the banking sector. Every 1 percent decline in the lira created about a 0.05 percent decline in capital ratios. It was artificial but helped with meeting regulatory requirements.

Turkey’s central bank also tried using reserves to halt the currency’s slide. Additionally, it tried borrowing foreign currencies from domestic banks and selling these funds to buy lira to prop up its price.

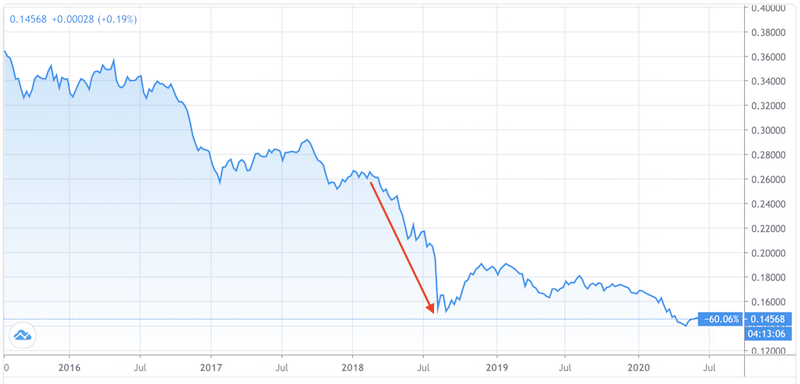

The lira’s fall was steepest in 2018, and remains too high as of July 2020

(Source: Trading View)

Today, traders still realize that more weakness is required and have continued selling the currency and getting out of its domestic bond market.

When the lira fell to a new low in early May, Turkish authorities blocked three international banks from trading its currency, accusing them of failing to fulfill in paying their liabilities in transactions with Turkish banks.

It’s widely believed that it was a tactic to prevent investors from betting against the currency and contributing to its fall. The ban was nonetheless lifted after a few days.

Borrowing costs have risen in Turkey with the fall in the lira. Oil and gas prices fell a lot with the 2020 downturn that dented demand. As an oil and gas importer, this was positive for Turkey, but not enough to offset its other issues.

Because of ongoing depreciation in the lira, Turkish banks will need to raise capital (their liabilities are going up in relative terms).

But continuing to borrow externally exacerbates the problem, and recent issues will curtail the availability of foreign lending. Consumer loan default rates will continue to go up.

Its central bank, the CBRT, has also traditionally had issues doing what it wants to do because of political interference.

Inflation is high at around 12 to 13 percent despite its short-term interest rates between 8 and 9 percent. That leaves the real (inflation-adjusted) interest rate right at around minus-4 percent.

When foreign investors and lenders can’t obtain a positive total return on their investment, they will typically try to move their money out of the country.

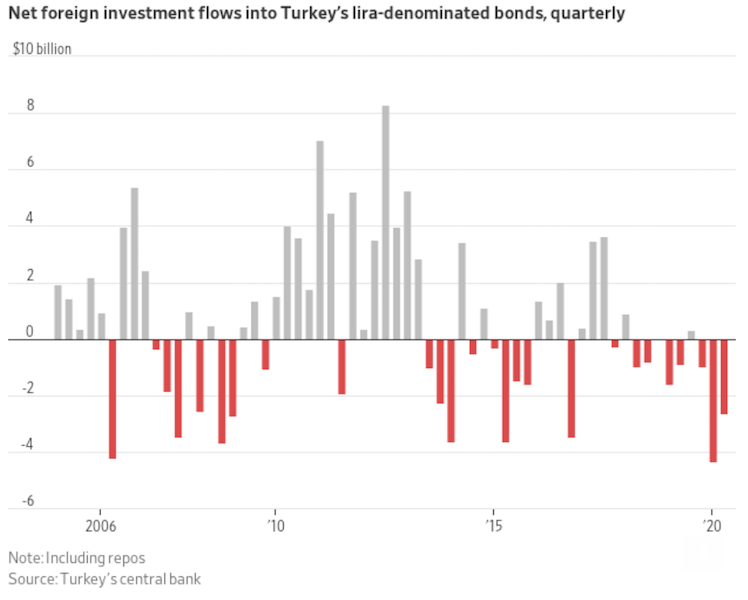

Fund managers took more than $7 billion out of Turkey’s local currency bond market in the first half of 2020. This was the largest drawdown in the first half ever, based on the CBRT’s data.

Foreign ownership in Turkey’s local currency bond market was over 30 percent in 2013. It’s now just 5 percent.

Turkey’s problems are a combination of the following issues

1. Too much USD-denominated debt. Servicing of this debt is harder if US rates rise (makes US dollar assets more attractive and raises the price of the dollar) or the USD rises relative to the lira independent of US rates policy, set by the Federal Reserve. Debt servicing becomes harder given they make their income in Turkish lira.

2. Its large current account deficit (a component of the balance of payments) and status as a debtor country makes it vulnerable to capital flight and weakness in its domestic currency.

3. Currency weakness and inflation can make even government short-term credit undesirable because it means a potentially negative real return for investors and lenders. This leads many domestic investors to the purchase of inflation-hedge assets and capital withdrawals (among both foreign and domestic) instead of the credit creation necessary to grow the economy.

4. Turkey has a large external financing need to the point where this requirement is about 80 percent of FX reserves. However, Turkish banks have a wholesale funding need that’s heavily in lira.

But this assumes depositors don’t engage in a “run” on this capital by shifting from lira to dollars or taking these deposits out of the commercial banking system entirely.

Historically, governments, not limited to any country in particular, have tried to counteract these measures by establishing foreign exchange controls and abolishing public gold ownership. Gold is a traditional inflation hedge and fallback when local and other available currencies don’t work as well.

Sometimes price and wage controls are instituted, but rarely do they solve problems and instead typically create distortions, with supply insufficient relative to demand. Capital controls can be a short-term fix in some cases, but don’t work long-term (unless capital flows are small enough to not make a difference).

5. The Turkish banking system has an atypical set of vulnerabilities because the banks need to rely on foreign exchange swaps to exchange dollar funding (i.e., foreigners want to lend to Turkey in dollars and to a lesser extent euros) into lira in order to preserve their ability to lend to individuals and households.

As part of Turkey’s macro-prudential regulation, the country’s commercial banks are barred from lending to households in foreign currencies. (Households generally want to borrow in lira anyway.)

These problems haven’t manifested in the past because its external funding and domestic deposit base have been resilient historically.

In 2020, the virus-related lockdowns reduced the European Union’s purchase of textiles and automobiles from Turkey. Most of the country’s tourism revenue was also wiped out.

6. This combination – foreign entities wanting to lend to Turkey in dollars and Turks wanting to borrow in lira, has led to a surplus of dollar funding and shortfall in lira funding – is easy to spot through the country’s loan-to-deposit ratios:

- Loan-to-deposit ratio in TRY: 1.4

- Loan-to-deposit ratio in USD or EUR: 0.8

7. Turkey’s central bank has often used macro-prudential regulatory measures to fight inflation rather than raise short-term interest rates. This is unlike most modern central banks and isn’t necessarily effective.

8. Turkey often gets paired together with Argentina as a place that has comparable economic and balance of payments issues.

However, unlike Argentina, Turkey’s vulnerabilities are predominantly in the private sector. Argentina’s issues are heavily rooted in the public sector’s excess external borrowing.

9. Much of Turkey’s economic difficulties rely in that it doesn’t have enough reserves to cover its external financing needs, which is the sum of its current account and maturing short-term debt (generally close to 30 percent of GDP).

They also don’t cover its short-term external debt, 60 percent of which is located in its banking sector.

So, when one takes into account a rising US dollar from rising US rates relative to other developed economies (increases the burden of servicing foreign debt) and rising oil in conjunction (Turkey has to import it, worsening the trade deficit), this makes for a bad combination.

When a country doesn’t have enough foreign currency reserves, it can lose control of the currency. Turkey’s central objective should be to build up its asset reserves. It can do so by getting domestic demand back in line with income.

The country needs a cheaper currency. A devaluation will boost inflation short-term, but will come with long-term benefits.

The IMF broadly identifies Turkey’s problem in their reserve metric, but not to the extent stated, making the issues in Turkey understated for anyone who relies on the IMF for research. The IMF uses M2 in their calculation. However, M2 is a misleading and non-robust monetary metric that conflates money (what payments are settled with) with credit (promises to pay).

Conclusion

Turkey has economic and monetary problems because it can’t use its reserves to defend its currency. If the country tries to cover a distended current account deficit it’s inviting a loss of access to bank funding through a run on foreign currency liquidity. In other words, foreign creditors withdraw it, as shown through their unprecedented level of bond market outflows.

Real rates in the country are negative as the interest on Turkey’s currency and bonds are below the rate of inflation. This encourages capital flight out of the country by residents, as their money loses its purchasing power. The threat of depreciation in the currency also discourages investment from non-residents.

This likely means another devaluation of the currency is necessary. While this will cause inflation to go up in the near-term, it will get the currency cheap enough such the depreciation pressures are no longer a factor (if devalued enough) to get the currency into a position such that it’ll provide a positive return.

Since Turkey’s corporations are indebted in US dollars, a drop in the lira/rise in the USD causes distress because this debt load becomes harder to pay off when income is earned in lira (falling) and liabilities are heavily denominated in dollars (rising in relative terms)).

If the country tries to fight this by raising rates, this diminishes credit creation and therefore slows the economy, though it helps to diminish the current account deficit.