How to Trade Emerging Markets (Part V)

This is Part V, and the final part of an ongoing series on how to trade emerging markets.

In Part I, we covered the early part of the cycle in emerging market economies.

Part II covered the up-cycle leading to the “bubble” phase and the lead-up to the consequent top in the market.

In Part III, we covered the market top, beginning of the reversal, and initial defense of the currency.

Part IV delved into the part of the cycle past the top related to economic weakness (income insufficient relative to expenses) and the letting go of the currency.

Part V will cover the recovery phase.

Recovery

Fundamentally, the recovery comes about when there is the appropriate supply and demand of the local currency relative to other currencies.

The currency is brought into equilibrium through a combination of two things:

(i) shoring up capital flows

(ii) trade adjustments

The first is normally more important than the second.

Namely, objective number one is for the central bank to make it attractive to hold the currency. Secondarily, when spending drops enough, imports will fall in conjunction.

Moreover, the decline in the currency will make exports cheap enough to stimulate buying of their goods (though usually to less of an extent than imports, at first, because other countries are often also having economic problems as well). This helps close the balance of payments deficit, or simply how much capital is flowing out of the country relative to how much is flowing out.

How does the central bank make the currency attractive to hold?

Monetary authorities need to incentivize people to save and lend in the currency. Moreover, they need to encourage fewer people to borrow in it.

One important way is to provide an interest rate on the currency that produces a positive total return that isn’t too high relative to domestic economic conditions.

Defending the currency during the currency defense phase, as covered in Part III and IV, is generally not the best thing to do.

When economic conditions are weak, a lower currency level is appropriate and the interest rate given to it will accordingly be appropriately low as well.

Getting the recovery phase under way will entail letting the currency devalue in a sharp and quick way to get it back into a two-way market where demand is back to being in line with supply.

The devaluation is painful for those long the currency and for foreign investors in the currency and debt (especially those that are unhedged). But it will make the currency more appealing for market participants who are long after the devaluation.

When a currency has been appreciable devalued, the total return on the currency – i.e., interest rate provided on it relative to the currency being borrowed in, plus the appreciation rate in the currency – has a positive expected value. The interest rate provided won’t need to be too high to make the currency attractive to buy when the currency has been severely devalued.

In sum, the best way to make the currency attractive is to ensure that investors can expect a positive total return moving forward while at the same time having an interest rate on the currency that is low enough in both nominal and real terms to ensure recovery in the economy.

This very typically makes a devaluation a necessary ingredient to some degree.

Domestic FX holders vs. Foreign FX holders

Domestic holders

When policymakers work through the motivations of everyone involved in their own currency market, it’s important to note that domestic holders of the currency have different motivations relative to foreigners who hold the currency.

When investors think about saving in cash or bonds (a promise to deliver currency over time), domestic investors are mostly concerned about the inflation rate.

Namely, they want to ensure they’re getting an adequate enough real return to compensate for holding their money in it. If they don’t, then they’re likely to seek alternatives.

This is why gold’s valuation in a currency tends to match inversely with the level of real interest rates.

If real rates are high (i.e., the interest rate paid on it is sufficiently in excess of inflation), savers and investors have the incentive to put their money in cash and other credit instruments.

If real rates are low, they seek out a variety of alternatives. This can be gold and other tangible assets like real estate, and riskier financial assets like stocks. Low real rates incentivize the purchase of riskier yield-bearing assets on leverage.

Foreign holders

Foreign traders, investors, and lenders care about the change in the currency relative to the change in the interest rate.

While domestic savers typically don’t care about day-to-day movement in the currency (their spending power stays the same either way), foreign participants don’t care much about inflation (which doesn’t directly affect their buying power not living in the country).

They want to ensure that their total return in the currency is positive.

For balance of payments purposes

When policymakers think about shoring up the balance of payments, they will need to focus more on the motivations of foreign lenders.

That means first getting the currency cheap enough through a devaluation. Second, they must produce an interest rate on it that produces a positive total return for the currency and is low enough to support domestic economic conditions.

What influences the total return of the currency?

The total return of the currency is the sum of currency changes plus interest rate differences.

Balance of payments fundamentals (i.e., closing the deficit or getting into a surplus) and the central bank’s ability to get the currency into a position where further currency depreciations won’t be a problem will determine whether the total return on the currency is positive.

At the bottom of the cycle, the economy is also weak, so there will be pressure by policymakers to “print” money, a depreciatory influence on the currency that will also have to control to keep the total return positive.

Devaluation is a valuable tool, but it can be abused. It can provide stimulation when needed, but can also produce very bad consequences related to inflation or in some cases a total loss of value when imbalances are never rectified.

Taking a long position in a devalued currency

The central bank largely dictates what happens, so it’s important to understand what they’re likely to do.

Taking a long position in a currency that’s undergone a large devaluation can be prudent if it helps close the balance of payments deficit and the interest rate paid on it is at a level amenable to economic conditions. On the interest rate front, it should be somewhat below the rate of nominal growth (i.e., real growth rate plus inflation). Higher and it will be a constraint on growth as the debt compounds faster than the nominal growth rate.

On the other hand, if the central bank doesn’t devalue far enough to close the balance of payments gap or prints money to offset economic weakness, the currency could decline further.

If investors, trader, and foreign lenders suffer negative returns for too long, confidence can fade that the central bank will provide the appropriate combination of stimulus (from the devaluation) and tightness in policy (high enough interest rate) to make buying the currency attractive.

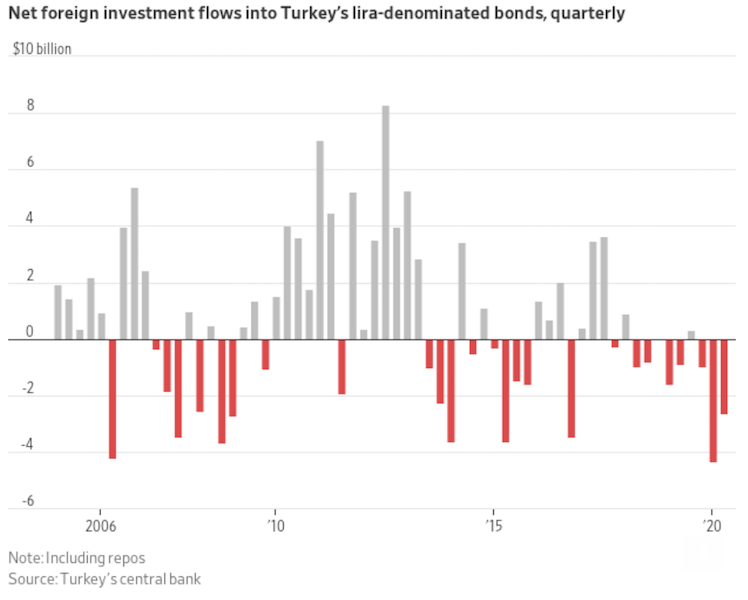

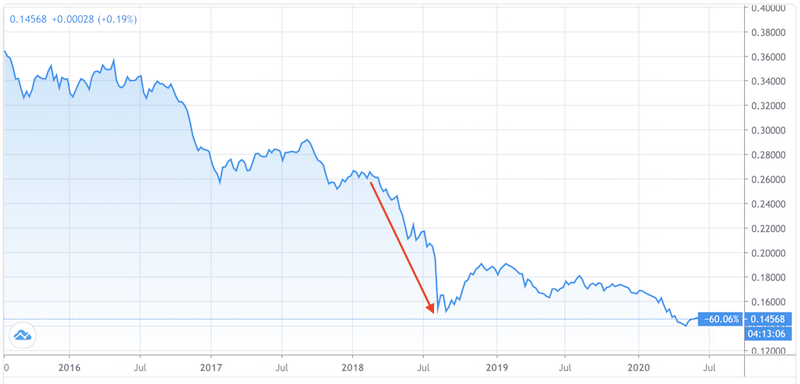

Turkey has traditionally had issues with its balance of payments with its heavy reliance of foreign lending. During its 2018 balance of payments crisis, the currency fell around 50 percent (in two notable chunks) before hitting the bottom.

(Source: Trading View)

It rebounded temporarily, but has since fallen again.

In July 2020, its central bank slashed interest rates below its domestic inflation. (At the time, the interest rate being paid on it is 8.25 percent while inflation is between 12 to 13 percent.)

This caused foreign investors to flee the bond market, given negative real return. In turn, this is creating a new drop in its currency.

To get the currency to bottom, they will need to tighten policy to get a positive spread between the interest rate and inflation. It will need to take some of the effect internally through lower growth and a temporary mild recession.

Post-devaluation, returns to holders of the currency tend to start out negative before becoming positive down the line.

Money printing considerations

“Printing money” is generally used when the adjustment of short-term interest rates is no longer effective.

So, the central bank will create money and buy its own bonds, which helps push down longer-term interest rates.

Holding all else equal, this reduces the currency level. In emerging markets, they have to be especially careful.

Sometimes a country is not tapped out on its debt limits, which is when the economy is growing and short-term interest rates are above zero. However, that can still mean certain entities in the country are experiencing their own limitations.

Policymakers must appropriately recapitalize such institutions systemically important to the economy in a targeted way. Debt crises are especially hard to manage when the problems are located within key entities.

Even if the broad economy metrics are fine and suggest the country isn’t at or approaching its limitations, certain important institutions could be and would be allowed to get worse because they’re concealed beneath the averages.

Bad debt needs to be managed to avoid a debt crisis that’s ultimately contractionary to the economy or could cause additional capital to move out of the country.

Any money printing associated with managing bad debts needs to be appropriately balanced against the inflationary effects.

Markers of the bottom

When a country reaches the bottom, you’ll typically see some of the following characteristics:

– Capital flight stalls.

– Capital inflows stop falling and stabilize.

– The drop in imports (from the lower currency) improves the balance of payments (often by 5 percent of GDP or more).

– The country often turns to the IMF, BIS, World Bank, or other entities for support and new capital, particularly if it has limited FX reserves.

– Short-term interest rates tend to come down some time after the bottom, but longer-term interest rates stay high relative to short rates. The fall in short-term interest rates is stimulative.

– As interest rates fall, the forward currency price converges to the spot price.

– As the currency stabilizes in value, the level and rate of change in inflation does so as well. The level of inflation usually decreases.

– Inflation doesn’t normally reach its (relatively low) level it had before the crisis for 1.5 to 3 years after the bottom.

While there are archetypical paths, each situation is different and no particular country or crisis has the exact same circumstances or pursues the exact same policies. No path is the same in depth or scope or takes the same amount of time.

The collapse in domestic economic conditions brings down spending and imports. Usually the equity market falls around 50 percent in local-currency terms and imports drop by about 10 percent.

Imports are initially more important than exports at getting the current account back into a breakeven or surplus situation.

The fall in imports generally brings the current account back into surplus again, an important step in rectifying the balance of payments gap.

The positive impact on exports comes later. When countries experience a balance of payments crisis, other countries are often experiencing problems as well, which can limit their ability to buy goods from other countries. Exports tend to rebound later.

The recovery

After the bottom, it usually takes a few years to recovery.

Investors who lost money in the past may be reluctant to return. Risk premiums tend to remain elevated.

Capital inflows may stabilize, but they may not be robustly positive. But when the currency is cheap enough, that means domestic goods, services, and labor fall in price as well. That makes it an attractive place for investment and capital will flow in if the country institutes good policies and is relatively economically stable.

Higher capital inflows and higher exports provide the capital required to boost growth.

If important financial institutions are appropriately capitalized, the financial machinery will be in place to support borrowing and lending and matching buyers and sellers of capital in the economy.

This effectively returns the country back to the early part of the cycle. New productive investment opportunities are available, which attracts capital, which drives up asset prices, which attracts more capital, and so on.

General points

– For the economy to reach its previous growth rate, it will generally take a few years. Income and spending pick up before that.

– When the economy and markets start to stabilize the currency is still relative cheap on a purchasing power parity (PPP) basis, usually by 5-15 percent. It generally stays cheap for a while.

– Exports will generally pick up slightly, by some 1 to 2 percent of GDP, but less so than the way imports fall (typically by 5 to 10 percent of GDP).

– Capital flows generally don’t return to normal until after the economy has resumed its normal growth rate, generally four years or more.

– Equities often take many years to recovery (about the same timeframe as capital flows), especially in foreign-currency terms due to the devaluation of the currency.

Characteristics of crises that are well managed

– In managing the currency, policymakers will say right up until the devaluation that they won’t let the currency go. If they get their communications right, it’s a surprise when they do.

– The devaluation will need to be sufficient enough such that market participants don’t expect additional currency weakening. Policymakers will at the same time, use reserves in a prudent way to smooth out capital flight while it works on getting external imbalances back in line.

– To close the balance of payments gap, monetary policy must be tight enough to get domestic demand in line with incomes.

– To get market participants in the currency, the interest rate provided on it must be enough to compensate for any further expectation in currency depreciation.

– For any entities that are overly indebted and systemically important to the smooth functioning of the economy, those will need to be properly capitalized.

Characteristics of crises that are poorly managed

– When the currency weakness is not well managed, policymakers are widely believed to allow more depreciation in the currency. They will sometimes hike interest rates on the currency to flush out speculative pressure downward. This won’t work when the depreciation pressures are large and the interest rate is typically bad for the economy, as it compounds debt servicing in excess of growth.

– If they do devalue, it is insufficient. Namely, it doesn’t get the currency cheap enough such the current account deficit turns into a balance or slight surplus. Market participants will anticipate further devaluation is needed and cause further capital outflow. Interest rates will rise, as will inflation expectations.

– Policymakers may try to stem capital outflows with capital controls or resort to things like wage and price controls. These access restrictions further incentivize capital to leave the country.

– In poorly managed crises, monetary authorities will place too much emphasis on domestic conditions, making monetary policy too easy, which sets off higher inflation.

– Instead of getting domestic demand back in line with income, they will rely more on reserve sales to keep imports and spending up.

– Policymakers may also allow excess defaults, including to systemically important entities, which leads to increased capital flight, more volatile markets, and more uncertainty about future economic conditions.

Cases where inflationary depressions spiral into hyperinflation

When handled well, policymakers can engineer a recovery in spending and incomes while getting inflation down to more normal levels. The balance of payments deficit closes and the problem is ultimately temporary.

However, some will end up spiraling into hyperinflation.

Hyperinflation occurs when inflation is very high and often increasing. Prices of goods and services in these scenarios double each year or worse.

This occurs when the imbalance between income, spending, and debt service is never closed. Monetary authorities create a lot of money, which ends up going offshore and into inflation-hedge assets.

This type of runaway inflation is not straightforward to get away from. It is not easy to stop printing money when the other option is a complete contraction in economic activity when there is no means of exchange available (reducing people to barter or use other national or alternative currencies).

In some cases, like in Weimar Germany, bad inflation problems were inevitable when its war reparations debt was unlikely to ever be paid and could not in effect be defaulted on, given delivery terms stipulated payment in gold.

The currency eventually becomes worthless. Bonds are zeroed. Stocks are somewhat of a hedge against the runaway inflation at first, but the fall in the exchange rate creates a wider gap between the appreciation in the stocks in local-currency terms. Commodities, gold, and other inflation-hedge assets become the assets of choice.

Losses of financial wealth are severe. Economic hardship becomes pervasive.

Hyperinflationary cases are more common than most assume and are thus a subset of Part V in trading emerging markets.

That topic is covered in more detail in the article below:

Hyperinflation: Definition, Causes, Examples, Remedies

Conclusion

Policymakers engineer a recovery in the economy when they get spending and domestic demand back in line with income and close the balance of payments gap (i.e., too much capital leaving the country relative to capital coming in).

At this point, capital outflow will abate. Capital inflows will stop declining and stabilize.

When policymakers get the devaluation right, this improves the balance of payments. Imports become more expensive, reducing the current account, and spending drops back in line with income.

The country may turn to the IMF or another international organization for aid to fill in the funding gap.

Once the currency stabilizes, short-term interest rates often come down a bit. Inflation typically decreases from its previous high levels, but can take a few years to get back to its formerly low level.

In cases where they are poorly managed (e.g., devaluation not sufficient, short-term interest rates not high enough to regain confidence in the currency), they can take longer than normal. A subset of these turn into hyperinflationary cases.