Best Forex Trading Platforms In Pakistan 2026

Forex traders in Pakistan need an online broker to speculate on currencies like the Pakistani rupee (PKR). However, with no forex trading platforms registered with the Securities and Exchange Commission of Pakistan (SECP), residents often open accounts with overseas brokers.

We’ve tested, rated and identified the best forex brokers in Pakistan, all accepting local traders, earning the trust of our experts, and supporting convenient deposits in Pakistani rupees.

6 Top Forex Brokers In Pakistan

Our years of hands-on evaluations and exhaustive analysis show these are the 5 best forex brokers for traders in Pakistan:

This is why we think these brokers are the best in this category in 2026:

- XM - XM offers a strong selection of currency pairs with no re-quotes or hidden charges, while spreads have come down over the years, now starting from 0.8 pips on the EUR/USD in the commission-free account.

- RoboForex - RoboForex offers trading on 30+ currency pairs, trailing category leaders like Pepperstone with its 90+ forex assets. That said, the Prime and ECN accounts feature competitive average spreads of 0.1 pips on the EUR/USD. Additionally, with a minimum investment of $100, traders can utilize the CopyFX system to replicate the strategies of seasoned currency traders.

- Exness - Exness offers an impressive selection of around 100 forex pairs - more than most brokers we've evaluated - along with competitive spreads on major pairs starting as low as 0.1 pips. Additionally, traders benefit from a robust suite of forex analysis tools, including market news powered by FXStreet.

- Vantage - Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

- IC Markets - IC Markets maintains its commitment to providing exceptionally tight 0.0-pip forex spreads on major currency pairs such as EUR/USD. This makes it an excellent option if you are seeking superior execution, with an average of 35 milliseconds. Additionally, if you are a high-volume trader, you can benefit from rebates of up to $2.50 per forex lot.

- AvaTrade - AvaTrade delivers 50+ currency pairs with tight spreads from 0.9 pips and zero commissions. Trade majors, minrs, and exotics 24/5 on leading forex platforms, notably MT4, with sophisticated charting tools and forex education to sharpen your edge, including a dedicated guide to 'Currency Trading'.

Best Forex Trading Platforms In Pakistan 2026 Comparison

| Broker | Forex Assets | EUR/USD Spread | Forex App Rating | Minimum Deposit | Regulator | Islamic Account |

|---|---|---|---|---|---|---|

| XM | 55+ | 0.8 | / 5 | $5 | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius | ✔ |

| RoboForex | 30+ | 0.1 | / 5 | $10 | IFSC | ✔ |

| Exness | 100+ | 0.0 | / 5 | Varies based on the payment system | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC | ✔ |

| Vantage | 55+ | 0.0 | / 5 | $50 | FCA, ASIC, FSCA, VFSC | ✔ |

| IC Markets | 75 | 0.02 | / 5 | $200 | ASIC, CySEC, CMA, FSA | ✔ |

| AvaTrade | 50+ | 0.9 | / 5 | $100 | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM | ✔ |

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| GBPUSD Spread | 0.8 |

|---|---|

| EURUSD Spread | 0.8 |

| EURGBP Spread | 1.5 |

| Total Assets | 55+ |

| Leverage | 1:1000 |

| Platforms | MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| GBPUSD Spread | 0.4 |

|---|---|

| EURUSD Spread | 0.1 |

| EURGBP Spread | 0.4 |

| Total Assets | 30+ |

| Leverage | 1:2000 |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Account Currencies | USD, EUR |

Pros

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

- The broker offers leverage up to 1:2000 for certain account types, which is among the highest in the industry. This high leverage allows day traders to maximize their trading potential, albeit with a corresponding increase in risk.

Cons

- RoboForex now restricts base currency options to USD and EUR. This limitation may inconvenience day traders preferring to manage their accounts in other currencies, while potentially leading to conversion fees.

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| GBPUSD Spread | 0.0 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.0 |

| Total Assets | 100+ |

| Leverage | 1:Unlimited |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

Cons

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| GBPUSD Spread | 0.5 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.5 |

| Total Assets | 55+ |

| Leverage | 1:2000 |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- There’s an excellent suite of day trading software, including the award-winning platforms MT4 and MT5

- Vantage maintains its high trust score thanks to its strong reputation and top-tier regulation from the FCA and ASIC

- It’s quick and easy to open a live account – taking less than 5 minutes

Cons

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| GBPUSD Spread | 0.23 |

|---|---|

| EURUSD Spread | 0.02 |

| EURGBP Spread | 0.27 |

| Total Assets | 75 |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

Cons

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| GBPUSD Spread | 1.5 |

|---|---|

| EURUSD Spread | 0.9 |

| EURGBP Spread | 1.5 |

| Total Assets | 50+ |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

How We Rate Forex Brokers In Pakistan

We focus on the following criteria when evaluating forex brokers, and recommend you do also:

Trust

Select a trusted broker to protect yourself from forex scams, which continue to make headlines in Pakistan.

In one example, reported by Pro Pakistani, a victim from Lahore lost millions of rupees after depositing money with two online trading platforms, Capital FX and Betfire, whose owners disappeared with his money.

Given that the State Bank of Pakistan (SBP) and the Securities and Exchange Commission of Pakistan (SECP) do not actively regulate forex brokers, our advice is to choose a well-established platform licensed by a respected overseas regulator, such as the UK’s FCA or Australia’s ASIC. This is the best sign that a forex broker is legitimate. If you do, make sure you adhere to local tax rules in Pakistan.

- IG is the most trusted forex broker accepting traders from Pakistan. It has 50 years of experience in the forex industry and authorization from 7 ‘green tier’ regulators. Also, our experts have traded forex with real money on the IG platform and praise the superb trading environment.

Currency Pairs

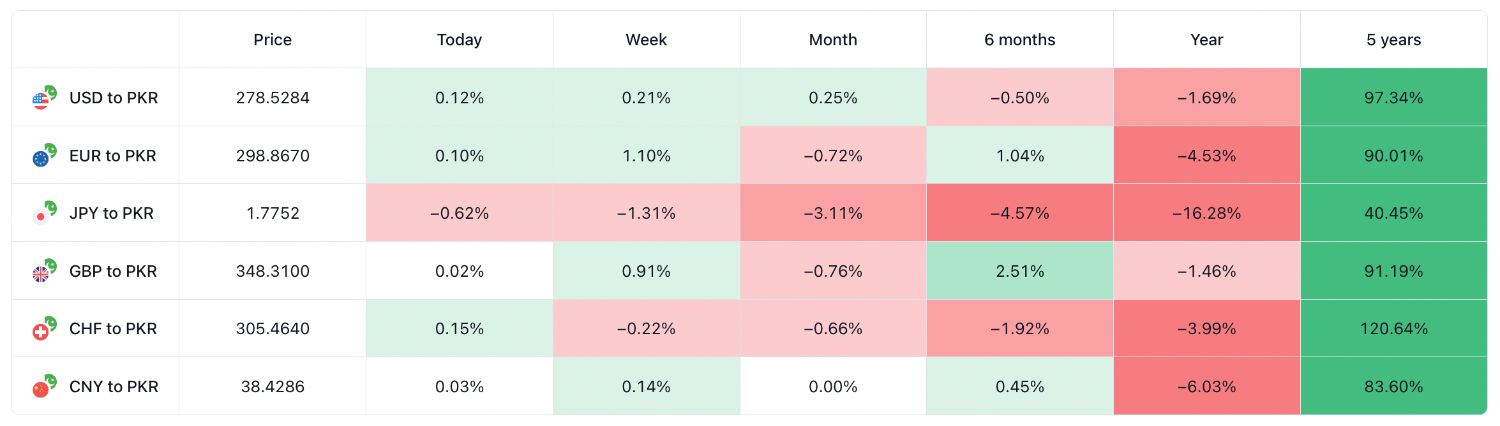

Pick a forex trading platform with the currency pairs you’re interested in speculating on.

For traders in Pakistan, this may mean those containing the Pakistani rupee, such as USD/PKR, EUR/PKR and GBP/PKR, though our research shows these are not commonly available.

- Pepperstone is our top choice for its range of currency pairs, with 100+ assets including USD/INR and USD/SGD, plus currency indices rarely found elsewhere. Its 30ms execution speeds also make it perfect for forex day traders, helping it win our ‘Best Forex Broker’ award twice now.

Trading Fees

Select a forex broker with excellent pricing, especially if you’re an active trader, as frequent costs can cut into profit margins.

We regularly evaluate brokers’ spreads on popular currency pairs, minimum and average spreads where possible, plus any commissions and non-trading fees for converting Pakistani rupees to an account based in another currency, painting a comprehensive picture of costs.

We then balance these with the overall offering, from education to tools that provide insights into State Bank of Pakistan decisions that could impact currency prices, for example, identifying the platforms that deliver the best value for money.

- IC Markets has maintained its position as one of the cheapest forex brokers for years now, with remarkably tight spreads from 0.0, a $3.50 commission, plus rebates up to $2.50 per forex lot. Its superior execution also helps active traders secure the best prices in volatile FX markets.

Forex Platforms

Pick a platform or forex app you enjoy using with the features you need, notably an excellent charting package if you are day trading FX.

MetaTrader 4 and MetaTrader 5 have long been the choice for experienced short-term traders, who value the speed, advanced charts, and algorithmic trading power they offer. However, after more than 15 years, these platforms are showing their age with bland designs that I don’t find intuitive.

Alternatively, increasingly popular solutions like TradingView provide more appealing interfaces and integrated research tools, including Pakistani economic indicators, calendars and exchange rates.

- Vantage offers a fantastic selection of forex platforms, from MT4, MT5 and TradingView, to its own ProTrader that I love with its 100+ indicators, 50+ drawing tools and easily customizable workspace and advanced order types.

Account Funding

Choose a broker that supports fast and affordable payments via Pakistani rupees so you can focus on forex trading.

Findings from Graana.com reveal some of the most common online payment methods in Pakistan include wire transfers, Payoneer and MoneyGram. Statista also reports that Pakistan is embracing digital payments, which accounted for more than $15 billion worth of its payments in 2023.

- AvaTrade excels in its convenient, low-cost payment methods, including wire transfers and digital solutions like MoneyGram, catering to Pakistani traders. Its 100 USD minimum deposit, around 28,000 PKR, is also accessible for forex traders at all levels.

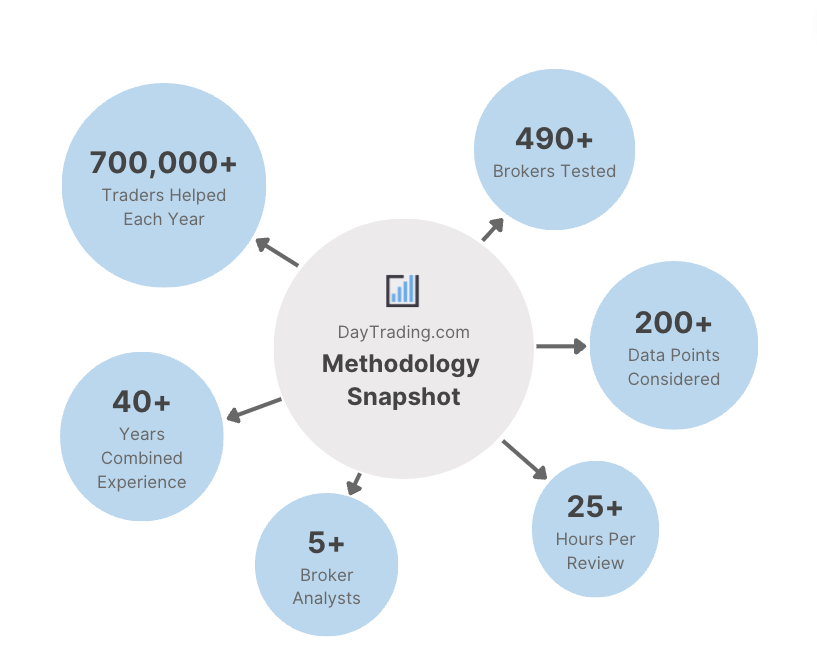

Methodology

To list the best forex trading platforms in Pakistan, we used our 140-strong directory of online brokers, filtered it by those accepting Pakistani traders and ranked them by their rating, which considers crucial factors, notably:

- A proven track record and authorization from a regulator if not Pakistan’s SECP.

- A great selection of currency pairs, including those of interest to Pakistani traders.

- Excellent pricing, especially for active forex traders.

- Terrific forex platforms and apps following testing.

- Convenient funding methods that work in Pakistan.

FAQ

Is Forex Trading Legal In Pakistan?

Trading forex is not prohibited in Pakistan so locals can register with online brokers, though remain vigilant against unauthorized trading firms.

Who Regulates Forex Brokers In Pakistan?

The Securities and Exchange Commission of Pakistan (SECP) and State Bank of Pakistan (SBP) oversee the country’s financial services, but do not actively oversee local brokers, so many traders turn to international platforms. It’s important to check your local regulations and comply with tax rules in Pakistan if you do opt for an overseas broker.

Note that if your forex broker is not tightly regulated you may not receive adequate legal protections. Only risk what you can afford to lose.

How Much Money Do I Need To Start Trading Forex In Pakistan?

After evaluating 140 brokers, our analysis shows you normally need up to 250 USD, or 70,000 PKR, to open a trading account.

That said, brokers like Pepperstone accept forex traders from Pakistan and excel for budget investors with no minimum deposit.

Recommended Reading

Article Sources

- Securities and Exchange Commission of Pakistan (SECP)

- State Bank of Pakistan (SBP)

- Lahori Man Falls Victim To Forex Scam - ProPakistani

- Islam in Pakistan - Wikipedia

- Online Payment Methods in Pakistan - Graana

- Digital Payments in Pakistan - Statista

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com