Forex Trading in Pakistan

Trading currencies in Pakistan is becoming increasingly popular. Thanks to its large economy, improving digital infrastructure, and growing interest in financial markets, forex dealing in the Asian territory is picking up steam.

This guide tells you what you need to know to start trading currencies online in Pakistan. It explains market regulations and tax rules, reveals the best time of day to do business, and illustrates how a trade involving Pakistan’s rupee (PKR) could go down.

Quick Introduction

- Pakistan’s fast-growing economy is helping to boost the volume of currency transactions.

- The forex market is regulated by the country’s central bank, the State Bank of Pakistan (SBK).

- The best time to trade in Pakistan is arguably late in the evening when both the London and New York markets are open.

- Profits from dealing forex are typically taxed at rates of between 2.5% and 35% in line with the Federal Board of Revenue (FRB).

Top 4 Forex Brokers in Pakistan

Our testing reveals these 4 platforms are the best for forex traders in Pakistan:

See all Forex Brokers in Pakistan

How Does Forex Trading In Pakistan Work?

Pakistan has a large and rapidly expanding economy. According to the World Bank, it is in the top quartile of the world’s biggest economies (in 41st place). This – combined with an improving technological ecosystem – means that interest in dealing currencies online is rising sharply.

Traders in the country have a wide selection of major, minor, and exotic currency pairings to choose from today. Forex crosses involving Pakistan’s official currency, the rupee (PKR), are also hugely popular.

Is Forex Trading Legal In Pakistan?

Currency trading is legal and regulated by the State Bank of Pakistan (SBK). According to its website, the central bank “issues policies, regulations and guidelines to facilitate smooth functioning of financial markets and ensure that the markets play their role effectively and efficiently in a prudent manner.”

The SBK regulates forex brokers which it often refers to as ‘exchange companies.’ It closely supervises them to confirm they are adhering to local rules and regulations, thus ensuring the integrity and smooth functionality of currency markets while boosting protections for forex traders.

Is Forex Trading Taxed In Pakistan?

Forex traders are required to pay tax on any gains they make. They need to be reported to the Federal Board of Revenue (FRB), which is responsible for administering Pakistan’s tax system and collecting taxes.

Pakistan’s tax year runs from 1 July to 30 June, and tax returns must be completed and dispatched to the FRB by 30 September the following year.

Profits are subject to income tax if a trader makes a living from trading currencies. Tax is applied at the following rates (subject to change):

| Profit (in PKR) | Tax Rate |

|---|---|

| Up to 600,000 | 0% |

| 600,001 – 1,200,000 | 5% |

| 1,200,000.01 – 2,200,000 | PKR 30,000 + 15% of the amount exceeding 1,200,000.01 |

| 2,200,000.01 – 3,200,000 | PKR 180,000 + 25% of the amount exceeding PKR 2,200,000.01 |

| 3,200,000.01 – 4,100,000 | PKR 430,000 + 30% of the amount exceeding PKR 3,200,000.01 |

| 4,100,000.01 and above | PKR 700,000 + 35% of the amount exceeding PKR 4,100,000.01 |

When Is The Best Time To Trade Forex?

Traders in Pakistan – like those in other regions – have the opportunity to trade currencies 24 hours a day, five days a week. However, there are specific times of the day when currency dealing can be especially effective.

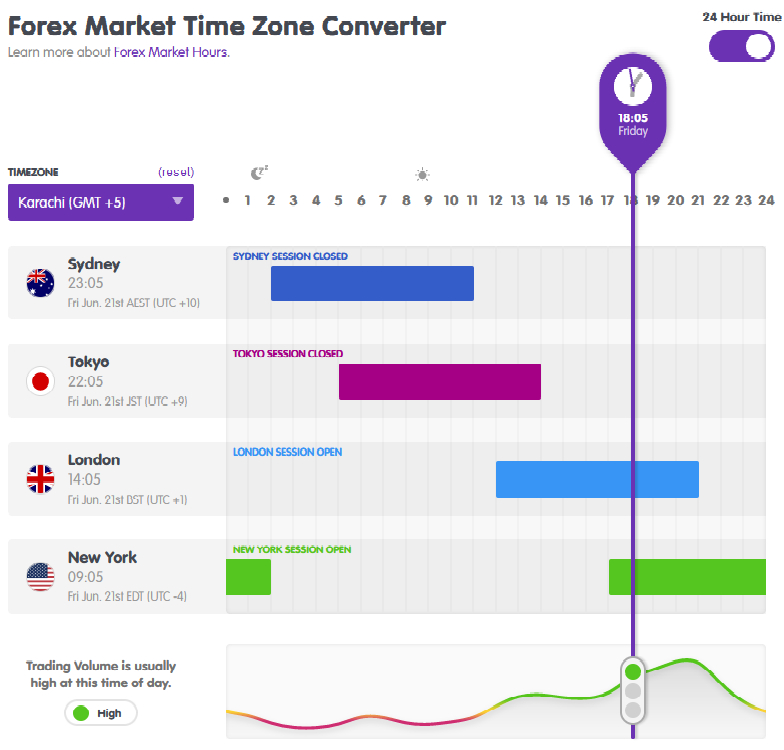

Under Pakistan Standard Time (PKT), the best time to trade is arguably between the hours of 17:00 and 22:00 when daylight saving time (DST) is observed across the world. When DST is not in action, the best trading hours shift to 18:00 to 23:00.

Unlike most of the world, Pakistan does not observe DST. Therefore, the best times to trade fluctuate in accordance with the changes in market openings in the UK and the US.

Between these times, the bustling London market is in full swing, while traders in New York are at the beginning of their trading day. During these overlapping trading periods, dealing volumes are especially high, which can lead to greater volatility and ease with which investors can enter and exit positions.

A Forex Trade In Action

Armed with this information, let’s now look at how a forex trade could work in real life. In this example, I’ll show how a trader like me could make money from a fluctuating PKR following the release of crucial US inflation numbers.

The Plan

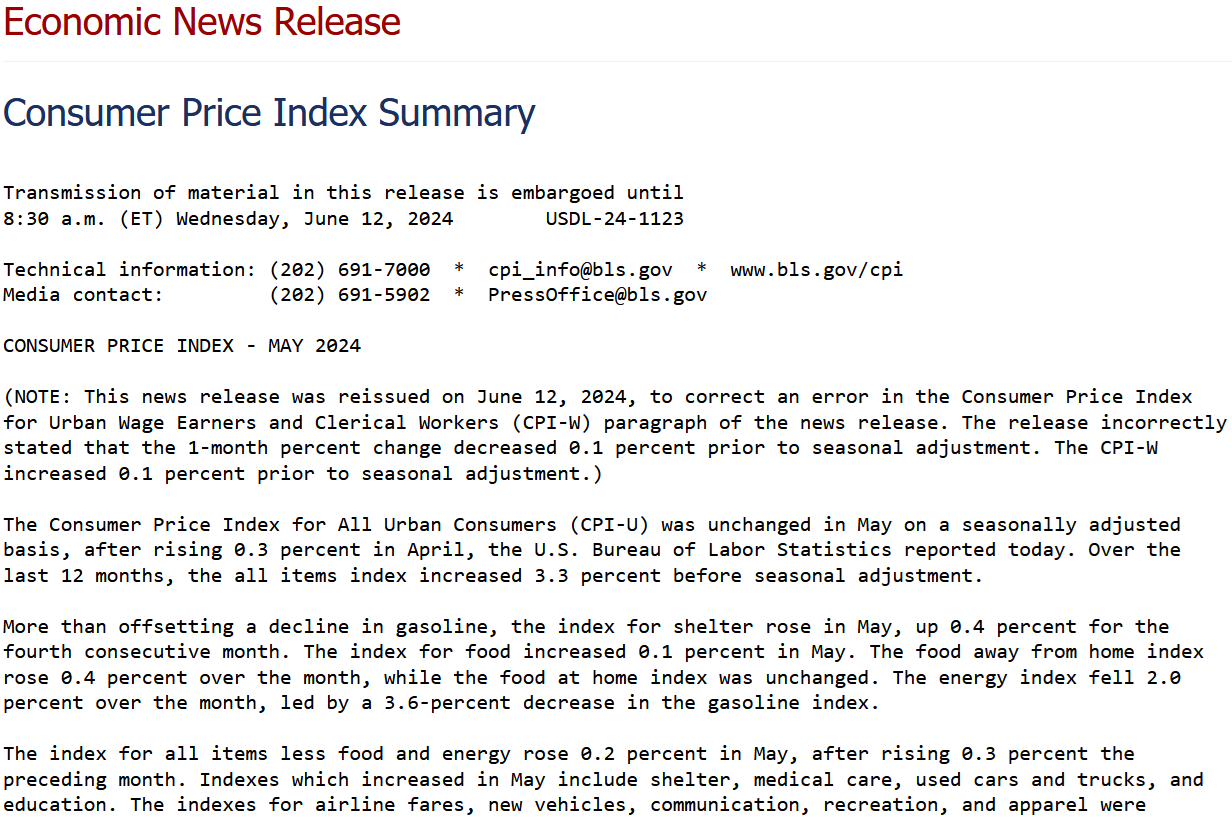

After studying key economic data, I’m confident that consumer price inflation (CPI) in the US will have fallen sharply in the last month. This is a view shared by the wider market, which is pricing in a 0.5% fall in headline inflation when the US Bureau of Labor Statistics (BLS) makes its upcoming announcement at 17:30 PKT.

However, I think that CPI is likely to fall by a sharper 0.7%. This in turn could cause the US dollar (USD) to weaken more significantly than investors expect, giving me a chance to book a profit.

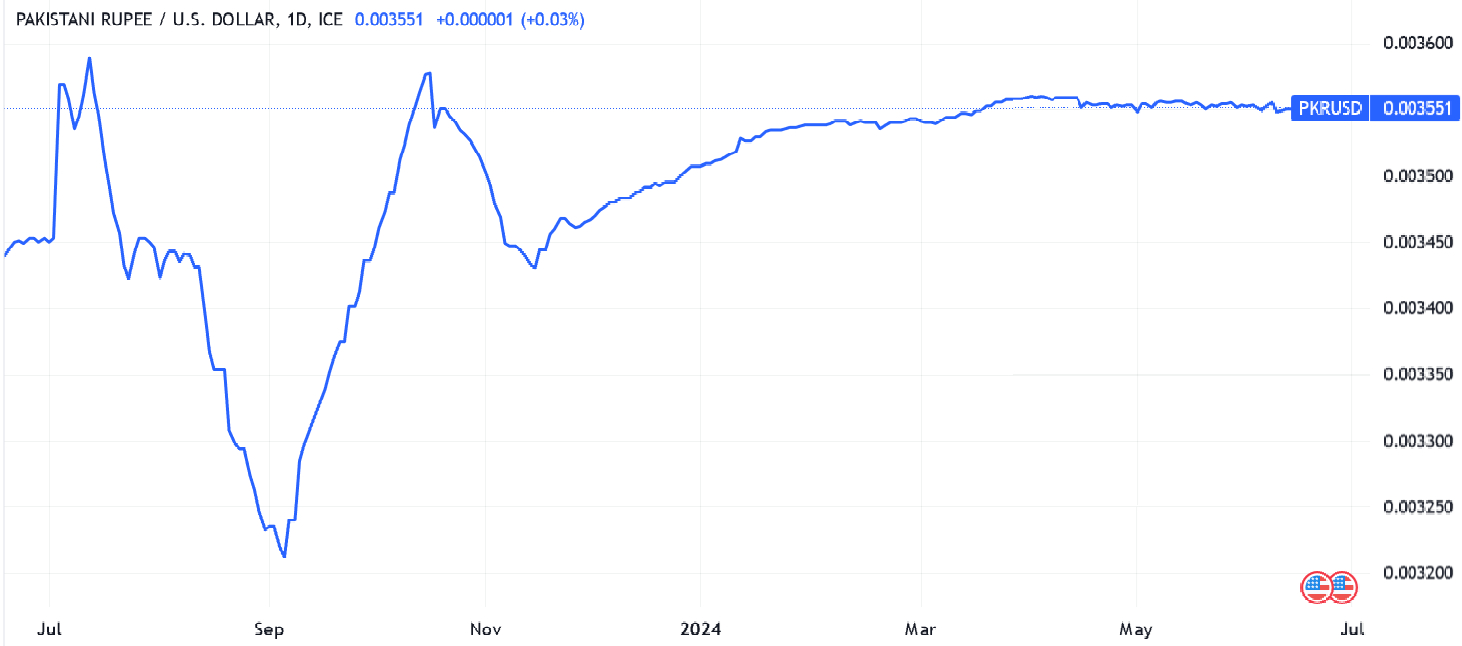

I decide to trade the PKR/USD pairing to capitalize on this potential scenario. I take out a long position, which involves buying the rupee (the base currency) at the same time as selling the dollar (the quote currency).

The Setup

My next step is to think about how to place the trade. To manage risk, I decide to set up ‘take profit’ and ‘stop loss’ orders.

The former device will automatically close my position if the PKR/USD rises to a certain level, in turn locking my profits in. The ‘stop loss,’ meanwhile, will shut my position if the currency cross unexpectedly drops, thus limiting any losses I may incur.

Before doing this, I study the charts to help me decide where to place these instructions. Technical analysis reveals patterns, trends, and indicators based on previous prices and volumes that can provide me with clues about where the PKR/USD pair could move next.

The Trade

Having completed this step, I decide to place my ‘take profit’ instruction at 0.003592, while my ‘stop loss’ is placed at 0.003551. I punch these orders in five minutes before the BLS makes its announcement. At this time, the PKR/USD cross is trading at 0.003561.

At 17:30 PKT, the labour department releases its much-awaited inflation report. It shows CPI having fallen 0.8%, even more than I expected. Within 15 mins the PKR/USD cross has risen to hit my ‘take profit’ order, at which point my position is closed and I’ve booked a profit of 31 pips.

Bottom Line

Pakistan is home to a growing community of forex traders. Investors have a wide selection of currency pairings to choose from, and can bolster their chances of turning a profit by trading in the evening when the London and New York trading sessions overlap.

While the market is regulated by Pakistan’s central bank, traders should still be vigilant against being scammed. At the very minimum, they should check that the forex broker they’re thinking of using is regulated.

Recommended Reading

Article Sources

- Gross Domestic Product Ranking Table – World Bank

- Policies and Guidelines for Financial Market players – State Bank of Pakistan (SBP)

- Finance Bill – Federal Board of Revenue (FRB)

- Pakistan – Overview - PwC

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com