Why Day Traders Lose Money

Trading is one of those things that a lot of people think they can do well.

But statistics show that the vast majority of day traders lose money.

Why is this?

This article goes into the reasons behind these losses, looking at the challenges and pitfalls that day traders face in their pursuit of quick profits.

Key Takeaways – Why Day Traders Lose Money

- Overconfidence and Emotional Trading

- Many traders grossly underestimate market complexity and let emotions override the disciplined decision-making processes required to have an edge.

- Finance/trading is one of those things where those with little to no experience are often more opinionated than those who successfully do it for a living.

- Traders know that markets operate based on probabilities and the key is to have a statistical edge over the long run.

- Broken Feedback System

- Markets distort feedback in dangerous ways. We cover 14 categories of the ways in which this is true.

- Information Disadvantage & Lack of Statistical Edge

- Retail traders often compete against sophisticated algorithms and lack access to timely, high-quality information.

- High Transaction Costs

- Frequent trading erodes profits due to fees, spreads, and slippage, which are often underestimated.

- Psychological Fatigue

- The constant need to make rapid decisions or simply forcing decisions can lead to poor judgment and costly mistakes.

The Illusion of Easy Money

Many aspiring day traders are lured by the promise of fast, substantial profits.

They’re captivated by stories of traders who turned small accounts into fortunes overnight – e.g., crypto, GameStop, AMC, and other social financial phenomena.

Inspiration is great, but it may lead to an inaccurate understanding of how difficult competing in markets actually is.

Day trading is a challenging, high-stress occupation that requires a unique set of skills, knowledge, and psychological fortitude.

Underestimating the Complexity of Markets

Novice traders often think the trading game is fairly simple.

They view charts and price movements as simple patterns to be decoded, ignoring the complex range of factors that drive market behavior.

There are all sorts of different buyers and sellers, of varying levels of size and influence, who all have different kinds of motivations for doing what they’re doing.

Economic indicators, geopolitical events, company fundamentals, and market sentiment and buying and selling activity all contribute to price movements in ways that are often unpredictable and difficult to analyze.

Not Just Fundamental Factors

Markets don’t trade just based on fundamental factors like the weather.

The weather is a very complex system, but it does whatever it does regardless of what humans and human-made systems think about it.

If you have more data and better computing power, the forecasts tend to become more accurate over time.

Markets, on the other hand, don’t work like that.

Markets trade based on discounted expectations, as people’s expectations, forecasts, and the decisions of others affect their own decisions, which in turn affect the pricing of markets.

In other words, people’s decisions become part of the system itself rather than existing independently from it.

This creates unique feedback loops.

It’s not whether things are a certain way, but how things transpire relative to what’s already discounted into the price.

Sometimes “good” things make markets fall and “bad” things cause markets to rise.

That’s markets reacting relative to the priced-in expectations – i.e., how events go and how discounted conditions change relative to what they were previously.

The Information Disadvantage

Algorithms

Human traders are at a significant disadvantage in certain ways.

Sophisticated algorithms can process vast amounts of data and execute trades in milliseconds.

They can process information faster, more accurately, and be less emotional and biased than any human could hope to be.

These algorithms, used by large financial institutions and hedge funds, can capitalize on small price discrepancies in milliseconds and are applying this logic in a consistent way.

This technological edge makes it incredibly difficult for individual traders to find and exploit profitable opportunities by tactically trading.

The (General) Myth of the Informed Retail Trader

Many day traders believe they can gain an edge through diligent research and analysis.

However, they’re often working with publicly available information that has already been priced into the market.

Professional analysts with access to superior resources, analytical capabilities, and insider connections have already dissected this information.

It’s not easy for an individual trader to have better information, analysis, or technology to have a statistical advantage over professional traders.

Difficulty in Discerning Whose Opinions Are Accurate or Valid

Novice traders often struggle to distinguish credible opinions from unreliable ones because they lack the experience and knowledge to judge.

Being new to trading, they may not fully understand how complex markets actually are, which leaves them vulnerable to persuasive but potentially misleading or wrong advice.

Without a solid foundation, they can’t easily evaluate the track record or expertise of different sources, leading them to trust popular opinions, simplistic gut judgments that “sound right,” social media hype, or confident-sounding individuals over those with true insight and proven strategies.

This lack of discernment makes it challenging to separate valuable guidance from noise.

It’s always a good idea to start by paying attention to people’s reasoning and not just their conclusions.

The Psychological Battle

Day trading can be an emotional minefield. The rapid gains and losses can trigger feelings of euphoria, fear, and anxiety.

These emotions can lead to impulsive decisions, causing traders to deviate from their strategies.

Winning streaks can create overconfidence, while losses can lead to risky behavior in an attempt to recover.

Your odds of making a trade and having it go in your favor are usually not much worse than 50-50*, so it seems like the average person has a chance.

You enter a trade and it either goes for you or against you.

*It’s less than 50-50 because of transaction costs (the spread + things like commissions).

To make matters worse, there are common narratives thrown around like “the average hedge fund doesn’t beat the S&P 500.”

A novice trader who hits on a few coin flips in a row might mistake this success for knowing what they’re doing when it’s just variance temporarily working in their favor.

The Stress of Constant Decision-Making

For day traders trying to make money, that means they’re under constant pressure to do something.

Each tick of the market might present a new decision point: buy, sell, or hold?

This need for rapid decision-making can lead to mental fatigue, clouding judgment and increasing the likelihood of errors.

And some have difficulty with the idea that they spent a lot of time doing something on any given day just to lose money.

This leads to all sorts of issues like revenge trading.

Over time, stress can take a toll and further impact their performance.

Technical Challenges

The Pitfalls of Technical Analysis

Many day traders rely heavily on technical analysis, studying charts and indicators to predict future price movements.

These can be helpful in some ways, such as understanding how the asset is likely to behave in various ways (e.g., volume, volatility, nature of the price moves, general liquidity of the asset), but they’re far from infallible.

Past price patterns don’t guarantee future performance, and many technical signals can be misleading or generate false positives.

Overreliance on technical analysis can lead to a false sense of certainty.

The Order Execution Trap

Day traders often fall victim to unfavorable order executions.

When placing market orders, they may receive fills at prices worse than expected due to slippage, especially in fast-moving or illiquid markets.

Limit orders, while providing price certainty, may not execute at all if the market moves away quickly.

This constant battle with order execution can erode profits and worsen losses.

Transaction Costs

Transaction costs can also be a lot worse than many think.

For example, let’s say a trader wants to sell a put option.

The spread is 0.25 (bid) – 0.28 (ask).

This is relatively tight but still wide considering 0.03 is more than 10% of the option’s value.

They sell at 0.25 ($25 given 100 shares per contract) and pay a $2 commission. Two dollars isn’t much but, again, it’s a lot relative to the size of what they’re doing.

Once they enter in, the option is priced at $28 (loss of $3) because of how the spread works and they paid a $2 commission.

So they lost $5 in value for an asset worth $25.

That’s 20% of the value(!)

Considering that if they have no edge on the market if they’re trading tactically, they are losing a lot of value in a zero-sum game.

Exchange fees can also take a toll as well, if applicable.

Many underestimate their cumulative effect.

The Tax Man Cometh

Day trading profits, when they occur, are typically taxed as short-term capital gains, which are subject to higher rates than long-term investments (because policymakers want to incentivize stable investment for the sake of capital formation).

This tax burden can substantially reduce net returns, making it even more challenging to achieve profitability.

Many novice traders fail to account for taxes in their performance calculations, leading to potentially unpleasant surprises come tax season.

Broken Feedback System

Most day traders lose money not just because the markets are hard, but because their feedback systems are fundamentally broken.

In a well-functioning skill-based environment, actions yield clear, consistent, and timely feedback – allowing people to improve.

But trading distorts feedback in subtle and dangerous ways.

Success is often decoupled from process quality, randomness is misread as skill, and the emotional noise of the experience overrides rational analysis.

Below are the key ways this manifests.

Misreading Results: The Illusion of Competence from Raw Earnings

Investor A saves $1,000 per month and passively invests in a broad market index, achieving average (~50th %ile) returns.

Investor B, on the other hand, saves $10,000 per month and actively trades the market yet, with their skill deficit, achieves only one-third the returns of the index.

After 40 years, Investor B ends up with more than double the wealth of Investor A.

The issue here is that Investor B’s greater outcome is entirely a function of capital input, not trading or investing skill.

Yet they may believe they are a successful trader/investor, when in fact their returns were objectively poor.

They simply saved a lot, and even had positive returns. They just significantly underperformed what they could have done doing nothing (i.e., indexing).

The feedback system here – “I made a lot of money” – masks the fact that their strategy underperformed by a wide margin. A faulty signal produces misplaced confidence.

Noise Disguised as Signal: Punditry, Bias, and False Authority

Every day, voices online and in the media make contradictory market claims.

Someone will always be “right,” simply due to the probabilistic nature of markets – especially over short timeframes.

A random market opinion is basically a coin flip on the surface – up or down. Trading it is well less than 50-50 odds and there are factors once the trade is made (if it is at all).

Combine this with hindsight bias, selective framing, and no real accountability, and you get a flood of confident-sounding commentary that has no predictive value.

Many traders mistakenly treat these as reliable inputs, reinforcing poor habits based on random success.

The feedback they’re acting on isn’t derived from any real edge – it’s performance theater.

Let’s say they have an opinion that the market will go down. That’s 50/50, heads or tails.

Let’s say it goes down at some point and they can frame it as being right. And some small fraction of the time maybe, they actually made the trade (they sold, shorted, whatever).

Okay, after a month or a few months the drawdown is recovered…

Is that opinion still right? Did they get back in at some point? Did they derive the intended benefit?

It’s all guesswork.

Even professional traders and investors only know things in the context of probability distributions and their evolution over time, not specific point forecasts.

Externalizing Failure: Attribution Error and Ego Protection

When things go wrong, many traders blame external forces: the Fed, politicians, “the algos,” their financial advisor, volatility, market makers, “fakeouts,” or bad luck.

Rarely do they accept that their entry was poor, their risk was misaligned, or their edge didn’t exist.

This attribution error is feedback avoidance. It insulates the ego but blocks growth.

As a result, they repeat the same behaviors, buffered from the painful (but necessary) introspection that leads to progress.

Mistaking Randomness for Skill

Traders who win early in their journey often do so by accident.

But emotionally, those wins feel validating – like the market is rewarding intelligence or intuition.

This perceived positive feedback leads to increased risk-taking, despite a lack of edge.

By the time they hit statistical reversion, they’ve scaled up and are overexposed.

Their feedback loop was never grounded in skill. It was built on misinterpreting variance as value.

Dopamine as Data: Psychological Reinforcement from the Act of Trading

The act of trading – watching charts, placing orders, seeing green flashes on a screen, and even the way some brokers gamify trading – creates its own emotional rewards.

This dopamine cycle reinforces activity, not profitability. Even traders who are consistently losing money may feel like they’re “in control” or “almost there,” simply because they’re stimulated.

The feedback they’re responding to isn’t financial, but neurochemical.

Short-Term Wins, Long-Term Leaks

Some trading systems produce frequent small wins (e.g., selling OTM options). These create confidence and the illusion of a good strategy.

But these same systems often carry the risk of rare, devastating losses due to poor risk controls or undefined exits.

When the inevitable blow-up comes, it wipes out months or even years of profits.

The feedback from short-term wins was misleading; it never accounted for the asymmetry of risk.

Market Movement ≠ Validation

Just because a trade eventually becomes profitable doesn’t mean the trade was good.

A trader might simply be bailed out by market variance.

When this happens, they learn the wrong lesson: that “sticking with it” works.

The feedback suggests resilience, but what’s really being reinforced is poor discipline and misaligned risk.

Outcome Bias Overriding Process Quality

Traders often judge themselves based on whether a trade made or lost money.

But that’s backward.

A well-structured trade with strong reasoning can still lose due to randomness. A reckless, all-in gamble can still win.

If traders let short-term outcomes dictate process evaluation, they end up abandoning good strategies too early or cementing bad ones through luck.

The feedback system is flipped: results become more important than reasoning.

Echo Chambers and Comparison Traps

On Twitter, Reddit, Discord, and YouTube, traders are constantly exposed to highlight reels of others’ wins – multi-baggers, perfect entries, fast riches.

This curated feedback skews perception. Traders begin judging their own competence based on how they compare to a distorted reality.

Worse, they begin chasing others’ strategies, thinking that what works for someone else should work for them too.

It’s feedback through comparison, not through mastery.

Emotion as Feedback: Highs, Lows, and Reactive Trading

Big wins feel good. Big losses feel bad (even worse than big wins feel good).

But when emotion becomes the main feedback signal, rationality gets hijacked. Traders begin chasing feelings rather than executing plans.

Overconfidence follows euphoria; revenge trading follows pain.

The market becomes an emotional opponent, not a probabilistic environment.

Traders who can’t detach emotion from evaluation become victims of their own brain chemistry.

Ignoring Net Results: Costs, Friction, and Illusions of Profitability

Gross P&L might look decent, but what about slippage, spreads, commissions, platform fees, and taxes?

Many day traders ignore the frictional costs that slowly erode their edge.

They may think they’re breaking even – or even winning – because they don’t track their net performance with precision.

This feedback failure keeps them locked into strategies that don’t actually work after costs.

No Structured Review or Learning Loop

Without a trade journal, performance tracker, or strategy audit, there’s no feedback system at all.

Many traders go months – or years – without doing a proper post-mortem.

They rely on memory, feeling, or cherry-picked outcomes to determine what’s “working.”

In this environment, it’s impossible to identify what to keep, tweak, or discard.

There’s no iterative loop – just reactive behavior.

Time Horizon Mismatch: Delay Between Action and Result

Trading decisions don’t always produce immediate feedback.

A macro view might be right, but mistimed. A position might be correct in principle, but unprofitable in the short term.

When traders can’t tolerate lagged feedback, they abandon viable strategies prematurely.

Or they stick with bad ones just because they haven’t lost… yet.

There are strategies that win over 90% of the time but have negative expected value.

Without patience and a proper understanding of timeframes, the feedback becomes noisy and unusable.

Premature Conclusion from Small Samples

Traders often pivot strategies after a few wins or losses – too soon to meaningfully evaluate anything.

Five losing trades doesn’t mean a system is broken; five winners don’t mean you’ve found the holy grail.

The human brain loves quick conclusions. But trading edge only reveals itself over dozens (if not hundreds) of trades.

Acting on feedback from tiny samples creates a constant loop of jumping, doubting, and chasing – never refining.

The Mathematics of Loss

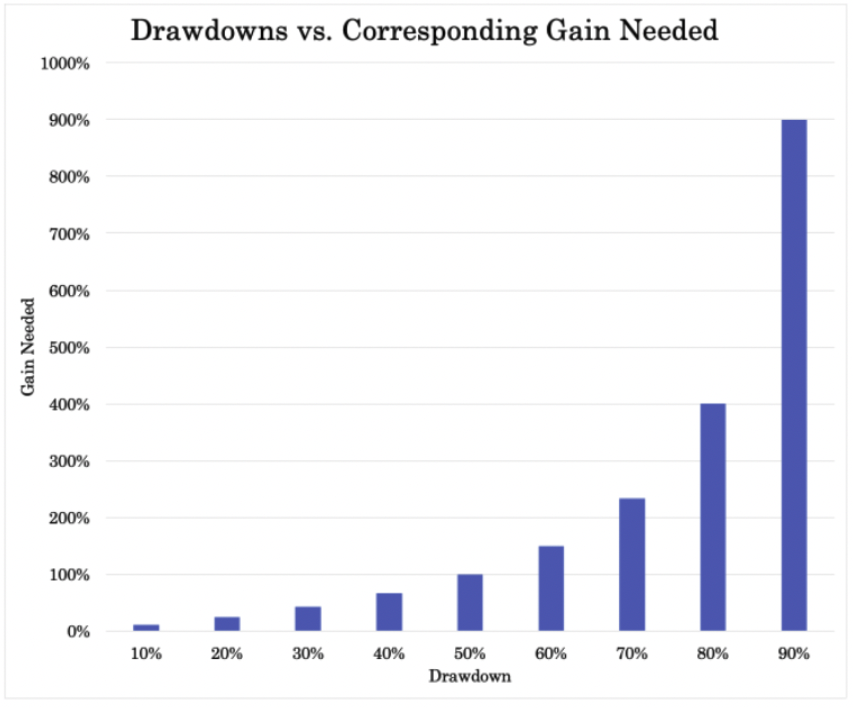

The Asymmetry of Gains and Losses

One of the most insidious traps for day traders is the asymmetrical nature of gains and losses.

A 50% loss requires a 100% gain just to nominally break even.

This mathematical reality means that a string of losses can be devastating to a trading account, requiring exponentially larger wins to recover.

Many traders fail to fully appreciate this asymmetry, leading them to take on excessive risk in pursuit of recovery.

Many institutional traders are fanatical about keeping their drawdowns limited to avoid the non-linear reality of this – often 10%-20%.

Most day traders, however, are very “offense” oriented and don’t keep a quality balance between risk and reward.

The Gambler’s Fallacy

Day traders often fall prey to the gambler’s fallacy, believing that a string of losses must be followed by a win.

This flawed thinking can lead to increasing position sizes or taking on more risk after a losing streak, amplifying potential losses.

In reality, each trade is an independent event, and past outcomes do not influence future results.

The Illusion of Control

Misinterpreting Random Reinforcement

The market occasionally rewards bad strategies through sheer chance.

These random successes can reinforce poor trading habits, leading traders to believe they have a winning edge when they’re simply experiencing short-term luck.

This misattribution of success can be particularly dangerous, as it encourages traders to take on more risk based on a false sense of skill.

The Dunning-Kruger Effect in Trading

Many novice day traders suffer from the Dunning-Kruger effect, overestimating their own abilities and underestimating the complexity of the markets.

This cognitive bias leads to excessive confidence and risk-taking, often resulting in significant losses.

As traders gain more experience and knowledge, they may paradoxically become less confident but more skilled at what they do.

The Path to Improvement

The Necessity of Capital

Successful day trading requires a significant amount of capital.

Many traders start with insufficient funds, forcing them to take on excessive risk to generate meaningful returns.

This undercapitalization can lead to a quick blowout of the trading account.

Additionally, having adequate capital allows traders to weather drawdowns and gives them the psychological comfort to stick to their strategies.

The Long Road to Proficiency

Becoming a consistently profitable day trader is a long and challenging journey.

It requires not just knowledge of markets and trading strategies, but also the development of emotional control, risk management skills, and a deep understanding of one’s own psychology (strengths, weaknesses, disposition).

Many aspiring traders underestimate the time and effort required to achieve proficiency, leading to premature discouragement.

Trading is just like any other business.

You don’t necessarily need a degree, but there’s learning and training involved like everything else.

Conclusion – Why Day Traders Lose Money

Day trading is not a path to easy riches.

It’s a challenging profession that requires a unique blend of skills, knowledge, and psychological fortitude.

The majority of day traders lose money due to a combination of factors: information disadvantages, psychological biases, technical challenges, and the unforgiving mathematics of trading.

Those who do succeed often do so after years of study, practice, and hard-won experience.

The typical process involves getting knocked around a lot and using that experience to learn how to do it differently.

Refining and iterating over time.

They develop strong risk management strategies, maintain strict emotional discipline, and possess a deep understanding of market dynamics.

Even then, success isn’t guaranteed.

Most people who have success simply index to the market.

For those considering day trading, it’s important to approach it with realistic expectations and a clear understanding of the risks involved.

Education, practice with simulated accounts, and a willingness to start small and learn from mistakes are essential.

Above all, aspiring day traders must be prepared for the possibility of losses and should never risk more than they can afford to lose.