Can GameStop and AMC ‘Go to the Moon’ Again?

GameStop (GME) and AMC Entertainment (AMC) made a notable run, ignited by a social media frenzy that took on a life its own. We discussed more of the backstory in other articles, such as here.

There was a pop and that eventually faded. This was inevitable, as these companies – and other widely shorted small caps that were targeted – were fundamentally weak companies.

They established new equilibriums lower, though they were still higher than their prices before they went higher.

In the end, the value of a cash flow-driven asset is the amount of cash you can earn from it over its life discounted back to the present.

Maintaining a high price on an otherwise “dead” asset is difficult given low future earnings expectations.

If “future success” isn’t the discounted narrative in some form, where those in the market expect to extract earnings out of it over time, it’s hard to keep it going.

To The Moon: Part II?

Can these stocks do it again? Can people buy off their now-diminished prices and repeat the process all over again?

The answer is that it’s quite unlikely for those stocks to become that ebullient again.

Those who got squeezed in these securities will be more careful. Anyone who shorts stocks knows that you will inevitably get a trade very wrong at some point on a risk/reward basis.

The right tail of the distribution (i.e., call options) has been reshaped on all the small-cap, low-float targets. This goes beyond GameStop and AMC and has bled over into other similar names.

Before there was a thin right tail in the distribution, meaning very few thought a big surge in price was likely.

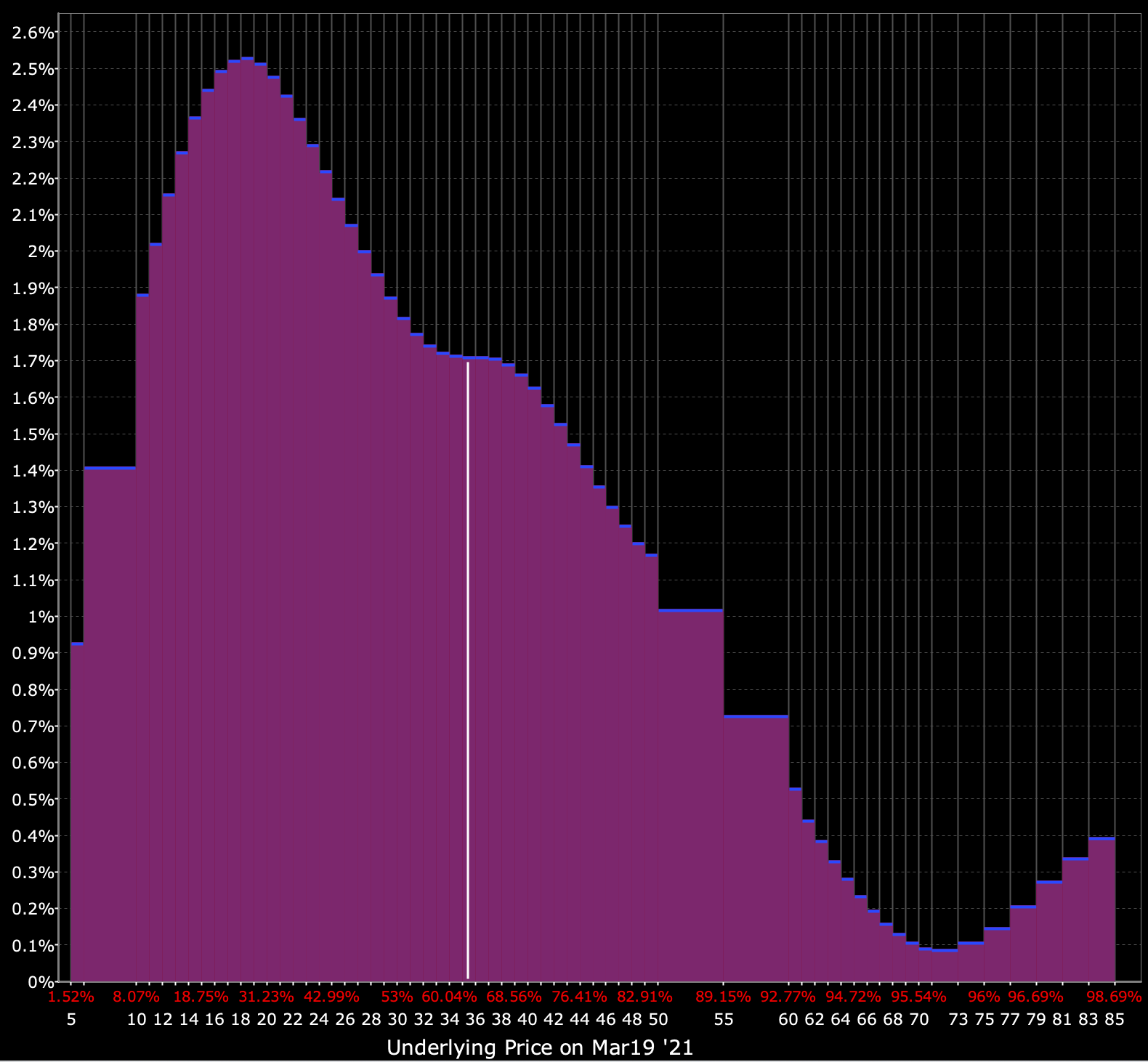

This was on January 16, 2021 for the March 2021 expiry, right before the speculative activity went wild.

(Source: Interactive Brokers ‘Probability Lab’ feature)

__

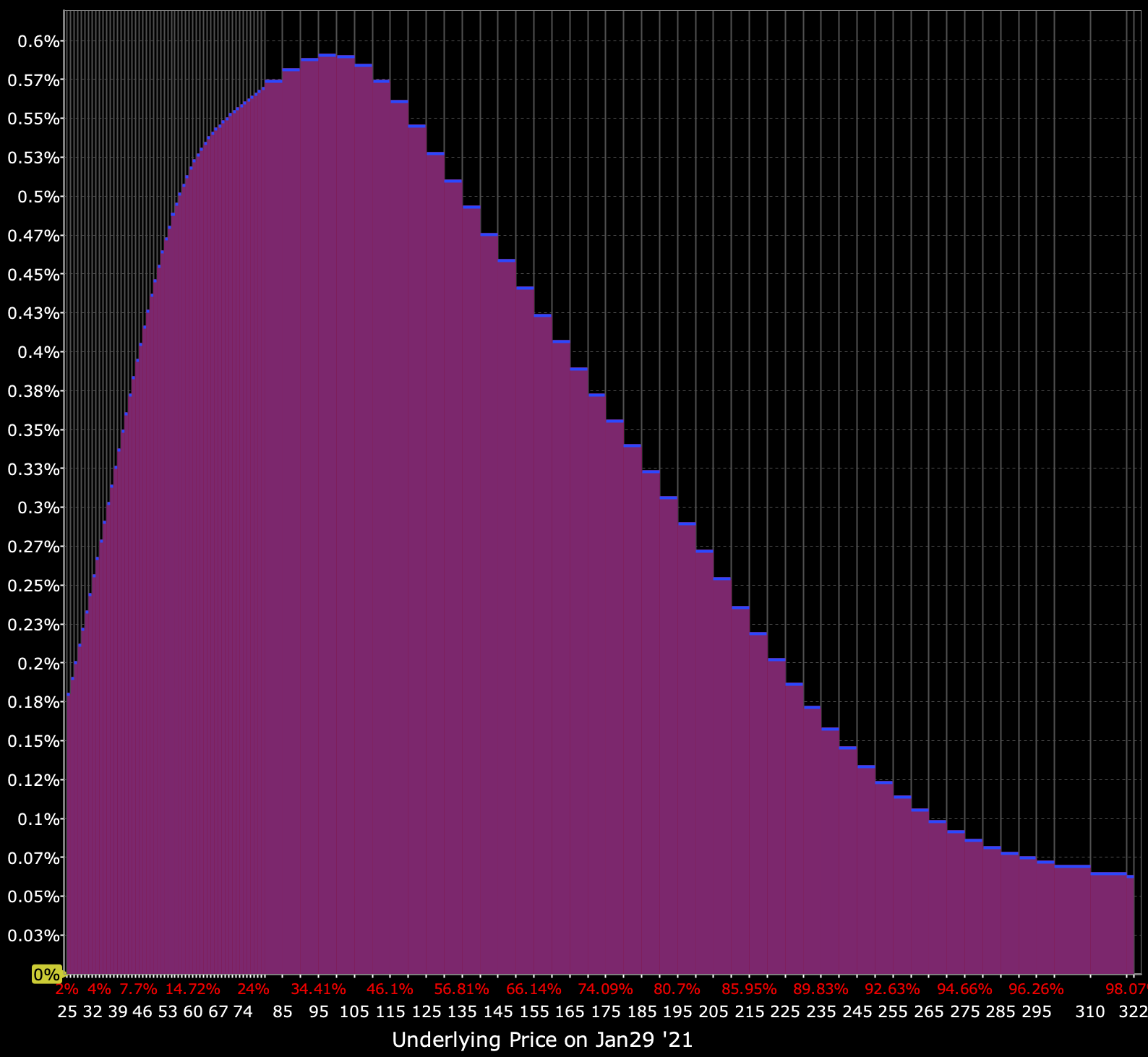

Here’s the distribution of potential outcomes on January 29. You can see the tail getting significantly longer and heavier.

__

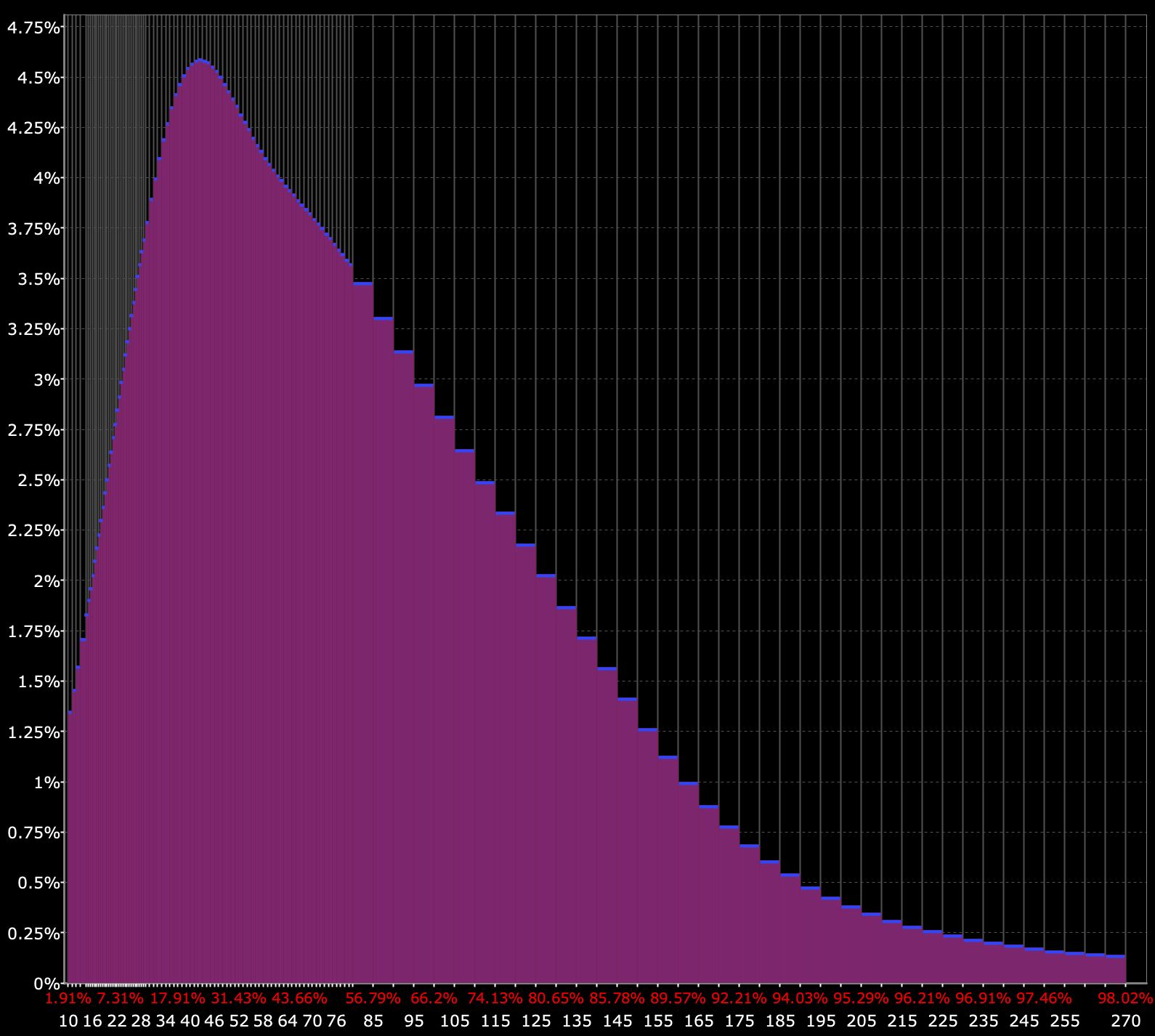

On February 2, after the stock fell about 80 percent from its high, the tail shortened slightly and thinned out.

But the market is still by and large aware of the highly speculative nature of GameStop relative to where it was a couple weeks before.

GameOver?

You’ll continue to get weaker pops in GME, AMC, and other low-float, small-cap names.

But getting the extreme upward speculative dynamic in GameStop and AMC, in particular, is not likely to repeat itself.

The right tail will remain expensive as option sellers need to be compensated for taking on such risk.

Institutions and those who can dynamically hedge delta, gamma, or other “Greeks” of interest will sell the calls for those looking to hit the jackpot.

Given the elevated risk premium, they’ll look to harvest the volatility risk premium associated with these options.

Implied volatility will gradually fall over time as the markets for these stocks recover from the high level of speculation and begin to trade more on their fundamentals (which are not good). This should help call option prices drop over time.

The companies themselves could consider using their more elevated share prices to issue equity offerings. This could give them more cash on hand to help them improve structurally challenged businesses.

But it’s also a matter of institutional demand, which is likely to be tepid. Most investors consider these stocks to be overvalued. Even with the plunge in their valuations after the speculative mania fizzled out, their prices are still well above their pre-frenzy prices.

Flare-ups in volatility will occur sporadically, but 500-1,000 percent implied volatilities are not at all that likely persist.