Traders Who Consistently Outperform – What Do They Do?

What separates the best traders from the rest isn’t a single skill or magic indicator.

It’s a collection of disciplined behaviors and structural principles applied consistently.

Key Takeaways: Traders Who Consistently Outperform – What Do They Do?

- They know how to make the most of their capital through efficient sizing and selective leverage.

- They trade with a structured, repeatable edge, not one-off guesses.

- Their risk is always defined in advance, never left to chance.

- Rather than bet everything on one market regime, they build portfolios of uncorrelated (or negatively correlated) return streams to absorb shocks and smooth out volatility.

- They minimize emotion by systematizing decisions, removing the mental noise that derails most traders.

- And above all, they never settle. No matter how successful they are, they’re always iterating – refining their edge, tightening their process, and searching for what’s next.

Capital Efficiency & Leverage: Doing More with Less

How do some traders get 20-30% returns per year over time (at scale) when stock indices commonly average around 7% per year?

The answer is that they’re very commonly leveraged.

One of the hallmark traits of traders who consistently outperform is their understanding and mastery of capital efficiency. They make the most of every dollar at work.

This isn’t just about leverage in the traditional sense, but about how they position size, manage exposure, and scale bets in alignment with risk and opportunity.

Selective, Not Aggressive

It’s calculated. They don’t throw 10x leverage at every trade.

Instead, they wait for high-conviction trades where the risk-to-reward ratio is firmly in their favor, and only then do they scale up size. Their edge is multiplied selectively.

Many use tiered risk allocation strategies: standard size for base hits, medium for solid setups, and high (but risk-controlled) exposure only for the rare “A+” trades.

They’re also intensely focused on return on capital, not just basic returns. That means avoiding capital sitting in low-return vehicles.

Capital efficiency very typically shows up in using futures or options to add overlays to a portfolio, or in expressing trades in ways that provide convexity – e.g., long-dated deep-in-the-money options for directional plays instead of buying stock outright.

They’ll also do it in a way that reduces carrying costs.

Options provide fixed downside exposure, but you have to pay for it. This is where options trade structures become more creative and selling premium can come into play (which can cap upside but help them improve the reward/risk ratio of their trades).

This allows for less capital committed with more upside, when structured properly.

Volatility Budgeting

Consistent traders are aware of how much daily or weekly portfolio volatility they’re comfortable with.

Capital isn’t spread evenly, but concentrated where edge exists, and hedged or sidelined when uncertainty is high.

Some will use dynamic sizing that expands or contracts position sizes based on market volatility or internal metrics like realized PnL or drawdown thresholds.

This self-regulation ensures they don’t get overexposed when markets go from calm to chaotic.

They may also apply vol-adjusted position sizing, using metrics like ATR (Average True Range) or implied volatility to size trades so that each carries a comparable risk footprint regardless of the underlying asset.

This avoids overleveraging in highly volatile markets while still participating in opportunity.

Capital Recycling & PnL Deployment

Top traders also “recycle” capital efficiently. If a trade plays out or breaks down, capital is quickly rotated rather than left stagnant.

They maintain a sharp balance between holding winners and freeing up capital for higher-return opportunities.

Some adopt a “house money” model: once a position is well in profit, they may trim size, roll up strikes, or move stops aggressively to keep capital working while protecting core gains.

In short, capital efficiency isn’t about just taking on more risk; it’s about smarter allocation.

Outperformance comes not just from being right, but from being sized appropriately when you’re right and being protected when you’re not.

That’s how capital compounds at a pace others struggle to match.

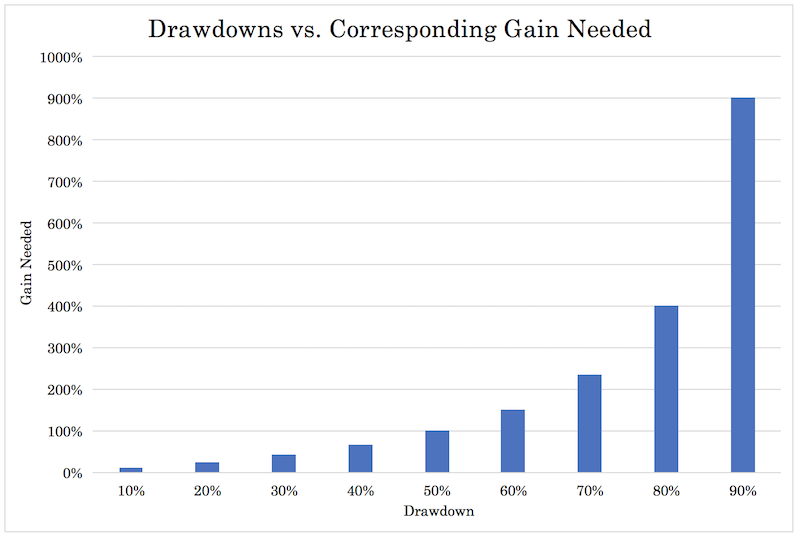

Drawdowns are the Worst

Drawdowns of any material size are the worst.

The relationship is non-linear. The bigger the drawdown, the greater the corresponding gain needed just to get back to breakeven.

In tabular format:

| Drawdown | Gain Needed |

| 10% | 11% |

| 20% | 25% |

| 30% | 43% |

| 40% | 67% |

| 50% | 100% |

| 60% | 150% |

| 70% | 233% |

| 80% | 400% |

| 90% | 900% |

Structured, Repeatable Edge: The Engine Behind Consistent Returns

Traders who consistently outperform the market are executing a plan.

Fundamentally, it’s a structured, repeatable edge: a methodical approach to generating returns that works not once or twice, but over hundreds or thousands of iterations.

Analogy: Professional Musicians and Bestselling Authors

Think of top traders like successful musicians or bestselling authors.

They’re not just improvising or chasing inspiration. They’re following a structured, proven system.

A great musician doesn’t just sit down and bang out random notes; they compose within a framework they’ve refined over years.

Similarly, a successful author isn’t writing whatever pops into their head. They develop themes, outlines, and styles that resonate with a defined audience with an established market.

The goal isn’t just to create and hope, but to create something that works repeatedly and reliably.

When these professionals release an album or a book, they expect it to sell consistently over years, even decades.

That’s because it’s built on a repeatable foundation.

Top traders approach the markets the same way.

They focus on strategies and return streams they know are structurally sound and durable, not flashy one-offs.

They aren’t trying to win the lottery; they’re building a catalog of trades that keeps performing.

System Over Story

The best traders know the difference between a one-off windfall and a dependable return stream.

They aren’t seduced by sensational trades that look good but are nearly impossible to forecast or reproduce itself over time.

For example, shorting S&P 500 volatility at 40% might be a winning move once in a decade or less, but it’s not a strategy. It’s an outlier event, not a foundation.

High performers focus instead on repeatable conditions – behavioral inefficiencies, structural flows, liquidity imbalances, seasonal dynamics, or statistical tendencies – that persist across time and regimes.

Are the influences universal and timeless?

Their edge is often built on a narrow, well-defined slice of the market they know inside and out.

That might be earnings momentum in small caps, ETF/underlying price arbitrage, the nuances of quantitative factors in commodities, event-driven setups in credit, or intraday volume dislocations in large-cap equities.

The key is consistency. Their edge doesn’t require a market crash or a freak news event to work – it shows up predictably, over and over again, across different time periods.

Probabilities, Not Predictions

Traders with a repeatable edge don’t rely on making bold predictions about the future.

Instead, they anchor themselves in probability. They know the win rate, expected value, and variance of their setups.

They’ve backtested or observed hundreds of instances, giving them the confidence to size up or ride out drawdowns without questioning the integrity of the approach.

They also document and systematize their setups.

Each trade is the result of conditions being met, not a gut feeling.

Checklists, triggers, filters, and defined criteria remove ambiguity and emotion from the decision-making process.

Every trade is intentional.

They Avoid “Tourist Trades”

Consistent performers don’t wander into markets or strategies they don’t understand just because “it looks like a good trade.”

They know that unfamiliar trades, even tempting ones, can erode edge, increase variance, and introduce hidden risks.

If a weird stock looks like a massive bubble, they don’t care if they don’t deeply understand it.

They focus on what they can reliably understand and execute.

If a unique opportunity arises (like a once-in-a-decade dislocation), they might participate with limited size, but it’s not their bread and butter.

In short, these traders are builders, not bettors.

They construct frameworks, not overly tactical forecasts.

They’re not just looking for edge, but engineering it into their process, so the next trade is just another brick in a durable, scalable structure.

That’s how long-term outperformance is earned.

Defined Risk Limits: Protecting the Downside So the Upside Matters

Traders who outperform over the long run treat risk not as an afterthought but as a design principle.

Their edge isn’t just about what they make, but about how much they don’t lose when wrong.

Defined risk limits act as a firewall between skill and destruction.

Without them, even a great strategy can be wiped out by a single poorly managed trade.

Risk Limits Frame Every Trade

Consistent traders never enter a position without knowing exactly what they’re willing to lose.

Whether it’s a hard stop, a volatility-adjusted position size, or a max drawdown threshold for a strategy, risk is quantified upfront.

They don’t move stops “just to give it more room.”

They don’t size up just because they feel good about a setup. Discipline is enforced by structure.

For some, this means risking 1% or less of capital per trade.

For others, it means sizing dynamically based on conviction and market conditions.

For others, it’s viewed at the portfolio level with strict drawdown controls (e.g., can never lose more than 15%).

Professional traders have rules around overall exposure, correlation risk, and maximum daily or monthly drawdowns.

But the key is clarity; the downside is always known and accepted in advance.

When limits are hit, risk is reduced or trading is paused.

This protects capital but also protects mental clarity, so they’re not operating from a compromised state when volatility spikes.

Losses Are Contained, Not Avoided

Top traders don’t aim to be right all the time; they aim to avoid catastrophic losses.

Their mindset is less about “How much can I make?” and more about “What happens if I’m wrong?”

Because they know that even with a great edge, a string of losses is inevitable. What separates the professionals from the amateurs is that pros are prepared for that sequence.

They set loss limits to avoid emotional spirals.

They cut underperforming strategies before they bleed too long.

They review stop placements and their use of protective options not for accuracy, but for consistency.

And they understand that volatility can cluster – when things go bad, they can get worse fast. Defined limits act as circuit breakers.

They may cause a trader to miss a rebound here or there, but they preserve the ability to keep trading tomorrow. That’s the real compounding advantage.

Diversification: Building a Portfolio That Can Withstand What You Can’t Predict

While some elite traders specialize in a narrow domain – because that focus is their edge – most consistent outperformers diversify in some form.

Not for the sake of dilution, but for the sake of resilience. Diversification isn’t about trading everything; it’s about constructing a return profile that doesn’t rely on any single regime, forecast, or factor being right.

The beauty of diversification is that it doesn’t require you to be a super forecaster.

Some people outside markets think traders and investors operate by “predicting the future.”

There can be an element of that, but that’s not how most operate.

You don’t have to outguess complex and relatively efficient markets.

Instead, you build a portfolio of uncorrelated, or ideally negatively correlated, return streams – strategies that behave differently under different conditions. If one zigs, another zags. One chops, another trends. One performs in crisis, another in calm.

The risk drops and it doesn’t have to hurt your return, especially with financial engineering experience.

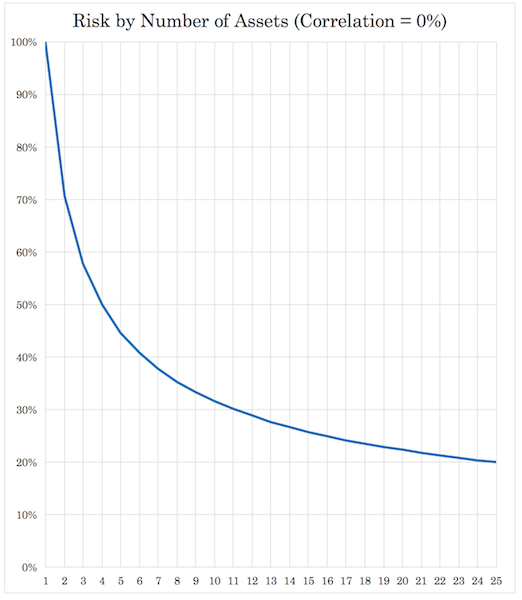

If the correlation between assets is zero, a fairly clear relationship develops.

If you have 4 equal-returning, equal-risk assets, you cut your risk in half without reducing your return.

If you have 9 equal-returning, equal-risk assets, you cut your risk by two-thirds without reducing your return.

If you have 16 equal-returning, equal-risk assets, you cut your risk by 75% (three-fourths) without reducing your return.

If you have 25 equal-returning, equal-risk assets, you cut your risk by 80% (four-fifths) without reducing your return.

As you will notice, all of these chosen numbers (4, 9, 16, 25) are all perfect squares and give a clean percentage in terms of the risk reduction.

Graphically:

Of course, not all streams are equally independent, and correlation can rise in crisis, but even partial diversification improves stability and lowers volatility drag.

That makes it easier to stay in the game and keep risk consistent across time.

Some traders diversify across strategies: momentum, mean reversion, volatility carry, macro trends. Others diversify across timeframes, asset classes, or models.

What matters is that the return drivers aren’t all pointing in the same direction under the same conditions.

In the end, diversification is about structural humility. It acknowledges that no one edge works forever.

Diversifying intelligently, you turn that uncertainty into a strength – and create a return profile that’s durably strong.

Emotional Neutrality: Why Removing Feelings Improves Performance

One of the biggest obstacles to consistent trading performance is harmful emotions. Fear, greed, hesitation, frustration: they cloud judgment, distort risk perception, and sabotage execution.

That’s why traders who outperform over time either systematize their process or train themselves to operate with machine-like neutrality.

The more emotionally reactive you are, the less consistent your results will be.

This is a key reason why most modern trading is dominated by algorithms. Computers don’t get spooked by a red candle.

They don’t chase missed moves. They don’t revenge trade. They simply execute code: at scale, with precision, and without second-guessing. When done right, this mechanical execution is a superpower. It turns a subjective art into a statistical process.

Humans, by contrast, are wired for survival and conserving energy, not optimal execution.

We avoid loss more than we seek gain.

- We hesitate in uncertainty.

- We anchor to past outcomes.

- We let recency bias or sunk cost fallacy override logic.

- We invent stories and narratives.

- We filter information to fit what we already think.

- We use easy mental shortcuts to simplify complex subject matter that we don’t have any knowledge or training in.

- We don’t know what we don’t know. When we’re incompetent at something, we’re prone to overestimating our abilities because we don’t have any foundation from which to recognize what’s not understood.

Emotional neutrality doesn’t mean not feeling: it means not acting on emotion that isn’t helpful. That’s much harder to do manually than most people realize.

Top traders build systems – whether fully automated or rule-based discretionary frameworks – that protect them from themselves. They define rules in advance, create pre-programmed responses to specific events, and execute with discipline even when it feels wrong in the moment. They don’t trade their mood, they trade their method.

In fast-moving markets, speed and emotional composure are critical. Computers naturally excel at both.

Traders who consistently outperform either emulate that precision or partner with machines to harness it.

Emotional neutrality is about removing variance from your decision-making, so the edge shines through cleanly, again and again.

Constant Iteration and Improvement: The Relentless Pursuit of Better

No matter how successful a trader is – whether managing millions/billions or just starting out – the mindset that separates consistent outperformers from the rest is the belief that better is always possible.

Trading is an adaptive game. Markets evolve. Competitors improve. What worked last year might not work in the future, which will always give you with the motivation to improve.

That’s why the best traders treat growth as a never-ending loop: test, refine, execute, review, repeat.

Success Is a Temporary Snapshot, Not a Final Grade

Profitable strategies can breed complacency.

But top traders know that just because something works now doesn’t mean it will continue indefinitely.

They question even their winners: Was it skill or luck? Can this edge be improved? Is it degrading over time?

They review trades not just to fix mistakes, but to find small advantages hidden in the data: better entries, cleaner exits, smarter filters.

Nothing is sacred. Everything is open to refinement.

Feedback Loops Drive Progress

Outperformers build tight feedback loops: daily trade journaling, performance reviews, peer discussions, and systematic tracking of metrics like win rate, expectancy, drawdowns, and variance.

These loops turn experience into insight, and insight into progress.

Every trade becomes a data point. Every week, a learning sprint.

Iteration is the culture. They evolve on purpose, not by accident.

Edge Decays. You Evolve.

Markets change. Competitors copy. Edges erode.

That’s the nature of it. The only sustainable edge is adaptability.

Top traders constantly test new ideas, incorporate new data sources, experiment with models, and stay curious.

Their mindset isn’t “I’ve made it” – it’s “Where’s the next inefficiency?”

This hunger for growth comes from understanding the truth: if you’re not getting better, you risk falling behind.