How to Control Emotions in Day Trading

Controlling emotions in day trading is very important for achieving consistent success.

Traders can have all the personal talent, but if their emotions aren’t steady, that can ruin everything.

We all have our own dispositions. Some of us are more stoic and some of us are more excitable.

Traits can help us and hurt us depending on their application.

We’ve all heard of traders having success and having inevitable rough patches, then trying to aggressively win back what they’ve lost and that rarely goes well.

We discuss various strategies in this article.

Key Takeaways – How to Control Emotions in Day Trading

- We cover the following ways to control emotions in trading:

- Developing a Trading Plan (Goals, Entry/Exit Criteria, Backtest)

- Systematize Your Decision-Making (where possible)

- Avoid Crowd Psychology

- Risk Management Strategies

- Maintaining Discipline

- Practicing Emotional Detachment

- Continuous Learning and Improvement

- Mindset and Psychological Techniques

1. Develop a Trading Plan

Define Clear Goals

Developing a trading plan begins with setting specific, achievable trading goals.

These goals should be clear and measurable, such as a target profit percentage.

By defining these goals, traders can create a roadmap that guides their actions and decisions.

Next, it’s important to outline both short-term and long-term objectives.

Short-term objectives might include monthly profit targets, learning a new trading strategy, or improving risk management techniques.

These objectives help maintain focus and provide immediate milestones to work toward.

Long-term objectives, on the other hand, could involve goals like:

- achieving a certain level of trading capital (e.g., saving up a certain amount)

- gaining proficiency in multiple trading instruments, or

- developing a well-structured trading portfolio that minimizes environmental bias

These broader goals provide a sense of direction and purpose and make sure that daily trading activities align with the overall vision.

By combining specific, achievable goals with well-defined short-term and long-term objectives, traders can develop a trading plan that fosters discipline, consistency, and continuous improvement.

Success is all about getting what you want.

Establish Entry and Exit Rules

Determining precise criteria for entering and exiting trades is important for a successful trading plan.

Entry criteria might include:

- specific technical indicators

- price levels

- yields, or

- market conditions (e.g., high inflation)…

…that signal a favorable trading opportunity

Similarly, exit criteria should define the conditions under which a trade will be closed, such as:

- reaching a target profit

- asset being fairly valued

- hitting a stop-loss level, or

- observing a reversal signal

Sticking to these rules consistently is important to avoid impulsive decisions that can lead to losses.

By adhering to predefined criteria – and ideally backtesting that criteria to make sure it’s good – traders can maintain discipline and reduce their emotional reactions to market fluctuations.

This consistency helps in developing a systematic approach to trading, which can be evaluated and refined over time.

In essence, clear entry and exit rules provide a structured framework that guides trading decisions, promotes discipline, and increases the likelihood of long-term success in the markets.

Backtest

A proven way to counteract fear and greed and impulsive decisions is by having a well-thought-out and backtested game plan.

This means developing a trading strategy rooted in sound principles and rigorous testing, rather than relying on gut feelings or spur-of-the-moment decisions.

A backtested game plan begins with research.

Start by identifying market patterns, technical indicators, or fundamental factors that have historically shown consistency.

For instance, you might develop a strategy based on moving averages, P/E ratios, or specific economic data releases.

Once you’ve identified a potential strategy, test it against historical data to evaluate its effectiveness across different markets and in all sorts of different environments.

This process allows you to refine your approach, identify weaknesses, and establish realistic expectations.

Iterate over time.

Sticking to your plan is equally important.

Emotions often tempt traders to deviate – buying into a soaring stock out of greed or selling prematurely out of fear.

However, a backtested plan provides the confidence needed to stay the course. For example, if your strategy signals a buy during a market dip, trusting the data and analysis behind your plan can prevent you from hesitating at a critical moment.

Additionally, have a documented trading plan for consistency.

It acts as a roadmap, helping you navigate unknowns and reducing the chances of making decisions driven by short-term emotions.

Over time, this disciplined approach can lead to more predictable outcomes and long-term success.

It transforms trading from a gamble into a calculated, strategic task, providing a solid foundation for long-term growth.

2. Systematize Decision-Making

Trading successfully requires rational and consistent decision-making – traits that are often at odds with human emotions.

One effective way to achieve this is through systematized decision-making.

Creating structured, repeatable processes, you can remove the influence of emotions and biases, allowing data and proven methodologies to guide your actions.

Systematizing decision-making begins with a clear framework.

Define the criteria for entering and exiting trades, the amount of risk you’re willing to take, and the metrics you’ll use to measure success.

For example, your system might use technical indicators like relative strength index (RSI) for overbought or oversold conditions or rely on fundamental triggers like earnings reports or leading macroeconomic indicators.

Advanced traders often take this a step further by incorporating algorithms or quantitative models.

These systems analyze large volumes of data to identify patterns and opportunities that might be invisible to the human eye, or simply invisible to standard human analysis.

The benefits of systemization extend beyond improved decision-making.

A structured approach also saves time, as it eliminates the need to go through processes manually over and over again.

It also ensures that every decision aligns with your broader strategy, reducing the risk of costly mistakes.

Developing a system takes effort and might temporarily divert you from your established tasks, but it pays dividends over the long term.

From relying on systematic processes, you gain clarity, consistency, and the ability to trade with more confidence.

3. Avoid Crowd Psychology

In financial markets, crowd psychology is a psychological force that often leads traders astray.

The tendency to follow the herd – to buy when everyone is bullish or sell when fear dominates – is a common trap.

Successful traders know that thinking independently and avoiding crowd psychology is important for long-term success.

Crowd psychology is rooted in human behavior. When markets are soaring, it’s tempting to jump in, fearing you’ll miss out.

Conversely, in a market downturn, panic can lead to hasty selling.

Nonetheless, these emotional reactions often occur at the worst possible times – when markets are overextended or poised for reversal.

This happens because the consensus view is already priced in, leaving little room for upside and a high risk of disappointment.

To counteract this, independent thinking is essential. Focus on the data and your strategy rather than market sentiment.

For instance, if everyone is bullish but your analysis indicates the asset is overvalued, it’s wise to proceed cautiously.

Similarly, a bearish market can present opportunities if you’ve identified strong fundamentals that others are overlooking.

Avoiding the herd requires discipline and the courage to act against the prevailing sentiment. It also helps to take a contrarian approach, looking for opportunities where the crowd might be wrong.

Warren Buffett has famously said, “Be fearful when others are greedy and greedy when others are fearful.”

Analogy

Imagine everyone uses a traffic app…

At a certain point in the road system, it advises them to leave the highway and take side streets to avoid congestion.

At first, this advice works well – those who follow it enjoy faster commutes while others are stuck in traffic. They have an edge over the “competition.”

But over time, more and more people start following the app’s guidance or hearing about and seeing what other drivers are doing. (Analogous to traders changing jobs and taking their knowledge to a new firm or analytically figuring out what other traders are doing.)

The side streets, once a clever shortcut, become so crowded that it’s now faster to just stay on the highway.

The original “obvious” decision rule has been pushed too far, and it no longer works anymore.

In fact, it’s actually now counterproductive to be doing that and is losing you time on your commute.

Markets operate in a similar way.

Alpha streams decay. Market inefficiencies don’t last forever.

When everyone follows the same strategy or trades based on the same piece of news, data, analysis, or whatever it may be, the effectiveness of that approach diminishes.

For example, if a stock is widely regarded as a “must buy,” its price often rises quickly as traders pile in.

However, by the time most people act, the stock may already be overvalued, leaving little room for further upside. The Nifty Fifty of the late-60s and early-70s and tech stocks of the late-90s are examples.

Similarly, in a bearish market, excessive selling can push prices so low that buying becomes the smarter move.

Contrarian thinking recognizes that the “obviously correct” decision used by the majority is often wrong precisely because it’s so widely adopted.

Markets are dynamic, “chaotic” systems where expectations are already baked into the price, and the crowd’s behavior can create new inefficiencies.

The key is to identify these moments when the conventional wisdom has gone too far – i.e., when the metaphorical side streets are jammed, and staying on the highway is now the better route.

“Boring” utility stocks can sometimes be better than the top perceived (or actual) innovators in the market if the pricing of the latter reflects unrealistic expectations.

Stepping back and analyzing whether the crowd’s behavior aligns with reality enables contrarian thinkers position themselves to make smarter, more independent decisions.

This doesn’t mean automatically going against the herd, but rather critically evaluating whether the majority’s actions have created opportunities in the opposite direction.

Just as in the traffic analogy, understanding when and why the obvious choice no longer works is a skill that can lead to better outcomes in trading.

4. Implement Risk Management Strategies

Use Stop-Loss Orders

Stop-loss order are a classic risk management technique.

They aren’t as popular these days as they used to be. More of the modern approach is focused on position sizing, options, and diversification.

But they’re still a staple of day trading.

Position Sizing

Effective position sizing is fundamental to managing risk and achieving long-term success in trading.

Position sizing involves allocating only a small percentage of your capital to each trade.

This practice limits the potential loss on any single trade, protecting your overall portfolio from large drawdowns.

A common rule of thumb is to risk no more than 1-2% of your total capital on a single trade or single security.

This helps avoid idiosyncratic risk.

This conservative approach helps make sure that a series of losses won’t deplete your trading account.

Diversification

Diversification improves risk management by spreading allocation across different assets.

By going into a variety of asset classes, such as stocks, bonds, commodities, and options, traders can reduce the impact of poor performance in any one area.

Diversification helps smooth out returns over time, as losses in one asset can be offset by gains in another.

Options

Options can play an important part in a diversified trading strategy.

They offer flexibility and can be used to hedge other positions, speculate on market movements, or generate income through strategies like covered calls.

Incorporating options into your portfolio can provide additional layers of risk management and potential return.

5. Maintain Discipline

Follow a Routine

Maintaining discipline is important for a lot of things.

Building habits so it becomes second nature.

Establishing a daily trading routine helps create consistency and structure in your approach.

This routine should include regular analysis and review sessions to evaluate performance, refine strategies, and identify areas for improvement.

By sticking to a set schedule, traders can avoid impulsive decisions driven by market movements and emotions.

Trading decisions have to be based on thorough analysis and strategic planning rather than short-term reactions.

Avoid Overtrading

Avoiding overtrading is important for maintaining a disciplined trading approach.

Trade only when your strategy signals a clear opportunity, so that it’s based on solid analysis rather than emotions.

Overtrading, often driven by boredom or frustration, can lead to impulsive decisions and unnecessary risks.

It inevitably depletes your capital and undermines your strategy.

6. Practice Emotional Detachment

Keep a Trading Journal

Maintaining a trading journal is a common practice for traders.

Documenting every trade, including the rationale behind each decision can help down the line.

What are the mistakes you made? Write it down.

This detailed record helps traders understand their behavior and identify emotional triggers that might lead to impulsive decisions.

Regularly reviewing the trading journal allows traders to spot patterns in their trading strategies, both successful and unsuccessful.

By analyzing these patterns, traders can refine their approaches, eliminate recurring mistakes, and improve their decision-making process.

Over time, this continuous improvement cycle can lead to more disciplined, informed, and profitable trading.

Writing Down Anything Related

Even basic processes are good to write down.

Let’s say you figured out how to set up your trading terminal a certain way.

Then you go on vacation with your laptop and you forgot how you got things that way.

Writing stuff down can help you develop systems so you can minimize the time and thought that goes into recurring tasks.

You can apply this to many other aspects of your life, too.

If you’re going on vacation, having a master list of everything you need can be helpful.

Do it once and then refer to it over and over again to save time and thinking.

Take Breaks

Taking regular breaks is important for maintaining mental clarity and focus in trading.

Stepping away from the screen periodically helps clear your mind, reduce stress, and prevent burnout.

Engaging in activities outside of trading, such as exercise, hobbies, or spending time with family and friends, is important for maintaining a healthy work-life balance.

These activities provide a necessary mental and emotional recharge, so you can stay grounded and resilient.

7. Continuous Learning and Improvement

Education

Continuous learning and improvement are important.

Markets are inherently self-learning over time and they’re always changing in certain ways.

Educating yourself through books, courses, articles, videos, whatever the medium, is important for expanding your trading knowledge and skills.

News

Staying updated on market news and trends is equally important.

Regularly following financial news, economic reports, and market analyses keeps you informed about factors that could impact your trades.

Being aware of global events, policy changes, and economic indicators so you know where things stand and adjust your strategies accordingly.

For example, if inflation is above a central bank’s target, you might expect monetary policy to stay on the tighter side. Accordingly, you might choose to not tilt your portfolio to more exposure to equities.

Seek Feedback

Seeking feedback is important in trading because nobody has all the answers, and our knowledge is always limited compared to what we need to know.

Engaging with other traders, mentors, or joining trading communities can provide diverse perspectives and things you haven’t thought of.

Constructive feedback helps identify blind spots, improve strategies, and refine decision-making processes.

By learning from others’ experiences and mistakes, traders can accelerate their growth and avoid common pitfalls.

When Things Go Poorly

When things go poorly in trading, it often forces us to evolve and view situations from different perspectives.

These challenging moments push us out of our comfort zones and compel us to reassess our strategies and approaches.

This adversity can lead to innovation and new methods and techniques we might never have considered otherwise.

By adapting to setbacks, we can discover more effective ways of doing things.

In the process, we improve our overall skills and resilience.

Example

Let’s say you noticed an obvious stock bubble and decided to short the stock because you figured there’s no reasonable way to justify the valuation.

Then… all it did was continue to go up and you eventually had to close your position at a significant loss.

This would help pound home the fact that valuation isn’t the only thing that matters in markets and sometimes valuation isn’t immediately tradable.

It might also teach a trader to limit position sizing and use risk management techniques (e.g., options for prudent hedging purposes or expressing the position itself as an options trade) to limit downside.

8. Mindset and Psychological Techniques

Practice Mindfulness and Meditation

Practicing mindfulness and meditation can be useful for maintaining a strong mindset and effective emotional control in trading.

Not everybody is naturally zen-like, but we can all improve.

Mindfulness techniques help traders stay present and focused.

This can enable them to make rational decisions without being influenced by stress or market noise.

By focusing on the present moment, traders can avoid impulsive reactions and maintain clarity during high-pressure situations.

Meditation, on the other hand, reduces stress and improves emotional regulation.

Regular meditation practice can lower anxiety levels and enhance overall mental well-being, making it easier to handle the ups and downs of trading.

Set Realistic Expectations

Setting realistic expectations is important for sustained success in trading.

Understanding that losses are an inherent part of trading helps maintain a balanced perspective.

Even the most experienced traders face losses – the key is to manage them effectively through sound risk management strategies.

Focusing on long-term success rather than short-term gains is essential.

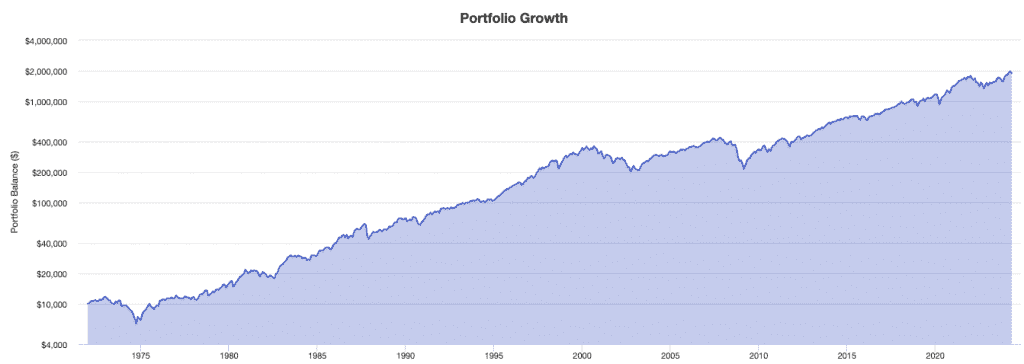

The daily wiggles aren’t always fun, but if we look at a 50+-year chart of stocks, for example, we see this:

Zoomed out, it doesn’t matter so much what happened on November 4, 1979 or any other day.

Most things tend to seem bigger up close or in the moment than they do in retrospect.

A long-term perspective helps traders avoid the pitfalls of chasing quick profits and putting too much emphasis on small time periods, which often leads to impulsive and risky decisions.

Understand That Things Evolve

Day trading is typically a younger person’s undertaking.

In the UK, around 65% of day traders are under the age of 35.

This probably extrapolates similarly in other countries.

As we get older, we tend to get into more passive, trading strategies like investing.

We also learn that we don’t need to be so active in the markets and that we can get quality, relatively stress-free returns without investing a lot of our own time into the day-to-day trading.

Conclusion

Controlling emotions in day trading is very important for consistent success.

By developing a solid trading plan, implementing risk management strategies, maintaining discipline, practicing emotional detachment, continuously learning, and using psychological techniques, traders can effectively manage their emotions and make more rational, informed decisions.