How to Offset Negative Carry in Options

Negative carry refers to the cost of holding an options position, usually from:

- Time decay (theta) on long options

- Premium paid for protection or leverage

- Bid-ask spread losses or margin costs

Since options are often used for convexity (leveraged exposure or downside protection), the cost is embedded in the premium.

The goal is to offset or subsidize that cost smartly.

Key Takeaways – How to Offset Negative Carry in Options

- 15 ideas to defray costs – We look at various ideas to help reduce the costs of options to provide better risk/reward lined up with your goals.

- Offset smartly – Don’t destroy your convexity just to make theta positive.

- Structure matters – Combine long and short legs thoughtfully.

- Watch correlation – Don’t hedge with correlated exposure.

- Risk is real – Selling options means you’re taking on exposure. Always size accordingly.

Ways to Offset Negative Carry in Options

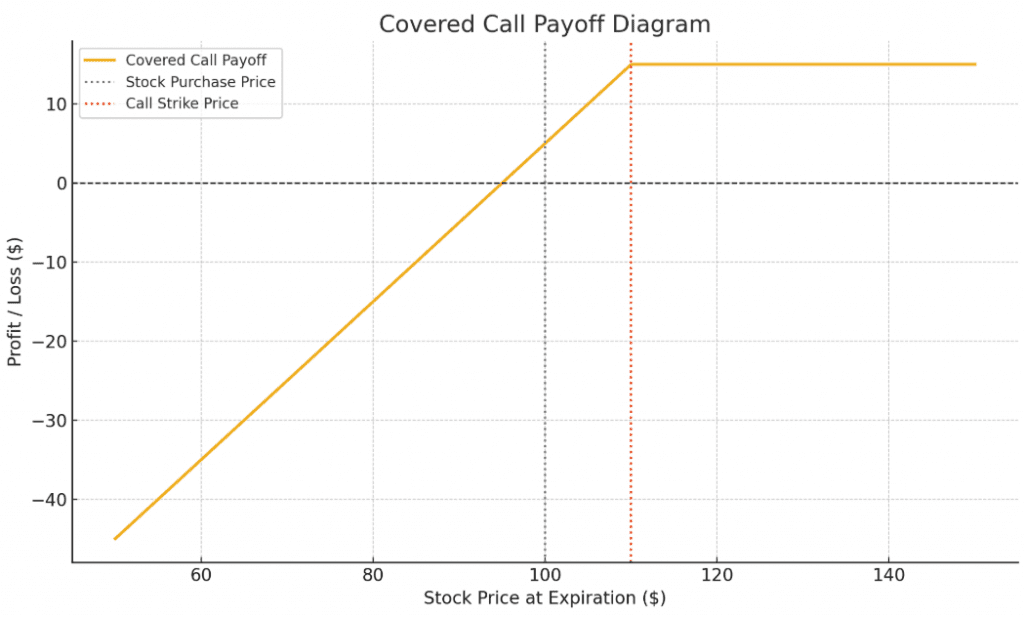

1) Sell OTM Calls to Offset Long Positions (Covered Call)

Covered calls are one of the simplest ways to offset/partially offset negative carry from holding a long stock or call position.

You sell an out-of-the-money (OTM) call option against a long position to generate income, which offsets time decay and reduces your overall cost basis.

The trade-off is that it caps your upside if the underlying rallies past the strike.

It’s best used in sideways or moderately bullish markets where explosive upside is less likely.

For example, if you’re long SPY, selling a monthly 10-delta call can provide steady theta income without too much risk of being called away (though it will occasionally happen).

Over time, these premiums can meaningfully cushion drawdowns and fund other positions.

Academic research (and trading experience) has shown that covered calls tend to improve the Sharpe ratio/risk-adjusted returns of a strategy – so long as it’s used thoughtfully.

2) Sell OTM Puts to Finance Upside (Cash-Secured Put or Collar)

Selling out-of-the-money (OTM) puts is another way to generate income while maintaining a bullish bias, especially if you’re comfortable owning the underlying asset at a lower price.

When you sell a put, you collect premium upfront.

That cash can offset the cost of a long call, long shares, or protective puts, reducing your net negative carry.

If the put expires worthless, you keep the premium.

If it’s exercised, you buy the asset at a discount, effectively entering at a lower basis.

This tactic is ideal in markets where you want upside exposure but don’t mind entering on a dip.

A classic example: long SPY and short a 10-delta put – synthetic long exposure with added income flow.

3) Use Put Spreads Instead of Naked Puts

Put spreads offer a defined-risk alternative to naked put selling, allowing you to still collect premium while controlling downside exposure.

You sell an OTM put and buy a further OTM put to cap risk.

This reduces margin requirements and cushions against major drawdowns.

While you give up some potential premium, you also protect yourself from tail events.

For example, shorting a 5-delta put and buying a 1-delta put gives you positive carry with limited risk.

4) Convert Long Option to Vertical Spread

When holding a long call or put, you’re constantly losing value to time decay.

One way to reduce this negative carry is by converting the position into a vertical spread.

This means selling a further out-of-the-money (OTM) option against your long option, same expiration, same type.

The premium collected from the short leg lowers your net cost basis and slows theta decay.

While this move caps your potential profit, it often increases the probability of a positive return.

For instance, if you’re long a 50-delta call, selling a 20-delta call turns it into a vertical spread, reducing premium burn while still giving you upside exposure within a defined range.

5) Customized Structures with Modified Ratios

It’s always important to know what you’re doing regardless of which strategy you’re pursuing.

If you’re sufficiently advanced, you can create your own customized structures.

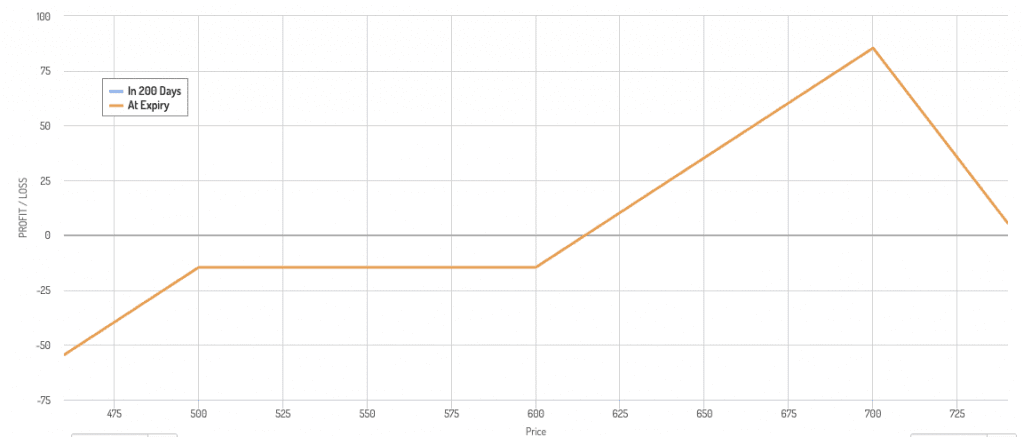

For example, here is a:

- 1 long ATM call

- 3 short OTM call

- 1 short OTM put

This is a modified ratio call spread with a downside kicker – 1 long at-the-money (ATM) call, 3 short out-of-the-money (OTM) calls, and 1 short OTM put.

The extra short calls and short put generate significant premium to offset the cost of the long call.

It works by reducing or eliminating negative carry while maintaining directional exposure.

5) Diagonal Spreads (Long DTE, Short Short-DTE)

Diagonal spreads are a powerful tool to offset negative carry while maintaining directional exposure.

This strategy involves buying a longer-dated option (often 60–90 days out) and selling a nearer-term option (like 7–30 days out) at a different strike, usually slightly out-of-the-money.

The short-dated leg decays faster, providing positive theta to help finance the long leg.

As the short option expires, you can roll it forward to continuously generate income.

This rolling structure keeps the long exposure alive while feeding it premium week after week.

For example, you could buy a 90-day 45-delta call and sell a 30-day 25-delta call.

If done repeatedly, this subsidizes the cost of holding the long leg.

Diagonals work best in gradually trending or mean-reverting markets, and they’re especially effective when volatility is higher in the short term than the long term.

6) Use Calendar Spreads

Calendar spreads are a strategic way to manage negative carry while positioning for specific price targets or volatility changes.

This structure involves buying and selling options at the same strike but with different expirations – typically long a further-dated option and short a nearer-term one.

The goal is to exploit the faster time decay (theta) of the front-month option while maintaining exposure through the back-month leg.

This setup can work in either calls or puts, depending on your directional bias.

For example, you might buy a 60-day call at the 100 strike and sell a 15-day call at the same strike.

If the underlying trades near that strike as expiration approaches, the short leg decays rapidly, and you can harvest that premium by rolling it forward.

Each roll adds income to the position, effectively reducing the cost of your longer-dated exposure.

Calendar spreads also benefit from volatility expansion in the long-dated option or volatility crush in the short-dated leg after an event.

They work especially well in range-bound markets or ahead of catalysts when near-term implied volatility is elevated.

With proper strike selection and timing, calendar spreads can provide a reliable way to reduce theta burn and improve overall carry dynamics.

7) Structured Collars (Zero-Cost or Cost-Reducing)

A structured collar is one of the most balanced ways to offset negative carry, especially when managing equity exposure.

It combines three elements: long shares (or long synthetic), a long protective put, and a short OTM call.

The short call generates income to help pay for the put, reducing or completely eliminating the cost of downside protection.

This trade caps your upside but limits your downside – a worthwhile exchange in choppy or overvalued markets.

These setups are often constructed to be “zero-cost,” meaning the premium received from selling the call is approximately equal to the premium spent on the put.

But even if the collar has a slight debit, it’s typically much cheaper than buying a standalone put.

For example, holding SPY shares, buying a 5% OTM put, and selling a 5% OTM call creates a defined return profile with little to no net premium outlay.

Collars are especially useful around known risks like earnings, Fed announcements, or economic data.

They can be actively managed – rolled monthly or adjusted based on volatility – to generate consistent premium while maintaining portfolio protection.

8) Trade High IV Options to Collect Rich Premium

Selling options when implied volatility (IV) is high relative to realized volatility can significantly improve carry.

High IV inflates option premiums, allowing you to collect more income per unit of risk.

This tactic works best on single stocks where event risk (earnings, news) or sentiment has driven IV above historical norms.

You can sell OTM puts, calls, or spreads—just ensure you size properly and use defined risk structures if needed.

Index options typically have more efficient pricing, so focus on individual names.

For example, selling a short-dated put on a high-IV tech stock after a sharp run-up can generate meaningful premium, helping offset the negative carry of your long options or hedges.

9) Exploit Vol Skew by Selling Rich Tails

Volatility skew refers to the pricing imbalance between OTM puts and calls – typically, puts trade at higher implied volatility due to crash risk.

You can take advantage of this by selling richly priced OTM puts or put spreads to collect premium and offset negative carry elsewhere in your portfolio.

For example, on the S&P 500, a 10-delta put might trade at a much higher IV than an equidistant call.

Selling that put or a put spread (e.g., short 10-delta, long 5-delta) generates disproportionately high income relative to the actual probability of breach, especially in calm markets.

You can pair this with long exposure in another name or asset class to balance the risk.

Another skew play: in names like TSLA, the call skew can invert near earnings, allowing you to sell inflated OTM calls.

Use this asymmetry to harvest premium without having to sell high-theta ATM options.

10) Dynamic Hedging Instead of Static Long Options

Instead of buying puts or calls that slowly bleed value through time decay, consider using dynamic hedging to reduce negative carry.

This involves managing directional risk through delta hedging—buying or selling the underlying asset (or a correlated ETF or future) based on your exposure, rather than locking in a decaying option.

This approach is especially useful when your goal is portfolio protection or convexity without overpaying for long premium.

For example, rather than buying an expensive SPY put to hedge downside, you could short SPY futures or ETFs as the market weakens, then reduce or unwind that hedge as volatility contracts or the market rebounds.

This avoids the embedded theta cost in protective puts, which lose value even if nothing happens.

Dynamic hedging requires attentiveness but gives you flexibility and cost efficiency.

It’s best used when markets are already elevated or vol is overpriced, and you’re more concerned with risk control than lottery-ticket upside.

Tools like trailing stops, delta targets, or moving averages can systematize the process.

This method doesn’t eliminate drawdowns but can reduce them meaningfully, without constantly bleeding capital on static, out-of-the-money options that expire worthless.

11) Use Inverse or Leveraged ETFs for Some Convexity

Inverse and leveraged ETFs like TQQQ or SQQQ can mimic option-like exposure without theta decay.

They offer directional convexity but are designed strictly for day trading due to compounding effects and tracking error.

Use cautiously to avoid drift over multiple days.

12) Harvest Skew or Term Structure Dislocations

Volatility dislocations offer a tactical edge for offsetting negative carry.

One method is to sell premium where short-dated implied volatility is unusually high relative to longer-dated IV – this happens around known events like earnings or FOMC meetings.

For example, if a 7-day call trades at 35% IV and the 45-day at 25%, you can sell the short-dated and buy the longer-dated option to create a favorable calendar spread or diagonal.

Another opportunity lies in steep skew: if OTM puts are disproportionately expensive, selling them or building put spreads (e.g., short 10-delta, long 2-delta) can capture rich premium.

These dislocations don’t last long and are best harvested in size-controlled, event-aware setups.

The goal is to exploit pricing inefficiencies, not to overexpose.

13) Trade Iron Condors or Iron Flies in Neutral Vol Regimes

Iron condors and iron flies are classic premium-harvesting structures that can neutralize the drag of negative carry.

In both, you sell an OTM call and an OTM put (the “wings”) while buying further OTM options to cap the risk, creating a defined-risk, theta-positive position.

These strategies thrive in range-bound, low-volatility markets where realized volatility stays below implied.

For instance, selling a 10-delta call and put on SPY while buying 2-delta wings creates a condor with a wide profit zone and controlled max loss.

The premium collected offsets other long gamma exposures or hedges in your book.

Iron flies concentrate the sold legs at the money, generating more premium but with a narrower range.

Risk control is essential – don’t size too aggressively.

14) Use Event-Driven Premium Harvesting

Around events like earnings, CPI releases, or Fed meetings, implied volatility often spikes, pricing in big moves that don’t always materialize.

You can sell rich options (calls, puts, or straddles) just before the event to harvest this premium.

For example, shorting a near-dated straddle on NFLX right before earnings can generate strong income if the actual move is muted.

This approach offsets negative carry elsewhere but requires tight risk management – vol crush can help you, but surprises can still hurt.

15) Long/Short Vol Spread: Buy Cheap Vol, Sell Rich Vol

A long/short vol spread allows you to express a relative value view on volatility, helping offset negative carry from long premium.

The setup typically involves buying a long-dated option with low implied volatility and selling a short-dated option with higher IV, creating a calendar or diagonal spread with a net-zero or modest delta.

For example, if a 60-day AAPL call trades at 22% IV and the 14-day version at the same strike trades at 30%, you can buy the long and sell the short.

As the short decays, you profit from theta and potentially from IV normalization.

This strategy doesn’t rely on price movement – it monetizes distortions in the volatility surface.

It’s especially useful when you’re long vol elsewhere and want a way to fund that exposure without giving up convexity.