How to Generate Leverage in a Portfolio

The concept of leverage involves using borrowed capital for investment and amplifying the potential returns.

While leverage can magnify profits, it also magnifies losses.

Below we focus on how you can generate leverage in your portfolio, through options, futures, borrowing, shorting, and more.

Key Takeaways – How to Generate Leverage in a Portfolio

- Leverage involves using borrowed capital to amplify potential returns, but it also magnifies losses.

- It can increase investment capacity and exposure to the market with a smaller investment.

- Options, futures, borrowing, shorting, and other techniques can be used to generate leverage in a portfolio.

- Each method has its own risks and benefits.

- Leverage should be approached with caution and used by experienced investors who understand the risks involved.

- Risk management, diversification, and regular portfolio review are important strategies for mitigating the potential downsides of leverage.

- We strongly don’t recommend using products you don’t understand.

- If you want leverage but only have access to expensive retail leverage, then it’s very tempting to use options or futures to get leverage at institutional costs.

- But these are complex products and not for everyone. Take it step by step.

- We have tables toward the end of the article to show comparisons.

Understanding Leverage

At its core, leverage is about increasing your investment capacity using borrowed funds.

It can be viewed as a financial tool that allows an investor to increase their exposure to the market with a smaller investment.

Leverage also shouldn’t be thought of in a black-and-white way – e.g., “any leverage is bad, no leverage is good.”

A well-diversified, balanced, and moderately leveraged portfolio can be significantly safer than an unleveraged, concentrated one.

Retail Leverage vs. Institutional Leverage

First, know what you’re paying for leverage.

For a 1-year holding, the benchmark borrowing cost is the 1-year SOFR. So, if you leverage your portfolio with any margin loan, option, future, etc., you should expect to pay around that rate.

Of course, that’s before the retail markup, which can add several percent on top. If your margin loan rate is 7%+, you can’t reasonably lever using those rates.

If you’re paying retail markup, consider options and futures, as they have embedded leverage (e.g., contango costs) that’s closer to institutional levels.

This makes sense because those who can borrow and lend at fair value are active in these markets and these benefits can accrue downstream to retail investors who operate in these markets.

Using Options for Leverage

Options are a type of derivative that provides a way to achieve leverage in your portfolio in a risk-limited way.

They provide the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific period.

When you buy an option, you control a larger amount of the underlying asset for a fraction of its direct purchase cost.

For example, buying call options allows an investor to benefit from a rise in the underlying asset’s price with a much smaller initial outlay than buying the asset outright.

Conversely, buying put options can protect an investor from a decline in the asset’s value.

However, options can expire worthless if they are out-of-the-money at expiry, leading to a total loss of the initial investment.

And the complex nature of options, along with their time sensitivity (expiration dates), requires a nuanced understanding of the market.

Deep ITM Call Options

Often the best way for retail traders to leverage their portfolios is by buying deep in-the-money call options.

You still pay the tail risk but with close to institutional borrowing costs.

For example, let’s say SPY is $683.64 per share. If you choose a $450 strike, that’s $233.64 per share of “moneyness.”

With 100 shares per contract, that’s $23,364.

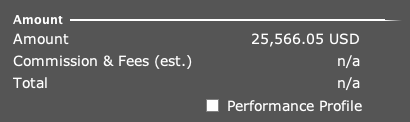

The premium for the option is $25,566.

Let’s say $25,570 after transaction costs.

To figure the transaction costs, we subtract the difference, then divide by the spot price.

So $25,570 – $23,364 = $2,206

$2,206 / $68,364 = 3.22%

That beats the high single-digit rates that would be common at retail markups.

And you’re controlling over $68,000 worth of assets for a cash outlay of $25,570, for a leverage ratio of 2.67x.

Leverage through Futures

Like options, futures contracts offer another way to achieve leverage in a portfolio.

They are agreements to buy or sell an asset at a future date for a specified price.

In futures trading, the trader only needs to deposit a small fraction of the total contract value, known as the margin.

This allows for large positions to be taken with a relatively small amount of capital, effectively creating leverage.

Traders nonetheless need to watch out for implied costs, such as contango, that can effectively be like paying interest.

Futures

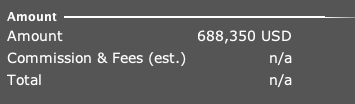

If we look at futures, we can look at the costs over one year.

The front month:

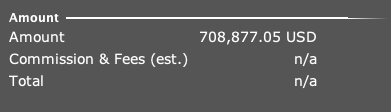

The one-year future:

Dividing the two, we take $708,877 / $688,350 = 2.98%

Borrowing to Generate Leverage

Direct borrowing is another method of creating leverage.

This involves borrowing money from a brokerage (margin account) to buy more securities than you could with just your available funds.

By borrowing funds, you can potentially earn a higher return due to the larger investment.

However, the risks are also magnified because if your investment doesn’t perform as expected, you still owe the borrowed money plus interest. It’s important to thoroughly understand the terms and risks of margin trading before employing this strategy.

Also note that when you borrow from brokerages, they are making a spread over government borrowing rates.

Example

If you are making a 5% yield on a leveraged investment and the margin rate is higher than that, then you would be losing money while also taking more risk.

Even if you leverage the investment 2:1 and have a 3% interest rate on the loan, you are doubling your risk to earn 7% (2*5% – 3%) instead of 5%.

Shorting as a Form of Leverage

Short selling or “shorting” is an investment/trading strategy that involves selling a borrowed asset with the expectation that its price will decline.

When shorting you receive a cash credit, which can offset borrowing or enable for additional purposes.

However, your main risks are:

- Borrowing fees

- Potential losses can be theoretically unlimited

- Shorting comes with margin requirements and its own interest costs on the trade itself (independent of borrowing fees), leaving less room for other trades

To offset potential losses, one strategy is to pair a short with a deep ITM put option.

For example, if SPY is at 450, a trader could short a 550 put to generate a cash credit from shorting SPY while also protecting against price rises up to 550.

That way, any price losses won’t affect you as long the price stays below the strike by expiration.

CFDs (contracts for difference)

Allow speculation on asset prices without owning the underlying asset.

Margin requirements are low, so large positions can be controlled with little upfront capital.

Note that CFDs aren’t available in many markets.

Other Leverage Techniques

Investing in companies that utilize leverage, either through corporate debt or by using derivatives, can also indirectly provide leverage in a portfolio.

But these methods carry their own risks and should only be used by those who understand these risks.

We’ll cover these more below.

How Do Hedge Funds, Banks & Institutions Borrow Cheaply and Leverage Their Trades?

Institutions, such as banks, hedge funds, and proprietary trading firms, have several ways to leverage their trading strategies without paying significant interest or other costs.

Here are some common methods:

Using Repo Financing

Institutions can engage in repurchase agreements (repos) to effectively borrow funds at low rates.

In a repo transaction, the institution sells securities (e.g., Treasuries) to a counterparty and agrees to buy them back at a slightly higher price in the future.

The price difference represents the implied borrowing rate, which is typically lower than traditional lending rates.

Accessing Credit Lines and Prime Brokerage

Large institutions often have access to low-cost credit lines and prime brokerage arrangements with investment banks.

These facilities allow them to borrow securities or cash at preferential rates, enabling leveraged trading strategies.

Using Derivatives

Institutions can use derivatives, such as options, futures contracts or swaps, to gain leveraged exposure to different asset classes without directly borrowing funds.

The leverage is built into the derivative instrument itself, and the institution only needs to post initial margin requirements.

Exploiting Regulatory Arbitrage

Some institutions may engage in regulatory arbitrage by structuring their trading strategies in a way that minimizes capital requirements or other costs.

For example, they may use off-balance-sheet vehicles or engage in netting of positions to reduce their overall capital charges.

Internal Funding and Netting

Within large institutions, different trading desks or divisions may internally fund each other.

This means they can effectively provide leverage without external borrowing costs.

Additionally, institutions can net offsetting positions across different desks, reducing their overall capital requirements and funding needs.

For example, if one trading desk is long 100,000 shares of a stock and another is short 70,000 shares of the same stock, their funding needs net to 30,000 shares overall.

Collateral Transformation

Institutions with access to diverse asset classes can engage in collateral transformation.

This is where they temporarily swap lower-quality collateral (e.g., stocks, corporate credit) for higher-quality collateral (e.g., Treasuries).

This allows them to use the higher-quality collateral for leveraged trading or financing operations.

Securities Lending

Institutions with large securities portfolios can lend out some of their securities to other market participants in exchange for a lending fee.

This generates additional income that can effectively offset some of the costs associated with leveraged trading strategies (or wherever else in the business).

Rehypothecation

When institutions receive cash or securities as collateral from counterparties, they may have the ability to reuse or “rehypothecate” that collateral for their own purposes, such as funding leveraged trades.

This allows them to effectively multiply the use of their capital without directly borrowing or paying interest.

Portfolio Margining

For institutions engaged in multiple asset classes or trading strategies, they can take advantage of portfolio margining.

This approach allows the institution to cross-margin their positions, and potentially reduce the overall margin requirements compared to margining each position individually.

Lower margin requirements translate to less capital tied up, which enables more leverage.

Synthetic Financing

Institutions can use derivatives, such as total return swaps or equity-linked notes, to synthetically replicate the exposure of a leveraged position without directly borrowing funds or securities.

This can sometimes be more cost-effective than traditional financing methods.

Things to Know

Not Truly “Free”

Some of these don’t involve explicit interest payments, but they carry implicit costs:

- Opportunity costs of assets tied up as collateral for margin.

- Fees associated with swaps or derivatives transactions.

- Implied leverage in the contract being traded (e.g., contango in future contracts, net premium outlay in options contracts).

Risk

Leverage inherently increases risk.

Derivatives and other structured transactions can be complex with the potential for large losses if markets move against them.

Institutions need to prudently manage their counterparty risk, liquidity risk, and overall leverage levels for financial stability and compliance with regulatory requirements.

Counterparty Risk

These strategies often involve relying on other institutions as counterparties, which exposes them to potential default risk.

Typical Leverage by Institution Type

| Institution | Typical Gross Leverage |

| Pension funds | 1.0x-1.3x |

| Endowments | 1.0x-1.5x |

| Risk-parity funds | 2x-3x |

| Macro hedge funds (normal) | 2x-4x |

| Macro hedge funds (high conviction) | 4x-6x |

| Fixed-income relative value desks | 5x-10x (low vol assets only) |

Pension Funds

Pensions funds generally run very low volatility. Often, they aren’t allowed per their mandate, as they can’t risk jeopardizing payouts.

When pensions do borrow, it’s primarily through derivatives rather than borrowing.

Pension funds use futures, swaps, and repo to gain this extra market exposure while holding the remaining capital in bonds or interest-bearing cash.

This preserves necessary liquidity, lowers funding risk, and allows for more precise volatility targeting without using traditional margin leverage.

Some of it is also structural leverage, as they access private equity, venture capital, hedge funds, and real estate funds.

Endowments

Endowments typically use structural leverage rather than explicit borrowing, as, like pensions, they allocate to private equity, real assets, hedge funds, and derivatives that embed leverage internally.

The leverage used is still low so that their liquidity buffers and long horizons carry them through.

Risk-Parity Funds

Risk parity funds use more explicit leverage via futures, swaps, derivatives, and repo to scale low-volatility assets like bonds up to equity-like risk.

Their goal is to balance risk contribution either among assets or among economic environments (based on the biases implicit in asset classes)

They rely on low financing costs, tight volatility controls, and – often, but not always – systematic deleveraging rules.

Macro Hedge Funds

Macro hedge funds commonly target 2x-6x leverage, but it depends because derivatives and hedging start to make notional exposure and headline leverage less relevant.

As convexity, net exposure, and correlation management increase, notional leverage ultimately can be quite a bit less informative than volatility, drawdown, tail risk, and liquidity risk.

Relative Value Desks

Relative value desks often use 5x-10x leverage because they trade lower-volatility, mean-reverting spreads, rather than directional risk.

For this, depending on the nature of the trade, they’re using repo, swaps, futures, and matched long–short books to finance positions at a low cost.

How Do Banks Leverage Themselves So High?

Banks can achieve very high leverage ratios, sometimes 15x or higher, through a combination of regulatory capital requirements, fractional reserve banking, and off-balance sheet activities.

Here are some of the key ways banks leverage themselves to such high levels:

Regulatory Capital Requirements

Banks are required to maintain a certain level of capital based on the riskiness of their assets, as determined by regulatory bodies like the Basel Committee on Banking Supervision.

Typical capital requirements range from 4-10% of risk-weighted assets.

This means banks can leverage their capital up to 25x for lower-risk assets.

Fractional Reserve Banking

Banks only need to hold a fraction of customer deposits as reserves, with the rest being used for lending and investing purposes.

This allows banks to multiply their leverage by essentially borrowing from depositors at a very low cost.

Off-Balance Sheet Activities

Banks engage in various off-balance sheet activities, such as securitization, derivatives, and loan commitments, which provide exposure and leverage without directly affecting their on-balance sheet assets and capital requirements.

Repo Financing

As mentioned in the previous section, banks can use repurchase agreements (repos) to effectively borrow funds at low rates by temporarily selling securities and agreeing to buy them back later.

This provides leverage without directly affecting capital ratios.

Accounting Treatment

Certain accounting rules allow banks to classify some assets and liabilities in ways that reduce their impact on regulatory capital calculations, enabling higher leverage.

Internal Risk Models

Banks often use their internal risk models, approved by regulators, to calculate capital requirements.

These models can sometimes underestimate risk, and allow banks to hold less capital and operate with higher leverage.

Post-2008 Regulation

Regulatory bodies have implemented measures to limit excessive leverage in the banking system following the 2008 financial crisis.

Nonetheless, banks continue to find ways to operate with significant leverage within the regulatory framework.

Risk Management & Considerations

Understand the Magnified Risk

Leveraging augments both gains and losses.

A small market movement in the wrong direction can lead to significant losses, possibly exceeding the initial investment.

Be Mindful of Costs

Interest on borrowed funds and transaction costs and fees associated with certain financial instruments (like shorting a stock) can erode returns.

For instance, with shorting a stock you might have interest accrue on the amount borrowed itself – independent of the borrowing fee.

Know Your Risk Tolerance

Leverage is typically more suited for traders who are risk-tolerant and well-versed in market dynamics.

It’s imperative to assess whether leverage aligns with your goals and risk appetite.

Continuous Monitoring & Management

Leveraged positions require active and continuous management, given their susceptibility to market volatility and potential for rapid losses.

Consult Financial Experts

Before engaging in leveraged investments, it’s advisable to consult with a financial advisor to understand the implications fully and make sure that the strategy aligns with your overall objectives.

Tables Comparing Leverage Options

1. Cash‑secured borrowing

| Tool | Typical advance / leverage | All‑in cost vs SOFR | How to minimize cost |

| Reg‑T margin (retail) | 2 : 1 | +150‑400 bp (broker call rate) | Shop multi‑broker quotes; move blue‑chip collateral into margin‑favoured categories |

| Portfolio margin / cross‑margin | 3‑6 × delta‑one; much higher on option spreads | +50‑150 bp (volume‑based) | Consolidate positions in a single PM account; keep offsets tightly hedged so the risk engine nets exposures |

| Prime‑broker financing | Negotiated; can exceed 10 × on government bonds | +30‑130 bp | Supply lendable stock (securities‑lending revenue lowers your spread) |

| Securities‑backed lines (SBLOC) | Up to 80 % LTV | +100‑250 bp | Pledge low‑haircut assets (T‑Bills, IG bonds) and keep utilisation below covenants |

2. Collateralized funding trades

| Tool | Mechanics | Typical cost vs SOFR | Cost‑control playbook |

| Repurchase agreements (repo / reverse repo) | Sell collateral, agree to repurchase at a premium; haircut 1‑10 % | +5‑15 bp on Treasuries; +20‑70 bp on equities | Trade overnight or term <14 d; use tri‑party to compress margins; reinvest excess cash at reverse‑repo rate |

| Stock‑loan (equity repo) | Borrow cash against equities; lender can rehypothecate | +50‑150 bp but very position‑specific | Offer hard‑to‑borrow names to your PB to offset funding spread |

| Convertible‑bond financing / asset swaps | Buy bond, repo finance bond, short equity; net capital small | Funding cost largely offset by short‑stock rebate | Target mis‑priced converts with positive carry |

3. Derivative overlays (delta‑one or near‑delta‑one)

| Instrument | Capital usage | Financing profile | When it’s cheapest |

| Listed futures | Initial + variation margin only (often 3‑10 % notionals) | Embedded rate = spot‑future basis (≃ risk‑free ± dividend/basis) | Short‑dated equity, commodities where open interest is deep |

| AIR Total‑Return Futures (CME) | Same margin as futures | Daily financing reset to SOFR; term‑basis risk removed | When classic quarterly futures trade rich to repo |

| Total‑return swaps / index forwards | Variation margin only; no exchange margin if OTC | SOFR + spread (20‑40 bp typical) | Horizons >3 m or when futures basis is wide; cleared TRS compress spread further |

| Contracts for Difference (CFD) | Cash or haircut held by broker | Benchmark + 100‑300 bp | Small‑lot, non‑US, after‑hours trading |

| Synthetic forward via options (buy call / sell put same strike) | Option margin only; delta ≈ 1 | Implied financing = (call‑put)/strike − dividends (put‑call parity) | When IV is low and skew cheap relative to futures basis |

Futures vs. TRS cost check – institutional overlay desks continuously compare:

- Implied future rate − (SOFR + repo haircut) → positive? switch to cash‑plus‑repo;

- TRS spread < futures basis? switch to TRS.

4. Public structured vehicles

| Vehicle | Embedded leverage | Running cost | Notes |

| Leveraged ETFs / ETNs (e.g., 2×, 3× indices) | Rebalanced daily via swaps & futures | Expense ratio 75‑100 bp + compounding drag | Tactically useful; expensive for holding > a few weeks |

| Structured notes / buffered or leveraged certificates | Issuer delta‑hedges with options/swaps | Coupon embed = funding + issuer spread | Retail‑friendly, but worst transparency |

5. Fund‑level credit (for private funds or SMA structures)

| Facility | Advance rate | Cost | Best practice |

| Subscription lines (uncalled commitments) | 60‑90 % of capital calls | SOFR + 150‑225 bp | Use only for bridge‑to‑call; avoid structural leverage |

| NAV‑based facilities / back‑leverage | 20‑50 % of portfolio NAV | SOFR + 200‑300 bp | Disclose terms to LPs; monitor asset covenants; ILPA now recommends treating as fund‑level leverage |

6. Tactics for shaving the financing bill (i.e., carrying costs)

Exploit risk‑based margining

Move correlated positions into the same portfolio‑margin account or cleared OTC pool so offsets reduce initial margin requirements.

Optimize collateral quality

Post T‑Bills or government bonds instead of cash where possible; earn reverse repo on excess collateral posted to CCPs.

Arbitrage the basis

Cash‑and‑carry: buy spot via cheap repo and short rich futures. If basis earns > funding, you end up paid for leverage.

Negotiate prime‑broker spreads

Financing rates are volume‑sensitive; concentrate flow, supply borrowable securities, and commit to term financing to win tighter spreads.

Use cleared TRS (e.g., CME’s Centrally Cleared TRF)

Uniform margin models and multilateral netting often knock 10‑15 bp off the swap spread relative to bilateral ISDA.

Deep‑ITM option synthetics

When 90‑delta calls and puts price at vol below 10 %, the implied financing can be tens of basis points under futures, especially around ex‑dividend dates.

Roll smart

Futures and ETF rebalancing drags are path‑dependent. Use shorter tenors during inverted curves. Lock longer tenor TRS or repo during steepening.

Cross‑currency funding

If foreign cross‑currency swap basis is negative, borrowing in JPY or CHF and swapping back can create sub‑SOFR synthetic leverage (after hedging FX).

7. “Avoiding” the embedded cost in futures

You can’t remove financing from any leveraged position – someone is still advancing cash – but you can migrate to the cheapest channel at any time:

| If futures basis is… | Switch to… | Why |

| Wider than repo + 1 % | Buy cash via repo, short future (cash‑and‑carry) | Capture basis spread, net financing ≈ repo |

| Wider than TRS spread | Replace position with cleared TRS | Funding charged as SOFR + spread only |

| Rich relative to option parity | Synthetic forward via options | Pay implied rate embedded in option parity; often lower when vol is cheap |

Continuous monitoring of the equity index or bond futures basis versus (SOFR + haircut × capital‑charge) is the hedge‑fund standard for funding‑cost minimization.

FAQs – How to Generate Leverage in a Portfolio

What does it mean to generate leverage in a portfolio?

Leverage in a portfolio refers to the use of various financial instruments (e.g., options, futures, swaps) or borrowed capital, such as margin, to increase the potential return of an investment.

If a portfolio is “leveraged,” it means that it includes financial derivatives or borrowed capital, amplifying both potential gains and losses.

It’s a strategy used to optimize returns, although it also increases risk.

How can I create leverage in my portfolio?

There are several ways to generate leverage in a portfolio:

- Borrowing money: This is often done through margin loans, where you borrow money from a broker to make investments. This effectively multiplies the capital you have available for investments.

- Leveraged financial products: These are financial instruments designed to amplify the returns of an underlying asset or index. Examples include options, futures, and more.

- Shorting: Shorting provides a cash credit, which can then be used to buy other securities. However, it also comes with borrowing fees, margin requirements, and price risk.

What are the risks associated with using leverage in a portfolio?

The key risk is that leverage can magnify losses as well as gains.

If your investment declines in value, you can lose more than your original investment.

Also, if you have borrowed money to make your investments, you will need to repay the loan regardless of how your investments perform.

This could potentially lead to financial distress if your assets perform poorly.

How does margin trading work in generating leverage?

Margin trading is one way to create leverage in a portfolio. It involves borrowing money from a broker to purchase securities.

The borrowed money is repaid when the securities are sold.

If the securities increase in value, the investor makes a larger profit than they would have without the use of borrowed money.

However, if the securities decrease in value, the investor may lose more than their original investment.

How can I manage the risks of leverage?

Risk management is essential when using leverage.

Here are some strategies:

- Diversification: Spreading your investments across various assets can help to mitigate the risks associated with leverage, as not all your investments will be subject to the same environmental biases.

- Stop losses: These are pre-set orders to sell an asset when it reaches a certain price. They can help limit losses in the event of a market downturn. However, markets can gap so stop losses aren’t necessarily reliable beyond day trading purposes.

- Regular portfolio review: It’s important to monitor and adjust your portfolio regularly to ensure it aligns with your investment goals and risk tolerance.

- Risk assessment: Before using leverage, look at your risk tolerance and investment goals. Make sure you can absorb potential losses without severely affecting your overall financial situation.

- Options to reduce left-tail risk: Options can hedge against losses.

Can leverage be beneficial for all types of investors?

Leverage can potentially increase returns, which might make it attractive to all types of investors.

However, due to the high risk associated with leveraging, it’s generally more appropriate for experienced investors who have a high risk tolerance and understand the complexities of financial markets.

Leveraging should be considered based on one’s individual investment goals, risk tolerance, and investment timeline.

Conclusion

Leverage can be a powerful tool for portfolio enhancement when used carefully and with a deep understanding of the potential risks and rewards.

Whether through options, futures, borrowing, short selling, or other techniques, leverage can significantly boost potential returns.

However, the increased potential for returns comes with an increase in risk, including the possibility of severe losses.

It’s important for investors to manage and diversify their portfolio risk, be aware of their risk tolerance, and understand the instruments they’re using before applying leverage and leverage-like techniques to your portfolio.