Synthetic Asset Creation

Synthetic assets are financial instruments that mimic the value of other assets without needing to own the underlying asset.

They’re essentially derivatives, meaning their value is derived from something else – a commodity like gold, a stock, index, or other asset.

Key Takeaways – Synthetic Asset Creation

- Versatility in Exposure

- Synthetic assets provide exposure to diverse markets and asset classes without the need to physically own the underlying assets.

- Cost Efficiency

- Trading synthetic assets typically incurs lower costs compared to direct investment in the actual assets.

- Risk Management

- Use synthetic assets for hedging and reducing risks in investment portfolios by creating counterpositions.

Overview of Synthetic Assets

Synthetic assets are prized for their versatility.

You get exposure to different markets without dealing with the complexities or costs of owning the actual asset.

Want to invest in Google without buying shares? There’s a synthetic asset for that.

Derivatives

How does one create these assets? It often involves using derivatives.

This can be done discretionarily or systemically.

In systematic approaches, these contracts automatically execute when certain conditions are met, so that the synthetic asset mirrors the underlying asset’s price movements.

Opportunities

Why do synthetic assets matter? They open up new opportunities.

For instance, you can trade assets that were previously inaccessible or trade/invest in various markets without, for example, leaving the crypto ecosystem (for those into cryptocurrencies).

They can also offer more liquidity compared to traditional markets.

For example, real estate is classically illiquid. But there are futures markets that emulate the price movements of various national and city-based housing markets.

Risks

Nonetheless, like any financial instrument, there are risks.

The complexity of synthetic assets can lead to misunderstandings and potential losses if not handled carefully.

Components and Structure of Synthetic Assets

Synthetic assets are like financial building blocks.

They are made up of different components that work together to replicate the value of another asset.

Derivatives

Derivatives are a key ingredient.

They’re financial contracts that derive their value from an underlying asset.

This could be a stock, bond, commodity, or even another cryptocurrency.

Futures contracts, options, and swaps are all examples of derivatives.

They allow us to speculate on the future price movements of an asset without actually owning it.

Securities

Securities also play a role.

These are tradable financial assets that hold some monetary value.

They can include stocks, bonds, and even synthetic assets themselves.

Collateral

Collateral is another important component.

This is an asset that is pledged as security for a loan or other financial obligation.

With derivatives, collateral is generally low relative to owning the underlying, which is part of their appeal.

Combining Them

By combining these components in different ways, we can create a wide variety of synthetic assets that offer exposure to different markets and asset classes.

Methods for Creating Synthetic Assets

There are a couple of main ways synthetic assets are created, each with its own flavor.

Derivatives

As you guessed, the first is all about derivatives.

With these, you can bet on price movements without owning the underlying asset. (Or they can be used for prudent hedging purposes.)

Options, for example, give you the right, but not the obligation, to buy or sell an asset at a certain price by a certain date.

You can combine options strategically to mimic the payoff of another asset, essentially creating a synthetic version.

Futures

Futures contracts are similar but involve an agreement to buy or sell an asset at a set price in the future.

By skillfully combining futures and other derivatives, you can create synthetic exposures to all sorts of assets.

Swaps

Swaps are another way.

These involve exchanging cash flows based on different underlying assets.

By swapping cash flows tied to different interest rates or currencies, for instance, you can create synthetic bonds or foreign exchange positions.

Structured Products

Another way you can create synthetic assets is by using structured products.

These are financial instruments designed to meet specific trading/investment goals.

Collateralized debt obligations (CDOs) are a good example.

They bundle together various debt instruments like mortgages or corporate bonds and then divide them into different risk tranches.

By strategically investing in different tranches, one can create synthetic exposures to specific types of debt.

Overall

So, whether it’s through clever combinations of derivatives or the use of sophisticated structured products, there are a variety of ways to build synthetic assets that offer unique investment or trading opportunities.

Examples of a Synthetic Asset

The most basic way to synthetically create an asset is via a synthetic long or short.

Synthetic Long

To create a synthetic long:

- Buy a call option on the underlying stock.

- Sell a put option on the underlying with the same strike price and expiration date.

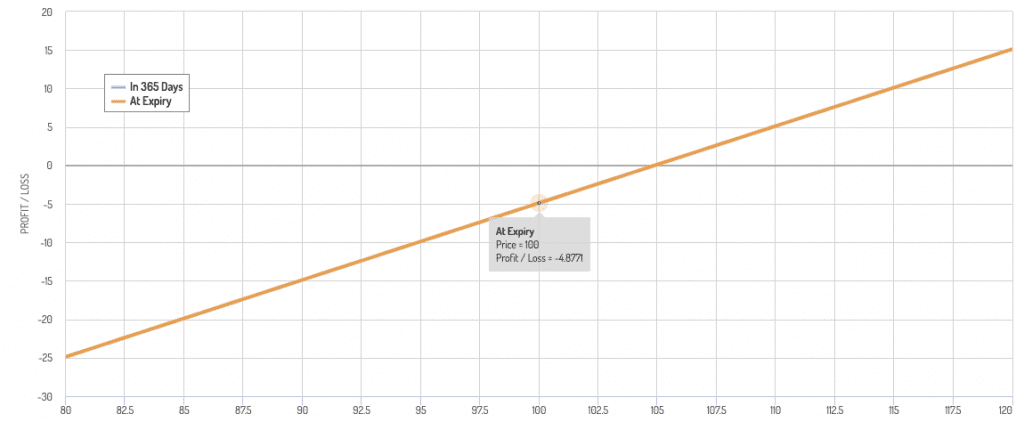

Below is the payoff diagram:

At the strike price (100), you’re already down (paying a net debit).

Why is this?

This is because calls and puts will have a wider discrepancy the higher interest rates are.

Due to higher interest rates, there will be higher demand for calls given the more expensive borrowing costs of the stock in the cash market.

As a result, this leads to higher call prices relative to puts – assuming nominal interest rates are above zero.

In terms of the Greeks, this is known as rho.

Synthetic Short

- Sell a call option on the underlying stock.

- Buy a put option on the underlying with the same strike price and expiration date.

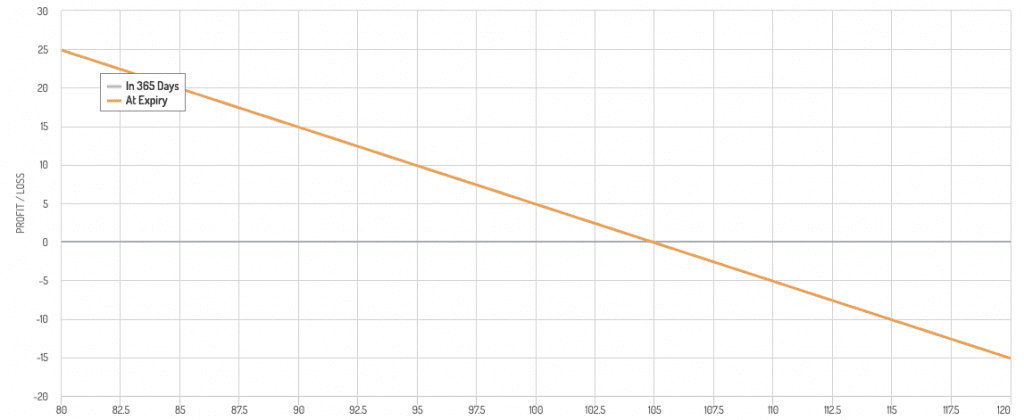

Here’s the payoff diagram:

Benefits of Synthetic Assets

Synthetic assets aren’t just a clever financial trick. They offer some serious advantages.

Flexibility

First, they’re incredibly flexible.

You can create synthetic versions of almost any asset imaginable.

This means you’re not limited to just stocks and bonds.

You can gain exposure to commodities, real estate, and other asset classes, all without leaving your current trading platform.

It does take some creativity, but if you have a strong derivatives background, this type of creativity and intuition will be developed.

Accessibility

They make the inaccessible accessible.

Some assets are notoriously difficult to trade due to regulations, high costs, or limited liquidity.

Synthetic assets can help eliminate these barriers, opening up new markets and trading/investment opportunities.

This is particularly beneficial for traders in regions with limited access to certain asset classes.

Risk Management

Synthetic assets can be a great risk management tool.

They allow you to hedge our existing holdings by taking opposite positions in synthetic versions.

If the market moves against you, the gains in your synthetic position can offset your losses in the original asset.

It’s like having an insurance policy for your trades or investments.

Efficiency

Then there’s the efficiency factor.

Trading synthetic assets is often cheaper and faster than dealing with the underlying assets themselves.

There are no custody fees, settlement delays, or other hassles associated with traditional markets. Plus, lower collateral costs (usually).

This streamlined process makes trading more accessible and efficient.

Risks and Challenges

Complexity

These assets are not beginner-friendly, built on layers of derivatives and financial engineering.

Understanding how they work and the risks involved requires more than a casual glance or gut judgment.

Some will just hop in without sufficient understanding and underestimate potential downsides.

Transparency

Transparency can also be a problem.

The underlying mechanisms of some synthetic assets aren’t always clear. This makes it difficult to assess their true value and risks.

This lack of transparency can create opportunities for manipulation and fraud.

Regulation

The synthetic asset space changes rapidly, and regulations often struggle to keep up.

This creates unknowns for both issues and the traders and investors in these products.

There’s always the risk that new rules could disrupt the market or even outlaw certain types of synthetic assets.

Ethical Concerns

We also need to consider the ethical side of things.

The ease of creating synthetic assets raises questions about market manipulation and potential bubbles.

Could these instruments be used to artificially inflate prices or create false demand?

It’s a valid concern that needs careful consideration.

Example: Gamma Squeezing

When traders buy out-of-the-money (OTM) call options, market makers who sell these options hedge their exposure by buying the underlying stock.

As the stock price approaches the strike price, the gamma (i.e., rate of change of delta) of the options increases.

This non-linearity causes market makers to buy more shares to remain delta-neutral.

This, in turn, drives the stock price higher.

This cycle creates artificial demand and price momentum – which can have knock-on effects triggering other algos (e.g., momentum, CTA) – potentially leading to a gamma squeeze.

It’s an example of how derivatives can be misused.

Counterparty Risk

There’s the issue of counterparty risk.

Many synthetic assets rely on third parties to fulfill their obligations.

If these counterparties fail, the value of the synthetic asset could plummet.

Real-World Applications

Synthetic assets have a rich history and have proven their worth in a variety of situations.

CDOs

In the 1990s, the derivatives market was booming, and creative financial people were crafting complex synthetic assets like collateralized debt obligations (CDOs).

These instruments bundled together various types of debt, from mortgages to corporate loans.

Traders/investors could buy into different tranches of a CDO, each with varying risk and return profiles.

This allowed them to gain exposure to diverse debt markets without directly holding the underlying loans.

While CDOs had a role in the 2008 financial crisis due to the hidden leverage they put on the balance sheets of key financial intermediaries in the economy, they also demonstrated the power of synthetics to create new trading and investment opportunities.

Cryptocurrencies

In cryptocurrencies, you see synthetics making waves in decentralized finance (DeFi).

Platforms have used the creation of synthetic cryptocurrencies that track the prices of other assets, like gold, stocks, or even other cryptocurrencies.

These “synths” allow traders to gain exposure to various markets without leaving the crypto ecosystem.

ETFs

In traditional finance, there are synthetic ETFs.

These exchange-traded funds use derivatives (i.e., swaps) to track the performance of an underlying index, like the S&P 500.

They offer traders/investors a convenient way to diversify their portfolios without buying individual stocks.

Prediction Markets

Another interesting application is in prediction markets.

These platforms allow users to create synthetic assets that represent the outcome of future events, like elections or sports events.

These assets can be bought and sold, with their prices reflecting the market’s prediction of the event’s outcome.

They function similarly to sportsbooks, trying to get roughly equal amounts of money on each side of the trade so they can capture their vig in a relatively risk-free way.

It’s a novel way to turn predictions into tradable instruments.

CBDCs

Even central banks are exploring the use of synthetic central bank digital currencies (CBDCs).

These digital versions of traditional currencies could be created and distributed on a blockchain, offering potential benefits in terms of efficiency, security, and financial inclusion.