Central Bank Digital Currencies (CBDC): New Additions to the Currency Landscape

The PBOC, ECB, Federal Reserve, and Riksbank all are looking to develop central bank digital currencies (CBDC). In this article, we’ll cover the status of each, the uses, and the implications.

CBDC is one of the most important topics in the currency markets at the moment. It has implications not just economically and technologically, but also geopolitically.

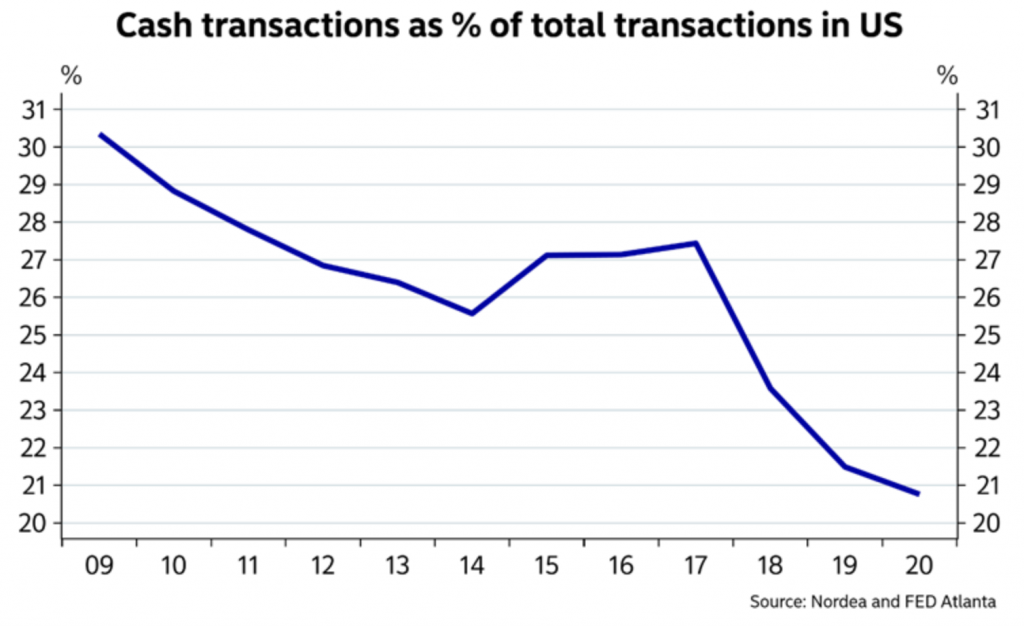

The world is increasingly going away from physical cash and coins to digital payments primarily as a means of flexibility and convenience.

With digital payment services, more and more consumers are accustomed to things like Venmo and CashApp in the US, Swish in Sweden, AliPay in China, among other localized mobile and online payment systems.

Cryptocurrency has also become popular as private electronic money projects. When alternative currencies come into circulation and become popular it makes fiat money less effective. Therefore, it can potentially inhibit policy effectiveness.

Rationale for CBDC

Central banks always want to control all money and credit within their borders. It’s one of the biggest powers a central bank can have.

Traditional interest rate policy flows through the system in an indirect way. When the Federal Reserve adjusts interest rates, those flow through the economy in their own way in a largely hands-off manner.

In secondary monetary policy, assets are purchased by the central bank to lower longer term interest rates. This mostly flows through the financial system since that’s where the money goes. It benefits those who own financial assets and less so those who don’t.

Direct money transmission can be not only more expedient but potentially more targeted and effective. A type of “people’s QE” rather than “asset market QE”.

These reasons alone are enough for central banks to want to investigate setting up a digital currency.

The current backdrop

China will launch the digital renminbi (yuan) in early 2022, which is likely to help the CNY in the FX markets. It can help bring about the currency’s increasing internationalization, though it will take time.

All central banks are likely to pursue their own digital currencies over time.

In the future, when policy needs additional stimulus, central bank digital currencies will help effectively pursue policy initiatives that would otherwise be difficult (negative rates, ineffective QE, slow or bobbled direct transfers).

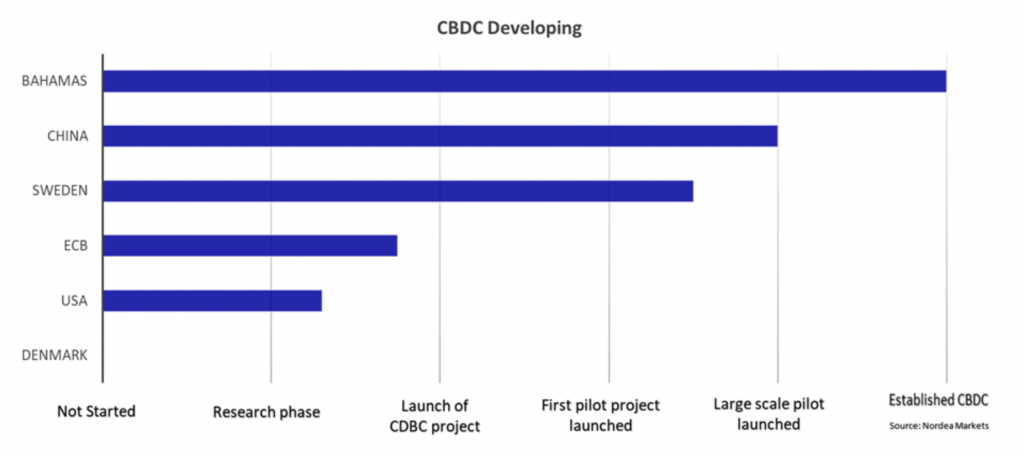

Sweden is currently on the forefront when it comes to Western economies and CBDC development.

What is a CBDC?

A CBDC is the digital version of a physical currency. It literally turns currency into code. Services like Apple Pay, PayPal, Venmo, AliPay, etc., are not true digital currencies. They are simply electronic exchanges or storage services.

They help to eliminate the need for physical money. But they don’t turn legal tender into computer code itself, which is what a digital national currency like the digital renminbi are doing.

A central bank can place a certain amount of currency in a digital wallet. This can be on an electronic device, such as a smartphone or any type of “node”.

Each individual, and potentially each company, is likely to get a digital wallet at the central bank over time.

A bank account today is insured up to a certain amount if your bank goes into bankruptcy. Any sum in excess of the insured amount would be lost. However, with a CBDC, the central bank backs it up. So it cannot be lost due to failure. Its value can nonetheless erode due to inflation.

Each digital unit of currency will be equal to the physical version.

Will CBDC money carry interest rates?

It should provide an interest rate on par with the central bank’s deposit rate. In the case of many central banks, this is around zero or even negative.

Will negative interest rate countries exempt CBDC from negative interest rates?

It is probable that CBDC wallets will be limited up to a certain size. It’s likely to start at a size of less than $5,000 for most central banks.

China’s Digital Currency Electronic Payment (CNY DCEP)

China’s PBOC became the first-mover in the CBDC space with its DCEP (digital currency electronic payment). The PBOC began with a pilot program targeted at the retail/household sector.

With full implementation in 2022, this put China far above the pack in terms of CBDC development.

Other emerging markets don’t have the expertise and resources to develop the infrastructure for digital currencies. CBDC would likely be the biggest benefit for emerging countries, given the state of their commercial banking system is not well-developed.

China will likely try to fill that market need. The yuan DCEP can be used by other countries as a source of savings. Or it can invoice other countries in the CNY DCEP. China has the largest share of trade of any country, so this brings opportunity.

If China were to provide other countries access to its DCEP, this could provide China the incentive to issue more “nodes” and bring along the CNY more broadly.

This is an issue for the US because it can undermine its reserve status. For reasons we’ve discussed in other articles, among the main reserve currencies today (e.g., USD, EUR, JPY, GBP), the CNY is perhaps the only one that makes sense to have more exposure to relative its weighting in global FX reserves.

(You could also include gold in this mix of the “old” reserve currencies. Gold used to mean money, but is largely an old relic that has limited transactional value in modern times. In a portfolio today, it can have value as a source of currency diversification.)

The CNY tends to gain in the market when the PBOC tests out the digital yuan.

Sweden and its CBDC lead in the West

Sweden is using a blockchain-based DLT technology for its digital krona, unlike China.

Accenture was hired to help with the project, which began in 2019 and is expected to run through 2026 if all extensions are exercised.

___

Can DLT technology handle retail payments?

The PBOC said this was DLT’s major flaw.

___

Also, how will the digital krona be stored?

There are three major ways, each with pros and cons.

a) The user could store a private key and CBDC on their phone on an app or card.

This would be most analogous to physical cash – if you lose your wallet, you lose your money.

b) The user has a private key it stores locally but is stored in the network or “node”.

This makes it harder to lose the money, as it will still exist in the node, but it’s possible to lose the money without access to the code.

c) The user stores both the private key and CBDC in a node.

This is analogous to how our bank accounts and other payment services work. But instead of it being a liability to the commercial bank (beyond a certain insured amount it would also be your liability), it would turn into the central bank’s ability.

Riksbank > ECB > Fed

Sweden is ahead of the ECB, which is ahead of the Fed. The projects of the ECB and Fed will get more mainstream attention as the world’s top two reserve currencies.

Digital dollar research is being done between Accenture, the Digital Dollar Foundation, the Boston Federal Reserve, and the Massachusetts Institute of Technology (MIT).

The digital dollar project will first start by launching five pilot projects. But the US is still well behind China and Sweden. The project could still nonetheless be expedited if it were deemed important enough.

i) Easier monitoring

Central banks fundamentally want to have control of all money and credit creation in the nation or jurisdiction they have control over.

CBDC enables central banks to monitor transactions.

ii) De-physical cashing society

Also, on the fiscal side, tax revenue is lost due to the informal (i.e., cash) economy. Limiting the physical cash market can help accomplish this.

In a previous era, the US government had $1,000, $5,000, and $10,000 denomination bills. But they were largely used to complete off-the-grid transactions. As a result, the US pulled them out of circulation.

India took a recent measure to crack down on the cash economy.

iii) Protect savers

CBDC may also help protect savers from negative interest rates by exempting central bank digital money from being subject to them (where they’re applicable).

This would allow the money to at least hold its value in nominal terms. But this would be up to the discretion of each individual central bank.

iv) Improve the policy toolbox

With standard monetary policy, central banks buy assets (mostly their own government’s bonds) from owners of them in the private sector or another government.

Those participants receive cash, which the central bank created. The central bank then holds those bonds on its balance sheet (its portfolio) and receives coupons and bears mark-to-market gains or losses from them.

This affects the economy very indirectly. When a bond is purchased, it helps increase its price and reduce its yield.

The lower interest rates help reduce borrowing costs, make debt easier to service or refinance, and help increase financial asset prices, such as stocks, real estate, and other things that are dependent on interest rates.

But the bulk of the benefits go toward asset owners because the money goes into the financial system via the bonds and other financial assets purchased as part of the program.

A type of people’s QE or helicopter money could better target policy. Money could more easily be put directly in the hands of consumers. And it can also be tied to the type of incentives policymakers want.

If central bankers and politicians want this money to be used for the purchases of goods and services to help get the spending and income flywheel going, they could deposit money into eligible individual’s digital wallet at the central bank.

To get it spent, the money could have an expiration date. It could literally disappear if not spent within, for instance, six months.

Such a policy could also have second-order consequences such as helping reduce things like wealth gaps that drive social friction in society.

Assets are largely concentrated among the wealthy while those who are poorer own few to no financial assets. So QE helps benefit those who own assets disproportionately.

Direct transfers don’t have the constraint of the bond market to work with.

For example, if the Fed is buying $120 billion worth of US Treasury bonds each month, the Fed could simply dole out $120 billion through its digital dollar by dividing that amount by the population size.

Or targeting it based on incomes. If 200 million people are eligible at an equal amount, it could simply pay out $120 billion / 200 million, or $600 per month.

That policy would have its critics whatever the term – e.g., universal basic income (UBI), helicopter money, people’s QE.

In a way, this is already occurring.

The Fed buys a certain amount of bonds, which help to issue direct transfers via various programs (e.g., unemployment). This is done to keep borrowing costs under control.

The fiscal government’s various types of spending needs will require an easing of policy even while inflation runs structurally higher.

Direct money transfer are also more effective in creating inflation. When money goes to those with a higher marginal propensity to spend the money (those with lower incomes), it more directly goes into goods and services inflation.

As a result, you might expect CBDC to have an influence on pushing interest rates higher on net.

Additional impacts

Bank disintermediation

Commercial banks could face some level of disintermediation. That means they could be removed as the middlemen in some transactions if more entities start using nonbank entities.

Once a digital currency launches, individuals will be able to transfer their bank deposits to their CBDC accounts up to the limits imposed by the central bank.

Nonbank entities may also find it easier to enter into the consumer payments space given the infrastructure set up in the CBDC ecosystem. Commercial banks are likely to see competitive pressures go up as the transition to CBDC deposits increases.

Data harvesting and privacy concerns

Transactions data is also likely to see disruption.

There is a popular debate going on between consumers who value their privacy and want to use the internet, social media, and payments as anonymously as possible and fintech companies that want to create incentives for consumers to use their services.

User transaction data can be valuable. Success in harvesting data and generating network effects may allow fintech payment services and nonbank entities to gain market share against traditional commercial banks.

Cross-border payments implications

CBDC can be vital in the international payments system. A country that has a CBDC that can be used for invoicing can enjoy an advantage in financing costs and control over financial transactions.

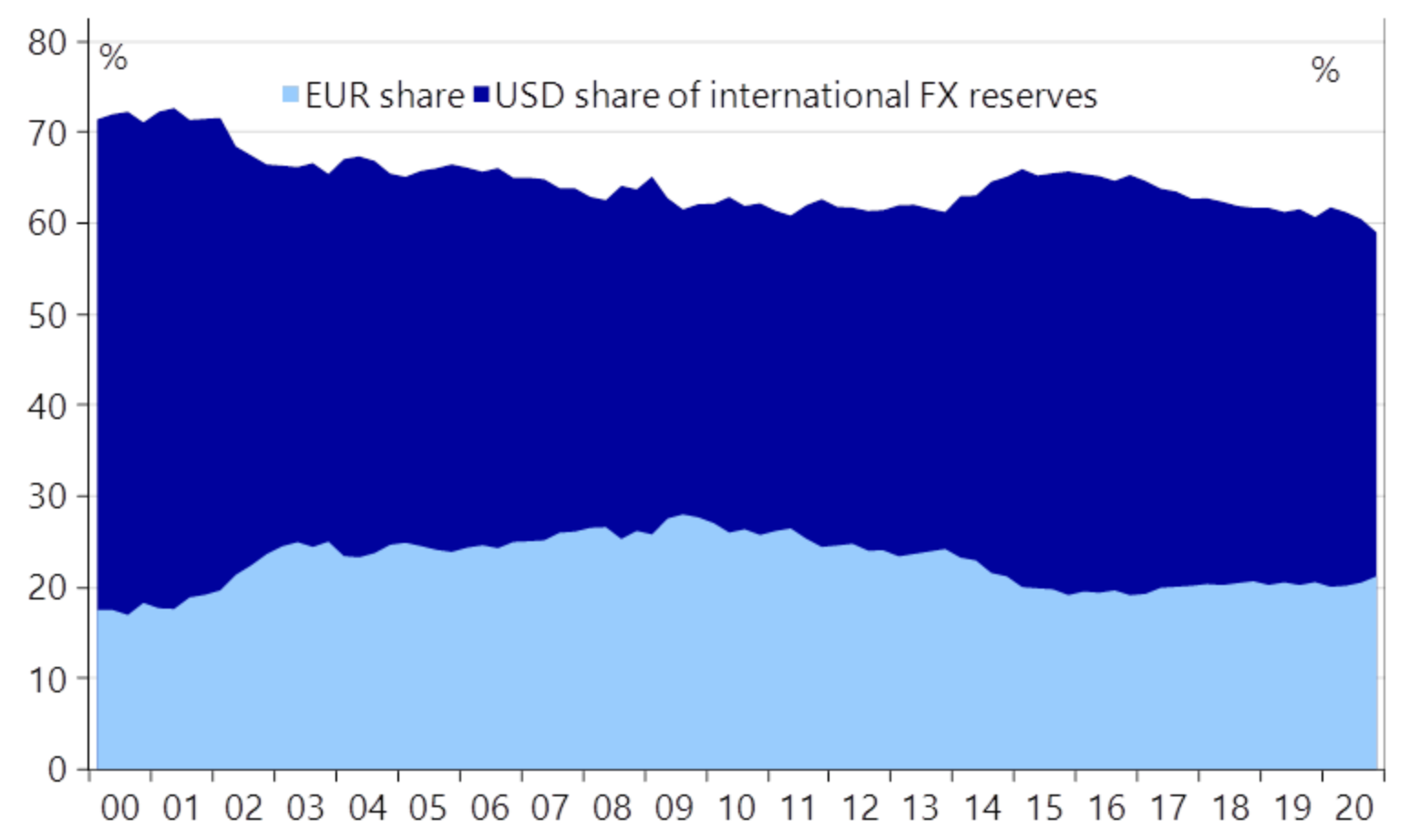

The dollar is most known for this role in the international payments system today. But the creation of a lot of new money and debt at very low interest rates is gradually chipping away at others’ desire to hold the USD (both domestic and abroad).

All countries want a reserve curency and for their currency to be internationalized.

Part of the idea behind the euro was to help it compete as a top reserve currency against the dollar. The trade-off is connecting a bunch of countries together with disparate financial and economic conditions, which can make the euro too strong for some countries (e.g., the periphery) and too weak for others (e.g., stronger countries like Germany).

The development of a CBDC can help both China and Europe grab a greater share of cross-border payments. But the Fed will respond through its digital dollar (“Fedcoin”) project.

Naturally, with the “exorbitant privilege” that comes with having a reserve currency, any external threat to reserve status is viewed as a national concern.

CBDCs aren’t intended to be disruptive, but they will inevitably be in some respect. Disruption will ultimately depend on the network effects in the CBDC system.

As digital currencies are more widely accepted, as they already are in the private sector, the opportunity for innovation will pick up and increase the scope for disruption in the financial system.

Will central bank digital currencies cause a de-dollarization and yuanization of the global FX landscape?

The PBOC views first-mover status as important. The digital yuan and its potential adoption in other countries could help open the door for some level of de-dollarization and yuanization of the global economy.

Emerging markets, as mentioned earlier, would best benefit from a digital currency in some form due to the weakness of their commercial banking system.

As China grows in terms of world trade and overall economic activity, more countries (especially those in Southeast Asia) will start to use the renminbi as a source of financing and for trade invoicing. If the yuan gains, the dollar will lose in relative terms.

That means an ongoing decline of USD as a percentage of global FX reserves. This is already true due to the US and the low yields it pays on its bonds, and reserve managers’ recognition that the US will need to print a lot more dollars to fund its deficits and ongoing spending.

Basically it involves the following:

i) The US spends more than it earns. That means deficits. Deficits mean debt. Debt means having to sell bonds.

ii) To borrow at current levels, the US will need to rely on international investors to buy them.

iii) There won’t be enough demand for those bonds given the low yields and the printing of money that’s perpetually required to reduce debt burdens, given the adverse impact on the currency. (For a foreign investor, the return is not just the yield, but also the P/L on the foreign exchange movements.)

iv) Not only will there not be enough free-market demand for the bonds, but they’re also more likely to want to move away from them for prudent diversification purposes.

Many are likely to consider selling and many already have. This comes at a time when there needs to be a lot more buying when you consider various metrics of what it might mean to be balanced (e.g., economicy size, trade volume, capital flows).

The USD reserve status is already fading. Can the digital yuan accelerate the process?

(Source: Nordea Markets, Macrobond)

Conclusion

Even despite all this, the USD is likely to remain the world’s top reserve currency for many more years, if not decades.

This can still be true even if China is dominant in terms of trade (as it already is), economic size, technology, militarily (as it’s likely to be by 2030), and later geopolitically – at least over certain spheres of the globe as it expands its dominance beyond the South China Sea.

Reserve status tends to go with a lag. Well after a powerful country’s economic, technological, and military dominance falls, its currency still tends to be widely used internationally. The status quo has been entrenched for decades. The USD has been the undisputed top reserve currency since the end of World War II in 1945.

But China’s first-mover advantage in the CBDC space may be an important milestone for currency markets.

It is likely to strengthen the renminbi and help bring along its internationalization with the benefits a CBDC can provide.

This includes:

- easier monitoring of transactions

- gradually removing physical cash from society

- protecting savers from negative interest rates (where applicable), and

- improving the policy toolbox with more direct policy transmission, such as giving cash to households directly and tying it to spending incentives