Synthetic Long & Synthetic Short (Options Strategy)

In options trading, synthetic positions offer traders flexibility and the opportunity to mimic the outcomes of traditional stock trading strategies using a combination of options contracts.

Essentially, synthetic long and synthetic short strategies let traders simulate the risk and reward profiles of buying or shorting a stock, respectively, without actually owning or borrowing the underlying shares.

These kind of strategies might be used by traders who otherwise want traditional long/short exposure but want to do it in a leveraged way (without using costly margin).

Key Takeaways – Synthetic Long & Synthetic Short

- Synthetic Long Strategy

- Mimics buying stock by combining a long call and a short put at the same strike and expiry.

- Offers stock-like gains with potentially lower capital outlay.

- Synthetic Short Strategy

- Simulates short-selling a stock through a long put and a short call.

- Provides downside exposure without borrowing shares.

- Flexibility and Risk

- Both strategies offer leverage and flexibility in bullish or bearish markets.

- These are nonetheless options strategies, so there are nuances to understand.

Definition of Synthetic Options Strategies

A synthetic options strategy is a combination of options contracts (and sometimes the underlying asset) designed to replicate the payoff pattern of another security or position.

The most common synthetic strategies are:

- Synthetic Long – Simulates the behavior of purchasing a stock outright.

- Synthetic Short – Simulates the behavior of shorting a stock.

Why Synthetic Options Strategies Are Used

There are several reasons why synthetic options strategies are important tools for options traders:

Capital Efficiency

Synthetic positions can often be established with less upfront capital than traditional stock positions.

This can be beneficial for traders with limited funds.

Doesn’t Tie Up Cash

In an account, if you buy a stock you’ll use up your cash balance, which can trigger margin costs if you start borrowing.

Options will use up cash as well, but it’s limited to the premium – plus with a synthetic long you’ll get a cash credit by shorting the put.

Avoids Borrowing Fees (Synthetic Short)

With a synthetic short, you’ll avoid the borrowing fees and interest costs associated with shorting the underlying stock.

Risk Management

Synthetic strategies can be used to hedge existing positions or tailor the risk profile of a portfolio.

For example, a synthetic long might be used to protect against downside risk in a stock you already own.

Strategic Flexibility

Options provide potential for unique and nuanced strategies.

Synthetic positions expand this, allowing traders to express their market views in a variety of ways.

How Synthetic Positions are Created

Synthetic positions are built using the principle of put-call parity.

This fundamental concept in options pricing states that there is a mathematical relationship between the price of puts and calls on the same underlying asset with the same strike price and expiration.

Here’s how the two most common synthetic positions are constructed:

Synthetic Long

- Purchase a call option on the underlying stock

- Sell a put option on the underlying stock with the same strike price and expiration date.

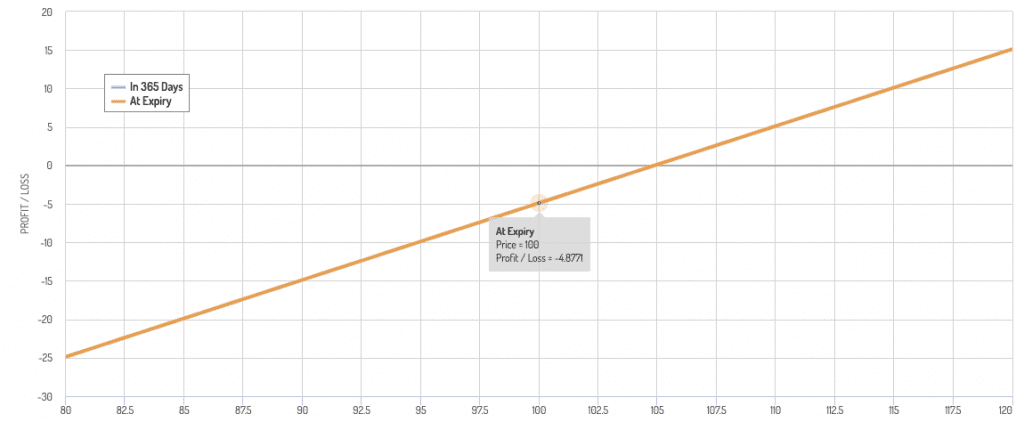

Here’s the payoff diagram:

You’ll notice that at the strike price (100), even if the price doesn’t move you’re already in the hole (paying a net debit).

Why?

This is because calls and puts will have a wider discrepancy the higher interest rates are.

Because of higher interest rates, there will be higher demand for calls given the more expensive borrowing costs of the stock in the cash market.

Accordingly, this leads to higher call prices relative to puts.

In terms of the Greeks, this is known as rho.

Synthetic Short

- Sell a call option on the underlying stock

- Purchase a put option on the underlying stock with the same strike price and expiration date.

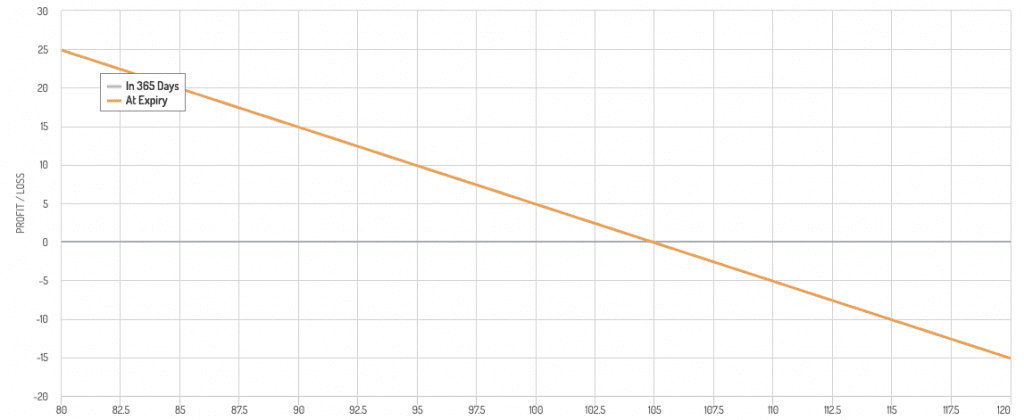

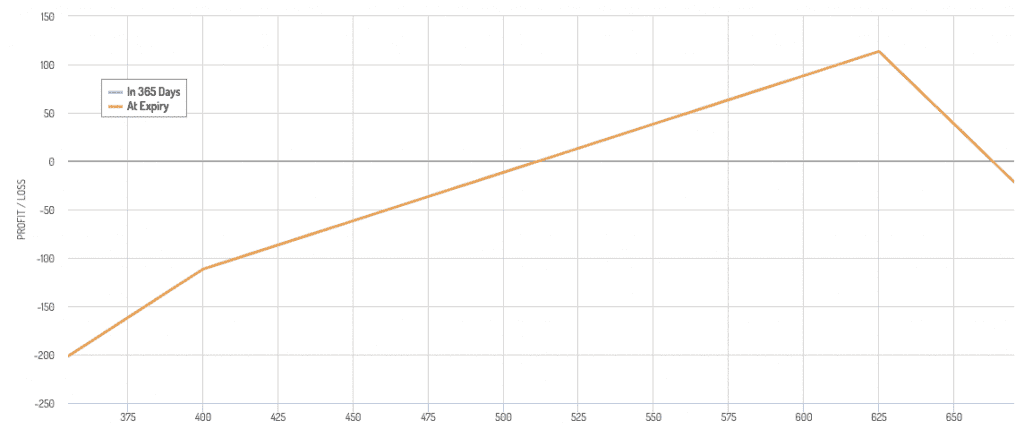

Payoff diagram:

Like in our above example, because calls are pricier than puts the higher interest rates go, if interest rates are 5%, for example, then you might expect to start at a 5% profit due to the net credit from the synthetic short.

This emulates traders shorting the underlying market, then using the cash credit to invest in prevailing interest rates (e.g., short-term bonds).

This put-call price adjustment from interest rates prevents arbitrage opportunities.

Comparison with Traditional Stock Positions

Synthetic strategies can mirror the risk/reward profiles of traditional stock positions, but there are a few key differences:

Time Decay

Options contracts have an expiration date, so their value decays over time (known as “theta”).

Synthetic positions are therefore time-sensitive.

You Might Be Assigned if the Trade Goes Against You

If you have a synthetic long trade on, if the underlying falls such that the short put is in-the-money, you might be assigned the shares (long).

Margin

Shorting stock or selling naked call options typically involves margin requirements.

Synthetic positions may have different margin implications.

Other Factors

Complexity

Synthetic options strategies can be more complex than simply buying or selling stocks.

It’s important to fully understand how they work before implementing them.

Costs

Transaction costs, such as commissions and bid-ask spreads, can eat into the profitability of synthetic strategies.

Liquidity

It may be harder to establish or exit synthetic positions in less liquid options markets.

Brokerage

Be sure your brokerage offers the necessary tools and permissions for options trading.

Synthetic Long Position

Definition & Construction

A synthetic long position replicates the profit and loss profile of owning a stock outright.

It’s constructed by:

- Buying an at-the-money (or slightly in-the-money) call option.

- Selling an at-the-money (or slightly in-the-money) put option with the same strike price and expiration date as the call.

Purpose & Advantages

- Capital Efficiency – Synthetic long positions often require less upfront capital than buying the stock directly.

- Leverage – Options provide inherent leverage. A synthetic long offers a leveraged way to gain exposure to an underlying stock’s potential upside.

Example Scenario

- Stock A is trading at $100. You believe the stock will appreciate in the near future.

- You buy one A call option with a $100 strike and September expiration for $5.

- Simultaneously, you sell one A put option with a $100 strike and September expiration for $4.

- Net cost of the position: $1 ($5 – $4).

- (The net cost should roughly mirror the risk-free interest rate.)

Possible Outcomes:

- If A rises above $101, it’ll begin mimicking the profit of owning the stock.

- If the stock stays flat around $100, you could expect a loss of the net premium of $1.

- If the stock falls, it’ll be a lot like owning the underlying, but you also face assignment risk.

Risks and Considerations

- Time Decay (Theta) – Options lose value over time. Your synthetic long needs the underlying stock to move in your favor before expiration.

- Implied Volatility – Changes in implied volatility can impact the prices of both options, affecting the overall position value.

- Pin Risk – If the underlying stock is trading at or very near the strike at expiration, you may be assigned on the short put, obligating you to buy shares.

- Assignment – If the short put is ITM, you might be assigned the shares (long) at any point.

Synthetic Short Position

Definition and Construction

A synthetic short position simulates the profit and loss profile of short-selling a stock.

It’s constructed by:

- Buying an at-the-money (or slightly in-the-money) put option.

- Selling an at-the-money (or slightly in-the-money) call option with the same strike and expiration date as the put.

Purpose and Advantages

- Bearish Speculation – Synthetic shorts are used to profit from a decline in the price of the underlying stock.

- Hedging – A synthetic short can be used to hedge downside risk in a long stock position.

Example Scenario

- Stock A is trading at $100. You have a bearish outlook on the stock.

- You buy one A put option with a $100 strike and September expiration for $4.

- You sell one A call option with a $100 strike and September expiration for $5.

- Net credit for the position: $1 ($5 – $4).

- Possible Outcomes:

- If A falls below $99, your put gains value while the sold call is likely worthless (you get the premium), mimicking the profit of shorting a stock.

- If the stock stays flat, both options may expire worthless (or close to it), allowing you to keep the net credit as a profit.

- If the stock rises sharply, the call option becomes expensive, leading to potential losses exceeding the initial credit.

Risks and Considerations

- Unlimited Upside Risk – This is the principal risk, as a stock can theoretically rise infinitely, causing large losses on the short call.

- Time Decay – Similar to the synthetic long, options lose value over time.

- Margin – Selling a call option can require significant margin due to the unlimited upside.

- Assignment – As we covered above, you might be assigned shares if the short part of the trade (the call in this case) is ITM.

Comparing Synthetic Long and Synthetic Short Strategies

| Characteristic | Synthetic Long | Synthetic Short |

| Market View | Bullish (expect the underlying stock to rise) | Bearish (expect the underlying stock to fall) |

| Profit Potential | Unlimited, mirroring the stock’s upside potential | Limited (to the strike price minus net premiums received), mirroring the stock’s downside potential |

| Maximum Loss | Downside risk | Unlimited (due to the short call) |

| Primary Uses | Capital-efficient bullish speculation, hedging a long stock position | Bearish speculation, hedging a short stock position |

When to Use Each Strategy

Choosing a synthetic long and synthetic short primarily depends on your market outlook:

Bullish Outlook

If you believe the underlying stock has the potential to move higher, a synthetic long allows you to benefit from the upside with reduced upfront capital (usually) compared to buying the stock outright.

Bearish Outlook

If you believe the stock price will decline, a synthetic short position allows you to profit from the potential downward move.

Market Volatility and Synthetic Strategies

Market volatility has a role in how synthetic positions behave:

High Volatility

- Increases the value of both calls and puts. Could potentially make both synthetic positions more expensive to establish.

- Underlying stock is more likely to make a significant move (up or down) before options expire.

- Could increase margin requirements.

Low Volatility

- Options become cheaper, reducing upfront costs for synthetic positions.

- Time decay (theta) becomes a bigger threat in low volatility markets since there’s less potential for a large move in the underlying stock.

Practical Tips for Implementing Synthetic Strategies

Choosing Strike Prices and Expiration Dates

- Strike Price – Generally at-the-money or slightly in-the-money strikes are used to closely mimic stock movement.

- Expiration Date – Choose an expiration based on your timeframe and outlook on potential price movement in the stock.

Monitoring and Adjusting

Synthetic positions are dynamic due to factors like time decay and volatility. So they require more regular monitoring.

Adjustments may be necessary:

- Rolling your options to a further expiration.

- Adjusting strike prices if your outlook changes.

Software and Platforms

Use options trading platforms with advanced tools like:

- Options chains for analyzing strike prices and premiums.

- “What-If” calculators to visualize potential outcomes of synthetic positions.

- Risk analysis tools to help manage the potential risks.

Understanding Synthetic Long Positions and Managing Leverage Costs

As covered, this synthetic long setup mimics owning the underlying stock/asset because it benefits from upward movements in the price while minimizing initial capital outlay compared to purchasing the stock/asset outright.

Interest Rates and Rho

The cost of holding a synthetic long position is affected by interest rates through the rho of an option.

Rho measures the sensitivity of an option’s price to a 1% change in interest rates.

- For call options, rho is generally positive, meaning calls increase in value as interest rates rise.

- For put options, rho is typically negative, meaning puts decrease in value as interest rates increase.

As interest rates rise, the cost of maintaining a synthetic long position can increase due to the positive rho of call options.

The rising cost makes the strategy less attractive unless mitigated.

Strategy: Short Calls and Puts to Offset Costs

Short Calls

Selling call options generates premium income, which can help offset the higher costs incurred from the purchased call options in a synthetic long setup.

This approach increases potential profit if the stock price remains below the strike price of the short calls but also adds the risk of losses if the stock price exceeds this level significantly.

Short Puts

Similarly, selling put options also generates income, helping to defray the costs of the synthetic long position.

However, this adds the risk of having to purchase the stock at the strike price if the stock price falls below it.

This increases exposure to downward price movements.

Example

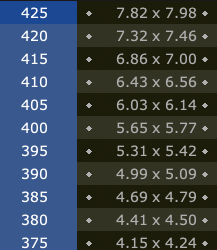

Let’s say you want to buy a stock ETF at 510.

You noticed that for every 100 shares’ of exposure, you’re paying $2,400 net (cost of call minus premium from shorting the put).

![]()

$2,400 divided by $51,000 ($510 multiplied by 100 shares per contract) is about 4.7% of the total underlying’s value.

Here are the cost of your puts:

Let’s say you wanted to select the 400 put.

In other words, you’d be willing to buy the underlying if it fell slightly more than 20%. (Make sure you’d actually be okay with doing this and have the capacity to do so.)

That gets you around $570.

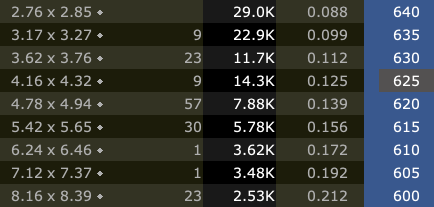

Let’s say you wanted to cover the other ~$1,800 on the short calls side.

Here are your calls:

You want to give the trade enough breathing room without being overly short gamma.

Let’s say you felt comfortable shorting four of the 625 calls, netting you $4.20*4 = $1,680 in premium.

So, this gets you $2,250 back in premium, or close to your $2,400 net premium paid for the synthetic long structure.

Balancing Risk and Reward

By shorting calls and puts, you can create a more complex position that potentially reduces the costs associated with higher interest rates.

Nonetheless, this approach also alters the risk profile, introducing elements of a short straddle or strangle, which can lead to significant losses if the underlying moves significantly in either direction.

Overall, this can reduce the costs associated with higher rho values, but it introduces additional risks that have to be managed to maintain a balanced and profitable trading strategy.

Conclusion

Synthetic long and short positions offer options traders a way to customize their exposure to various market scenarios.

They can provide capital efficiency, a means to hedge existing positions, and facilitate bullish or bearish speculation.

Understanding the construction, risks, and advantages of these strategies is important.

Options are complex, so it’s important to proceed with caution, start small, and always do your own research before risking real money.