SuperForex Review 2025

Awards

- Best Cryptocurrency broker LATAM 2022 – Global Business Magazine

- The Best Withdrawal Options Africa 2022 – World Financial Award

- Best ECN Broker in Africa 2021 – Global Business Magazine

- Best ECN Broker in Africa 2021 – International Business Magazine

- Best New ECN Broker in Africa 2020 - Global Brands Magazine

Pros

- SuperForex is accessible for beginners, with minimum deposits from $1, a choice of fixed or variable spreads, and access to copy trading

- Various accessible payment methods are supported, including crypto, with zero fees and fast processing times

- The broker offers an impressive range of 12+ account base currencies covering multiple global regions

Cons

- The 0.5-pip minimum spreads in the standard ECN accounts are not as tight as some of the cheapest ECN brokers, such as Pepperstone

- The Belize IFSC is not considered a top-tier regulatory provider, so clients may receive fewer financial safeguards

SuperForex Review

SuperForex is an online securities and derivatives broker offering 400+ instruments on the MetaTrader 4 platform with ECN and STP execution. This 2025 SuperForex review will cover client login and account verification, how to sign up and open a real account, plus maximum leverage ratings, members area security features, and more. Find out whether our experts recommend trading with SuperForex.

Company Details

SuperForex was founded in 2013 with a mission to make forex accessible to all. Today, the broker operates from Europe but caters to clients in 150+ countries. Its office locations can also be found across the world, including in Zambia, Malaysia, Indonesia, Zimbabwe and South Africa.

The brokerage is regulated by the International Financial Services Commission (IFSC) with suitable ID verification and sign-in security measures.

Note, this review has no affiliation to Super Forex (Super Corp) Financial Pty. Ltd., based in Sydney.

Trading Platform

SuperForex clients have access to the hugely popular MetaTrader 4 (MT4) platform which can be downloaded onto desktop devices. The terminal is compatible with Windows and macOS devices.

As well as an intuitive interface and options for customization, MT4 offers:

- Historical data

- 39 graphic objects

- Live news streams

- Customizable charts

- 4 pending order types

- View full trading history

- One-click order execution

- SuperForex flash MT4 scalper

- 50+ built-in technical indicators

- User-friendly, multilingual interface

When we used SuperForex’s MT4 platform, our experts were pleased with the suite of analysis tools and reliable user interface.

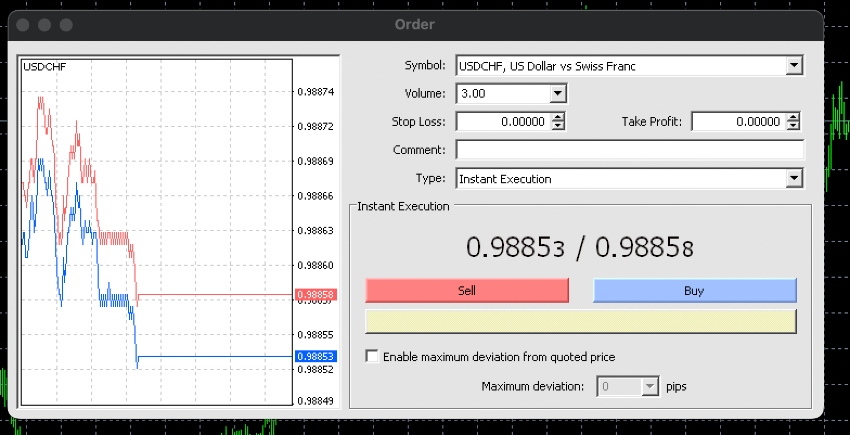

How To Place A Trade

- To place a trade, select New Order. This is available in the toolbar at the top

- From the drop-down menu, choose the asset you wish to speculate on

- Decide whether to use Market Execution or Pending Order

- Enter the trade parameters, including the position size, any stops and limits, plus any comments or notes

- Click on Buy or Sell to enter the trade. A dialogue box should pop up to confirm the trade has been entered

Fo more guidance on how to make the most of the MT4 platform, helpful resources including a video tutorial are available on the Services tab on the SuperForex website.

Note, SuperForex does not currently offer the MetaTrader 5 (MT5) platform.

Assets & Markets

SuperForex offers clients investment and trading opportunities in the following markets:

- Currencies – 100+ forex pairs

- Commodities – speculate on precious metals like gold and oil

- Indices – trade global indices including the FTSE, Dow Jones, Nasdaq and S&P

- Cryptos – popular cryptocurrency/USD pairs including Bitcoin, Ethereum and Litecoin

- Stocks – trade shares in some of the world’s top companies including Amazon, Apple, Tesla and IBM

SuperForex Spreads & Fees

Spreads offered by the broker vary depending on account type. They are fairly competitive vs similar brokers. ECN accounts benefit from floating spreads with direct market execution. Typical spreads on the STP standard account were USD/CAD 2.5 pips and GBP/JPY 3 pips. XAU/GBP was offered at 8 pips.

Commission applies on the Profi STP account, including a $21.50 fee on some instruments. SuperForex does also charges swap rates for positions held overnight.

Leverage

SuperForex leverage also vary by account type, with rates going up to 1:2000. This is high so we would recommend implementing careful risk management strategies. Crypto trading is only offered at a maximum leverage rate of 1:10.

Retail clients can change their leverage limits by contacting customer support via email or live chat. There are no legislative leverage restrictions as the broker is not compliant with ESMA trading regulations.

Mobile Apps

The SuperForex mobile app creates a complete trading experience straight from your mobile or tablet device. The MT4-integrated application is available for free download to iOS and Android (APK) devices. Access the full features of the desktop trading platform, including analytical tools and customizable charts and graphs while on the go.

Functionality and tools include:

- Copy-trading

- Trading signals

- Open or close trades

- Access analytical articles

- Track quotes in real-time

- Live streaming economic news

- Deposit and withdraw to your trading account

Payment Methods

Deposits

Minimum deposit requirements vary, though the lowest limit is $1/£1/€1, which is ideal for a new trader. Accounts can be opened in a range of base currencies.

SuperForex does not charge a fee for any deposit methods, although third-party bank charges or exchange fees may apply.

Payment methods include:

- Bank Wire Transfers – 2-4 day processing time

- Credit/Debit Cards – Instant processing. Includes Visa and Mastercard

- SuperForex Money – Instant processing. 7% discount as deposit cashback

- Local Payments – Instant processing. Transfer currencies include MYR, IDR, ZWD and NAD

- Cryptocurrencies – Instant processing. Accepted coins include Bitcoin, Dogecoin and Litecoin

- Electronic Payments – Instant processing. E-wallets including Skrill, Neteller, SticPay and Perfect Money

Note that some methods may only be available in certain jurisdictions.

Withdrawals

SuperForex withdrawal charges do apply, varying by transaction method. Minimum withdrawal limits are also applicable on some methods.

- Cryptocurrencies – 1-3 hours processing time. 5% commission

- SuperForex Money – 1-3 business days processing. No commission

- Credit/Debit Cards – 1-3 hours processing time. 3% commission +$7

- Local Payments – 1-3 hours processing time. Local bank wire fees apply

- Electronic Payments – 1-3 hours processing time. Various commissions and fees are applicable

- Bank Wire Transfers – All account currencies, 2-4 business days withdrawal processing time, 3% commission +$35

Note that verified accounts will require a withdrawal pin code to be entered before funds can be removed from a live account.

Demo Account

A free demo account is available via the broker’s website in USD or EUR currencies. These accounts are a good way to practice trading, navigate platform features and test strategies risk-free.

SuperForex demo traders can access up to £50,000 in virtual funds and experience real-time trading conditions and prices. And a simple online registration form is required to open a demo account, similar to XM and Tickmill.

SuperForex also offers unique demo account contest cycles throughout the year. These can be targeted at specific instruments, like the Bitcoin Mania and Gold Rush contests. Retail traders with the highest account balance at the end of the cycle can win rewards of up to $100 deposit into a real account.

Deals & Promotions

SuperForex offers various bonus and incentive programs. At the time of writing, this includes a 50% welcome bonus on initial deposits, a no-deposit bonus, a hot bonus, and an energy bonus.

Note that some incentives are not compatible with others. The broker provides a comparison chart to help determine the best option for your needs. Always review bonus claim terms and conditions as there may be hidden stipulations for withdrawing cash.

A membership club provides additional benefits based on account earnings. A $100 minimum deposit is required to join but there are no minimum trading volumes so all SuperForex customers can sign up. Members can access lowered spreads, unique analytics, 24/7 customer support and extended deposit protection.

Regulation & Licensing

SuperForex is authorized and regulated by the International Financial Services Commission (IFSC). Traders should be aware that the IFSC is not regarded as a top-tier regulator and therefore might not offer the same levels of protection as other established financial bodies. Nevertheless, some regulation is better than none.

The broker also ensures compliance with anti-money laundering policies, provides fund safety via a deposit protection scheme, and segregates client funds.

Services are not available to residents of the United States of America or Ukraine.

SuperForex Additional Features

There are some useful education services available at SuperForex, such as YouTube video content based on trading for beginners, a forex glossary of terms and PDF investment articles. Topics include understanding financial indicators, using a profit and loss calculator, copytrade tips, spreads, benefits of using a trading bot and more. Live seminar events and training center details can also be found. Resources are accessible to all customers.

SuperForex also runs a number of physical education centers located in countries such as Kenya, Tanzania, Rwanda, Nigeria and Uganda.

Pattern Graphix

The broker provides Pattern Graphix software free of charge to all customers. This is an expert advisor (EA) automated trading tool, working in conjunction with the MetaTrader 4 platform. The system identifies patterns in price movement graphs and can make suggestions on the best trades to execute.

Simply download it and the service will sync with your MT4 account.

Forex Copy

SuperForex supports social trading through its Forex copy service. Copy trading provides clients with a large community of trading professionals from whom they can learn from. An initial deposit of $10 is required to use the service.

Account Types

SuperForex offers several real account types with either ECN or STP execution. Each account has different trading conditions, suitable for different strategies and lifestyles.

Minimum deposit requirements are low, which is ideal for new traders. Base currencies vary but include USD, EUR, GBP and ZAR account options, reducing the need for sometimes costly exchanges.

ECN Execution

- Standard – $1/€1/£1 minimum deposit, $100,000 lot size, floating spreads

- Swap-Free – $1/€1/£1 minimum deposit, $100,000 lot size, floating spreads

- Standard Mini – $1/€1/£1 minimum deposit, $10,000 lot size, floating spreads

- Swap-Free Mini – $1/€1/£1 minimum deposit, $10,000 lot size, floating spreads

- Crypto – $100 minimum deposit, 10 BTC lot size, floating spreads, USD account currency only

STP Execution

- Standard – $1/€1 minimum deposit, $10,000 lot size, fixed spreads, forex copy included

- Swap-Free – $1/€1 minimum deposit, $10,000 lot size, fixed spreads, forex copy included

- Crypto – $100 minimum deposit, 10 BTC lot size, fixed spreads, USD account currency only

- Profi STP – $500 minimum deposit, $100,000 lot size, 0.01 spreads, USD/EUR/GBP/ZAR account currencies only

- No Spread – $100/€100 minimum deposit, $100,000 lot size, 0 spreads, USD/EUR/GBP account currencies only

- Micro Cent – $1/€1 minimum deposit, $3000/€3000 maximum deposit, 10,000 cents lot size, fixed spreads, USD/EUR account currencies only

It is a quick process to open a live account. Traders must complete an online registration form, which may require identification verification documents such as proof of residency under know your customer (KYC) compliance.

It is good to see SuperForex also offers an Islamic trading account, providing Muslim traders with a swap-free account.

Trading Hours

The brokerage follows standard office hours, available 07:00 to 17:00 GMT, and 24-hour trading hours Monday-Friday, though these timings may vary by instrument.

Check the broker’s official website and trading platform updates in terms of public holidays.

Customer Support

SuperForex offers several customer contact options:

- Telephone – +442045771579

- Email – support@superforex.com

- Live Chat – logo located bottom right of each webpage

- Social Media – including WhatsApp, Twitter and Facebook

It was good to see that the broker has a comprehensive FAQ section. Topics covered include how to download MetaTrader 4, details on how to delete a SuperForex account, adding the easy $50 deposit bonus or affiliate code, card verification support and MPESA deposits.

Safety & Security

Our experts were pleased to see a good level of fund security measures available to all customers. This includes IP address access options, account verification combinations, segregated funds and log-in history access. All personal data between client terminals and the platform service is also encrypted via an SSL certificate.

While using SuperForex, it was clear that the MT4 trading terminal offers secure login features, industry-standard data privacy and integrates dual-factor authentication.

SuperForex Verdict

SuperForex offers a decent trading environment with zero, fixed and floating spread options across an impressive range of trading instruments. Although the broker’s regulation isn’t the most well-regarded, its negative balance protection, deposit protection and fund segregation schemes are reassuring. With its range of order execution methods, low minimum deposit, promotions and educational content, when we used SuperForex we found it to be a competitive broker, especially for beginner traders.

FAQs

Is SuperForex A Regulated Broker?

Yes, SuperForex is a legitimate brokerage firm that is regulated by the International Financial Services Commission (IFSC). This, alongside its customer reviews and security features, indicates that the trading provider is likely not a scam.

What Account Types Does SuperForex Offer?

SuperForex offers several account types with ECN or STP execution. These are split into fixed, floating or no spread account options, ideal for meeting different strategy needs. Minimum deposit requirements start as low as £1/$1/€1.

Does SuperForex Have Nasdaq Trading Opportunities?

Yes, Nasdaq is available on SuperForex. The broker offers several popular global indices with competitive trading conditions like leverage up to 1:1000, macroeconomic indicators and technical analysis.

Is SuperForex Legit Or A Scam?

We are confident SuperForex is a legit broker with regulation, deposit protection schemes and negative balance protection. With that said, be wary that the IFSC does not provide top-tier regulation vs other legislative bodies.

Is SuperForex A Good Broker?

SuperForex provides security protocols, a level of regulatory protection, partnership with software providers, the MT4 platform and competitive trading conditions. It also offers a decent range of welcome and loyalty bonuses. It is a good choice for beginners.

Top 3 Alternatives to SuperForex

Compare SuperForex with the top 3 similar brokers that accept traders from your location.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- AZAforex – Established in 2016, AZAforex is an offshore broker offering short-term trading on 235+ global financial markets, including through binary options with payouts of up to 90%. Three accounts (Start, Pro and VIP) offer unique features, but all provide access to the broker’s Mobius Trader 7 platform, which has benefited from performance upgrades over the years.

SuperForex Comparison Table

| SuperForex | Dukascopy | Interactive Brokers | AZAforex | |

|---|---|---|---|---|

| Rating | 2.6 | 3.6 | 4.3 | 3.4 |

| Markets | CFDs, Forex, Stocks, Cryptos, Commodities | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $1 | $100 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.0001 Lots |

| Regulators | IFSC | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | GLOFSA |

| Bonus | $88 No Deposit Bonus | 10% Equity Bonus | – | 25% Crypto Deposit Bonus, 120% Loyalty Bonus, 30% Spread Rebate |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | Mobius Trader 7 |

| Leverage | 1:2000 | 1:200 | 1:50 | 1:1000 |

| Payment Methods | 12 | 11 | 6 | 14 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Dukascopy Review |

Interactive Brokers Review |

AZAforex Review |

Compare Trading Instruments

Compare the markets and instruments offered by SuperForex and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| SuperForex | Dukascopy | Interactive Brokers | AZAforex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | Yes | No | No |

SuperForex vs Other Brokers

Compare SuperForex with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of SuperForex yet, will you be the first to help fellow traders decide if they should trade with SuperForex or not?