Meme Stock Options: What to Know

The rise of meme stocks such as Gamestop (GME) and AMC Entertainment Holdings (AMC) created not just a frenzy of activity in the shares themselves but also their options markets. The boom in meme stocks options trading has resulted in a burst in activity across the entire options landscape, particularly among retail traders.

Options basics

Options are used to bet on price moves in the underlying security or to protect a portfolio.

Put options can be used to hedge against downside losses associated with owning stocks.

Selling calls, covered by the underlying shares, is also a viable tactic for traders who may be willing to offload their shares at a given price point (i.e., the strike of the options). The covered call can provide additional income and offset at least some losses if the stock were to decline.

Options were once a more obscure part of the securities market. Linear bets on stocks are straightforward and easy for new traders to understand.

Options are a different story. They have many factors governing their prices – delta (price), vega (volatility), theta (time), and second- and third-order factors (Greeks) to consider like gamma.

But with new technological tools that provide easier access to financial markets combined with social tools (e.g., Reddit, online forums) and plenty of media attention behind meteoric price rises, many new traders are trying their hands with these more complex instruments.

Meme stock options – big risks for the potential of big payouts

Meme stock options markets become a feature of any new mania. Many traders are drawn to the idea of buying options for the potential of seeing big payouts.

Call options, which provide traders the right to purchase a stock at a set price in the future, have seen particularly heavy trading.

Despite their rich prices, they provide a limited-risk way to pursue large gains trading the market.

One options contract covers 100 shares. As a result, small traders who are strapped for funds and could otherwise afford only a small number of shares are attracted to options for the prospect of a big payday.

For example, in one week in June 2021, traders spent nearly $12 billion on options contracts tied to AMC. This was more than SPY (the most popular S&P 500 ETF), QQQ (the most popular QQQ ETF), and Tesla (TSLA) combined based on CBOE Global Markets data. Options on those stocks are consistently the most popular.

Call options on meme stocks tend to get very expensive

As stock prices rise quickly, the implied volatility that’s implicit within options pricing expands. They get more expensive and that makes those bets harder to win.

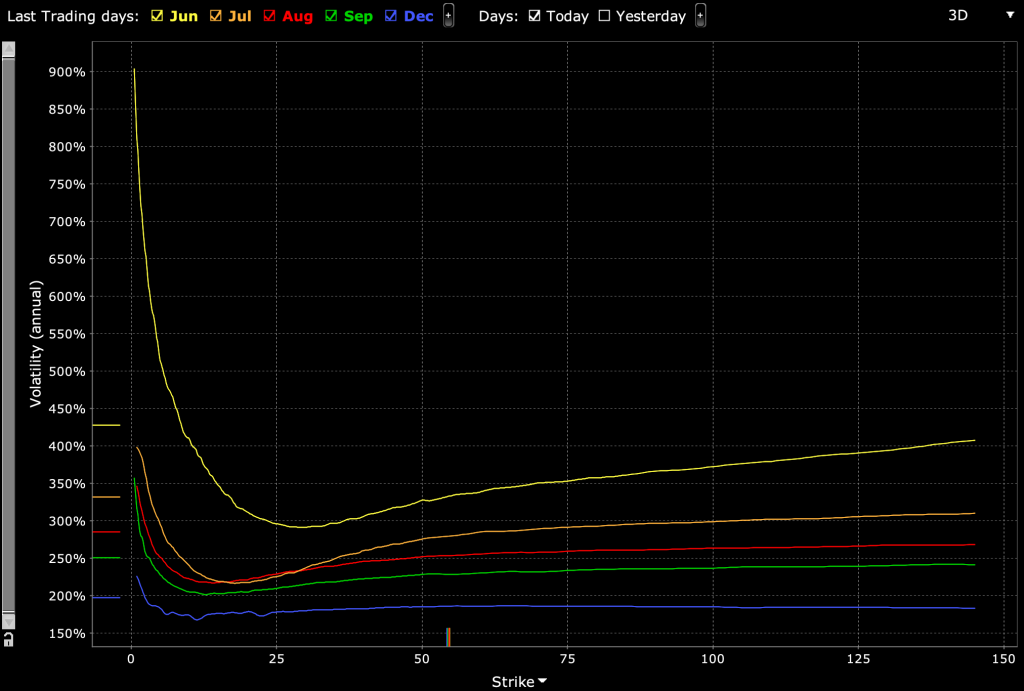

Implied volatility is backed out from options pricing. The pricier the option, the higher the implied volatility. Usually meme stocks tend to have higher implied volatility in the near-term expiries and lower implied volatility in the longer-term expiries.

This can be plotted out along date and strike price.

Implied volatility curves for AMC during its 2021 meme stock run

(Source: Interactive Brokers)

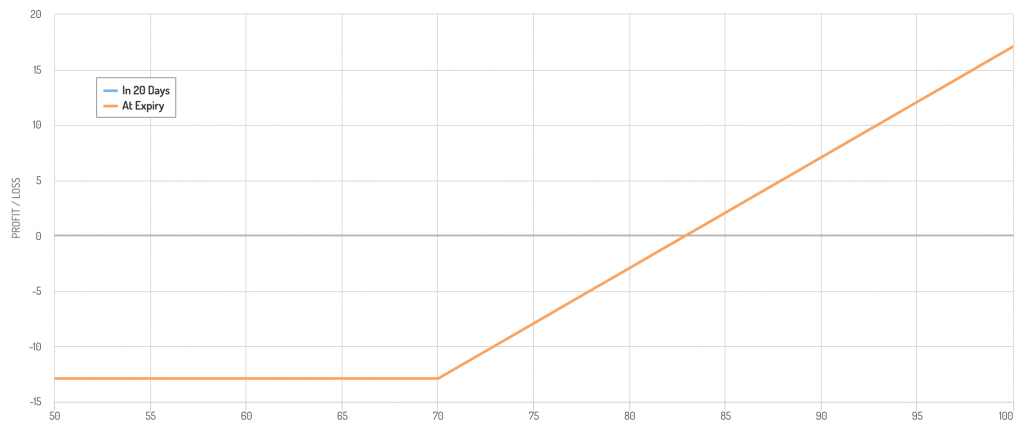

For example, if a stock is priced at $50 and a call option with a 70-strike is priced at 15.00 ($15 per share, or $1,500 per contract, given 100 shares per contract), that means the breakeven price for the trade at expiration is $85.

That means the stock has to rally 70 percent just to breakeven on the trade.

Options sellers have an inherent small advantage over options buyers because of the volatility risk premium (VRP).

Because of the convexity associated with options – fixed price, but unlimited to near-unlimited upside for the buyer – options sellers charge a premium to underwrite the contract.

The options trader can also make money in other ways.

For instance, if the stock price rises and/or the market’s volatility increases more due to the relentless momentum often seen in meme stocks, the trader can make mark-to-market gains and exit at a profit before expiration.

Payout possibilities examples

If a stock is trading at $50 and you buy a 70 call with 20 days to expiration with an implied volatility of 400 percent, the premium on that will be around $13 per share, or $1,300 for each contract.

Your breakeven is $83, if holding to expiration.

If the stock doubles to $100 by expiration, you made a bit more than double your premium. You’re in-the-money (ITM) at $70 and make $30 per share at $100 ($100 minus the 70 strike). With 100 shares per contract, you made $3,000 ($30 per share multiplied by 100 shares). Subtracting out the premium of $1,300 paid, you made $1,700.

But most buying these options are pricing them that way because they think the upside could be even higher.

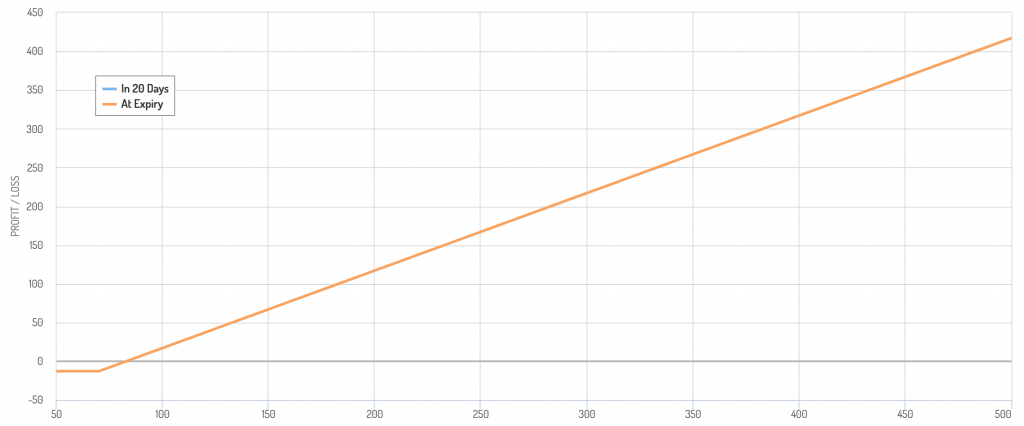

If a stock goes from $2 to $50, that’s 25x. If it goes up another 10x, that’s $500. If there’s that type of move, that $13 per share in premium is trivial compared to what was made – e.g., $500 minus the 70 strike ($430 per share).

That’s a gain of 33x ($430 divided by $13), as borne out by the chart below.

With that said, there’s a big difference between going from a $3 billion company to a $30 billion company relative to going from a $30 billion company to a $300 billion company.

There are lots of public companies valued at around $30 billion. But $300 billion is getting into rarer territory.

And the move from billions in market cap to tens of billions didn’t have business logic behind it in the first place. It was largely the work of speculators looking to drive up the price in a coordinated way.

Stretching the valuation 10x higher would be even more difficult, requiring hundreds of billions of dollars.

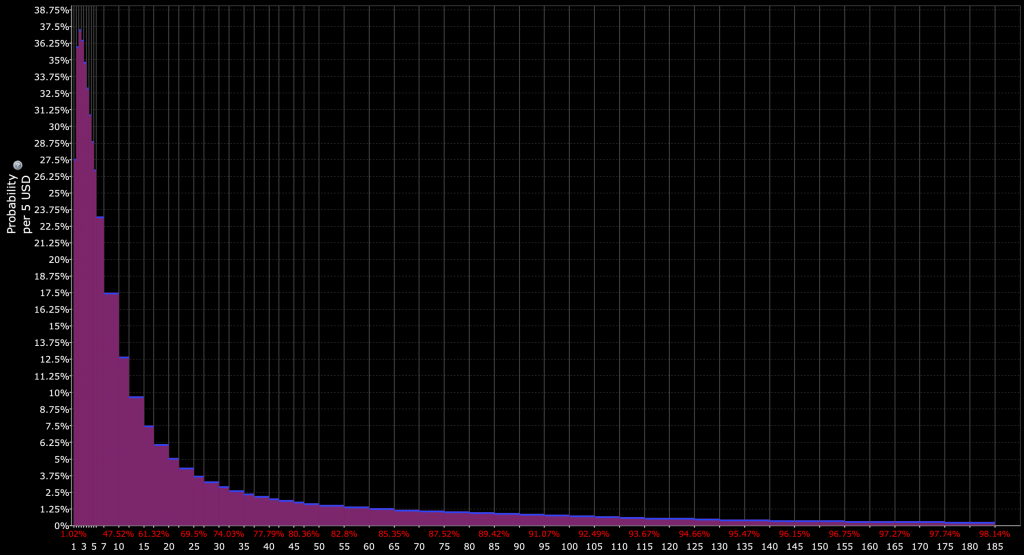

In trading everything is a distribution

Trading is all about probabilities, distributions, and expected values.

Practically anything is technically possible, it’s the probabilities that ultimately matter.

There is no one outcome that’s highly probable. Everything should be expressed as a potential distribution of outcomes, with each potential outcome assigned a probability. Comparing that with what’s baked into the market can help you decide on whether to trade it.

Meme stocks are commonly companies that were already heavily shorted. So if their shares blew up in price they should theoretically be even better shorts.

But as the saying goes, the market can stay irrational longer than you can stay solvent. So expressing a trade in anything should be done in a risk-limited way that gives the big upside without the unacceptable downside.

Looking out more than two years, the market fully expects AMC to re-rate downwards looking at the distribution backed out by options pricing.

AMC stock pricing distribution

(Source: Interactive Brokers)

AMC embracing its meme stock status

A large rise in a company’s stock price provides the great advantage of being able to issue additional shares at the inflated price.

After AMC saw its stock surge by 2,700 percent in only five months, it sold an additional 20 million shares in three different batches for an average price of around $41.

Considering the average sell-side target was around $5 per share, this was a huge win for the company.

AMC’s CEO Adam Aron has been rationally opportunistic in taking advantage of AMC’s inflated shares to fill up the company’s coffers.

Because of the surge, AMC no longer has to focus on cash conservation and basic survival. Contrarily, it can make productive investments to turn around the company.

GameStop, on the other hand, was more hesitant to issue shares, fearing the potential response from regulators, though it eventually followed AMC in doing so.

Management teams who benefit from the meme stock phenomena know their share price is much more than they deserve.

It’s not like traders are shrewdly betting on something that recently changed for the better or even that something could resurrect the company’s prospects.

And they aren’t pretending there’s any business case for what they’re doing.

Ostensibly, sending these stocks “to the moon” is to “stick it to the shorts” who are betting against the company and believe the short covering can force a squeeze higher when the shares are bought back.

Moreover, hedging by shorts and speculative bets by longs in call options force market makers to hedge the selling of those call contracts by buying the underlying shares. This is commonly called delta and gamma hedging.

In general, the social aspect is most influential in getting more flows into the market. Many buy the stock with large amounts of borrowed money.

Brokers often respond by hiking margin requirements on the purchases of shares and require traders to post more collateral when transacting in the options markets of meme stocks as well.

The case of Tesla

These stocks are heavily prone to distortions based on the public narrative. Management teams are typically the ones who get to control the flow of information. But they need to be careful.

If a company executive works to justify a stock price or attempt to increase a share price with information that is knowingly false, the Securities and Exchange Commission could decide to press forward with an investigation and potential charges.

Shareholder lawsuits and regulators will be around when a stock falls precipitously.

Tesla is a well-known example of a company with a highly promotional executive who has often flown too close to the sun in hyping the company and its stock.

Because Tesla is in a very difficult, capital-intensive business, Elon Musk regularly makes big promises to help boost the price of the stock to give the company the resources it would need to help its odds.

But it can cross the line into securities fraud. That said, even if it does, will regulators mete out punishment that dissuades management from hyping up their company’s shares?

Some may judge that the reward of filling a company’s balance sheet with cash outweighs the risk of regulatory sanctions.

The SEC has chosen not to act against Musk and Tesla regarding the executive’s communications with the public vis-a-vis the stipulations laid out in his 2018 securities fraud settlement from the CEO’s infamous “funding secured” tweet (and additional charges after subsequently violating the agreement).

If and when Tesla tumbles and/or Musk loses the faith of the investing public, the SEC may be more inclined to act rather than be the entity blamed for anything that could cost investors in the present.

Diluting the ‘apes’?

Some traders long speculative meme stock markets styles themselves “apes” after the rebellious simians in the “Planet of the Apes” movies.

Public filings have stated the obvious: “market and trading dynamics unrelated to our underlying business” and investors should be cautious given the potential to lose “all or a substantial portion” of their money.

In truth, a company is stronger when it can sell an asset – in this case, its own shares – for more than it’s worth. New shareholders may or may not get the short end of the stick in the long-run, but existing shareholders are better off, including management.

Some holders of the stock have complained about the prospect of dilution. If the number of shares issued goes up, that dilutes existing shareholders.

But if the capital issued results in investments that make the company worth more, it will pay off for itself.

Jeff Bezos owns less than 15 percent of Amazon, but the company wouldn’t be where it is if he hadn’t diluted his stake along the way to give the company the resources it needed to become successful.

Owning 10 percent of $1,000 is better than owning 20 percent of $100.

The cash AMC got to add to its balance sheet is much more valuable than the movie theaters were back when the stock traded in the single digits.

Will meme stocks crash?

The underlying fundamentals of the business may not support the valuation. But the issuance of additional shares can help it better approach the value of where it’s trading, simply based on the influx of new cash.

Management teams are right for taking advantage of the irrational demand for its shares if that’s where people wish to dump their money.

Aron, the AMC CEO, wanted to use the spike in the stock price to nearly double the company’s share count. But the dilution matter caused the company to drop the plan and decide on a much smaller figure (approximately 25 million).

Meme stocks and market structure

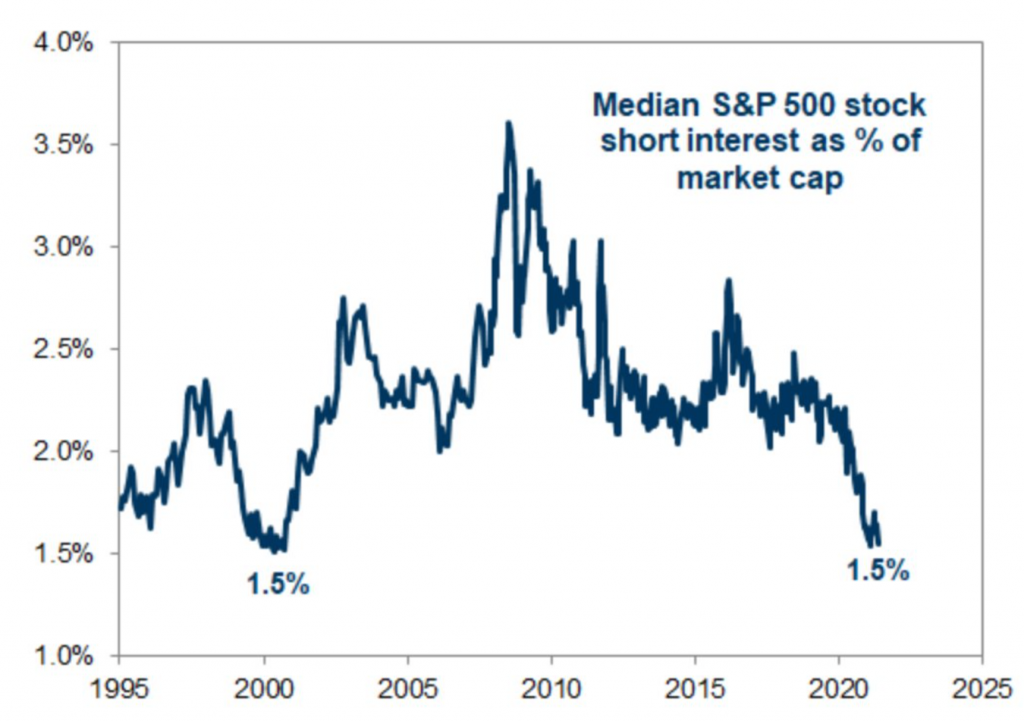

The meme stocks phenomenon is largely predicated on the idea of exploiting the large short interest in the market.

That can be part of it, but shorts are not the main risk in the market structure. Individual short positions at hedge funds are generally a very small percentage of the book – typically 1-3 percent of the overall book.

And the peak of the meme stock phenomenon came at a time when market liquidity was high and lots of new traders were coming into the market.

Naturally, at such a time, short interest in the broader market is pretty low, as it was.

(Source: GSAM)

Moreover, each share sold share creates an offsetting long share in the float. The float increases, but the number of shares outstanding remains the same.

In bad bear markets, governments sometimes ban short-selling, believing it’ll help or to prevent the optics of people benefiting from the losses of others. But it generally simply creates distortions and reduces a source of liquidity in the markets.

Taking away shorting removes “information” from a market.

AMC and GME did not have low share prices pre-memeification because they were heavily shorted. It’s because they are/were fundamentally weak businesses.

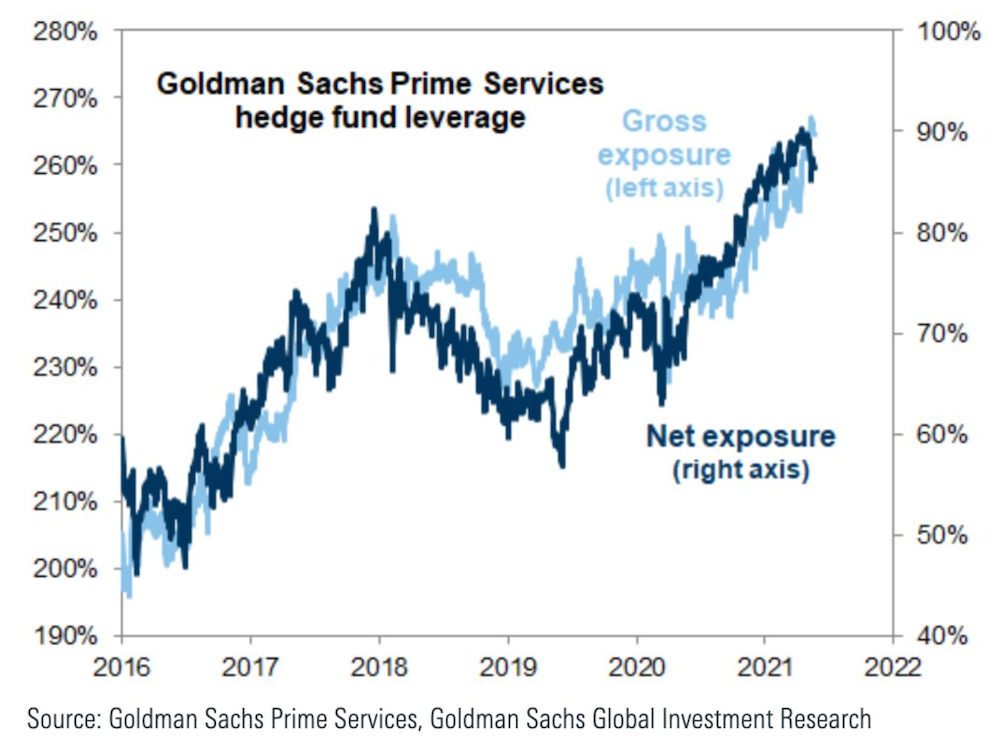

What is a genuine problem in the market structure is retail buying concentrated positions on leverage. This is also generally true for the entire market. Low forward returns generally encourage leveraging up to obtain the desired returns on equity.

When shares are bought at very high prices relative to the underlying fundamentals of the business, it sets up for a lot of disappointment. All it takes is a small move down and many retail speculators who bought on leverage in a concentrated way will be wiped out.

Winners in the meme stocks battles

Those who benefited from the pop and sold successfully at a profit are the obvious beneficiaries, whether in the shares or in options.

Volatility sellers, such as investment banks and institutional funds, will also benefit. They’re more likely to recognize that the high implied volatilities can make for very profitable trade opportunities. The IVs observed are unlikely to be sustainable for very long.

As soon as the stock drops – or the momentum rally tapers – and the volatility dies down, being short options can be very lucrative. But it has to be done in a smart way.

Wild options markets can get even more wild. Institutional investors have the ability to hedge their positions in a dynamic and sophisticated way.

If they sell OTM call options, they can buy the underlying shares in the quantity necessary to dynamically hedge as a way to prevent losses.

They also have access to pre-market and after-hours trading where they can potentially have access to the market up to 16 hours per day (4am to 8pm EST) rather than the standard 9:30am to 4pm EST market hours.