How to Live Off Dividends

The concept of using a portfolio to live off dividends is considered by many to be the point at which they’ve officially “made it”.

How can we turn this ideal of living off dividends into a safe and viable strategy?

We’ll cover all of this in this article.

Dividends and the basics of why we trade and invest

The entire purpose of why we trade and/or invest our money is to get back more in return over time and to develop income streams from our investments.

Most people’s assets go into accounts dedicated to this purpose – you put up a lump sum for a future stream of income.

Nonetheless, living off your dividends and investments once you finally retire can be challenging.

The famous “four percent rule” in personal finance – that is, you can safely withdraw 4 percent of your account balance each year – involves a combination of receiving interest, dividend, and distribution payments from your assets while liquidating other assets.

The four percent rule is designed to provide a steady stream of income to the retiree.

At the same time, it helps keep an account balance that will allow funds to last a long time.

The problem with needing to sell assets is the worry that someday you might run out.

So what if there was another way to get the four percent or more from your portfolio every year so you don’t have to dip into the principal?

One way to increase your retirement income is to invest in stocks, ETFs, and mutual funds that pay dividends.

As those investments grow and throw off more cash, they can begin to supplement any other income sources (e.g., pension, Social Security or a government-sponsored pension plan).

Perhaps it can even provide all the income you need, which is possible with some planning and saving enough.

In order to live off dividends, an individual would need to have a portfolio that provides a high yield in order to generate the necessary income.

There are a few different ways to achieve this, but the most common is to invest in companies that have a history of paying and growing their dividend payments.

The benefits of these funds are that they offer instant diversification and are relatively low cost in comparison to the standard mutual fund.

The trade-off is that you don’t get the same level of control as you would if you owned the underlying stocks directly.

Dividend growth is a key ingredient to live off dividends successfully

Dividend growth means that your payments increase over time, which gives you some protection against inflation.

There are a number of strategies for how to live off dividends, but one common way is to reinvest the payments back into the underlying security.

This is often called a Dividend ReInvestment Plan, or DRIP.

This has the effect of compounding your returns, and it can help you increase your income streams over time.

Of course, you can also take the payments as cash and use them to cover expenses if you need them.

The important thing is to develop a plan that works for you and fits with your overall financial goals.

Is living off dividends possible?

With some careful planning, it is possible to live off dividends alone – and enjoy a comfortable retirement in the process.

It will require plenty of saving and investing, but it can be done.

The key is to start early, invest in high-quality companies that pay regular dividends, and reinvest the payments back into the security.

How much is needed to live off dividends?

How much you’ll need can be reverse engineered.

For example, say you need $5,000 per month in order to live.

That means you’ll need $60,000 in dividends per year.

If your dividend stocks throw off 4 percent in cash flow, then you’ll need $60,000 / 0.04 = $1.5 million invested.

We have a chart in this article (reproduced below) that covers how much you’ll need as a function of your monthly payments and yield on your investments.

The top axis shows the amount of desired dividends achieved per month. The left axis shows the yield on investments. The outputs (in blue) show how much you would need invested.

Example

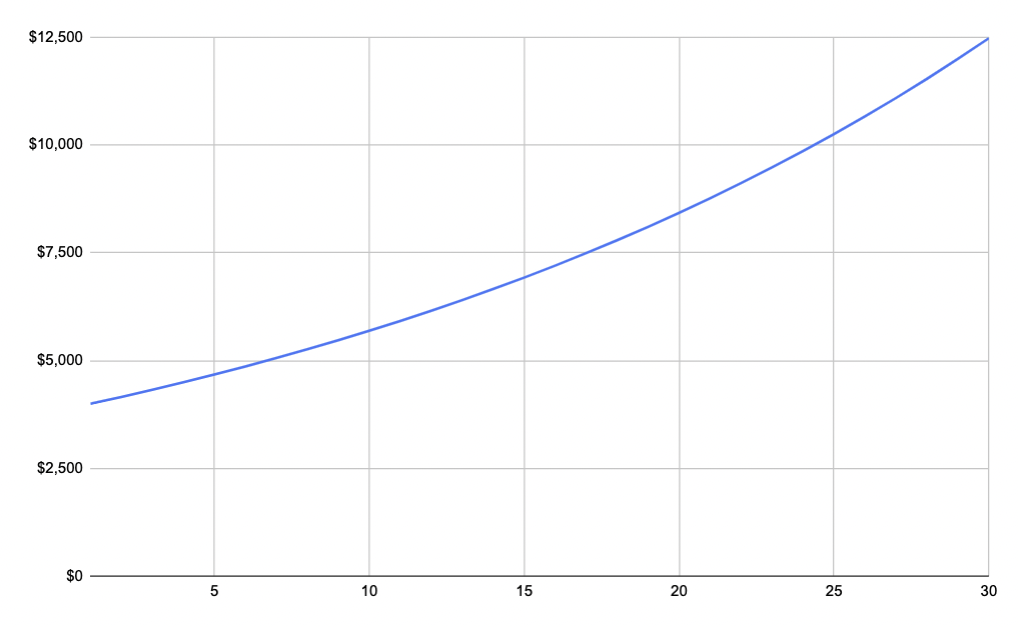

Let’s say you start out with $100,000 and invest in a stock that gives you a four percent dividend each year.

And assume no capital appreciation, if you continually reinvest that dividend over 30 years, you’ll eventually have an investment that throws off about $12,500 per year.

If you can contribute additional funds on a continual basis, the process is much easier.

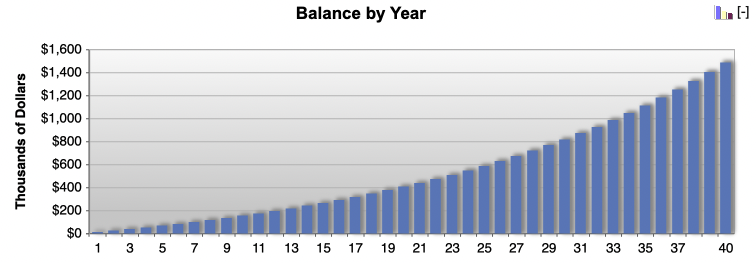

For example, for someone who has 40 years to compound (e.g., age 25 to 65, age 30 to 70), can get a 5 percent return per year, and can contribute $1,000 per month, they’ll have $1.5 million.

If that $1.5 million portfolio throws off 4 percent in dividend income, that’s $60,000 per year in income from their portfolio.

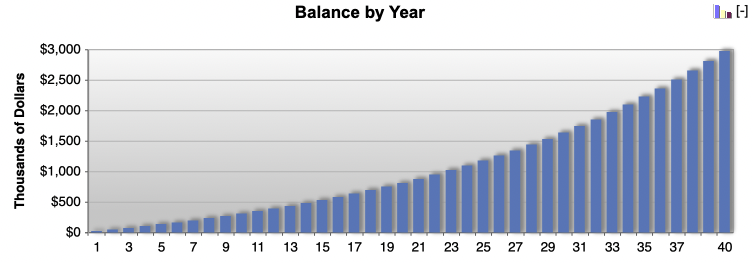

Of course, if you contribute double the contributions, then you’ll have $3 million and $120,000 per year in dividend income if 4 percent.

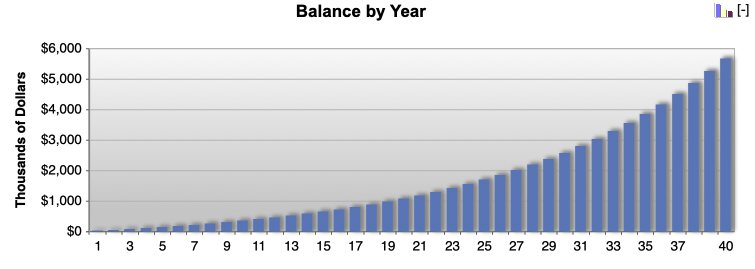

If the yield on the portfolio can be improved to 7.5 percent, then compound interest will magnify the result.

That $3 million achieved off the $2,000 per month in contributions over 40 years and 5 percent returns, would turn into $5.7 million with $2,000 per month over 40 years with 7.5 percent returns.

Compounded returns operate on a curve, so the higher the return the better. But it has to be achieved at the appropriate risk level.

What if you’re already retired?

If you’re already retired, you won’t have the same amount of time to compound returns like someone who is younger.

In this case, retired investors looking to live off their dividends and investments may want to increase their portfolio’s yield.

High-yielding stocks and securities include such instruments like:

- REITs

- Preferred shares

- Master limited partnerships (MLPs)

- Dividend ETFs

REITs and MLPs are subject to certain laws where they have to return at least 90 percent of their earnings back to shareholders in exchange for certain tax advantages provided to the company.

As such, they don’t always have much in the way of share price appreciation giving so much back to shareholders. This may even cannibalize some of the share price, which is why securities can’t be chosen off just yield considerations.

What matters most is how much the business is earning. If it is consistently earning enough to cover the dividend yield by a healthy margin, it should be sustainable.

But for a retiree, that’s of little concern as they’re more focused on income.

And when you have enough income being thrown off by your portfolio, that means you can pay your expenses without having to liquidate the assets in your portfolio.

REITs

REITs are real estate investment trusts.

They own and operate real estate properties and, as mentioned, are required by law to return at least 90 percent of their taxable income back to shareholders in the form of dividends.

This provides a high and ideally sustainable dividend yield, which is perfect for retirees looking for income.

And because they own physical real estate, the value of their assets is generally relatively stable over time.

One drawback of REITs is that they can be volatile in the short term, as they do use leverage. Many REITs, especially mREITs, have plenty of interest rate risk.

But for retirees with a long time horizon, this shouldn’t be too much of a concern.

Preferred shares

Preferred shares are another way to boost income in your portfolio.

Preferred shares are like a hybrid between common stock and bonds.

They typically pay a higher dividend than common shares, but they also have a claim on the company’s assets ahead of common shareholders. This means they also tend to have more price stability relative to regular stocks.

One downside of preferred shares is that they often don’t have much in the way of price appreciation potential.

They may also be retired by the company before their maturity date. Callable preferred stock is a form of preferred shares that can be redeemed by the issuer at a set value before the maturity date.

Issuers use callable preferred stock for financing purposes as they like the flexibility of being able to redeem it.

Overall, for someone who is looking for income and doesn’t mind owning a static position, preferred shares can be a good choice.

Not all brokers have preferred shares, but most dedicated full-service brokers will.

Master limited partnerships (MLPs)

MLPs are similar to REITs in that they own physical assets and are required to pay out most of their income to shareholders.

The main difference is that MLPs own oil– and energy-related infrastructure like pipelines, storage facilities, and processing plants.

Like REITs, MLPs can be volatile in the short term. They are also dependent on oil prices.

Some MLP traders and investors will hedge their positions by shorting some amount of oil to reduce their sensitivity to the commodity.

Dividend ETFs

A dividend ETF is a basket of stocks that pays dividends.

They’re a good way to get exposure to a bunch of different companies without having to buy each one individually.

And because they’re diversified, they can help smooth out the ups and downs of any one company.

One thing to watch out for with dividend ETFs is that they often have high expense ratios.

So make sure you’re aware of the fees before you invest.

Popular dividend ETFs include:

- Vanguard Dividend Appreciation ETF (VIG)

- iShares Select Dividend ETF (DVY)

- Schwab US Dividend Equity ETF (SCHD)

These funds tend to hold mostly larger, more established companies that have a history of paying and growing their dividend payments.

The benefits of these funds are that they offer instant diversification and are relatively low cost in comparison to the standard mutual fund.

The trade-off is that you don’t get the same level of control as you would if you owned the underlying stocks directly.

Utility stocks

Utility stocks are a good way to get income and stability in your portfolio.

Utilities are companies that provide essential services like electricity, gas, and water.

Because they provide essential services, they tend to be less volatile than the market as a whole.

And because they have a lot of fixed costs and have fairly predictable cash flows and profit margins, they’re able to pay out a large portion of their earnings as dividends.

One thing to watch out for with utility stocks is that they may often have high price-to-earnings (P/E) ratios.

This means they can be overvalued and may not offer much in the way of price appreciation potential.

Consumer staples stocks

Consumer staples stocks are another way to get stability and income in your portfolio.

Consumer staples are companies that sell essential products like food, beverages, and personal care items.

Like utility stocks, consumer staples stocks tend to be less volatile than the market overall.

Because they sell products that have pretty stable demand no matter what part of the business cycle they’re in, their earnings are relatively predictable.

Accordingly, they are often considered good stores of value.

As such, the mature consumer staples companies are generally able to pay out a decent portion of their earnings as dividends. Dividend yields of 2-4 percent are common among consumer staples.

Staples are the most bond-like sector of the equity market.

If nominal spending in an economy falls more than discounted, then staples can fall just like any other part of the stock market.

And like in any other industry, some individual consumer staples companies can be leveraged too high, which can make them more volatile.

Final Thoughts

If you’re looking to live off dividends and investments, there are a few things you need to consider.

First, you need to make sure you have enough money invested to cover your expenses.

This can be done by reverse engineering how much you’ll need as a function of your monthly payments and yield on your investments.

Second, if you’re already retired, you may want to increase your portfolio’s yield in order to have enough income to cover your expenses.

And finally, you’ll need to decide what kinds of investments you want to own.

There are a number of different options, each with its own set of pros and cons.

The important thing is to do your research and find an investment that meets your needs.

Living off dividends is possible with some careful planning and saving. It will require plenty of time to compound returns ideally, but it can be done.

It’s vital to start early if possible, invest in high-quality companies that pay regular dividends, and reinvest the payments back into the security.

Those who are already retired may want to focus on companies that have higher yields, with such yields covered by the economic earnings of the business.

With some careful planning and ample execution, you can live off dividends alone and enjoy a worry-free retirement.