Best Forex Trading Platforms in India 2026

Leap into DayTrading.com’s pick of the best forex brokers in India. Our experts have vetted every platform to ensure they provide a great environment for Indian traders, such as currency pairs with the Indian Rupee (INR).

Due to strict regulations from the Securities and Exchange Board of India (SEBI) on local brokers, residents often use overseas forex platforms like those below, which all accept forex traders from India. However, citizens must adhere to Indian laws and may need permission to trade foreign currencies and use international brokers.

Top 6 Forex Trading Platforms In India

After years of hands-on testing and analysis, these 6 brokers reign as superior for forex traders in India:

Here is a short summary of why we think each broker belongs in this top list:

- XM - XM offers a strong selection of currency pairs with no re-quotes or hidden charges, while spreads have come down over the years, now starting from 0.8 pips on the EUR/USD in the commission-free account.

- RoboForex - RoboForex offers trading on 30+ currency pairs, trailing category leaders like Pepperstone with its 90+ forex assets. That said, the Prime and ECN accounts feature competitive average spreads of 0.1 pips on the EUR/USD. Additionally, with a minimum investment of $100, traders can utilize the CopyFX system to replicate the strategies of seasoned currency traders.

- Vantage - Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

- IC Markets - IC Markets maintains its commitment to providing exceptionally tight 0.0-pip forex spreads on major currency pairs such as EUR/USD. This makes it an excellent option if you are seeking superior execution, with an average of 35 milliseconds. Additionally, if you are a high-volume trader, you can benefit from rebates of up to $2.50 per forex lot.

- AvaTrade - AvaTrade delivers 50+ currency pairs with tight spreads from 0.9 pips and zero commissions. Trade majors, minrs, and exotics 24/5 on leading forex platforms, notably MT4, with sophisticated charting tools and forex education to sharpen your edge, including a dedicated guide to 'Currency Trading'.

- FOREX.com - FOREX.com continues to uphold its stature as a premier FX broker, offering 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $7 commission per $100k, it stands out.

Best Forex Trading Platforms in India 2026 Comparison

| Broker | Currency Pairs | EUR/USD Spread | Forex App Rating | Trust Rating | Minimum Deposit | INR Account |

|---|---|---|---|---|---|---|

| XM | 55+ | 0.8 | / 5 | / 5 | $5 | - |

| RoboForex | 30+ | 0.1 | / 5 | / 5 | $10 | - |

| Vantage | 55+ | 0.0 | / 5 | / 5 | $50 | - |

| IC Markets | 75 | 0.02 | / 5 | / 5 | $200 | - |

| AvaTrade | 50+ | 0.9 | / 5 | / 5 | $100 | - |

| FOREX.com | 84 | 1.2 | / 5 | / 5 | $100 | - |

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| GBPUSD Spread | 0.8 |

|---|---|

| EURUSD Spread | 0.8 |

| EURGBP Spread | 1.5 |

| Total Assets | 55+ |

| Leverage | 1:1000 |

| Platforms | MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| GBPUSD Spread | 0.4 |

|---|---|

| EURUSD Spread | 0.1 |

| EURGBP Spread | 0.4 |

| Total Assets | 30+ |

| Leverage | 1:2000 |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Account Currencies | USD, EUR |

Pros

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

- The broker offers leverage up to 1:2000 for certain account types, which is among the highest in the industry. This high leverage allows day traders to maximize their trading potential, albeit with a corresponding increase in risk.

- RoboForex offers over 12,000 instruments, providing more short-term trading opportunities than the vast majority of online brokers, with forex, stocks, indices, ETFs, commodities, and futures.

Cons

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| GBPUSD Spread | 0.5 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.5 |

| Total Assets | 55+ |

| Leverage | 1:2000 |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- Vantage caters to hands-off investors with beginner-friendly social trading via ZuluTrade & Myfxbook

- The ECN accounts are very competitive with spreads from 0.0 pips and a $1.50 commission per side

- It’s quick and easy to open a live account – taking less than 5 minutes

Cons

- Unfortunately, cryptos are only available for Australian clients

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| GBPUSD Spread | 0.23 |

|---|---|

| EURUSD Spread | 0.02 |

| EURGBP Spread | 0.27 |

| Total Assets | 75 |

| Leverage | 1:1000 |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

Cons

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| GBPUSD Spread | 1.5 |

|---|---|

| EURUSD Spread | 0.9 |

| EURGBP Spread | 1.5 |

| Total Assets | 50+ |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

Cons

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| GBPUSD Spread | 1.3 |

|---|---|

| EURUSD Spread | 1.2 |

| EURGBP Spread | 1.4 |

| Total Assets | 84 |

| Leverage | 1:400 |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- The in-house Web Trader continues to shine as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- Funding options are limited compared to leading alternatives like IC Markets and don’t include many popular e-wallets, notably UnionPay and POLi.

- Despite increasing its range of instruments, FOREX.com's product portfolio is still limited to forex and CFDs, so there are no options to invest in real stocks, real ETFs or real cryptocurrencies.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

How Did DayTrading.com Choose The Best Forex Brokers?

To list the top FX platforms in India, we leveraged our database of 140 brokers and followed these steps:

- We filtered for brokers offering trading on currency pairs like INR/USD.

- We pinpointed forex trading platforms that accept Indian residents.

- We sorted brokers by their overall rating, balancing 100+ data entries with observations from our experts.

What Is A Forex Broker?

A forex broker allows you to buy and sell currency pairs like the INR/USD (Indian Rupee/US Dollar), with the aim of profiting from market fluctuations.

It works like this in India:

- Select a forex platform that accepts Indian traders. Think about your requirements, such as a sophisticated charting platform, fast execution speeds and tight spreads for forex day trading in India. FX brokers should be authorized by the SEBI.

- Sign up for an account. This generally involves verifying your identity and address, which can often be done by providing a copy of your Aadhaar card that contains a 12-digit number tied to your biometric and demographic data.

- Deposit Indian Rupees. Entry requirements have fallen over the years, with brokers now normally requiring 0 USD to 250 USD, or around 0 INR to 21,000 INR, based on our research.

- Start trading currencies. Buy or sell currencies like INR directly or make use of derivatives like forex CFDs, entering and exiting positions on your broker’s desktop client, web solution, or for the growing class of mobile traders, on a forex app.

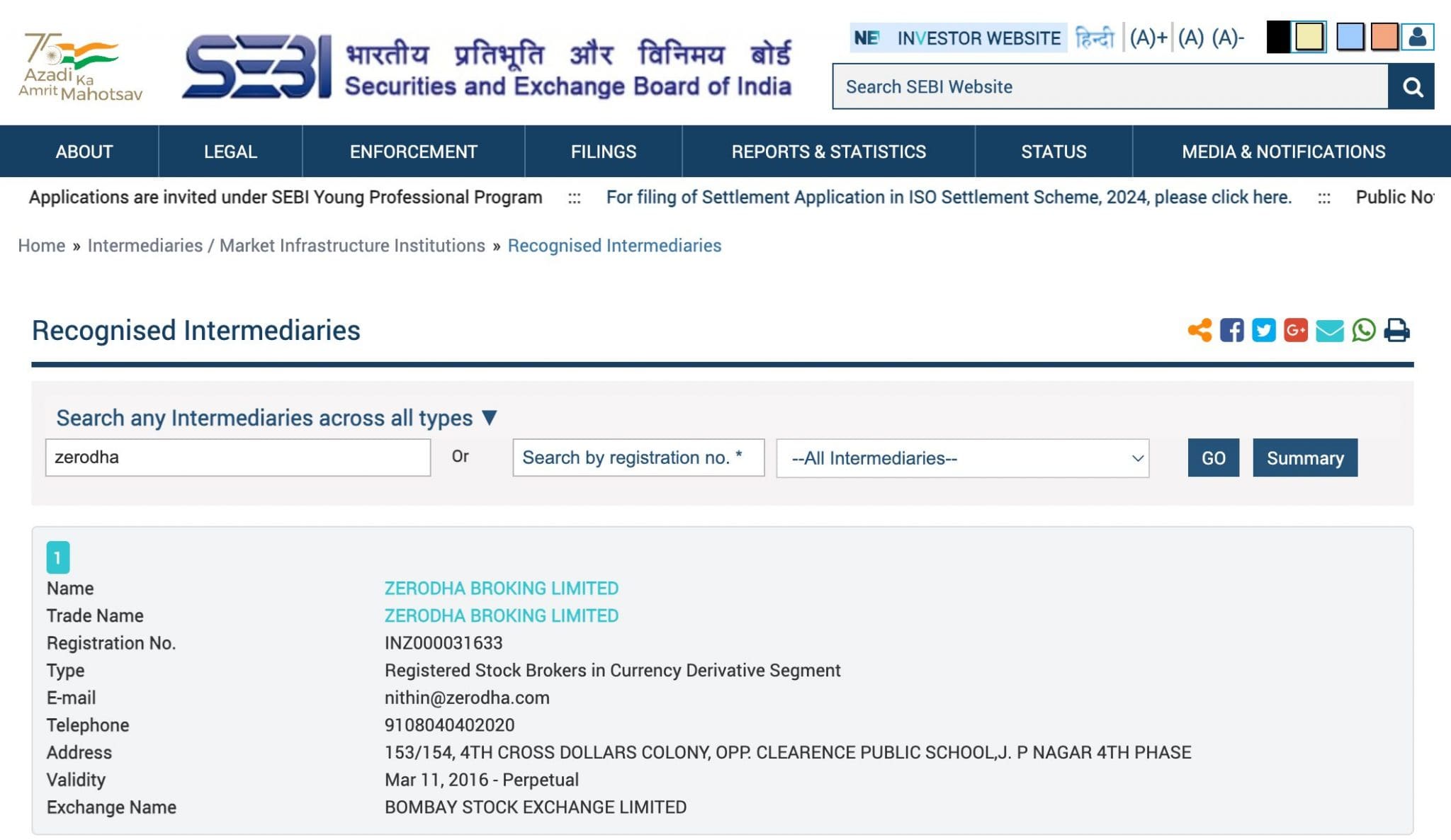

The Role Of The SEBI

The Securities Exchange Board of India (SEBI) oversees forex brokers in India. Considered a ‘yellow tier’ regulator in line with DayTrading.com’s Regulation & Trust Rating, it’s an active financial watchdog that provides strong investor protections.

Forex brokers in India should hold a license with the SEBI, and meet various requirements that are verified through audits and compliance checks, notably:

- Brokers should only facilitate trading in currency pairs that contain the INR, such as INR/USD, INR/EUR, INR/JPY, and INR/GBP. Cross-currency pairs like EUR/USD, USD/JPY and GBP/USD can also be traded on the Bombay Stock Exchange (BSE) and the National Stock Exchange of India (NSE).

- Brokers should not provide leverage beyond a specified amount, typically up to 1:20 when dealing currency pairs involving the INR. This is lower than the 1:30 limit in tightly regulated jurisdictions like Europe and the UK and is in place to minimize the risk of you incurring huge losses.

- Brokers must segregate client funds from company capital in segregated accounts. This protects your Rupees in case the broker runs into financial difficulties.

- Brokers be transparent about the risks of trading currencies, ensuring you understand the dangers of leverage and the highly volatile nature of the FX market. You could lose any Rupees you invest.

With an unusually restrictive set of rules placed on local brokers, some residents sign up with international forex platforms that accept Indian traders.

However, it’s important to understand that the SEBI actively deters residents from investing in foreign currencies. Depositing Rupees from your local bank account to an overseas account is not generally allowed. Additionally, Indian citizens may need permission from the relevant government authority.

Given the complex set of regulations that apply to Indian forex brokers and traders, I recommend consulting a local professional who can advise you on the latest rules from the SEBI. This will help ensure you choose a legal forex broker.

How Do Forex Trading Platforms Make Money?

Forex platforms primarily make their money through two trading costs: spreads and/or commissions.

Spreads

Many brokers incorporate their charges into the bid-ask spread of the currency pair, which is the difference between the buy and sell price of the asset.

Let’s say your chosen Indian forex broker quotes a bid price for INR/USD of 74.105 and an ask price of 74.100. The spread is, therefore 0.005 INR (74.105 – 74.100), or 5 pips.

Now if you decide to buy 10,000 USD, at the bid price this would cost 74,105 INR. If you were to then sell it at the same quote of 74.105/74.100, you would get back 74,100 INR.

The missing 5 INR has been charged by the broker as the spread. Of course, you would want to sell at a higher price point that would at least cover the cost of the spread.

Commissions

Forex brokers, especially Electronic communications network (ECN) brokers, may also charge a commission, which is a fixed fee.

They normally do this in return for much tighter spreads, which can start from near 0.0 pips on popular currency pairs based on our experience.

Let’s say your chosen forex broker in India charges a fixed rate of 200 INR commission per lot (100,000 units). The bid price given by the broker is 74.00, or 74 INR for 1 USD and you decide to buy 10,000 USD for 740,000 INR.

The order size is therefore 0.1 lots, so you would pay a commission of 20 INR (0.1 x 200 INR)

Choosing A Forex Broker

The choice of forex trading platform will always be a personal one, depending on your trading style and preferences.

However, based on our many years working in the industry and thousands of hours examining forex brokers that accept Indian traders, we believe there are five key factors you should take into account:

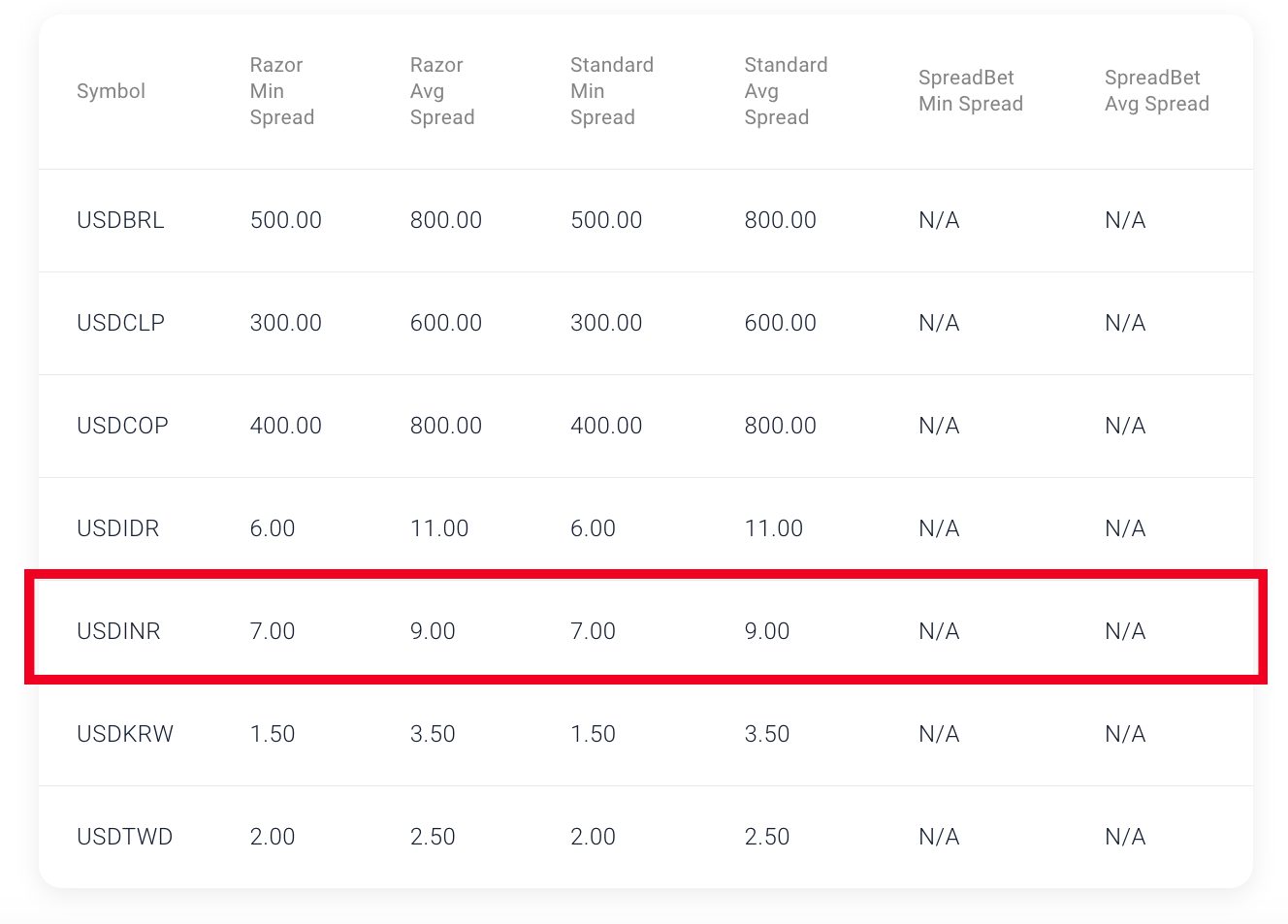

1. What currency pairs can you trade?

Check the currencies you want to speculate on are available on the platform.

Keep in mind that the SEBI only allows local brokers to offer seven currency pairs – INR/USD, INR/EUR, INR/GBP, INR/JPY and cross-currency pairs – EUR/USD, GBP/USD and USD/JPY. Buying or selling non-authorized currencies is prohibited in India and could lead to legal ramifications.

Some international forex platforms that operate in India and that we’ve evaluated may offer other currencies. For example, Pepperstone is among the best for its range of 100+ currency pairs (including INR/USD), but these may not be SEBI-approved.

2. Is the broker authorized to deal FX in India?

As we’ve outlined, the SEBI has strict regulatory rules that make it challenging to buy and sell through non-authorized methods.

Fortunately, it’s straightforward to check whether a forex broker is authorized in India. A genuine firm will clearly have an Indian forex broker license number. For example, Zerodha provides SEBI registration details at the bottom of each webpage. Simply search this number in the SEBI’s directory of Recognised Intermediaries.

Other indicators that an FX broker is legitimate are an office in India and customer support in Hindi and one of the 22 reocgnized regional languages, such as Bengali.

3. Are the trading fees competitive?

Check the costs you will incur on the currency pairs you’re interested in, especially as a short-term trader for whom transaction costs can mount up quickly.

For example, Zerodha offers a flat Rs. 20 fee or 0.03% of the trade value (whichever is lower) on intraday trades across currencies, which primarily user derivatives like futures and options.

Also factor in additional costs. For instance, you may have to pay a conversion fee if your deposit Rupees to an account based in another currency, though brokers with INR accounts can help you avoid this.

4. Is the forex platform user-friendly with the features you need?

Ensure you get on with the forex platform, whether a desktop client or web trader. This is where you may spend a significant amount of time analyzing the impact of monetary policy decisions from the Reserve Bank of India (RBI) for example, and executing short-term trading strategies.

Based on our analysis, MetaTrader 4 (MT4) remains the most widely available platform (it was designed for FX trading), but brokers are increasingly integrating other third-party solutions, notably TradingView and cTrader.

We’re also witnessing a shift in forex trading patterns to using mobile apps that support full account management, market analysis and easy order execution. For example, Zerodha’s proprietary platform Kite, is available as an iOS and Android app, offering a simple yet intuitive user experience for all your forex needs.

After personally testing almost every major forex platform on the market, from third-party solutions like MT4, MT5, cTrader and TradingView to countless in-house terminals and apps, I strongly recommend starting with a forex demo account.I believe these simulators are the best way to learn a platform’s features and check the broker is a good fit, before risking your Rupees.

5. Is it easy to make deposits and withdrawals?

Make sure the firm makes funding and emptying your forex trading account cheap and convenient.

Based on our investigations, some top FX brokers for Indian traders offer international solutions like wire transfers and debit cards, plus more localized solutions like RuPay and Paytm.

Bottom Line

India is unusual in its heavily restrictive approach to forex trading, which can make choosing an online broker challenging.

A SEBI-regulated forex broker will guarantee legitimacy and should give you important client safeguards. However, we’re seeing some traders turn to overseas forex platforms for their wider market access. If you opt for this route, it is imperative you adhere to Indian laws, which may require getting approval from the relevant government department.

To find the right brokerage for your needs, use DayTrading.com’s selection of the best forex brokers that accept Indian traders.

Recommended Reading

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com