IFC Markets Review 2025

Awards

- Best MT5 Trading Platform SEA 2025 - World Business

- Best Multi-asset CFD Broker SEA 2025 - World Business

- Best CFD Trading Platform East Asia 2025 - Global Business and Finance Magazine

- Best ECN Broker Malaysia 2025 - Global Business and Finance Magazine

- Best International Forex Broker – Vietnam 2024 - Gazet International

- Best MT5 Trading Platform East Asia 2024 - World Business

Pros

- MT4, MT5, and NetTradeX are all available on desktop, web and mobile, each with live and demo access, full functionality, and no platform restrictions even on micro accounts.

- With leverage up to 1:400 and $1 account minimums, IFC Markets offers easy entry for beginners and high-leverage traders. Unlike brokers under stricter ESMA or ASIC rules, its offshore regulation allows more flexible margin and account options.

- We’ve seen meaningful improvements over time, including the addition of a Standard ECN account on MT5 and expanded synthetic instruments on NetTradeX, showing IFC Markets is evolving to better serve active traders.

Cons

- While ECN spreads on MT5 were tight in our tests, fixed spreads on MT4 are wide (1.8 pips on EUR/USD), and crypto spreads are very high (500+ pips on ETH/USD).

- Support hours are regional and weekday-only. During late trades, don’t expect to get help via chat or phone – a big miss for day traders operating in global markets.

- With 10+ account types across 3 platforms, it’s hard to know what suits you initially, potentially confusing beginners. During setup, we had to cross-check multiple account specs to avoid mismatches.

IFC Markets Review

Discover the realities of trading with IFC Markets in this comprehensive, objective review. We provide a clear analysis of the broker’s key features, highlighting its strengths and areas for improvement.

Based on our direct experience with the platform, we focus on the aspects that matter most to active, short-term traders.

Regulation & Trust

2.5 / 5IFC Markets is averagely trusted. IFC Market Corp is regulated by the British Virgin Islands Financial Services Commission (BVI FSC) – a ‘red tier’ body in DayTrading.com’s Regulation & Trust Rating.

The BVI FSC mandates compliance with key operational standards such as client fund segregation, capital adequacy, and anti-money laundering protocols.

Yet while these requirements provide a foundational layer of security, the BVI FSC’s regulatory framework is less comprehensive than that of authorities like the UK’s Financial Conduct Authority (FCA), Europe’s Cyprus Securities and Exchange Commission (CySEC), or the Australian Securities & Investments Commission (ASIC), which enforce stricter measures, including regular audits, negative balance protection, and investor compensation schemes.

From a trading perspective, especially for active day traders who rely on fast execution and platform stability, the broker’s regulatory environment should be considered alongside its technological infrastructure and risk management policies.

The relatively lighter regulatory oversight means you must exercise enhanced due diligence, particularly regarding leverage limits and margin calls, to mitigate counterparty and operational risks.

The broker’s professional indemnity insurance and industry awards add some credibility, but do not substitute for the robust protections found under more stringent regulators.

| IFC Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | BVI FSC | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

3.8 / 5Live Accounts

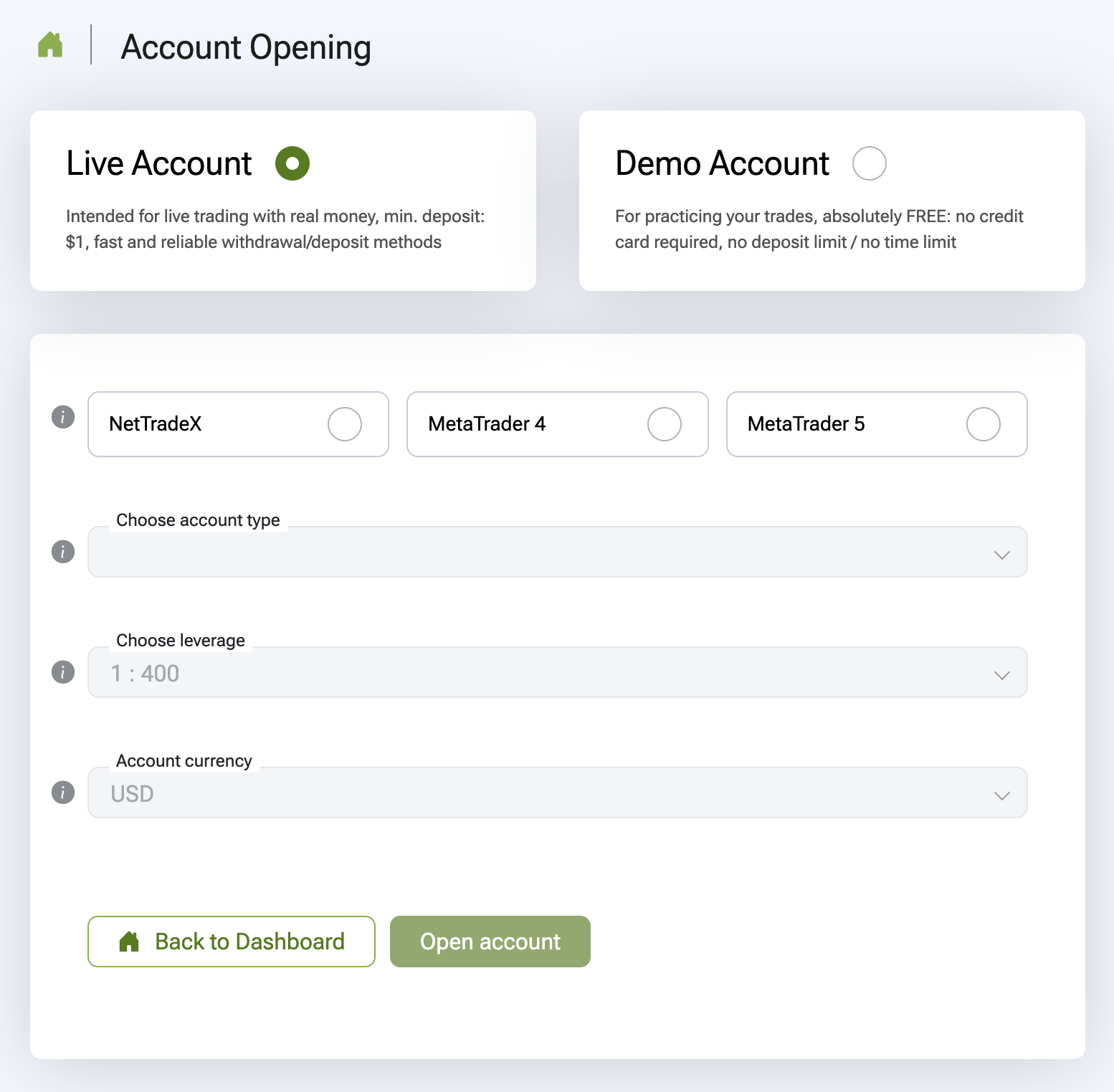

IFC Markets offers various account types across its three supported platforms – NetTradeX, MetaTrader 4 (MT4), and MetaTrader 5 (MT5) — each tailored to different trading needs and experience levels.

This multi-platform approach is initially confusing, but provides flexibility by allowing you to choose between fixed and floating spreads, micro and standard contract sizes, and even swap-free Islamic accounts.

- NetTradeX: You can select between Standard and Beginner accounts, each available with fixed or floating spreads. The Standard account is best for experienced traders, requiring a $1,000 minimum deposit and offering access to the broker’s full suite of over 600 instruments. The Beginner account, with a minimum deposit of just $1, is ideal for newcomers or those wanting to test strategies with minimal risk. Both accounts support leverage from 1:1 to 1:200 and hedging/netting.

- MetaTrader 4: IFC Markets provides Standard (fixed spread) and Micro (fixed spread) accounts. The Standard account suits active traders seeking predictable trading costs and robust execution. In contrast, with its $1 minimum deposit, the Micro account is designed for beginners or those trading smaller lots. Unlike some leading brokers we’ve tested that restrict micro accounts to demo environments or limit available features, IFC Markets allows live trading with full platform functionality even at the lowest entry level.

- MetaTrader 5: These accounts include Standard (floating spread), Micro (floating spread), and a more recently introduced Standard-ECN option. The Standard and Micro accounts cater to those who prefer MT5’s advanced charting and order management, with floating spreads that can offer lower costs during high liquidity. The Standard-ECN account provides direct market access, raw spreads, and ultra-fast execution, making it particularly attractive for high-frequency traders and scalpers. This feature puts IFC Markets on par with top ECN brokers.

All account types offer negative balance protection, multiple base currency options, and the ability to open swap-free Islamic accounts on request.

A notable differentiator for IFC Markets is its support for PAMM accounts on MT4 and MT5. PAMM accounts allow investors to allocate funds to experienced traders, who then manage these pooled investments and proportionally share profits (or losses).

Demo Accounts

IFC Markets offers demo accounts across all its trading platforms – NetTradeX, MT4, and MT5 – making it easy to practice in a simulated environment that closely mirrors live market conditions.

Each demo account type reflects the features of its corresponding live account, allowing you to choose between fixed and floating spreads, test different leverage levels (from 1:1 up to 1:400), and select from multiple base currencies, including USD, EUR, JPY, and even MicroBitcoin (uBTC) for NetTradeX.

There are no restrictions on the amount of virtual capital or the duration of use, which is a significant advantage over some brokers that limit demo access to 90 days or less.

What I like about IFC Markets’ demo accounts is their flexibility and ease of use. I can quickly open demos on any platform – NetTradeX, MT4, or MT5 – and try Standard or Micro accounts.The simple registration meant no extended verification, so I traded with virtual funds in minutes, testing hedging, netting, and various instruments. This quick access and flexibility is a real plus compared to some brokers.

Deposits & Withdrawals

Compared to other leading brokers, IFC Markets stands out for its diverse payment options, including regional solutions and cryptocurrencies, which are not always available elsewhere.

The low minimum deposit is also a significant advantage, as many top brokers require $50–$200 to start, as is the choice of four account base currencies – USD, EUR, JPY and uBTC.

You can fund and withdraw using international bank transfers, credit/debit cards, e-wallets (such as WebMoney, Bitwallet, ADVCash, TopChange, and IRPAY), mobile payment systems like M-Pesa and African Local Bank, and a variety of cryptocurrencies, including Tether TRC20, Bitcoin, and others.

The minimum deposit is impressively low – starting from just $1 for e-wallets and $5 for mobile money – making it easy for new traders to get started or test the platform with minimal risk.

In my experience, most deposit methods are processed instantly, while traditional bank transfers may take 2–3 business days.

On the withdrawal side, IFC Markets mirrors its deposit flexibility, allowing you to use the same payment methods that align with AML requirements.

Withdrawal processing times vary. I find that e-wallets and crypto can be completed in minutes to a day, while bank cards and wire transfers typically take 1–5 business days.

Fees also vary by method – bank transfers incur a $20 fee plus your bank’s charges, e-wallets like WebMoney charge 0.8% (capped at $50), and crypto withdrawals (such as USDT TRC20) have a fixed fee (e.g., $3 for TRC20).

While some methods, like bank cards and mobile money, are often fee-free for deposits, withdrawal fees can add up, especially if you trade frequently.

Although the platform’s flexibility is a plus, the sheer number of payment options and varying fees may confuse newcomers, especially compared to brokers like eToro that offer a more streamlined approach.

| IFC Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Bitcoin Payments, Bitwallet, Credit Card, Debit Card, M-Pesa, Mastercard, Visa, Volet, WebMoney, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer |

| Minimum Deposit | $1 | $100 | $0 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

4 / 5IFC Markets offers a huge and well-rounded selection of over 30,000 tradable assets (650+ CFDs and forex), with strong coverage in forex, stocks, indices, commodities, and unique features like synthetic instruments.

While the range is competitive and suitable for most active traders, those seeking the absolute widest selection – especially in stocks, ETFs, or cryptocurrencies – may find other leading brokers like CMC Markets offer more depth.

We’ve used IFC Markets’ platforms, here’s what instruments you’ll find to trade:

- Forex: Over 50 currency pairs, covering majors, minors, and exotics. This range is competitive with many leading brokers, giving you ample diversification and strategy development choices.

- Stocks: CFDs are available on more than 300 global stocks, including those from the US, UK, Germany, and Japan. While this is a solid selection, some of the largest brokers provide access to thousands of equities and, in some cases, direct stock trading (not just CFDs). Still, IFC Markets’ coverage is sufficient for most traders looking to speculate on major international companies.

- Indices: IFC Markets supports trading on 10+ global stock index CFDs, such as the S&P 500, FTSE 100, DAX, and Nikkei 225. Improvements have reduced the minimum transaction volume and margin requirements, making index trading more accessible, especially for those with smaller accounts.

- Commodities: You can trade CFDs on a variety of over 50 commodities, including precious metals (gold, silver), energy products (oil, natural gas), and agricultural goods (wheat, coffee, soybeans). The selection is broad and rivals most competitors, but if you seek niche or less common commodities, you may find more variety elsewhere.

- Cryptocurrencies: IFC Markets offers CFDs on 13+ popular cryptocurrencies such as Bitcoin, Bitcoin Cash, Litecoin, Ethereum, and Ripple, providing exposure to this volatile asset class without needing a separate crypto wallet. While this is a plus for diversification, the range of available crypto assets is more limited than at some brokers specializing in digital currencies.

- ETFs: The broker also lists a small selection of ETF CFDs, allowing you to gain exposure to baskets of assets or specific sectors like iShares US Real Estate (IYR) and SPDR Gold Trust (GLD). While this adds to the diversity, the ETF offering is less extensive than major brokers.

- Synthetic Instruments: IFC Markets offers 35+ synthetic instruments using the proprietary NetTradeX platform. These instruments are created by the analysts of IFC Markets and include pairs like Currencies/USD (EUR, GBP, JPY, AUD, CHF, CAD/USD) and Grain Index (corn, oats, soy, wheat/USD). However, a unique feature lets you combine multiple assets into a single instrument. This level of customization is extremely rare and can be a significant advantage for advanced traders seeking to implement complex strategies.

| IFC Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs, Synthetics | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:400 | 1:200 | 1:50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

3.5 / 5IFC Markets’ fee structure is generally transparent and competitive, but our investigations show its cost-effectiveness varies depending on the account type, asset class, and trading style.

On forex, IFC Markets offers fixed spreads starting from 1.8 pips on MT4 accounts, which is about average for the industry but higher than the tightest spreads offered by leading ECN brokers, which many day traders prefer.

For floating spread accounts (NetTradeX and MT5), spreads on major pairs can be as low as 0.4 pips, making them more attractive if you prioritize lower costs.

However, spreads can widen during volatile periods, causing actual trading costs to fluctuate. The newer ECN account on MT5 offers even tighter effective spreads (around 1.1 pips on EUR/USD after commission), which is competitive for high-frequency traders.

For stock CFDs, commissions start at $0.02 per US share or 0.1% of the order volume for most international equities, with minimum commissions applied depending on the market and platform.

These rates align with, but not necessarily better than, major multi-asset brokers. All stock and ETF trading is via CFDs, so you do not own the underlying asset – something to consider if you want direct ownership, as some brokers like DEGIRO or Trade Republic offer spot market access.

Cryptocurrency CFDs are commission-free but have spreads starting at 500 pips on ETH/USD, which is wider than you’d find on dedicated crypto exchanges like Coinbase or Kraken.

This makes IFC Markets less suitable for active crypto trading, though it remains convenient if you want simple CFD exposure.

Other costs include overnight swap/rollover fees, which are transparently published and derived from interbank rates plus a markup. There are no inactivity or currency conversion fees.

| IFC Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.4 | 0.1 | 0.08-0.20 bps x trade value |

| FTSE Spread | 300 | 100 | 0.005% (£1 Min) |

| Oil Spread | 6 | 0.1 | 0.25-0.85 |

| Stock Spread | 25 (Apple) | 0.1 | 0.003 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

3.8 / 5IFC Markets offers a robust suite of trading platforms, including its proprietary NetTradeX, MT4 and MT5.

This multi-platform approach allows you to choose the environment that best fits your needs, whether you prioritize advanced customization, industry-standard tools, or mobile trading.

NetTradeX distinguishes itself with features like Personal Composite Instruments (PCI), which allow you to create custom baskets of assets – a unique capability not commonly found at other brokers.

From my hands-on use, NetTradeX feels reliable and offers fast execution, advanced order types, and server-side trailing stops, which are practical for active trading.

However, the platform’s learning curve is steeper for those accustomed to MetaTrader, and its community and third-party support are limited compared to the broader MetaTrader ecosystem.

There’s also no web version, so you must download the software onto your Windows PC or mobile device (iOS and Android supported). I was also particularly disappointed that there is no support for macOS devices.

MetaTrader 4 remains a favorite for many traders due to its reliability, a vast library of indicators and EAs, and broad community support. Our testing shows IFC Markets’ MT4 offering works smoothly on Windows, macOS, Android and iOS.

The fixed spread accounts and instant execution are attractive for day traders, though MT4’s charting and order management tools are now somewhat dated compared to MT5.

MetaTrader 5 is also available for Windows, macOS, Android and iOS. In my experience, MT5 delivers a more modern experience than MT4, with 21 timeframes, more technical indicators, and an integrated economic calendar.

Mobile support is solid, and the platform is reliable for manual and automated trading. However, IFC Markets does not currently offer a native macOS version, which could be a drawback for Apple desktop users.

There’s no support for third-party platforms like TradingView or cTrader, which are increasingly popular among traders for their advanced charting, social features, and broader broker integrations.

Ultimately, IFC Markets’ platform lineup is strong for those who want to choose between proprietary and MetaTrader platforms, and the unique PCI feature on NetTradeX is a real differentiator for advanced users.

However, some leading brokers provide more advanced charting, social trading, and a larger ecosystem of plugins and tools. You may find more options with top-tier competitors like Pepperstone if you seek the latest platform innovation or broader third-party integrations.

| IFC Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | NetTradeX, MT4, MT5 | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

4 / 5IFC Markets provides a solid suite of in-house research and analytics tools with several unique features that set it apart from many competitors.

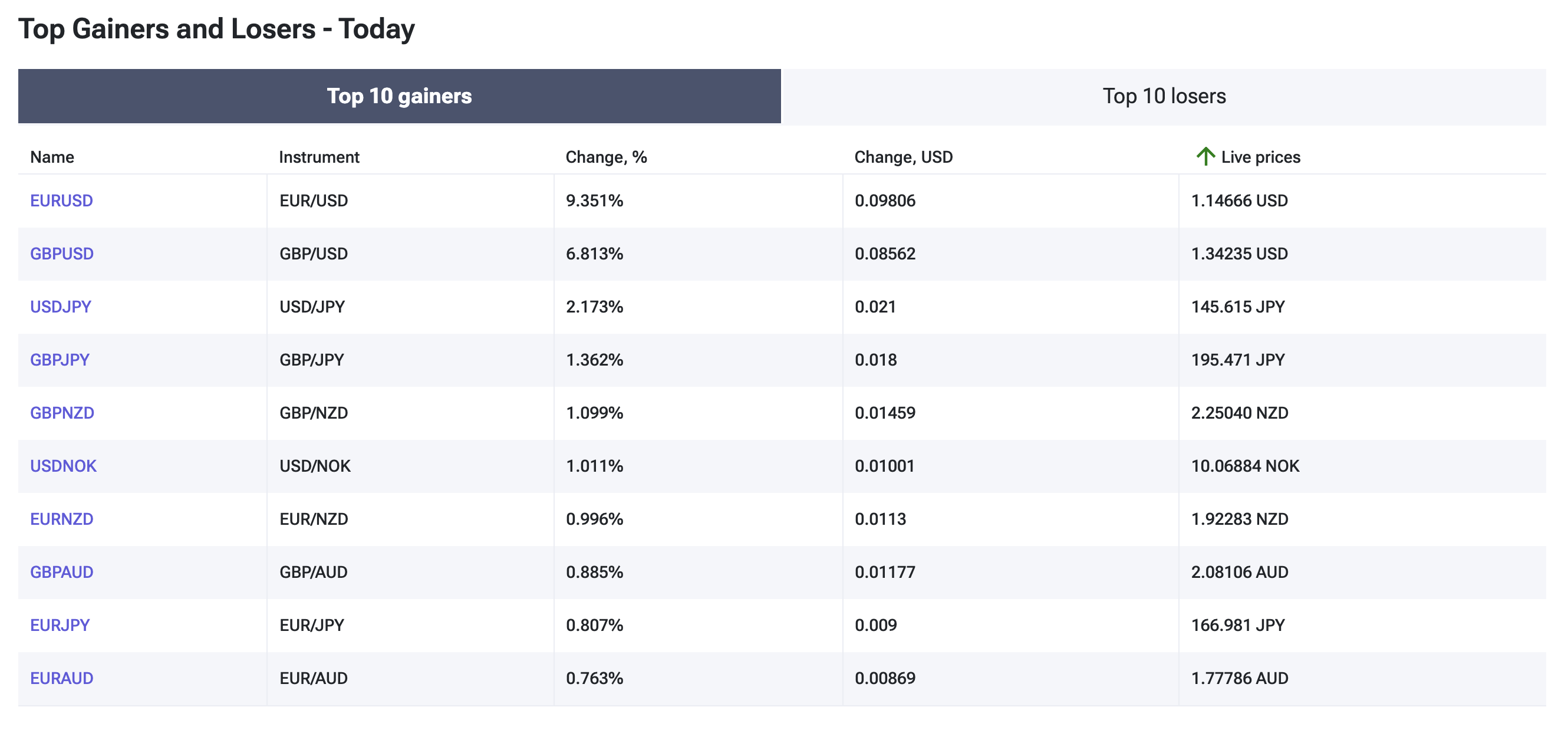

One standout is the Top Gainers and Losers tool, which instantly identifies the 10 instruments with the highest gains and losses over customizable timeframes – from a single day to a full year – across asset classes like stocks, forex, indices, commodities, ETFs, and even synthetic instruments.

I find this feature especially useful for spotting momentum opportunities and market trends at a glance, and it allows for further filtering by exchange or sector, which I’ve found handy for narrowing down actionable ideas.

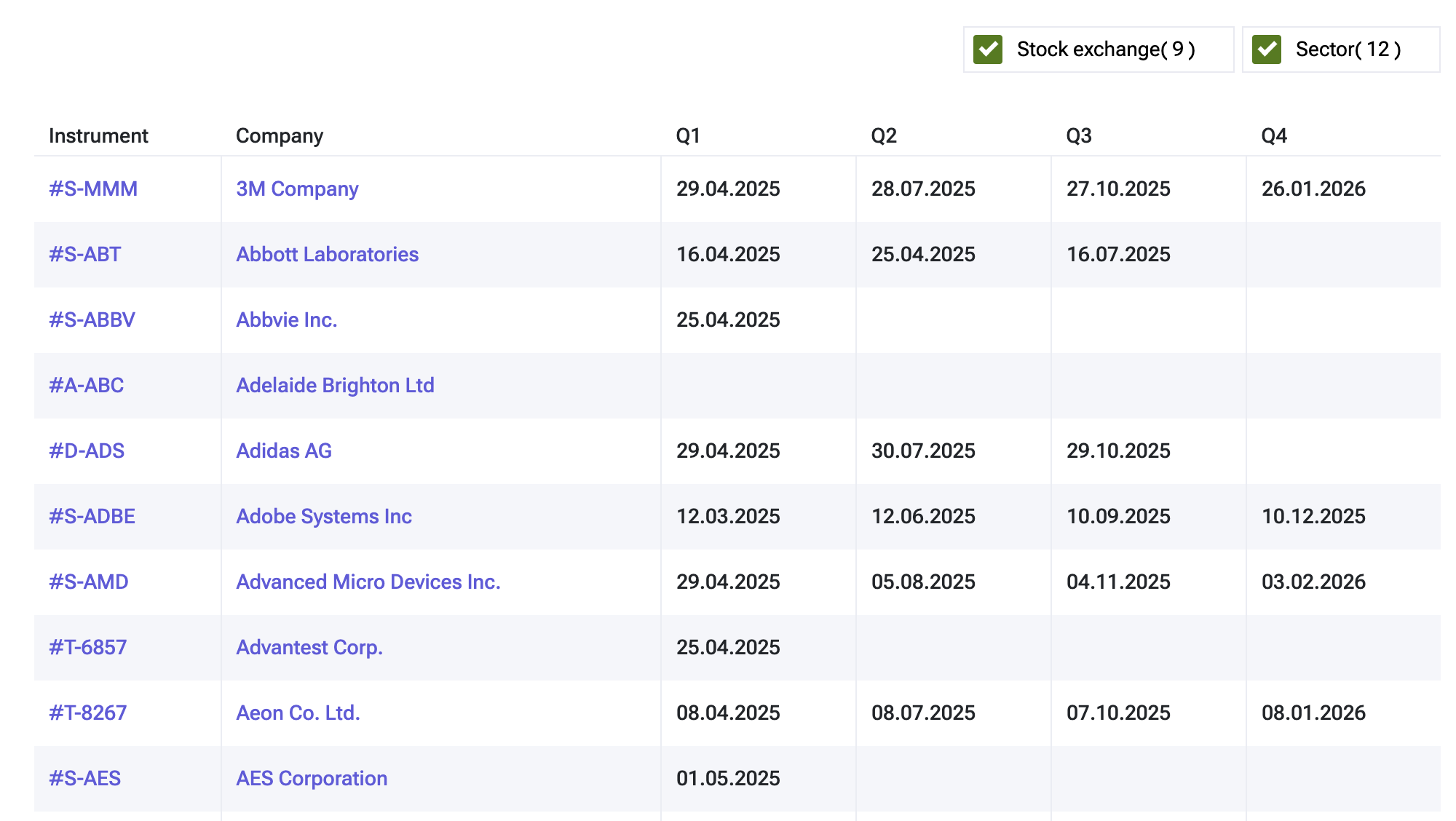

Another valuable resource is the Earnings Calendar, which tracks upcoming corporate earnings announcements across major global exchanges.

This tool helps to anticipate volatility and plan stock or index trades around key financial releases, a crucial aspect of trading equities or sector-based instruments.

IFC Markets also offers Trading Signals (live account holders only), providing actionable trade ideas based on technical analysis for various instruments. While these signals are not as advanced as those from providers like Trading Central or Autochartist, they offer practical entry and exit suggestions for novice traders.

Technical Analysis is a core part of IFC Markets’ research suite, with regular written updates covering forex, stocks, commodities, and cryptocurrencies. I’ve read many of them and these analyses are detailed and easy to follow, often highlighting key chart patterns, support/resistance levels, and trend directions.

In addition, the Trading News also delivers timely articles on market-moving events, fundamental developments, and sector-specific stories, helping you stay informed about global financial markets.

Unfortunately, IFC Markets does not integrate third-party research from leading providers such as Trading Central or Autochartist. It also does not provide live news feeds from major agencies like Reuters or Dow Jones or produce research videos or podcasts, which are increasingly common among top-tier brokers like IG to deliver timely market insights.

Although you’ll need to supplement IFC Markets’ resources with external tools for multi-source research or multimedia analysis, the broker’s research suite is more comprehensive than many mid-tier brokers.

| IFC Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

3.5 / 5IFC Markets offers a comprehensive suite of educational resources with a clear emphasis on supporting beginner and intermediate traders.

The broker provides a structured introduction to forex trading, covering essential concepts, trading terminology, and practical guidance on using their platforms.

The educational content is delivered through articles, tutorials, and video lessons, which I’ve found easy to follow and designed to build foundational knowledge step by step.

The video content is practical and beginner-friendly, and the articles are well-organized, making it easy for new traders to progress from basic concepts to more advanced topics.

However, IFC Markets’ educational resources are somewhat limited for advanced traders. While the materials are thorough for beginners, they are less in-depth in advanced technical analysis, risk management, or algorithmic trading.

| IFC Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

3.8 / 5IFC Markets offers a comprehensive customer support system accessible through multiple channels, including live chat, phone, email, Telegram, WhatsApp, and even callback requests.

Support is available in several languages – such as English, Russian, Spanish, Vietnamese, French, Portuguese, and Korean – covering a broad international client base with dedicated service hours for each language.

In my hands-on experience speaking to IFC Markets, the live chat and email responses were prompt and professional, with most inquiries resolved efficiently, particularly during standard business hours.

A notable strength is the breadth of contact options and the ability to reach support directly from trading platforms or websites, which streamlines the process for urgent queries.

Multilingual support is a significant advantage for non-English speakers, and the company’s commitment to regional service hours demonstrates a focus on global accessibility. The availability of standard inquiry forms – such as password resets, complaints, and callback requests – further simplifies issue resolution for common problems.

However, there are some areas where IFC Markets lags behind top-tier brokers. Customer support is not available 24/7 – instead, it operates primarily during weekdays and within specific regional time slots (e.g. Mon-Fri, 06:00-19:00 CET in the UK).

This can be a drawback for traders in different time zones or those who require assistance on weekends or after hours. While most leading brokers now offer round-the-clock support, IFC Markets’ broad coverage may not be as convenient for highly active or international traders.

Additionally, while the support team is generally knowledgeable, high-volume or professional traders may notice the absence of a dedicated account manager during peak times.

| IFC Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With IFC Markets?

IFC Markets offers strong flexibility, innovative synthetic asset creation, and broad market access, making it appealing for day traders who value variety and customization. Its low minimum deposits and multi-platform support are also pluses for newer traders.

However, it lacks top-tier regulation, 24/7 support, and advanced features like integrated news and analysis from third-party sources, which seperate it from the best day trading brokers we’ve tested.

If you prioritize the MetaTrader platform and ease of entry, IFC Markets is a solid option, but top global brokers may be better suited for the most advanced tools and choice of trading platforms.

FAQ

Is IFC Markets Legit Or A Scam?

IFC Markets is a legitimate broker regulated by the BVI FSC. The company also maintains professional indemnity insurance, which adds more protection for clients.

While it does not hold licenses from top-tier regulators like the FCA, CySEC or ASIC, there isn’t evidence of scam activity from our research, and it is generally considered secure for most retail traders.

Is IFC Markets Suitable For Beginners?

IFC Markets is generally suitable for beginners due to its low minimum deposit, well-supported platforms and educational resources, including demo accounts and beginner-focused materials.

However, the lack of top-tier regulation means lower investor protection than leading brokers, and the availability of high leverage can increase risk for inexperienced traders if not used carefully.

Top 3 Alternatives to IFC Markets

Compare IFC Markets with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

IFC Markets Comparison Table

| IFC Markets | Interactive Brokers | Dukascopy | World Forex | |

|---|---|---|---|---|

| Rating | 2.9 | 4.3 | 3.6 | 4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs, Synthetics | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $1 | $0 | $100 | $1 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | BVI FSC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | SVGFSA |

| Bonus | – | – | 10% Equity Bonus | 100% Deposit Bonus |

| Education | Yes | Yes | Yes | No |

| Platforms | NetTradeX, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5 |

| Leverage | 1:400 | 1:50 | 1:200 | 1:1000 |

| Payment Methods | 10 | 6 | 11 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by IFC Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| IFC Markets | Interactive Brokers | Dukascopy | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | Yes | No | Yes | No |

IFC Markets vs Other Brokers

Compare IFC Markets with any other broker by selecting the other broker below.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of IFC Markets yet, will you be the first to help fellow traders decide if they should trade with IFC Markets or not?