FxPro Review 2025

Awards

- Best Online Broker (MENA) 2024 - Forex Awards

- Best Trading Conditions APAC 2023 - Forex Awards

- Best Trading Platform 2023 - Investors Chronicle & Financial Times

- Best FX Service Provider 2023 - City of London Wealth Management Awards

- Most Trusted Broker (Global) 2021 - Ultimate Fintech Awards

- Best Broker 2021 (UK) - Ultimate Fintech Awards

- Best Mobile Trading App 2021 - Ultimate Fintech Awards

Pros

- FxPro's Wallet is a standout feature that allows traders to manage funds securely. By segregating unused funds from active trading accounts, the Wallet provides additional protection and convenience.

- FxPro operates under a 'No Dealing Desk' (NDD) model, ensuring fast and transparent order execution, often under 12 milliseconds, ideal for short-term trading strategies.

- FxPro offers four reliable charting platforms, notably the intuitive FxPro Edge, with over 50 indicators, 7 chart types and 15 chart timeframes.

Cons

- While FxPro provides 24/5 customer support through multiple channels that performed well during testing, it lacks 24/7 availability, which can disadvantage traders needing assistance outside traditional market hours.

- There are no passive investment tools like copy trading or interest paid on cash. While active traders may not miss these, competitors like eToro catering to active and passive investors have more comprehensive offerings.

- Despite a growing Knowledge Hub and a $10M funded demo account, FxPro is geared towards advanced traders, with beginners potentially finding the account and fee structure complex.

FxPro Review

Regulation & Trust

4.4 / 5Established in 2006, FxPro is a multi-award-winning broker with a strong reputation for providing reliable and technologically advanced trading solutions to retail and institutional traders in over 170 countries.

FxPro is regulated by two ‘green tier’, one ‘yellow tier’ and two ‘red tier’ financial authorities in DayTrading.com’s Regulation and Trust Rating:

- FxPro UK Limited is authorized by the Financial Conduct Authority (FCA) (license number 509956). ‘Green tier’.

- FxPro Financial Services Ltd is authorized by the Cyprus Securities and Exchange Commission (CySEC) (licence number 078/07). ‘Green tier’.

- FxPro Financial Services Ltd is authorized by the South African Financial Sector Conduct Authority (FSCA) (license number 45052). ‘Yellow tier’.

- FxPro Global Markets Ltd is authorized by the Securities Commission of The Bahamas (SCB) (license number SIA-F184). ‘Red tier’.

- FxPro Global Markets Ltd is authorized by the Seychelles Financial Services Authority (FSA) (licence number SD120). ‘Red tier’

This regulatory structure emphasizes FxPro’s commitment to compliance, financial stability, and client protection.

The broker also offers negative balance protection, adding an extra layer of safety during volatile market conditions, ensuring you can’t lose more than your account balance.

Retail traders from the UK and the EEA are further protected under the Financial Services Compensation Scheme up to £85,000 and the Investors Compensation Scheme up to €20,000, respectively.

| FxPro | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FCA, CySEC, FSCA, SCB, FSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

3.8 / 5Live Accounts

FxPro offers several account types depending on your preferred pricing model, budget, location and primarily, trading platform:

- FxPro Standard: Suitable for beginner traders seeking competitive, all-inclusive spreads from 1.2 pips without commissions. There is no minimum deposit. It is available for the MT4/5 and cTrader platforms.

- FxPro Raw+: Focused on providing raw spreads without markups, making it an excellent choice for active traders prioritizing direct market pricing. A $200 minimum deposit and commissions are added at $3.50 per lot per side. Available for MT4/5 platforms only.

- FxPro Elite: A premium offering tailored for traders with minimum deposits over $1,000. It combines the benefits of the Raw account with additional perks like trading rebates, making it ideal for high-volume traders. Available for MT4/5 platforms only.

FxPro’s accounts offer flexibility for short-term traders, notably minimum lot sizes from 0.01 lots, catering to traders dealing in smaller volumes, and high leverage up to 1:2000 depending on your location, catering to advanced traders.

Demo Accounts

When I started with FxPro, its demo account was the perfect introduction to trading without any financial risk.

Upon signing up, I could assign up to a whopping $10,000,000 in virtual funds to experiment with trading across realistic market conditions.

FxPro’s demo platforms – MT4, MT5, cTrader, and FxPro Edge – each offer unique features, and exploring them helped me find what worked best for my style.

My only disappointment is that demo accounts are limited to 180 days, which needed to be longer to test some swing trading strategies I was developing.

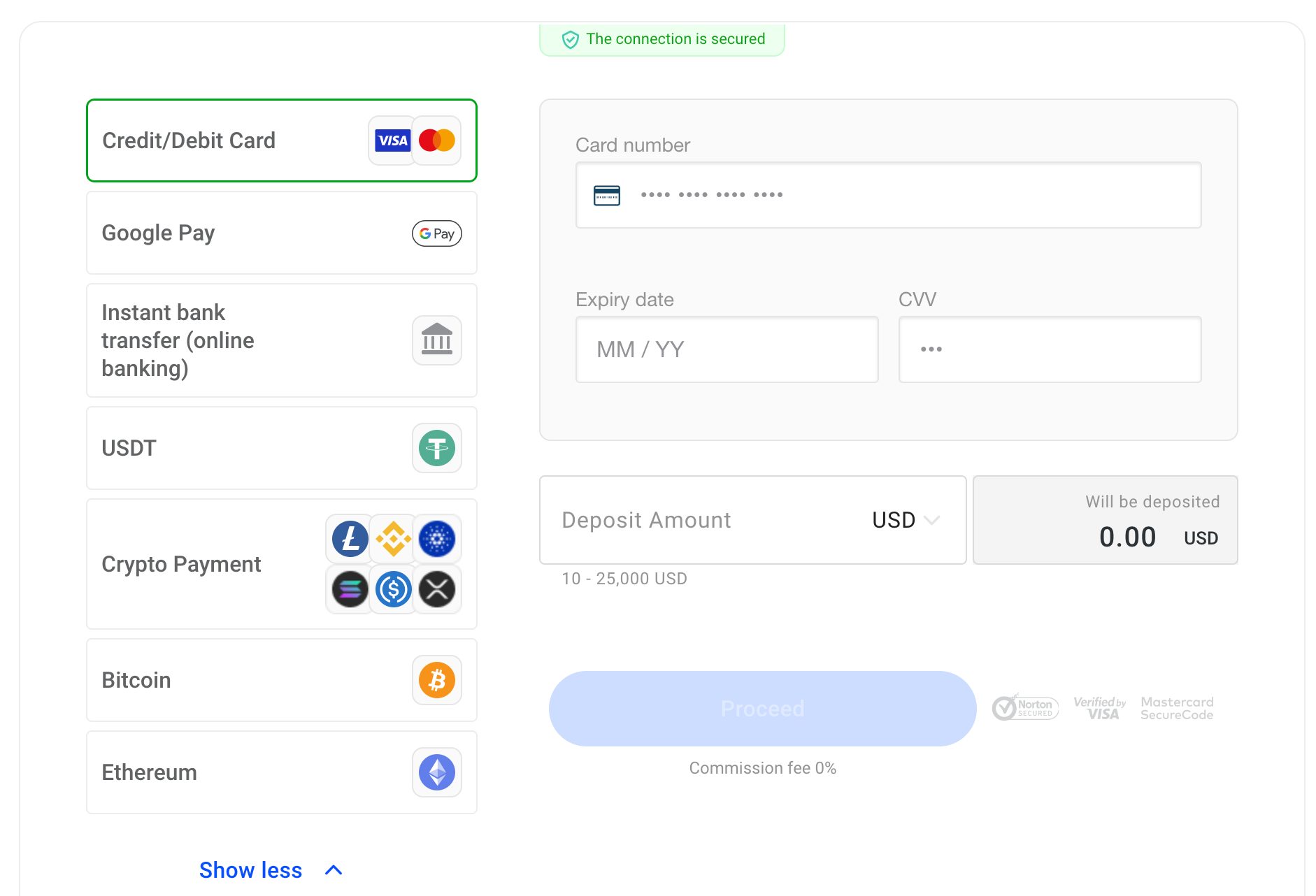

Deposits & Withdrawals

FxPro offers a good variety of funding methods to make deposits into your trading account or FxPro Wallet, catering to different needs.

From personal experience, the process is intuitive and versatile. Once you log into the client area, you can access the virtual Wallet and choose your preferred deposit method.

Depending on your location, supported options can include debit cards, credit cards, Google Pay, and 10+ cryptocurrencies (eg Bitcoin payments, Ethereum payments). However, I am limited to debit/credit card and bank transfers for my GBP base account.

The minimum deposit at FxPro is $100 (or equivalent base currency), an affordable entry point for newer traders, and can be made in AUD, CHF, EUR, GBP, JPY, PLN, and USD.

Withdrawals are equally hassle-free, with most of the same methods available. Based on my experience, withdrawals are typically processed within a few hours, while bank transfers can take a few business days, depending on the provider.

A significant advantage is that FxPro does not charge fees for deposits or withdrawals. However, your payment provider may impose charges – especially if it’s crypto – so it’s important to verify beforehand so you’ve got a handle on all costs.

The FxPro Wallet is already a strong tool, but introducing multi-currency wallets with dynamic conversion rates or integrated budgeting tools could improve fund management.For instance, automatic savings of a portion of deposits could help me to manage risk more effectively.

| FxPro | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Bitcoin Payments, Credit Card, Ethereum Payments, Google Pay, Maestro, Mastercard, Neteller, PayPal, Skrill, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Minimum Deposit | $100 | $0 | $100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

4 / 5FxPro specializes in CFD trading, a popular instrument with day traders. Traders in the UK can also spread bet for short-term trading opportunities with tax advantages.

Its depth of assets is fairly strong, particularly in terms of currency pairs, equities and indices, however it doesn’t rival the 26,000+ markets advanced traders will find at category leader BlackBull.

You can trade:

- Forex: 70+ major, minor and exotic pairs (eg EUR/USD, AUD/NZD).

- Stocks: 2,000+ stocks across major US and European stock exchanges (eg Apple, Barclays).

- Crypto: 28+ cryptocurrency pairs (eg BTC/USD, ETH/USD) available for 24/7 trading since 2021.

- Metals: 12+ metals (eg gold, silver, palladium).

- Indices: 18+ covering the US, Europe, Asia, and Australia (eg DAX 40, US 30).

- Energy: 3+ energy commodities (eg Brent crude oil, natural gas).

- Futures: 38+ contracts (eg cocoa, sugar, crude oil).

To expand its user base, FxPro could diversify its offerings by including ETFs, options, fixed-income securities, and interest rate derivatives.Moreover, introducing a social trading feature available at brokers like eToro would allow users to replicate the strategies of experienced traders and pursue passive investment approaches.

| FxPro | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:30 (Retail), 1:500 (Pro), 1:1000 (Via Prime Ash Capital Limited) | 1:50 | 1:200 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

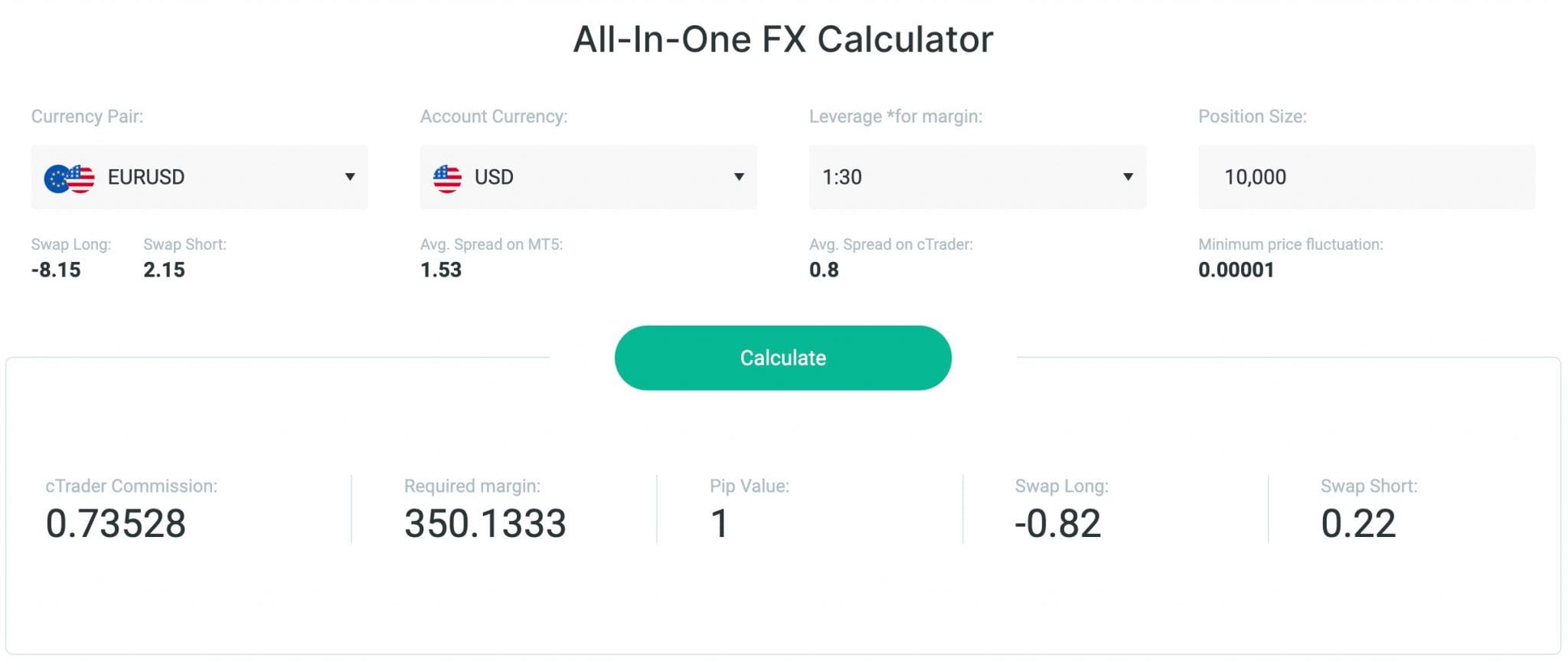

Fees & Costs

4 / 5FxPro offers competitive spreads that vary by account type and asset. However, while fees offer good value, particularly with the available trading tools and resources, they’re not low enough to rival industry giants such as IG and CMC Markets.

The MT4 account features minimum fixed spreads starting at 1.2 pips, while the MT5 and cTrader accounts provide variable spreads starting at 1.4 and 0 pips, respectively.

Unusually, FxPro offers fixed spreads on 9 currency pairs (including EUR/GBP, EUR/JPY, an EUR/USD, GBP/JPY) on MT4, offering greater price certainty for cost-conscious traders.

In 2022, FxPro revised its pricing, reducing spreads by up to 20% on popular instruments like major forex pairs, indices, metals, and energies, enhancing competitiveness for heavily traded assets.

But it’s FxPro’s cTrader platform that provides the most competitive spreads, using a commission-based pricing model, making it an attractive option for active traders.

Additional fees include overnight swap rates and a one-off inactivity fee of $15 (followed by a monthly fee for each further inactive month) for accounts not used within six months.

| FxPro | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.45 | 0.08-0.20 bps x trade value | 0.1 |

| FTSE Spread | 171.63 | 0.005% (£1 Min) | 100 |

| Oil Spread | 39 | 0.25-0.85 | 0.1 |

| Stock Spread | Variable | 0.003 | 0.1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

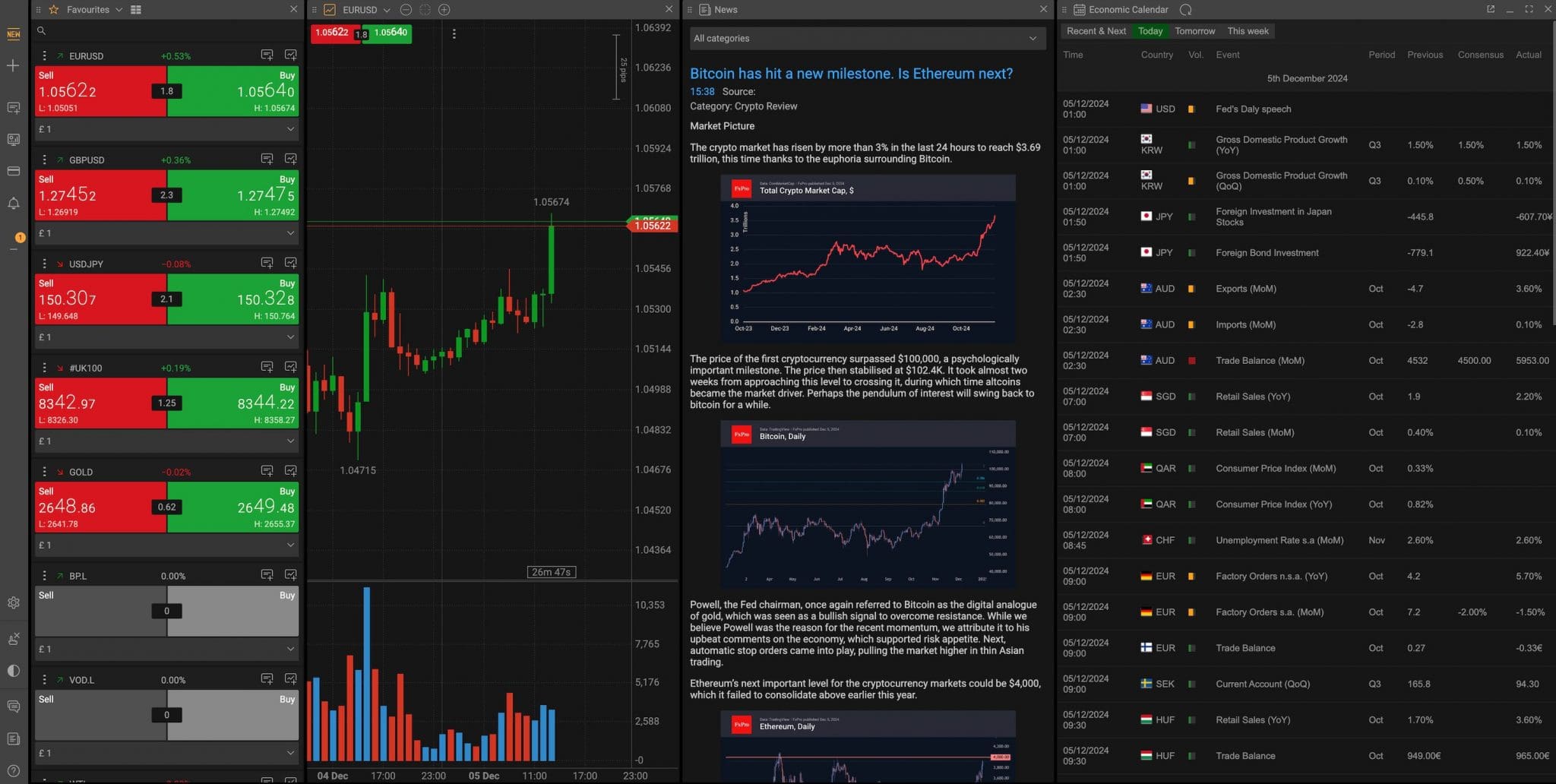

4.3 / 5FxPro’s trading platforms are a strong point, offering flexibility and choice for day traders of all levels.

The broker provides access to industry-standard platforms like MT4 and MT5, which are reliable and provide an extensive range of tools for forex traders.

Additionally, the cTrader platform stands out for its advanced charting, customizable interface, and suitability for algorithmic trading.

I like the FxPro Edge platform and think it’s one of the best proprietary platforms I’ve used due to its simplicity and flexibility.

Being web-based, FxPro Edge is also accessible from any device with a browser, eliminating the need for downloads or installations.

With 53 indicators and several selectable chart types, a standout feature for me is its customizable interface, which allows me to arrange and resize windows, enabling a personalized trading experience.

I also especially like the draggable take-profit (TP) and stop-loss (SL) levels, which make managing trades incredibly smooth and visually intuitive.

It also seamlessly integrates with FxPro’s other tools, such as the economic calendar and news, enhancing its utility.

However, the FxPro Edge platform has some limitations. Compared to advanced platforms like MT4, MT5, or cTrader, it lacks support for algorithmic trading and complex analytical tools, which could be a drawback for experienced or technically inclined traders.

Additionally, unlike cTrader or MetaTrader, it does not integrate Trading Central signals within the platform and does not offer features like copy trading or social trading. While its simplicity benefits beginners, more advanced users may find it limiting.

The platforms are highly responsive, with excellent execution speeds and minimal slippage, especially during peak trading hours.The ability to trade via desktop, mobile, or web ensures I can stay connected to the markets wherever I am.

However, there is room for improvement. Compared to brokers like eToro, FxPro could enhance its platforms by integrating social trading features or a built-in copy trading system, which are increasingly popular among beginners and those seeking passive strategies.

| FxPro | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

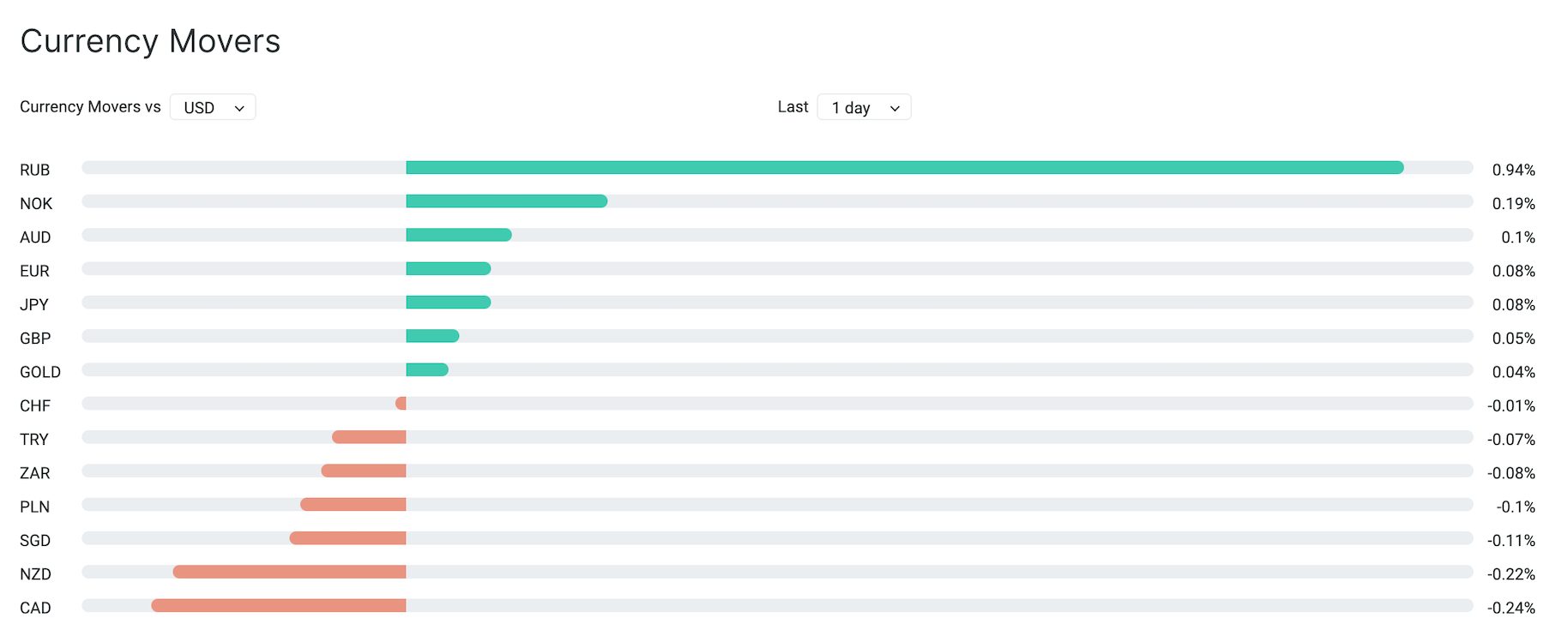

Research

4 / 5I’ve found FxPro’s research tools to be particularly helpful for beginners. The Trading Central signals, which provide actionable insights based on technical analysis, are especially valuable.

These signals, integrated into platforms like MetaTrader and cTrader, highlight key levels and potential opportunities, making it easier for newcomers to understand how professional traders spot market movements.

For those who prefer less active involvement, FxPro also offers an end-of-day email summarizing any opportunities identified for the following day, which is great for staying informed without constant monitoring.

Another helpful tool is the economic calendar, which keeps active traders like me updated on upcoming events – like financial reports or central bank announcements – that could influence market movements.

The market news feature also ensures I’m always aware of global developments that may affect my trades.

However, I have noticed that FxPro lacks regular webinars or podcasts, unlike XM and Tickmill, for ongoing insights. These additional resources could make its research tools even more accessible for traders at all levels.

While Trading Central signals are great, FxPro lacks real-time market analysis. I’d love to see regular webinars and podcasts providing valuable live interaction and direct insights from experts.

| FxPro | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

4 / 5FxPro offers a range of educational tools aimed at beginners. Available for free on its website, resources include trading basics, tutorials, and explanations of market concepts.

These tools are accessible and straightforward, providing a good foundation for new traders. I particularly appreciate the glossary of terms and guides on trader psychology and high-frequency trading strategies, amongst many others.

However, FxPro’s educational offering could be more comprehensive. Some competitors like IG include interactive features like structured courses, quizzes, and live webinars.

Additionally, while the written guides are clear, incorporating more multimedia content like video tutorials or step-by-step walkthroughs could cater better to different learning styles.

Expanding topics to include advanced trading strategies or market analysis techniques would make the resources appealing to intermediate and advanced traders.

| FxPro | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

4 / 5I’ve found FxPro’s customer service options to be accessible and generally reliable.

The broker offers 24/5 live chat, WhatsApp, Telegram, Facebook Messenger, email, and phone support, which is convenient for resolving most trading-related queries during market hours.

The live chat feature, available directly on the website and within the client dashboard, is my go-to option for quick responses to questions like account setup and platform features.

The email support is professional for more complex inquiries, though frustratingly response times can sometimes stretch to a few hours.

Phone support is also straightforward, with knowledgeable and willing staff. A callback option is available upon request too.

FxPro’s Help Centre offers a well-organized FAQ section covering key topics like account setup, deposits, withdrawals, platform use, and trading conditions. I’ve found it particularly useful for finding quick answers and solving issues, especially for beginners, and the video tutorials are excellent.

Offering 24/7 support, like IC Markets, would be invaluable for traders handling issues outside regular trading hours.Additionally, providing dedicated account managers to all clients – not just high-volume traders – could greatly enhance personalized assistance.

| FxPro | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With FxPro?

FxPro is a trusted broker that’s upped its game over the years, offering competitive spreads, especially in its raw account, fast execution with speeds of less than 13 ms, and access to popular platforms like MT4, MT5, and cTrader.

If you prioritize short-term trading with advanced tools and strong regulatory oversight, FxPro is worth considering.

FAQ

Is FxPro Legit Or A Scam?

FxPro is a legitimate and well-established broker that has been operating since 2006.

It is regulated by reputable authorities, including the FCA (UK) and CySEC (Cyprus), ensuring compliance with strict financial standards.

It also expanded its presence in the Middle East and North Africa (MENA) in 2023, opening a new office in Dubai.

FxPro offers a secure trading environment with segregated client funds, negative balance protection, and no re-quote execution policies.

However, as with any broker, it’s essential to research and assess its suitability for your trading needs.

Is FxPro Suitable For Beginners?

FxPro is suitable for beginners thanks to its range of well-supported platforms, including MT4, MT5, and cTrader, and its own easy-to-use web-based platform.

The demo account provides $10,000,000 in virtual funds, allowing new traders to practice risk-free. Additionally, FxPro offers negative balance protection and a responsive support team, which are crucial for beginners.

However, its various account types, variable spreads, and commission structures require some learning to be wholly understood.

Does FxPro Offer A Mobile App?

Yes, FxPro offers an excellent app for iOS and Android devices.

Undergoing a revamp in 2024, it now sports an intuitive mobile trading environment, complete with CFD trading, account management, in-app deposits and withdrawals, plus an integrated economic calendar and push notifications.

Top 3 Alternatives to FxPro

Compare FxPro with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

FxPro Comparison Table

| FxPro | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| Rating | 4.4 | 4.3 | 3.6 | 4.4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, Stock CFDs, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $100 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FCA, CySEC, FSCA, SCB, FSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | NFA, CFTC |

| Bonus | – | – | 10% Equity Bonus | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Education | Yes | Yes | Yes | Yes |

| Platforms | FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:30 (Retail), 1:500 (Pro), 1:1000 (Via Prime Ash Capital Limited) | 1:50 | 1:200 | 1:50 |

| Payment Methods | 11 | 6 | 11 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by FxPro and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| FxPro | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | Yes | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | Yes | No | No | No |

| Volatility Index | No | No | Yes | No |

FxPro vs Other Brokers

Compare FxPro with any other broker by selecting the other broker below.

The most popular FxPro comparisons:

- FXPro vs FBS

- Exness vs FxPro

- FXPro vs Pepperstone

- XM vs FXPro

- FxPro vs MultiBank FX

- FxPro vs IronFX

- IC Markets vs FxPro

Customer Reviews

4 / 5This average customer rating is based on 2 FxPro customer reviews submitted by our visitors.

If you have traded with FxPro we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of FxPro

Article Sources

- FxPro

- FxPro UK Limited - FCA License

- FxPro Financial Services Ltd - CySEC License

- FxPro Financial Services Ltd - FSCA License

- FxPro Global Markets Ltd - SCB License

- FxPro Global Markets Ltd - FSA License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

What I really like about day trading with FxPro is the little details. For example, in the client area they have a dashboard that counts down until various global exchanges open, including the ones I trade on (New York and Tokyo). The financial calendar you can filter by importance, which is great for me who trades around major economic announcements. EVen the FxPro app I downloaded through a useful QR code so it took 30 seconds flat. All these little things click together for a genuinely smooth trading experience without all the hiccups and annoyances I’ve had day trading at other providers.

FxPro offers multiple platforms—MT4, MT5, and cTrader—which is perfect for traders who like flexibility. I personally use MT5 for its advanced charting and indicators, but I’ve also tested cTrader and was impressed by the precision and speed. It’s great to have options depending on your trading style.