Exness Review 2025

See the Top 3 Alternatives in your location.

Awards

- Best Multi-Asset Broker - Finance Magnates Africa Summit (FMAS) 2024

- Most Trusted Broker in Africa - Finance Magnates Africa Summit (FMAS) 2024

- Most Trusted Broker MEA 2024 - iFX EXPO Dubai 2024

- Best IB/Affiliate Programme MEA 2024 - iFX EXPO Dubai 2024

- Best Trading Conditions 2024 - UF Awards LATAM 2024

- Best Multi-Asset Broker - Smart Vision Investment Expo 2023

- Most Trusted Broker - Smart Vision Investment Expo 2023

Pros

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

Cons

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

Exness Review

This review of Exness evaluates the trading experience using the 200+ data points and multiple rounds of hands-on tests we’ve been conducting since August 2021, plus comparisons with our 232 alternative brokers.

Regulation & Trust

Exness is trusted. It’s a long-standing, award-winning global brokerage operating since 2008.

The broker is regulated by one ‘green tier’ regulators (FCA), two ‘yellow tier’ regulators (FSCA, CMA), and four ‘red tier’ regulators (FSA, FSC, CBCS, BVIFSC) according to DayTrading.com’s Regulation & Trust Rating.

Exness also complies with international security standards like PCI DSS, ensuring robust financial protections.

Pros

- Client funds are kept in segregated accounts for added security.

- Negative balance protection prevents you from losing more than your deposit.

- Follows stringent international standards for data protection and financial transparency.

Cons

- No longer authorized by the FCA or CySEC to provide retail trading services.

- Lack of investor compensation schemes could be a drawback for risk-averse clients.

- Varying jurisdictional protections may lead to inconsistent client experiences across regions.

| Exness | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Exness has refined its account options over the years, notably introducing commission-based accounts like Raw Spread that will appeal to day traders.

Live Accounts

- Standard: The most popular account has a low minimum deposit (varies by country and payment method), spreads from 0.2 pips, no commission, and a full range of instruments (forex, metals, cryptocurrencies, energies, stocks, indices).

- Standard Cent: Similar to the Standard Account, but designed for new traders. Spreads are slightly higher at 0.3 pips, but trading is limited to micro lots (0.01). Instruments are also limited to forex and metals.

- Pro: Tailored for more experienced traders with lower margin calls (30% down from 60%). Spreads are also tighter (from 0.10 pips), but the minimum deposit is $200.

- Raw spread: Ideal for day traders looking for tight spreads starting from 0.0 pips on popular assets like major forex pairs, though it charges a commission ($3.50 each side per lot). Minimum deposit is $200.

- Zero: Offers traders ultra-tight spreads, starting at 0.0 pips on major assets, providing an appealing option for active traders prioritizing minimal spreads. Exness applies a per-lot commission of $0.05 for each side per lot to balance these low spreads.

When I set up my live account with Exness, I appreciated the Google social login option because it saved me time. However, I would have liked two-factor authentication (2FA) to provide an added layer of security.

To deposit funds and start trading, I first had to confirm my email address and phone number (the dialing code had to match the country code I signed up with) before uploading Proof of Identity (POI) and Proof of Residence (POR) documents. Once submitted, my account was approved in under 24 hours.

Deposits & Withdrawals

Exness provides a wide range of deposit and withdrawal options, including credit/debit cards and e-wallets. Many transactions are processed instantly, and most methods have no fees. However, there’s no bank wire transfer option, which is unusual.

Exness offers base accounts in over 40 currencies (AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MBT, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR), which is by far the most extensive selection we’ve ever seen and can undoubtedly help you save on currency conversion fees. eToro, by comparison, only supports GBP and USD for deposits, holdings, and trades.

Pros

- Excellent variety of account types for both beginners and experienced traders.

- Faster execution speeds are now available in advanced trading accounts.

- Industry-leading choice of 40+ base currencies.

Cons

- Standard Cent account limits base currency accounts to six.

- Minimum withdrawal thresholds differ for specific methods.

- Payment methods can vary by region.

| Exness | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Bitcoin Payments, JCB Card, Mastercard, Neteller, Perfect Money, Skrill, Sticpay, Visa, WebMoney, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Minimum Deposit | Varies based on the payment system | $0 | $100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

Exness offers a strong array of instruments for short-term trading notably over 100 currency pairs, in addition to cryptocurrencies, commodities, indices, and stocks.

This selection is competitive with other CFD-only brokers we’ve evaluated, many of whom provide similar or slightly fewer offerings.

However, despite increasing its range of CFDs over the years, firms like Interactive Brokers, IG, and eToro still offer a much more comprehensive selection, especially for traders interested in a broader range of stocks and ETFs.

Additionally, passive income options like interest on uninvested cash aren’t available.

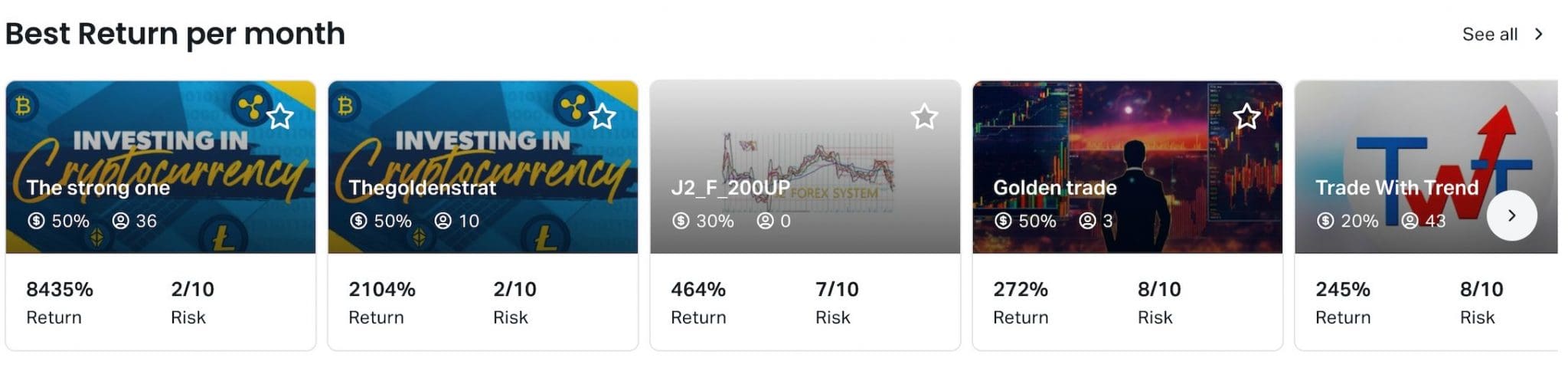

Exness has brought out a unique copy trading feature on both its web platform and mobile app, although I found that a strategy’s performance statistics need to be more thorough to help investors make informed decisions.

Pros

- Excellent range of over 100 currency pairs.

- Popular cryptocurrencies like Bitcoin are available to trade through CFDs.

- Exclusive copy trading feature on both web and mobile apps.

Cons

- Limited selection of individual stocks.

- Cryptocurrency range is significantly smaller than dedicated crypto exchanges.

- No ETFs, options or bonds.

| Exness | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:Unlimited | 1:50 | 1:200 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

Exness is reasonably cost-effective compared to leading brokers. In particular, it’s best for forex and high-volume traders seeking low fees, especially since lowering its spreads in 2024.

Exness offers particularly competitive trading fees on its Raw Spread and Zero accounts, where active traders benefit from very low or zero spreads on popular instruments, although commissions are added per lot.

Standard accounts feature no commission, with floating spreads beginning at around 0.2 pips, making them appealing for traders seeking cost-effective options.

Pros

- Exness waives deposit and withdrawal fees.

- Standard accounts have no commission fees.

- Raw Spread account offers near-zero spreads, ideal for scalpers and high-frequency traders.

Cons

- Fee structures and spreads vary by account, which may confuse beginners.

- Standard Cent account has significantly reduced instruments.

- Many top-tier brokers like IC Markets can better Exness’ spreads.

| Exness | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.0 | 0.08-0.20 bps x trade value | 0.1 |

| FTSE Spread | 15.2 | 0.005% (£1 Min) | 100 |

| Oil Spread | 0.0 | 0.25-0.85 | 0.1 |

| Stock Spread | 0.5 (Apple Inc.) | 0.003 | 0.1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

Exness has expanded its platform offering, first adding MetaTrader 4 (MT4) and then MetaTrader 5 (MT5) for desktop, web and mobile trading.

Additionally, the broker provides its proprietary Exness Terminal app as a unique web trading solution, although it’s not available for mobile devices in certain areas.

MetaTrader

For straightforward forex trading, MT4 is a reliable albeit dated-looking choice. However, its technical indicators, customizable charts, and automated trading capabilities make it a popular option.

MT5, the more advanced platform, offers a broader range of features, including additional technical indicators, diverse order types, and access to multiple asset classes.

Its Depth of Market (DOM) and economic calendar provide in-depth market insights, but its design is still dated compared to popular alternatives like TradingView.

Exness Terminal

While MetaTrader is a popular platform for forex traders, beginner traders might prefer the Exness Terminal, which provides a simplified trading experience.

Powered by TradingView, the intuitive Exness Terminal makes setting up a watch list a snap and also makes it easy to manage account details such as trading history, balance, equity, margin, free margin, margin level, and leverage settings in real-time.

There’s also a primary built-in economic calendar to take advantage of every important economic event.

The majority of TradingView’s essential features, such as various chart types, timeframes, and indicators, are included in the Exness Terminal, but the collection isn’t as comprehensive as TradingView. For example, I noticed there’s no 2-hour timeframe or Renko chart type.

Check out my video walk through of the Exness Terminal below to get a feel for the design and watch me place a trade.

Pros

- Traders have a choice of three platforms depending on experience.

- All three platforms are accessible on the web without needing downloads.

- Proprietary copy trading features that are intuitive.

Cons

- Beginners may find MetaTrader complex.

- No support for newer platforms like cTrader or TradingView.

- Exness Terminal lacks a lot of MetaTrader’s features.

| Exness | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Mobile App | iOS & Android | iOS & Android | iOS |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

Exness provides various research tools to support traders, including an economic calendar, real-time market news from third-party FXStreet, and trading analysis and signals from third-party Trading Central.

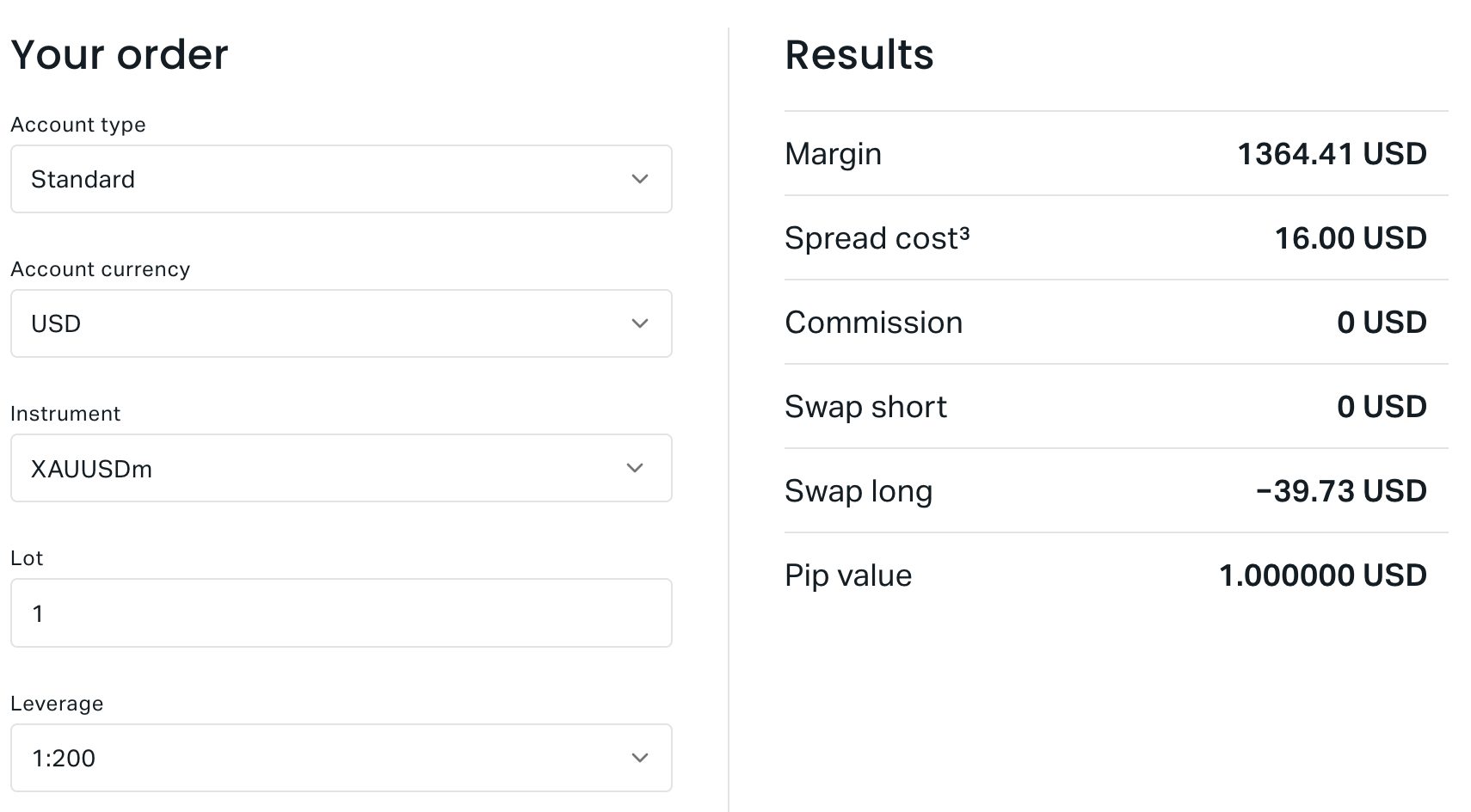

Beginner traders will also appreciate the trading calculator, which lets you calculate pips, margin, spread, and commission depending on your Excess account type and leverage to help simplify complex calculations for your potential trading positions.

Also worth mentioning is the currency converter, which lets you calculate live foreign exchange rates and convert all major and exotic currency pairs. This is a nice touch not usually available at alternatives and is another reason Exness is a great option for forex traders.

The only noticeable omission is Exness’s need for valuable in-house analysis reports to educate and inform beginner traders.

Other brokers like IG produce informative and easy-to-understand reports that break down market movements, making it easier for beginners to understand price fluctuations and discover profitable trading opportunities.

Pros

- Real-time market analysis and news updates.

- A trading calculator helps simplify complex position calculations.

- Technical analysis and trading signals from Trading Central.

Cons

- No in-house analysis reports to inform traders.

- The economic calendar is basic and lacks filtering options.

- News and Trading Central analysis isn’t integrated into Exness Terminal.

| Exness | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

Exness needs to seriously improve its education – it’s a woeful offering that makes it less suitable for beginners.

Competitors like eToro offer a wide array of educational resources, including tutorials, articles, and videos that explore fundamental trading concepts, technical analysis, risk management strategies, and platform navigation. Exness, meanwhile, barely offers any such resources.

Beginner traders will also balk at the lack of interactive live webinars and podcasts you get at many top brokers.

Also disappointing is the lack of structured learning materials tailored to different skill levels, which would provide a more systematic approach to learning and ensure that beginners have the necessary tools and knowledge to navigate the financial markets confidently.

Finally, a glossary of trading terms would help newcomers quickly grasp industry jargon and accelerate their learning process.

Pros

- The blog provides insightful articles on market trends, trading strategies, and economic updates.

- The Help Centre offers informative descriptions of key trading terms.

- Demo account for risk-free practice, which is invaluable for hands-on learning.

Cons

- There are no structured learning courses for complete beginners.

- There are no tutorials, articles, or videos to explore trading concepts.

- No webinars for real-time interactive learning with expert insights.

| Exness | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

Exness offers 24/7 customer support with live chat, email, and phone options, making it accessible and convenient for beginner traders.

Support is available in 15 languages, including English, Chinese, Thai, Vietnamese, Arabic, Bengali, Hindi, and Urdu, which is a plus for global clients, and response times are generally fast based on our tests.

Compared to market-leading brokers, Exness’s around-the-clock 7-day support is a standout feature, while some competitors may only offer limited hours.

Additionally, Exness provides a thorough FAQ and help center, giving beginners quick answers to common questions. However, some brokers offer more comprehensive in-platform support features like guided tours or in-app tutorials.

I’ve relied on the live chat service several times for quick assistance. One instance involved clarifying withdrawal fees. The representative promptly addressed my query within minutes.For more complex issues, I’ve turned to email support. When I needed to enquire about VPS, I submitted an email inquiry. While the response time was a few hours, the detailed, step-by-step instructions made the process straightforward.

One improvement I’d suggest is including a localized direct telephone line or a call-back feature, similar to the service offered by ActivTrades.

Pros

- Multilingual 24/7 support in 15 languages.

- Excellent live chat based on tests.

- FAQ addresses common questions.

Cons

- No phone line support.

- No dedicated account manager support.

- Lacks comprehensive platform video tutorials.

| Exness | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With Exness?

Exness offers improved spreads, enhanced execution speeds, a fantastic selection of currency pairs, a market-leading range of base currencies, and instant withdrawals (depending on your chosen payment provider), making it attractive for cost-conscious but active forex traders.

It also has a user-friendly proprietary platform (as well as MT4/5), and 24/7 support, making it beginner-friendly, though its education offering still needs work.

However, if you’re looking for more regulatory coverage, a broader selection of stocks, insightful in-house analysis, or advanced tradable instruments like options or ETFs, brokers like IG or eToro are a better fit.

FAQ

Is Exness Legit Or A Scam?

Exness is a legitimate broker based on its strong track record, transparent operations, and positive reviews both from its large user base and our years of personally testing the firm.

These features suggest that Exness is trustworthy and not a scam, although traders should always conduct their research before committing to any broker.

Is Exness Suitable For Beginners?

Exness is suitable for beginners due to its user-friendly platform, low minimum deposits, and the availability of a demo account for practice. It allows for smaller trade sizes through its Standard Cent account, which helps new traders manage risk.

Additionally, Exness provides 24/7 customer support and instant withdrawals (depending on the payment method), making the trading process smoother for those just starting.

However, its educational tools are still lacking, marking it behind the best day trading brokers for beginners.

Does Exness Offer Low Fees?

Exness offers relatively low fees, mainly through its Raw Spread and Zero accounts, which feature tight spreads and competitive commission structures.

The Standard account has no commissions, and spreads are kept relatively low.

Exness also does not charge deposit or withdrawal fees for most payment methods, which adds to the cost-effectiveness.

Best Alternatives to Exness

Compare Exness with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

Exness Comparison Table

| Exness | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 4.6 | 4.3 | 3.6 |

| Markets | CFDs on Forex, Stocks, Indices, Commodities, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | Varies based on the payment system | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | – | – | 100% Anniversary Bonus |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:Unlimited | 1:50 | 1:200 |

| Payment Methods | 10 | 6 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by Exness and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Exness | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | Yes |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

Exness vs Other Brokers

Compare Exness with any other broker by selecting the other broker below.

The most popular Exness comparisons:

- Vault Markets vs Exness

- IQ Option vs Exness

- Exness vs WazirX

- FBS vs Exness

- FXTM vs Exness

- Alpari vs Exness

- Libertex vs Exness

- Eightcap vs Exness

- FOREX.com vs Exness

- IC Markets vs Exness

- Exness vs IG

- Pocket Option vs Exness

- Fusion Markets vs Exness

- Olymp Trade vs Exness

- Exness vs VT Markets

- Exness vs MultiBank FX

- Admiral Markets vs Exness

- Bybit vs Exness

- Exness vs Saxo Bank

- XTB vs Exness

Customer Reviews

4.5 / 5This average customer rating is based on 2 Exness customer reviews submitted by our visitors.

If you have traded with Exness we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Exness

Article Sources

- Exness

- Exness (UK) Ltd - FCA License

- Exness ZA (Pty) Ltd - FSCA License

- Exness (SC) Ltd - FSA License

- Exness B.V. - CBCS License

- Exness (VG) Ltd - FSC License

- Exness (MU) Ltd - FSC License

- Exness (KE) Limited - CMA License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I’m in absolute no doubt that Exness is the best broker if you live in Asia or Africa. I spent literally weeks looking for a broker that actually caters to traders from this part of the world (I’m in India) because I wanted to fund my trading account in my own currency and a payment method local to me. Soooo many brokers simply don’t offer that but Exness offers the most base currencies and payment methods tailored to local traders in my part of the world. Eg I opened and run my account in INR and deposit and withdraw through UPI. No stess, no huge fees, just a much smoother and more enjoyable trading experience.

I’m a new forex trader and have been pretty impressed with Exness. Customer support is always available when I need them and the app has a user-friendly interface so easy to learn. It does lack educational tools though so there’s room for improvement.