What Is A Currency Defense?

A currency defense is an economic policy implemented by a government in order to protect its currency’s value from speculators in the foreign exchange market.

A currency defense can take many different forms, but typically involves intervention in the foreign exchange market to buy or sell the currency in order to keep its value within a predetermined range.

Currency defenses can take many different forms, but they all have the same goal: to stabilize the value of a currency and protect the economy from any adverse influence of speculative trading activity.

What is currency speculation?

Currency speculation happens when traders buy and sell currencies in an attempt to make a profit off of changes in exchange rates.

While currency speculation is not necessarily harmful, it can put downward pressure on a currency’s value.

Central banks may try to ward off speculation in their currency to better control inflationary pressures that could ultimately undermine their policy objectives and harm the economy.

A currency defense is one way that a government can try to stabilize its currency and protect it from speculators.

By buying or selling the currency on the open market, the government can help to keep its value within a desired range or at a specific level. This can help to avoid inflation and other economic problems that could be caused by unwanted currency movements.

However, while it’s common to scapegoat speculators, short sellers, and other market participants who might bet against a currency (or stock or other financial asset), they are simply making deductions about what’s likely due to transpire.

For example, George Soros is famous for his 1992 short of the British pound, which earned him more than $1 billion.

But his actions were based on a deep understanding of the UK’s economic situation at the time. In other words, he wasn’t just a rogue trader who caused it all by himself; he (along with his assistant Stan Druckenmiller) had done his homework.

While currency speculation that drives excess volatility and detaches a currency from its fundamental value can be harmful to an economy, it’s important to remember that speculators are almost never to blame when a currency declines in value.

In many cases, they are simply trying to make a profit by correctly predicting what will happen in the market and allocating capital accordingly.

How can a government implement a currency defense?

There are a few different methods that a government can use in order to implement a currency defense. One common method is known as currency intervention.

This involves the government buying or selling currency on the open market in order to influence the exchange rate. Another method is through the use of capital controls, which restrict the flow of currency into and out of the country.

While currency intervention and capital controls can be effective in the short term, they can also have negative effects on the economy in the long term. For example, currency intervention can lead to currency manipulation, which can create an uneven playing field for global trade.

What are some examples of currency defenses?

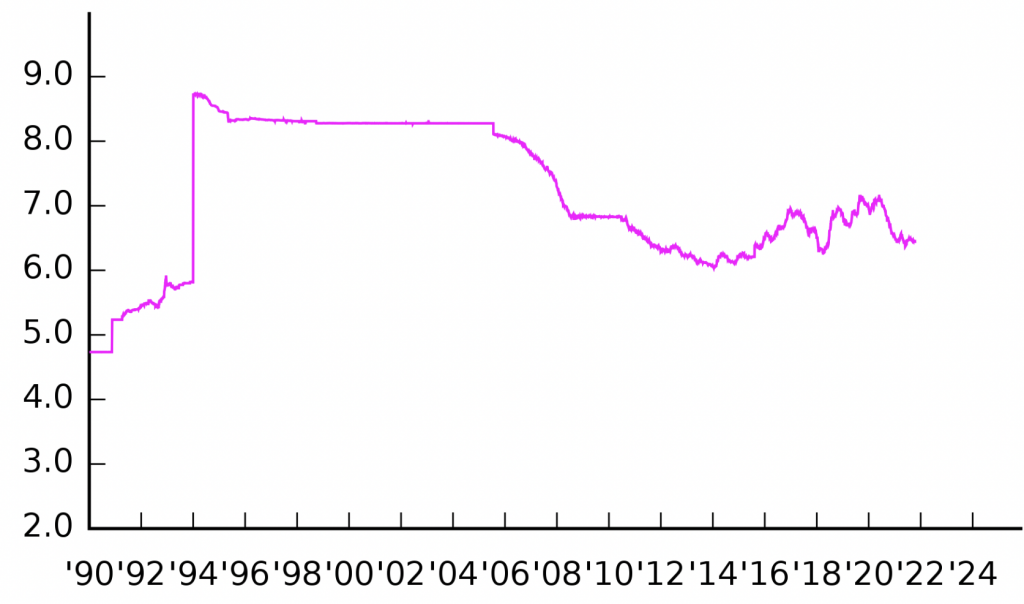

There are many different examples of currency defenses that have been implemented by governments around the world. One example is China’s currency defense against the US dollar.

China had commonly managed its currency within a tight band of the US dollar.

(It’s common for emerging countries to peg their currency to that of their top export partner or that of the world’s top reserve currency. That is the US in each case for China.)

To defend its currency within that band, China will buy dollars when the yuan gets too strong against the greenback and sell dollars to buy yuan when the yuan gets too weak.

China has been more willing to float its currency as time has gone on and its economy has grown stronger and more dynamic.

Another example is Russia in 2022 after its invasion of Ukraine.

The invasion triggered sanctions from countries globally, which meant there was a large risk of capital flight out of Russia.

To stem the potential flow of capital, Russia imposed capital controls and also raised interest rates from 9.5 percent to 20 percent to get more savings into the ruble in order to defend its currency.

A large amount of interest rate hikes were naturally priced into the FX forwards.

(Source: IIF)

Drawbacks of a currency defense

Currency defenses can be effective in stabilizing a currency’s value, but they can also have some drawbacks.

One potential drawback is that currency intervention can require a large amount of capital in order to be effective.

Another potential problem is that currency defenses can create moral hazard.

Moral hazard occurs when a country or government is shielded from the negative consequences of its actions. This can lead to recklessness and further economic problems down the road.

Despite these potential drawbacks, currency defenses can be an effective way for a government to stabilize its currency’s value and protect its economy from speculative attacks.

Types of currency intervention

Sterilized intervention

Sterilized intervention refers to the process of central banks or monetary authorities influencing the value of their currency without changing the monetary base.

This type of currency intervention is usually done through the use of foreign exchange reserves.

For example, if a central bank wants to devalue its currency, it would sell its currency on the open market and use the proceeds to purchase foreign currency.

The central bank would then hold onto the foreign currency until the value of its own currency decreases to the desired level.

Once this happens, the central bank can then reverse the process by selling the foreign currency and buying back its own currency.

Unsterilized intervention

Unsterilized intervention is when a central bank or monetary authority changes the money supply in order to influence the value of its currency.

This type of currency intervention is usually done through open market operations.

For example, if a central bank wants to devalue its currency, it would sell its currency on the open market and use the proceeds to purchase foreign currency.

This process increases the money supply and put downward pressure on the value of the currency.

Some central banks, like the Swiss National Bank (SNB), have created money and bought foreign stocks as a way to devalue their currency and using foreign assets as a source of funding.

Indirect intervention

There are other form of indirect intervention.

Capital controls

Capital controls are restrictions that a government places on the flow of currency into and out of a country.

Capital controls can be used to defend a currency by making it more difficult for speculators to bet against the currency.

For example, if a country imposes capital controls, speculators would need to buy the currency in order to bet against it.

This would put upward pressure on the currency and make it more difficult for the speculators to profit from a currency decline.

Raising interest rates

Another form of indirect intervention is raising interest rates. This can be done in order to attract foreign investment and capital into the country.

Higher interest rates make it more attractive for investors to park their money in the country. This inflow of capital can help to support the currency and defend it from speculative attacks.

Exchange controls

A country may choose to influence its currency by imposing trade restrictions in certain currencies.

This is done in order to make it more difficult for speculators to bet against the currency or transact in other currencies in ways that could influence the exchange rate.

Price and wage controls

A government may also choose to implement price and wage controls in order to defend its currency.

Price and wage controls are sometimes used help to prevent inflation from eroding the value of the currency.

They can also help to keep wages in check, which can make a country’s exports more competitive.

“Jawboning”

Jawboning refers to policymakers using words or guidance to move a market in one direction or another.

In the context of currency intervention, jawboning usually refers to policymakers publicly stating their intention to defend a currency at a certain level.

This can be an effective way to deter speculators from betting against the currency and can help to stabilize the currency’s value.

Drawbacks of currency intervention

Policy maneuvers that are inconsistent with the fundamentals are bound to fail.

Measures like exchange controls and other restrictions can simply lead to the creation of a black market.

Capital controls are generally easy to get around, as people will try to get their money out one way or another. People might try alternative currencies, such as other national currencies, gold, cryptocurrency, or other stores of value.

In fact, just the idea of people knowing they might not be able to get their money out will typically want to them to get their money out, similar to a run on a bank.

Many policies like price and wage controls typically create distortions rather than alleviate any problems.

Another potential drawback is that currency intervention can require a large amount of capital in order to be effective.

Moreover, currency defenses can create moral hazard, which is the idea that people are more likely to take risks if they know that there is a safety net.

For example, if a country knows that it can rely on currency intervention to prop up its currency, it may be less likely to pursue sound economic policies of getting spending in line with revenue and getting its assets above its liabilities.

Currency intervention is not without its risks and drawbacks, but it can be an effective way for a country to defend its currency.

Policymakers need to be mindful of the potential pitfalls of currency intervention, but currency defense can be a helpful tool in stabilizing a currency’s value.

Currency defense – FAQs

How do central banks engineer a currency defense?

There are a few ways central banks can go about defending their currency’s value, including:

- open market operations

- indirect intervention

- capital controls

- raising interest rates

- exchange controls

- price and wage controls, and

- “jawboning” or forward guidance

What are the benefits of currency intervention?

Currency intervention can help to stabilize a currency’s value and prevent inflation from eroding the currency’s purchasing power.

It can also help to keep wages in check, which can make a country’s exports more competitive.

What are the drawbacks of currency intervention?

Policies that are out of whack with the fundamentals are unlikely to be successful.

It’s not uncommon for policymakers facing the need to devalue to bluff publicly saying they’ll defend the currency, only to let it fall to better create a two-way market.

Exchange controls and other capital restrictions may simply lead to the creation of a black market.

And finally, many policies like price and wage controls commonly create distortions rather than alleviate any problems.

What is a currency crisis?

A currency crisis is typically characterized by a rapid and steep decline in the value of a currency.

A currency crisis can be caused by a number of factors, including:

- unsustainable trade deficits

- high levels of debt (spending too much and/or earning too little)

- political instability, and

- central bank intervention

What are some examples of currency crises or currency collapses?

Some notable currency crises include: the Latin American debt crisis of the 1980s, the East Asian financial crisis of the late 1990s, and the subprime mortgage crisis of 2007-2008 that induced currency issues in various countries.

What is a currency war?

A currency war is an economic conflict between two or more countries in which each side tries to devalue its currency in order to gain a competitive advantage.

Currency wars can lead to trade wars, as well as currency crises and currency collapses.

What is currency manipulation?

Currency manipulation is the deliberate intervention in the foreign exchange market by a central bank or other authority in order to achieve a specific goal, such as propping up the value of the currency.

Currency manipulation is sometimes also referred to as “dirty floating”.

What are some examples of currency manipulators?

Some notable currency manipulators historically have included: China, Japan, and South Korea.

More recently, Switzerland and Vietnam have been identified by the US government for their currency and financial management practices.

Can currency crises be avoided?

There is no one-size-fits-all answer to this question, as currency crises can be caused by a variety of factors.

That said, some economists believe that currency crises could be avoided if countries implemented sound economic policies and maintained healthy levels of FX reserves.

Ultimately, currency crises commonly develop because countries earn more than they spend and have too much debt relative to assets.

What is the best way to protect against currency risk?

There are a few different ways to protect oneself against currency risk, including: hedging, diversifying one’s portfolio, and owning some amount of non-financial assets such as commodities.

Hedging is the use of financial instruments to offset exposure to currency risk.

Diversifying one’s portfolio across different asset classes can also help to mitigate currency risk.

For those without broad access to currencies, investing in currency-backed securities, such as currency ETFs, can also provide some protection against currency risk.

How does the government control currency?

The government can control currency through a variety of methods, including: setting interest rates, printing money, and intervening in the foreign exchange market.

The government can also influence currency through trade policy, such as tariffs and other restrictions.

What is the difference between currency and money?

Currency is a type of money that is used as a medium of exchange in transactions.

However, not all currency is money.

Some currency, such as cryptocurrency, is not backed by a government and may not be accepted as legal tender outside rare exceptions (e.g., El Salvador).

Money, on the other hand, refers to anything that is accepted as payment for goods and services or repayment of debts.

This includes currency, as well as other assets such as gold and silver.

Can a country change its currency?

Yes, a country can change its currency.

However, this is a major decision that is usually only undertaken in times of economic crisis or to be part of a currency union that a country perceives has more pros than cons.

Some examples of countries that have changed their currency include: Zimbabwe, which abandoned its currency in 2009; and Greece, which introduced the euro in 2002.

What happens to a country’s currency when it undergoes hyperinflation?

The most common path is to phase out the old currency and adopt a new one with a very hard backing.

This hard backing can be gold, silver, oil, land, and other things that have a tangible basis.

This helps ensure the trust of the currency.

Why does China manipulate its own currency?

China has intervened in its currency markets in order to keep the value of the currency low.

This has helped to make Chinese exports more competitive and has contributed to the country’s economic growth.

Now that China has grown into a more consumption-focused economy, it is more willing to float its currency.

What are the consequences of currency manipulation?

Currency manipulation can have a number of consequences, both intended and unintended.

Some of the intended consequences of currency manipulation include: stimulating exports, boosting economic growth, and creating jobs.

However, currency manipulation can also lead to unintended consequences such as: inflation, currency wars, and asset or economy-wide bubbles.

What is the difference between currency and currency exchange?

Currency is a type of money that is used as a medium of exchange in transactions.

Currency exchange, on the other hand, refers to the process of exchanging one currency for another.

This can be done for a variety of reasons, such as: to conduct international trade, to invest in foreign assets, or to pay for goods and services purchased from abroad.

What are some popular currency pairs?

Some popular currency pairs include: EUR/USD, USD/JPY, GBP/USD, USD/CHF, and AUD/USD.

These currency pairs are typically traded on the foreign exchange market.

The USD is the world’s top reserve currency, so it is often associated with the most popular currency pairs.

What factors influence currency exchange rates?

Currency exchange rates are influenced by a variety of factors, including: economic indicators, central bank policy, global events, and market speculation.

Economic indicators, such as inflation and gross domestic product (GDP), can influence currency exchange rates.

Central bank policy, such as interest rate changes, can also affect currency values.

Global events, such as political instability or natural disasters, can also cause currency values to fluctuate.

Finally, market speculation can play a role in currency exchange rate movements.

Can a country have two currencies or more than one currency?

Yes, a country can have more than one currency in use.

Cuba and France have been examples.

Why devalue a currency?

A currency may be devalued for a variety of reasons, such as: to boost exports, to combat deflation, or to correct an overvalued currency.

A currency devaluation can also be a competitive move in response to another country’s currency devaluation.

How does a currency devaluation boost exports?

A currency devaluation does not impact domestic incomes.

It is essentially like giving a discount to the rest of the world.

If an exchange rate falls from 2.00 to 1.00, that means an external country buying with that foreign currency can buy twice as much stuff.

It helps stoke demand for exports.

Also, it means that domestic holders of the currency can only buy half as many imports.

This means that if a country has a wide current account deficit, devaluing a currency is a good way to get it back in equilibrium by boosting exports (income) and reducing imports (spending).

This is why the current account level is watched by currency traders.

What is the difference between a currency and a commodity?

Currency is a type of money that is used as a medium of exchange in transactions.

Commodities, on the other hand, are natural resources that are used to produce goods and services.

Some examples of commodities include: oil, gold, silver, natural gas, copper, wheat, and corn.

What is the difference between currency and debt?

Currency is a type of money that is used as a medium of exchange in transactions.

Debt, on the other hand, is an obligation to repay a sum of money.

Debt can be in the form of bonds, loans, notes, or other debt instruments.

What is a currency peg and why does a country do it?

A currency peg is when a country ties the value of its currency to another currency, typically the US dollar or another reserve currency.

A currency peg can be used as a way to stabilize a currency’s value.

Summary – Currency Defense

A currency defense is when a country or government intervenes in the foreign exchange market in order to stabilize the value of its currency.

Currency defenses can take many different forms, but they all aim to stabilize a currency’s value and protect the economy from the influence of speculation.

Different techniques can be used, including sterilized intervention, unsterilized intervention, capital controls, raising interest rates, and exchange controls.

While currency defenses can have some potential drawbacks, they can be an effective way for a government to defend its exchange rate.