Best Forex Trading Platforms In The United Arab Emirates In 2026

The United Arab Emirates (UAE) has emerged as a significant forex trading hub, experiencing a 9% rise in the number of FX/CFD traders in 2023, alongside 18,500 retail investors placing their first trades. This expansion means the UAE’s chief federal regulator, the Securities and Commodities Authority (SCA), now oversees a growing number of forex trading platforms.

Explore our selection of the best forex brokers in the UAE to find the platforms that excel for their range of currency pairs, charting tools, trading fees, and convenient account funding, including e-wallets like Alipay which is rising in popularity among Emirati residents.

Top 6 Forex Trading Platforms In The United Arab Emirates

Our hands-on tests and exhaustive analysis of hundreds of brokers show these to be the top 6 platforms for forex traders in the UAE:

Here is a short summary of why we think each broker belongs in this top list:

- FXCC - FXCC's key selling point is its forex trading conditions. ECN spreads come in as low as 0.0 pips during peak trading hours, while it supports a wider range of currency pairs than the majority of rivals with over 70 forex assets. Additionally, you have access to MT4, which was built specifically for forex trading and excels for its charting tools.

- XM - XM offers a strong selection of currency pairs with no re-quotes or hidden charges, while spreads have come down over the years, now starting from 0.8 pips on the EUR/USD in the commission-free account.

- IC Markets - IC Markets maintains its commitment to providing exceptionally tight 0.0-pip forex spreads on major currency pairs such as EUR/USD. This makes it an excellent option if you are seeking superior execution, with an average of 35 milliseconds. Additionally, if you are a high-volume trader, you can benefit from rebates of up to $2.50 per forex lot.

- RoboForex - RoboForex offers trading on 30+ currency pairs, trailing category leaders like Pepperstone with its 90+ forex assets. That said, the Prime and ECN accounts feature competitive average spreads of 0.1 pips on the EUR/USD. Additionally, with a minimum investment of $100, traders can utilize the CopyFX system to replicate the strategies of seasoned currency traders.

- Vantage - Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

- AvaTrade - AvaTrade delivers 50+ currency pairs with tight spreads from 0.9 pips and zero commissions. Trade majors, minrs, and exotics 24/5 on leading forex platforms, notably MT4, with sophisticated charting tools and forex education to sharpen your edge, including a dedicated guide to 'Currency Trading'.

Best Forex Trading Platforms In The United Arab Emirates In 2026 Comparison

| Broker | Forex Assets | EUR/USD Spread | Forex App Rating | Minimum Deposit | Regulator |

|---|---|---|---|---|---|

| FXCC | 70+ | 0.1 | / 5 | $0 | CySEC, MISA |

| XM | 55+ | 0.8 | / 5 | $5 | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| IC Markets | 75 | 0.02 | / 5 | $200 | ASIC, CySEC, CMA, FSA |

| RoboForex | 30+ | 0.1 | / 5 | $10 | IFSC |

| Vantage | 55+ | 0.0 | / 5 | $50 | FCA, ASIC, FSCA, VFSC |

| AvaTrade | 50+ | 0.9 | / 5 | $100 | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

FXCC

"FXCC continues to prove itself an excellent option for day traders with a particularly strong selection of 70+ currency pairs, ultra-tight spreads from 0.0 pips during testing, high leverage up to 1:1000 in the ECN XL account, and a free VPS for qualifying traders."

Jemma Grist, Reviewer

FXCC Quick Facts

| GBPUSD Spread | 0.4 |

|---|---|

| EURUSD Spread | 0.1 |

| EURGBP Spread | 0.4 |

| Total Assets | 70+ |

| Leverage | 1:1000 |

| Platforms | MT4, MT5 |

| Account Currencies | USD, EUR, GBP, CAD |

Pros

- FXCC’s ECN XL account has been built with active traders in mind, featuring spreads from 0.0 with no commission, while also passing our execution speed benchmark for day traders.

- Customer support still relies on human agents with response times of under three minutes on live chat during our tests and knowledgeable reps - a welcome break from the frustrating AI chatbots increasingly offered by brokers.

- FXCC has stepped up its offering over the years, adding MT5 to its suite of platforms, hundreds of stocks and more cryptos to its product line-up, plus a copy trading feature and greater margin trading opportunities.

Cons

- Although the economic calendar has benefited from a facelift, FXCC still offers very little in terms of market research beyond basic daily technical analysis and aggregated market news, with no tools like Autochartist or social sentiment data.

- FXCC charges steep withdrawal fees on many of its payment methods, including $45 for bank transfers and 2% crypto transfers, which may cut into the returns of traders making regular withdrawals.

- Although FXCC has bolstered its range of markets with US, European and Asian stocks, the choice of metals and energies is light, and there are no soft commodities.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| GBPUSD Spread | 0.8 |

|---|---|

| EURUSD Spread | 0.8 |

| EURGBP Spread | 1.5 |

| Total Assets | 55+ |

| Leverage | 1:1000 |

| Platforms | MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

Cons

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| GBPUSD Spread | 0.23 |

|---|---|

| EURUSD Spread | 0.02 |

| EURGBP Spread | 0.27 |

| Total Assets | 75 |

| Leverage | 1:30 (ASIC & CySEC), 1:1000 (FSA) |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

Cons

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| GBPUSD Spread | 0.4 |

|---|---|

| EURUSD Spread | 0.1 |

| EURGBP Spread | 0.4 |

| Total Assets | 30+ |

| Leverage | 1:2000 |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Account Currencies | USD, EUR |

Pros

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

- The broker offers leverage up to 1:2000 for certain account types, which is among the highest in the industry. This high leverage allows day traders to maximize their trading potential, albeit with a corresponding increase in risk.

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

Cons

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

- RoboForex now restricts base currency options to USD and EUR. This limitation may inconvenience day traders preferring to manage their accounts in other currencies, while potentially leading to conversion fees.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| GBPUSD Spread | 0.5 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.5 |

| Total Assets | 55+ |

| Leverage | 1:500 |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- The broker has recently made efforts to expand its suite of CFDs providing further trading opportunities

- Vantage maintains its high trust score thanks to its strong reputation and top-tier regulation from the FCA and ASIC

- There’s an excellent suite of day trading software, including the award-winning platforms MT4 and MT5

Cons

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| GBPUSD Spread | 1.5 |

|---|---|

| EURUSD Spread | 0.9 |

| EURGBP Spread | 1.5 |

| Total Assets | 50+ |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

How We Rate Forex Trading Platforms In The United Arab Emirates

Trust

Our recommended forex brokers have earned our trust through a balance of their regulatory credentials, our direct experiences on their platforms, and their reputation among our experts, who have over 25 years of industry experience.

This helps protect traders from predatory forex fraudsters that the Emirati law firm Raya al Ameri warns “continue to pose a threat to investors” by luring them in with “aggressive marketing techniques”.

The Dubai Financial Services Authority (DFSA), a prominent regulator in the region, has also issued helpful advice on avoiding forex trading scams, including verifying the broker’s regulatory details on the agency’s website and ensuring emails match the company’s official website.

- AvaTrade is highly trusted with a long history spanning 15+ years – it fosters a transparent forex trading environment with robust safety measures (including SSL encryption to protect data and AvaTrade Protect to insure against losses), plus a long row of licenses, including from the Abu Dhabi Financial Services Regulatory Authority (FSRA).

Account Funding

Support for accessible, affordable payment methods is key, so we looked for platforms that make it easy to deposit using UAE dirhams (AED). Many forex platforms even offer AED accounts, ensuring a smooth trading experience while minimizing conversion fees.

Statista has also noted the rise in digital payments in the UAE, which they forecast to be fully cashless by 2030, so we highly rate brokers that support popular online payment methods in the region like Alipay and Klarna.

- Markets.com caters to forex traders in the UAE with an AED account, swap-free trading conditions, convenient payment options, plus an affordable starting deposit of 100 USD, around 370 AED.

Currency Pairs

Our analysis shows that the majority of online forex platforms do not offer trading on the AED (د.إ), despite it playing a vital role in facilitating economic development in the Middle East, especially in key industries like tourism, financial services, and oil.

That said, the top forex trading platforms offer at least 50 currency pairs, providing opportunities to speculate on the currencies of major countries.

Some brokers also excel with upwards of 80 currency pairs, notably many exotics with high volatility that can offer profit potential for skilled traders.

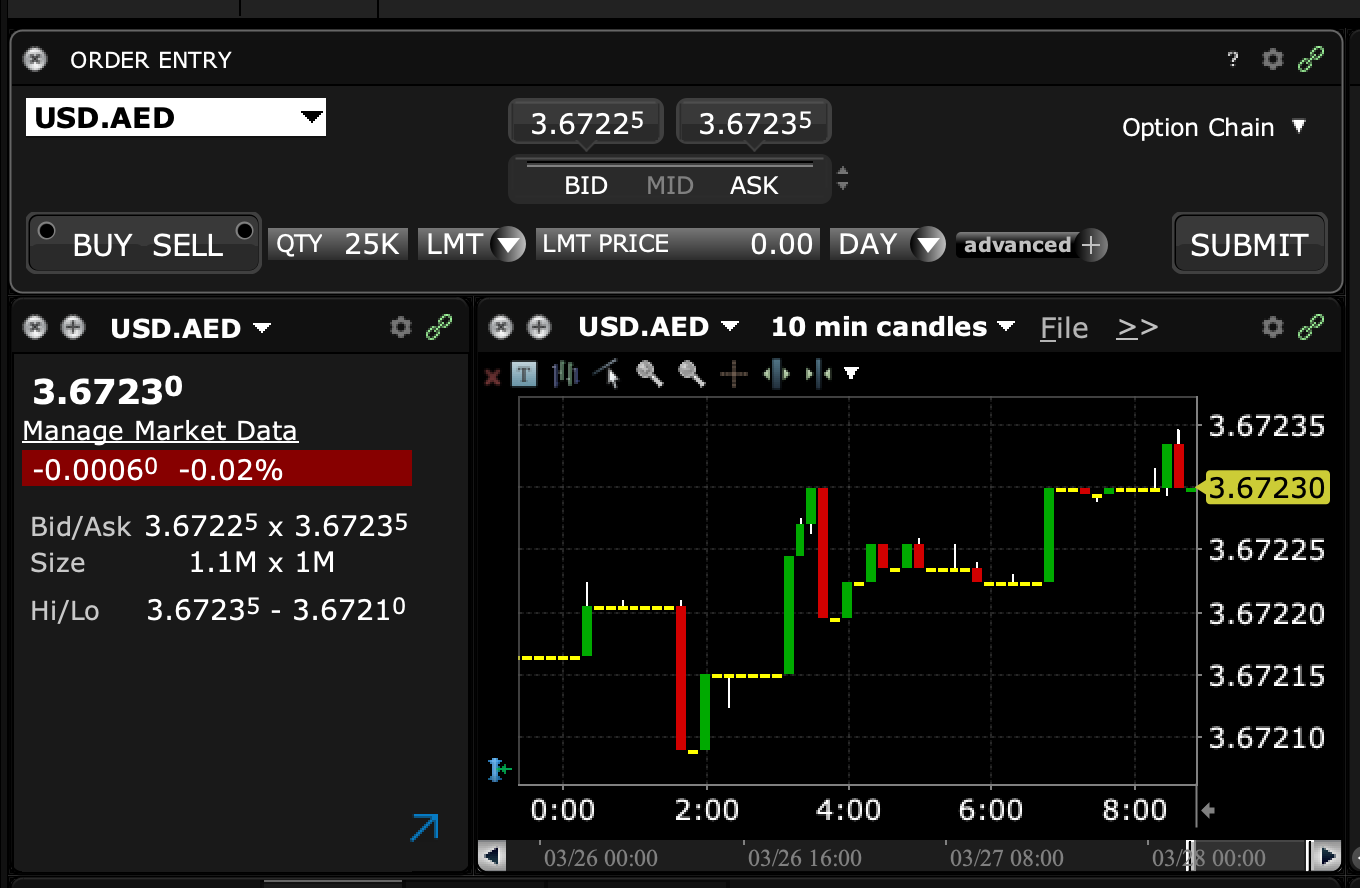

- Interactive Brokers stands out for forex traders in the UAE because it offers trading on 100+ FX pairs spanning 24 currencies, notably the AED, featuring pairs like the USD/AED with deep liquidity and quotes from the world’s 17 biggest forex dealers.

Platforms & Tools

We prioritize brokers that support high-quality trading platforms that deliver an optimal environment for forex traders, sporting intuitive interfaces and useful tools for analyzing foreign exchange markets, such as heatmaps and market sentiment.

After years of testing and reviewing forex brokers in the UAE, we’ve found the established MetaTrader 4 and MetaTrader 5 to be most popular among seasoned traders, which offer customizable interfaces with one-click trading, powerful charting tools with multiple timeframes and support for algorithmic trading.

However nowadays, more modern third-party options like TradingView as well as bespoke in-house platforms have made inroads thanks to slick and eye-catching designs that we’ve found appeal to newer forex traders while still delivering sophisticated tools.

- IC Markets remains our top contender for forex trading tools with support for four excellent platforms – MT4, MT5, cTrader and TradingView. It also shines by providing useful extras like VPS hosting for algo traders and Autochartist for technical analysis and market scanning.

Pricing

Choosing a broker with excellent pricing is an important step towards profiting from the forex markets because trading fees can quickly pile up when you’re day trading in the UAE.

For short-term traders, the most significant expense often comes from the spread – the difference between the bid and ask price – so we evaluate a broker’s pricing by rating the spreads of the most popular currency pairs like the EUR/USD, EUR/GBP and GBP/USD.

Commission charges can also factor in, especially if you opt for a raw-spread account, though many top forex platforms offer commission-free trading with affordable spreads on currency pairs.

We also evaluate non-trading fees such as deposit and withdrawal charges, conversion costs when transferring in AED, plus additional fees for tools and data.

- Vantage maintains its place as one of the best-value forex brokers in the Emirates thanks to its ultra-tight spreads from 0 pips and low commissions of $1.50 in its Pro ECN account, alongside the chance to reduce fees through the Vantage Rewards program.

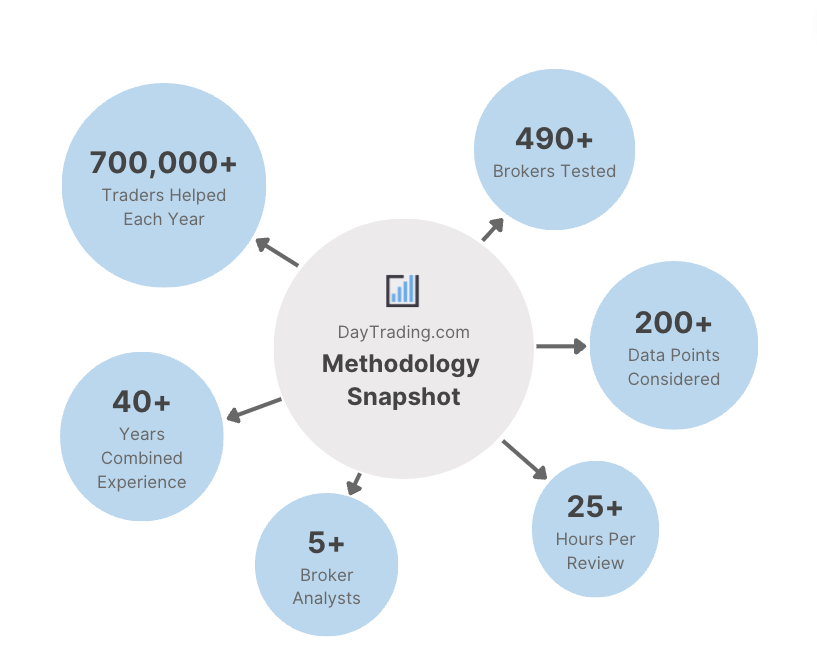

Methodology

To identify the top forex brokers for the United Arab Emirates, we shortlisted platforms accepting Emirate traders and evaluated them based on their comprehensive rating. This rating includes:

- Licensing by trusted regulatory bodies, if not by the SCA, DFSA and FRSA

- Support for convenient payment methods and swap-free accounts for Muslim traders

- Examination of the broker’s market offerings for currency pairs preferred by Emirate investors

- Support for advanced trading platforms and apps suitable for intraday forex trading

- Analysis of pricing on popular currency pairs in relation to service quality

FAQ

Is Forex Trading Legal In The UAE?

Forex trading is legal in the UAE and also on the rise, with an increasing number of retail investors speculating on currencies online.

Forex day traders in the UAE also have the advantage that capital gains aren’t taxed, so traders can keep 100% of any profits.

Who Regulates Forex Trading In The UAE?

The UAE is a federal state that includes several different Emirates with their own authorities. The federal regulators that oversee the financial markets, such as forex trading, include the Securities and Commodities Authority (SCA) and Central Bank of the UAE, while Dubai has its own Financial Services Authority (DFSA) and Abu Dhabi has the Financial Services Regulatory Authority (FSRA).

How Much Money Do I Need To Start Trading Forex In The UAE?

Our years of testing forex brokers accepting traders from the UAE show that platforms are becoming increasingly accessible, with minimum deposits typically ranging from 0 to 250 USD, around 0 to 920 AED.

Having said that, some forex trading platforms excel with no minimum investment, notably Pepperstone, making it an excellent option for budget traders.

Recommended Reading

Article Sources

- Securities and Commodities Authority (SCA)

- Central Bank of the UAE

- Dubai Financial Services Authority (DFSA)

- Financial Services Regulatory Authority (FSRA)

- Abu Dhabi Global Markets

- Statista Report on Digital Payments in the UAE

- Investment Trends Report on Retail FX/CFD Trader Population in the UAE

- Raya al Ameri Warning Against Forex Fraudsters

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com