Spread Trading

Spread trading is a trading strategy that involves buying and selling two related financial instruments in order to profit from the difference between their prices.

This difference is known as the “spread.”

Spread traders aim to make money by betting on the direction in which the spread between two instruments will move (e.g., convergence, divergence), rather than the direction of the instruments themselves.

There are many different types of spread trades that traders and investors can execute, depending on the instruments involved.

Key Takeaways – Spread Trading

Spread trading involves the simultaneous purchase and sale of two financial instruments, typically futures or options, in order to profit from the difference between their prices.

Spreads can be either bullish, bearish, or neutral, depending on the direction of the price difference.

Spread traders aim to profit from changes in the price relationship between the two instruments, rather than the outright movement of their prices.

Spread trading can offer several benefits, including lower risk, lower capital requirements, and the potential for profit in both rising and falling markets.

However, spread trading also involves its own set of risks, including the potential for unlimited losses and the need to constantly monitor and adjust positions. It is important for traders to fully understand the mechanics and risks of spread trading before attempting to engage in this strategy.

Examples of Types of Spreads to Trade

Some common examples include:

Calendar spreads

Involves buying and selling options or futures contracts with different expiration dates in order to profit from the difference in their prices.

Intermarket spreads

Involves buying and selling instruments that are related but traded on different markets or exchanges, such as buying corn futures and selling wheat futures.

Intramarket spreads

Involves buying and selling instruments that are related and traded on the same market or exchange, such as buying a long-term bond and selling a short-term bond.

Traders and investors can execute spread trades using a variety of financial instruments, including stocks, options, futures, and currencies.

They may use a variety of strategies, such as selling spreads, buying spreads, or using a combination of both.

How to Execute a Spread Trade

To execute a spread trade, a trader or investor will typically:

- Identify the two instruments that they want to trade and the spread between them.

- Determine the direction in which they expect the spread to move, based on their analysis of market conditions and trends.

- Place orders to buy one instrument and sell the other at the same time, using a brokerage account.

- Monitor the positions and adjust their trade as needed in order to manage risk and maximize profits.

Spread trading can be a complex and risky strategy, and it is important for traders and investors to have a thorough understanding of the instruments and markets involved in order to be successful.

Spread Trading Strategies

The effective implementation of spread trading strategies will involve buying and selling two different financial instruments at the same time, or simultaneously, in order to profit from the difference in their prices.

This difference, or spread, is normally measured in terms of the price of one instrument relative to another.

Here are a few examples of spread trading strategies:

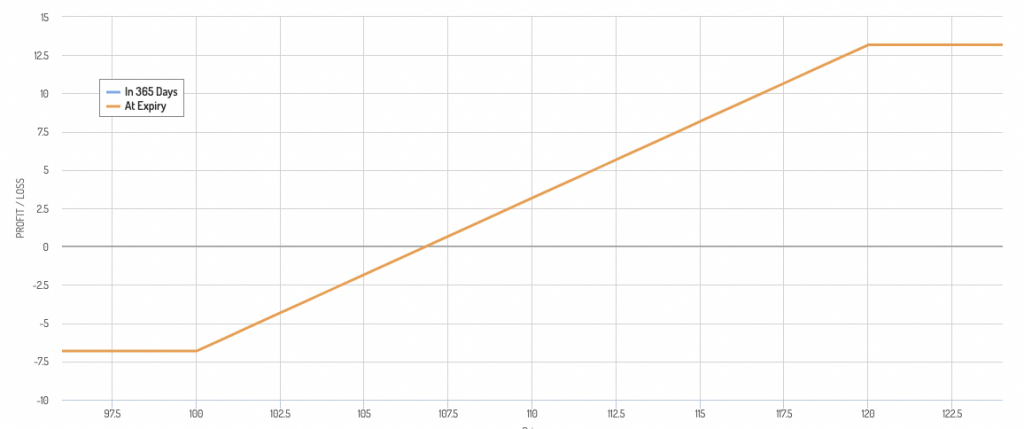

Bull Call Spread

This is a bullish strategy that involves buying a call option with a lower strike price and selling a call option with a higher strike price on the same underlying security.

The goal is to profit from an increase in the price of the underlying security.

In terms of an options payoff diagram, a bull call spread is typically shown as:

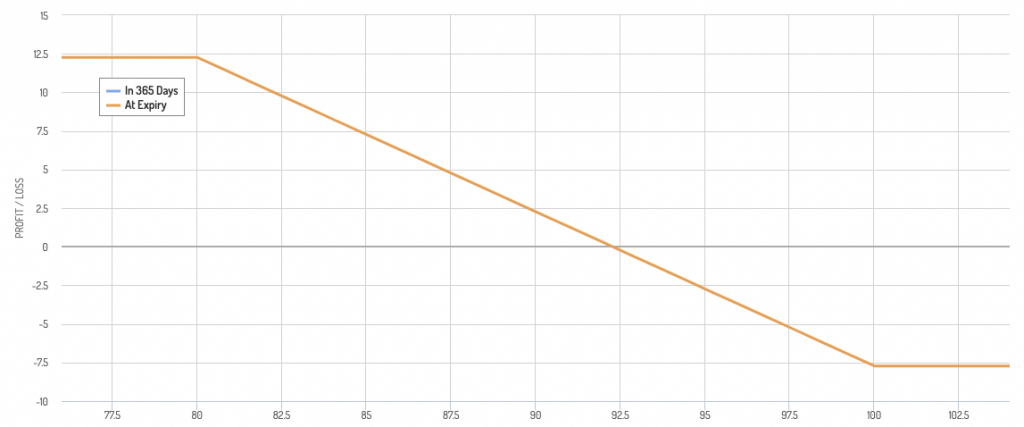

Bear Put Spread

This is a bearish strategy that involves buying a put option with a higher strike price and selling a put option with a lower strike price on the same underlying security.

The goal is to profit from a decrease in the price of the underlying security.

In terms of an options payoff diagram, a bear put spread is typically shown as:

Calendar Spread

This strategy involves simultaneously buying and selling options with the same underlying security and strike price, but with different expiration dates.

The goal is to profit from the difference in the time value of the options.

Diagonal Spread

This strategy involves simultaneously buying and selling options with the same underlying security, but with different strike prices and expiration dates.

The goal is to profit from the difference in the price and time value of the options.

This is a more complicated strategy due to the dual price and time components.

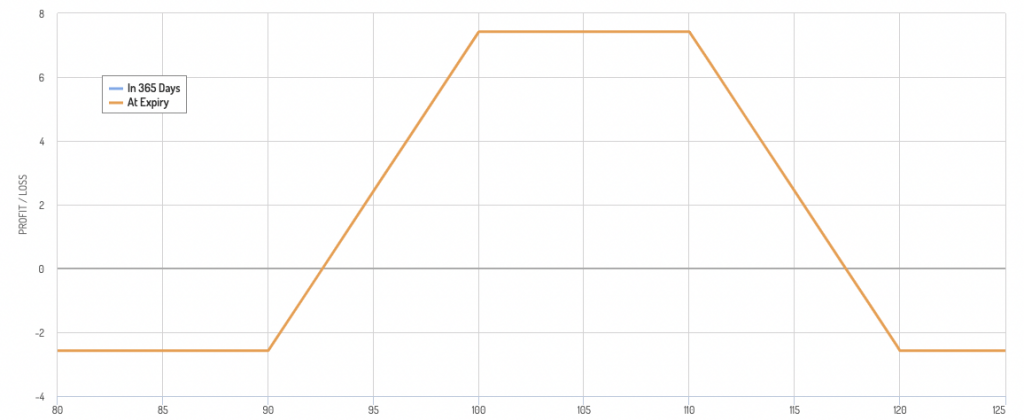

Butterfly Spread

This strategy involves buying and selling options with the same underlying security and expiration date, but with multiple different strike prices.

The goal is to profit from a narrow range in the price of the underlying security.

It often comes in the form of a straddle or strangle.

An example:

Spread Trading Options

Spread trading involves buying and selling options contracts concurrently in order to profit from the difference in the price of the two options.

These options can be on the same underlying asset, or on two different underlying assets.

Spread trading can be used to hedge risk, speculate on market movements, or generate income through the collection of premiums.

There are several different types of spread trades, including:

Bull spread

This involves buying a call option with a lower strike price and selling a call option with a higher strike price.

This trade profits if the underlying asset price increases, and the maximum profit is achieved if the underlying asset price is at or above the higher strike price at expiration.

Bear spread

This involves buying a put option with a higher strike price and selling a put option with a lower strike price.

This trade profits if the underlying asset price decreases, and the maximum profit is achieved if the underlying asset price is at or below the lower strike price at expiration.

Butterfly spread

This involves buying a call or put option at the middle strike price, selling two call or put options at a higher and lower strike price, and buying another call or put option at an even higher or lower strike price.

This trade profits if the underlying asset price is at or near the middle strike price at expiration, and the maximum profit is achieved if the underlying asset price is exactly at the middle strike price – or between the middle strike prices – at expiration.

Calendar spread

This involves buying a long-term option and selling a short-term option with the same strike price and underlying asset.

This trade profits if there is a difference in the time decay of the two options, with the trader collecting the premium from the short-term option and hoping that the long-term option will not decline in value as much.

Traders and investors execute these strategies by placing orders with a broker.

They can either manually enter the trade themselves using a trading platform, or they can use a pre-defined spread trading strategy that’s often executed through an API.

It is important for traders and investors to carefully consider the potential risks and rewards of spread trading, and to have a solid understanding of the underlying assets and market conditions before entering into any trades.

Spread Trading Futures

Spread trading is a strategy that involves buying and selling futures contracts of the same or related commodities, but with different delivery months.

The goal is to profit from the difference in the prices of the two contracts (i.e., the spread concept we’ve covered).

Example of Spread Trading in Futures

Let’s say you are a farmer who grows corn.

You know that the price of corn is likely to fall in the next few months due to oversupply.

You can take advantage of this expected price increase by selling a corn futures contract for delivery in a future month when you’re expected to sell your havest, which essentially locks in your prices since you’re “long” the underlying market (i.e., the physical crop).

This form of spread trading is to hedge risk.

Other Types of Spread Trading in Commodities

Spread trading can also involve buying and selling futures contracts of related commodities, such as crude oil and gasoline.

For example, you might buy a crude oil futures contract and sell a gasoline futures contract, with the expectation that the price of crude oil will rise relative to the price of gasoline. An example of this is the crack spread.

There are many different spread trading strategies that traders can use, depending on their market outlook and risk tolerance.

Spread trading can be a useful way to manage risk and diversify a portfolio, but it also carries the potential for significant losses if the market moves against you.

As with any futures trading strategy, it is important to thoroughly understand the risks and to have a well-defined risk management plan in place.

Futures Spread Trading 101 – Everything You Need to Know

Credit Spread Trading

Credit spread trading involves selling a credit instrument, such as a bond or credit default swap, and buying a similar instrument with a lower credit rating.

The difference between the two instruments is known as the “credit spread.”

Traders can profit from credit spread trades by collecting the difference in the spread, as long as the difference is positive.

For example, if a trader sells a bond with a yield of 2% and buys a bond with a yield of 4%, they will earn a profit of 2% on the trade as long as the price of the bond they sold does not decline significantly.

There are several different types of credit spreads that traders can use for a single bond or credit instrument, including bull spreads, bear spreads, and butterfly spreads.

Bull spreads are used when a trader expects the price of the bond they are selling to increase, while bear spreads are used when a trader expects the price of the bond they are buying to decline.

Credit spread trading can be a complex and risky endeavor, as it involves predicting changes in interest rates or the creditworthiness of the bonds being traded.

It is important for traders to carefully consider the risks and rewards of credit spread trades before entering into them.

FAQs – Spread Trading

How do market makers take advantage of trading spreads?

Market makers are financial firms or individuals that facilitate the trading of securities by quoting bid and ask prices and standing ready to buy or sell at those prices.

Market makers play a crucial role in providing liquidity to financial markets by continuously quoting prices and standing ready to buy or sell securities.

One way that market makers can take advantage of trading spreads is by “arbing,” or arbitraging, the spread.

This involves buying a security at the bid price and simultaneously selling it at the ask price, pocketing the spread as profit.

Market makers can also take advantage of spreads by holding positions in securities and collecting the spread as the price changes over time.

Another way that market makers can take advantage of spreads is by taking on risk.

Market makers often hold positions in securities in order to provide liquidity to the market, and they can profit from the spread by hedging their risk.

For example, a market maker might hold a long position in a security and offset the risk by taking a short position in a related security.

By hedging their risk in this way, market makers can profit from the spread even if the price of the security they are holding moves against them.

Overall, market makers play a critical role in the functioning of financial markets by continuously quoting prices and providing liquidity to traders.

By taking advantage of spreads, market makers can generate profits while also helping to facilitate the smooth functioning of the markets.

How do you make money from spread trading?

In spread trading, traders aim to profit from the difference in price between two different financial instruments, known as the spread.

For example, a trader might buy one security and sell another, hoping to profit from the difference in the prices of the two securities.

Spread traders can use a variety of different financial instruments, including stocks, futures, options, and currencies.

To make money from spread trading, traders need to be able to correctly predict which direction the spread will move in.

If the trader thinks the spread will widen, they are making a divergence trade.

If the trader thinks the spread will narrow, they are making a convergence trade.

Traders can also use leverage to increase the potential profits from spread trading.

Leverage allows traders to control a larger position with a smaller amount of capital, but it also increases the risk of loss if the trade doesn’t go as expected.

In short, spread trading can be a risky but potentially rewarding way to make money, and it requires a deep understanding of the financial markets and a solid trading strategy to be successful.

What is spread trading in futures with examples?

Spread trading in futures is a trading strategy that involves buying and selling two or more different futures contracts simultaneously.

The goal of spread trading is to profit from the difference in the price of the two futures contracts, known as the spread.

There are several types of spreads that traders can use in futures markets, including calendar spreads, inter-commodity spreads, and intra-commodity spreads.

Calendar spreads, also known as time spreads, involve buying and selling futures contracts that have different expiration dates.

For example, a trader might buy a December corn futures contract and sell a March corn futures contract, hoping to profit from the difference in price between the two contracts.

Inter-commodity spreads involve buying and selling futures contracts for different underlying commodities.

For example, a trader might buy a crude oil futures contract and sell a heating oil futures contract, hoping to profit from the difference in price between the two commodities.

Intra-commodity spreads involve buying and selling futures contracts for the same underlying commodity but with different delivery months.

For example, a trader might buy a July wheat futures contract and sell a September wheat futures contract, hoping to profit from the difference in price between the two delivery months.

Spread trading in futures can be a complex and risky strategy, as it involves predicting the price movements of multiple futures contracts.

It is important for traders to have a solid understanding of the futures markets and to carefully manage their risk when engaging in spread trading.

What is spread trading in crypto?

Spread trading is a type of trading strategy that involves buying and selling pairs of assets, such as cryptocurrency pairs, with the goal of profiting from the difference in the price spread between the two assets (e.g., buying bitcoin and shorting ethereum, or vice versa).

This type of trading can be done on a variety of different assets, including cryptocurrencies.

In the context of cryptocurrency trading, spread trading might involve buying one cryptocurrency and selling another, with the expectation that the price of the first cryptocurrency will rise relative to the second.

If the price does indeed rise, the trader can then close the position and realize a profit.

Spread trading can be a relatively low-risk way to trade, as it involves buying and selling assets simultaneously, rather than holding a single asset for an extended period of time.

However, spread trading can be very risky without a solid understanding of the market before attempting to engage in spread trading.

Is spread trading arbitrage?

Spread trading can involve elements of arbitrage, as it involves taking advantage of differences in the price of two assets in order to profit from the spread between them.

Arbitrage is the practice of buying and selling assets in different markets or in different forms in order to take advantage of discrepancies in the price of the asset.

In the context of spread trading, the trader might buy an asset in one market and sell it in another market where the price is higher, or they might buy an asset in one form (such as cryptocurrency) and sell it in another form (such as fiat currency) in order to profit from the difference in the price of the asset.

However, it is important to note that spread trading is not necessarily the same as arbitrage, as it involves taking a position on the direction of the price spread rather than simply profiting from price discrepancies.

Spread traders are betting that the price of one asset will rise relative to the other, while arbitrageurs are simply trying to profit from price differences without taking a position on the direction of the market.

Conclusion – Spread Trading

Spread trading is a popular strategy that involves buying and selling two different types of contracts, with the goal of profiting from the difference in their prices.

The strategy can be used in futures markets to take advantage of price movements across delivery months, in credit markets to capitalize on changes in bond yields, or in any market where traders are looking to capture a spread in whatever form.