Best Forex Brokers In Kenya 2026

Interest in forex trading is rising in Kenya, fuelled by the adoption of smartphones, an increasingly financially literate demographic, and a volatile Kenyan shilling (KES). The country’s Capital Markets Authority (CMA) is also one of the most prominent regulators on the African continent and has stepped up its oversight of forex trading activities in recent years.

Discover the best forex brokers in Kenya. We’re seeing a growing number of brokers cater to forex traders in Kenya, supporting convenient deposit options like M-Pesa and KES-based trading accounts. Every forex platform recommended has been personally tested by our experts.

6 Top Forex Brokers in Kenya

After reviewing 139 brokers, these 6 stand out as the best for forex traders in Kenya:

Here is a short overview of each broker's pros and cons

- XM - XM offers a strong selection of currency pairs with no re-quotes or hidden charges, while spreads have come down over the years, now starting from 0.8 pips on the EUR/USD in the commission-free account.

- RoboForex - RoboForex offers trading on 30+ currency pairs, trailing category leaders like Pepperstone with its 90+ forex assets. That said, the Prime and ECN accounts feature competitive average spreads of 0.1 pips on the EUR/USD. Additionally, with a minimum investment of $100, traders can utilize the CopyFX system to replicate the strategies of seasoned currency traders.

- Vantage - Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

- IC Markets - IC Markets maintains its commitment to providing exceptionally tight 0.0-pip forex spreads on major currency pairs such as EUR/USD. This makes it an excellent option if you are seeking superior execution, with an average of 35 milliseconds. Additionally, if you are a high-volume trader, you can benefit from rebates of up to $2.50 per forex lot.

- AvaTrade - AvaTrade delivers 50+ currency pairs with tight spreads from 0.9 pips and zero commissions. Trade majors, minrs, and exotics 24/5 on leading forex platforms, notably MT4, with sophisticated charting tools and forex education to sharpen your edge, including a dedicated guide to 'Currency Trading'.

- FOREX.com - FOREX.com continues to uphold its stature as a premier FX broker, offering 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $7 commission per $100k, it stands out.

Best Forex Brokers In Kenya 2026 Comparison

| Broker | Forex Assets | EUR/USD Spread | Forex App Rating | Minimum Deposit | Regulator |

|---|---|---|---|---|---|

| XM | 55+ | 0.8 | / 5 | $5 | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| RoboForex | 30+ | 0.1 | / 5 | $10 | IFSC |

| Vantage | 55+ | 0.0 | / 5 | $50 | FCA, ASIC, FSCA, VFSC |

| IC Markets | 75 | 0.02 | / 5 | $200 | ASIC, CySEC, CMA, FSA |

| AvaTrade | 50+ | 0.9 | / 5 | $100 | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| FOREX.com | 84 | 1.2 | / 5 | $100 | NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA |

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| GBPUSD Spread | 0.8 |

|---|---|

| EURUSD Spread | 0.8 |

| EURGBP Spread | 1.5 |

| Total Assets | 55+ |

| Leverage | 1:1000 |

| Platforms | MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

Cons

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| GBPUSD Spread | 0.4 |

|---|---|

| EURUSD Spread | 0.1 |

| EURGBP Spread | 0.4 |

| Total Assets | 30+ |

| Leverage | 1:2000 |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Account Currencies | USD, EUR |

Pros

- RoboForex offers over 12,000 instruments, providing more short-term trading opportunities than the vast majority of online brokers, with forex, stocks, indices, ETFs, commodities, and futures.

- The R Stocks Trader platform rivals leading solutions like MT4, with netting and hedging capabilities, comprehensive backtesting, Level II pricing, and a flexible workspace.

- The broker offers leverage up to 1:2000 for certain account types, which is among the highest in the industry. This high leverage allows day traders to maximize their trading potential, albeit with a corresponding increase in risk.

Cons

- RoboForex now restricts base currency options to USD and EUR. This limitation may inconvenience day traders preferring to manage their accounts in other currencies, while potentially leading to conversion fees.

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| GBPUSD Spread | 0.5 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.5 |

| Total Assets | 55+ |

| Leverage | 1:500 |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- The broker has recently made efforts to expand its suite of CFDs providing further trading opportunities

- Vantage caters to hands-off investors with beginner-friendly social trading via ZuluTrade & Myfxbook

- The low minimum deposit of $50 and zero funding fees make this broker a great choice for new traders

Cons

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

- Unfortunately, cryptos are only available for Australian clients

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| GBPUSD Spread | 0.23 |

|---|---|

| EURUSD Spread | 0.02 |

| EURGBP Spread | 0.27 |

| Total Assets | 75 |

| Leverage | 1:30 (ASIC & CySEC), 1:1000 (FSA) |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

Cons

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| GBPUSD Spread | 1.5 |

|---|---|

| EURUSD Spread | 0.9 |

| EURGBP Spread | 1.5 |

| Total Assets | 50+ |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

Cons

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| GBPUSD Spread | 1.3 |

|---|---|

| EURUSD Spread | 1.2 |

| EURGBP Spread | 1.4 |

| Total Assets | 84 |

| Leverage | 1:400 |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

How We Rate Best Forex Brokers In Kenya

These are the key areas we assess forex brokers in and recommend you do too:

Trust

Choose a trustworthy broker to safeguard your funds from forex trading scams.

This is especially important given the number of fraudsters targeting Kenyan forex traders. In one notable example, reported by Bizna Kenya, Limuru-based VIP Portal tricked “unsuspecting investors” out of a staggering Sh. 1 billion.

The Capital Markets Authority (CMA) is providing tighter oversight of forex trading activities, for example cracking down on 40 unlicensed forex trading firms, however there remains a high risk to your funds.

If you don’t choose a locally registered forex broker, our recommendation is to select a well-established trading platform tightly regulated by ‘Green Tier’ bodies like the FCA in the UK or the ASIC in Australia. Make sure you also stay up to date with Kenyan tax rules.

- Pepperstone is one of the most trusted forex brokers in the industry, thanks to its 10+ year history and multiple licenses from top-tier bodies, including the FCA, ASIC, CySEC and DFSA. Crucially, Pepperstone is also authorized by Kenya’s CMA and has an office in Nairobi.

Currency Pairs

Choose a broker that offers the currency pairs you wish to trade.

For local traders this might mean those containing the Kenya shilling (KES), such as the USD/KES, however we’ve evaluated hundreds of brokers and these are not usually available.

With this in mind, consider a broker with a wide range of majors, minors and exotics, offering diverse opportunities, including those in prominent currencies on the African continent, such as the South African Rand (ZAR).

- IG stands out with its fantastic selection of 80+ currency pairs, including the USD/ZAR, EUR/ZAR, GBP/ZAR, and JPY/ZAR. Combined with its advanced ProRealTime charting software, IG is an excellent choice for active forex traders.

Pricing

Select a low-cost broker, especially if you’re day trading forex. This will help protect slim profit margins from frequent transaction costs.

Our experts regularly evaluate trading fees on currency pairs, from minimum to average spreads where practical. We also consider non-trading fees such as conversion costs for transferring Kenyan shillings to a trading account based in another currency.

- Vantage’s flexible pricing model with no hidden fees caters to a broad spectrum of forex traders. The broker offers three accounts: Standard (commission-free pricing that will appeal to newer traders), Raw (low spreads with $3 commissions that will appeal to active day traders), and Pro (even more competitive commissions from $1.50 for high-volume traders).

Forex Platforms

Find a forex platform you enjoy using with the tools you need, for example, day traders may need a strong charting package for technical analysis.

Kenyans, like many retail investors, are also increasingly turning to forex trading apps, the reliability and features of which we’ve seen significantly improve in recent years.

You’ll normally have two options when it comes to forex software:

- Third-party: MetaTrader 4 and MetaTrader 5 have dominated the industry for years with advanced charting tools, various order types and support for algorithmic trading, though alternatives like TradingView and cTrader are making up ground with more intuitive workspaces.

- In-house: Many forex brokers have poured money into proprietary platforms, now sporting more user-friendly interfaces for beginners, often with tutorials and straightforward accessibility through web browsers.

- FOREX.com excels in this category thanks to its superior range of charting platforms, including MT4, MT5, TradingView and a WebTrader with one of the slickest designs I’ve seen. Its SMART Signals also provide valuable insights into price patterns across various currencies, potentially helping identify opportunities.

Account Funding

Choose a forex broker that makes account deposits and withdrawals in Kenyan Shillings low-cost and hassle-free.

Since very few online brokers support accounts based in Kenyan Shillings based on our findings, consider platforms with convenient local solutions. M-Pesa, for example, remains one of the most popular payment methods in Kenya, according to Akurateco.

- XM is a great choice for Kenyan forex traders looking for fast and affordable payment methods, from bank transfers and credit cards to digital solutions like M-Pesa. Additionally, the 5 USD, around 660 KES, minimum deposit is among the lowest in the industry.

Methodology

We leveraged our extensive database of forex brokers to focus on those accepting Kenyan traders, ranking them based on their rating derived from key factors, including:

- Regulation by reputable authorities, if not Kenya’s CMA then other trusted bodies.

- A wide selection of currency pairs to provide ample short-term trading opportunities.

- Competitive pricing for day traders with no hidden fees.

- User-friendly and reliable platforms following hands-on tests.

- Smooth account funding, considering the availability of local solutions like M-Pesa.

FAQ

Is Forex Trading Legal In Kenya?

Yes, residents of Kenya are permitted to trade currencies online.

However, we recommend keeping up with the latest regulations from the Capital Markets Authority (CMA) and tax rules from the Kenya Revenue Authority (KRA).

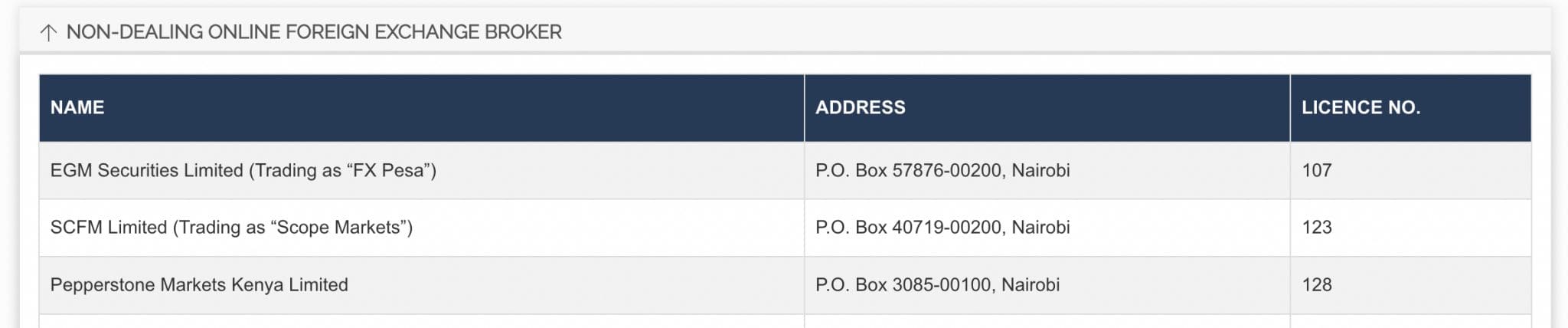

Who Regulates Forex Trading In Kenya?

The Capital Markets Authority (CMA) regulates forex trading in Kenya.

It’s a respected regulator that’s ramped up its oversight of forex brokers in recent years. Licensed firms must meet capital requirements of 50 million Kenyan Shillings, have a Director with experience in financial services, and maintain an office in Kenya.

Forex traders in Kenya can also open accounts with forex brokers based overseas though you may not be protected under domestic laws. As such, only trade currencies with established, tightly regulated international firms.

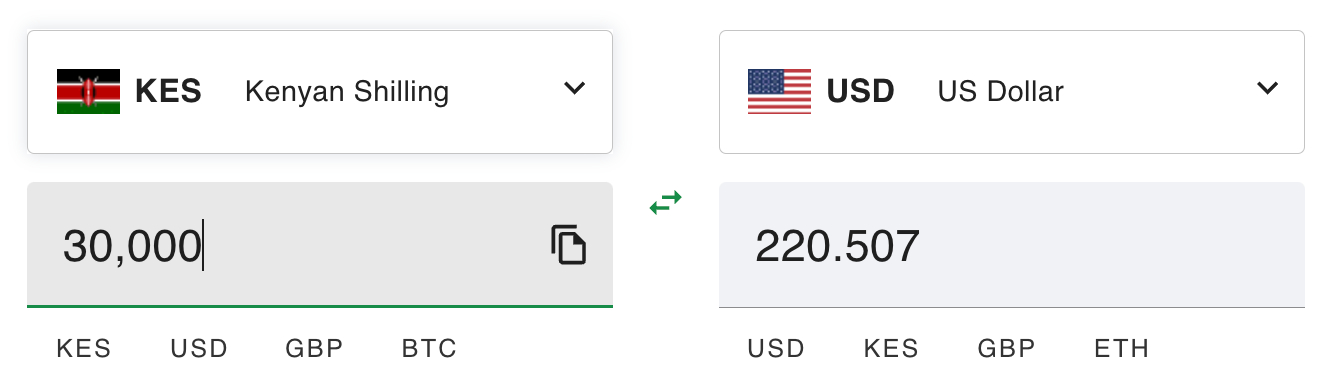

How Much Money Do I Need To Start Trading Currencies In Kenya?

Based on our vast directory of forex brokers accepting Kenyan traders, a deposit of up to 250 USD is normally required, equivalent to approximately 35,000 shillings.

That said, several leading forex brokers have no minimum deposit catering to budget traders, notably Pepperstone, which is also authorized by the CMA.

Is Forex Trading Safe In Kenya?

No, forex trading in Kenya, like all countries, is not safe. There is the risk of losing your money if the markets do not move in your favor, alongside scams which we’ve seen target Kenyan traders in recent years.

Recommended Reading

Article Sources

- Kenya Capital Markets Authority (CMA)

- CMA Cracks Down On Unlicensed Firms - Business Daily Africa

- VIP Portal Forex Scam - Bizna Kenya

- Payment Gateways In Kenya - Akurateco

- Kenya Revenue Authority (KRA)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com