City Index Review 2025

Awards

- Best CFD Provider 2024 - ADVFN International Financial Awards

- Best Trading Platform 2022 - Online Money Awards

Pros

- City Index provides versatile trading platforms for all skill levels. The intuitive Web Trader platform is ideal for beginners, while support for MetaTrader 4 (MT4) and TradingView adds robust analysis and automation features, ensuring a flexible experience for traders of all levels.

- City Index has made strides to enhance the trading experience, notably through its Performance Analytics in 2024 for insights into trades and discipline, plus an upgraded mobile app featuring in-built market research and news at a swipe.

- City Index boasts 13,500+ markets spanning forex, indices, shares, commodities, bonds, ETFs, and interest rates, with the platform's inclusion of niche markets like interest rates offering unique trading avenues not always found elsewhere.

Cons

- While many brokers like eToro have expanded their crypto offerings, City Index only provides crypto CFDs, and the limited range may not satisfy traders looking for a broader selection of altcoins.

- Unlike brokers such as AvaTrade and BlackBull, City Index does not provide passive investment opportunities like social copy trading, or real stock or ETF ownership, making it less appealing for hands-off trading.

- City Index lacks an Islamic account with swap-free trading conditions, making the broker less appealing to Muslim traders compared to providers like Eightcap and Pepperstone.

City Index Review

Regulation & Trust

4.2 / 5Founded in London in 1983, City Index has grown into a highly trusted global broker.

City Index is now part of the StoneX Group – a Nasdaq-listed, US-based company – suggesting a high degree of financial transparency and rigour in its operations.

It has steadily expanded its offerings and global reach over the past 40 years. In 2001, it introduced CFD trading in the UK, a significant milestone.

It’s authorized by four ‘green tier’ entities in line with DayTrading.com’s Regulation & Trust Rating:

- City Index, the trading name of StoneX Financial Ltd, is regulated in the UK by the Financial Conduct Authority (FCA), reference number 446717.

- City Index, the trading name of StoneX Europe Ltd, is regulated in Europe by the Cyprus Securities and Exchange Commission (CySEC), license number 400/21.

- City Index, the trading name of StoneX Financial Pte. Ltd. (“SFP”), is regulated in Singapore by the Monetary Authority of Singapore (MAS), registration number 446717.

- City Index, the trading name of StoneX Financial Pty Ltd, is regulated in Australia by the Australian Securities and Investments Commission (ASIC), license number 000345646.

In the event of insolvency, the UK’s Financial Services Compensation Scheme (FSCS) provides up to £85,000 in protection per person registered with StoneX Financial Ltd, while negative balance protection limits potential losses to the initial investment amount.

Similarly, StoneX Europe Ltd clients benefit from the Investors Compensation Scheme (ICS) for up to €20,000.

It’s worth remembering that even if a broker operates under tight regulation, it can break the rules. In 2023, StoneX Financial Pty Ltd was fined by ASIC due to issuing CFDs with a leverage ratio exceeding the permitted limit. As a result, we’ve lowered its trust score.

| City Index | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FCA, ASIC, CySEC, MAS | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

3.8 / 5Accounts

Depending on your location, City Index offers two primary account types: retail traders’ accounts and two accounts for financial professionals.

Unfortunately, there is no zero-spread account, which would be ideal for active traders interested in trading small price movements.

Here’s a detailed comparison to help you choose the one that best suits your trading needs:

- Standard: Access to City Index’s proprietary platforms, including Web Trader, desktop, and mobile applications. Variable spreads start from as low as 0.8 points. No commissions are charged except for stocks where standard commissions apply.

- MT4: Utilizes the globally recognized MetaTrader 4 (MT4) platform, available on web, desktop, and mobile. Variable spreads start from as low as 0.5 points. Most markets have no commissions, but stocks may incur standard commissions.

- Professional: This account is tailored for experienced traders who meet specific eligibility criteria, such as having a substantial trading history, relevant professional experience, or a significant investment portfolio. Professional account holders benefit from higher leverage options, allowing for larger position sizes and access to advanced trading tools – at the cost of certain regulatory protections afforded to retail clients, such as negative balance protection and leverage restrictions.

- Corporate: Designed for businesses and institutional clients, this corporate solution provides advanced features like multiple-user access, dedicated account management, and customizable reporting.

City Index’s demo accounts are excellent for experiencing the broker’s two trading environments without risking real money.

When I first signed up – which took only a few minutes – I had access to £10,000 in virtual funds, giving me plenty of room to experiment with different strategies and markets.My only criticism is that the 12-week time frame didn’t allow me to explore the platform’s capabilities and thoroughly test potential swing trading strategies.

Once the trial ended, I had to start fresh with a new demo account(s), which was inconvenient.

Deposits & Withdrawals

City Index’s deposit and withdrawal processes are straightforward, offering multiple options to manage trading funds efficiently into multiple base currencies depending on your location, including EUR, GBP, USD, AUD, PLN, and CHF.

You can fund your account using debit/credit cards, or bank transfers, though PayPal was removed in 2024 and there aren’t crypto solutions like Bitcoin payments, which you can find at alternatives like Eightcap.

Deposits are free of charge and typically reflect in my trading account within minutes, except for bank wires, which can take 1-3 working days.

My experience withdrawing funds has been equally user-friendly. Requests are processed within 1–2 business days, and card withdrawals take 3–5 working days to complete.

Domestic bank transfers usually take 1–2 working days, potentially quicker if your bank subscribes to the faster payments service. Unlike eToro, City Index does not charge fees for withdrawals, so I am delighted to receive my funds without deductions.

Throughout my experience, the platform’s intuitive interface made managing deposits and withdrawals seamless, allowing me to focus on trading strategies without concerns about fund accessibility.

| City Index | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Credit Card, Debit Card, Maestro, Mastercard, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Minimum Deposit | $0 | $0 | $100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

4.5 / 5City Index provides access to a growing roster of over 13,500 global markets, a huge library that offers a broad spectrum of opportunities.

It only trails a handful of brokers in terms of its market offering, such as BlackBull and IG.

Depending on your location, you can trade:

- Forex: 84+ pairs including majors (eg GBP/USD), minors (eg AUD/JPY) and exotics (eg USD/SGD).

- Stocks: 4,700+ stock CFDs across major US and European stock exchanges (eg Alibaba, Netflix, Tesla) with commission-free trading on spread bets (permitted regions like the UK).

- Indices: 28+ covering the US, Europe and APAC (eg EURO STOXX 50 and FTSE China A50).

- Commodities: 20+ commodities let you speculate on gold, silver, copper and soybean prices, either as futures contracts or spot prices.

- Cryptocurrencies: 10+ coins including Bitcoin, Ethereum and Ripple (not available to traders based in the UK or Singapore).

- Bonds, Thematic Indices & Interest Rates: 50+ assets including UK Long Gilt and Euro Bund, as well as baskets of US-listed stocks like ‘The Magnificent Seven’ (Alphabet, Apple, Amazon, Meta, Microsoft, Nvidia, Tesla).

On the downside, unlike AvaTrade, eToro and Pepperstone, City Index does not provide passive investment options such as real stocks or an in-house copy trading service.

| City Index | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Margin Trading | No | Yes | Yes |

| Leverage | 1:30 (Retail), 1:50 (Accredited Investor), 1:200 (Sophisticated Investor), 1:300 (Wholesale Investor), 1:400 (Professional Trader). Varies with jurisdiction. | 1:50 | 1:200 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

3.8 / 5City Index offers competitive fees and costs across various markets.

For example, the average spread for EUR/USD is around 0.74 pips, aligning with industry standards. However, some brokers like Exness and FP Markets may offer lower spreads for specific currency pairs.

In indices trading, major indices like the FTSE-100 and Dow Jones 30 have spreads starting from 0.4 points, which is competitive.

Stock (CFD) trading incurs a commission of 0.08%, with £10 for UK shares, €10 for European shares, and $10 USD for US shares.

Commodities trading, including gold and oil, is commission-free, but costs are incorporated into the spread.

It’s also worth remembering that financing charges apply to positions held overnight, a standard practice in the industry when trading forex and CFDs.

There’s also a relatively high monthly inactivity fee of £12 (or equivalent) that may apply if your account remains inactive for 12 consecutive months.

Notably, City Index does not charge for deposits and withdrawals, though the minimum amounts are a little higher than the industry average.

| City Index | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.8 | 0.08-0.20 bps x trade value | 0.1 |

| FTSE Spread | 1.0 | 0.005% (£1 Min) | 100 |

| Oil Spread | 1.5 | 0.25-0.85 | 0.1 |

| Stock Spread | Variable | 0.003 | 0.1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

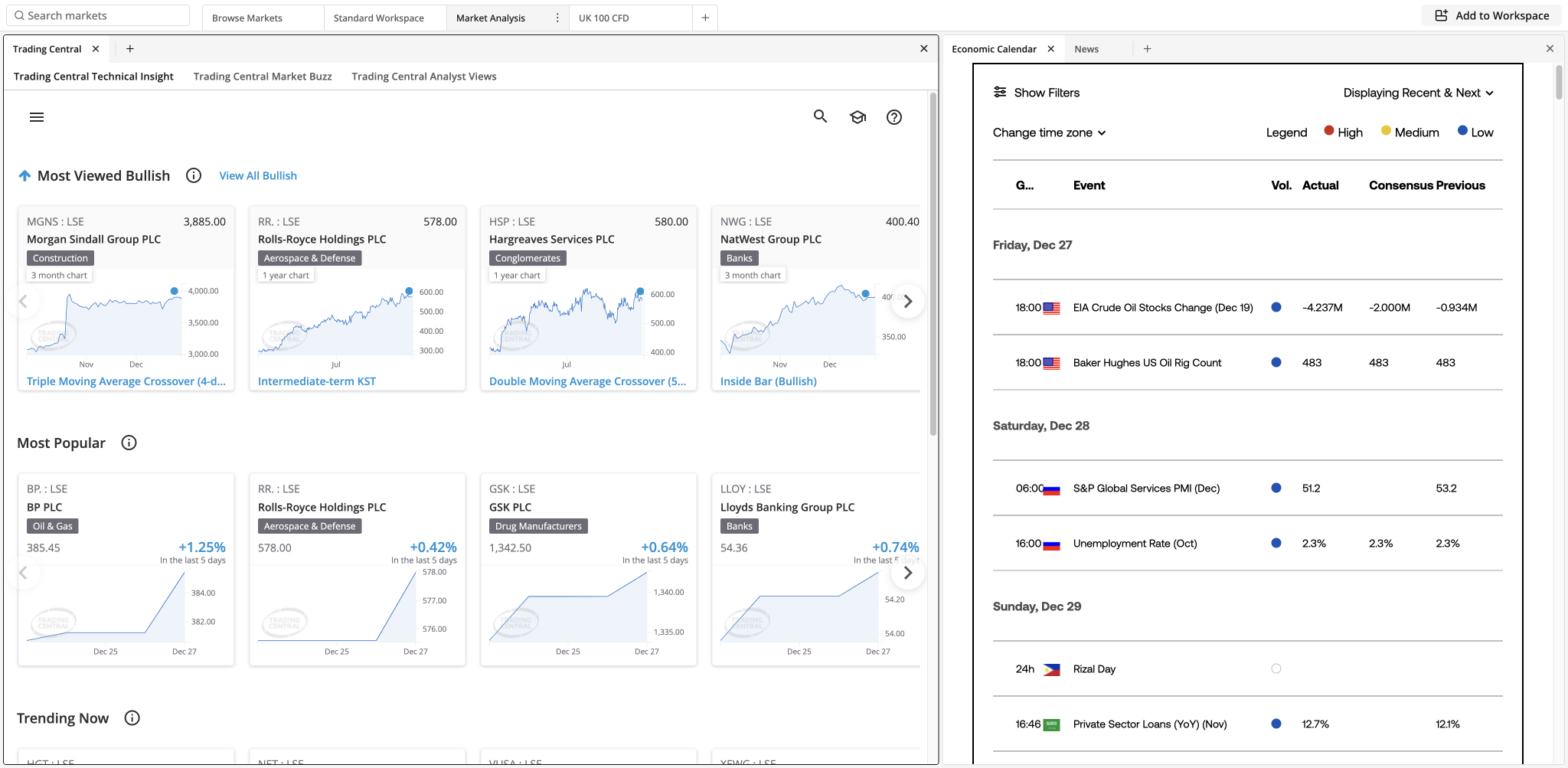

Platforms & Tools

4 / 5City Index offers a range of browser and app-based trading platforms designed to cater to specific trading preferences:

Web Trader

City Index introduced its proprietary Web Trader platform in late 2018 for CFD and spread betting accounts.

One of the platform’s standout features is a fully customizable trading workspace, which allows me to tailor the interface to my preferences for easy management across multiple trading windows.

Thanks to its TradingView integration, Web Trader boasts advanced charting capabilities. I can access over 90 indicators, drawing tools, and other charting enhancements directly within the platform.

These tools make analyzing trades more streamlined, reducing the need to rely on external software for technical analysis.

The platform also integrates intelligent trading tools to simplify the trading process. For instance, it is very convenient to visually adjust stop-loss and take-profit orders by dragging them to new price levels.

The system then automatically updates the order with the latest price, which saves me a lot of time and reduces errors.

Additionally, Web Trader provides curated market insights from Reuters. This includes in-depth market analysis and detailed information to help me identify opportunities or delve deeper into potential setups.

MetaTrader 4

A globally popular platform known for its advanced charting capabilities and a rich library of custom indicators for CFD trading.

One of MetaTrader 4 (MT4)‘s standout features is its support for APIs, which enables automated trading through Expert Advisors (EAs). This functionality is invaluable if you want to execute strategies around the clock without manual intervention.

The biggest downside of MT4 is its non-intuitive and outdated interface.

Unfortunately, MT5 is not yet available.

TradingView

TradingView offers sophisticated charting tools, technical analysis capabilities, and one of the world’s largest social trading communities where you can share and discover trade ideas.

What I also like best about this highly customizable charting platform is its 100% synced layouts, watchlists, and settings across desktop and mobile devices.

| City Index | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | Web Trader, MT4, TradingView, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

4.3 / 5City Index’s research tools provide an insightful experience, offering a wealth of resources to support informed trading.

The in-house market news and analysis on its website are particularly valuable, keeping you updated on key events and market movements across forex, indices, and commodities.

The ‘Trade ideas’ section on its website stands out as a feature I regularly return to. It provides concise and actionable insights into potential market opportunities, combining technical analysis with expert opinion.I especially appreciate the ability to filter articles by asset class, category subject, and author.

City Index’s excellent YouTube channel is equally helpful for watching hands-on technical analysis.

Another standout feature is the Trading Central portal within the Web Trader platform. By navigating to the research tab, you can access detailed and actionable technical and fundamental analysis.

Furthermore, news headlines from third-party Reuters help you stay on top of breaking news, and integrating an economic calendar allows you to anticipate market-impacting events.

While the tools are highly effective, I’ve noticed some areas for improvement. It would be great to have more interactive options, like live weekly webinars or Q&A sessions with analysts, to discuss real-time market developments.

Podcasts would further enrich the experience for traders like me who like to listen on the move.

Overall, City Index’s research tools provide a strong foundation for market analysis, but a few additional features could make them even more dynamic.

| City Index | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

4.3 / 5City Index’s trading education is amongst the best in the business. The ‘Trading Academy’ provides a range of written lessons suitable for both beginners and experienced traders.

Topics cover the fundamentals of market operations, technical analysis, risk management, and advanced trading strategies. Courses are also available, allowing you to build your trading knowledge progressively.

The broker’s YouTube channel is another excellent resource. It is updated regularly and provides market analysis, primarily of forex markets.

While City Index’s educational offerings are robust, there is potential for improvement. Expanding the range of advanced courses could cater to more experienced traders seeking to deepen their expertise.

Additionally, incorporating more interactive elements, such as interactive courses, live trading sessions and community forums, could enhance engagement and provide practical insights, bringing it closer to the quality of education at IG.

By implementing these enhancements, City Index could further solidify its position as a leading trading education provider, accommodating a broader spectrum of traders and fostering a more interactive learning environment.

| City Index | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

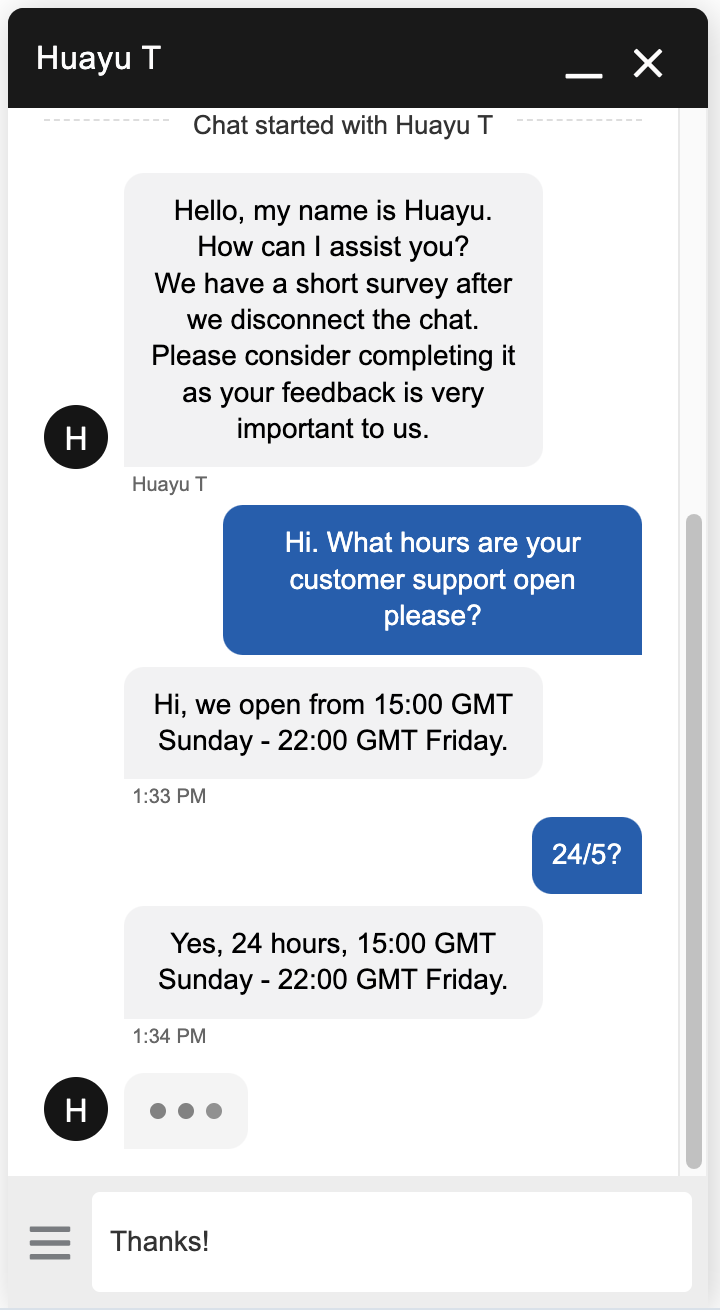

Customer Support

4 / 5City Index offers customer support through various channels, including phone, email, and live chat, available 24 hours a day, from 15:00 Sunday to 22:00 (GMT) Friday.

From my experience, the support team provides prompt and relevant assistance, with live chat connecting almost instantly. There’s also support through social media platforms like Facebook, X, Instagram, LinkedIn and YouTube.

For non-urgent enquiries, I find City Index’s comprehensive FAQs section an excellent self-service resource. This tool allows me to quickly find answers to common questions related to account management, trading platforms, fees, and market access.

The FAQs are well-organized and provide detailed information, but I would appreciate some hands-on video tutorials on specific topics, like those at Axi.

While the overall quality of City Index’s customer service is commendable, there is room for improvement.

Expanding support hours to include weekends could better accommodate clients who trade or require assistance outside standard trading hours.

Increasing the availability of multilingual support would cater to a more diverse client base, enhancing accessibility for non-English speakers.

| City Index | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Customer Support | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With City Index?

City Index is a well-established and reputable broker, offering access to over 13,500 markets. It provides competitive spreads and a user-friendly platform with TradingView integration, making it a solid choice for day traders.

The demo account and educational resources are helpful starting points for beginners, but the platform may cater more to experienced traders due to its focus on active trading rather than passive investment options.

Overall, City Index is a reliable choice for those seeking a well-regulated broker with diverse market access and robust tools for short-term trading.

However, comparing its offerings to those of other brokers will help you decide if it matches your needs.

FAQ

Is City Index Legit Or A Scam?

City Index is a legitimate broker with over 40 years of experience, regulated by top authorities like the FCA in the UK, ASIC in Australia, and MAS in Singapore.

StoneX Group Inc., a publicly traded company on Nasdaq, owns it. City Index operates transparently with these regulatory protections and ensures client funds are safe.

While it’s not a scam, as with any trading platform, it’s essential to understand the risks before trading. Always verify that you’re on the official website and trading within your country’s regulations.

Is City Index Suitable For Beginners?

City Index can be suitable for beginners, especially if you’re looking for a user-friendly platform to start trading. The broker offers a demo account, allowing you to practice risk-free with virtual funds, although this is limited to 12 weeks.

The proprietary platform is solid – if a little unintuitive – and offers a raft of educational resources, such as market analysis, video tutorials, and trading guides.

However, beginners should be aware that City Index primarily caters to more active traders. If you’re completely new to trading, you may want to take your time exploring the platform and the different assets available before diving into live trading.

Top 3 Alternatives to City Index

Compare City Index with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

City Index Comparison Table

| City Index | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| Rating | 4.4 | 4.3 | 3.6 | 4.4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, Stock CFDs, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FCA, ASIC, CySEC, MAS | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | NFA, CFTC |

| Bonus | – | – | 10% Equity Bonus | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Education | Yes | Yes | Yes | Yes |

| Platforms | Web Trader, MT4, TradingView, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:30 (Retail), 1:50 (Accredited Investor), 1:200 (Sophisticated Investor), 1:300 (Wholesale Investor), 1:400 (Professional Trader). Varies with jurisdiction. | 1:50 | 1:200 | 1:50 |

| Payment Methods | 6 | 6 | 11 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by City Index and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| City Index | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | Yes | Yes | No | Yes |

| Options | Yes | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | No |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | Yes | No | No | No |

| Volatility Index | Yes | No | Yes | No |

City Index vs Other Brokers

Compare City Index with any other broker by selecting the other broker below.

Article Sources

- City Index

- City Index - FCA License

- City Index - CySEC License

- City Index - MAS License

- City Index - ASIC License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of City Index yet, will you be the first to help fellow traders decide if they should trade with City Index or not?