What Is Basis Risk?

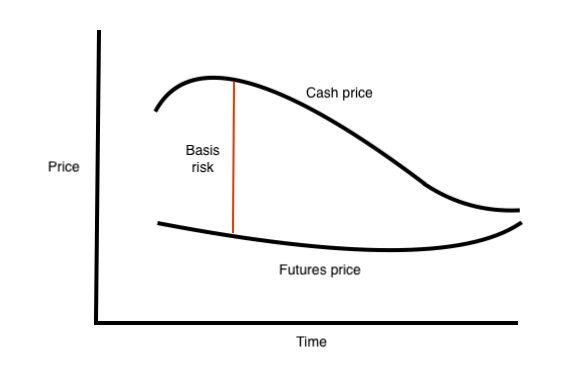

Basis risk pertains to the risk that the basis, or the difference in price between two similar financial instruments, will change unexpectedly.

This type of risk is often present when an investor is holding a position in one security while simultaneously trying to hedge against moves in another related security.

Conceptual Diagram of Basis Risk

This basis risk can be managed through the use of derivative instruments such as options and futures contracts. These derivatives can be used to establish positions that offset any basis risk that might be present in the underlying security.

Managing basis risk

There are several ways to manage basis risk.

The first is to choose hedging instruments that are highly correlated with the underlying security. This can be difficult to do in practice, however, as even seemingly similar securities can diverge in price over time.

Another way to manage basis risk is through the use of derivative instruments such as options and futures contracts. These derivatives can be used to establish positions that offset any basis risk that might be present in the underlying security.

For example, consider a situation where an investor buys futures contracts on oil as a way to hedge against increases in the price of gasoline. If the basis between oil and gasoline widens unexpectedly, the investor may not be adequately hedged against rising gasoline prices.

Basis risk can also arise when an investor tries to hedge using a financial instrument that is not perfectly correlated with the underlying security.

For example, an investor holding a long position in gold might use gold-based ETFs as a hedge.

However, because ETFs are subject to changes in investor sentiment and other factors, they may not move in perfect tandem with the price of gold. As a result, basis risk is always present to some degree when hedging.

Basis risk can also be managed through the use of statistical techniques such as regression analysis. This approach can be used to identify relationships between securities and to develop hedging strategies that minimize basis risk.

Basis risk in illiquid investments

Basis risk exists in venture capital where hedges for startup investments don’t exist.

Unlike investing or trading in public equities, where many stocks (especially large, liquid ones) will have underlying options markets to hedge in a pure way, startup investments typically don’t have any market for that to any extent.

In these cases, the investor in a startup might want to go to an investment bank (or some type of investor that works in that field) and see if there’s anything they’ve run across that could help them hedge out their risk.

Options in public market proxies – such as the NASDAQ ETF (QQQ) – could provide only an okay job.

If the startup is in the tech sector and there was a macro-driven sell-off it might do a better job of providing some type of offset compared to something idiosyncratic (something happens to a single company not tied to the economy that a public market hedge is unlikely to capture).

Basis risk even when natural hedging instruments are available

The basis is the difference between the price of the underlying security and the price of the hedging instrument.

For example, if an investor buys a stock for $100 and wants to hedge it with an option, they will have to pay a premium for that option.

If the stock goes down to $90, the option will increase in value, but perhaps not by as much as the stock went down. The basis is $10 in this case.

The basis risk exists because there is no guarantee that the option will increase in value by exactly $10. It could go down by more or less depending on a number of factors such as implied volatility and time decay.

As options get further in-the-money (ITM) they act like the underlying shares.

For example, the trader may have paid $5 per share for the option. If it’s worth $10 by expiry, that’s a profit of $5 on the option but a loss of $10 on the shares, for a net loss of $5 per share.

Different types of basis risk

Locational basis risk

One type of basis risk is locational basis risk. This is the risk that arises from differences in the price of a commodity at different locations.

For example, crude oil might be selling for $100 per barrel in Cushing, Oklahoma but only $90 per barrel in Rotterdam.

An investor or trader who is long crude oil in Cushing and wants to hedge their position with a futures contract might find that the basis between the two contracts has widened unexpectedly.

This basis risk can be managed by using derivatives such as options and futures contracts (to the extent they exist) to establish positions that offset any basis risk that might be present in the underlying security.

Regulatory basis risk

Regulatory basis risk is the risk that arises from changes in government regulations.

For example, consider a situation where an investor or trader holds a long position in a stock that is subject to environmental regulations.

If the government imposes new regulations that increase the costs of doing business for the company, the stock price might fall.

The basis risk in this situation is the risk that the stock price will fall more than expected. This basis risk can be managed through the use of hedging strategies such as short selling or buying put options.

Related: 9+ Strategies to Lower Your Delta to the Market

Event-driven basis risk

Event-driven basis risk is the risk that arises from events such as earnings announcements, natural disasters, and political upheaval.

For example, consider a situation where an investor holds a long position in a stock that is scheduled to release its earnings report after the market close.

If the earnings report is worse than expected, the stock price might fall sharply in after-hours trading.

In this case, the basis risk is that the stock price will fall more than expected, which can be managed via hedging strategies like owning put options.

Product or quality basis risk

Jet fuel is commonly used in this situation as something that might be commonly hedged with crude oil.

Oil has a liquid futures market as well as lots of oil derivatives. For jet fuel, there is not.

So, an airline that is effectively “short” jet fuel (it needs to buy it) might want to hedge against a rise in the price of jet fuel by being long crude oil.

However, the prices of jet fuel, crude oil, and others might diverge, making no other commodity a very pure hedge. In turn, this creates basis risk.

Another example is basis risk between two different grades of the same product.

For example, Brent crude oil and WTI crude oil are both types of crude oil, but they are not interchangeable. They are produced in different locations and have different properties. As a result, they trade at different prices.

An investor who holds a long position in Brent crude oil and wants to hedge it with a WTI crude oil futures contract might find that the basis between the two contracts has widened unexpectedly.

This basis risk can be managed by using derivatives such as options and futures contracts to establish positions that offset any basis risk that might be present in the underlying security.

Calendar basis risk

Calendar basis risk is the risk that arises from the difference in the maturity dates of two related securities.

For example, consider a situation where an investor or trader holds a long position in a stock and wants to hedge it with a put option.

The trader might buy a put option with a strike price that is lower than the current price of the stock and a maturity date that is longer than the expected holding period for the stock.

However, if the stock price falls sharply and the put option expires before the stock is sold, the investor will be exposed to basis risk.

This basis risk can be managed by choosing derivatives with expiration dates that match the expected holding period for the underlying security.

Conclusion

An important concept in finance, basis risk is the risk that arises from the difference in the maturity dates of two related securities.

While basis risk is always present to some degree, it can be managed through the use of careful analysis and strategic hedging.

There are a few different ways to manage basis risk:

– Use statistical techniques such as regression analysis to identify relationships between securities and develop hedging strategies that minimize basis risk.

– Use derivatives such as options and futures contracts to establish positions that offset any basis risk that might be present in the underlying security.

– Use hedging strategies such as short selling or buying put options to offset basis risk.

– Monitor the basis between two securities on a regular basis and adjust hedging strategies as needed to keep basis risk at a minimum.

By understanding how basis risk works, traders and investors can take steps to protect themselves from unexpected moves in the market.