Yield Trading Strategies

Yield-focused trading strategies prioritize generating regular income (interest, dividends, rent, premiums, etc.) over capital appreciation.

Below, strategies are categorized by asset class and include descriptions, typical instruments, risk profiles, and yield generation mechanisms.

Notable regional considerations or prevalent markets are mentioned where relevant.

Key Takeaways – Yield Trading Strategies

Equities & Hybrids

- Dividend Stock Investing

- Preferred Stock Investing

- Covered Call Writing (Buy-Write Strategy)

- Cash-Secured Put Selling

- Master Limited Partnerships (MLPs)

- Royalty Trusts

- Business Development Companies (BDCs)

Fixed Income

- Government Bonds (Sovereign Debt)

- Investment-Grade Corporate Bonds

- High-Yield Corporate Bonds (Junk Bonds)

- Emerging Market Bonds

- Municipal Bonds (Tax-Exempt Income)

- Structured Credit (MBS, CLOs, ABS)

- Private Credit & Peer-to-Peer Lending

- Bond Laddering

- Leveraged Bond Funds

Real Estate

- Direct Rental Property Ownership

- Real Estate Investment Trusts (REITs)

- Mortgage REITs (mREITs)

- Real Estate Crowdfunding

- Private Equity Real Estate Funds

- Sale-Leaseback Investments

- Triple-Net Lease Investments

Commodities

- Futures Carry & Roll Yield Strategies

- Selling Commodity Options (Premium Harvesting)

- Commodity Royalties

- Streaming Agreements (in mining/oil)

- Midstream Infrastructure Investments (e.g., pipelines)

- Commodity Trade Financing

Currencies (FX)

- FX Carry Trade

- Dual-Currency Investments (Yield-Enhanced Deposits)

- FX Option Writing & Volatility Selling

Cryptocurrency

- Staking (Proof-of-Stake Yield)

- Crypto Lending (CeFi & DeFi Platforms)

- Yield Farming

- Liquidity Mining

- Crypto Arbitrage

- Basis Trading (Cash-and-Carry Futures)

- Masternodes & Node Operation Rewards

Dividends

What Is Dividend Stock Investing?

Dividend stock investing is a yield-focused equity strategy where investors buy stocks that regularly pay out a portion of earnings as dividends.

These are typically mature companies in sectors like utilities, telecom, healthcare, and consumer staples – businesses with stable cash flows and limited need to reinvest aggressively (so it can be returned to shareholders).

The goal isn’t explosive capital growth, but rather steady, predictable income through quarterly or annual payouts.

Typical Instruments Used

Investors can buy individual high-dividend-paying stocks, such as blue-chip names known for consistent payments.

“Dividend aristocrats” – companies with 25+ years of uninterrupted dividend increases – are especially popular.

Others prefer dividend-focused ETFs or mutual funds that pool together many such stocks, offering diversified exposure to income-producing equities.

Risk and Limitations

Dividend stock strategies come with a moderate risk profile.

These stocks generally have lower price volatility than high-growth tech or biotech names, but they’re not without risk.

A company can cut its dividend if profits fall – this happened widely during the 2008–09 financial crisis.

There’s also opportunity cost: focusing on dividends can mean missing out on higher growth from reinvested earnings.

Still, in market downturns, dividend stocks tend to outperform because income offers a buffer when prices fall.

How Yield Is Generated

The income comes from cash dividends, usually paid quarterly.

Dividend yields vary by company and sector.

Utility and telecom companies, for instance, may yield 4–6%, while the broader market average is closer to 1.5–2% (say, the S&P 500).

Long-term investors often reinvest dividends, which compounds returns over time and boosts the overall income stream.

Regional Considerations

Dividend investing is especially common in countries like the UK and Australia, where favorable tax treatment (like Australia’s franking credits) boosts after-tax returns.

In emerging markets, some companies offer even higher yields to attract foreign investment, though with added political and currency risks that can undercut returns or stability.

Preferred Stock

What Are Preferred Stocks?

Preferred stocks are hybrid securities that combine features of both stocks and bonds.

They offer fixed dividend payments, giving investors a predictable income stream often higher than common stock dividends.

Unlike common shares, preferreds usually come with no voting rights but priority on dividends – meaning preferred holders get paid before common shareholders if the company distributes profits.

Typical Instruments

Most preferred shares are exchange-traded, issued by banks, REITs, utilities, and other capital-intensive sectors.

They’re often labeled by series (e.g., Series A, Series B) and may be perpetual or have callable features that let the issuer redeem them after a set date.

Some are also convertible into common stock under certain conditions.

Risk Profile

The risk level ranges from moderate to high.

Preferreds are highly sensitive to interest rate changes – as rates rise, their fixed income becomes less attractive, driving prices down.

They also face credit risk: in tough times, dividends can be suspended (without triggering default).

And it typically hits the stock price in a big way.

Preferred holders sit below bondholders in the capital structure, though their shares tend to be less volatile than common stock from the same issuer due to income stability.

How Yield Is Generated

Preferreds typically pay quarterly dividends based on a fixed rate or percentage of par value.

Yields of 5–7% are common, often exceeding the yields on the same company’s bonds or common stock.

Many preferreds offer qualified dividends, which may enjoy favorable tax treatment for individual investors.

Regional Considerations

Preferred shares are most prevalent in the US and Canada.

Though other countries issue similar instruments (usually called preference shares), the North American market is largest.

US investors particularly favor preferreds in sectors like financials and real estate, and many issues carry credit ratings to guide selection.

Covered Call Writing

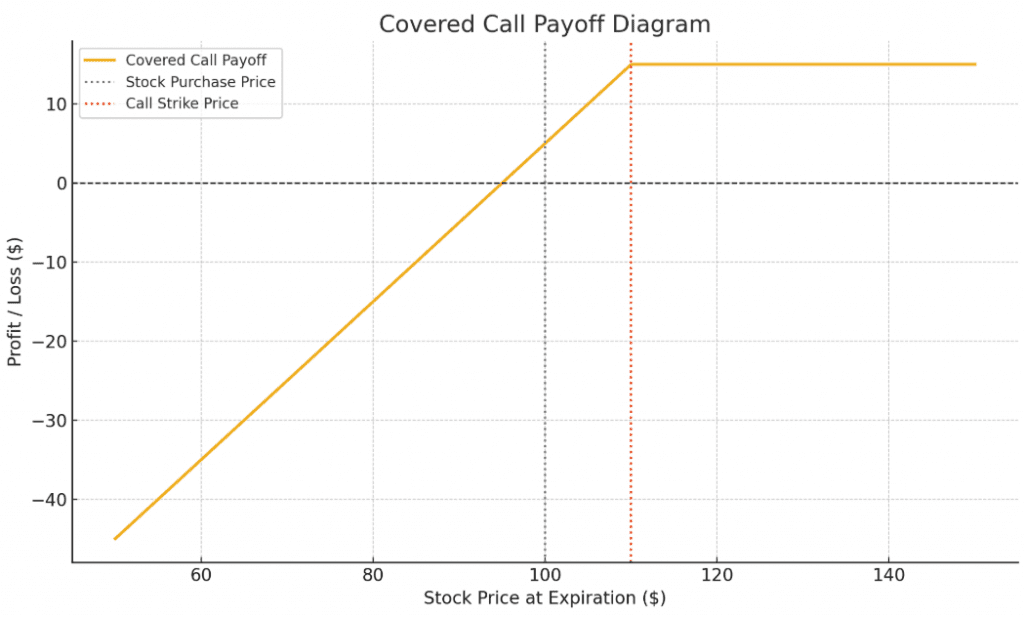

How Covered Call Writing Works

Covered call writing involves owning a stock or ETF and simultaneously selling a call option on it.

The call gives someone else the right to buy the stock at a set price (strike), typically expiring in a month or two.

In exchange, the seller receives upfront premium income.

If the stock stays below the strike, the option expires worthless, and the seller keeps both the stock and the premium.

Income and Risk Dynamics

This strategy generates yield by collecting option premiums, which enhance total returns, especially in sideways markets.

The trade-off is that upside is capped: if the stock rallies past the strike price, it may be “called away,” limiting gains.

On the downside, the premium offers a modest buffer, but losses still occur if the stock falls sharply.

It’s best suited for flat or mildly bullish outlooks.

Where It’s Used and Why

Covered calls are popular in US equity markets, especially on large-cap stocks with liquid options.

Investors use them to boost yield on long-term holdings or generate monthly cash flow.

Many retirement accounts and income-focused funds employ covered calls to add consistent, option-driven income on top of dividends.

In volatile markets, premiums rise, making this strategy even more attractive.

That is, if you’re willing to trade away some upside.

Cash-Secured Puts

What Is Cash-Secured Put Selling?

Cash-secured put selling is a strategy where an investor sells a put option on a stock they’d be comfortable owning, while setting aside enough cash to buy the stock if assigned.

If the stock stays above the strike price, the option expires worthless and the investor keeps the premium.

If the stock falls below the strike, they buy it at the strike price, effectively getting it at a discount (strike minus premium).

Instruments and Use Cases

The strategy involves short puts on individual stocks or ETFs, backed by cash equal to the full purchase obligation.

Investors commonly sell puts on blue-chip stocks they’re willing to own or use index-based strategies (like selling puts on the S&P 500) to generate yield from broad market exposure.

It’s often used monthly or weekly as a systematic income approach.

Risks and Trade-Offs

The main risk is downside exposure: if the stock crashes/falls a lot, the investor/trader still has to buy it at the strike price, incurring a loss offset only by the premium received.

Upside is capped at the premium earned: if the stock goes up a lot, the investor misses those gains.

Compared to covered calls, the risk profile is very similar, but this method starts from cash, not stock.

It’s a useful way to earn income or enter a position at a lower cost, but not without potential drawdowns.

Yield Potential and Where It’s Used

The yield comes from option premiums, which rise with market volatility.

Many income-focused investors and funds sell puts continuously, rolling contracts to earn recurring income.

In markets like the US and Europe with deep options liquidity, this strategy is widely used.

In less-developed markets, investors may turn to structured products to mimic the same effect.

Master Limited Partnerships (MLPs) & Royalty Trusts

Master Limited Partnerships (MLPs) are publicly traded entities, primarily in the US energy sector, that own and operate infrastructure assets like pipelines, storage facilities, and processing plants.

They’re structured to pass through most of their cash flow to investors in the form of high quarterly distributions.

MLPs benefit from long-term contracts and relatively stable revenues, making them attractive for income-seeking investors.

Royalty trusts are similar vehicles, commonly found in the US and Canada, which collect income from oil and gas wells or mineral rights and distribute it directly to unitholders.

These trusts don’t own the underlying assets outright but receive a percentage of the production revenue.

While both offer high yields – often 6–10% or more – they come with risks such as commodity price sensitivity, depletion of underlying resources (especially in royalty trusts), interest rate exposure, and complex tax reporting (e.g., K-1 forms).

Still, they’re prized for steady, tax-advantaged income.

Business Development Companies (BDCs)

Business Development Companies (BDCs) are closed-end investment vehicles that provide funding (primarily debt but also equity) to small and mid-sized US companies that might not qualify for traditional bank loans.

In exchange for this financing, BDCs receive high-interest payments and sometimes equity stakes.

By law, BDCs must distribute at least 90% of their taxable income to shareholders, which translates into high dividend yields, often in the 8–12% range.

Many BDCs use leverage to enhance returns, borrowing at relatively low rates and lending at much higher ones.

However, this also increases risk. The loan portfolios often consist of below-investment-grade borrowers, so credit risk is substantial, especially in economic downturns.

BDC shares are traded on public exchanges, making them accessible to individual investors.

Despite market volatility and potential credit losses, BDCs remain popular among income-focused investors for their strong yield potential and exposure to private credit markets otherwise unavailable to most retail portfolios.

Fixed Income

Government Bonds (Sovereign Debt)

Sovereign bonds are issued by national governments and are generally considered the safest fixed-income instruments.

Developed countries like the US, Germany, and Japan issue low-risk bonds backed by their taxing authority.

Emerging markets offer higher yields to compensate for default and currency risk.

Investors seeking stability and predictable income often allocate to these.

Investment-Grade Corporate Bonds

These are debt securities issued by financially strong companies with credit ratings of BBB/Baa or higher.

They typically offer higher yields than government bonds with relatively low credit risk.

Suitable for conservative investors aiming to enhance yield without taking on high levels of default risk.

High-Yield Corporate Bonds (Junk Bonds)

These are issued by companies with lower credit ratings and offer significantly higher interest payments.

Investors are compensated for the increased risk of default and economic sensitivity.

Junk bonds can perform well in economic expansions but suffer disproportionately during downturns or credit events.

Emerging Market Bonds

These bonds are issued by governments or corporations in developing countries and usually come with high yields.

The extra income compensates for elevated risks like political instability, inflation, and currency devaluation.

Investors can access them in local currency or through dollar-denominated options to manage FX risk.

Municipal Bonds (Tax-Exempt Income)

Primarily in the US, municipal bonds are issued by local governments and agencies.

Their interest is typically exempt from federal income tax, and often state tax as well.

This makes them attractive for high-income investors seeking tax-advantaged income.

Structured Credit (MBS, CLOs, ABS)

Structured credit pools together loans (like mortgages, auto loans, or business loans) and slices them into tranches with different risk levels.

Senior tranches offer modest yields with lower risk; junior tranches offer higher yield but with more credit exposure.

Private Credit & Peer-to-Peer Lending

These involve lending directly to individuals or businesses outside of traditional banking.

Investors earn high yields in exchange for illiquidity, credit risk, and limited transparency.

Popular platforms and funds enable fractional lending or participation in middle-market private debt.

Bond Laddering & Leveraged Bond Funds

Bond laddering involves owning bonds with staggered maturities to manage reinvestment risk.

It creates a stable, recurring income stream as bonds mature at regular intervals.

Leveraged bond funds, by contrast, borrow to buy more bonds – boosting yield but also magnifying risk during rate spikes or downturns.

Real Estate

Direct Rental Property Ownership

Owning physical property can generate steady monthly income and long-term nominal appreciation.

It also brings headaches: maintenance, vacancies, and local regulatory risk.

Investors take on operational responsibility, but they also retain full control.

Leverage amplifies both returns and downside.

Real Estate Investment Trusts (REITs)

REITs pay out at least 90% of taxable income as dividends.

They offer liquid exposure to commercial real estate across sectors like healthcare, industrial, and multifamily housing.

Mortgage REITs (mREITs)

These are yield machines with serious rate risk.

mREITs borrow short-term to invest in long-term mortgage assets.

Their double-digit yields come at the cost of high leverage and vulnerability to sudden shifts in interest rates or financing markets.

Real Estate Crowdfunding & Private Equity Real Estate

These platforms pool investor capital into single deals or portfolios.

They often have target yields of 6-12%.

Access is easier than ever, but liquidity is not.

Most deals have multiyear lockups, limited secondary markets, and depend heavily on the skill and honesty of deal sponsors.

Sale-Leaseback & Triple-Net Lease Investments

The tenant pays rent and covers all expenses.

Cash flows are highly predictable.

It’s a bond-like real estate strategy favored by conservative investors.

Commodities

Futures Carry & Roll Yield Strategies

Commodities don’t pay interest, but in backwardated markets, rolling futures contracts forward generates a positive yield as prices converge to spot.

This works best when volatility is low and the curve stays favorable.

Selling Commodity Options (Premium Harvesting)

Traders sell options on oil, metals, or agricultural products to collect premium.

If the underlying stays within a set range, they keep the income.

But sharp moves (often driven by weather or geopolitics) can wipe out months of gains quickly.

Sometimes, they’re done in the context of selling covered calls.

Commodity Royalties, Streams, & Infrastructure Investments

Covered above, these investments don’t involve trading commodities but earning from their production.

Streaming and royalty companies take a percentage of mine or well revenues, often at fixed, favorable terms.

Midstream pipeline companies operate on volume, not price, offering more stability.

Yields can be substantial, and operations are often asset-light.

Commodity Trade Financing

This is short-term lending to fund physical commodity shipments.

It’s typically low-risk and collateralized by the goods in transit.

Funds targeting this niche aim for steady yields in the 4–8% range, often uncorrelated with markets.

Currencies (FX)

FX Carry Trade

The FX carry trade is simple in theory: borrow in a low-yield currency and invest in a high-yield one.

You pocket the interest rate difference – until the currency pair moves against you.

These trades work well in calm, “risk-on” environments but can unravel quickly during global stress.

Dual-Currency Investments (Yield-Enhanced Deposits)

You deposit in one currency but agree to potentially be repaid in another at a pre-agreed exchange rate.

The reward?

A significantly higher yield.

The risk?

Getting stuck with a depreciated currency if the market moves past the strike.

FX Option Writing & Volatility Selling

This strategy sells insurance on currency moves.

If the exchange rate stays in range, the seller keeps the premium.

But when it doesn’t, losses can be steep – especially with naked positions.

Cryptocurrency

Staking (Proof-of-Stake Yield)

Staking involves locking up tokens to help validate transactions on proof-of-stake networks.

In return, you earn new tokens as rewards.

Yields vary by network and participation rate – typically 4–10%.

It’s less risky than lending but still exposed to token price volatility and network risks.

Crypto Lending (CeFi & DeFi)

You lend your crypto out and earn interest.

Simple in concept, risky in execution.

Centralized platforms can fail (and have), while DeFi protocols rely on smart contracts and collateralization ratios.

Yields can be 2–15%, often higher for stablecoins.

Choose platforms carefully, or you might not get your principal back.

Yield Farming & Liquidity Mining

This is the most aggressive income strategy in crypto.

You provide liquidity to protocols and earn trading fees plus token rewards.

APYs can hit strong double-digits – but so can losses, thanks to impermanent loss, token inflation, and smart contract exploits.

Crypto Arbitrage & Basis Trading

Market-neutral in theory, profitable in practice – if executed with precision.

You exploit price differences across exchanges or between spot and futures.

Returns were once high but have compressed as competition and efficiency increased.

Masternodes & Node Operation Rewards

Run a server, lock up collateral, and earn ongoing payouts in tokens.

It’s like staking with more hardware responsibility.

Rewards can be generous but depend on the health of the network and token price.

Once popular, now largely niche as staking dominates.

Conclusion

Across equities, fixed income, real estate, commodities, currencies, and crypto, there’s a wide spectrum of yield-focused strategies.

From simply holding dividend stocks or bonds, to engaging in derivatives and DeFi yield farms, investors can tailor income strategies to their risk tolerance and expertise.

The trade-off between yield and risk is a constant theme: higher yields typically require taking on more credit risk, market risk, or complexity.

Additionally, many yield strategies are sensitive to interest rate changes and economic cycles (e.g., what looks attractive in a low-rate environment might underperform when rates rise, and vice versa).

Regional market structures and regulations also shape these opportunities – what’s common in one country (like US MLPs or Japanese yen carry trades) may be absent or different in another.

Ultimately, a well-constructed yield-focused portfolio often blends multiple asset classes and strategies to balance risk for a stable income stream, while staying vigilant to changes in market conditions that can impact each yield source.

Yield strategies continue to evolve (especially in crypto and alternative assets), but the fundamental goal remains the same: generate a dependable yield that meets the investor’s needs without undue erosion of capital.