Currency Risk Premia

Currency risk premium refers to the additional return a trader or investor demands for holding a currency that may depreciate against their home currency.

This concept is important in international finance and investing.

The risk premium is influenced by various factors:

Key Takeaways – Currency Risk Premia

Interest Rate Differentials

According to the Interest Rate Parity theory, the difference in interest rates between two countries can indicate the expected change in exchange rates.

If a foreign country has a higher interest rate than the home country, its currency is expected to depreciate in the future.

This creates a risk for investors.

Economic and Political Stability

Currencies from countries with stable political and economic environments typically carry lower risk premia.

Traders demand higher returns for holding currencies from countries with higher economic or political risks.

Higher political risks = greater risk of capital outflows, which puts pressure on the exchange rate.

Accordingly, traders will increase the required premium to keep holding the currency.

Related: Emerging Markets FX

Expected Inflation

High inflation can erode the value of a currency.

Investors demand a higher risk premium for currencies expected to be impacted by higher inflation.

To get a currency to hold its value, the central bank must provide an interest that offsets the combination of the inflation rate and any depreciation pressure from the net capital flow.

For example, if a country has a 5% inflation rate, it is not enough to simply provide a 5% nominal interest rate on the currency for it to hold its value if the country sees capital outflow in adverse ways.

This capital withdrawal issue can be a bigger part of the currency risk premia than inflation and other factors, depending on the situation.

This is why some countries tie up their capital account and don’t let money leave the country (capital controls).

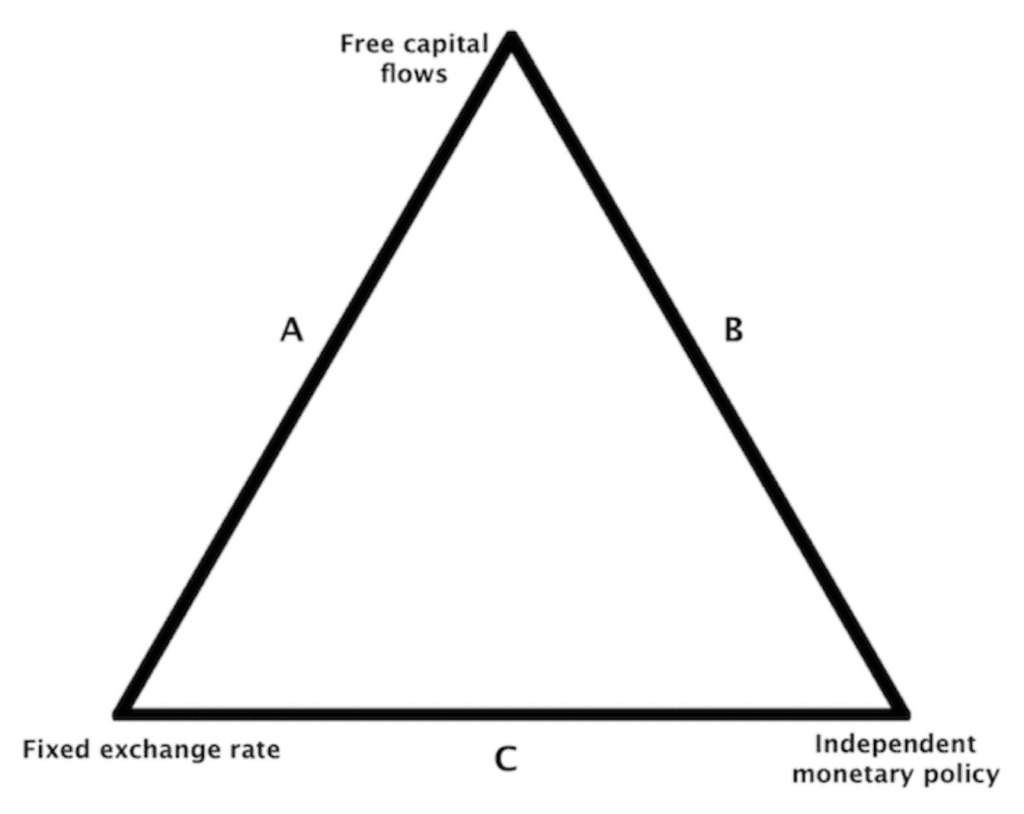

But capital controls come with other trade-offs for policymakers, in what’s commonly called a trilemma.

For example, if a country wants to fix its exchange rate to a certain benchmark (most commonly this is pegged to the world’s leading reserve currency or its top trading partner) it will need to control capital flows in and out of the country if it wants to retain an independent monetary policy.

China and Vietnam are examples.

Market Sentiment and Speculation

Short-term market sentiment and speculative activities (e.g., hot money flows chasing short-term profits rather than long-term investment in a country) can also influence currency risk premiums.

In times of greater volatility in global markets, investors might prefer safe-haven currencies (i.e., higher demand for the cash, credit, equities, and assets in reserve currencies, or non-credit/non-liability reserve assets like gold).

This can increase the risk premium for other currencies.

Historical Currency Movements

Past volatility and trends in a currency’s value can influence its perceived riskiness.

A history of significant depreciation or volatility can lead to a higher risk premium.

How to Find Currency Risk Premiums

To find currency risk premiums, analyze the interest rate differentials between two currencies, considering factors like inflation rates, economic stability, and monetary policies.

Some of it may be due to inflation differentials, while some may be credit-related (e.g., a risk that the government doesn’t pay its bills, suffers from economic instability)

Forward exchange rates compared to spot rates can also provide insight into expected currency movements.

This reflects the market’s anticipation of future changes in currency values.

Related

How Much Currency Diversification Should I Have?

The ideal level of currency diversification depends on your risk tolerance, investment horizon, and overall portfolio strategy.

A common approach is to allocate a portion of your portfolio to foreign assets. It typically ranges from 20% to 50%.

But it depends on where you’re from, how stable your currency is, and so on.

For example (and example only), a US-based investor might have 60% of their portfolio in US assets, 20% in other developed markets, and the other 20% in emerging markets and non-credit assets (e.g., commodities).

This balances exposure to currency risks while exploring diversification benefits.

If something brings in a higher return and has diversification value, then it can be worth pursuing. It’s really about the balance of it all.

Adjust this based on market conditions, currency volatility, and changes in your goals and risk appetite.

What Are Some Key Political Risks Affecting FX Risk Premia?

When traders price securities and currencies, they carefully consider political risks, as they can materially impact the returns and risk profiles of their investments/positions.

Political risk encompasses the uncertainty and potential instability caused by political changes, government actions, and geopolitical events.

Here’s how traders typically evaluate and incorporate political risks:

Government Policies and Regulations

Changes in government policies, such as tax laws, trade tariffs, foreign investment rules, and regulations, can directly affect company profits, investment climates, and economic conditions.

Traders assess the stability and predictability of a government’s policies to gauge potential risks to their investments.

Elections and Political Transitions

Elections and changes in leadership can lead to shifts in economic and foreign policies.

Traders often monitor election cycles and political developments to predict potential policy changes.

Geopolitical Tensions and Conflicts

Geopolitical risks, including international conflicts, territorial disputes, and diplomatic tensions, can disrupt global trade and financial markets.

This is most important in regions prone to geopolitical instability, though developed markets experience these issues as well.

Country-Specific Risk Assessment

Political risk varies significantly by country.

Traders often use country-specific risk assessments and ratings provided by agencies or consult geopolitical experts to understand the unique political landscapes of different countries.

Economic Sanctions and Trade Policies

Governments may impose economic sanctions or change trade policies, which can affect international trade and investment flows.

Currency Risk

Political issues can lead to currency depreciation, and affect the returns of investments denominated in that currency.

For example, if you own stocks from Brazil, denominated in BRL, it’s not just the nominal returns, but nominal returns + FX effects (unless they’re directly hedged).

Traders might use hedging strategies to mitigate currency risk stemming from political uncertainties or limit the position size.

How to Protect Against Political Risk

Some ways to protect against political risk.

Scenario Analysis and Stress Testing

Traders often conduct scenario analyses and stress tests to understand how different political outcomes could affect their portfolios.

This helps in developing strategies to manage potential risks.

Related

Diversification

To mitigate political risk, traders often diversify their portfolios across different geographies and asset classes.

This even includes developed markets and those from strong economies.

For example, most Americans would be very surprised if their own democratic systems were eventually toppled because it’s a relatively young country with a limited history.

Conversely, most Chinese find this type of circumstance (the current system eventually being phased out in favor of a new one) to be an inevitability because China’s history is longer and full of these types of events.

Most portfolios are biased toward their own domestic equity market.

This leaves them very concentrated toward:

- one country

- one currency

- one asset class

Spreading capital widely in a portfolio (by asset class, country, and currency) can help limit the impact of adverse political events in any single country or region.

Monitoring and Agility

Continuous monitoring of political developments and maintaining agility in investment decisions is crucial.

This allows investors to respond quickly to changing political scenarios that could impact their investments.

Conclusion

The currency risk premium is a factor in international investment decisions and currency trading.

It’s an essential component of the returns for traders/investors engaging in foreign exchange markets or holding assets denominated in foreign currencies.

Managing this risk through hedging strategies or diversifying currency exposure is a common practice among international investors.