Best Forex Trading Platforms In Uzbekistan 2026

Uzbekistan used to restrict forex trading tightly, but since capital controls were lifted in 2017 it’s become much easier to trade currencies online. Still, the Central Bank of the Republic of Uzbekistan does not actively oversee forex brokers, so local traders often open accounts with international firms (local tax rules still apply).

Discover the best forex trading platforms in Uzbekistan, personally tested by our experts. Every broker listed accepts forex traders from Uzbekistan.

6 Top Forex Trading Platforms In Uzbekistan

Following our extensive tests, these 6 brokers emerge as the best for forex traders in Uzbekistan:

-

1

XM

XM -

2

Vantage

Vantage -

3

IC Markets

IC Markets -

4

AvaTrade

AvaTrade -

5

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs -

6

Eightcap71% of retail traders lose money when trading CFDs

Eightcap71% of retail traders lose money when trading CFDs

This is why we think these brokers are the best in this category in 2026:

- XM - XM offers a strong selection of currency pairs with no re-quotes or hidden charges, while spreads have come down over the years, now starting from 0.8 pips on the EUR/USD in the commission-free account.

- Vantage - Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

- IC Markets - IC Markets maintains its commitment to providing exceptionally tight 0.0-pip forex spreads on major currency pairs such as EUR/USD. This makes it an excellent option if you are seeking superior execution, with an average of 35 milliseconds. Additionally, if you are a high-volume trader, you can benefit from rebates of up to $2.50 per forex lot.

- AvaTrade - AvaTrade delivers 50+ currency pairs with tight spreads from 0.9 pips and zero commissions. Trade majors, minrs, and exotics 24/5 on leading forex platforms, notably MT4, with sophisticated charting tools and forex education to sharpen your edge, including a dedicated guide to 'Currency Trading'.

- Pepperstone - Pepperstone offers ultra-competitive forex spreads averaging 0.12 pips on EUR/USD in the Razor account, accompanied by a diverse portfolio comprising 100+ currency pairs - an extensive selection surpassing most competitors. Additionally, Pepperstone distinguishes itself by offering three currency indices (USDX, EURX, JPYX), not commonly found among alternative platforms. Pepperstone has now won our annual 'Best Forex Broker' award twice.

- Eightcap - Eightcap offers 50+ currency pairs in line with the industry average but trailing category leaders like CMC Markets with its 300+ currency pairs. However, Eightcap stands out with institutional-level spreads from 0.0 pips on major pairs like the EUR/USD, alongside low $3.50/side commissions. The broker also offers rich forex data to inform trading decisions, including key fundamentals, bullish/bearish indicators and a calendar that tracks key events in the foreign exchange market.

Best Forex Trading Platforms In Uzbekistan 2026 Comparison

| Broker | Forex Assets | EUR/USD Spread | Forex App Rating | Minimum Deposit | Regulator |

|---|---|---|---|---|---|

| XM | 55+ | 0.8 | / 5 | $5 | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| Vantage | 55+ | 0.0 | / 5 | $50 | FCA, ASIC, FSCA, VFSC |

| IC Markets | 75 | 0.02 | / 5 | $200 | ASIC, CySEC, CMA, FSA |

| AvaTrade | 50+ | 0.9 | / 5 | $100 | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Pepperstone | 100+ | 0.1 | / 5 | $0 | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Eightcap | 50+ | 0.0 | / 5 | $100 | ASIC, FCA, CySEC, SCB |

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| GBPUSD Spread | 0.8 |

|---|---|

| EURUSD Spread | 0.8 |

| EURGBP Spread | 1.5 |

| Total Assets | 55+ |

| Leverage | 1:1000 |

| Platforms | MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| GBPUSD Spread | 0.5 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.5 |

| Total Assets | 55+ |

| Leverage | 1:2000 |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- There are no short-term strategy restrictions with hedging and scalping permitted

- The broker has recently made efforts to expand its suite of CFDs providing further trading opportunities

- The low minimum deposit of $50 and zero funding fees make this broker a great choice for new traders

Cons

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

- Unfortunately, cryptos are only available for Australian clients

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| GBPUSD Spread | 0.23 |

|---|---|

| EURUSD Spread | 0.02 |

| EURGBP Spread | 0.27 |

| Total Assets | 75 |

| Leverage | 1:30 (ASIC & CySEC), 1:1000 (FSA) |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

Cons

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| GBPUSD Spread | 1.5 |

|---|---|

| EURUSD Spread | 0.9 |

| EURGBP Spread | 1.5 |

| Total Assets | 50+ |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| GBPUSD Spread | 0.4 |

|---|---|

| EURUSD Spread | 0.1 |

| EURGBP Spread | 0.4 |

| Total Assets | 100+ |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Platforms | Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

Cons

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| GBPUSD Spread | 0.1 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.1 |

| Total Assets | 50+ |

| Leverage | 1:500 |

| Platforms | MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- After bolstering its roster in 2021, Eightcap offers one of the most extensive selections of cryptocurrency CFDs in the market, with crypto/fiat pairs, crypto/crypto pairs, plus crypto indices for broader exposure to the market.

- Eightcap stands out with a selection of powerful trading tools and resources, including MT4 and MT5, and more recently the 100-million strong social trading network TradingView.

- Eightcap added TradeLocker in 2026, marking it out as the best regulated TradeLocker broker, while still delivering Eightcap's ultra-fast execution and low fees for active traders on the charting software.

Cons

- Despite a useful library of educational guides and e-books in Labs, Eightcap still trails IG’s comprehensive toolkit for aspiring traders with its dedicated IG Academy app and 18 course categories.

- Eightcap needs to continue bolstering its suite of 800+ instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

How We Rate Forex Brokers In Uzbekistan

We concentrate on these areas when rating forex brokers and suggest you do too:

Trust

Find a trustworthy broker to help protect you from forex trading scams, such as those the Uzbekistan Central Bank discovered were tricking customers by posing as legitimate investment firms and promising access to the financial markets in exchange for “payment in foreign currency.”

Our recommendation is to choose a long-standing forex broker authorized by ‘green-tier’ regulators, such as the ASIC in Australia or the FCA in the UK. In our experience, they often provide the most transparent forex trading conditions and should follow rules to protect retail investors.

- There’s good reason AvaTrade maintains its near-perfect 4.8/5 Trust rating (no broker can ever be fully trusted). It boasts licenses from a host of top regulators including ASIC and CySEC, and it’s maintained a sterling reputation over nearly 20 years in the forex industry.

Currency Pairs

Look for a forex broker that allows you to trade the currencies you’re interested in.

While this may be the Uzbekistani som (UZS), our years evaluating hundreds of forex trading platforms show this is rarely available. However, traders in Uzbekistan may find regional currencies they’re familiar with such as Russian roubles (RUB).

Ultimately, the best forex brokers tend to offer upwards of 50 currency pairs, with majors, minors and more volatile exotics, catering to various strategies.

- Pepperstone continues to stand out in the market with its 100+ currency pairs, offered with tight spreads including a 0.1-pip average on the EUR/USD. Combine this with its fantastic platform selection and you’ll see why we’ve awarded this brand our ‘Best Forex Broker’ twice now.

Pricing

Choosing a low-cost forex broker is important for all traders, but it’s especially important if you’re forex day trading and racking up charges by placing multiple trades per day.

We always weigh up trading fees such as spreads on currency pairs, plus non-trading fees such as charges to deposit in UZS, and consider these in relation to the full range of services offered.

We’ve also been pleased to find many forex brokers nowadays offering a choice between spread-only pricing, which tends to suit newer traders, and raw pricing with tight spreads and a commission charged per forex lot, which tends to keep costs down for experienced day traders.

- IC Markets consistently ranks as one of the cheapest forex brokers following years of tests, delivering ultra-tight spreads on both its Raw and Standard accounts, as well as superior execution speeds averaging 35 milliseconds, helping active traders lock in optimal prices in fast-moving foreign exchange markets.

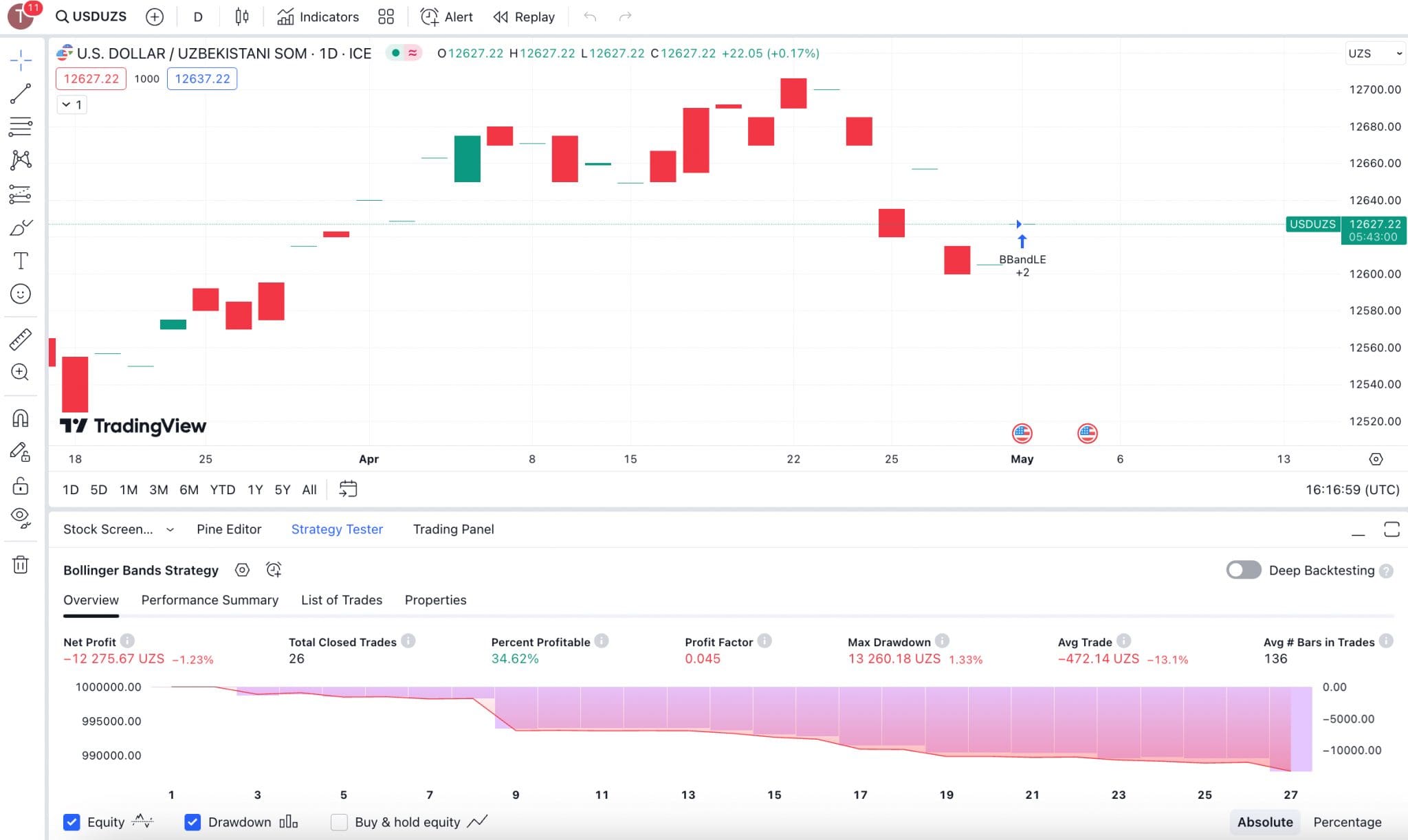

Forex Platforms

Choose a user-friendly, well-equipped platform or app. This can make a huge difference to your forex trading experience, especially for day traders looking for robust charting tools.

In our experience, advanced traders often enjoy the MetaTrader 4 and MetaTrader 5 platforms, which provide charting power, plenty of indicators, trading robots and more.

However, we’re increasingly seeing newer platforms like TradingView and in-house terminals rival the MetaTrader suite in terms of features, from integrated analysis tools to insights into central bank decisions, all while being more intuitive for beginners.

I recommend using a demo account to make sure you like the platform before trading forex.Available at all our recommended brokers, I find them the best way to make sure you enjoy using the software and that they provide the features you need.

- FOREX.com offers superb forex trading tools, thanks to its suite of MetaTrader platforms plus TradingView and a bespoke app with one of the slickest designs I’ve seen. There’s also a range of signals and analyses from Trading Central and AutoChartist, giving traders flexible ways to research foreign exchange markets.

Account Funding

Select a broker with convenient ways to fund your trading wallet with Uzbekistani Soms.

Many of the best forex brokers in Uzbekistan accept both classic card and wire payments, as well as e-wallets like Skrill, which we see increasingly as the preferred way of making cross-currency payments.

These digital payment methods are also growing more popular in Uzbekistan, where Finextra reports that there were 47 licensed payment companies and some 12 million users of digital payment services in 2023.

- Vantage is still our top pick for account options in Uzbekistan because it provides an Islamic account, accepts a low 50 USD (around 635,000 UZS) minimum deposit and supports convenient funding options including Skrill and other e-wallets. It’s also a highly trusted forex trading platform with 900,000+ clients and ASIC regulation.

Methodology

To compile a list of the best forex trading platforms in Uzbekistan, we took our database of 139 online brokers, identified those accepting traders from Uzbekistan and listed them by their rating, which factor in whether:

- They are trusted and authorized by a regulator if not the Uzbekistan Central Bank.

- They offer a wide range of currency pairs catering to different strategies.

- They deliver excellent pricing with no hidden costs for forex traders.

- They support intuitive and dependable forex platforms following tests.

- They offer convenient account funding in local currencies like UZS.

FAQ

Is Forex Trading Legal In Uzbekistan?

Forex trading is legal in Uzbekistan, and the removal of capital controls in 2017 means you can now sign up with international brokers since cross-currency transactions are allowed.

Still, we recommend checking the latest rules regarding taxes on forex trading profits with the Uzbekistan Tax Committee to make sure you understand your obligations.

Who Regulates Forex Trading In Uzbekistan?

The Central Bank of the Republic of Uzbekistan is responsible for regulating the country’s financial markets, but it does not play an active role in licensing forex brokers.

As a result, many residents turn to forex trading platforms that are authorized by trusted regulators like the UK’s FCA or Australia’s ASIC.

How Much Money Do I Need To Start Trading Forex In Uzbekistan?

The exact amount depends on the forex trading platform you choose, but out of the hundreds we’ve reviewed very few require more than 250 USD, around 315 million UZS.

That said, many forex brokers are significantly more affordable, appealing to budget traders. Pepperstone, for example, doesn’t require any initial deposit.

Recommended Reading

Article Sources

- Central Bank of Uzbekistan

- Uzbekistan Tax Committee

- Finextra report on digital payments in Uzbekistan

- Islam in Uzbekistan - Wikipedia

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com