What Is Portable Alpha?

Portable alpha is an investment strategy that involves separating the alpha and beta components of an investment portfolio.

The alpha component is the portion of the portfolio that seeks to generate returns through active management, while the beta component is the portion that tracks a benchmark index.

Key Takeaways – Portable Alpha

- Portable alpha separates alpha (active return) from beta (market return), letting investors pursue excess returns without losing market exposure.

- Portable alpha pairs a high-quality long/short alpha strategy with an equity beta overlay (usually via futures).

- This structure preserves traditional beta exposure while capturing alpha from hedge fund-like strategies.

- High equity valuations and macroeconomic volatility make portable alpha an increasingly compelling solution for those seeking better risk-adjusted returns.

- By using equity futures, options, or synthetic ETFs, core beta can be maintained with minimal capital, freeing up the rest for alpha strategies.

- This structure improves capital efficiency and return potential.

- Simulations show higher returns than traditional 60/40 portfolios, and while volatility increases, it can be managed through careful selection of uncorrelated alpha sources and risk-aware portfolio construction.

Portable alpha and generating higher returns

Portable alpha strategies aim to provide investors with the potential to generate higher returns than what can be achieved by investing in a traditional index-tracking product.

Portable alpha strategies can be used to enhance the performance of both long-only and long-short portfolios.

There are many different ways to construct portable alpha portfolios, but they all share one common goal: to decouple the return streams of the alpha and beta investments in order to achieve higher overall returns.

Portable alpha theory

The portable alpha theory was first popularly introduced by Goldman Sachs in the early 1990s.

The idea behind portable alpha is that the returns of a portfolio are determined by two factors:

- the underlying investment strategy (alpha) and

- the market movement of the underlying assets (beta)

By separating these two return streams, investors can theoretically achieve higher returns than what would be possible by investing in a traditional index-tracking product.

The portable alpha strategy has been popular with institutional investors, such as pension funds and endowments, for many years.

However, it is only recently that portable alpha products have become available to retail investors.

Portable alpha strategies can be used to achieve higher returns than what would be possible by investing in a traditional index-tracking product.

Key Problems Addressed with Portable Alpha

- High Equity Valuations – US equities are expensive by historical standards, suggesting lower forward returns. Real annual returns over the next 10 years are below the long-term expected average.

- Long-Only Active Management Underperformance – Over the past decade, median long-only managers added virtually no alpha. Even top quartile managers barely beat benchmarks (US: +0.4%, International: +1.0%).

- Macro Volatility Risks – Geopolitical instability and policy uncertainty make traditional, long-only portfolios vulnerable during macro shocks, when equities tend to perform poorly.

- “Funding Problem” – Adding long/short diversifiers often forces investors to underweight traditional beta (stocks and bonds), which hurt returns during the past bull market.

Portable Alpha: The Proposed Solution

- Higher Alpha Potential – Hedge funds (beta-adjusted) added +2.3% alpha on median over the last 10 years, versus near-zero for long-only. Top-quartile hedge funds delivered +4.5% alpha.

- Avoids the Funding Problem – Investors no longer need to reduce core equity holdings to allocate to diversifying strategies.

- Unconstrained Execution – Long/short managers can short weak securities and use leverage to build diversified portfolios, making index concentration irrelevant.

Implementation Models

Complex Model:

- Separate alpha manager and beta overlay provider.

- Higher operational complexity and risk (e.g., cash management, performance reporting, beta mismatch).

- Typically suitable only for sophisticated institutions.

Turnkey Model:

- Alpha manager also manages the beta overlay.

- Simpler, more transparent, and accessible for all investor types.

- Integrated risk and performance management.

Portable alpha’s decline in popularity in 2008

Portable alpha fell out of favor in 2008 as most investment managers who used it did poorly during the financial crisis.

While alpha strategies are supposed to be uncorrelated to the broader market, sometimes that’s easier said than done.

Despite its decline in popularity, portable alpha remains an important tool for institutional investors and remains in popular use during the 2020s, used by some of the largest hedge funds and institutional investment managers today.

While portable alpha has been around since the early 2000s, better design, infrastructure, and fee alignment now make it a practical solution for a broader set of traders and investors.

In today’s environment of elevated market risk and constrained return expectations, turnkey portable alpha with fair fee structures offers an attractive, scalable way to improve portfolio outcomes without sacrificing traditional exposures.

Portable alpha and derivatives

Derivatives such as options are one tool that traders can use to obtain alpha in a market.

They can use options to design very specific exposures that can’t be obtained with basic beta strategies.

Portable alpha strategies

The most popular portable alpha strategy is known as the ” beta and alpha replication strategy.”

This approach involves investing in a portfolio of stocks that mimic the performance of a benchmark index, such as the S&P 500, and then overlay an alpha-seeking investment, such as a hedge fund or market-neutral strategy, to generate returns that are not correlated with the market.

Other portable alpha strategies include:

“Beta neutral portable alpha”

This approach invests in both long and short positions in order to cancel out the market exposure of the underlying beta investments.

The goal is to generate pure alpha returns that are not impacted by market movements.

“Alpha portable”

This strategy seeks to invest only in highly-concentrated portfolios of securities that have the potential to generate significant alpha returns.

Investments are selected based on fundamental analysis and a bottom-up approach.

“Portable alpha with options”

This strategy uses options to generate alpha returns while also hedging away market risk.

The Benefits of Portable Alpha

There are many potential benefits of portable alpha strategies, including:

- The ability to achieve higher returns than traditional index-tracking products

- The potential to generate pure alpha returns that are not impacted by market movements

- The ability to hedge away market risk

- The ability to use a variety of portable alpha strategies to suit different investment objectives

However, it is important to remember that portable alpha strategies come with their own set of risks and challenges.

Step-by-Step Portable Alpha Implementation

So, how do we do this?

Step 1: Define Core Beta Exposure

You need to first decide what beta exposure you want to maintain. For most, this is equity beta (e.g., S&P 500, MSCI ACWI, etc.).

- Example: Target is a 60% equity, 40% bond portfolio (traditional 60/40).

However, rather than holding physical equities, you’ll replace the equity exposure with futures to free up capital to invest in alpha strategies.

Step 2: Select the Beta Overlay Instrument

Use equity index futures to synthetically replicate your core beta exposure.

- S&P 500 Beta Overlay:

- Instrument: E-mini S&P 500 Futures (ES)

- Exposure: $1 million per contract (approx., varies with market)

- Capital requirement: ~5–10% margin

Result: You maintain full equity exposure, but free up ~90–95% of the capital.

Step 3: Select the Alpha Engine

Use a diversified, market-neutral hedge fund strategy or multi-strategy long/short manager as your alpha source. The alpha strategy must be:

- Uncorrelated with equities (low beta)

- Able to generate positive net alpha

- Liquid enough to integrate with futures

Examples of Alpha Strategies:

- Market-neutral equity L/S

- Global macro

- Statistical arbitrage

- Multi-strategy hedge funds

- Systematic trend-following

Step 4: Allocate Capital

Here’s how you structure your capital:

| Component | Allocation | Notes |

| Equity Futures Overlay | 60% | S&P 500 or MSCI World futures, margined (~5–10% cash) |

| Long/Short Hedge Fund(s) | 40% | Diversifying alpha strategies |

| Cash Buffer/Margin | 5–10% | For futures margin and liquidity management |

Total exposure: 100%+ (gross), but capital is used efficiently.

Step 5: Integrate with a Turnkey Provider (Optional but Ideal)

Use a turnkey portable alpha manager (e.g., AQR, BlackRock, JPMorgan OCIO) who provides:

- Futures beta overlay

- Alpha sourcing

- Integrated operations and reporting

- Fair fee structure (performance fee only if total return > benchmark)

This removes operational complexity and risk of managing overlay and alpha separately.

Step 6: Monitor and Evaluate Performance

Track two key metrics:

- Total portfolio return vs. stated benchmark (e.g., MSCI ACWI or 60/40)

- Alpha engine return (net of fees), adjusted for beta

Set clear governance rules:

- When to replace underperforming alpha managers

- How much tracking error is acceptable

- Rebalancing cadence

Example Portfolio: $100M Portable Alpha Allocation

Traditional Approach (Without Portable Alpha)

| Asset Class | Allocation |

| Equities | $60M |

| Bonds | $40M |

Portable Alpha Approach

| Component | Capital Allocated | Economic Exposure |

| Equity Futures Overlay | ~$6M margin | $60M |

| Bonds | $40M | $40M |

| Hedge Funds (Alpha) | $54M | ~$54M |

- Total portfolio beta: 60% equity, 40% bonds (unchanged)

- Extra alpha layer: $54M in diversified long/short strategies

- Net invested capital: $100M (fully used)

Portable Alpha Performance Target (Example)

- Equity Market Return (S&P 500): 6%

- Bond Return: 3%

- Hedge Fund Alpha Return (net of beta): 4%

Expected Total Portfolio Return:

- 60% * 6% (equity) = 3.6%

- 40% * 3% (bonds) = 1.2%

- 54% * 4% (alpha) = 2.16%

- Total = 6.96% (vs. 4.8% in traditional 60/40)

You gain alpha without changing your beta exposure.

Risks and Practical Tips

- Margin Risk – Futures can be volatile; maintain cash buffers.

- Alpha Volatility – Choose managers with low correlation to equities.

- Tracking Error – Your return path will differ from a traditional 60/40.

- Governance – You need good oversight or a trusted integrated provider.

Turnkey Managers Offering Portable Alpha

- AQR – Multi-strategy, integrated overlay, fair fees

- BlackRock – OCIO + hedge fund platform with overlays

- Man Group – Market-neutral alpha + index overlay

- GMO – Active beta with alpha overlays

- Bridgewater (institutional scale) – alpha + synthetic beta capabilities

Portable Alpha for Retail and Institutional Investors

Using ETFs and Liquid Alternatives

You don’t need hedge fund access to implement a version of portable alpha.

With index ETFs, liquid alternative funds, and futures-based mutual funds, retail and institutional investors can build a portable alpha-like structure using what’s accessible.

Step 1: Replace Equity Exposure with Futures or ETFs

Instead of holding 60% equities directly, use S&P 500 futures (via a futures-enabled brokerage) or synthetic equity ETFs like DBEF, BBEU, or BBJP.

These use derivatives to replicate equity exposure while requiring minimal capital.

- Allocate ~$5K margin per $100K exposure using S&P 500 E-mini futures

- Or invest in synthetic beta ETFs for passive equity exposure with internal leverage

Step 2: Invest Freed-Up Capital into Alpha Strategies

Use liquid alternatives (mutual funds or ETFs) with low equity beta and potential for alpha. Look for:

- Market-neutral equity ETFs: e.g., BTAL (anti-beta), QAI, MNA

- Multi-strategy liquid alt funds: e.g., PAUIX, ADANX, AMFAX

- Trend-following ETFs: e.g., DBMF, TFPN

These funds aim to deliver uncorrelated returns that act as the alpha engine.

Step 3: Maintain Risk Discipline

- Keep a 10–15% cash buffer for futures margin and volatility

- Use automated rebalancing if available through platforms like Schwab Intelligent Portfolios or Fidelity managed accounts

Example Portfolio (on $100K)

- $60K notional S&P 500 exposure via futures (margin: ~$6K)

- $40K in liquid alt funds (diversified across 2–3 alpha strategies)

- $10K cash reserve

This replicates a 60/40 beta portfolio while layering in alpha.

Tip

Use ETFs and mutual funds with daily liquidity, low correlation to stocks, and clear risk disclosures.

Portable alpha can be done without hedge funds, just with smart structuring.

What about the carrying costs of futures?

Equity futures aren’t free; they have implicit financing costs embedded in the futures basis, which reflects interest rates, dividends, and demand dynamics.

When the futures curve is in contango, you pay a negative roll yield (carry cost) as futures expire and are rolled forward at higher prices.

How to minimize carry costs in a portable alpha setup

- Use Total Return Swaps or Synthetic ETFs – Instead of directly holding futures, use ETFs like DBEF, BBJP, or BBUS, which internalize futures exposure and often optimize roll strategies. These can reduce slippage versus manual futures rolling.

- Trade Calendar Efficiently – Use quarterly futures (e.g., March, June, Sept, Dec) and roll just before expiry to avoid excess bid/ask spreads.

- Use ETFs – Use ETFs for beta exposure and futures only for alpha overlay, essentially flipping what’s standard.

- Net Carry vs. Expected Alpha – Make sure it generates excess return well above the annualized carry cost.

- Monitor Futures Basis – Avoid high-cost contracts (e.g., during extreme contango or dividend-heavy periods) and shift to cheaper index variants if needed (e.g., MSCI World over S&P 500).

Strategy Simulation

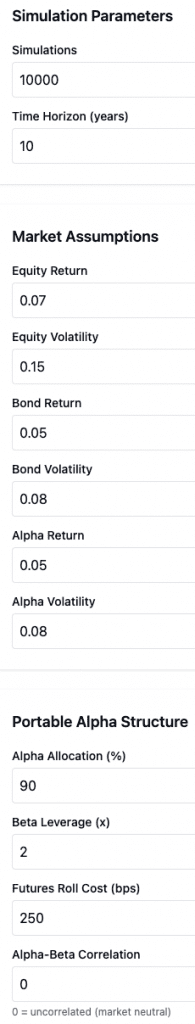

Let’s say we have the following setup:

Traditional 60/40 vs. Portable Alpha: 90% alpha strategies + 10% margin for 2x leveraged beta overlay

We’ll run a Monte Carlo simulation setup.

Here are our parameters:

And the results:

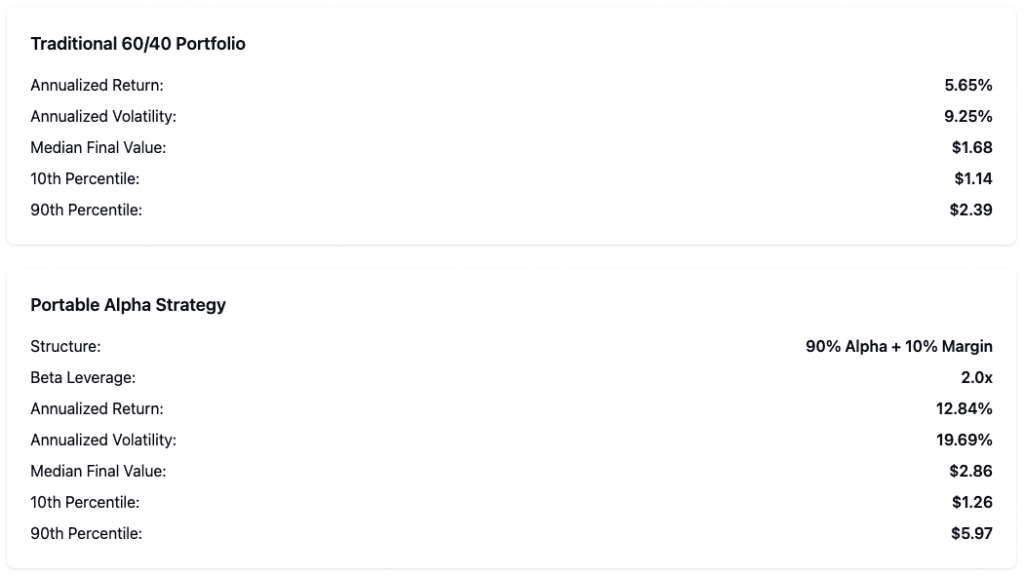

The data compares a Traditional 60/40 Portfolio with a Portable Alpha Strategy.

The Traditional 60/40 portfolio has:

- 5.65% annualized return and 9.25% volatility.

- Median final value of $1.68 (off a $1 initial investment over 10 years).

In contrast, the Portable Alpha Strategy leverages 90% alpha with 10% margin and has:

- 12.84% annualized return and 19.69% volatility.

- Median final value of $2.86.

The Portable Alpha strategy shows higher returns with increased volatility, while the Traditional portfolio is more stable but underperforms in terms of return.

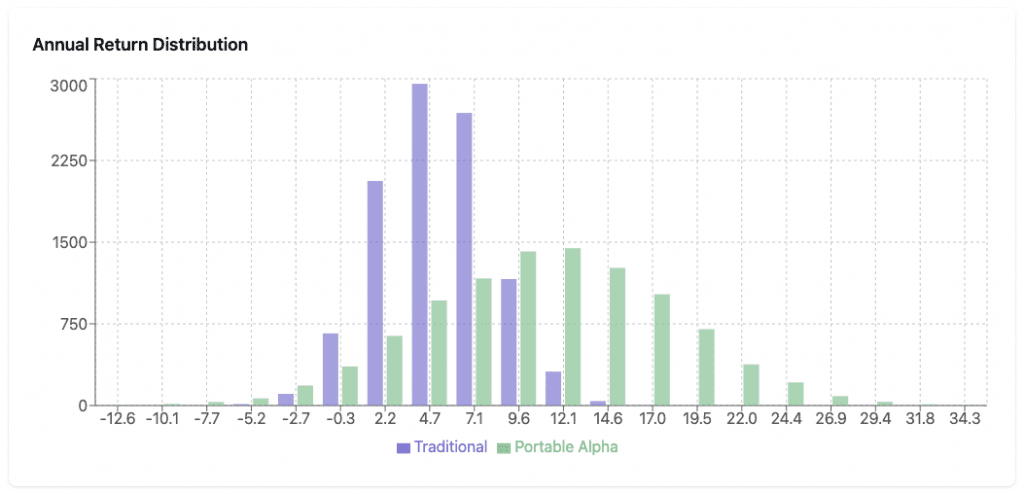

The distribution of returns in the graph shows Portable Alpha achieving higher returns in a more concentrated range.

This is a quick and dirty simulation, but the elevated volatility in the portable alpha strategy can likely be reduced through careful portfolio engineering that manages correlations between the equity, bond, and alpha components.

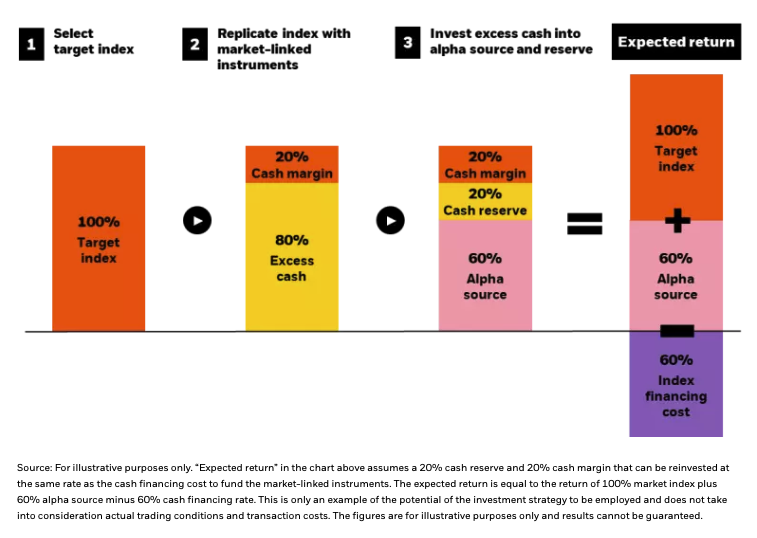

Conceptualization of Portable Alpha

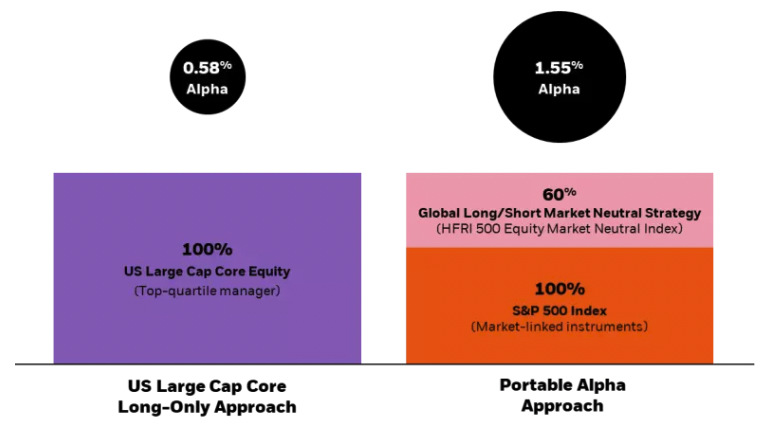

Below shows a graphical depiction of portable alpha from investment manager BlackRock.

Example implementation and expected return of a portable alpha strategy

Traditional long-only results compared to a portable alpha approach

Hypothetical annual alpha generation based on approach

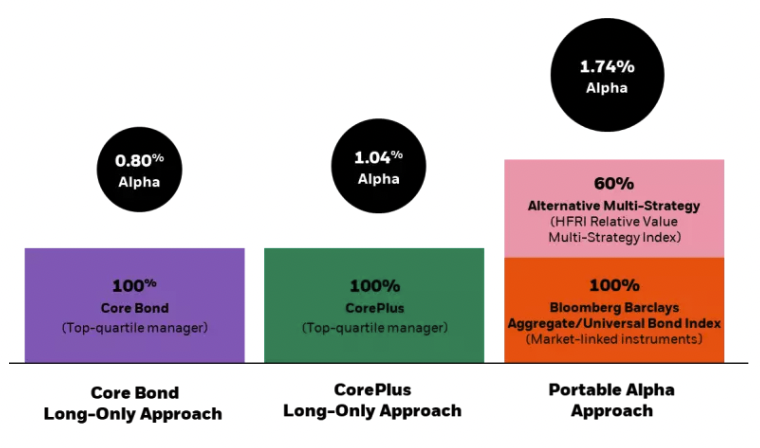

Comparing results of a traditional long-only and portable alpha approach

Hypothetical annual alpha generation based on approach

Conclusion

Portable alpha can be used to achieve higher returns by decoupling the return streams of the alpha and beta investments.

This strategy can be implemented using a variety of different securities, including options.

Portable alpha is an investment strategy that can offer many benefits, including the potential for higher returns, pure alpha returns, and hedging away market risk.

There are many different portable alpha strategies that can be used to suit different investment objectives.