Pepperstone Review 2025

Awards

- Best Overall Broker - DayTrading.com 2025

- Best Forex Broker Runner Up - DayTrading.com 2025

- Best Trading App Runner Up - DayTrading.com 2025

- Best MT4/MT5 Broker Runner Up - DayTrading.com 2025

- Best TradingView Broker Runner Up - DayTrading.com 2025

- Best Forex Broker - DayTrading.com 2024

- Best Overall Broker - DayTrading.com 2023

- Best Trading App - DayTrading.com 2022

- Best Forex Broker - DayTrading.com 2021

Pros

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

Cons

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

Pepperstone Review

In this review of Pepperstone, we weigh the benefits and drawbacks of opening an account by examining the overall day trading environment, drawing on first-hand testing experiences and comparisons with our extensive database of online brokers.

Regulation & Trust

4.6 / 5Year after year, Pepperstone emerges as one of the most trusted brokers with authorization from 4 Green-Tier regulators, a clean track record and dozens of industry awards, underscoring its reliability.

Pepperstone has obtained approval from various regulatory bodies in recent years and operates in compliance with industry standards across the jurisdictions it operates in:

- Pepperstone Limited is regulated by the UK Financial Conduct Authority (FCA)

- Pepperstone Financial Services (DIFC) Limited is regulated by the Dubai Financial Services Authority (DFSA)

- Pepperstone Group Limited is regulated by the Australian Securities & Investments Commission (ASIC)

- Pepperstone EU Limited is regulated by the Cyprus Securities and Exchange Commission (CySEC)

- Pepperstone Markets Limited is regulated by the Securities Commission of The Bahamas (SCB)

- Pepperstone Markets Kenya Limited is regulated by the Capital Markets Authority (CMA)

- Pepperstone GmbH is regulated by the Federal Financial Supervisory Authority (BaFin)

Pepperstone adheres to industry safeguards such as segregating client accounts from business assets and providing negative balance protection to retail investors.

This means that should serious issues arise with the broker, clients based in the UK are covered by the Financial Services Compensation Scheme for sums up to £85,000. Clients from Germany and Austria can recover 90% of their securities claims, capped at €20,000, and receive full reimbursement for cash claims up to €100,000.

Clients from other European countries (EU and EEA nations) are protected by the Cyprus Investor Compensation Fund (ICF) for amounts up to €20,000. Unfortunately, clients located outside the EU and the UK do not receive any form of protection.

Considering the negatives, Pepperstone does not hold a banking license, is not listed on a stock exchange, and its financial information is not publicly available – unlike category leaders IG and Plus500, which are listed on the London Stock Exchange.

I’d also like to see the company implement two-factor authentication (2FA) for additional account security.

| Pepperstone | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Visit | Visit 81.8% of retail investor accounts lose money when trading CFDs |

Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

4 / 5Live Accounts

Pepperstone offers a choice between two main accounts: Standard and Razor.

The Standard account features variable spreads without commissions, ideal for beginners, whereas the Razor account caters to traders seeking the narrowest spreads, ideal for experienced day traders.

Both account types provide access to all instruments and share the same minimum deposit of $0 and minimum order size of 0.01. No minimum deposit is a real advantage, as some day trading brokers require a minimum of at least $250, making them less attractive to budget traders.

Accounts can be opened in 10 base currencies, including USD, EUR, GBP and AUD, simplifying account management in your preferred currency. By comparison, eToro accounts are restricted to a USD base currency, with the broker charging a currency conversion fee if you deposit or withdraw with another currency.

Pepperstone also offers a swap-free account option for Islamic traders who can’t receive or pay swaps.

The process of opening a live account with Pepperstone was refreshingly straightforward and digital, with the online application taking just a few minutes to fill out. Despite a bit of a wait for account verification, which took a few hours, the option to fund my account in the interim was a convenient surprise.

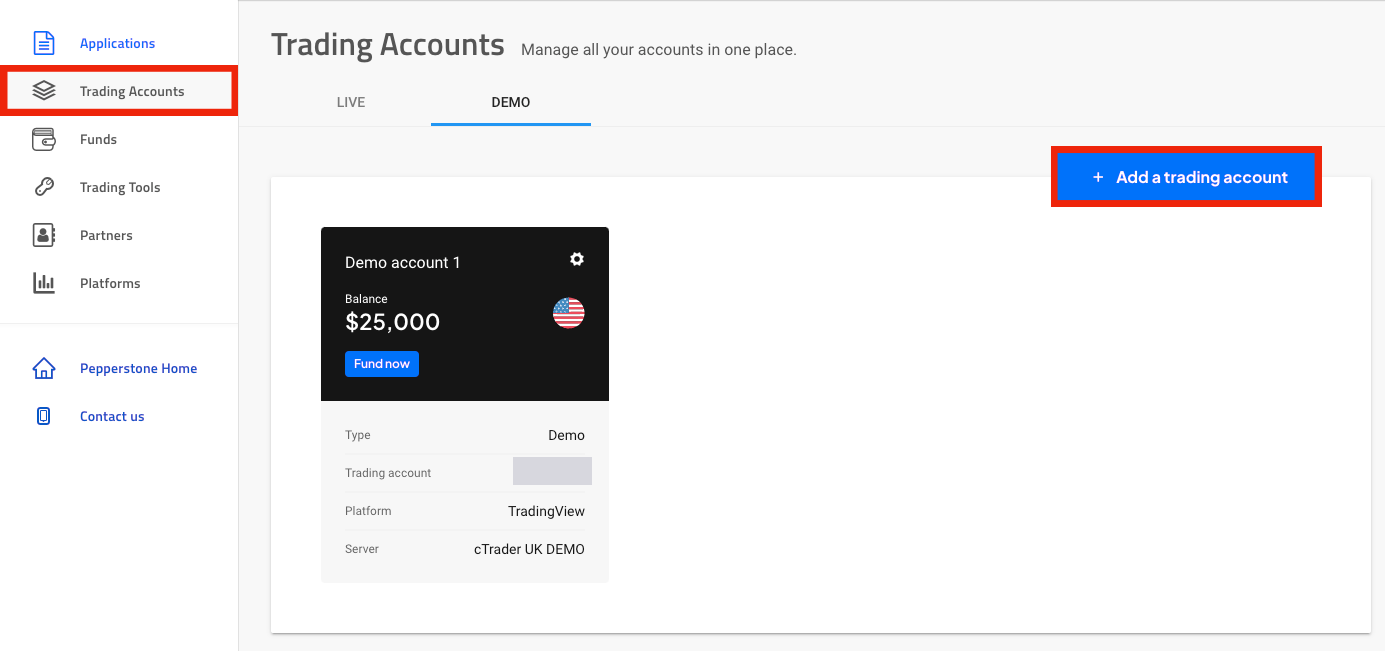

Demo Accounts

A complimentary demo account lets you test the variety of trading platforms without financial risk with up to $50,000 in virtual funds.

However, a notable drawback is the limited duration of the demo account for MT4/5, which remains active for only 60 days (cTrader/TradingView demo accounts do not expire).

I prefer brokers offering unlimited demo accounts, facilitating ongoing trials of new trading systems alongside my live accounts. Although Pepperstone says it can change an MT4/5 demo account to a non-expiry demo account if you are approved and have a live and funded account, a non-expiry demo account can still be archived if it’s non-active after 90 days.

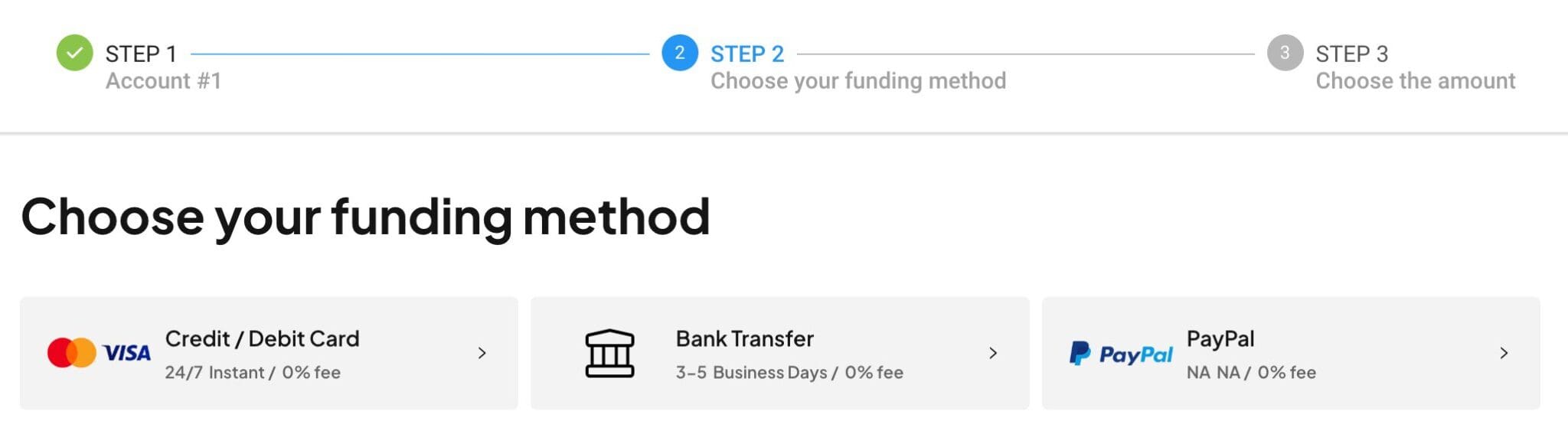

Deposits & Withdrawals

Pepperstone doesn’t provide a huge range of deposit methods, but those offered are low-cost, secure, and rapid. As with other brokers, the availability of supported payment methods varies based on your location.

For EU and UK traders, options include credit/debit cards, bank wire transfers, and PayPal. Meanwhile, day traders operating under different jurisdictions gain access to additional e-wallets including POLi, BPay, Neteller, Skrill, and Union Pay.

Pepperstone also bolstered its payment options in 2024 with PIX and SPEI for clients in Brazil and Mexico respectively. Plus, its integrated SOL transfers, alongside existing cryptos USDT, BTC, ETH, and USDC.

It also made strides in 2025, adding Apple Pay and Google Pay, meeting the growing demand for convenient and secure mobile trading transactions.

I find funding my Pepperstone account really easy, especially with cards and PayPal offering nearly instant deposits.

Additionally, the absence of deposit or withdrawal fees is a significant relief. Having said that, clients residing outside the EU and Australia encounter a less competitive withdrawal fee of $20 for bank withdrawals.

Withdrawals take longer, but I’ve never waited more than 2-3 days for my payments to arrive.

| Pepperstone | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Apple Pay, BPAY, Credit Card, Debit Card, Google Pay, Mastercard, Neteller, PayPal, PIX Payment, POLi, Skrill, UnionPay, Visa, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer |

| Minimum Deposit | $0 | $100 | $0 |

| Visit | Visit 81.8% of retail investor accounts lose money when trading CFDs |

Visit | Visit |

| Review | Review | Review | Review |

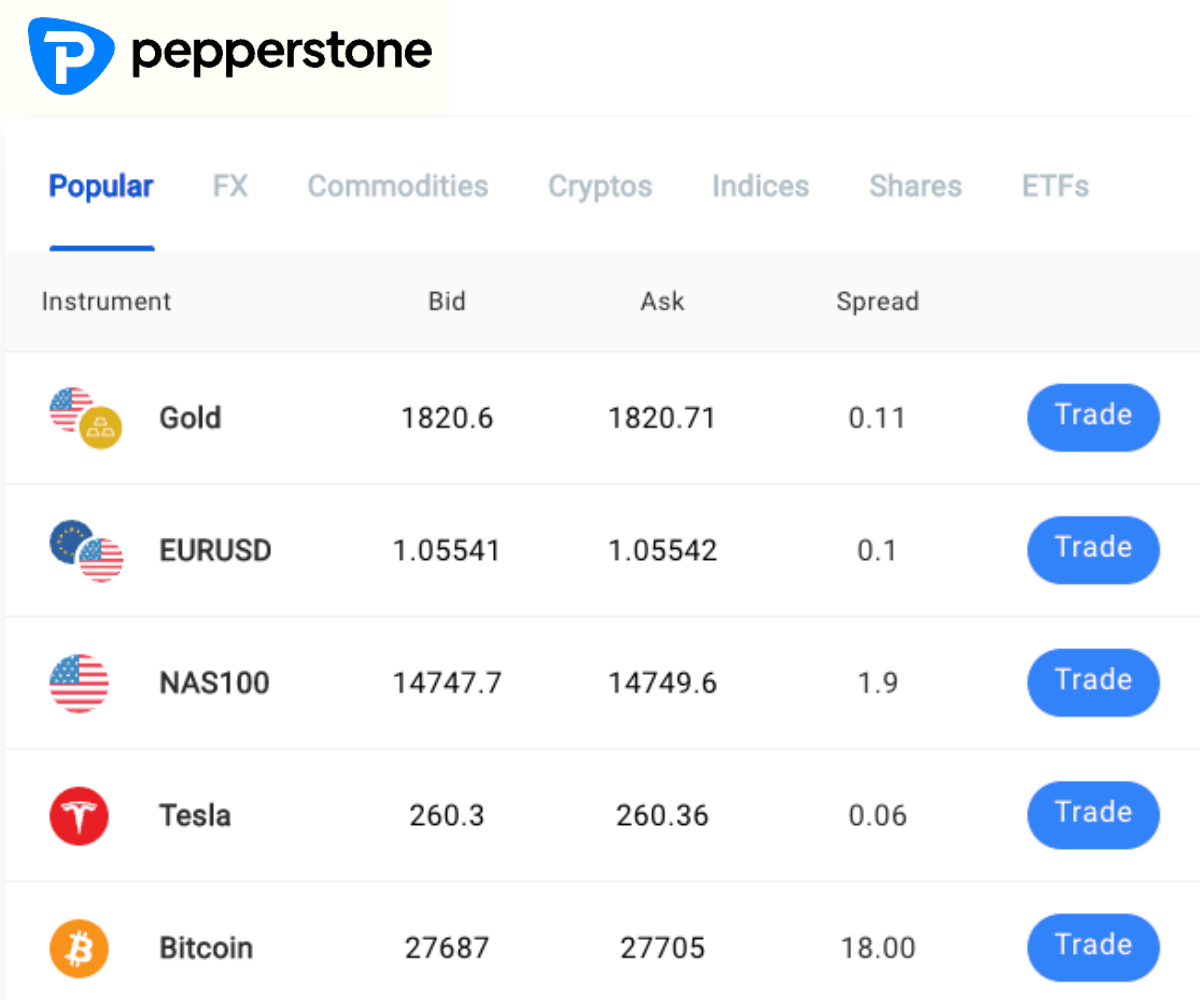

Assets & Markets

3.8 / 5Pepperstone boasts a fantastic array of trading instruments, offering opportunities across global markets, and visible in the latest Markets and Instruments section on desktop.

With over 1,300 assets available, ranging from forex and stock CFDs to commodity CFDs, ETF CFDs, and cryptocurrency CFDs, Pepperstone offers more diversity than the majority of competing brokers, but its offerings are limited to CFDs, so you won’t own the underlying stocks, ETFs or cryptocurrencies.

The selection of indices is particularly strong, with stock indices, currency indices and crypto indices, offering broader exposure to popular markets.

In recent years, Pepperstone has also made significant enhancements to its instrument suite, continually adding new equities, currency pairs, and commodities, thereby expanding opportunities for day traders. In early 2024, it added dozens of new European share CFDs.

You can speculate in various asset classes, including:

- Forex: 100+ major, minor, and exotic currency pairs

- Stock CFDs: 1,400 stocks from US, UK, AU, HK, and EU markets

- Commodity CFDs: 32 commodities including agricultural products, precious metals, and energies

- Stock Index CFDs: 23 major indices including North American, European, Asian, and African

- ETF CFDs: 101 exchange-traded funds including iShares China 25 and SPDR S&P Bank

- Crypto CFDs: 21 crypto/fiat pairs, including BTC/USD, ETH/EUR, DASH/USD, and three funds

| Pepperstone | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:30 (Retail), 1:500 (Pro) | 1:200 | 1:50 |

| Visit | Visit 81.8% of retail investor accounts lose money when trading CFDs |

Visit | Visit |

| Review | Review | Review | Review |

Leverage

Leverage differs based on the market, registered entity, and account type.

UK and Australian traders, for instance, have a maximum leverage of 1:30, while international clients can access up to 1:200. Professional clients may have access to higher leverage, up to 1:500.

All retail accounts feature a 50% stop-out level, which is reasonable. Professional accounts have a lower stop-out level of 20%.

Given the risk of large losses while trading with leverage, I recommend that new traders in particular take a proactive approach to risk management.

Fees & Costs

4.5 / 5Pepperstone provides excellent pricing, especially since it tightened forex spreads in 2021, but still can’t beat IC Markets for spreads or commissions.

The Standard account offers commission-free trading, featuring variable spreads averaging around 1 pip, which should be appealing if you’re a casual trader seeking transparent pricing.

Alternatively, the Razor account provides raw spreads starting from 0 pips, coupled with a nominal commission of $3 per lot, per side. This offering compares favorably with industry averages and is an attractive choice if you are looking for the narrowest spreads when day trading.

Gold CFDs are also notably cost-effective with rich liquidity, zero commissions and spreads from 0.05, following a reduction of up to 30% in 2025.

However, it’s when you factor in the Active Trader program, which offers spread rebates based on your monthly trading volume and the relevant tier, that Pepperstone emerges as a particularly low-cost option for serious day traders.

In the UK and EU, trading a minimum of $10 million per month (equivalent to 100 standard lots) in any commodity qualifies for rebates, which is 5% per lot (rates differ for forex and indices).

Traders conducting over 500 lots monthly can negotiate further rebates.

It’s worth mentioning that during my in-depth tests I found that commissions on MetaTrader platforms were slightly higher at $3.50 per lot per side compared to cTrader and TradingView.

Additionally, Pepperstone applies a modest commission on share CFDs, applicable across all account types. This includes a 0.10% fee for UK stocks and 0.07% for Australian shares.

One notable downside is that costs for holding positions overnight are higher than average, though this won’t impact day traders closing out positions before the end of the day.

Also, in contrast to brokers like Interactive Brokers and eToro, Pepperstone does not provide interest payments on cash balances, an increasingly attractive use for idle funds.

| Pepperstone | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.1 | 0.1 | 0.08-0.20 bps x trade value |

| FTSE Spread | 1.0 | 100 | 0.005% (£1 Min) |

| Oil Spread | 2.5 | 0.1 | 0.25-0.85 |

| Stock Spread | 0.02 | 0.1 | 0.003 |

| Visit | Visit 81.8% of retail investor accounts lose money when trading CFDs |

Visit | Visit |

| Review | Review | Review | Review |

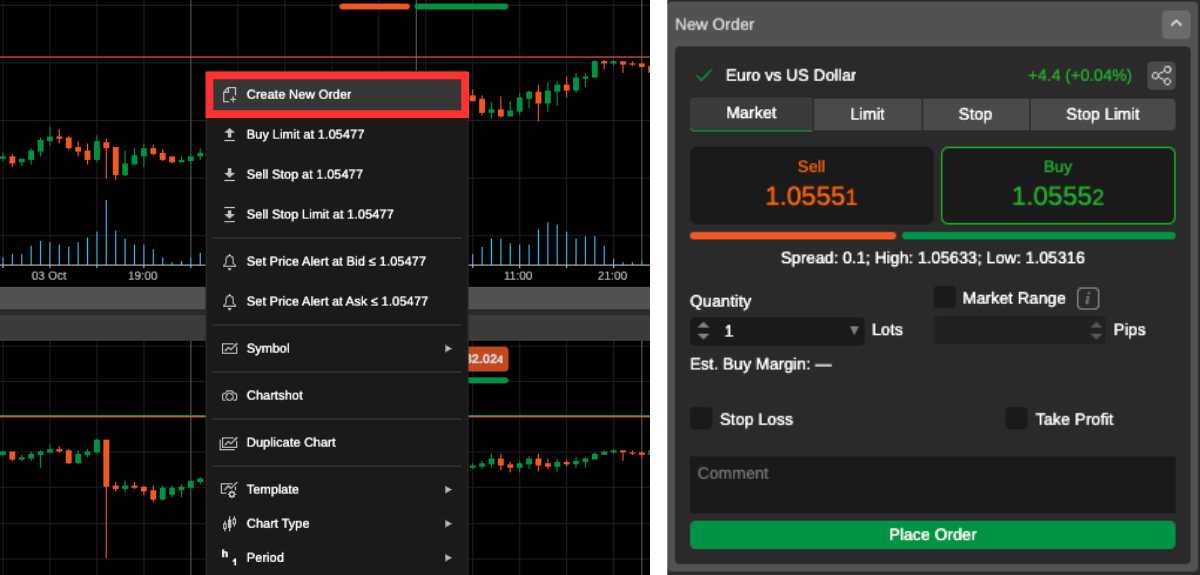

Platforms & Tools

4.4 / 5Desktop Platforms

Pepperstone does not offer its own proprietary platform, which is a frustrating omission for newer traders, but it compensates for this by supporting four leading third-party platforms: MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

Despite my personal reservations about MetaTrader’s somewhat outdated interface, its extensive customization options, wide range of technical indicators, advanced charting tools, and comprehensive back-testing capabilities make it hard to overlook for serious traders.

Additionally, MetaTrader offers access to a diverse library of pre-built robots available in the marketplace, plus Pepperstone provides access to Smart Trader tools for a superior MetaTrader experience.

cTrader presents a strong competition to MetaTrader, particularly in its charting module, which offers a greater variety of time frames (26) compared to MT4 (9) or MT5 (21).

With its user-friendly order entry and one-click trading features, along with customizable configuration settings, cTrader is my preferred platform.

Both MetaTrader and cTrader offer default indicators and additional algorithmic plugins.

Disappointingly, although cTrader has built-in copy trading functionalities for replicating the trades of other traders, Pepperstone does not support this functionality – unlike IC Markets.

But it does support MetaTrader Signals and DupliTrade if you are interested in copy trading alternatives. Pepperstone has also rolled out its own copy trading app (available through SCB and CMA-regulated entities) with one-click trading and access to thousands of signal providers.

The integration of TradingView by Pepperstone is a game-changer, offering not just advanced charting but also a social network for traders to exchange ideas, making it an invaluable tool for traders aiming to stay ahead of the curve.

Also, its intuitive design and customizable interface allows effortless adjustments to layouts, color themes, and technical indicators.

| Pepperstone | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit 81.8% of retail investor accounts lose money when trading CFDs |

Visit | Visit |

| Review | Review | Review | Review |

Mobile Apps

Access to the MetaTrader, cTrader and TradingView platforms is available via independent mobile apps for Android and Apple devices, as well as through their web-based platforms.

During testing, the apps integrated seamlessly with my Pepperstone account, making for a smooth and thoroughly enjoyable trading experience with most of the functionality found on the desktop software.

My only minor complaint is that smaller screen sizes can make charting trickier, even on mobile-optimized trading apps.

Also, there is no proprietary app, offered by brokers like AvaTrade, with comprehensive account management and trading capabilities, which ensure a more complete mobile trading experience.

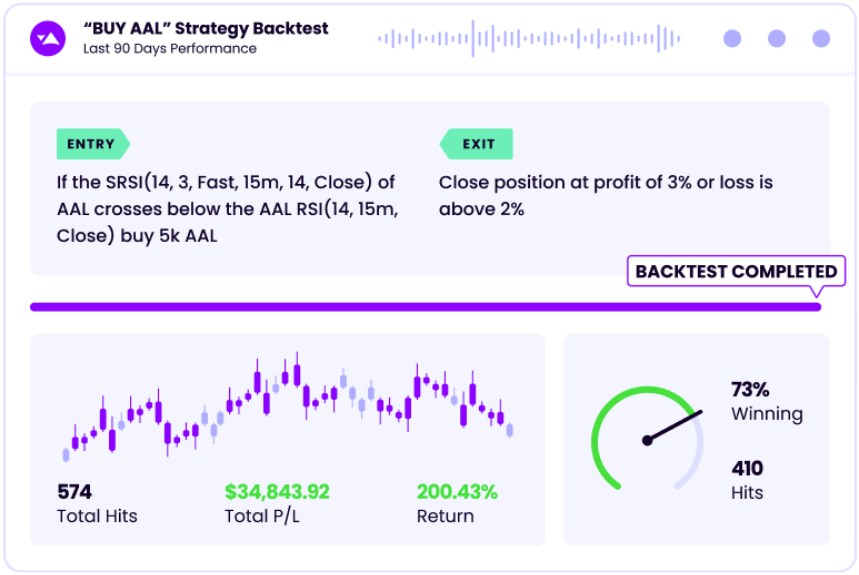

Extra Tools

Pepperstone is one of a select number of day trading brokers to offer Capitalise.ai. The powerful tool helps you automate trading based on pre-defined instructions with simple English commands.

I particularly like that you can backtest and simulate strategies before executing under live market conditions. Additionally, the large catalog of examples is useful for traders looking for a starting point.

Pepperstone also offers two virtual private server (VPS) solutions, providing 24/7 connectivity: ForexVPS and New York City Servers. These are reliable, low-latency services that protect against technical interruptions, making Pepperstone a premier option for algo traders.

Another bonus is that Pepperstone will cover VPS fees for users who are part of the Active Trader program.

Research

4.3 / 5There’s a well-rounded array of research content, available in both video and written formats, but there’s no real news feed or social community beyond TradingView, which detracts from the trading experience, especially compared to eToro.

That said, Pepperstone’s ‘Smart Trader Tools’ is a really useful suite of 28 MetaTrader add-ons with features including sentiment and trend line indicators, as well as a correlation matrix to help reduce your trade exposure to similar currency pairs.

Autochartist is also available for pattern recognition and trading ideas.

In-house research includes multiple daily articles and videos covering technical and fundamental analysis. This content is available across Pepperstone’s website and YouTube channel.

It’s clearly presented and easy-to-follow, making it a valuable resource for day traders at all levels.

| Pepperstone | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit 81.8% of retail investor accounts lose money when trading CFDs |

Visit | Visit |

| Review | Review | Review | Review |

Education

4 / 5Aimed at beginner traders, the official website hosts trading guides, videos, webinars, and more. There are also educational videos available on Pepperstone’s YouTube channel which I’ve poured through.

The educational resources are reasonable and cover most of the basic aspects of trading forex and CFDs. It’s a shame the resources aren’t categorized by experience level, which would help to simplify the process of finding suitable materials.

Particularly valuable are the comprehensive MetaTrader 4 guides, which offer detailed assistance for traders unfamiliar with the platform.

The guides cover everything from platform download procedures to chart customization and Expert Advisors installation, providing valuable support for beginners.

It’s a just shame that these resources can’t accessed from your account page, so many traders might be oblivious to them. I’d also like to see Pepperstone add more advanced courses with progress tracking for a more interactive learning experience.

In 2024, Peperstone introduced a comprehensive toolkit for trading with AI, covering how to get the most out of ChatGPT for market analysis, trading ideas, performance reviews and more.

With five expert-led talks and a downloadable manual, it’s among the most comprehensive educational packages we’ve seen for day traders interested in capitalizing on the power of AI.

| Pepperstone | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit 81.8% of retail investor accounts lose money when trading CFDs |

Visit | Visit |

| Review | Review | Review | Review |

Customer Support

4.6 / 5Pepperstone stands out among leading brokers for providing customer support 24 hours on weekdays and 18 hours on weekends.

Support is offered in multiple languages via telephone, email, and live chat. In 2024, the broker also added Arabic support in its trading app.

Additionally, Pepperstone offers a comprehensive FAQ section on its website, covering major topics such as deposits and withdrawals, account opening, platforms and tools, and trading conditions.

While I find the chatbot function somewhat frustrating, you can easily transfer to a live agent from the menu without waiting to be prompted. I consistently receive helpful responses within minutes.

| Pepperstone | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit 81.8% of retail investor accounts lose money when trading CFDs |

Visit | Visit |

| Review | Review | Review | Review |

Should You Trade With Pepperstone?

Based on our personal tests and in-depth evaluation, Pepperstone emerges as one the best forex and CFD brokers. It boasts a versatile range of trading platforms and tools, coupled with excellent fees, superb customer service, and a heavily regulated trading environment.

Beginner traders will find the $0 minimum deposit, complimentary demo account, comprehensive educational resources, and transparent fee structure particularly appealing.

Meanwhile, experienced traders will appreciate the features of the Razor account, the Active Trader program, and the cutting-edge technology that ensures reliable execution.

Finally, scalping, hedging and algo trading are all allowed, making Pepperstone a terrific option for a variety of trading styles.

FAQ

Is Pepperstone Legit Or A Scam?

Pepperstone is a legitimate and reputable day trading broker. It is regulated by several respected financial authorities, has won numerous awards for its services, and has a large client base of over 400,000 traders across the globe.

Is Pepperstone A Regulated Broker?

Pepperstone is a heavily regulated broker, operating under the oversight of several reputable financial regulatory authorities worldwide, including ASIC in Australia, FCA in the UK, and CySEC in Cyprus, among others.

Is Pepperstone Suitable For Beginners?

Pepperstone is suitable for beginners thanks to its $0 minimum deposit, free demo accounts, rich educational resources, and transparent fee structure.

Although the broker doesn’t offer its own proprietary platform to simplify trading, it supports all the market-leading third-party platforms and offers excellent customer service.

Does Pepperstone Offer Low Fees?

Yes, Pepperstone offers relatively low fees compared to many other brokers, especially for serious day traders using the Razor account and qualifying for the Active Trader program.

Additionally, Pepperstone does not impose deposit or withdrawal fees, nor does it charge an account inactivity fee, reducing non-trading costs to near zero.

Is Pepperstone A Good Broker For Day Trading?

Pepperstone is one of the best brokers for day trading because it offers competitive pricing with tight spreads and low commissions, making it cost-effective for frequent trading. Additionally, it provides fast order execution speeds and reliable trade execution, which is crucial for capitalizing on short-term market movements.

Furthermore, there’s support for a range of advanced trading platforms, including MetaTrader and cTrader, which offer comprehensive charting tools, automated trading plug-ins and VPS hosting.

Does Pepperstone Have A Mobile App?

Alongside its own app available in certain countries, and which was enhanced with chart improvements and news filtering in 2024, clients can utilize the mobile versions of one of the supported third-party charting tools: MT4/MT5, cTrader, or TradingView. These are available on iOS and Android devices and provide a reliable environment for mobile traders.

Is Pepperstone An ECN Broker?

Pepperstone is an ECN/STP broker. It sources prices directly from external liquidity providers with no dealing desk intervention. It also boasts an impressive 99.90% fill rate.

Top 3 Alternatives to Pepperstone

Compare Pepperstone with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Pepperstone Comparison Table

| Pepperstone | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| Rating | 4.8 | 4.3 | 3.6 | 4.4 |

| Markets | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, Stock CFDs, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | NFA, CFTC |

| Bonus | – | – | 10% Equity Bonus | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:30 (Retail), 1:500 (Pro) | 1:50 | 1:200 | 1:50 |

| Payment Methods | 14 | 6 | 11 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Pepperstone and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Pepperstone | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | Yes | No | No | No |

| Volatility Index | Yes | No | Yes | No |

Pepperstone vs Other Brokers

Compare Pepperstone with any other broker by selecting the other broker below.

The most popular Pepperstone comparisons:

- Pepperstone vs Deriv.com

- XM vs Pepperstone

- Fusion Markets vs Pepperstone

- Pepperstone vs TradeStation

- Pepperstone vs IC Markets

- RoboForex vs Pepperstone

- Interactive Brokers vs Pepperstone

- Pepperstone vs FBS

- Exness vs Pepperstone

- Pepperstone vs Kucoin

- Pepperstone vs FXTM

- Pepperstone vs FOREX.com

- FXPro vs Pepperstone

- Pepperstone vs Eightcap

- XTB vs Pepperstone

- Pepperstone vs FXOpen

- ThinkMarkets vs Pepperstone

- Templer FX vs Pepperstone

- Pepperstone vs AvaTrade

Customer Reviews

3.3 / 5This average customer rating is based on 6 Pepperstone customer reviews submitted by our visitors.

If you have traded with Pepperstone we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Pepperstone

Article Sources

- Pepperstone Website

- Pepperstone YouTube Channel

- Pepperstone Limited - FCA License

- Pepperstone GmbH - BaFin License

- Pepperstone EU Limited - CySEC License

- Pepperstone Group Limited - ASIC License

- Pepperstone Markets Limited - SCB License

- Pepperstone Markets Kenya Limited - CMA

- Pepperstone Financial Services (DIFC) Limited - DFSA License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I’m a longtime user of Pepperstone and found them a genuoinely reliable broker with great tool if you’re an active trader. Their Mt4 integration works without a hiccup in my experience. And they run really useful webinars/training sessions with guys who really know what they’re talking about, eg Mark Holstead. My trading knowledge and skills have come a long way and Pepperstone has played a part in that. I’;m giving a 4 not a 5 because they don’t have the best selection of equities so I had to open another brokerage account for that.

Won’t let me use it. They ask questions and if you don’t have an investment job they won’t let you in.

Not sure I’ll keep trading with Pepperstone. Signing up took me ages and I can’t trade Bitcoin, which I thought most brokers offer these days. Will probably change broker.

Pepperstone has been really good for my day trading strategies. Execution speeds are fast and the charting platform is really good with more indicators and drawing tools than I need. I’ve also found the support team are always quick to respond if I have a question. I won’t move from Pepperstone any time soon.

This is a great broker for day trading. Reliable execution, very tight spreads and excellent charting tools in cTrader. I would have liked longer to use the demo account but not the end of the world.

Pepperstone is a top-rate broker in my view. The selection of tools is excellent, especially Capitalise.ai which lets me build algo trading strategies with zero coding background. Execution is also fast and reliable which is important for me as a day trader. Signing up took a while, but a small price to pay.