Day Trading With AI

Large institutions have historically used artificial intelligence (AI) to distinguish meaningful signals from market noise, gaining an edge. However, these tools are now being democratized, making them accessible to day traders, and helping them make smarter, faster decisions.

Discover the different ways day traders can use AI to inform strategies, alongside the benefits and challenges of day trading with AI.

Quick Introduction

- AI’s role in day trading isn’t limited to digesting millions of data points and distilling market trends. It can be used to uncover new ideas and evaluate the confidence level of each idea.

- Yet, human traders can interpret market sentiment, news, rumors, and psychological factors that may elude AI systems. Humans can also adapt to unprecedented market conditions lacking historical data.

- So will AI bring an end to day trading as we know it? No. It’s reshaping it, and there’s a place for everyone, both AI and humans.

- Brokers are introducing instruments that enable traders to speculate on AI-related stocks and technologies, such as IG’s AI Index, which tracks 25 US companies like Nvidia and Palantir.

- There’s also a growing number of brokers that have AI trading tools, enabling active traders to identify and execute positions leveraging the latest in artificial intelligence.

Best Brokers With AI Day Trading Tools

These 4 brokers continue to offer the best AI-powered tools to support day traders:

-

1

Interactive Brokers

Interactive Brokers -

2

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

3

FOREX.com

FOREX.com -

4

XM

XM

Best Brokers With AI Trading Software

AI Tools For Day Trading

Our experts, comprised of active traders and industry veterans, have observed an increasing number of ways that artificial intelligence can be used to support day trading activities:

Trading Signals

Trading signal providers are increasingly using AI to present opportunities for day traders.

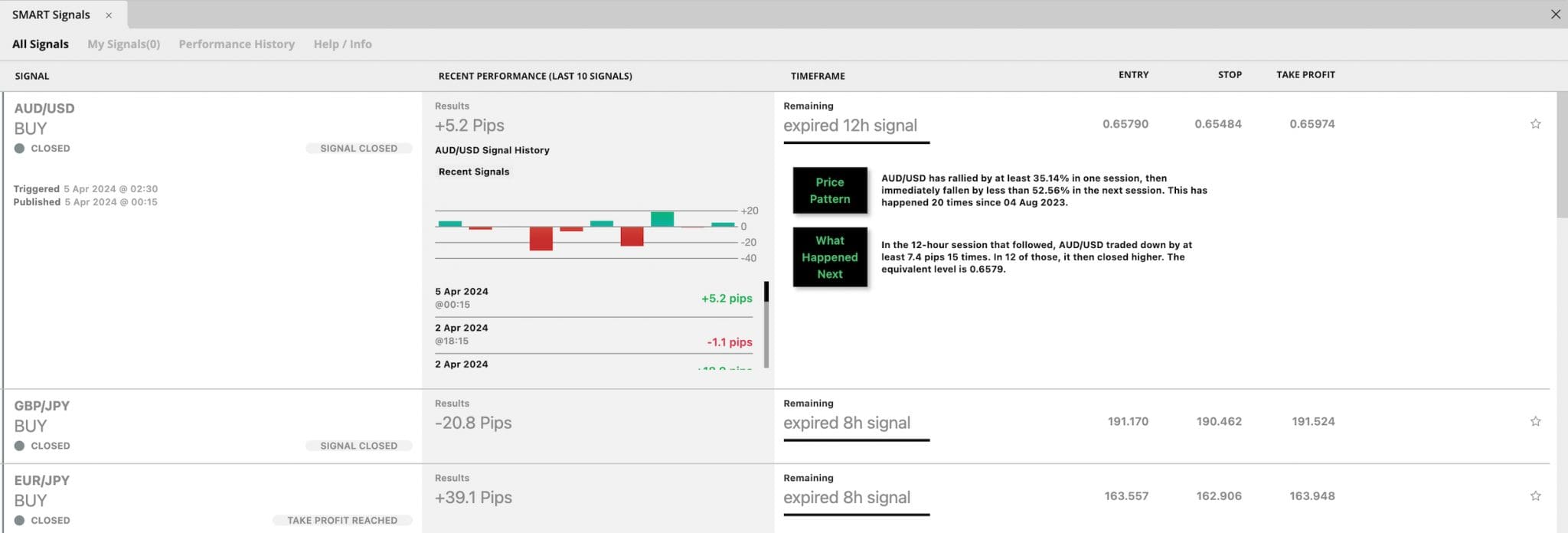

SMART Signals, available at FOREX.com, is a stand-out example. It’s an easy-to-use tool that identifies potential opportunities through a sophisticated algorithm.

This system dissects thousands of daily data points across 36 major markets to unearth patterns that have historically led to successful trades.

Offering a range of signals that suggest specific entry points along with recommended take profit and stop loss levels, SMART Signals simplifies the day trading process.

It’s also tailored to short-term traders, providing signals for time frames ranging from 4 hours to 12 hours.

While I’ve found SMART Signals largely beneficial, the wealth of information presented is sometimes overwhelming, especially for newer traders.Additionally, while the signal success rates are helpful, I’ve found that not all suggested trades align with real-time market conditions, underscoring the importance of combining the tool’s insights with your own market analysis.

Auto Trading

AI is making it easier for day traders to build, test and deploy automated trading strategies.

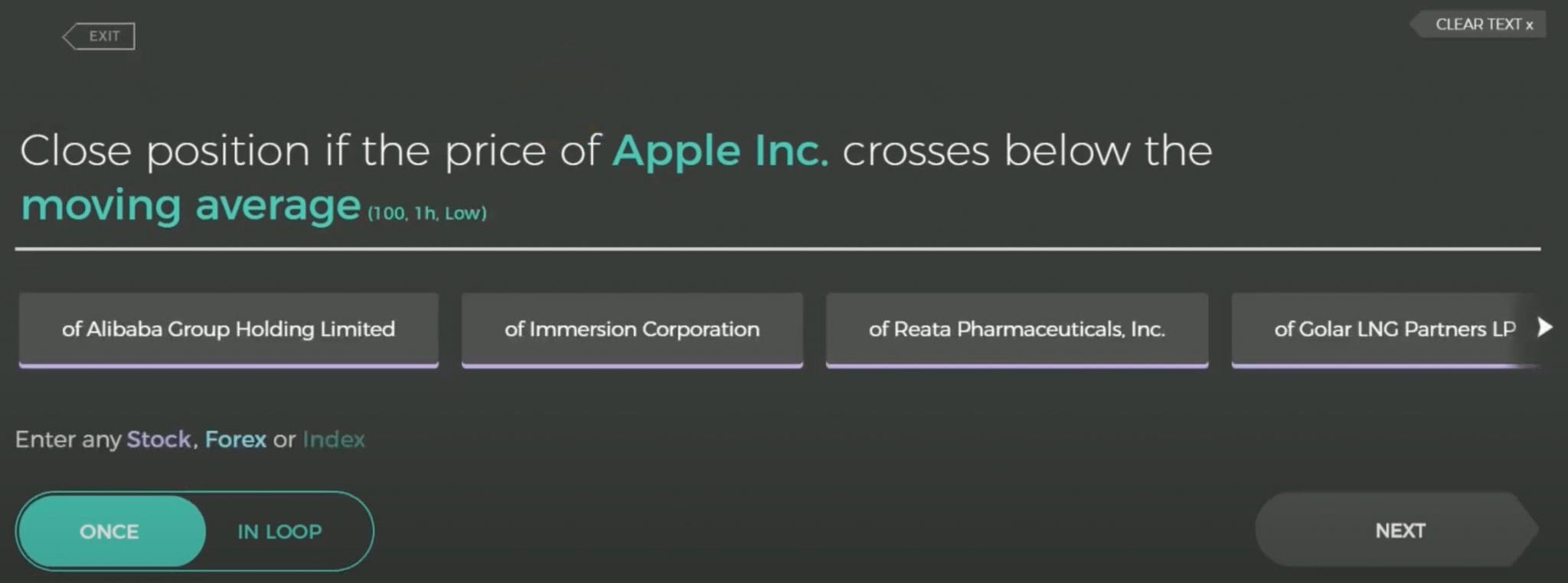

For example by leveraging artificial intelligence, Capitalise.ai, available at Interactive Brokers, enables traders to automate trading systems using plain English, without the need for any coding skills.

It supports a wide array of conditional and scenario-based strategies, including ‘if-then’ statements, allowing traders to specify conditions for entry and exit, set stop loss and take profit levels, and even incorporate market indicators and economic events into their strategies.

Capitalise.ai provides opportunities on forex, stocks, CFDs, and cryptocurrencies. However, the assets available for day trading will depend on your broker.

Using Capitalise.ai feels like I have a personal trading assistant that’s both intelligent and intuitive.

I experimented with creating a strategy that would buy a certain stock if its price dropped by 5% from the weekly high but sell if the price rebounded by 3% from the day’s low.

The process was straightforward: I simply typed my strategy into the platform’s interface in plain English and Capitalise.ai took care of the rest, translating my words into a live trading strategy.

Technical Analysis

One of the key areas AI tools are supporting active day traders is in technical analysis.

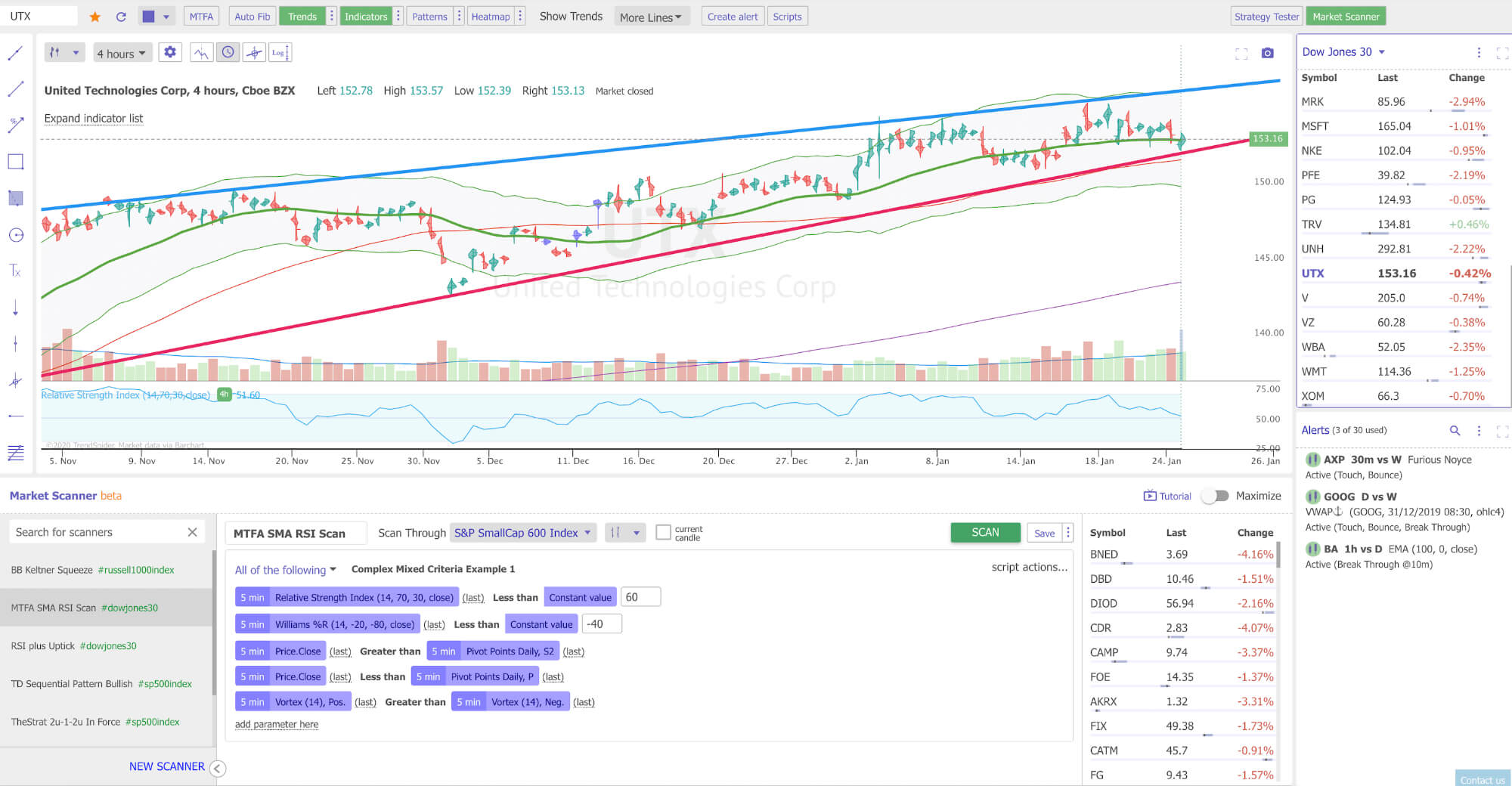

For example TrendSpider, available at Interactive Brokers, is a powerful trading software that leverages AI-driven tools to automate market analysis.

The platform’s AI capabilities include automatic trend line detection, pattern recognition, and advanced technical analysis, which can drastically reduce the time day traders spend analyzing charts.

By employing algorithms that can quickly identify trends and chart patterns across multiple timeframes, TrendSpider enables traders to spot potential entry and exit points with greater precision.

Moreover, the platform’s Market Scanner allows users to scan for stocks that meet specific criteria, making it easier to identify trading opportunities that align with their strategies.

I’ve found the automatic trend line and pattern recognition tools particularly impressive, as they effortlessly highlight significant technical patterns that I might have otherwise overlooked.This feature not only saves me considerable time but also enhances the accuracy of my technical analysis.

That said, I encountered a learning curve in fully understanding how to customize the AI tools to match my specific trading style. Initially, the sheer volume of data and analysis provided felt overwhelming.

One notable consideration is that the software is relatively expensive for new day traders with small accounts (from $99.37 per month).

Economic Calendars

We’re seeing AI improve the quality of financial calendars used by many active traders to capitalize on events that may result in trading opportunities.

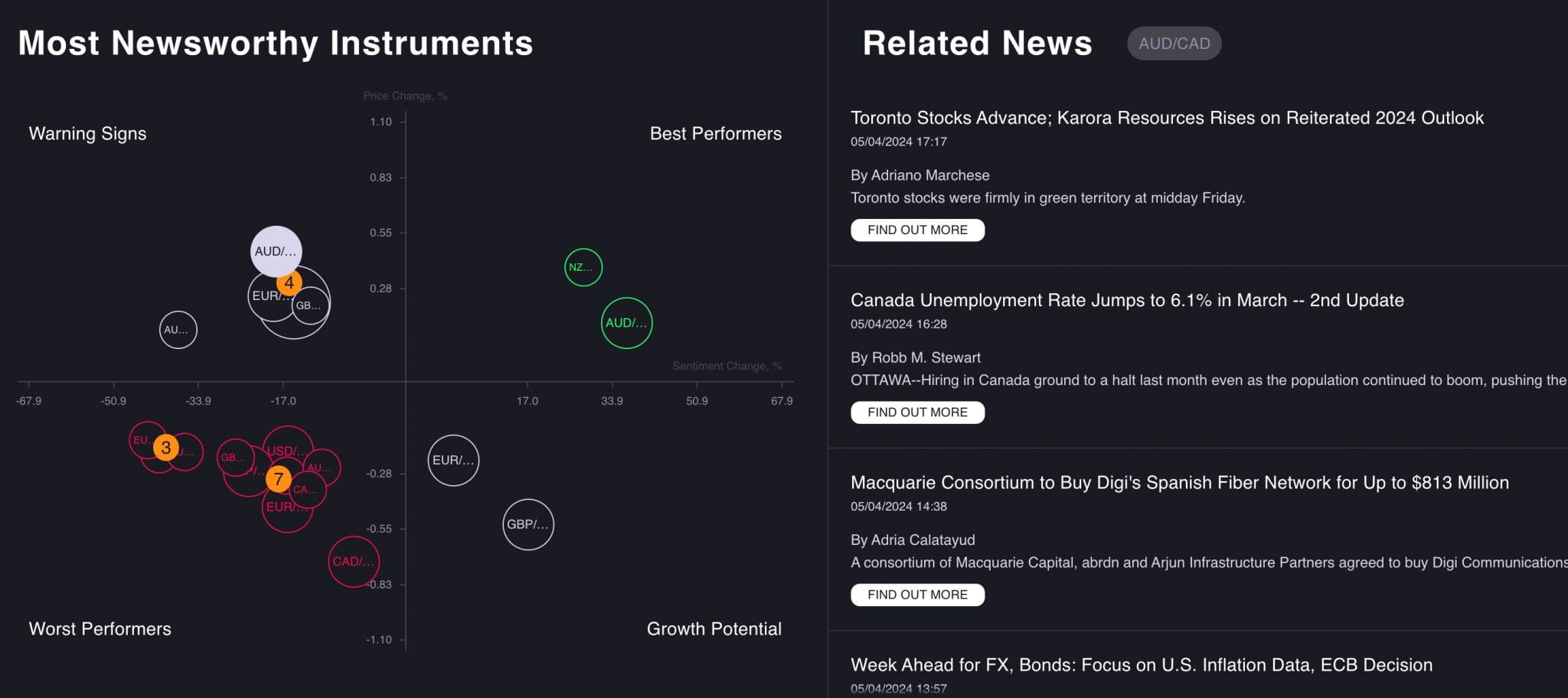

Acuity’s Economic Calendar, available at Eightcap, is a particularly sophisticated platform that harnesses the power of big data analytics and natural language processing (NLP) to provide traders with advanced market insights and sentiment analysis.

The platform aggregates news, social media chatter, and various other textual data sources to offer a comprehensive view of market sentiment and emerging trends.

By analyzing vast amounts of data in real-time, the Economic Calendar aims to give traders a competitive edge by uncovering hidden patterns and potential market movements before they become apparent through traditional analysis methods.

I’ve been impressed by the Economic Calendar’s user-friendly interface and the depth of insight provided.The platform’s ability to distill complex data into easily understandable sentiment scores and trend predictions allows me to gauge market sentiment at a glance.

I’ve also found the news aggregator tool invaluable; it not only curates relevant financial news from across the globe but also highlights how each piece of news might impact market sentiment.

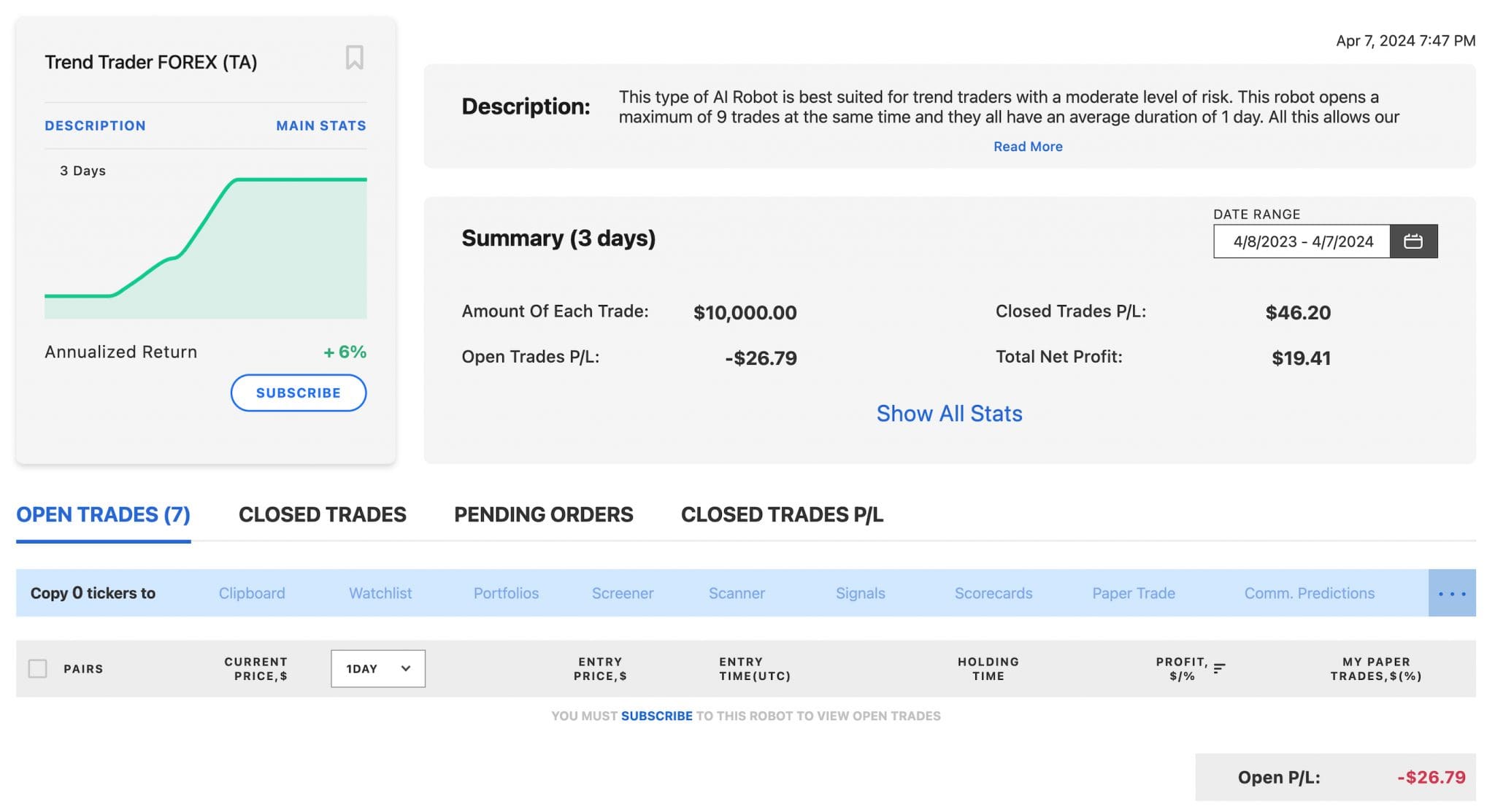

Trading Bots

There is a growing number of day trading bots that use AI to automatically make trades, from Pionex and Cryptohopper to StockHero.

Tickeron’s trading bot functionality is also a prominent option aimed at traders looking to automate their strategies through AI-driven insights. These bots execute trades automatically based on set criteria, leveraging Tickeron’s AI to spot market opportunities.

The appeal of constant market monitoring and the potential for quick, emotion-free decision making is undeniable. Customization options allow traders to set their risk levels and trading parameters, providing a tailored trading experience.

However, my experience with Tickeron’s trading bots highlighted several areas for improvement. Initially, the setup process, while designed to be user-friendly, presented challenges in aligning the bot’s operations with my specific trading strategy, requiring a steeper learning curve than anticipated.

Also, while the bots efficiently execute trades, their strict adherence to predefined parameters sometimes results in missed opportunities during unexpected market events, underscoring a lack of adaptability.

The necessity for regular oversight became evident, as the bots did not always adjust to the dynamic nature of the markets, necessitating frequent manual adjustments to strategy settings to prevent losses.

Ultimately, while AI trading bots offer a step towards automation, they are not a set-and-forget solution, requiring significant input and vigilance to truly align with ongoing market conditions and individual goals.

AI Assistants

ChatGPT and Gemini (formerly Bard) are AI assistants that can provide general information about day trading, explain concepts, and discuss strategies, but they’re not designed to offer personalized trading advice or real-time market analysis.

For successful day trading, it’s important to rely on up-to-date market data, real-time analysis, and possibly professional advice tailored to your specific situation.

Having said that, these AI assistants can be used to start devising basic day trading strategies.

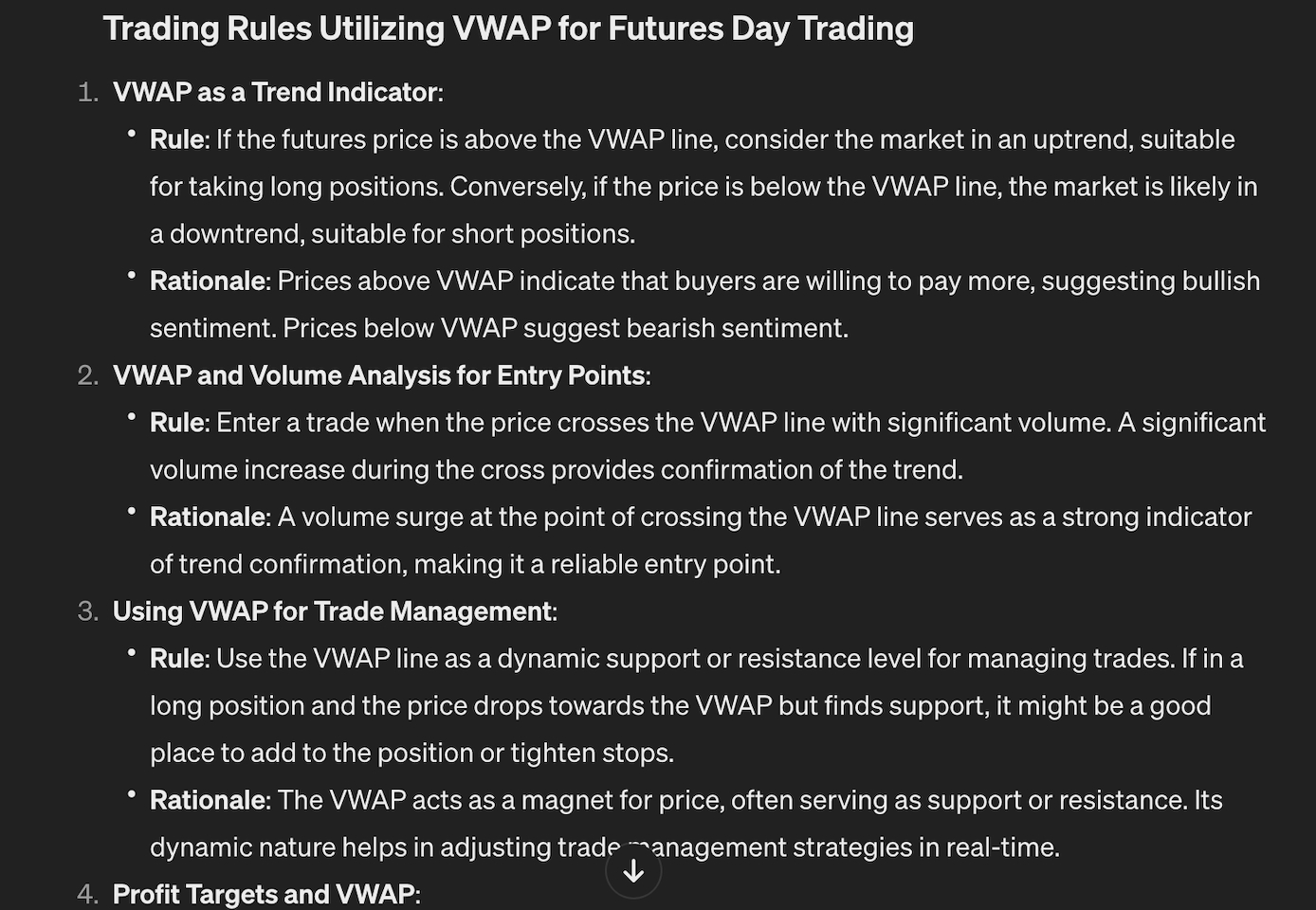

I created a strategy in just a few minutes. In the ChatGPT prompt, I entered: “Create trading rules that utilize the VWAP indicator for a futures day trading strategy.”

From this foundation, I then added follow-up prompts that addressed several important aspects of a well-rounded strategy, from setting profit targets to risk management.

The suggestions were reasonable, if not very basic, highlighting the need to invest time in validating any suggestions.

Pros And Cons Of Using AI To Day Trade

Pros

- AI tools can analyze vast amounts of diverse data, identifying short-term patterns and insights that might be missed by humans.

- AI removes emotional bias, making decisions in fast-moving markets based purely on data and pre-defined strategies.

- With sophisticated protocols, AI systems automatically adjust day trading strategies based on real-time market conditions to manage risk.

- AI trading systems can monitor multiple markets and securities simultaneously, a task that would be impossible for a human trader to perform with the same efficiency.

- AI can learn from market data and its own performance, continuously improving its day trading setups over time.

Cons

- AI tools may overfit to historical data, making strategies that appear effective in backtesting but perform poorly in real-world trading conditions.

- Like any technology, AI systems are susceptible to glitches, downtime, or errors, which can be particularly detrimental in the fast-paced environment of day trading.

- AI tools, despite their advanced algorithms, may still struggle to predict sudden market shifts caused by unforeseeable events, leading to potential losses.

- There’s a risk of becoming overly dependent on AI for day trading, potentially leading to a disconnect from market sentiment and trader intuition.

- High-quality AI trading tools can be expensive, with substantial subscription fees or initial costs, making them less accessible to retail traders with limited capital.

Bottom Line

It is possible to day trade successfully with brokers offering AI tools. These services can analyze vast amounts of data quickly and identify trading opportunities at speeds unattainable by humans.

However, success requires understanding the AI’s strategy, managing risks effectively, and staying updated on market conditions.

AI isn’t an infallible solution that delivers perfect outcomes. Think of it more as an exceptionally smart and tireless ally that can enhance your trading skills.

Ultimately, you are in control, making the final calls, tailoring strategies, conducting backtesting, and assuming all the risks associated with day trading in live market conditions.

FAQ

What Is AI Day Trading?

An AI day trading tool is a sophisticated system that utilizes artificial intelligence, including machine learning and deep learning, to analyze financial markets and predict short-term market movements.

It processes vast amounts of data, learns from its successes and failures, and adapts its trading strategies over time to improve performance, all while operating at speeds and levels of complexity beyond human capability.

Is AI & Algorithmic Day Trading The Same Thing?

No, they are not the same. Algorithmic trading refers to the use of algorithms to automate trading decisions based on predefined criteria, without necessarily learning from past actions or adapting over time.

AI trading, a subset of algorithmic trading, incorporates artificial intelligence, including machine learning, to analyze data, predict market trends, and make short-term trading decisions, with the capability to learn and improve from historical data.

Ultimately, AI day trading is more dynamic, adapting its strategies based on new information.

Does AI Day Trading Really Work?

AI day trading tools can be effective, leveraging advanced algorithms to analyze market data, predict trends, and make trades quickly. Their success varies, depending on the tool’s design, the quality of data, and the strategies employed.

While they offer potential advantages like speed and data processing beyond human capabilities, their effectiveness is influenced by market conditions and the inherent complexities of trading, making outcomes variable.

Are AI Tools Suitable For Beginner Traders?

AI tools can be a double-edged sword for beginner day traders. On one hand, they offer the potential to analyze data and execute trades at a level of speed and complexity not possible manually, which could be advantageous.

On the other hand, the effectiveness of AI trading tools depends on their design, the strategies they employ, and the user’s understanding of those strategies.

Without a solid foundation in trading principles and risk management, beginners might find these tools challenging to use effectively and could be at risk of significant losses.

Will Day Trading Be Replaced By AI?

AI already powers a huge part of modern markets (just look at algorithms and high-frequency trading), and its role in scanning charts, executing orders and managing stops will only grow, but it’s unlikely to completely replace humans.

Short-term trading still relies on judgement around messy real-world events, macro context and shifts in sentiment, so humans are increasingly becoming “supervisors” of AI systems – overseeing models, stepping in during shocks or black swan events, and deciding when the data doesn’t tell the whole story (which is often).