Algo Trading

Algorithmic trading offers day traders fast execution, the ability to execute trades at optimal prices, and the removal of emotional biases. But it’s no magic bullet – systems can be costly, they can experience glitches, and over-optimization in backtesting can result in poor real-world performance.

We explain how algo trading works for beginners through examples and unpick its strengths and limitations.

Quick Introduction

- Algorithmic trading, or algo trading, involves using computer algorithms to automatically execute day trading strategies based on predefined criteria.

- Algo trading has grown rapidly since its inception in the 1980s and is increasingly employed by institutional investors and retail traders.

- But it’s not without critics – esteemed investor, Stanley Druckenmiller, commented that “algos have taken all the rhythm out of the market”.

- Successful algo trading requires the development of robust trading strategies based on thorough research, analysis, and testing.

- Having reliable technology – including fast and stable internet connections and powerful trading platforms – is essential for algo day trading.

Best Brokers For Algo Trading

These 4 brokers stand out for their excellent integration with algorithmic trading tools:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

4

FOREX.com

FOREX.com

Understanding Algo Trading

Algo trading involves using algorithms to automatically execute strategies according to pre-agreed criteria.

These algorithms analyze market data, such as price movements and volume, to make trading decisions without human intervention.

By leveraging algorithms, you can execute trades at high speeds and frequencies, capitalizing on fleeting market opportunities that may arise within milliseconds.

The primary benefit of algo trading lies in its capacity for simultaneous monitoring of multiple metrics.

This capability enables the algorithm to consider real-time data from various markets and sectors when executing trades, unlike humans which are limited in their capacity to track multiple data sets.

Day traders may want to consider algo trading for three key reasons:

- It offers increased speed of execution, enabling you to react swiftly to market movements and capitalize on opportunities that may arise and disappear rapidly.

- It may be ideal for emotional traders who let psychological influences affect their short-term trading decisions, as algos should operate in a neutral manner.

- It allows you to handle large volumes of trades simultaneously, enhancing scalability and efficiency in managing multiple positions across various markets.

Example Trade

Let’s explore the algorithmic trading process through a simple example…

I want to trade Apple (NASDAQ: AAPL) stock using a popular moving average indicator. I can use an algorithm to configure a trade that:

- Purchases 100 shares of Apple when the share price exceeds the 200-day moving average of the stock.

- Conversely, a sell order can be initiated to sell 100 shares of Apple when the price falls below the 200-day moving average of the stock.

The software then actively monitors real-time market prices and executes my trades accordingly, saving me valuable time by eliminating the need for manual monitoring and order placement.

How To Create An Algo Trading System

Algo trading entails issuing a series of instructions to computers to execute trades automatically based on predefined criteria. The underlying structure often follows a pattern akin to ‘when X occurs, execute Y.’

While traditional algo trading required coding skills to develop these algorithms, modern advancements in technology mean we’re increasingly seeing tools that enable you to create strategies with zero coding.

However, if you possess a proficient understanding of programming, particularly in languages like Python and C++, you can construct algo trading systems from the ground up.

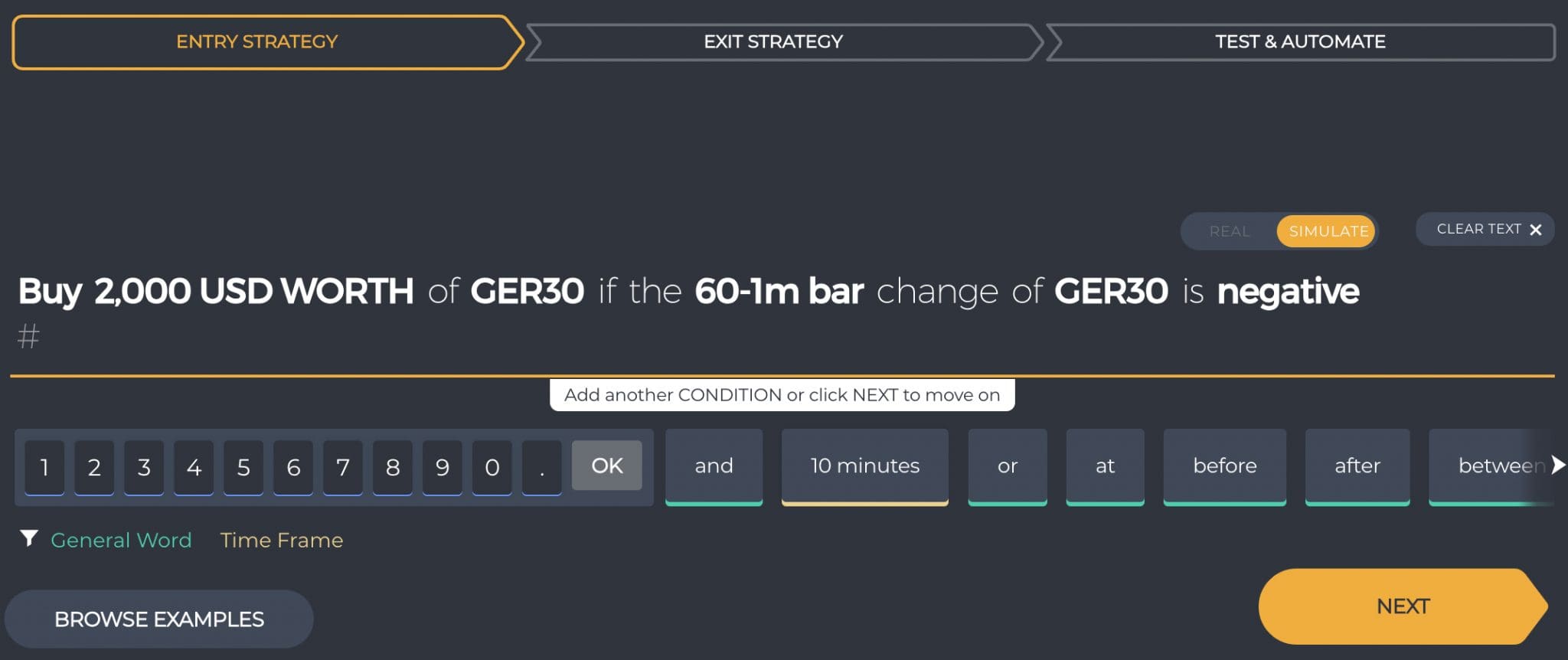

If you’re interested in developing an algorithmic trading strategy without the need for coding, which may appeal to beginners especially, I recommend exploring the following platforms:

- Capitalise.ai: Capitalise lets you create, test, and deploy trading strategies without the need for coding. The platform’s innovative AI-driven technology allows you to automate your strategies based on simple English commands, making it accessible to a wide range of users. Additionally, the platform provides access to a diverse set of financial instruments, including stocks, forex, commodities, and cryptocurrencies. It’s also supported by a growing number of leading brokers, notably AvaTrade, Eightcap and FOREX.com.

- Tickeron: Tickeron offers customizable AI bots that deliver real-time price alerts for optimal trade timing across various markets, including stocks, ETFs, forex, and cryptocurrencies. Leveraging advanced AI pattern recognition, Tickeron identifies top-ranked daily stock price patterns, assigning confidence levels to trading ideas for informed decision-making. Additionally, Tickeron provides robust trend forecasting tools. Tickeron robots integrate with several brokers, notably Interactive Brokers and Kraken.

- Composer: Composer is a no-code algorithmic trading platform equipped with an AI copilot powered by ChatGPT4. Featuring an intuitive drag-and-drop interface, Composer enables you to easily create, test, and deploy advanced trading strategies. With its extensive library of pre-built indicators, professional-grade data, and trading actions, Composer lets you build a diverse range of strategies without writing any code.

Algo Trading Strategies

Three primary algorithmic trading strategies include:

- A price action strategy

- A technical analysis strategy

- A hybrid strategy combining elements of both

Price Action Strategy

A price action algo trading strategy analyzes previous open and close, or session high and low prices, triggering buy or sell orders if similar levels are reached in the future.

For instance, I could design an algorithm to initiate buy or sell orders when the price surpasses a certain threshold (point X) or falls below another threshold (point Y).

This approach is favored by scalpers seeking quick but modest profits throughout the day on highly volatile markets, for example, commodities and cryptocurrency.

Creating a price action trading algorithm involves determining when to go long or short and implementing risk management measures such as stops and limits.

You can tailor the algorithm to suit market conditions, trade size, and preferred trading times, enabling you to capitalize on volatility during market openings or closings.

Technical Analysis Strategy

A technical analysis algo strategy relies on various technical indicators such as moving averages, Bollinger Bands, and others.

This approach involves creating an algorithm to respond to the parameters of these indicators, such as closing a position when volatility levels surge.

To implement a technical analysis strategy, you need to research and become proficient in using different technical indicators. For instance, algorithms can be designed based on Bollinger Bands to execute trades during periods of high volatility.

The decision to open or close trades depends on risk tolerance and whether you hold long or short positions in rising or falling markets.

With a technical analysis strategy, you prioritize the use of indicators or combinations of indicators to trigger buy and sell orders, rather than solely focusing on price movements.

Hybrid Strategy

A hybrid algo trading strategy integrates both price action and technical analysis to validate potential price movements, allowing algorithms to execute buy or sell orders accordingly.

To develop a combination trading strategy, you need to analyze historical price action in the underlying market, requiring a comprehensive understanding of various technical indicators and their implications for past asset price movements.

In a combination strategy, you need to establish whether to take long or short positions and determine the algorithm’s trading schedule throughout the day.

Configuration of a combination strategy involves customization based on market conditions, timeframe, trade size, and the selection of different indicators incorporated into the algorithm’s design.

Pros & Cons Of Algo Day Trading

Pros

- Algo trading enables rapid execution of trades, capitalizing on fleeting market opportunities that may arise within milliseconds.

- Algo trading allows day traders to handle large volumes of trades simultaneously, enabling scalability and efficiency in managing multiple positions across various markets.

- By automating trading strategies, algorithmic trading eliminates emotional biases and ensures consistent adherence to predefined rules, enhancing discipline in decision-making.

- Algo traders can backtest their strategies using historical data to assess their viability and optimize parameters before deploying them in live markets, helping to reduce the risk of losses.

- Algorithmic trading systems continuously monitor market conditions and execute trades based on preset conditions, enabling day traders to react swiftly to changing market dynamics and news.

Cons

- Algo trading requires a solid understanding of programming languages and financial markets, making it inaccessible to many beginner traders, though this is changing due to the advent of code-free trading platforms.

- Developing and maintaining algorithmic trading systems can be costly, including expenses related to software development, data acquisition, and infrastructure.

- Algo trading systems are susceptible to technical glitches, software bugs, and connectivity issues, which can lead to unexpected losses or missed opportunities.

- Over-optimizing trading algorithms based on historical data can lead to curve-fitting and poor performance in live markets, as strategies may not generalize well to unseen data.

- Algo trading strategies may be vulnerable to sudden market changes or extreme market conditions, leading to losses if risk management measures are not properly implemented.

Faulty programming, in particular, can be devastating. In 2012, Knight Capital created a platform that would link with the then new, New York Stock Exchange (NSE).

When they launched their software it malfunctioned, resulting in the company losing money at a rate of around $10,000,000 a minute. They lost around $440 million in total.

Bottom Line

Algo trading offers a powerful tool for you to automate and optimize day trading strategies, providing benefits such as increased speed, efficiency, and objectivity. With proper diligence and discipline, algo trading can be a valuable addition to your toolkit.

But you should approach algo trading with careful consideration, as it requires technical expertise, rigorous testing, robust risk management, and ongoing adaptation to changing market conditions.

It’s also essential to emphasize that algo trading depends on intricate technology, which is susceptible to malfunction or hacking. Additionally, it has the potential to exacerbate risks, including market volatility and execution errors.

To get started, see our pick of the best brokers for algo day trading.

FAQ

Can Algo Trading Be Used For Day Trading?

Absolutely! In fact, it is quite common among day traders due to its ability to execute trades rapidly and efficiently, capitalize on short-term market movements, and automate trading strategies.

Algo trading algorithms can be designed to analyze market data and execute trades within very short timeframes, making it well-suited for day trading strategies aiming to profit from intraday price fluctuations.

Is Algo Trading The Same As Automated Trading?

Automated trading typically involves the automation of manual trading through stops and limits, enabling the automatic closure of positions at predefined levels.

In contrast, algorithmic trading typically involves traders developing and refining their own codes and formulas to analyze market conditions and execute trades accordingly.

Is Algo Trading The Same As AI Trading?

Algorithmic trading employs algorithms to automate trading decisions according to predefined criteria, without inherent learning or adaptability over time.

In contrast, AI trading integrates artificial intelligence, such as machine learning, to analyze data, forecast market trends, and execute trades, with the capacity to learn and enhance performance through historical data.

Does Algo Trading Really Work?

Algo trading can be effective when implemented correctly. By automating trading decisions based on predefined criteria, algo trading removes human emotion and bias, leading to more disciplined and consistent execution of trading strategies.

Additionally, algo trading systems can analyze vast amounts of market data and execute trades at high speeds, enabling traders to capitalize on market opportunities that may not be feasible for manual traders.

However, algorithmic trading does not eliminate risk. The majority of retail traders lose money, using algo trading tools or not.

Is Algo Trading Suitable For Beginners?

Algo trading can be challenging for beginners due to its technical complexity and the need for programming skills. While increasingly platforms offer user-friendly interfaces for algorithmic trading, beginners may struggle to develop and implement effective trading strategies without a solid understanding of financial markets and algorithmic principles.

Beginners should first gain experience with manual trading and market analysis before transitioning to algo trading.

Article Sources

- Algorithmic Trading with Python – Free 4-hour Course With Example Code Repos

- Algorithmic Trading Tutorial for Beginners: A Complete Guide

- Capitalise.ai

- Tickeron

- Composer

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com