Hantec Markets Review 2026

See the best Hantec Markets alternatives in your location.

Awards

- Most Reliable Global Forex Broker - Global Forex Awards 2022

- Best Forex Trading Experience (Latin America) - Global Forex Awards 2022

- Most Trusted Forex Broker (Africa) - Global Forex Awards 2022

- Best Value Broker (Asia) - Global Forex Awards 2022

- Most Transparent Forex Broker (Middle East and Northern Africa) - Global Forex Awards 2022

- Most Transparent Global Broker - Global Forex Awards 2021

- Most Trusted Broker (Africa) - Global Forex Awards 2021

Pros

- Hantec Markets offers a great range of 8 account base currencies, helping global traders avoid conversion fees while delivering a hassle-free day trading experience.

- Hantec Markets is a trusted broker, with a track record stretching back to 1990 and authorization from ‘green tier’ regulators, notably the FCA and ASIC.

- High leverage up to 1:1000 is available for experienced investors in some jurisdictions, amplifying trading results (profits and losses).

Cons

- The educational tools, consisting primarily of long-form articles, need revamping with interactive elements and videos to match the training materials at IG.

- Despite reliable order execution, Hantec Markets does not permit scalping strategies, reducing its appeal compared to Pepperstone, whose Razor account is set up for scalpers.

- There is no proprietary software aimed at newer traders, nor integration with the increasingly popular TradingView and cTrader platforms. Additionally MT5 is not available in certain regions, including the UK.

Hantec Markets Review

In this Hantec Markets review, we reveal our findings after testing the broker’s day trading environment. We also compare the broker to suitable alternatives, drawing on the first-hand experiences of our industry experts.

Regulation & Trust

Hantec Markets is trusted with oversight from two green-tier regulators (ASIC and FCA) and one yellow-tier regulator (JSC):

- Hantec Markets (Australia) Pty Limited is regulated by the Australian Securities and Investments Commission (ASIC)

- Hantec Markets Limited is regulated by the UK Financial Conduct Authority (FCA)

- Hantec Markets Limited Jordan is regulated by the Jordan Securities Commission (JSC)

As such, the broker ensures fund safety via several measures, including negative balance protection, segregated accounts, and access to compensation schemes (location dependent).

On the negative side, the global branch is regulated offshore by the Mauritius Financial Services Commission (FSC), a red-tier regulator that provides limited safeguards.

| Hantec Markets | Interactive Brokers | xChief | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FCA, ASIC, FSC, JSC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | ASIC |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Trading Accounts

Hantec Market offers a retail account alongside a professional account, though variations may occur in different jurisdictions.

Both retail and professional accounts require accessible minimum deposits of $100 and $1,000, respectively. That said, the retail account minimum is not as low as some brokers, including XM‘s ultra-low entry point of $5.

Hantec also offers a demo account, where you can download MT4 and start trading in minutes, with a virtual balance of $10,000.

However, free access to MT4 lasts for only 30 days, which isn’t sufficient for fully practising strategies before using real money. Nevertheless, I was able to contact the broker to request an extension of the demo period.

When I created a real-money account at Hantec Markets, I found the process to be quick and straightforward. It took me just a few minutes to complete, and I had to answer a suitability questionnaire.

Deposits & Withdrawals

Hantec Markets offers a great selection of payment methods, ensuring convenient funding. Payments can be made primarily via wire transfer, credit/debit cards, BPAY, Skrill and Neteller, though availability depends on your location.

Notably, there’s an excellent selection of base currencies, including USD, EUR, GBP, CHF, CAD, AUD, PLN, and AED. This variety is advantageous as it allows global traders to manage accounts in their local currencies, helping to avoid conversion fees.

Hantec Markets also doesn’t charge any deposit fees, regardless of the payment method used. Once a deposit request is processed and approved, the funds appear in your trading wallet swiftly.

Withdrawals follow a similar process to deposits, and requests must be executed using the same payment method originally used for deposits.

Traders are required to complete a simple withdrawal form to initiate the process. I’ve found that it typically takes between 2 to 5 working days for withdrawn funds to reflect in my bank account or on a credit card statement.

While some brokers offer same-day withdrawals, notably Eightcap, these timeframes are quite standard within the industry.

| Hantec Markets | Interactive Brokers | xChief | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | BPAY, Credit Card, Debit Card, Mastercard, Neteller, Skrill, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, FasaPay, Neteller, Perfect Money, Skrill, UnionPay, Volet, WebMoney, Wire Transfer |

| Minimum Deposit | $100 | $0 | $10 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

Hantec Markets offers CFD day trading opportunities across stocks, forex, indices, commodities and cryptos, though the range of instruments will depend on your jurisdiction.

This includes a selection of stocks from renowned companies such as Amazon and Apple, alongside 30+ forex assets covering major and minor currencies.

Furthermore, the platform caters to cryptocurrency enthusiasts by offering options like Bitcoin and Ethereum, in addition to opportunities to trade in precious metals such as gold and silver denominated in USD, several commodities including oil, and major indices like the FTSE 100 and S&P 500.

Yet while this range may be sufficient for beginners, it trails popular alternatives. For instance, RoboForex boasts over 8,400 stock and ETF CFDs sourced from leading global exchanges. Blackbull also blows Hantec out of the water with over 26,000 instruments.

Ultimately, there is considerable opportunity to expand into more diverse asset classes, such as soft commodities like wheat and coffee, as well as bonds and options.

Hantec Markets

Interactive Brokers

xChief

Assets & Markets Rating

Trading Instruments

Forex, CFDs, Indices, Stocks, Commodities, Cryptos

Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies

CFDs, Forex, Metals, Commodities, Stocks, Indices

Margin Trading

Yes

Yes

Yes

Leverage

1:1000

1:50

1:1000

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Fees & Costs

Opening an account with Hantec Markets is free of charge, with no fees for holding funds in your account, along with zero inactivity fees.

Trading fees on most assets are competitive, starting from 1 on the UK 100, 0.05 on oil, and 2.315 on stocks like Google. However, while spreads for the EUR/USD start as low as 0.2, they are not as low as those offered by IC Markets or Pepperstone, for instance, which provide spreads from zero.

That said, the broker’s swift execution speeds reduce the risk of slippage and help ensure competitive pricing.

Currency conversion fees might also apply, and holding positions overnight results in swap fees, contributing to trading costs in specific scenarios, though these won’t impact day traders.

Regarding currency conversion, a fee of 0.6% is charged, which aligns with industry standards. This fee is added to the settlement exchange rate based on the market rate at the time of settlement.

| Hantec Markets | Interactive Brokers | xChief | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.2 | 0.08-0.20 bps x trade value | 0.4 |

| FTSE Spread | 1.0 | 0.005% (£1 Min) | 70 |

| Oil Spread | 0.05 | 0.25-0.85 | 12 |

| Stock Spread | Variable | 0.003 | 50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

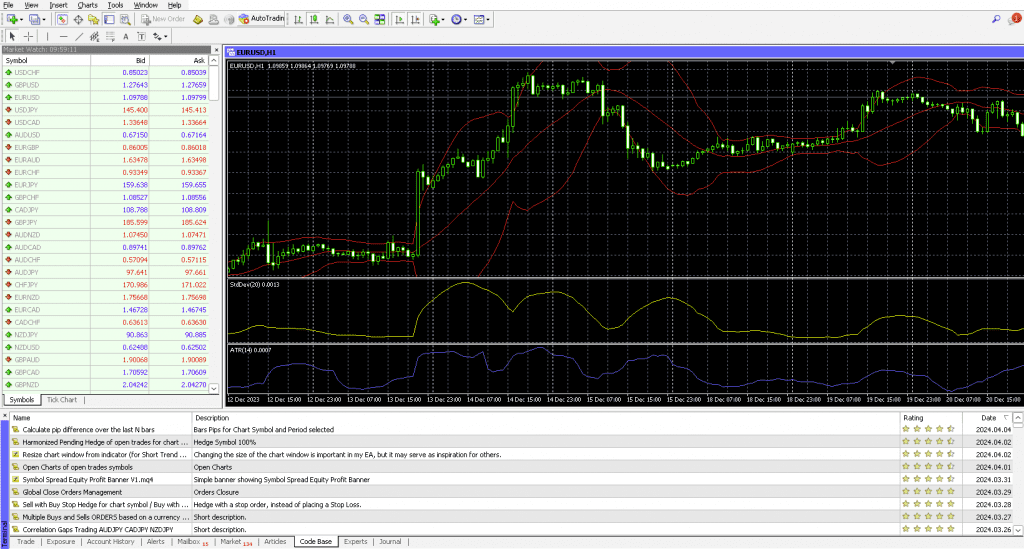

One notable challenge for new traders is the absence of a proprietary platform tailored to simplify the day trading process. Instead, the broker relies on MetaTrader 4 (although MetaTrader 5 is available in select jurisdictions).

While using MT4, which is accessible across various devices including Mac, PC, Linux, and mobile, I found that its outdated interface takes some time to get acquainted with. That said, it offers a range of comprehensive features making it suitable for traders of all skill levels.

Particularly, seasoned traders praise its deep customization capabilities and seamless integration with Expert Advisors (EAs) for automated trading strategies.

To assist traders in managing multiple MT4 accounts simultaneously, Hantec Markets also provides a Multi-Account Manager (MAM). This tool proves invaluable in streamlining account management processes, allowing efficient oversight and operation of several accounts from a single interface.

Having explored both Hantec Markets’ MT4 and MT5 platforms, I’ve noticed several differences. MT5, for instance, offers more advanced features for comprehensive price analysis, algorithmic trading, and copy trading capabilities. It also boasts exclusive indicators and broader market access, catering to traders seeking a more sophisticated trading experience.

MetaTrader 4 remains a popular platform for forex trading due to its extensive technical analysis tools and automated trading capabilities, but I prefer to use TradingView or cTrader, which unfortunately aren’t supported at Hantec Markets.

| Hantec Markets | Interactive Brokers | xChief | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | MT4, MT5, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Mobile App | Yes | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

Compared to category leaders like IG, Hantec Markets’ own research features lack depth, breadth and regularity. Traders do, however, have the option to subscribe to Daily Analysis Reports delivered via email.

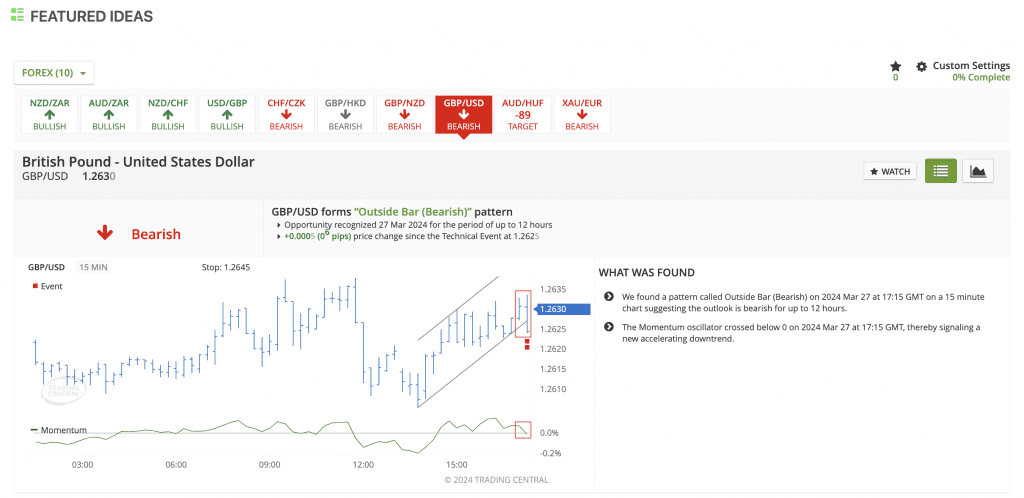

The research tools primarily rely on integration with Trading Central. This third-party provider offers excellent trading ideas based on technical analysis, ideal for short-term trading.

Within the account page, there is also a featured Market Buzz tool, which provides valuable analytics and sentiment indicators sourced from Trading Central. This resource allows you to search for specific symbols or names, enabling effective monitoring of assets such as indices or currency pairs.

Furthermore, by tailoring the news feed to focus on a particular asset, you can stay updated on developments relevant to your trading strategies and interests.

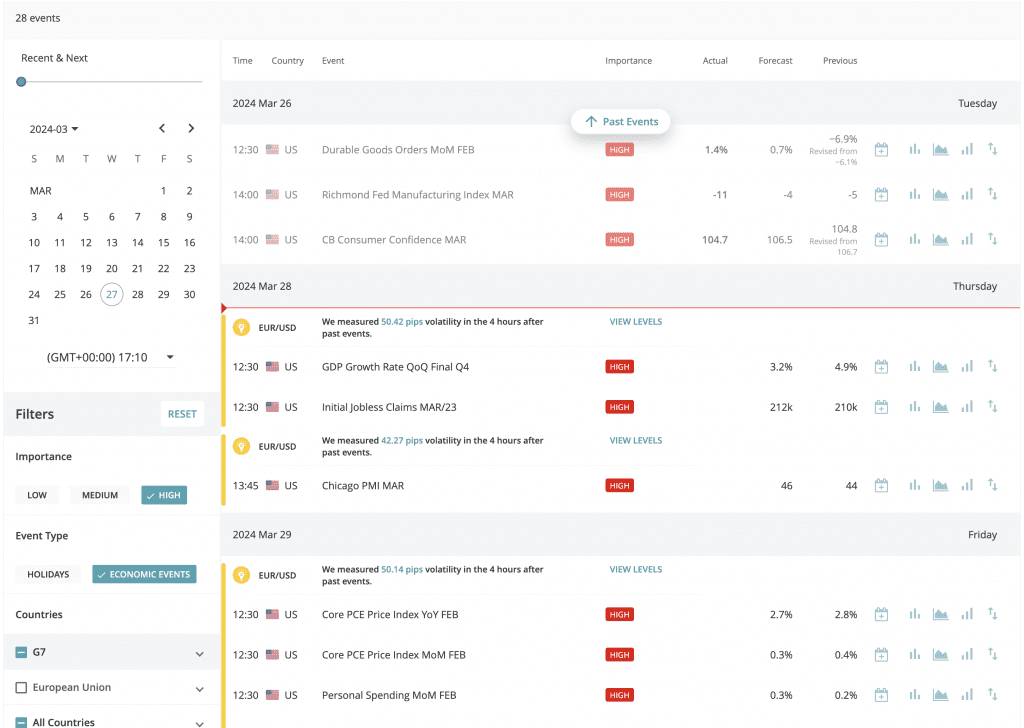

There’s also an economic calendar that offers insights into key global economic events and indicators.

However, I’ve noted the absence of a trading calculator, which hinders my ability to estimate potential profits, losses, and trading costs across various instruments.

| Hantec Markets | Interactive Brokers | xChief | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

The broker strives to support beginner traders through a basic collection of trading education.

These resources primarily comprise well-written articles covering a diverse range of topics, from interest rates and inflation to position sizing and risk reward ratios. Content is also helpfuly split by experience level (beginner, intermediate, advanced).

However, there is significant room for improvement. Hantec Markets could enhance its offerings by introducing a selection of video content, including tutorials, webinars, and guides. This would better assist novice traders in grasping the essentials of trading, aligning more with category winners like eToro.

Accessing these educational resources can also be somewhat cumbersome, as they are located on Hantec Markets’ website rather than being directly accessible through the trader’s account area.

| Hantec Markets | Interactive Brokers | xChief | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

Hantec Markets offers various contact methods including a 24/5 live chat, telephone, email, and contact form. The brokerage boasts dedicated support teams across multiple locations, including Hong Kong, Australia and the UK.

During my trial of the live chat service, I just had to provide my name, email, a brief query description, and select my preferred location for assistance.

However, while responses were provided promptly, the agents would often close the chat almost immediately after answering my initial question, without inquiring if I had any further queries. This meant that when I did have additional questions, I had to reconnect and go through the process again – very frustrating.

Hantec Markets

Interactive Brokers

xChief

Customer Support Rating

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Should You Trade With Hantec Markets?

Hantec Markets is a reputable broker providing a decent range of assets, popular third-party trading platforms, and a reasonable fee structure. Additionally, with the $100 minimum deposit, it’s an accessible option for most day traders.

However, the broker’s range of platforms and apps greatly trails alternatives, and it doesn’t permit scalping. Additionally, there is room for improvement in the broker’s education and research offerings, with both lacking in depth and breadth for serious day traders.

FAQ

Is Hantec Markets Legit Or A Scam?

Hantec, established in 1990, is a legitimate broker trusted by many global traders. The broker commits to customer protection and security measures, including negative balance protection and segregated client accounts.

Is Hantec Markets A Regulated Broker?

The Hantec brand is regulated by several financial authorities including the FCA, ASIC and JSC.

Regulation by such authorities means that the broker must comply with financial laws, undergo regular audits, and maintain transparent operations to protect traders.

Is Hantec Markets Suitable For Beginners?

Hantec is reasonably well-suited for beginners. The broker offers access to educational resources and market analysis, so novices can deepen their understanding of the financial markets.

The availability of a demo account allows for risk-free practice, and customer support in over 15 languages also makes Hantec an appealing option for those starting their trading journey.

Does Hantec Markets Offer Low Fees?

Hantec offers competitive fees compared to other heavily regulated brokers. For instance, its spread is lower than the industry average for EUR/USD pairs, making it an economical choice for traders focusing on cost efficiency.

Additionally, with no deposit or withdrawal fees and only some accounts facing commission charges, Hantec can be considered an affordable option for most day traders.

Is Hantec Markets A Good Broker For Day Trading?

Hantec may be a suitable broker for day trading, primarily due to its competitive trading fees, a variety of instruments suitable for fast-paced strategies, and support for the MT4 platform.

That said, the broker does not permit scalping – a popular day trading strategy.

Does Hantec Markets Have A Mobile App?

Hantec Markets does not offer its own bespoke trading app. Instead, MetaTrader (MT4/MT5) is available for both Android and iOS devices and allows traders to access financial markets, manage trades, and analyze trends.

Best Alternatives to Hantec Markets

Compare Hantec Markets with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

Hantec Markets Comparison Table

| Hantec Markets | Interactive Brokers | xChief | |

|---|---|---|---|

| Rating | 3.8 | 4.3 | 3.9 |

| Markets | Forex, CFDs, Indices, Stocks, Commodities, Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $10 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA, ASIC, FSC, JSC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | ASIC |

| Bonus | – | – | $100 No Deposit Bonus |

| Platforms | MT4, MT5, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | 1:1000 | 1:50 | 1:1000 |

| Payment Methods | 8 | 6 | 12 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by Hantec Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Hantec Markets | Interactive Brokers | xChief | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | No |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Hantec Markets vs Other Brokers

Compare Hantec Markets with any other broker by selecting the other broker below.

The most popular Hantec Markets comparisons:

Article Sources

- Hantec Markets Website

- Hantec Markets Limited - FCA License

- Hantec Markets Ltd - FSC License

- Hantec Markets (Australia) Pty Ltd - ASIC License

- Hantec Markets Limited Jordan - JSC License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of Hantec Markets yet, will you be the first to help fellow traders decide if they should trade with Hantec Markets or not?