Cryptocurrency and ESG: Balancing the Two

The popularity of cryptocurrency has created a balancing act that traders and investors may have to consider – how to balance the upside of bitcoin and cryptocurrency against its inherent environmental, social, and governance (ESG) impacts.

Even for market participants that aren’t particularly concerned about these environmental, social, and governance matters, other players in the market will be, which in turn influences the price of the instrument.

Despite the massive growth in the cryptocurrency industry, there are lots of questions for those looking to understand the ESG impact.

Cryptocurrency can offer some societal benefits, such as better financial inclusion and the ability to “be your own bank” and take out some transactional intermediaries.

But there are also potential downsides, such as its carbon emissions footprint, the risk of it being hacked and seized, and the lack of regulation and centralized governance.

These issues are debated not only within the crypto community, but also by government policymakers, corporations, and other entities globally.

Traders and investors can consider the nuances of individual digital currencies and weigh the pluses and minuses of them in the context of their own ESG and sustainability goals.

Crypto and ESG at the institutional level

For example, large institutional investors are starting to take ESG into account when making decisions on where to allocate capital.

Vanguard Group, one of the world’s largest investment management firms, said in a recent report that it will soon offer ESG-themed mutual funds.

BlackRock, the world’s largest asset manager, has also been vocal about its ESG focus. The company recently said they have upcoming plans to have $1 trillion in ESG-themed investments.

The growth of cryptocurrency and blockchain is happening alongside the growth of ESG investing, and the two are not mutually exclusive. In fact, there may be opportunities for overlap and synergy between the two industries.

Cryptocurrency and blockchain projects with strong ESG credentials could see an increase in interest from investors looking to align their portfolios with their ethical values. Conversely, projects with poor ESG track records could face backlash from socially conscious investors.

As traders and investors become more aware of ESG issues, they will likely play an increasingly important role in the cryptocurrency market. It’s important to be mindful of these impacts as one considers investing in this new and exciting asset class.

Carbon intensity of crypto

Crypto requires a lot of computing power to create and verify new transactions on the blockchain – which is termed “crypto mining” and this consumes a lot of energy.

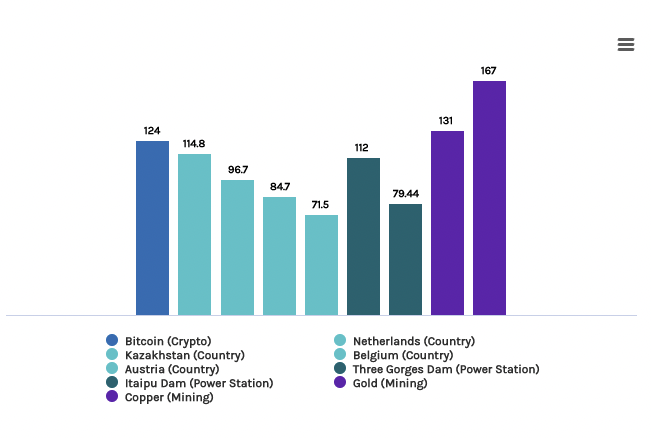

For example, the annual energy consumption of bitcoin is equal to the total electricity produced in the Netherlands, which is around 18 million people and nearly $1 trillion in GDP.

Bitcoin’s carbon intensity is much higher than that of gold, dollar for dollar. Bitcoin’s carbon intensity is around 15 million times that of Visa credit card transactions.

And many variables affect the carbon intensity of maintaining the cryptocurrency network. This includes how new transactions are validated.

For example, the “proof of work” process involved in bitcoin requires a lot more energy than the “proof of stake” that Ethereum, the world’s second most popular cryptocurrency, is looking to adopt.

Some miners are looking to move operations to cooler climates, such as Iceland, to reduce energy costs and lower their carbon footprint.

But this comes with its own set of problems, including the risk that extreme weather conditions could damage or disable mining hardware.

Crypto and renewable power

Many cryptocurrency mining companies are using renewable energy sources to power their mining and/or looking to engage in carbon offsetting.

Nonetheless, it’s difficult, given that renewables only provide a fraction of the total energy needs globally.

For example, only 20 percent of electricity creation comes from renewables such as wind and solar in the United States. Another 20 percent comes from nuclear power and 60 percent comes from hydrocarbons.

So, crypto mining globally does and will continue to (for a very long time) require hydrocarbons as an energy source.

As long as bitcoin mining and other forms of crypto mining are profitable, the energy requirements of mining it will increase over time.

But it may require energy from increasingly renewable sources.

More than just social responsibility

Concerns about the environmental impact of crypto are more than just social responsibility.

Governments are increasingly likely to restrict how much energy can be used for crypto mining.

China has banned crypto mining (which also has a lot to do with not wanting private forms of money competing with their own money and credit). Many other countries have restricted crypto mining as well.

Due to the largely democratic nature of developed markets, mining bans are unlikely.

But the climate impacts are debated with the US government and some EU officials have proposed banning crypto mining because of its energy intensity.

Bitcoin’s energy use exceeds electricity produced in many small countries

(Source: Centre for Alternative Finance, IEA, Power-Technology, Water Power Magazine, Morgan Stanley Research)

Social pros and cons of cryptocurrency

Even with the high energy demands of bitcoin, its social benefits are what make it attractive as a currency and store of value, such as greater financial inclusion.

For those who are unbanked (i.e., lack access to traditional bank accounts and financial services), cryptocurrencies are one way to increase the accessibility to the financial system.

Because cryptocurrencies can be accessed with any internet-connected device, this is arguably an easier entry point into the financial system than traditional bank accounts.

The volatility of cryptocurrencies doesn’t make them ideal for holding large sums of money, so this is where creations like stablecoins come in.

Cryptocurrencies can also support faster and more affordable transactions across borders.

Crypto is an easier way to send money to people in other countries.

Despite crypto’s notorious volatility, it may also be a better alternative when local currencies are highly volatile or depreciating (e.g., currency crises that have taken hold in countries like Turkey, Argentina, and Russia).

Crypto and illicit activity

And while crypto can open up possibilities for financial inclusion and the ability to transact without middlemen, it has been used for illegal purposes, such as money laundering and terrorism financing.

Academic research into bitcoin transactions found that 46 percent of bitcoin transactions were linked to illicit activity between January 2009 (bitcoin’s inception) and April 2017.

The total amount was $76 billion, which is equal to the black markets for illegal drugs in the US and European Union.

However, 2017 was a long time ago.

A more recent data point found that in 2021, an estimate of $14 billion in cryptocurrency was used for illegal activity. Because of the growth in the size of the cryptocurrency markets, this came to just 0.15 percent of the total amount of cryptocurrency that was traded.

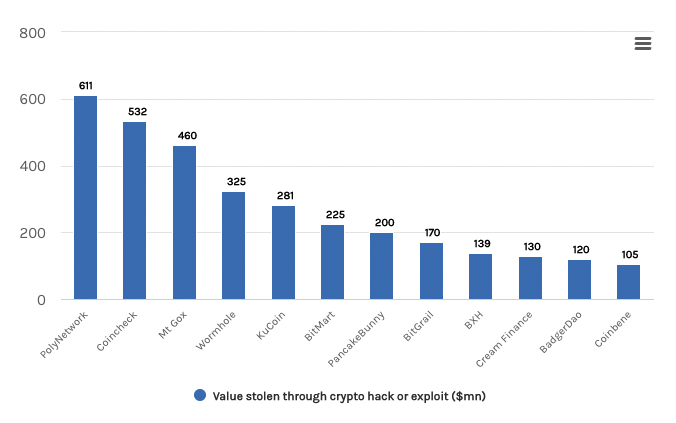

Cryptocurrency hacks

Another key ESG concern related to crypto is the security of digital currencies and the vulnerability of investors to hacks.

Crypto hacks have grown in size and prevalence

(Source: Elliptic, Coindesk, Twitter, Morgan Stanley Research)

Crypto hacks are when cyber criminals gain access to digital wallets or exchanges and steal cryptocurrencies.

The first major hack occurred in 2011, when Mt. Gox, a bitcoin exchange, was hacked and lost $470 million worth of bitcoin.

Since then, there have been a number of high-profile hacks, including one that resulted in the theft of more than $1 billion in cryptocurrency from Coincheck, a Japanese cryptocurrency exchange.

And while investors are not always the victims of hacks (exchanges and wallets have also been hacked), they can lose a lot of money when they occur.

The role of governance in crypto

Most cryptocurrencies use blockchain networks that are decentralized databases of transactions wherein there is no single entity that regulates them and enforces such regulation.

Anyone can create a new cryptocurrency.

In fact, it’s still not known for sure who created bitcoin.

Satoshi Nakamoto is the name used by the presumed pseudonymous person (or persons) who developed and invented bitcoin and authored the bitcoin white paper.

Many have come forward claiming to be Nakamoto, but there is no definitive proof that any of them are the real individual(s).

Naturally, this type of decentralized structure can be a challenge for governance and raises plenty of questions, such as:

- Who makes the rules as it pertains to how a cryptocurrency operates? Can they change the rules?

- Is there a system of checks and balances to help enforce these rules, such as a board of directors?

- Do the cryptocurrency and its applications comply with rules, laws, and regulations?

Those arguing in favor of cryptocurrencies often believe this type of structure is the definition of good governance – because no single entity has control over it.

However, new crypto regulations are highly likely to be part of it one way or another. One of the most effective powers of a national government is to control all the money and credit produced within its borders.

No country wants private forms of money to compete with their own currency. Even gold has been banned throughout the centuries by several governments.

When governments create money and it doesn’t go into assets denominated in its own currency, this defeats the purpose.

The easiest way for this to happen is for governments to control the on and off ramps.

To buy cryptocurrency, one needs to use their bank account (or some type of bank card) to send in funds. Governments could potentially shut down this pathway and effectively kill cryptocurrencies of various sorts that way.

Regulations are likely to change how people trade and invest in crypto-related products down the line.

In the short-term, however, this isn’t likely to simplify the complicated nature of crypto for sustainability-focused investors.

Are crypto and ESG a good fit?

There is potential synergy between the two industries.

Cryptocurrency projects with strong ESG credentials could see an increase in interest from investors looking to align their portfolios with their ethical values.

Conversely, projects with poor ESG track records could face backlash from socially conscious investors.

As traders and investors become more aware of ESG issues, they will likely play an increasingly important role in the cryptocurrency market. It’s important to be mindful of these issues when making trading or investment decisions.

ESG and crypto are two industries that are still in their early stages of development. As such, they are constantly evolving and changing.

It’s important to stay up-to-date on the latest news and developments in both industries in order to make informed investment decisions.

Cryptocurrencies offer a new way of conducting transactions and storing value. They have the potential to revolutionize how we do business online and offline.

At the same time, ESG is becoming an increasingly important consideration for investors.

As the two industries continue to grow, it’s likely that they will become more intertwined.

Conclusion

Cryptocurrencies are a relatively new phenomenon, and as such, ESG concerns related to them are still evolving.

Some of the key ESG issues around crypto include energy consumption and emissions from mining, the security of digital currencies and investors, and the role of governance in cryptocurrencies.

ESG and cryptocurrency have been thrust into the spotlight as the industry has continued to grow at a rapid pace.

Despite its potential downsides, there are many potential benefits to cryptocurrency that should not be ignored, such as what crypto can bring to those who don’t have access to traditional financial services and its potential portfolio benefits.

By considering ESG factors when making investment decisions, traders and investors can ensure their portfolios align with their ethical values.