Crypto.com Review 2026

Pros

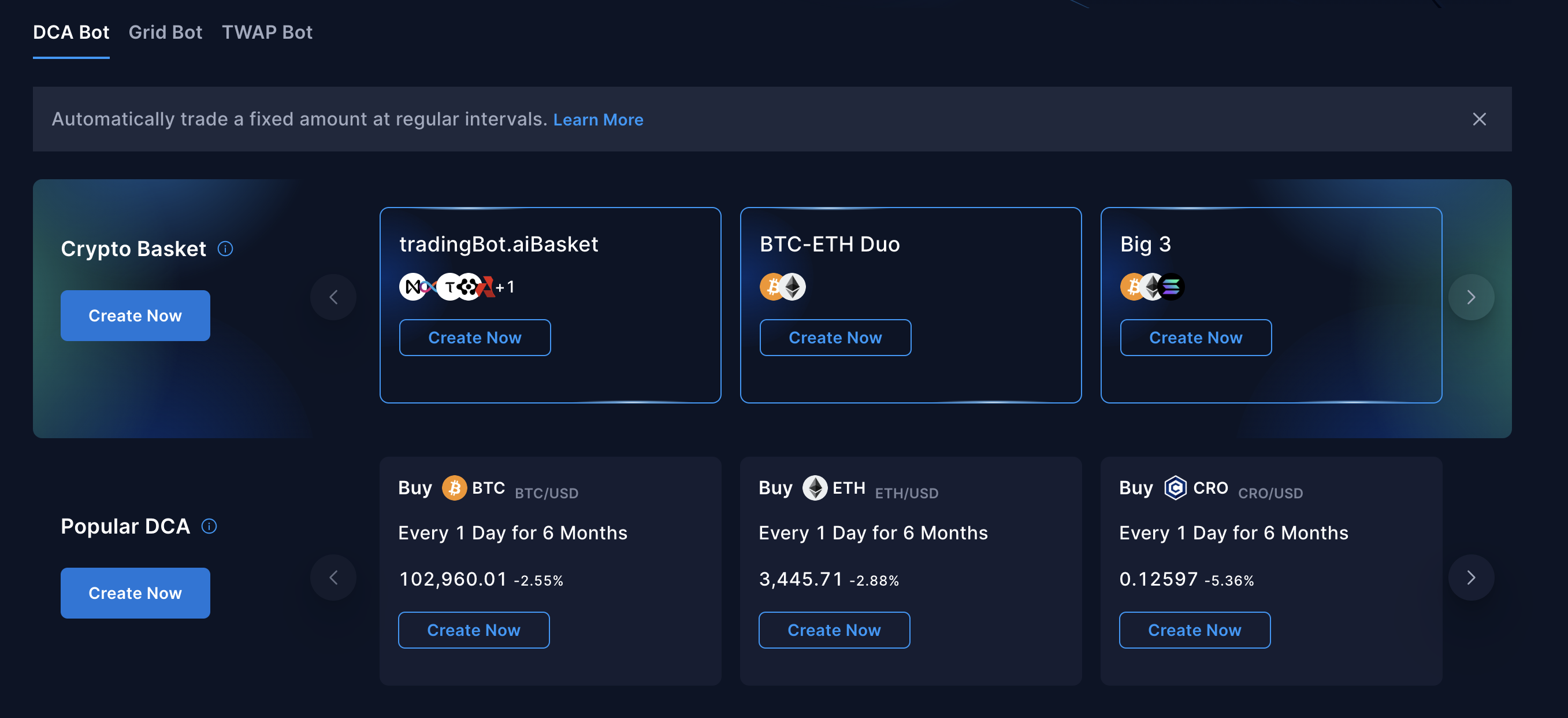

- The Crypto.com Exchange platform offers sophisticated bots, including Dollar Cost Averaging (DCA), Time-Weighted Average Price (TWAP), and Grid Trading bots. These tools allow traders to automate strategies, including leveraged perpetual trades, minimizing manual effort and slippage.

- Crypto.com uses a cold wallet solution that integrates multi-signature technology and geographic distribution to enhance security. This approach ensures robust protection of user assets with highly secure offline storage.

- Crypto.com has expanded beyond crypto in some regions, offering over 5000 stocks and ETFs for traders looking to build diverse portfolios and opportunities in different sectors.

Cons

- The app's high bid-ask spreads on many coins can be costly for traders placing market orders. Wide spreads mean the price you pay when buying is noticeably higher than the price you receive when selling, cutting into profits, especially on lower-volume trades.

- Customer support primarily relies on chatbots and email, with limited reliable phone support from our testing. This can lead to delays in resolving urgent issues, such as account access or transaction problems, which can be frustrating for crypto day traders who need quick assistance.

- Withdrawal fees apply to crypto transfers and fiat withdrawals, and these can be significant for active traders making smaller transfers. The minimum withdrawal limits are also relatively high, which restricts flexibility for managing smaller portfolios or quick liquidity needs.

Crypto.com Review

This Crypto.com review unpacks the results of our hands-on tests, conducted over multiple rounds since 2021, to reflect product changes and the evolving needs of active traders. We examine every important area active traders should consider before opening an account.

Regulation & Trust

Crypto.com was founded in Hong Kong in 2016, initially known as Monaco. It rebranded as Crypto.com in 2018. Today, the cryptocurrency exchange is based in Singapore with extensive global operations, and claims to have over 150 million users.

Crypto.com is registered with major regulators, including the UK’s ‘green tier’ FCA (company registration number 12843841), as an Electronic Money Institution.

It’s approved to operate as a cryptoasset business in the UK and holds licenses in France, Singapore, Australia, Canada, and several other countries. Each permit requires adherence to specific rules. However, the rules governing exchanges are less stringent than those governing brokers.

For US traders, securities are offered through Foris Capital US LLC, a separate entity registered as a broker-dealer with the SEC, and a member of FINRA and SIPC (CRD#: 282331/SEC#: 8-69712). Foris Capital does not handle crypto assets, which remain separate from traditional securities offered through the broker.

For day traders, this matters. For example, traditional brokers in the UK offering stocks or forex fall under tighter FCA rules, which protect your funds up to £85,000 under the Financial Services Compensation Scheme (FSCS) and provide recourse through the Financial Ombudsman Service (FOS).

However, with Crypto.com, although the broker is regulated, the cryptoassets themselves are not regulated in the UK by the FCA, so holders aren’t eligible for FSCS or FOS protection.

Ultimately, Crypto.com is regulated as a company but not as closely supervised as top-tier brokers according to DayTrading.com’s Regulation & Trust Rating, and remains exposed to risks such as hacks and outages. That said, the exchange holds several top-tier industry certifications, including SOC 2 Type 2 and PCI DSS 4.0.

It also utilizes advanced fraud detection systems, regularly updated blacklists, and anti-phishing protocols to strengthen user protection.

It offers a wide range of coins and fast trading, but day traders must accept the higher risk of trading on a crypto exchange. That’s the trade-off.

Here’s a list of jurisdictions where Crypto.com holds licenses:

- Brazil: COAF Registration and Payment Institution License – Conselho de Controle de Atividades Financeiras (yellow tier) and Banco Central do Brasil (yellow tier)

- Canada: Money-services business registration – Financial Transactions and Reports Analysis Centre (green tier) and Restricted Dealer Registration – Canadian Securities Administrators (provincial regulators)

- Cayman Islands: Virtual Asset Service Provider – Cayman Islands Monetary Authority (red tier)

- United States: Broker-Dealer Registration – Securities and Exchange Commission (green tier), Derivatives Clearing Organization license – Commodity Futures Trading Commission (green tier), Designated Contracts Market license – Commodity Futures Trading Commission (green tier), Money Services Business Registration – Financial Crimes Enforcement Network (green tier), Money Transmitter Licenses – state-level regulators, and Non-depository Trust Company Charter – state or federal level regulators

- European Economic Area: Class 2 Crypto-Asset Service Provider license (MiCA), Electronic Money Institution License and Investment Firm License (under MiFID) – national banks or financial regulators in each EEA country (green tier)

- UK: Crypto-Asset Business Registration and Electronic Money Institution License – Financial Conduct Authority (FCA)

- Australia: Digital Currency Exchange Service Provider Registration – Australian Transaction Reports and Analysis Centre (green tier) and Financial Services License – Australian Securities and Investments Commission (green tier)

- Hong Kong: Virtual Asset Trading Platform License – Securities and Futures Commission (green tier)

- Singapore: Major Payment Institution License – Monetary Authority of Singapore (green tier)

- South Korea: Electronic Financial Transaction Act and Virtual Asset Service Provider – Financial Services Commission and Financial Supervisory Service (yellow tier)

- Abu Dhabi: ADGM Category 3A License – Financial Services Regulatory Authority (yellow tier)

- Bahrain: Payment Service Provider License – Central Bank of Bahrain (yellow tier)

- Dubai: Virtual Assets Service Provider License – Financial Services Regulatory Authority (yellow tier)

- Mauritius: Investment Dealer License – Financial Services Commission (red tier)

| Crypto.com | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | SEC, FCA, MAS, AMF, CySEC, CBI, ASIC, FINTRAC, CIMA, VARA, OAM, HCMC, CFTC, OSC, KoFIU | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Proof of Reserves | Yes | No | No |

| SegregatedAccounts | Yes | Yes | Yes |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Live Accounts

When you open a live account with Crypto.com, you’re able to buy, sell, and hold over 400 cryptocurrencies through its mobile app, desktop, and Web exchange.

I’ve found its Level Up program particularly interesting – you can trade with zero fees and earn a decent percentage APY interest on cash balances and up to 6.3% staking CRO tokens.The tiers (Basic, Plus, Pro, and Private), which cost from $4.99 per month, unlock progressively better perks like cashback and improved staking returns.

What’s exciting is that Crypto.com expanded in 2025 beyond crypto alone. You can now trade 5,000+ stocks and ETFs with zero commissions, plus try predictions trading on sports, politics, and crypto events – all from the same app.

Before you can start trading on Crypto.com, you’ll need to verify your identity. The entire process is conducted digitally through the app, and it’s pretty straightforward once you know what to expect. It took me about 5 minutes to complete.

First, you need to sign up with your email and create a passkey. Then comes email confirmation and a quick SMS code sent to your mobile number.

Here’s where it gets hands-on: the app will ask for your full name and personal details, such as your salary and trading experience, and then prompt you to photograph a government-issued ID, such as your passport, driver’s license, or national ID card.

Finally, you need to record a live selfie video on your phone, following the on-screen instructions. This step proves you’re really you, not someone just uploading stolen photos.

Once you’ve submitted everything, Crypto.com reviews it before unlocking any trading features. From my experience, approval was instant, although it can take a few hours to a couple of days, depending on the completeness and accuracy of your documents and your location.

Demo Accounts

Crypto.com doesn’t offer a built-in demo account on its main exchange. However, if you want to practice before risking real money, you have a couple of workarounds.

One option for advanced traders is to utilize third-party platforms like Bitsgap, which enable the simulation of trading strategies on Crypto.com’s exchange through paper trading modes. These tools are excellent for testing out bot strategies and getting a feel for how trades work in a risk-free environment before you commit actual funds.

Alternatively, if demo trading crypto is a must-have feature for you, consider starting with other firms that offer proper demo accounts. Platforms like Bybit offer comprehensive demo trading options, allowing you to practice extensively without any financial risk.

Deposits & Withdrawals

Getting money in and out of Crypto.com isn’t as straightforward as brokers like eToro, and deposit methods vary significantly by region.

For example, in the UK, you can’t deposit via bank card or e-wallets, such as Google Pay, unless you’re using the mobile app. Instead, you’re required to do a manual bank transfer. Other regions may offer debit card or credit card options.

For crypto deposits, you transfer tokens from external wallets into your Crypto.com wallet. Most deposits clear quickly, though banks and blockchain networks occasionally cause delays.

Withdrawals let you send crypto externally or cash out fiat to your bank, but you’ll need to whitelist addresses and complete 2FA and SMS verification – no shortcuts.

Minimum deposits are technically low, as little as 0.00001 BTC (approximately $1) for cryptocurrency, €1 for EUR via SEPA, or £20 for GBP. USD and stablecoin deposits start around $1.

Here’s the catch: while these minimums sound great, withdrawal minimums are much higher. GBP withdrawals require a minimum of £70, so small deposits may hold your funds until your balance grows. Factor in payment fees too – they can eat into small accounts.

| Crypto.com | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Minimum Deposit | $0 | $0 | $100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

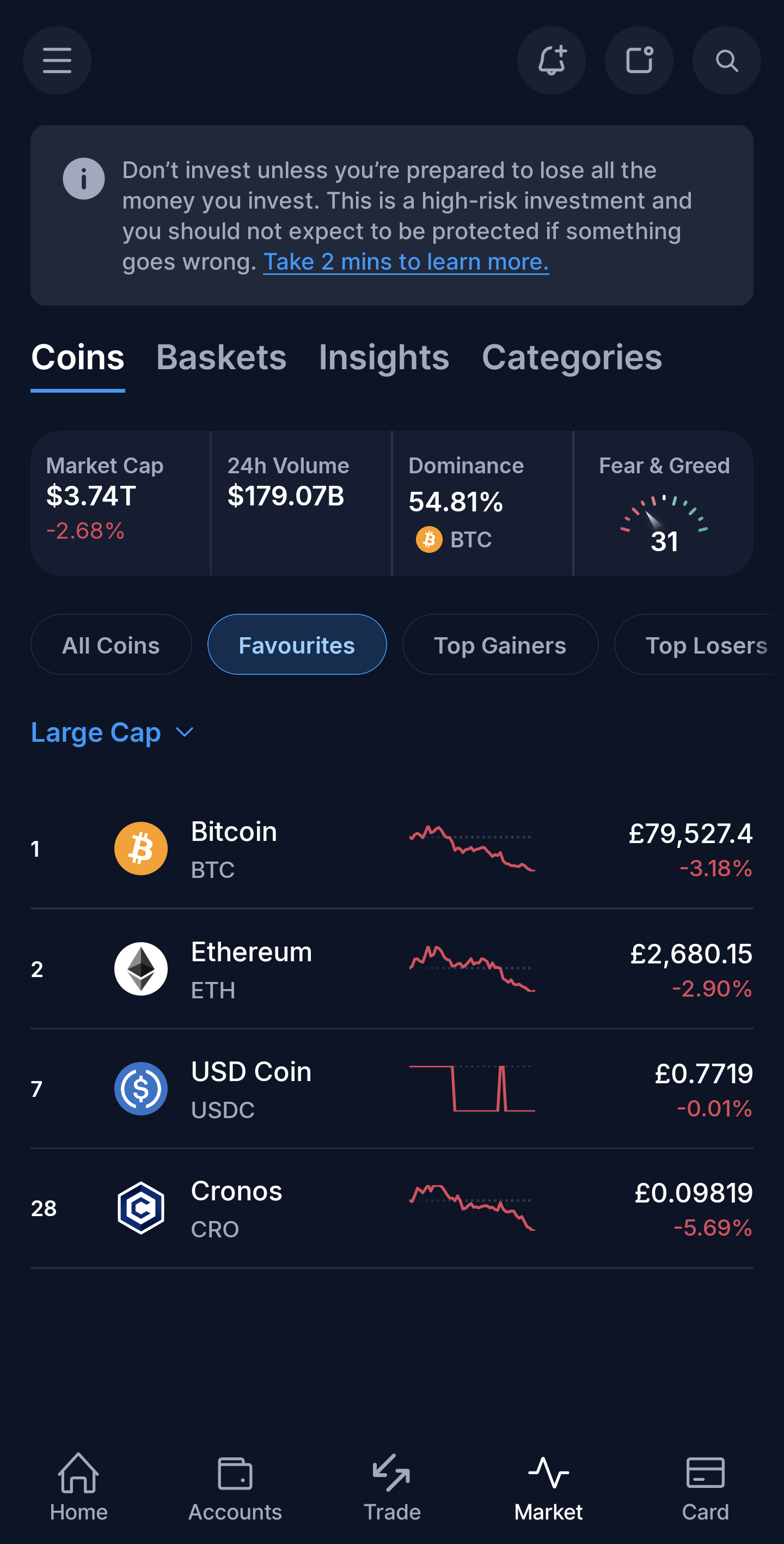

Crypto.com gives you access to over 400 cryptocurrencies, covering everything from major coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) to stablecoins like Tether (USDT) and USD Coin (USDC). You’ll also find popular altcoins such as Polkadot (DOT), Chainlink (LINK), and VeChain (VET).

By comparison, Binance offers the most coins to trade, with over 500 cryptocurrencies and 1,500 trading pairs available to its global users, but has a sketchy past so we’d urge caution.

What sets Crypto.com apart is the expansion beyond crypto. In 2025, the exchange introduced stock and ETF trading for US-based traders, providing access to over 5,000 US equities. Plus, there’s predictions trading (also exclusive to US traders) – you can wager on event outcomes like sports matches or political elections.

Although the focus remains on cryptocurrencies, the exchange doesn’t provide access to traditional forex or commodities. Still, its broader ecosystem – featuring equities, ETFs, and other fintech assets – makes it appealing if you’re looking to blend crypto exposure with wider financial instruments.

Crypto.com’s mix gives you a broader playground than exchanges that focus solely on pure crypto. While dedicated crypto platforms like Bybit often offer deeper liquidity and faster updates on new tokens, Crypto.com appeals to those who want exposure to both digital assets and traditional markets without having to juggle multiple accounts.

It’s a middle ground – less specialized for hardcore crypto traders, but more convenient for investors building a diversified portfolio.

| Crypto.com | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | Crypto, Stocks, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Crypto Lending | Yes | No | No |

| Crypto Mining | No | No | No |

| Crypto Staking | Yes | No | No |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

Crypto.com’s fee structure can be confusing and expensive, especially if you’re not careful about which platform you use.

On the Crypto.com Exchange, trading fees start at 0.075% for spot trades and 0.034% for derivatives – pretty competitive if you’re a high-volume trader. VIP users who stake CRO tokens can reduce fees even further, sometimes achieving 0% maker fees or earning rebates.

Here’s where it gets tricky: if you’re trading via the Crypto.com app instead of the exchange, fees jump dramatically. The app uses spread pricing, typically around 3%, meaning you pay 3% above market price when buying and sell at roughly 3% below. If you’re day trading crypto and working on tight margins, this markup will quickly eat into your profits.

Withdrawals add another layer of costs – crypto withdrawals incur network fees, while fiat withdrawals vary depending on the method and region.

Basically, the fee model rewards serious traders who stake CRO and use the exchange, but it’s costly and less transparent for beginners on the app. Before you start, calculate the real cost by factoring in spreads, maker/taker fees, and withdrawal charges to understand what you’re actually paying.

| Crypto.com | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Fees & Costs Rating | |||

| Crypto Fee | 0.075% (spot), 0.034% (derivatives) | 0.12%-0.18% | 0.1 |

| Inactivity Fee | $5 | $0 | CHF 100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

Crypto.com provides a comprehensive trading ecosystem accessible through mobile, web, and desktop platforms. Whether you prefer on-the-go trading or advanced desktop tools, the proprietary platform provides access to crypto, equities, and ETFs, but there are important differences between platforms.

Mobile App (iOS/Android)

The app is smooth to install and great for basic buying and selling. I find it excellent for banking-like features – fiat deposits, card payments, and staking are all straightforward. It’s ideal for monitoring your portfolio on the move.

However, for day trading, there are noticeable limitations. The app offers fewer order types compared to the full exchange (limited advanced conditional orders), spreads are wider, and trade execution is slower. If you’re making multiple trades or need sub-second responsiveness, the app will frustrate you.

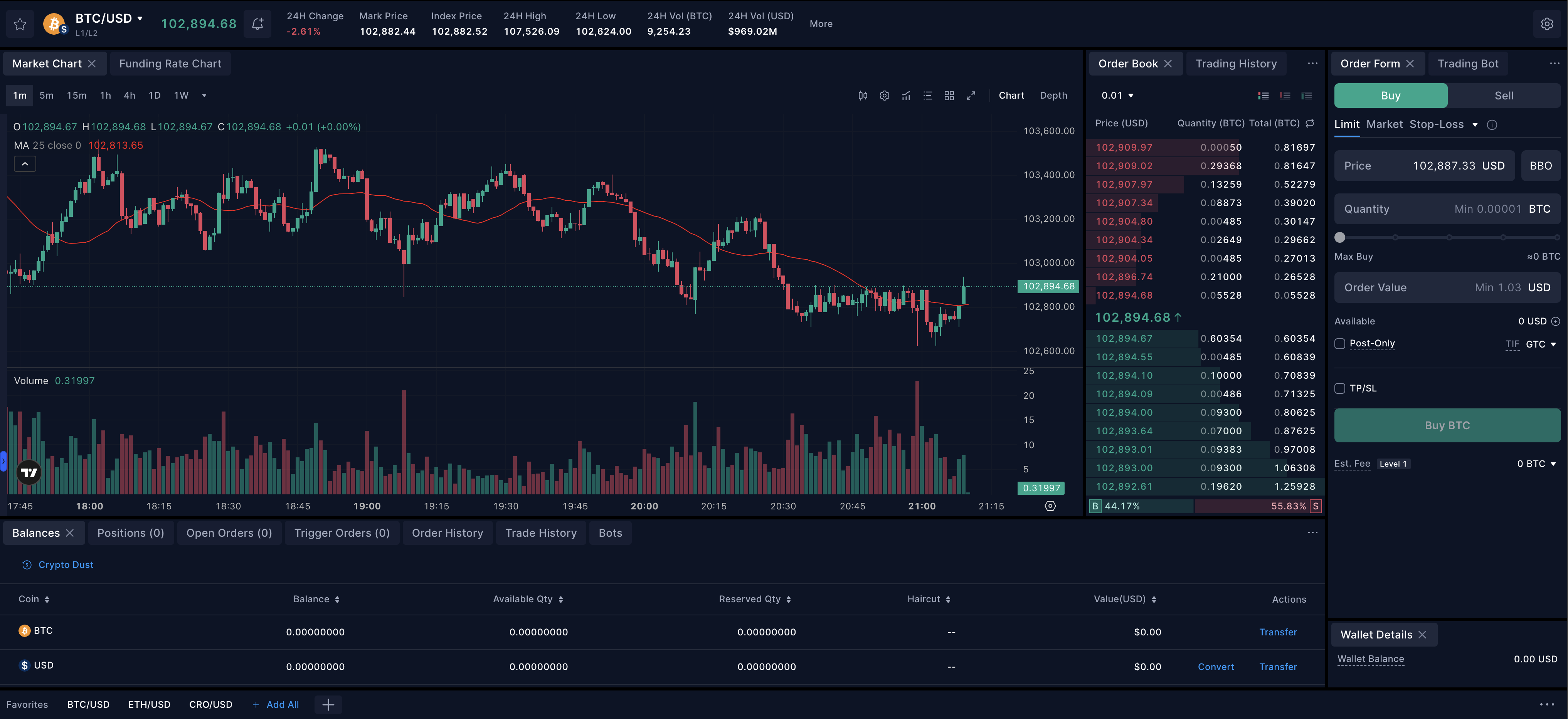

Web/Desktop Exchange Platform

This is where serious trading happens. You get traditional trading interfaces, including charts, order books, and deeper market data. The platform supports both spot and derivative trading, as well as automated trading through customizable strategies and API integrations.

The desktop platform provides multiple screens and faster execution, which is essential for day traders. However, the tools and advanced charting features are less comprehensive than what you’d find at top crypto brokers like Bybit.

If you’re making just a few trades per session, the app works fine. However, for active day trading with tight spreads and fast execution, you’ll want to use the Exchange platform.

| Crypto.com | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Mobile App | iOS & Android | iOS & Android | iOS |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

Crypto.com offers research through its Research and Market Updates pages on its website.

I’ve explored both, and they provide regular reports, newsletters, and in-depth analyses of crypto market trends, institutional developments, and monthly reviews that cover both crypto and traditional assets. Topics include prediction markets, institutional stablecoin adoption, and sector performance analysis.

While these resources offer valuable insights and stay reasonably current, they lean heavily toward high-level market commentary rather than actionable trading signals or technical analytics.

You won’t find advanced charting integrations, social sentiment tools, or real-time alerts built into the platform like you would with top crypto brokers.

For beginners, this is actually helpful – the accessible overviews give you a solid foundation for understanding market conditions and trends without overwhelming you.

But if you’re an active day trader needing granular market data, real-time scanning tools, or technical breakdowns, you’ll quickly realize the limitations.

| Crypto.com | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

Crypto.com offers two main education hubs: Learn and University. I’ve worked through both, and they do an excellent job by teaching beginners about crypto trading, blockchain basics, and market trends.

The Learn center offers concise explanations – how crypto wallets work, what staking means, how to read basic charts, and similar topics. It’s simple and easy to follow, great for getting your feet wet.

However, if you’re planning to day trade, it’s too basic. You won’t find more in-depth material on trading setups, risk management, or advanced chart analysis that actually helps you make informed trading decisions.

The University takes it a step further with more structured lessons and visuals. The content is organized and clear, but it still feels like general education rather than trader-focused training.

There’s no real-time analysis, no live workshops, and no advanced technical instruction, such as you’d find on platforms like eToro.

Crypto.com’s educational resources work well for absolute beginners learning the language of crypto and understanding basic concepts. However, new traders looking for help to manage entries and exits, or develop a comprehensive strategy, will need to supplement their knowledge with outside education or tools specifically designed for active traders.

| Crypto.com | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

Crypto.com has a searchable Help Center covering common issues, such as deposits, withdrawals, and KYC steps. It also offers an in-app Live Chat for logged-in users, which sounds promising on paper.

But here’s where it gets frustrating. There’s no phone number or callback service, and I couldn’t easily find a support email address.

During testing, I found that Live Chat support was slow, unresponsive, or provided generic replies that didn’t resolve issues.For example, I was unable to speak to a human to ask whether there was a demo account—just automated responses pointing me back to help articles.

For day traders, this matters more than you might think. If something goes wrong – a withdrawal delay, account freeze, or execution problem – you need fast help. Waiting days for a response or getting copy-paste answers can seriously disrupt your trading and lock up your funds at critical moments.

By comparison, some top crypto brokers often provide phone support, email, and live chat with faster turnaround times, especially for active traders who generate more volume.

Crypto.com’s support works adequately for general use and casual trading. However, if you’re planning high-frequency day trading and rely on quick issue resolution or hands-on service when problems arise, you may find better support with brokers specifically oriented toward active traders.

Good support can make or break your trading experience when things go wrong.

| Crypto.com | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With Crypto.com?

Crypto.com is well-suited for beginners who want a broad range of assets in one place and don’t require advanced features or rapid support.

However, serious day traders who rely on tight spreads, quick execution, sophisticated platforms and comprehensive assistance should consider alternatives.

It’s a solid entry-level choice but falls short for advanced-level trading demands.

FAQs

Is Crypto.com Legit Or A Scam?

Crypto.com is a legitimate and secure platform with strong safety measures in place. It holds multiple industry-recognized security certifications and stores nearly all customer funds in cold wallets, reducing hack risks.

The platform enforces multi-factor authentication (MFA) for sensitive actions, uses withdrawal address whitelisting with a 24-hour lockout, and includes anti-phishing codes to protect users from scams.

While no platform is risk-free, Crypto.com’s ongoing commitment to security and compliance makes it a trusted option for crypto trading. Users should still practice good security habits like enabling MFA and cautious transaction management to safeguard their assets.

Is Crypto.com Suitable For Beginners?

Crypto.com is designed with beginners in mind. It offers a simple app and easy navigation, making it straightforward to buy, sell, and manage over 400 cryptocurrencies.

New users can find helpful guides on setting up accounts, making their first trades, and utilizing features such as price alerts and portfolio tracking.

However, while the learning curve is low, beginners should be aware of higher fees on the app and limited customer support.

Best Alternatives to Crypto.com

Compare Crypto.com with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

Crypto.com Comparison Table

| Crypto.com | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 3.5 | 4.3 | 3.6 |

| Markets | Crypto, Stocks, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | No | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 |

| Minimum Trade | $1 | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | SEC, FCA, MAS, AMF, CySEC, CBI, ASIC, FINTRAC, CIMA, VARA, OAM, HCMC, CFTC, OSC, KoFIU | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | – | – | 100% Anniversary Bonus |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | – | 1:50 | 1:200 |

| Payment Methods | 6 | 6 | 10 |

| Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by Crypto.com and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Crypto.com | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | No | Yes | Yes |

| Forex | No | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | No | Yes | Yes |

| Oil | No | No | Yes |

| Gold | No | Yes | Yes |

| Copper | No | No | Yes |

| Silver | No | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | Yes | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

Crypto.com vs Other Brokers

Compare Crypto.com with any other broker by selecting the other broker below.

The most popular Crypto.com comparisons:

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Crypto.com yet, will you be the first to help fellow traders decide if they should trade with Crypto.com or not?