Anti-Growth Assets (List of Stores of Value)

There are several assets that can be considered stores of value that hold their value over time and are less dependent on infusions of liquidity and good economic conditions.

Including some level of “anti-growth” assets in a portfolio can help to mitigate risk and provide a store of value for a more balanced portfolio or during times when growth and/or inflation or overall economic conditions are unfavorable.

These assets, also known as defensive assets, tend to perform well when growth assets, such as stocks, are performing poorly.

Key Takeaways – Stores of Value & Anti-Growth Assets

- Anti-growth assets provide stability and diversification, and can serve as a store of value during economic downturns or periods of high inflation.

- Examples of anti-growth assets include predictable cash flow equities, private assets, gold, real estate, art, rare collectibles, cryptocurrencies, commodity currencies, and less growth-sensitive commodities.

- The specific allocation of anti-growth assets will depend on an investor’s risk tolerance, investment goals, and market conditions.

Benefits of Anti-Growth Assets & Stores of Value

Anti-growth assets help to provide stability and diversification.

By investing in assets that have a low correlation with the broader stock market (and risk assets, generally), traders/investors can reduce the overall volatility of their portfolios.

For example, during times of economic recession or market downturns, defensive assets such as government bonds or gold tend to perform well as investors seek safe havens for their investments.

In contrast, growth assets such as stocks may experience significant losses during these times.

Another benefit of anti-growth assets is that they can provide a hedge against inflation or stagflationary conditions.

As inflation rises, the value of growth assets can be eroded, but the value of defensive assets may hold steady or even increase.

Anti-Growth Assets List (Stores of Value)

Some of these assets include:

Predictable cash flow equities

Predictable cash flow equities are stocks of companies that generate consistent and reliable cash flows, which allows them to pay stable and growing dividends over time.

These equities can be a good store of value for several reasons.

Less volatile

First, they tend to be less volatile than growth or cyclical equities.

Predictable cash flow equities typically represent mature, established companies that operate in stable industries and have a long track record of generating consistent earnings.

As a result, their stock prices tend to be less volatile, which can provide a sense of stability and predictability for investors.

Consumer staples and utility stocks tend to be common as this type of asset because they sell things that people need to physically live.

Dividends

The dividends often paid by these equities can provide a steady stream of income for investors.

This income can be reinvested back into the stock or used to fund other investments or expenses.

In addition, the reliable and growing dividends can provide a hedge against inflation, as they tend to increase over time and can help to maintain purchasing power.

Supported by their own income streams

The predictable cash flows generated by these equities can provide a buffer against market downturns.

Even during periods of economic recession or market volatility, companies that generate consistent cash flows are often able to maintain their dividend payments and avoid significant declines in their stock prices.

Private Assets

Private assets can be a good store of value for several reasons.

Not traded publicly

Private assets are not traded publicly.

This doesn’t mean their exempt from the same economic forces as their public counterparts, but it does mean that investors should expect to be compensated for the illiquidity, simply known as an “illiquidity premium.”

Longer-term time horizon

Private assets are often held by individuals or companies with a long-term investment horizon, which means they are less likely to be influenced by short-term market movements.

Diversification benefits

Private assets can provide diversification benefits to an investor’s portfolio, as some may have low correlations with traditional asset classes like stocks and bonds.

Can be skill- or process-driven

Private assets may offer higher potential returns than publicly traded assets, as they are often associated with higher levels of risk and require specialized knowledge or skills to invest in them.

For example, if one wants to invest in commercial real estate, that takes a certain skill set to do successfully.

It can also mean that they will consume your time if they’re dependent on your skills or know-how. Or you may need to hire out certain tasks, which will create costs.

With private assets, you might be essentially buying yourself a job.

Whatever the case, it’s important to ensure that it’s well-understood what exactly you’re signing up for.

Privacy

Private assets can also provide a level of privacy and confidentiality that public assets do not offer.

This can be especially valuable to high-net-worth individuals who wish to protect their wealth from public scrutiny.

Gold

Gold is a classic example of a store of value, as it has been used as a currency for centuries, as something that almost everyone agrees has intrinsic value.

It is a finite resource that is difficult to extract and has limited supply, which helps to maintain its value over time.

Central banks also buy gold as a reserve.

While it doesn’t explicitly pay a yield and isn’t the best investment over the long run (about the same return as cash or a bit better), it’s no one else’s liability and generally holds its real (after-inflation) value over time.

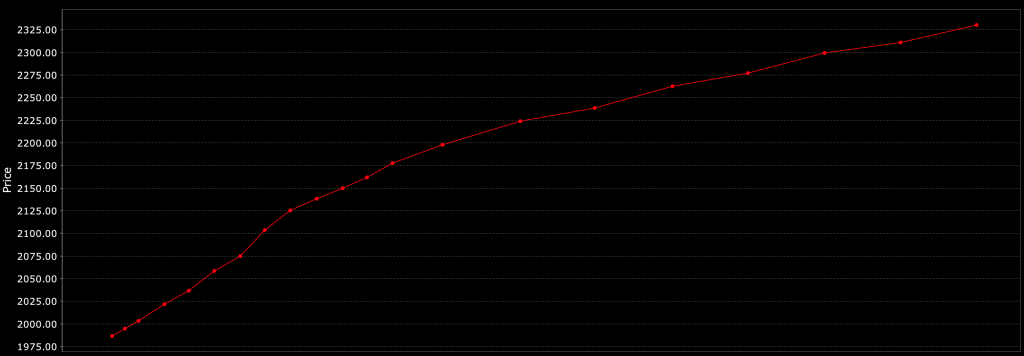

There are also storage and insurance costs to consider with physical gold, which also shows up in the shape of its upward-sloping futures curve (contango), which represents these costs, as seen below.

Gold Futures Term Structure

Real Estate

Real estate is a tangible asset that has historically held its real value and has the potential for long-term appreciation.

While real estate values can fluctuate in the short-term due to market conditions and the fact it’s a debt- and interest rate-sensitive investment. Over the long-term, it has been a relatively stable investment.

It’s also important for people to differentiate real estate for living in and real estate for investment.

Real estate for living comes with a stream of expenses that typically isn’t supported by an offsetting income stream from the asset itself (like the case with real estate for investment purposes). It has to be funded from other income sources and there are expenses associated with homes that are infrequent and occur over longer cycles that make it very easy to chronically underestimate the operating costs associated with it.

It typically is not a good store of value because you normally don’t get a nominal rate of return that compensates you for the sum of the inflation rate and the annual net carrying costs expressed as a percentage of the notional market value of the home.

It’s also not a very effective inflation hedge over the short-run because of its debt and rate sensitivity that makes it cyclical.

That equity is also illiquid until it’s realized in some way, and there are costs associated with that.

Accordingly, primary residences should be a reasonable part of one’s budget.

Real estate for investment purposes is a different story and is a large and diverse asset class.

Art

Art is another tangible asset that can serve as a store of value.

While the value of individual works of art can be highly variable, the overall art market has shown to be relatively stable over time.

And, of course, what’s considered “art” and how it’s valued varies wildly.

Rare collectibles

Rare collectibles, such as stamps, coins, and other items that have historical or cultural significance, can be valuable and serve as a store of wealth.

This can also include things like wine, scotch, and other things.

These assets are often not correlated with other investments, making them a useful diversification tool for investors.

Cryptocurrencies

It is controversial to include cryptocurrency as a store of value.

Crypto is almost a pure liquidity asset because it’s not an asset that’s supported by its own income stream.

It essentially requires the production of new liquidity to find the next buyer.

While cryptocurrencies can be volatile, some traders/investors view them as a potential store of value over the long term due to their limited supply and decentralized nature.

However, it is important to note that cryptocurrencies are a relatively new asset class and come with higher risks compared to other traditional assets.

Crypto is also a relatively small asset class (a fraction of the size of the market of just Apple common stock, for example), so it’s normally not practical for large institutional investors or central banks, and doesn’t fit what they look for in an asset.

That said, for anyone looking for widespread diversification, crypto is another potential area to consider.

Commodity currencies

Commodity currencies are currencies that are heavily influenced by the price of a particular commodity, such as oil, gold, or agricultural products.

These currencies include currencies like the Canadian dollar (CAD), Australian dollar (AUD), New Zealand dollar (NZD), and Chilean Peso (CLP).

Commodity currencies can be a good store of value for a few reasons:

- Inflation hedge: Commodity currencies tend to perform well in times of high inflation as commodity prices typically rise with inflation. This makes them a good hedge against inflation, as the value of the currency tends to rise in tandem with the price of the commodity.

- Diversification: Investing in commodity currencies can provide diversification benefits to an investment portfolio. Commodity prices are often driven by different factors than traditional assets like stocks and bonds, which means that commodity currencies can provide currency diversification.

- Global demand: Commodity currencies are often linked to global demand for the underlying commodity. As such, they can benefit from global economic growth and rising demand for commodities. This can help to support the value of the currency over the long term.

Commodity currencies can also be subject to significant volatility, as commodity prices can be volatile themselves.

Less growth-sensitive commodities

Less growth-sensitive commodities, such as agriculture products, can be a good store of value for several reasons:

- Limited Supply: Unlike currencies, which can be printed/minted at will, the supply of agricultural commodities is limited by the amount that can be grown or raised in a given period. This limited supply can help to protect the value of the commodity over time, particularly if demand increases.

- Diverse Use: Agricultural commodities have a diverse range of uses, from food and clothing to fuel and building materials. This means that demand for these commodities can come from a variety of sources, which can help to insulate them from economic downturns.

- Non-Correlated: Agricultural commodities have historically had low or negative correlations with other assets, such as stocks and bonds. This means that adding agricultural commodities to an investment portfolio can help to diversify the portfolio and reduce overall risk.

- Inflation Hedge: As inflation rises, the price of goods and services increases, reducing the purchasing power of currency. Agricultural commodities can act as an inflation hedge because their prices tend to rise with inflation (or even partially be the cause of the higher inflation rate), which can help to protect the value of the investment.

FAQs – Anti-Growth Assets (Stores of Value)

What are anti-growth assets and why are they important in a portfolio?

Anti-growth assets, aka defensive assets or stores of value, are investments that hold their value over time and perform well during economic downturns or recessions.

Including these assets in a portfolio can help mitigate risk, provide stability, and diversify the range of investments (i.e., their environmental sensitivities), reducing overall volatility.

How do anti-growth assets provide a hedge against inflation?

As inflation rises, the value of growth assets can erode, but the value of defensive assets may hold steady or even increase.

This helps maintain purchasing power and protects the value of an asset portfolio.

What are some examples of anti-growth assets?

Examples of stores of value include predictable cash flow equities (e.g., consumer staples, utilities), some private assets, gold and precious metals, some forms of real estate, some art and rare collectibles, cryptocurrencies, commodity currencies, and commodities that are less growth-sensitive.

The extent to which any given asset within these categories might qualify as a good store of value will largely depend on its character and how it may change through time.

How do predictable cash flow equities differ from growth equities?

Predictable cash flow equities represent mature, established companies that generate consistent cash flows and pay stable dividends.

They tend to be less volatile and provide a steady stream of income, while growth equities are more focused on capital appreciation and may have higher volatility because their cash flows are discounted to come far in the future.

Why are private assets considered stores of value?

Private assets offer several benefits, including an illiquidity premium, long-term investment horizon, diversification, potential for higher returns, and privacy.

These factors contribute to their ability to store value over time.

Is real estate always a good store of value?

The effectiveness of real estate as a store of value depends on its purpose.

Primary residences often have expenses that offset any potential gains, while investment real estate can provide cash flow and represents a diverse asset class.

Can non-income-generating assets be good stores of value?

For a non-income-generating asset, if the nominal rate of return doesn’t compensate for the sum of the inflation rate and the net carrying costs as a percentage of its notional value, the owner is being stripped of economic value.

Even if something is supposedly worth a lot or increasing in nominal value, cash-flow problems can develop if the all-in holding costs are too high because the equity is illiquid.

For these reasons, things like a home can’t be too big of a piece of one’s budget and one needs to be careful about the premise that buying/holding one for investment purposes.

Can cryptocurrencies be considered a store of value?

Cryptocurrencies are a controversial store of value due to their lack of intrinsic value, high volatility, and relatively small market size.

However, some traders/investors view them as a long-term store of value due to their capped supply and decentralization.

How do commodity currencies provide a hedge against inflation?

Commodity currencies, such as the Canadian dollar, Australian dollar, and New Zealand dollar (among others), tend to perform well in times of high inflation as commodity prices typically rise with inflation.

This helps maintain the currency’s value alongside the price of the commodity.

Why are less growth-sensitive commodities considered stores of value?

Less growth-sensitive commodities, like agricultural products, have limited supply, diverse uses, may have non-correlated performance with other assets, and act as inflation hedges.

These factors help maintain their value over time and make them suitable stores of value.

Conclusion

Overall, including some level of anti-growth assets in a portfolio can help to balance risk and provide a store of value during times of less-than-stellar economic conditions or to simply have better balance and diversification.

The specific allocation of anti-growth assets will depend on an investor’s risk tolerance, investment goals, and market conditions.