Risk Management Strategies of Japanese Life Insurers

The risk management strategies of Japanese life insurers are slightly different from those of other investment managers given the nature of their business model and low-return realities of their domestic market.

Traders and investors can always learn something from other types of investment managers. There are multiple ways and strategies to make money and manage risk in the trading and investing game.

Japanese Life insurers

The insurance model works a bit differently from the standard way a hedge fund or other trading shop works.

A hedge fund basically takes in money (from the founder(s), employees, and/or limited partners) and puts it to use in various ways through bonds, stocks, commodities, real assets, and so on.

An insurance company operates by underwriting insurance policies in exchange from a premium paid by their customer.

It then takes this premium and invests the money into various assets to achieve higher returns relative to the liabilities that it underwrites (i.e., insurance claims).

A low or zero interest rate environment is particularly challenging for these types of companies. Low interest rates on cash and bonds forces them to take on more risk in other ways.

Given zero interest rates pulls down the yield of all assets while insurers’ liabilities remain the same, this compresses their net margins.

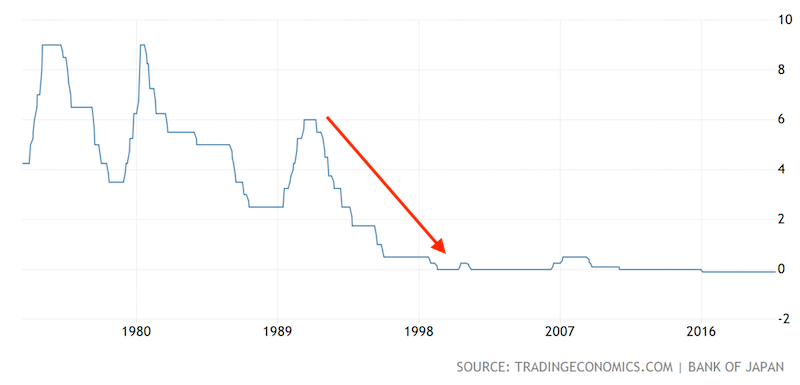

This is particularly true in a market like Japan, which has been in this environment for decades.

Japan short-term interest rates

A prolonged period of low, zero, and negative interest rates forces Japanese life insurers to adapt in other ways. They are forced to generate returns in new ways while also managing the risk of those new liabilities, which we’ll go through below.

The context of the Japanese life insurance industry

The Japanese life insurance market is the third largest globally after the US and China.

Life insurance is particularly popular in Japan, with almost 90 percent of Japanese households having some form of an active life insurance policy.

This contrasts with 70 percent of households in the US and just 38 percent of households in the UK.

The industry is particularly important to the Japanese economy.

It serves as a repository for a large amount of the country’s overall savings. It also a large institutional investor in both the country’s domestic financial markets as well as in international bond and equity markets.

The industry operates on two basic drivers:

i) Influx of premiums

ii) Yields that can be earned on assets

Premiums

The amount of premiums that can be taken in are dependent on the population size and the proportion owning life insurance policies.

As is well-known, Japan has aging demographics, with the average age in the country now above 50. This is compounded by a low birth rate and a declining overall population, which peaked around 2010 and isn’t likely to increase without immigration.

A lower population means fewer people that hold policies, unless a higher proportion of the population takes up life insurance policies to offset the population loss.

But with approximately 90 percent of the population already holding one, there’s limited capacity to increase this amount.

Japanese in-effect life insurance policies peaked in 1996 and have fallen since.

Yields

Falling yields have nonetheless been more of an influence on the industry since Japan began instituting its negative interest rate policy (NIRP) and yield curve control (YCC) in 2016.

This not only hurt profitability and compressed margins in the short term but forced them to alter their investing strategies toward riskier alternatives.

This buildup of risk in the system could generate consequences for the Japanese economy and impact the status of an important buyer in the international capital markets. This will be particularly true if regulatory changes affect what kind of decisions life insurers can make with their capital.

Risks for Japanese life insurers

Negative cash rates in Japan and negative to zero interest rates many years out on the curve (up to 10 years) has been a major hit to the traditional business model of Japanese life insurers.

Life insurers rely on charging their customers premiums in exchange for insurance coverage. Life insurers then take these premiums and invest them in other interest-bearing or yield-generating assets.

In simple terms, for a life insurance company to be profitable, the sum of its premiums taken in plus the returns generated on them must exceed claims paid out plus fixed costs.

Before, Japanese life insurers would predominantly buy Japanese government bonds (JGBs).

Their returns were stable and the credit risk was practically zero, as the obligor (the government) would always be able to pay on its debts having control of the money creation process.

JGBs also offer important regulatory advantages for Japanese life insurance companies given their safety and liquidity. Because of their safe status, life insurers are not required to hold any of their capital reserves against them.

But JGB yields had been falling for decades after the popping of Japan’s economic and market bubble in 1989.

The Bank of Japan lowered interest rates into negative territory to further stimulate the economy. Japan has struggled with near-zero growth rates and near-zero inflation rates since the financial crisis.

The BOJ’s decision benefited borrowers, but further worsened the returns for creditors.

The impact of negative interest rates for life insurers

There are two main impacts of negative interest rates for Japanese life insurance companies.

Profitability squeeze

First, negative interest rates have hurt profitability.

Even though the BOJ controls the overnight rate and the 10-year yield, the central bank has helped push other yields down in the back end of the curve as well. Even the largest tenor issued by the Bank of Japan, a 40-year tenor, yields less than one percent.

(Source: investing.com)

Moreover, when cash and bond rates fall, this impacts other investable asset classes as well. When yields get bid down, investors go out over the risk curve, compressing the yields of those riskier assets and asset classes as well.

This squeezes the types of returns that life insurers can generate.

Low yields also make life insurance policies less attractive to consumers.

Asset-liability mismatch

Second, life insurers are now faced with an asset-liability mismatch.

This is the liability associated with a difference in the interest rates and maturities on assets versus those of liabilities.

When a life insurance company sells policies, it takes on longer dated liabilities. This, in turn, exposes them to market fluctuations as a result of how interest rates have a larger effect on longer duration instruments.

Buying JGBs should traditionally act as a hedge to this kind of risk. The JGBs of a certain tenor would provide yield and help hedge against longer dated liabilities.

But with practically no yield and higher yield liabilities (i.e., claims on policies), it forces Japanese life insurers to take more credit, interest rate, and currency risk.

Steps life insurance companies have taken to mitigate risks

Japanese insurers have gone the route of turning to foreign securities in order to achieve higher yields.

Bonds have been the primary asset of choice due to their relative safety compared to equities.

Total foreign bonds holding by Japanese life insurers are now around ¥100 trillion, or around USD$950 billion. These holding were less than $600 billion five years ago, controlling for currency effects.

These provide greater returns. But investing in foreign securities poses FX risks.

Namely, the income Japanese life insurers generate is in Japanese yen but their investment exposure from buying overseas bonds, stocks, etc., is in dollars, euros, francs, or another national currency.

Embedded in that trade is not just the standard bet on that particular security and its set of risks (i.e., liquidity, credit, duration), but it’s essentially an FX trade as well.

Longer duration securities are also dependent on the interest rate movements in those markets.

Moreover, in 2025, Japanese life insurance companies will face regulatory changes. These will raise capital requirements for Japanese insurers that have longer duration liabilities that are left unhedged.

More risk for less return?

The general priority for Japanese life insurers is to mitigate risk by hedging against fluctuations in interest rate and FX risks.

This helps them lower their capital requirements per the regulatory restrictions they’re subject to.

As a result, more life insurers have turned to using derivatives in their portfolios to hedge away the duration risk associated with their asset and liability mix and the currency movements associated with their growing foreign securities holdings, which are now roughly one-quarter of their asset mix.

Some Japanese life insurers are relatively new to using derivatives in their portfolios, but more in the industry are becoming accustomed to using more options-based solutions to solve their asset-liability mismatches.

This includes instruments from cross-currency swaps and regular interest rates swaps to the more complex structured products designed by investment banks to control their risks.