Forex Trading in Palestine

Forex trading is gaining popularity in Palestine, especially among aspiring investors looking to exploit the currency markets’ liquidity and 24-hour operation.

However, traders in Palestine face challenges; limited access to certain financial services, no separate Palestinian currency, concerns over local regulatory oversight, and a fragile geopolitical situation.

Looking to start forex trading in Palestine? This guide for beginners will equip you with the essentials.

Quick Introduction

- Palestine does not have its own currency that residents can trade online. Instead, it relies on the United States dollar (USD), Israeli new shekel (ILS), and Jordanian dinars (JOD).

- Beware of “fighting the Fed.” US monetary policy dominates the fundamentals of the Palestine and Israel economies and hostilities. Changes in Fed interest rates affect all USD pairs; if the USD strengthens, it often rises against all currencies as the reserve currency.

- The Palestine Capital Market Authority (PCMA) does not regulate forex trading specifically but it provides information on Palestine’s broader financial market environment. Traders should stay informed about any updates on regulations.

Top 4 Forex Brokers in Palestine

Based on our latest in-depth evaluations, these 4 platforms are the frontrunners for forex traders in Palestine:

How Does Forex Trading Work?

Forex trading in Palestine works similarly to how it operates globally but with local considerations due to economic and regulatory factors.

Traders speculate on the price movements of currency pairs like EUR/USD, GBP/USD, or USD/JPY, buying pairs when they think the first currency listed will appreciate and selling when they think it will depreciate.

Traders often use leverage, allowing you to control larger positions with a smaller amount of capital. For example, with leverage of 1:100, you can control a $10,000 position with just $100. This can amplify trading returns and also losses, so risk management is essential.

Alongside charts and indicators, active forex traders pay attention to economic news, geopolitical events, and financial reports impacting currency values.

Challenges Facing Forex Traders In Palestine

Since there are limited local forex brokers in Palestine, traders generally access the market through international firms regulated by authorities in Europe, Australia, or other countries.

These firms offer access to currency markets through web-based platforms, desktop software, or increasingly forex trading apps.

Due to the lack of direct banking support, Palestinian traders often fund their accounts using e-wallets (like Skrill or Neteller), credit cards/debit cards, or Bitcoin payments. These methods help bypass local banking restrictions and enable quick deposits and withdrawals.

Access to stable internet and secure platforms can also sometimes be an issue. Forex traders might use VPNs for uninterrupted access to trading platforms.

The often volatile geopolitical situation in the region can also impact market sentiment and forex trading conditions.

Is Forex Trading Legal In Palestine?

The Palestine Capital Market Authority (PCMA), which regulates the country’s financial markets, doesn’t have specific regulations addressing forex trading because no local framework legalizes or prohibits such activities.

Currency exchange is legal in Palestine; there are no restrictions against individuals engaging in currency trading for investment purposes. However, due to the absence of local regulation, Palestinian traders may not have legal recourse in disputes with providers.

Some regional banks may also restrict transactions related to forex trading or transfers, which could pose challenges for funding and withdrawing from trading accounts.

Is Forex Trading Taxed In Palestine?

No tax laws directly address income or profits generated from trading currencies in Palestine. However, there are a few key points to consider.

Palestine does have an income tax system operated by the Palestinian Authority in accordance with Israel. This system applies to all forms of income, including business income, salaries, and investment income.

Since there are no specific regulations, there is no guidance on whether forex profits should be taxed as regular income, capital gains, or in another category.

If forex trading profits are considered capital gains (similar to earnings from other investments), traders might be subject to tax. However, the current tax code in Palestine does not provide clear instructions on handling capital gains from forex trading.

Given the lack of specific guidelines, I recommend traders in Palestine consult with a local tax professional or accountant to ensure compliance with applicable tax laws.Maintain detailed records of all trades, including dates, amounts, profits, and losses. These records will be helpful if earnings from forex trading are considered taxable.

When Is The Best Time To Trade Forex In Palestine?

The best time to trade forex in Palestine generally depends on the overlap of major global forex market sessions and periods of high volatility and liquidity.

Since forex trading is a 24-hour market, choosing trading times that align with your strategy and the most active market sessions is essential.

- London-New York Overlap (3:00 PM – 7:00 PM Palestine Time) is often considered the best time to trade forex due to the overlap between the London and New York sessions. Trading volume is high, and market volatility is increased, offering more opportunities for trading and potential profit. Major currency pairs like EUR/USD, GBP/USD, and USD/JPY often experience the most activity during this time.

- London Session (10:00 AM – 7:00 PM Palestine Time) is one of the most critical periods for forex trading, as it accounts for a significant amount of daily trading volume. The highest liquidity is typically observed during the middle of the London session (around 1:00 PM to 4:00 PM Palestine Time), when economic news from the UK and the Eurozone is released, leading to potential price movements.

- New York Session (3:00 PM – 12:00 AM Palestine Time) is highly active, particularly at the start when vital US economic data and news releases occur. This session is ideal for traders who trade currency pairs including the USD (such as EUR/USD, GBP/USD, and USD/JPY), as the USD is involved in approximately 80% of forex trades.

A USD/ILS Trade

Background

Palestine has no currency, but three are used extensively: Israeli shekels (ILS), United States dollars (USD), and Jordanian dinars (JOD). The US Dollar vs. Israeli Shekel is one of Israel and Palestine’s most active currencies traded on currency markets.

The possibility of hedging and exploiting carry trade opportunities will also be at the forefront of many Palestinian traders’ thinking.

Analysis

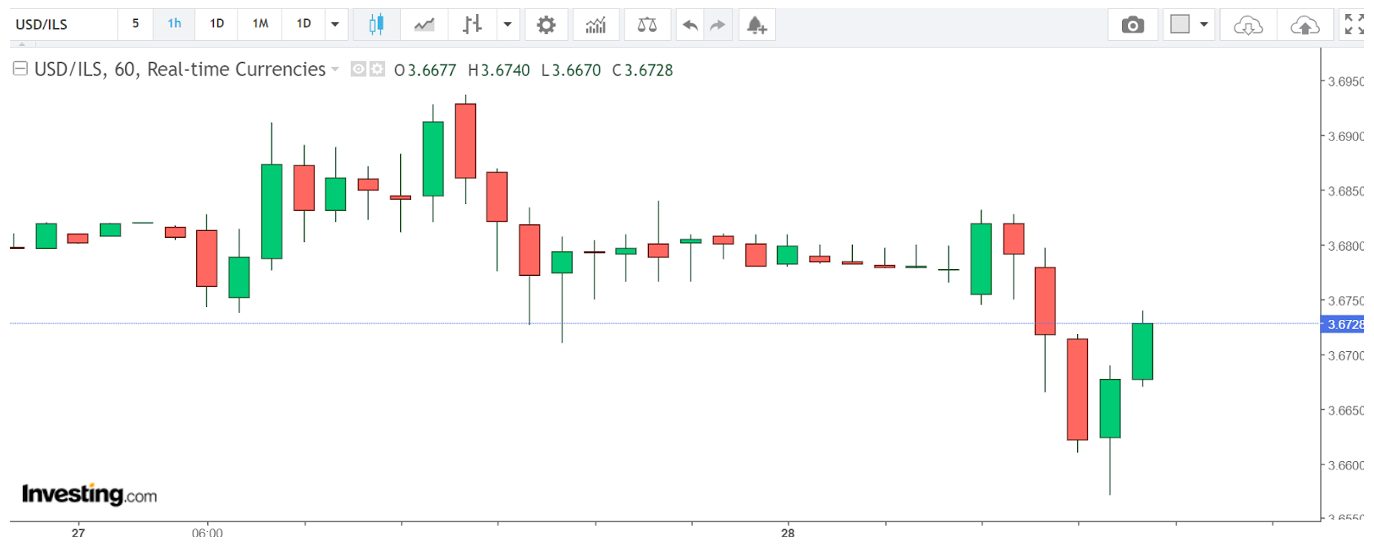

I’ve developed a tight forex trading discipline, including thorough fundamental analysis and technical analysis. Part of my technical analysis always involves looking at lower and higher timeframes to try and get a complete overview of any currency pair I’m considering trading.

If I consider executing a forex day trade, I’ll analyze the daily and 1-hour time frames. That way, I get the bigger picture and (hopefully) avoid trading against underlying solid trends.In short, I’m looking for proof that the short-term session trend I’ve identified in lower time frames is supported in higher time frames like the daily one.

Looking at the above daily chart, the candlestick pattern suggests that the bearish momentum is beginning to exhaust. The price is ranging and not trending, and there appears to be market indecision.

Although the last two days’ candles weren’t perfect, text-book examples of a morning star or spinning top give me confidence that the selling pressure is subsiding.

When I examine the one-hour timeframe, I see a momentum reversal. Again, we’re not observing a classic, bullish engulfing pattern, but the body and wick of the candles give me enough reason to believe that USD/ILS is a long trade opportunity.

Execution

My deal ticket reads like this:

- Buy entry order at 3.6400.

- Stop loss order at 3.6000

- Profit limit order at 3.6800

I always remember that you see a snapshot of the current situation when you enter. Indicators can re-paint tick by tick, and candlestick formations are not set in stone; that perfect bullish engulfing pattern encouraging you to take a long trade can quickly alter on your chart.

That’s why I risk a small percentage of my capital on every trade and always set targets for stop loss and profit limit orders.

When I trade exotic or minor currency pairs, I’m also mindful that the spreads, fills, and liquidity will not be optimized compared to major FX pairs; I, and you, should know such trades come with extra risk.

Bottom Line

Forex traders in Palestine face unique hurdles. These include regional conflicts that have resulted in restrictions on trade that impact the flow of goods and currency and limited direct banking support.

The London-New York overlap (3:00 PM – 7:00 PM) and the London session (10:00 AM – 7:00 PM) are when the market experiences the highest activity, liquidity, and volatility. These generally provide the best opportunities when trading major currency pairs.

To get going, turn to DayTrading.com’s pick of the top forex trading platforms in Palestine.

Recommended Reading

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com