Hierarchical Risk Parity (A ML Approach to Building Balanced and Well-Diversified Portfolios)

In portfolio optimization, the traditional approach has long been Modern Portfolio Theory (MPT), which focuses on constructing portfolios that maximize returns for a given level of risk.

However, recent years have seen the emergence of an alternative method that’s come to be known as Hierarchical Risk Parity (HRP).

This approach tries to create well-diversified portfolios that does better under various market environments.

It weights assets in a portfolio by their risk contribution and how they vary relative to other assets in the portfolio.

So, assets that have better return-to-risk ratios and lower correlation with other assets in the portfolio get weighted higher.

In this article, we will explore the HRP method, its key advantages, and how it compares to traditional portfolio optimization techniques.

Key Takeaways – Hierarchical Risk Parity

- Hierarchical Risk Parity (HRP) is a portfolio optimization method focused on allocating assets based on their risk contributions to provide a more balanced and diversified portfolio.

- HRP uses hierarchical clustering and risk parity principles to construct portfolios. This allows for better risk management and adaptability to changing market conditions.

- HRP’s focus on risk contributions reduces its susceptibility to estimation errors, potentially leading to more consistent results over time.

- While HRP offers several advantages over traditional methods like Modern Portfolio Theory (MPT), it’s important to consider individual goals and risk tolerance when evaluating its suitability for your investment needs.

- We do a Python example below.

Understanding Hierarchical Risk Parity

Hierarchical Risk Parity is a portfolio optimization method that seeks to allocate assets based on their risk contributions, rather than solely on their expected returns and volatilities.

This is like traditional risk parity, but focuses on using graph theory and machine learning.

The HRP approach is built on two main concepts:

Hierarchical Clustering

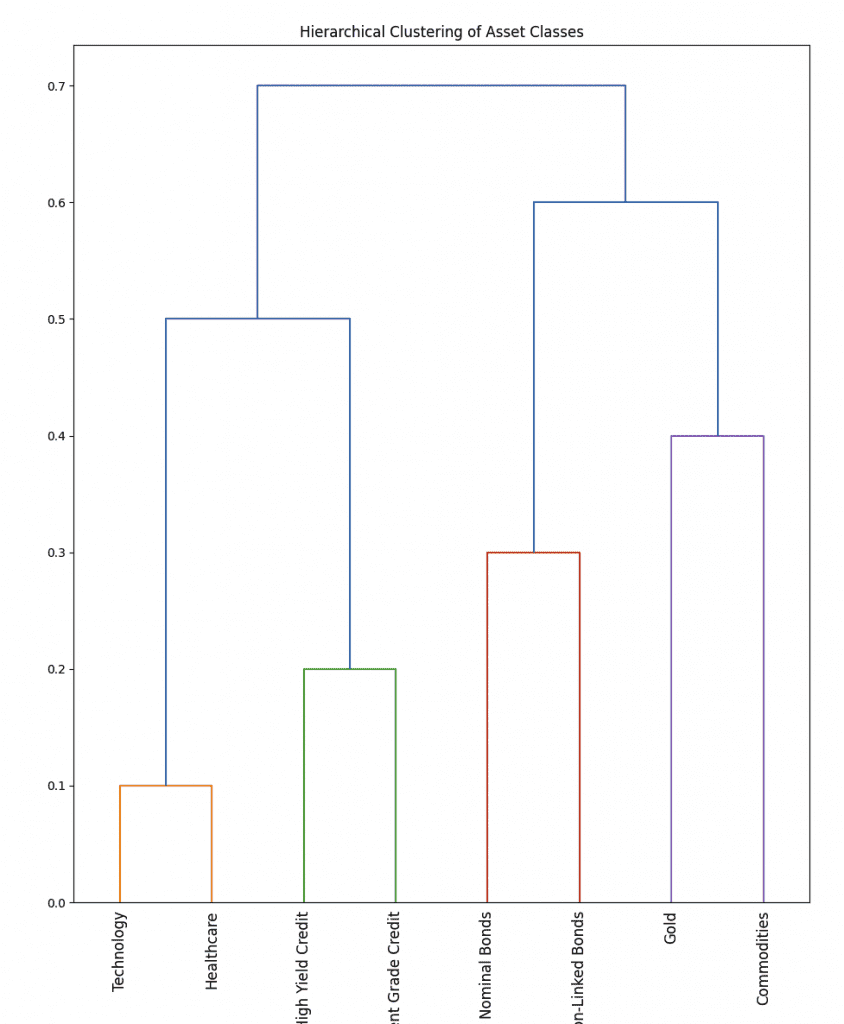

HRP employs a tree-like structure, known as a dendrogram, to group assets based on their similarities in terms of price movements or correlation. (See our Python example below.)

This process helps to identify clusters of assets that behave similarly, allowing for better risk management and diversification.

Risk Parity

Once the hierarchical clustering is complete, HRP allocates assets within each cluster based on the principle of risk parity.

This means that each asset’s allocation is proportionate to its risk contribution, ensuring that no single asset or group of assets dominates the portfolio’s risk profile.

Key Advantages of Hierarchical Risk Parity

The HRP approach offers several benefits over traditional portfolio optimization techniques, such as MPT, including:

Enhanced Diversification

HRP’s focus on risk contribution, as opposed to returns and volatility, allows for a more balanced and diversified portfolio.

By considering the relationships between assets and clustering them accordingly, HRP can help investors avoid concentration risk and better manage market volatility.

For example, a 60/40 portfolio may seem ostensibly balanced because of the way it allocates the money.

But stocks (a theoretically perpetual duration instrument) have structurally higher volatility than most forms of bonds (fixed duration instruments).

So a 60/40 portfolio can really be more like an 88/12 portfolio in terms of how it allocates the risk.

Robustness to Market Changes

HRP’s hierarchical structure enables it to adapt more effectively to changing market conditions.

As new information becomes available, the approach can quickly identify shifts in asset correlations and adjust the portfolio accordingly, providing investors with a more stable and resilient investment strategy.

Reduced Estimation Errors

Unlike MPT, which relies heavily on estimates for future returns and covariances, HRP focuses on historical risk contributions.

This means that it is less susceptible to estimation errors and can deliver more consistent results over time.

Ease of Implementation

HRP is relatively straightforward to implement for those with software to implement such an approach, even for investors with limited resources or expertise.

Some investment management software programs may now offer HRP as an option, making it accessible to a wide range of investors.

HRP is more on the “systematic” side to investment approaches, which can help remove some emotion from the process of trading/investing.

Hierarchical Risk Parity vs. Risk Parity

Hierarchical Risk Parity (HRP) and Traditional Risk Parity (RP) are two approaches to portfolio construction that aim to optimize the allocation of assets based on their risk contributions.

Nonetheless, they differ significantly in their methodologies and underlying assumptions.

Traditional Risk Parity (RP)

Equal Risk Contribution

RP aims to allocate assets in such a way that each asset contributes equally to the portfolio’s overall risk.

This is usually measured in terms of volatility or variance.

Correlation and Covariance

RP relies on the correlation and covariance matrix of the asset returns to determine the asset weights.

Assumption

Many RP approaches assume that the historical correlations and volatilities will remain relatively stable over the investment horizon.

Challenges

One challenge with RP is its sensitivity to the estimation of correlations and volatilities.

This can lead to significant changes in asset allocation with small changes in these parameters.

Hierarchical Risk Parity (HRP)

Cluster-Based Approach

HRP is a more sophisticated approach that first clusters assets based on their price movements and then applies risk parity within and across these clusters.

Hierarchy and Tree Structures

HRP uses a hierarchical tree (dendrogram) to understand the structure of asset correlations.

Assets are grouped into clusters with similar price behavior, and then these clusters are themselves clustered, creating a tree-like structure.

Less Sensitivity to Estimation Errors

Since HRP doesn’t solely rely on the covariance matrix, it tends to be less sensitive to estimation errors in correlations and volatilities.

Intuitive and Adaptive

HRP is considered more intuitive and adaptive to changing market conditions, as it recognizes the inherent structure in asset movements.

Summary

Traditional risk parity focuses on equalizing risk contribution based solely on volatility and correlation.

HRP takes a more nuanced approach by recognizing the hierarchical structure in asset correlations and can be further tailored by incorporating various constraints (which we discuss in the next section).

Hierarchical Risk Parity with Constraints

Incorporating Constraints

HRP can be adapted to include various constraints, such as maximum or minimum weights on certain assets, sector constraints, liquidity considerations, or regulatory requirements.

Customization for Specific Goals

By adding constraints, investors can tailor the HRP model to specific investment goals or risk management requirements.

Complexity in Optimization

The inclusion of constraints adds complexity to the optimization process.

It requires more sophisticated mathematical techniques to ensure that the portfolio adheres to the constraints while still maintaining the benefits of the HRP approach.

Potential for Enhanced Performance

If properly implemented, HRP with constraints can potentially lead to enhanced performance and risk management.

It allows for a more tailored approach to portfolio construction that aligns with specific trading/investment objectives or regulatory requirements.

Comparing Hierarchical Risk Parity to Traditional Portfolio Approaches

HRP’s focus on risk management, adaptability, and ease of implementation make it an attractive option for investors seeking a more balanced and diversified approach to portfolio construction.

But traders/investors should carefully consider their individual risk tolerance, investment objectives, and time horizons when determining which approach is most suitable for their needs.

Downsides to Hierarchical Risk Parity

While Hierarchical Risk Parity (HRP) offers several advantages as a portfolio optimization method, it’s important to recognize its potential limitations.

Changing Correlations: The Non-Static Nature

One significant drawback of many approaches to HRP is its reliance on historical correlations between assets.

Correlations are not static and can change over time, making it challenging to predict future relationships based on past data.

Relying on historical correlations can lead to an over- or underestimation of the actual risk in the portfolio.

When a bunch of data is fed into the computer and this spits out algorithms for dealing with the future, this is often known as overfitting.

When the past is different from the future and the past is what those algorithms are based on, this can be very risky.

Moreover, during periods of market stress or significant shifts in market conditions, correlations between assets can change rapidly.

In such cases, HRP’s often backward-looking approach to constructing portfolios may not provide adequate protection against changing correlations, potentially leading to a less diversified and more vulnerable portfolio.

Instead, correlations are best known in the form of what fundamentally drives an asset’s pricing and movement.

Ideally, you’re looking for returns streams that are uncorrelated to each other.

And you can even do better than that through negatively correlated assets.

Overemphasis on Clustering

HRP’s reliance on hierarchical clustering can be both a strength and a weakness.

While clustering can help identify and group assets with similar risk profiles, it may also lead to an overemphasis on certain clusters or sectors.

This could result in under-diversification within the clusters themselves, potentially leading to increased vulnerability to sector-specific risks or market shifts.

Applicability in Certain Market Conditions

HRP may not be as effective during periods of significant market shifts or structural changes if the approach is heavily backward-looking, as its reliance on historical risk contributions might not always be indicative of future risk.

In such situations, the HRP approach might not provide adequate diversification, leaving the portfolio exposed to potential losses.

Hierarchical Risk Parity in Python – Clustering Example

Let’s first simulate a basic hierarchy, then show it visually.

We’ll do it this way:

- Equity Sectors cluster first

- Corporate Credit joins the equity cluster

- Nominal Government Bonds join next

- Inflation-Linked Government Bonds follow

- Gold joins thereafter

- Commodities join last

Here’s how we can simulate this in Python:

import numpy as np

import matplotlib.pyplot as plt

from scipy.cluster.hierarchy import dendrogram, linkage

# Manually define the asset classes in the desired hierarchical order

assets = [

'Technology', 'Healthcare', # Equity Sectors

'High Yield Credit', 'Investment Grade Credit', # Corporate Credit

'Nominal Bonds', # Nominal Government Bonds

'Inflation-Linked Bonds', # Inflation-Linked Government Bonds

'Gold', # Gold

'Commodities'# Commodities

]

# Manually create a linkage matrix to reflect the desired hierarchy

# The numbers here are fabricated to demonstrate the hierarchy and do not represent actual distances or metrics

link = np.array([

[0, 1, 0.1, 2], # Technology and Healthcare cluster first

[2, 3, 0.2, 2], # High Yield Credit and Investment Grade Credit cluster

[4, 5, 0.3, 4], # The above two clusters join

[6, 7, 0.4, 5], # Nominal Bonds join

[8, 9, 0.5, 6], # Inflation-Linked Bonds join

[10, 11, 0.6, 7], # Gold joins

[12, 13, 0.7, 8], # Commodities join last

])

# Plot the dendrogram

plt.figure(figsize=(10, 7))

dendrogram(link, labels=assets, leaf_rotation=90)

plt.title("Hierarchical Clustering of Asset Classes")

plt.show()

# Get the order of assets according to the hierarchical tree

# Normally, leaves_list would be used here, but given the manual nature of 'link', we already have the order in 'assets'

sorted_assets = assets

# Display the sorted assets

print("Sorted Assets according to Hierarchy:")

print(sorted_assets)

Results

In this example, the linkage matrix (link) is manually constructed to demonstrate the hierarchy.

Each row in the matrix represents a merge between clusters, with the first two values being the indices of the clusters/leaves being merged, the third value being the distance (or dissimilarity) between these clusters, and the fourth value being the number of original observations in the newly formed cluster.

This structure is purely illustrative and serves to demonstrate how the assets would be arranged hierarchically.

In a real-world application, the linkage matrix would be derived from the data using clustering algorithms.

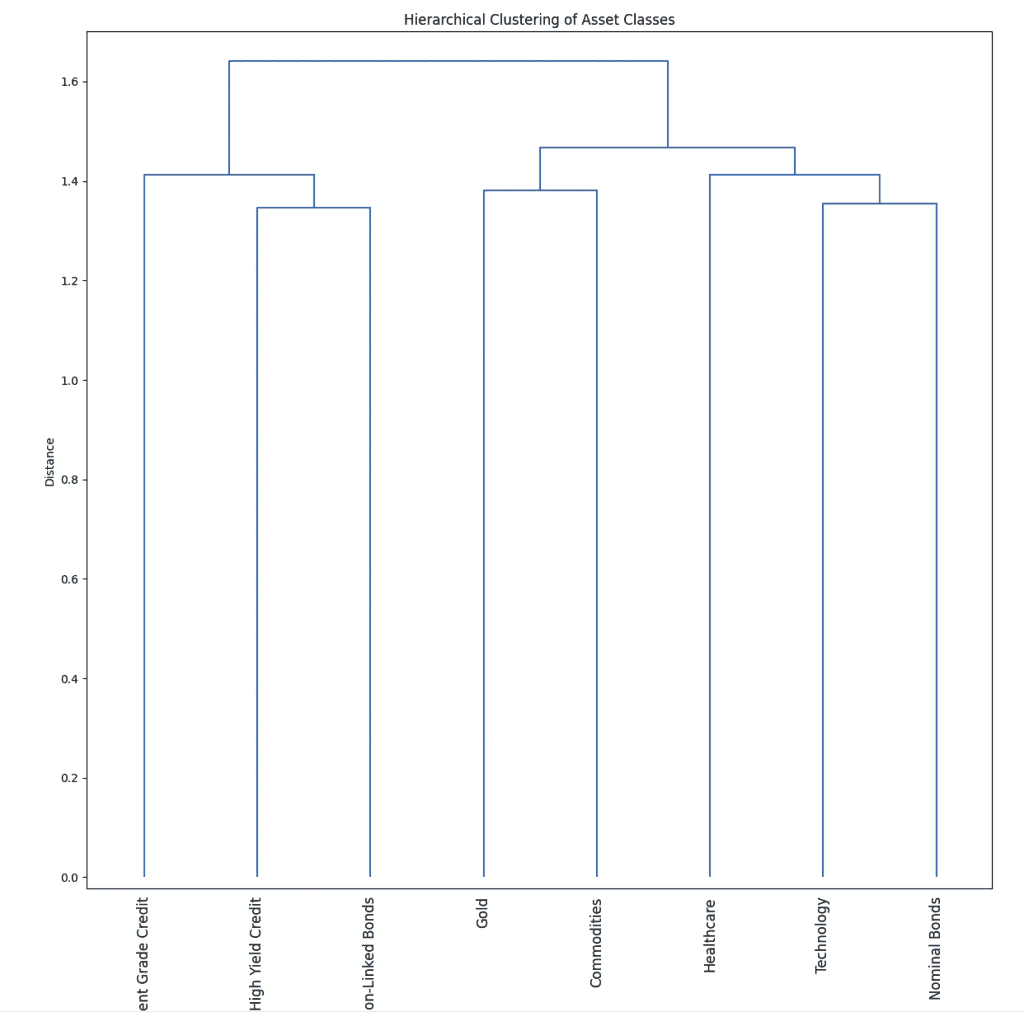

Simulate Hierarchical Clustering Algorithms

To perform hierarchical clustering on the specified asset classes, we typically use their historical return data to compute a distance or similarity measure (like correlation or covariance).

Since we’re being illustrative in this context, we’ll use synthetic data here and we’ll simulate the process as if we had such data, allowing us to use a clustering algorithm to generate a linkage matrix.

We’ll then compare it with the manually specified hierarchy in the link array.

Given asset classes:

- Technology

- Healthcare

- High Yield Credit

- Investment Grade Credit

- Nominal Bonds

- Inflation-Linked Bonds

- Gold

- Commodities

We will simulate returns for these assets and apply hierarchical clustering:

import numpy as np

import pandas as pd

from scipy.cluster.hierarchy import dendrogram, linkage

import matplotlib.pyplot as plt

# Asset classes

assets = [

'Technology', 'Healthcare',

'High Yield Credit', 'Investment Grade Credit',

'Nominal Bonds',

'Inflation-Linked Bonds',

'Gold',

'Commodities'

]

# Simulate some return data for these assets

np.random.seed(68)

num_days = 1000

returns = np.random.normal(0, 1, size=(num_days, len(assets)))

# Create a DataFrame for the returns

returns_df = pd.DataFrame(returns, columns=assets)

# Compute the correlation matrix, which will serve as our basis for clustering

correlation_matrix = returns_df.corr()

# Perform hierarchical clustering

linkage_matrix = linkage(correlation_matrix, method='ward')

# Plot the dendrogram

plt.figure(figsize=(12, 8))

dendrogram(linkage_matrix, labels=assets, leaf_rotation=90)

plt.title("Hierarchical Clustering of Asset Classes")

plt.xlabel("Asset Classes")

plt.ylabel("Distance")

plt.show()

To sum what we did in this code:

- Simulate daily returns for each asset class to mimic real-world data.

- Compute the correlation matrix from these returns, which reflects how the assets move relative to each other.

- We use this correlation matrix as input to the linkage function, with the ‘ward’ method, to perform hierarchical clustering.

- The dendrogram visually represents the results. This shows how assets cluster together based on their simulated return patterns.

This process mimics how you’d typically perform hierarchical clustering in a financial context – i.e., by using historical returns data to inform the structure of the portfolio and understand the relationships between different asset classes.

The ‘ward’ method minimizes the variance when forming clusters, aiming to form internally consistent but distinct clusters.

Results

Hierarchical Risk Parity in Python – Portfolio Weighting Example

To go off what we did in the above section, let’s weight an actual portfolio using hierarchical risk parity principles.

To simulate a logical covariance matrix for the asset classes with specific volatility characteristics and then estimate their relative weightings in a portfolio, we can follow these steps:

Define Volatilities

Assign a volatility value to each asset class, respecting the relative volatility characteristics (e.g., high yield (HY) credit more volatile than investment grade (IG) credit, etc.).

Simulate Correlations

Define logical correlations between asset classes.

Construct Covariance Matrix

Use the volatilities and correlations to construct a covariance matrix.

Portfolio Optimization

Use the covariance matrix to estimate relative weightings in the portfolio, assuming we aim to minimize portfolio variance.

Code

import pandas as pd

import numpy as np

# Annualized volatilities (in percentage)

volatilities = {

'Technology': 20,

'Healthcare': 14,

'High Yield Credit': 12,

'Investment Grade Credit': 10,

'Nominal Bonds': 9,

'Inflation-Linked Bonds': 8,

'Gold': 15,

'Commodities': 16

}

correlations = pd.DataFrame(

[[1.00, 0.75, 0.30, 0.25, 0.10, 0.05, 0.20, 0.50], # Technology

[0.75, 1.00, 0.25, 0.20, 0.15, 0.10, 0.15, 0.45], # Healthcare

[0.30, 0.25, 1.00, 0.80, 0.40, 0.35, 0.25, 0.60], # High Yield Credit

[0.25, 0.20, 0.80, 1.00, 0.45, 0.40, 0.20, 0.55], # Investment Grade Credit

[0.10, 0.15, 0.40, 0.45, 1.00, 0.90, 0.10, 0.20], # Nominal Bonds

[0.05, 0.10, 0.35, 0.40, 0.90, 1.00, 0.15, 0.25], # Inflation-Linked Bonds

[0.20, 0.15, 0.25, 0.20, 0.10, 0.15, 1.00, 0.70], # Gold

[0.50, 0.45, 0.60, 0.55, 0.20, 0.25, 0.70, 1.00]], # Commodities

columns=volatilities.keys(), index=volatilities.keys()

)

# Convert annualized volatilities to standard deviations

std_devs = {k: v / 100 for k, v in volatilities.items()}

# Construct the covariance matrix

cov_matrix = pd.DataFrame(

data=np.zeros((len(correlations), len(correlations))),

columns=correlations.columns,

index=correlations.index

)

for asset_i in cov_matrix.columns:

for asset_jincov_matrix.index:

cov_matrix.loc[asset_i, asset_j] =correlations.loc[asset_i, asset_j] *std_devs[asset_i] *std_devs[asset_j]

from scipy.optimize import minimize

# Define the objective function for optimization (portfolio variance)

def portfolio_variance(weights, covariance_matrix):

return weights.T @covariance_matrix@weights

# Initial guess for weights

initial_weights = np.array(len(volatilities) * [1 / len(volatilities)])

# Constraints: sum of weights = 1

constraints = ({'type': 'eq', 'fun': lambda weights: np.sum(weights) - 1})

# Boundaries: weights between 0 and 1

bounds = tuple((0, 1) for asset in range(len(volatilities)))

# Perform optimization

result = minimize(

portfolio_variance,

initial_weights,

args=(cov_matrix,),

method='SLSQP',

bounds=bounds,

constraints=constraints

)

# Display the optimized weights

optimized_weights = pd.Series(result.x, index=cov_matrix.columns)

print("Optimized Portfolio Weights:")

print(optimized_weights)

Here, we:

- Defined relative volatilities for each asset class

- Assumed logical correlations between them

- Constructed a covariance matrix based on these assumptions

- Used optimization to find the portfolio weights that minimize the overall portfolio variance

This approach demonstrates how to integrate logical market assumptions into portfolio construction using hierarchical relationships and optimization techniques.

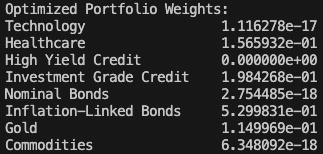

Results

We got the following:

In percentages:

- Tech = 0%

- Healthcare = 15.7%

- HY Credit = 0%

- IG Credit = 19.8%

- Nominal Bonds = 0%

- Inflation-Linked Bonds = 53.0%

- Gold = 11.5%

- Commodities = 0%

So, basically, it likes some assets but doesn’t like others at all, effectively weighting them at zero.

In this particular algorithm, it picks the asset in the cluster it likes and down-weights the other to zero, then weights the “winner” of the cluster in relation to the other winners.

Asset Allocation – Hierarchical Risk Parity

FAQs – Hierarchical Risk Parity

What is the main difference between Hierarchical Risk Parity (HRP) and Modern Portfolio Theory (MPT)?

The main difference between HRP and MPT is the way they optimize portfolios.

MPT focuses on maximizing returns for a given level of risk, relying heavily on estimates for future returns and covariances.

In contrast, HRP allocates assets based on their risk contributions, using hierarchical clustering and risk parity principles.

This approach focuses on historical risk contributions, making it less susceptible to estimation errors and potentially more robust to changing market conditions.

How does Hierarchical Risk Parity help in reducing portfolio risk?

HRP helps reduce portfolio risk by ensuring that no single asset or group of assets dominates the portfolio’s risk profile.

By clustering assets based on their similarities in terms of price movements or correlation and allocating assets within each cluster based on risk parity principles, HRP promotes a more balanced and diversified portfolio.

This approach can help investors avoid concentration risk and better manage market volatility.

Is Hierarchical Risk Parity suitable for all types of investors?

While HRP is a powerful portfolio optimization method, it may not be suitable for all types of investors.

Individual risk tolerance, investment objectives, and time horizons should be carefully considered when determining which approach is most suitable.

That said, HRP’s focus on risk management, adaptability, and ease of implementation make it an attractive option for traders/investors seeking a more balanced and diversified approach to portfolio construction.

Can HRP be combined with other portfolio optimization techniques?

Yes, HRP can be combined with other portfolio optimization techniques to create a more comprehensive investment strategy.

For example, some investors may choose to combine HRP with traditional MPT, using HRP for risk management and diversification purposes while still considering expected returns and covariances.

This hybrid approach can provide the benefits of both methods, potentially resulting in a more robust and resilient investment strategy.

There are many ways to skin a cat when it comes to trading and investing and not everything fits into a clean label.

How can I implement Hierarchical Risk Parity in my investment portfolio?

There are several ways to implement HRP in your investment portfolio.

Many investment management software programs now offer HRP as an option, making it accessible to a wide range of traders/investors.

Alternatively, you can work with a financial advisor or investment manager who is familiar with HRP to help you create a tailored investment strategy based on this approach.

Are there any limitations or drawbacks to using Hierarchical Risk Parity?

While HRP offers several advantages, it is not without limitations.

One potential drawback is that HRP does not explicitly consider expected returns when constructing portfolios, which some investors may find undesirable.

Additionally, HRP’s reliance on historical risk contributions may not always be indicative of future risk, and the approach may be less effective during periods of significant market shifts or structural changes.

There are always non-economic things that can influence financial markets and returns, such as wars and natural disasters.

Despite these limitations, HRP remains a valuable tool for investors seeking a more balanced and diversified approach to portfolio construction.

Conclusion

Hierarchical Risk Parity presents a compelling alternative to traditional portfolio optimization methods.

Its focus on risk contribution and adaptability to market changes allows investors to construct more balanced and well-diversified portfolios.

As with any investment strategy, it’s essential to consider individual goals and risk tolerance when evaluating the suitability of HRP for your investment needs.